Remittances, outbound: India

(→Apr-Feb '16: surge in outbound remittances) |

(→Apr-Feb 2016: surge in outbound remittances) |

||

| Line 105: | Line 105: | ||

“The argument of mutual fund inflows acting as a drag on bank deposits is a false negative, as such cheques are actually written on banks in India and unlike the US, mutual funds in India cannot write cheques on their own,“ said Mitra. | “The argument of mutual fund inflows acting as a drag on bank deposits is a false negative, as such cheques are actually written on banks in India and unlike the US, mutual funds in India cannot write cheques on their own,“ said Mitra. | ||

| + | =See also= | ||

| + | [[Remittances, outbound: India]] | ||

| + | |||

| + | [[Remittances, inward: India]] | ||

| + | |||

| + | [[Remittances: South Asia]] | ||

Revision as of 20:41, 9 May 2018

This is a collection of articles archived for the excellence of their content. |

Contents |

Liberalised Remittance Scheme (LRS)

The Times of India, Apr 05 2016

What's illegal in owning a firm abroad? Does LRS enable round-tripping? What's illegal in owning a company abroad?

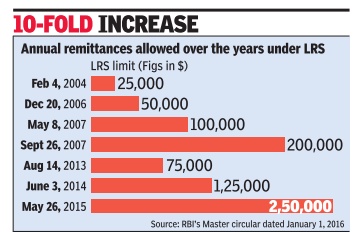

The amount and purpose of remitting money abroad has historically been tightly controlled by the RBI. Till 2004, all investments abroad required prior approval of the central bank. Sending money overseas by resident Indians was made simpler in 2004 with the introduction of the Liberalised Remittance Scheme (LRS). Since then, the amount of money that can be remitted without approval has been increased by 10 times -from $25,000 to $250,000.

Along with liberalisation, disclosure norms under other legislations have been changed. For example: details of foreign assets have to be disclosed in the I-T returns.

An amnesty scheme -the Black Money (Undisclosed foreign income and assets) and Imposition of Tax Act, 2015 -had provided a three-month window which expired in September last year, to declare undisclosed assets held abroad and pay taxes and penalty on the value of assets declared. Under this scheme, 644 declarations were made involving Rs. 4,164 crore.

The Panama Papers disclose that certain Indian residents hold shares in firms incorporated through Panama based firm Mossack Fonseca. TOI walks you through key disclosure requirements relating to remittance of money and shows the potential misuse of the LRS regulations.

What is LRS?

Under LRS, all resident individuals (including minors), are allowed to remit up to $250,000 in a financial year for any permissible current account (such as for medical treatment or education) or capital account transactions (such as buying property overseas, or holding shares in an overseas company) or a combination of both. No prior permission from the RBI is needed.

On June 1, 2015, the RBI reiterated that the permissible capital account transactions include the following: opening of foreign currency account abroad with a bank; purchase of property abroad; making investments abroad; setting up wholly owned subsidiaries and joint ventures abroad; and extending lo ans to NRI relatives.

Another circular issu ed recently on January 1, 2016 also sta tes the same.

However, remit ting money overseas to certain countries (such as Pakistan) or for certain purposes is prohibited under For instance, buying LRS. For instance, buying overseas lottery tickets or sweep stakes is not allowed, nor can one purchase foreign currency convertible bonds (FCCBs) issued by Indian firms abroad.

Did grey areas exist about holding of shares in an overseas company or setting up of a company abroad?

While holding of shares of an overseas company has been permitted since 2004, a grey area prevailed for a few years on whether a resident Indian individual was permitted to set up a company overseas -as opposed to acquiring shares in an existing overseas company .

In an FAQ dated September 17, 2010, the RBI had said: “LRS did not permit remittance by an individual for setting up a company overseas“. This FAQ did not specifically prohibit investing in shares of existing overseas companies.

Representations were made to the RBI and subsequent notifications cleared the air.The RBI's notification dated March 5, 2013 but published on August 5, 2013 clarified that an overseas company can be set up by a resident Indian individual. However, experts claim that for the period between 2010-2013 a grey area continues on the legality of setting up of overseas companies by resident individuals.

The 2013 notification has added that the joint venture or wholly owned subsidiary to be acquired or set up by a resident individual shall be an operating entity only .

This overseas company could not in turn act as an investment company and acquire another subsidiary or set up another subsidiary (In technical terms, there was a prohibition on stepdown subsidiaries be it fully owned or by way of controlling interest.

In other words, a company in a tax haven, be it Panama, or the British Virgin Island, which has been set up under the LRS scheme by a resident individual, cannot invest in another company , say a company in India.

Does LRS enable roundtripping?

Round tripping involves getting money out of one country (say India) and sending it to a tax haven only to be dressed up as foreign capital and sent back to India.

While LRS permits holding shares in an overseas company or even setting up a JV or WOS overseas, it is clear that such an overseas company has to be an operating entity engaged in business.Such a company cannot have a step down subsidiary (as ex plained above). Thus, round tripping isn't permissible.

