Remittances, inward: India

This is a collection of articles archived for the excellence of their content. |

The quantum (amount) of remittances

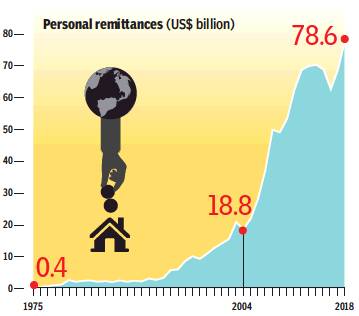

1975-2018: personal remittances

July 11, 2019: The Times of India

From: July 11, 2019: The Times of India

Last year, Indians living abroad sent $78.6 billion (Rs 5.4 lakh crore) home to their families and other households. This was not only a record for personal remittances to India but also exceeded remittances by people of other countries. Forty years ago, personal remittances by Indians amounted to just over a billion dollars.

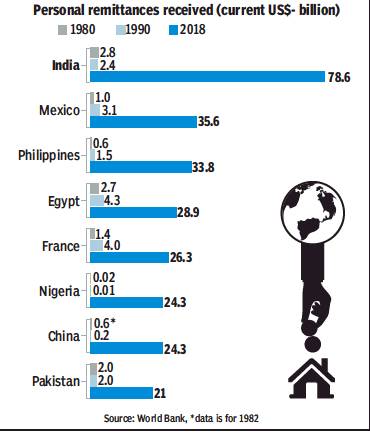

1980-2018: India, China, Pakistan

August 22, 2019: The Times of India

From: August 22, 2019: The Times of India

Expats now send home over half a trillion dollars

In 1970, people working abroad sent home altogether less than $2billion. Last year, such personal remittances from the world’s non-resident population had increased to $626 billion. The Indian diaspora was in first place with almost $79 billion sent home. Mexicans took second place with less than half as much.

2006: Each UK NRI sent £1,000/year home

RASHMEE ROSHAN LALL, Each UK NRI sends £1,000/year home, July 28, 2006: The Times of India

India's overseas sons and daughters loyally continue to send roughly £1,000 each home every year, putting India in the top five recipients of money repatriated from Britain to some of the poorest parts of the world.

A new British government survey of the private money transfer habits of Britain's Asian, African, Caribbean and Chinese communities confirmed that Indians remain one of the biggest contributors to the lives of families and friends back home.

British Indians are second only to British Nigerians in their generosity and zeal over those in the motherland, said officials at the Department for International Department (DFID), which commissioned the survey.

DFID said that more than 50 developing countries receive significant sums in expatriate remittances from the UK and the five largest recipients are Nigeria, India, Pakistan, Jamaica and Ghana. India takes second place on the list, it said.

The survey revealed that more than a third of Britain's ethnic minority households sent an average of £870 home. DFID said that the typical British South Asian family topped that average by nearly £ 200 each.

South Asians, on average, repatriated more than £1,000 last year. Interestingly, British Africans were not far behind the Asians with average remittances of £910.

Despite its increasingly sunshine image in the West as a high-earning, hard-working, high-achieving community, however, the Chinese languished in the lower, sending roughly £ 870 pounds home each.

The Chinese remittances dovetailed with the average figures for black Caribbean Britons, said the survey. Britain's minister for international development Gareth Thomas said on Thursday that this, the most comprehensive survey of private remittances, underlined several important facts.

It showed that "sending money home to families in developing countries plays a vital role in helping to tackle poverty"...

...Thomas's comments come after a recent World Bank report on the increasingly important role of money transfers to developing countries. Expat remittances are now thought to be more than double the world's total aid budget of $106.5 billion.

2015: India, largest remittance recipient

The Times of India, April 14, 2016

India world’s largest remittance recipient in 2015: World Bank

India was the world's largest remittance recipient in 2015 despite experiencing a $1 billion drop from 2014, the first decline in its remittances since 2009, the World Bank said.

India retained its top spot in 2015, attracting about $69 billion in remittances, down from $70 billion in 2014, the World Bank said in its annual report "Migration and Development Brief".

Other large remittance recipients in 2015 were China, with $64 billion, the Philippines ($28 billion), Mexico ($25 billion) and Nigeria ($21 billion). "Remittances to India, the (South Asian) region's largest economy and the world's largest remittance recipient, decreased by 2.1 per cent in 2015, to $68.9 billion. This marks the first decline in remittances since 2009," the World Bank report said.

Officially recorded remittances to developing countries amounted to $431.6 billion in 2015, an increase of 0.4 per cent over $430 billion in 2014. The growth pace in 2015 was the slowest since the global financial crisis, the report said.

Global remittances, which include those to high-income countries, contracted by 1.7 per cent to $581.6 billion in 2015, from $592 billion in 2014, the World Bank said.

"Remittances are an important and fairly stable source of income for millions of families and of foreign exchange to many developing countries," said Augusto Lopez-Claros, Director of the World Bank's Global Indicators Group.

"However, if remittances continue to slow, and dramatically as in the case of Central Asian countries, poor families in many parts of the world would face serious challenges including nutrition, access to health care and education," Lopez-Claros said. According to the report, the growth of remittances in 2015 slowed from eight per cent in 2014 to 2.5 per cent for Bangladesh, from 16.7 per cent to 12.8 per cent for Pakistan, and from 9.6 per cent to 0.5 per cent for Sri Lanka.

"Slower growth may reflect the impact of falling oil prices on remittances from GCC countries," the report said.

For example, in the fourth quarter of 2015, year-on-year growth of remittances to Pakistan from Saudi Arabia and the UAE were 11.7 per cent and 11.6 per cent, respectively, a significant deceleration from 17.5 per cent and 42.0 per cent in the first quarter, the report explained.

Also, deprecation of major sending country currencies (for example, the euro, the Canadian dollar and the Australian dollar) vis-a-vis the US dollar may be playing a role, it noted.

Remittances to Nepal rose dramatically in response to the earthquake, by 20.9 per cent in 2015 versus 3.2 per cent in 2014.

2016: $62.7 billion

At $63bn, India top receiver of remittances, June 16, 2017: The Times of India

Indians working across the globe sent home $62.7 billion in 2016, making India the top remittance-receiving country surpassing China, according to a UN report.

The `One Family at a Time' study by the UN International Fund for Agricultural Development (IFAD) said about 200 million migrants globally sent more than $ 445 million in 2016 as remittances to their families, helping to lift millions out of poverty.

It said 80% of remittances are received by 23 countries, led by India, China, the Philippines, Mexico and Pakistan.The top 10 sending countries account for almost half of annual flows, led by the US, Saudi Arabia and Russia.

The study said India was the top receiving country for remittances in 2016 at $62.7 billion, followed by China ($61 billion), the Philippines ($30 billion) and Pakistan ($20 billion).

In the decade between 2007 and 2016, India surpassed China to become the top receiving country for remittances. In 2007, India was on the second spot, behind China, with $ 37.2 billion in remittances.

2017: Remittances increase by 10%

Atul Thakur, Remittances to India up 10% in 2017, April 25, 2018: The Times of India

ii) Top sources of remittances to India,presumably as in 2017;

iii) Top destinations of remittances from India- 2017; and

iv) The four countries with the highest number of their people having migrated abroad, 2017.

From: Atul Thakur, Remittances to India up 10% in 2017, April 25, 2018: The Times of India

Country Retains Long-Held Position Of Top Remittance Destination Of Migrants

Remittances to India from abroad rose in 2017 after declining for two consecutive years and touched $69 billion, still a little short of the $70.4 billion reached in 2014. Outflows of remittances from India too continued to rise reaching $5.7 billion, according to a World Bank report.

The 9.9% increase in remittance inflows in 2017 was enough to ensure that India comfortably retained its long held position of the largest destination of remittances from international migrants, according to the Bank’s report titled ‘Migration and Remittance Outlook’, released late on Monday.

Of the $5.7 billion sent home by foreigners working in India, Bangladesh alone accounted for over $4 billion or about 71%.

The data also shows that Indians constitute the world’s largest diaspora population, making it the largest source of labour for the world market. In 2017, there were 16.4 million Indians living abroad. Mexico and Russia had 11.9 million and 11million people respectively working in foreign countries. China has the fourth largest overseas population at slightly over 10 million.

Although Bangladesh and Pakistan too have significant migrant populations, this doesn’t get reflected in their remittance receipts. Legal international migration is often seen as a rather costly economic investment and hence only relatively well-off sections of any country’s population are able to afford it. The increase in income levels in China and India and the ever increasing presence of the expat community in the Western world helps augment migration from these countries to the West.

China received $64 billion from its overseas citizens. This was the world’s second highest and the two Asian neighbours accounted for more than one-fifth of the global remittances inflows. They were followed by the Philippines, Mexico and France.

Of the 131 countries from where India received remittances, UAE contributed the highest, $13.8 billion or about 20% of India’s total receipts. The West Asian country was followed by the US, Saudi Arabia, Qatar and UK. There were 12 countries from which India received in excess of $1 billion each. Among them, six are in West Asia, the region accounting for 55.6% of India’s total remittance receipts.

Other than Bangladesh, Nepal and Sri Lanka received 17.9% and 9.1% respectively of remittances flowing out from India. Thus, these three neighbours got about 98% of remittances from India. India was the largest source of remittances to Bangladesh, accounting for about 30% of its total overseas remittances.

With $80bn, India tops remittances list

December 9, 2018: The Times of India

India retains the top spot as the country receiving the largest amount in remittances in 2018 with $80 billion being sent home by the diaspora, a World Bank report said.

It is followed by China ($67 billion), Mexico and the Philippines ($34 billion each), and Egypt ($26 billion). India has been a top country in terms of remittances as the large diaspora in the Gulf and other countries send money home.

The recent floods in Kerala in August is likely to have boosted remittances to India , as migrants sent financial help to families back home, according to the World Bank’s Migration and Development Brief.

Remittances to south Asia are projected to increase by 13.5% to $132 billion in 2018, a stronger pace than the 5.7% growth seen in 2017. The upsurge

is driven by stronger economic conditions in advanced economies, particularly the United States, and the increase in oil prices having a positive impact on outflows from some GCC countries, such as the United Arab Emirates, which reported a 13% growth in outflows for the first half of 2018.

Bangladesh and Pakistan experienced upticks of 17.9% and 6.2% in 2018, respectively. For 2019, it is projected that remittance growth for the region will slow to 4.3% due to a moderation of growth in advanced economies, lower migration to the GCC and the benefits from the oil price spurt dissipating.

The World Bank estimates that officially recorded remittances to developing countries will increase by 10.8% to reach $528 billion in 2018. This new record level follows robust growth of 7.8% in 2017. Global remittances, which include flows to high-income countries, are projected to grow by 10.3% to $689 billion.

2017–21

August 29, 2022: The Times of India

From: August 29, 2022: The Times of India

Mumbai : Private banks, including multinationals, are getting a larger share of the inward remittances from non-resident Indians (NRIs). The reason: North America now plays a more significant role with the US overtaking UAE in remittance flows.