However, experts point out that there are instances where the overseas company in a tax haven (set up under the LRS route), buys shares in an Indian private company at prices lower than fair market value (the shares are undervalued) and subsequently on sale of such shares makes a killing. In other words, the overseas company makes investments in an Indian company contrary to the LRS norms.

For instance, if the over seas company is a Mauritius firm, the capital gains arising on a subsequent sale of shares of the Indian investee company is not taxable in India under the India-Mauritius tax treaty . If a Panama Company has been incorporated, typically the shares in the Indian company are held via an intermediary company in Mauritius, to avoid tax on capital gains.

As the ownership in some offshore companies is opaque, such as in Panama where bearer shares do not have the name of the shareholder, keeping track of such roundtripping is difficult for Indian regulatory authorities.

Have tax disclosure norms been strengthened?

For the first time, in respect of the financial year 2011-12, resident individuals had to file details of foreign assets in their income-tax returns, which included: bank accounts held in foreign countries (details of the bank, the account held and peak balance during the year); financial interest in a foreign entity (including the investments made); overseas immovable property , any other assets held outside India.

The disclosure details have been tightened with the income-tax returns for the financial year 2014-15 calling for disclosures in foreign trusts (even if the Indian resident taxpayer was a beneficiary or trustee).

Failure to furnish I-T returns or furnishing incorrect details entails significant penalty of up to Rs 10 lakh and imprisonment of up to seven years.

Funds remitted abroad

2009-2017, year-wise

October 18, 2017: The Times of India

From: October 18, 2017: The Times of India

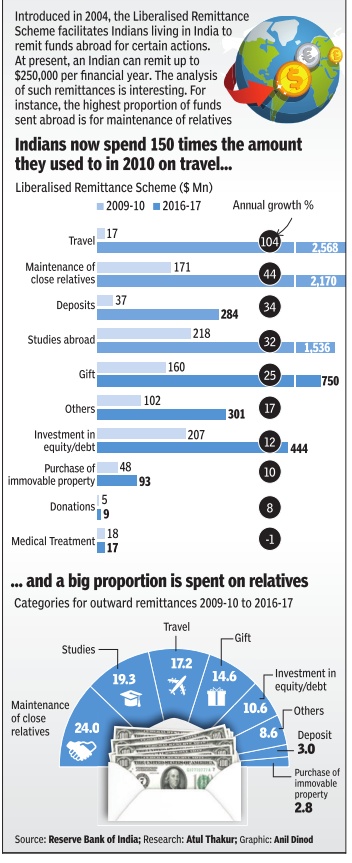

See graphic:

Money spent by Indians on travel, 2009-10-2016-17; categories for outward remittances, 2009-10-2016-17, year-wise

Apr-Feb 2016: surge in outbound remittances

The Times of India, Apr 13 2016

Mayur Shetty

High outbound flows slow deposit growth

Indians Remit 3 Times More In Apr-Feb '16 Than Entire FY15 After RBI Doubles Cap

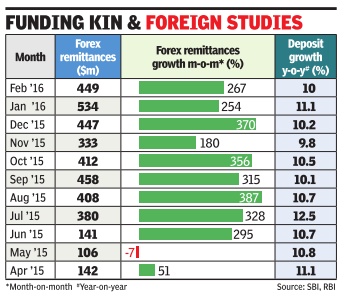

A surge in outbound remittances following a hike in the limit of money that Indians are allowed to send abroad could be one of the causes behind slower deposit growth. In FY15, the total amount sent out of the country was $1.3 billion. As against this, monthly remittances by Indians have been averaging nearly half a billion dollars.

Total outflows under the remittance scheme in FY16 (till February 2016) touched $3.8 billion as against $1.3 billion in the entire 2014-15 financial year . According to a research report by State Bank of India, the increasing outward fund transfers under the liberalized remittance scheme could be one of the reasons for the decline in deposits.

The limit for overseas remittance by an Indian was doubled to $2,50,000 from $1,25,000 on May 26, 2015. Soon after the limit was raised, there was a huge jump in outward remittance under this scheme.From $106 million in May 2015, the remittances reached $449 million in February 2016 -a jump of 324%.

The study shows that among the various categories under which overseas remittances have been distributed, “maintenance of close relatives“ and “studies abroad“ have shown a significant jump, signalling the increasing inclination of Indian parents to send their children overseas to study . “This should be a wake-up call for the government for building better institutions of education within the country . Another category that shows considerable jump is the `travels' component,“ said Soumya Kanti Mishra, chief economist, SBI, in a report.

According to Mitra, contrary to popular perception, high real interest rate is actually leading to lower deposit growth rate. While interest rates have come down, real interest rates have risen as the drop in inflation has been faster than the reduction in interest rates. Deposits with banks have remained sluggish with a growth of 9.9% in FY16 (till March 18, 2016 -a 53year low).

Mitra said that despite deposit rates coming down, the real return for bank customers has gone up due to lower inflation. The drop in nominal rates is causing people to spend more, rather than being encouraged to boost savings.

“The argument of mutual fund inflows acting as a drag on bank deposits is a false negative, as such cheques are actually written on banks in India and unlike the US, mutual funds in India cannot write cheques on their own,“ said Mitra.

See also

Remittances, outbound: India