In FY21, the share of US in remittances was 23. 4%, while that of the UAE was 18%. “Flows from North America and Europe are primarily driven by individuals operating in the services sector and hence depend on macroeconomic conditions of the underlying countries,” said a research report by Axis Mutual Fund.

In the Middle East North Africa (MENA) region, rising oil prices fuel a construction and tourism boom, increasing the demand for labour. In FY17, the MENA region accounted for 53% of total remittances to India. The region’s share dropped to 28. 6% in FY21, while North America’s rose marginally to 24% from 23. 9% in FY17.

NRIs in the gulf region largely remit their money to public sector banks. But the North American NRIs mostly use private (and multinational) banks to send money. As a result, the share of private banks in NRIs’ remittances has risen to 53%, overtaking public sector banks which are left with the remaining 47%.

According to the report, the widespread perception that a major chunk of India’s NRI population hails from Kerala is only partly true and is likely to change. Rising wages in the southern states have resulted in a drop in emigration. Nearly 50% of emigration cleared by the external affairs ministry in 2020 was from other states like Uttar Pradesh, Orissa, Bihar and West Bengal.

“The role of remittances in GSDP (gross state domestic product) is already falling in states like Kerala (7. 5% as of FY21) and Karnataka, whereas it is rising in northern states. Significant rise in remittance percentage of the GSDP in Maharashtra and Delhi could be support to families, given the severe Covid impact and the GSDP itself falling drastically during FY21,” the report said.

2018, $79 billion: India highest recipient of remittances

India retained its position as the world's top recipient of remittances with its diaspora sending a whopping $79 billion back home in 2018, the World Bank said in a report.

India was followed by China ($67 billion), Mexico ($36 billion), the Philippines ($34 billion), and Egypt ($29 billion), the global lender said.

With this, India has retained its top spot on remittances, according to the latest edition of the World Bank's migration and development brief.

Over the last three years, India has registered a significant flow of remittances from $62.7 billion in 2016 to $65.3 billion 2017.

"Remittances grew by more than 14 percent in India, where a flooding disaster in Kerala likely boosted the financial help that migrants sent to families," the bank said.

In Pakistan, remittance growth was moderate (seven per cent), due to significant declines in inflows from Saudi Arabia, its largest remittance source. In Bangladesh, remittances showed a brisk uptick in 2018 (15 per cent).

According to the report, remittances to low-and middle-income countries reached a record high of $529 billion in 2018, an increase of 9.6 per cent over the previous record high of $483 billion in 2017.

Global remittances, which include flows to high-income countries, reached $689 billion in 2018, up from $633 billion in 2017, it said.

The Bank said, remittances to South Asia grew 12 per cent to $131 billion in 2018, outpacing the six per cent growth in 2017.

"The upsurge was driven by stronger economic conditions in the United States and a pick-up in oil prices, which had a positive impact on outward remittances from some GCC countries," it said.

The Gulf Cooperation Council (GCC) is a regional inter-governmental political and economic bloc of Bahrain, Kuwait, Oman, Qatar, Saudi Arabia and the UAE.

However, the Bank in its report rued that the global average cost of sending $200 remained high, at around seven per cent in the first quarter of 2019.

Reducing remittance costs to three per cent by 2030 is a global target under Sustainable Development Goal (SDG) 10.7. Remittance costs across many African corridors and small islands in the Pacific remain above 10 per cent.

On ways to lower remittance costs, Dilip Ratha, lead author of the Brief and head of KNOMAD, said, "Remittances are on track to become the largest source of external financing in developing countries. The high costs of money transfers reduce the benefits of migration. Renegotiating exclusive partnerships and letting new players operate through national post offices, banks, and telecommunications companies will increase competition and lower remittance prices."

2018-19

Lubna Kably, Nov 28, 2019: The Times of India

From: Lubna Kably, Nov 28, 2019: The Times of India

India continues to retain its position as the world’s top recipient of remittances, with its diaspora sending back $78.6 billion in 2018. Considering that India’s diaspora is the largest in the world, at 17.5 million (as of mid-2019), this ranking in terms of remittances is not surprising. India’s remittances were 14% of the global remittance figure of $689 billion. China was next in line, with remittances of $67.41 billion (which is 5.4% of the global remittance figure).

Even in 2010 and 2015, for which data is available, India was the top recipient of remittances. Remittances during 2010 were $53.48 billion, rising to $68.91 in 2015 — an increase of nearly 29%. The increase in remittance between 2015 and 2018 is 14%. As compared with the remittances in 2010, the latest figure of $78.61 billion shows a rise of nearly 47%. These statistics were disclosed in the World Migration Report 2020, which was released by International Organisation for Migration (IOM), which is United Nation’s migration unit.

High income countries are almost always the main source of remittances. For decades, the US has consistently been the top remittance-sending country, with a total outflow of $68 billion, followed by UAE ($44.4 billion) and Saudi Arabia ($36.1 billion), the report states.

TOI had in its edition of September 19 analysed the raw data set that had been released by the UN earlier, which is now contained in the migration report. At 17.5 million, India’s diaspora was the largest in the world during 2019, with majority of Indians in UAE (3.4 million), US (2.7 million) and Saudi Arabia (2.4 million). Mexico’s diaspora of 11.8 million was the second largest, followed by China at 10.7 million.

2020: India and the other Top 9 recipients

From: May 14, 2021: The Times of India

See graphic:

2020: India, Bangladesh, China, Pakistan and the other top recipients of inward remittances

2020-21

Country-wise

Mayur Shetty, July 18, 2022: The Times of India

From: Mayur Shetty, July 18, 2022: The Times of India

Mumbai: The US is playing an important role in the supply of foreign exchange not just in terms of investment and trade but also in remittances from non-residents — an area hitherto dominated by the Gulf region. Since Covid, the composition of remittances has changed, and India’s linkage to the US economy has increased.

According to an article by the Reserve Bank of India (RBI) on the impact of Covid on remittances, in 2020-21, the US surpassed the United Arab Emirates (UAE) as the top source country, accounting for 23% of total remittances in 2020-21. This corroborates with the World Bank’s report in 2021, citing economic recovery in the US as one of the important drivers of India’s remittances growth.

Remittances from overseas workers — one of the biggest suppliers of foreign exchange to India — have helped the country to live with a current account deficit. Money sent by non-residents has helped the economy during past crises, including the aftermath of the Lehman Brothers collapse, with remittances peaking at 4% of GDP in 2009. In FY21, remit- tances amounted to $87 billion, nearly 2. 75% of GDP.

The RBI article said that the share of remittances from the Gulf Cooperation Council (GCC) region in India’s inward remittances is estimated to have declined from more than 50% in 201617 (last surveyed period) to about 30% in 2020-21. Amid the steady migration of skilled workers, the US, the UK and Singapore emerged as important source countries of remittances, accounting for 36% of total remittances in 2020-21.

The UAE, the US and Saudi Arabia have been the three major destinations of Indian migrants for the past two decades. Out of the total migrants from India, 48. 6% were in the UAE, the US and Saudi Arabia as of end-2020.

Historically, the GCC region accounted for half of India’s remittances, making up for a major chunk of the oil trade deficit with the region. Post-Covid, the migration pattern to the GCC countries has changed significantly with a sharp contraction in the number of emigration clearances (ECs) issued since 2015, generally issued to unskilled or semi-skilled workers and women seeking overseas employment.

Analytic graphics

From: Sushmita Choudhury, Sources: World Bank, Institute for the Study of Labor, United Nations' reports, Nov 24, 2021: The Times of India

From: Sushmita Choudhury, Sources: World Bank, Institute for the Study of Labor, United Nations' reports, Nov 24, 2021: The Times of India

From: Sushmita Choudhury, Sources: World Bank, Institute for the Study of Labor, United Nations' reports, Nov 24, 2021: The Times of India

From: Sushmita Choudhury, Sources: World Bank, Institute for the Study of Labor, United Nations' reports, Nov 24, 2021: The Times of India

See graphics:

India remittances growth (yoy growth) and oil price, 2008- 21

Regional remittance costs, 2020-21

5 least expensive corridors in South Asia, 2020-21

5 most expensive corridors in South Asia, 2020-21

Statistics:1990- 2020

From: May 11, 2024: The Times of India

See graphic:

Personal remittances received in India from Indians living and working abroad, 1990- 2020

2020-2023

Lubna Kably TNN, May 9, 2024: The Times of India

Mumbai: India is the origin of the largest number of international migrants — nearly 18 million, with large diasporas in the UAE, US and Saudi Arabia. And it continues its march as the top country receiving remittances from its diaspora: the figure crossed $110 billion in 2022.

According to the World Migration Report, 2024, released in Dhaka on Wednesday by the UN's International Organisation for Migration, India, Mexico and China were the top three remittance recipient countries in 2022, followed by the Philippines, France and Pakistan. India received $111 billion, the first country to reach and even surpass the $100-billion mark. In 2020, it had received $83 billion. Mexico, with inward remittances of $61 billion, was the second-largest recipient; in the previous year it had replaced China to occupy the second spot and continued to hold sway.

The report points out that international remittances have recovered from the dip in 2020 due to the pandemic. Migrants sent an estimated $831 billion in international remittances globally in 2022.

Size of migration corridors hints at top sources of remittances

UAE Has 3.5m Indians, US 2.7m And Saudi Arabia 2.5m: IOM Report

The figure of $831 billion for international remittances globally is an increase from $791 billion in 2021 and significantly more than $717 billion in 2020.

China’s inward remittances in 2022 were $51 billion. The contraction and its slipping to third spot has been attributed to multiple factors, including demographic shifts that have resulted in shrinking of the working age population and the country’s zero-Covid policy, which prevented people from travelling abroad for work. During 2022, India’s other neighbouring countries Pakistan (rank 6) saw an inflow of nearly $30 billion and Bangladesh (rank 8) received $21 billion.

Migration corridors: In 1970, there were just 84 million international migrants, which translated to 2.3% of the world’s population. By mid-2020 (per latest available data), nearly 280 million people lived in a country other than their country of birth, constituting 3.6% of the world’s population.

The size of a migration corridor from ‘country A’ to ‘country B’ is measured as number of people born in ‘country A’ who were residing in ‘country B’ at the time of the estimate. The Mexico-to-US corridor is the largest in the world at nearly 11 million people. This is fol- lowed by the Syrian Arab Republic to Turkiye and Russian to Ukraine corridors, attributed largely to displacement of people owing to civil unrest and invasions. The India-UAE corridor is the fourth largest. An interactive map released by IOM shows there were 3.5 million Indians in UAE, followed by 2.7 million in US (which was the sixth largest international migration corridor) and 2.5 million in Saudi Arabia (in ninth position).

The report does not sepa- rately reflect the top source countries of inward remittances to India, but understandably it would be from the top diaspora-centric countries. US and Saudi Arabia were the top two in the list of those sending remittances overseas, with outflows of $79 billion and $39 billion, respectively, in 2022.

Net migration is the difference between inflow of migrants into a country and those who migrate from it overseas. For 10 countries including India, estimated net outflow of migrants exceeded one million over the period from 2010 through 2021. India’s net migration flow was (–)3.5 million during this period. Interestingly, India, which in mid-2020 had the largest diaspora of nearly 18 million (1.3% of the global population) occupied the 13th rank as a destination country, hosting 4.5 milliom migrants (0.3% of the global population).

2022

Remittances to India and other low and middle income nations in 2022

Dec 1, 2022: The Times of India

From: Dec 1, 2022: The Times of India

New Delhi : Remittance flows to India are estimated to grow 12% to reach $100 billion for the first time this year — way ahead of Mexico, China and Philippines — according to World Bank’s Migration and Development brief, helping India retain the top position.

The multilateral body said that several longerand short-term trends that were obscured by the pandemic were catalytic in spurring remittance flows to India.

It pointed out remittances have benefitted from a gradual structural shift in Indian migrants’ key destinations — from largely low-skilled, informal employment in Gulf countries to a dominant share of high-skilled jobs in highincome countries such as theUS, the UK, Singapore, Japan, Australia & New Zealand. At $100 billion, remittances from Indians overseas will be 25% higher than FDI flows, which the government estimated will reach around $80 billion this year.

At $100bn, remittances higher than FDI

Between 2016-17 and 2020-21, the share of remittances from the US, the United Kingdom and Singapore increased from 26% to over 36%, while the share from the five Gulf Cooperation Council (GCC) countries (Saudi Arabia, UAE, Kuwait, Oman, and Qatar) dropped from 54% to 28%,” the World Bank said.

In 2020-21, the US had surpassed the UAE as the top source country, with a share of 23% of total remittances. Citing the US Census, it said that of the approximately five million Indians in the US in 2019, about 57% had lived in the nation for morethan 10 years. Elaborating further, the report said that during this time, many earned graduate degrees that groomed them to move rapidly into the highest-income-earner category.

Remittances are seen as a crucial source of foreign exchange. At $100 billion, remittances from Indian workers overseas will be 25% higher than the FDI flows, which the government estimated will reach around $80 billion this year. The money that workers send home will also help close some of the gap created by a higher trade deficit, which is the gap between imports and exports. Thanks to high oil and other commodity prices, importshave soared at a faster pace than exports this year. The report said that the structural shift in qualifications and destinations has accelerated growth in remittances tied to high-salaried jobs, especially in services. “During the Covid-19 pandemic, Indian migrants in high-income countries worked from home and benefited from large fiscal stimulus packages. Post pandemic, wage hikes and recordhigh employment conditions supported remittance growth in the face of high inflation,” it said.

Besides, the economic conditions in Gulf countries, which accounts for nearly a third of the remittances, played out in India’s favour as a majority of migrants, who are blue-collar workers, returned home during the pandemic. “Vaccinations and the resumption of travel helped more migrants to resume work in 2022 than in 2021. GCC’s price support policies kept inflation low in 2022, and higher oil prices increased demand for labour, enabling Indian migrants to increase remittances and counter the impact of India’s record-high inflation on the real incomes of their families,” according to the report. Further, the depreciation of the rupee against the dollar may have resulted in increased remittance flows.

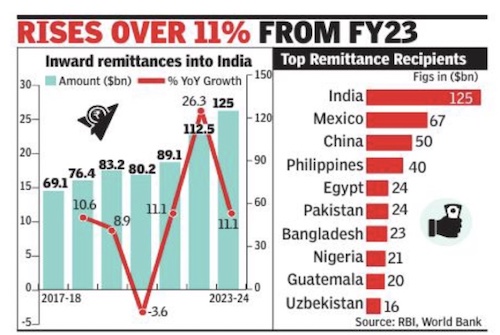

2023

Dec 19, 2023: The Times of India

From: Dec 19, 2023: The Times of India

India stays No. 1 in remittances, up 11% to $125bn

Remittances to India are estimated to rise over 11% to $125 billion in 2023, helping it retain the top spot ahead of Mexico ($67 billion) and China ($50 billion), data released on Monday showed. A strong base of skilled and unskilled workers in the US, UK, Singapore and Gulf nations is expected to result in an 8% rise in flows to around $135 billion in 2024, according to the World Bank’s latest migration and development brief. Driven by remittances to India, flows to South Asia are estimated to have grown 7.2% in 2023 to reach $189 billion, tapering off from the over 12% rise in 2022.

With $125bn, India retains top spot in remittance chart: WB

Says Strong Labour Mkts In Source Countries Key Drivers

TIMES NEWS NETWORK

New Delhi : Remittances to India are estimated to rise over 11% to $125 billion in 2023, helping it retain the top spot ahead of Mexico ($67 billion) and China ($50 billion), data showed.

A strong base of skilled and unskilled workers in the US, the UK, Singapore and Gulf nations is expected to result in an 8% increase in flows to around $135 billion in 2024, World Bank’s latest migration and development brief showed. Driven by remittances to India, flows to South Asia are estimated to have grown 7.2% in 2023 to reach $189 billion, tapering off from the over 12% increase in 2022. These flows are significant for a country like India as it helps reduce the impact of falling foreign direct investment and higher trade deficit. It said the key drivers of remittance growth in 2023 are a historically tight labour market in the US, high employment growth in Europe reflecting extensive leveraging of worker retention programmes, and a dampening of inflation in high-income countries. The US has continued to be the largest source of remittances, followed by Saudi Arabia. As a share of GDP, however, Saudi Arabia has a significantly larger volume of outward remittances than the US. Top remittance source nations include several countries of the Gulf Cooperation Council (GCC).

The main contributing factors are declining inflation and strong labour markets in high-income source countries, which boosted remittances from highly skilled Indians in the US, the UK, and Singapore, which collectively account for 36% of total remittance flows to India.

The report said that remittance flows to India were also boosted by higher flows from the GCC, especially the UAE, which accounts for 18% of India’s total remittances and is the second-largest source of them after the US. Remittance flows to India benefited particularly from its February 2023 agreement with the UAE for setting up a framework to promote the use of local currencies for cross-border transactions and cooperation for interlinking payment and messaging systems.

“The use of dirhams and rupees in cross-border transactions would be instrumental in channelling more remittances through formal channels. More generally, despite low oil prices and production cuts, and a near collapse in GDP growth in the GCC from 8% in 2022 to 1.5% in 2023, lower inflation (2.6% in 2023 compared with 3.3% in 2022) orchestrated by domestic policy played a key role in sustaining Indian migrants’ ability to continue to send remittances to India,” said the report.

2000-24

April 2, 2025: The Times of India

Millions of Indians working and studying abroad are sending record amounts of money back. But it’s not just the volume that’s changing — it’s also who is sending money, from where, and how. A recent RBI report reveals a quiet transformation in the story of India’s global migrants, finds Richa Gandhi

From Gulf Workers to Global Professionals

The New Face of India’s Remittances

Millions of Indians working and studying abroad are sending record amounts of money back home. But it's not just the volume that's changing — it's also who is sending the money, from where, and how. A recent RBI report reveals a quiet transformation in the story of India's global migrants.

India Retains Global Remittance Leadership

India topped the global remittance chart in 2024, as it has consistently done for nearly two decades. Top countries by remittance inflows in 2024 (in USD Billion):

India: $129 bn

Mexico: $68 bn

China: $48 bn

Philippines: $40 bn

France: $37 bn

Egypt: $33 bn

Pakistan: $26 bn

Remittances Surpass Foreign Investment

Remittances from Indians abroad have consistently exceeded foreign direct investment (FDI). In 2023-24:

Remittance Inflow: $119.5 bn

Total FDI Inflow: $71.3 bn This indicates that families, rather than corporations, are fueling India’s economy.

Cushioning India’s Trade Deficit

Remittances help offset India's trade deficit. While the trade deficit reached $241.1 bn in 2024, remittance inflows of $119.5 bn provided a significant buffer, consistently covering nearly 50% of the gap.

India Leads the World on Transfer Costs

Sending money to India is among the cheapest globally.

Average cost of sending $200 globally: 6.65%

India Average: 5.0%

India Digital Channels: 4.0% Digital platforms have made remittances faster and more affordable.

Digital Takes Over: 3 in 4 Remittances Now Online

73.5% of remittances to India now arrive via digital channels, indicating a clear move away from cash-based transfers. Digital transfer shares by country:

Saudi Arabia: 92.7%

Australia: 89.5%

Qatar: 76.2%

UAE: 75.2%

US: 69%

UK: 65.2%

Kuwait: 63.2%

Global Average: 73.5%

Maharashtra and Kerala Lead in Remittance Inflows

Between 2023–24, Maharashtra emerged as the top recipient of remittances, followed by Kerala and Tamil Nadu. Top States Receiving Remittances (% of total):

Maharashtra: 20.5%

Kerala: 19.7%

Tamil Nadu: 10.4%

Telangana: 8.1%

Karnataka: 7.1%

These figures reflect increased student and professional migration from these states.

US, UK, and Singapore Now Top Remittance Sources

There has been a major shift in remittance sources over the last seven years:

The US surged to become the top remitter, overtaking Gulf countries.

The UK and Singapore also rose significantly, pointing to a migration trend from blue-collar jobs in the Gulf to white-collar employment in developed nations.

Top Source Countries (2023–24):

US: 28%

UAE: 19%

UK: 14%

Saudi Arabia: 7%

Singapore: 7%

Impact on Kerala

2016: Gulf remittances

The Times of India, May 06 2016

Subodh Varma

The simmering crisis in the Gulf region, an impact of plummeting oil prices and global economic woes, is sending ripples across the seas to pollbound Kerala. There are over 2.4 million Keralites working abroad of which 85% work in the Gulf region, according to the Kerala Migration Study (KMS 2014) by Centre for Development Studies, Thiruvananthapuram. That's over 2 million emigrant workers.

The remittances sent home by this huge workforce is estimated at Rs 24,374 cr while total remittances, which include investment flows etc.add up to over Rs 71,142 cr as per the study. About 19% households currently had an emigrant member while another 29% had in the past.

Remittances make up over a third of the net state domestic product -20% more than the revenue income of the state government and five times the funds the Centre gives the state.

But all this is changing. Since 2014, remittances inflow started faltering; it has since dipped by over Rs 23,350 cr in 2015 (World Bank). This follows a smaller slip in 2014. Can this likely impact the elections? The decline is not big, it will not have a big effect says S Irudaya Rajan, CDS professor and a co-author of the study . The impact will be visible if the decline continues for three to five years, he believes, adding that the emigrant Keralite does play a significant role in elections.

“In earlier elections, about 10,000 emigrants came back to vote. But more importantly , the 2.4 million Keralites working abroad have their wives, brothers, sisters and parents, estimated to be about 10 million votes in Kerala. They can change the political scenario of Kerala, if they influence their families,“ Irudaya Rajan said.

The long term trends of emigration are not very rosy says the KMS analysis. Emigration is likely to decline not because of external factors but due to Kerala's contracting youth population, better education, higher wages in India and prospects in other states.

There were an estimated seven lakh migrants living in other states of India in 2014 while about four lakh Keralites had returned back to the state after working in other states.While these numbers are small compared to emigrants going abroad, but adding the two together, the total number of Keralites seeking work outside the state is enormous. This is an indication of the severe employment crisis in the state which will cast a shadow on the electoral process.

Remittances and the global oil economy

2016

Remittances slip on oil, down $1.5 billion

Subodh Varma

Global economic slow down and turmoil has led to a decline in remittances -money sent from Indians working abroad -in 2015, an estimate by the World Bank indicates.

Although India still continues to be the topmost remittance receiving country , the flow was $68.9 billion in 2015, a dip of about $1.5 billion over 2014.

This is the first time since the global financial crisis of 2008-09 that remittances have gone down.

Falling oil prices, sluggish growth in the United States, slowing economies in Europe and adverse currency exchange rates have contributed to this decline, said DilipRatha, who heads the World Bank unit responsible for studying global migration and remittances.

“India gets remittances from all over the world but the bulk comes from the oil producing Gulf countries, US and also Europe. The effect of oil glut and resultant downswing of economies in the Gulf countries has had some delayed impact on remittances,“ he told.

The effect of global economic turmoil was becoming evident in remittance flows to India since 2013 when yearly growth plummeted to just 1.7% over 2012. In 2014, inflows increased by just 0.6% . The last time remittances had declined was in 2009.

For countries where clear data is not available, the number of migrants from a country , and the cost of living in both the source and receiving countries are used to work out an estimate of remittances, Ratha explained. The data also does not capture money flows through informal channels, like hawala.

A notable feature of India's inbound remittances is the $9 billion coming in from the neighbours. These are based on estimates made by UN of Indian born people residing in these countries.

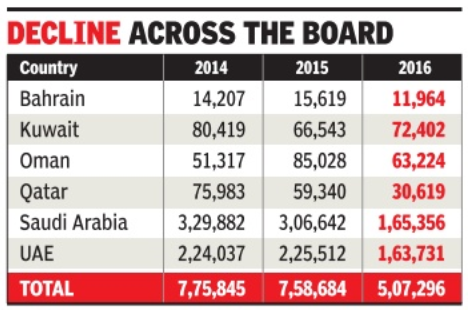

2017: Fewer Indians head to Gulf, remittances dip

The number of Indian workers emigrating to the Gulf for work has dropped in the past couple of years, possibly due to slowing economies of countries part of the Gulf Cooperation Council (GCC), which have been hit by weaker oil prices. The decline has been significant between 2014 and 2016.

According to official figures, the number of Indian workers emigrating to the GCC countries was 775,845 in 2014 and fell to 507,296 in 2016.Though disruptions due to the Islamic State were largely in Iraq-Syria, the instability affected perceptions about the region as a whole.

The reduced flow of Indian workers to the Gulf is seen to have impacted remittances from these countries. While the breakup is not available, overall remittances as recor ded in India's balance of payments statistics fell slightly from $69,819 million in 2014-15 to $65,592 million in 2015-16.

In terms of number of Indians emigrating, Saudi Arabia showed a sharp decline from 329,882 in 2014 to 165,356 in 2016, almost a 50% drop.Part of this is attributable to a slowing Saudi economy due to low oil prices. But for the past few years, Saudi Arabia has been following what the Indian government calls a `Saudiisation' policy , which is aimed at employing more Saudi nationals rather than foreigners.

“This is to encourage the private sector to employ greater number of Saudi nationals as well as to reducing reliance on expatriate workers. Further, against the backdrop of declining oil prices, the Saudi government has introduced a number of new taxesVAT to augment the sources of government revenue,“ the foreign ministry told Parliament this week.

One of these is the dependant tax, which started on July 1, reported by TOI earlier. From this year, Saudi Ara bia has begun levying a de pendant tax on non-nationals residing in the kingdom. The tax rate is SR 100 (Rs 1,700 approx) per month on each dependent. It will be increased to SR 200 in 2018, SR 300 in 2019 and SR 400 in 2020 per dependent member of the expatriate family ,“ Saudi government said. There are around 3 million Indians in Saudi Arabia.

For now, official figures do not show any noticeable impact on Indians there. Indian officials had, however, raised the issue with a visiting Saudi delegation on July 11, the MEA told the House.

In Bahrain, a construction company employing nearly 1,500 Indians laid off around 700 workers but was unable to repatriate them after clearing their dues due to the financial crisis. All such stories have an adverse impact on worker mobility. Indians also continue to get duped by fake recruiting agents. Instances of mistreatment of Indian workers could have added to the slowdown.

Source countries

2017 – 2024

March 21, 2025: The Times of India

The main states that received the remittances

From: March 21, 2025: The Times of India

Mumbai : While Gulf nations still host about half of Indian migrants, more skilled workers are moving to advanced economies with the US contributing 27.7% of total remittances. According to a study published by RBI,India’s remittance patterns are shifting as advanced economies surpass the Gulf as the dominant source. In 2023-24, over half of total remittances came from advanced economies, reflecting a rise in skilled migration.

While the US is the largest source, rising to 27.7% in FY24 (from 23.4% in 2020-21), reflecting a steady recovery in the US job market, the share of UK has also increased to 10.8% in 2023-24 from 6.8% in 2020-21, which may be attributed to the ‘Migration and Mobility Partnership’ (2021) between India and the UK,” the report said.

Remittances also grew from Singapore (6.6%), Canada (3.8%), and Australia (2.3%). GCC countries (UAE, Saudi Arabia, Kuwait, Qatar, Oman, &Bahrain) contributed 38%. State-wise, Maharashtra received the largest share of remittances at 20.5%, followed by Kerala at 19.7% and Tamil Nadu at 10.4%. Telangana and Karnataka also received significant inflows. A growing number of Indian students are opting for non-GCC countries for higher education.

India’s migrant stock has tripled since 1990 to 18.5 million, with its share of global migrants rising from 4.3% to 6%. With the country’s working-age population set to rise until 2048, it is expected to remain the world’s leading labor supplier.

Continuous upskilling and reskilling will be critical in maximising this potential, the report published in RBI’s latest bulletin said. Remittances remain a major source of foreign exchange, consistently exceeding gross inward FDI flows and serving as a key buffer against external shocks. They have accounted for around 3% of GDP since 2000, far exceeding China’s 0.3%, though trailing the Philippines. India’s remittances have more than doubled from $55.6 billion in 2010-11 to $118.7 billion in 2023-24, growing at an average annual rate of 14.3% post-pandemic. They also help fund the country’s merchandise trade deficit, reinforcing their economic significance.

Transaction fees

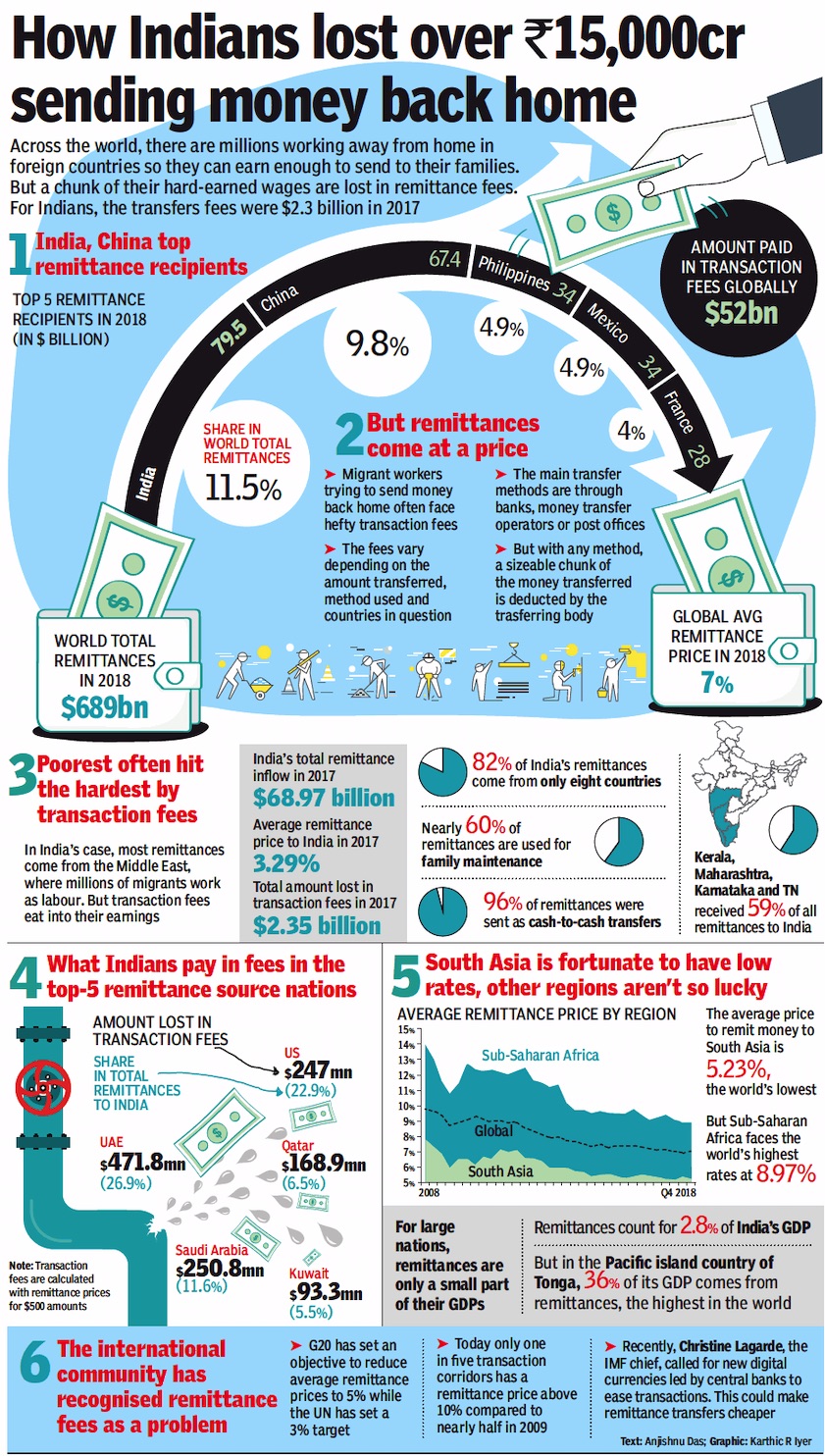

2018: remittances and transaction fees

From: February 6, 2019: The Times of India

See graphic:

2018: remittances sent home by Indians, Chinese and others, and the transaction fees paid by them

See also

Remittances, inward: India