Remittances, outbound: India

This is a collection of articles archived for the excellence of their content. |

Contents |

Forex fees

2020-21

Oct 28, 2021: The Times of India

From: Oct 28, 2021: The Times of India

MUMBAI: Indians paid nearly Rs 9,700 crore in the form of fees hidden in inflated exchange rates while making remittances in 2020. This is more than a third (36%) of the total fees of Rs 26,300 crore that Indians paid for sending money across their country’s borders.

The fees reflect a lack of transparency and high charges applied by banks on remittances. Banks have been reducing the fees on foreign remittances and their income under this head fell from Rs 15,017 crore in 2016 to Rs 12,142 crore in 2019. However, they have protected themselves by recovering Rs 4,422 crore through exchange mark-up in 2020, which was up from Rs 2,505 crore in 2016.

These figures were from independent research carried out by Capital Economics in August 2021, which aimed to estimate the scale of foreign exchange transaction fees in India. The study was released by Wise, the technology company that was founded with the objective of reducing cross-border remittance costs.

Overseas workers sending money into India are also losing money. Over the past five years, money lost to exchange rate margins on inward remittances has grown from Rs 4,200 crore to Rs 7,900 crore. Meanwhile, fees paid to transaction costs have grown from Rs 10,200 crore in 2016 to Rs 14,000 crore in 2020.

“A significant portion of these fees paid on remittances to India come from people in Gulf countries where most are employed in blue-collared jobs to support their families back home in India,” a statement issued by Wise said. Of the share of total fees paid on inward remittances to India in 2020, Saudi Arabia ranked first at 24%, followed by the US (18%), the UK (15%), Qatar (8%), Canada (6%), Oman (5%), UAE (5%), Kuwait (5%), and Australia (4%).

“While technology and internet have eased some of the issues related to the convenience and speed of foreign funds transfers, the age-old practice of hiding fees in the exchange rate results in people spending too much on hidden foreign currency fees — money which should rightfully stay in their pockets,” said Wise India country manager Rashmi Satpute. Indian consumers spending abroad paid Rs 1,441 crore as transactions fees, of which Rs 1,303 crore was hidden charges in the form of exchange mark-up.

Liberalised Remittance Scheme (LRS)

The Times of India, Apr 05 2016

What's illegal in owning a firm abroad? Does LRS enable round-tripping? What's illegal in owning a company abroad?

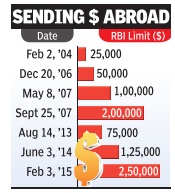

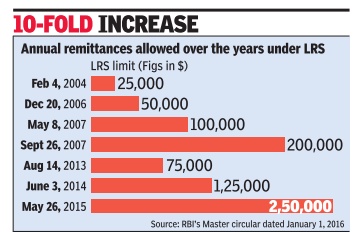

The amount and purpose of remitting money abroad has historically been tightly controlled by the RBI. Till 2004, all investments abroad required prior approval of the central bank. Sending money overseas by resident Indians was made simpler in 2004 with the introduction of the Liberalised Remittance Scheme (LRS). Since then, the amount of money that can be remitted without approval has been increased by 10 times -from $25,000 to $250,000.

Along with liberalisation, disclosure norms under other legislations have been changed. For example: details of foreign assets have to be disclosed in the I-T returns.

An amnesty scheme -the Black Money (Undisclosed foreign income and assets) and Imposition of Tax Act, 2015 -had provided a three-month window which expired in September last year, to declare undisclosed assets held abroad and pay taxes and penalty on the value of assets declared. Under this scheme, 644 declarations were made involving Rs. 4,164 crore.

The Panama Papers disclose that certain Indian residents hold shares in firms incorporated through Panama based firm Mossack Fonseca. TOI walks you through key disclosure requirements relating to remittance of money and shows the potential misuse of the LRS regulations.

What is LRS?

Under LRS, all resident individuals (including minors), are allowed to remit up to $250,000 in a financial year for any permissible current account (such as for medical treatment or education) or capital account transactions (such as buying property overseas, or holding shares in an overseas company) or a combination of both. No prior permission from the RBI is needed.

On June 1, 2015, the RBI reiterated that the permissible capital account transactions include the following: opening of foreign currency account abroad with a bank; purchase of property abroad; making investments abroad; setting up wholly owned subsidiaries and joint ventures abroad; and extending lo ans to NRI relatives.

Another circular issu ed recently on January 1, 2016 also sta tes the same.

However, remit ting money overseas to certain countries (such as Pakistan) or for certain purposes is prohibited under For instance, buying LRS. For instance, buying overseas lottery tickets or sweep stakes is not allowed, nor can one purchase foreign currency convertible bonds (FCCBs) issued by Indian firms abroad.

Did grey areas exist about holding of shares in an overseas company or setting up of a company abroad?

While holding of shares of an overseas company has been permitted since 2004, a grey area prevailed for a few years on whether a resident Indian individual was permitted to set up a company overseas -as opposed to acquiring shares in an existing overseas company .

In an FAQ dated September 17, 2010, the RBI had said: “LRS did not permit remittance by an individual for setting up a company overseas“. This FAQ did not specifically prohibit investing in shares of existing overseas companies.

Representations were made to the RBI and subsequent notifications cleared the air.The RBI's notification dated March 5, 2013 but published on August 5, 2013 clarified that an overseas company can be set up by a resident Indian individual. However, experts claim that for the period between 2010-2013 a grey area continues on the legality of setting up of overseas companies by resident individuals.

The 2013 notification has added that the joint venture or wholly owned subsidiary to be acquired or set up by a resident individual shall be an operating entity only .

This overseas company could not in turn act as an investment company and acquire another subsidiary or set up another subsidiary (In technical terms, there was a prohibition on stepdown subsidiaries be it fully owned or by way of controlling interest.

In other words, a company in a tax haven, be it Panama, or the British Virgin Island, which has been set up under the LRS scheme by a resident individual, cannot invest in another company , say a company in India.

Does LRS enable roundtripping?

Round tripping involves getting money out of one country (say India) and sending it to a tax haven only to be dressed up as foreign capital and sent back to India.

While LRS permits holding shares in an overseas company or even setting up a JV or WOS overseas, it is clear that such an overseas company has to be an operating entity engaged in business.Such a company cannot have a step down subsidiary (as ex plained above). Thus, round tripping isn't permissible.

However, experts point out that there are instances where the overseas company in a tax haven (set up under the LRS route), buys shares in an Indian private company at prices lower than fair market value (the shares are undervalued) and subsequently on sale of such shares makes a killing. In other words, the overseas company makes investments in an Indian company contrary to the LRS norms.

For instance, if the over seas company is a Mauritius firm, the capital gains arising on a subsequent sale of shares of the Indian investee company is not taxable in India under the India-Mauritius tax treaty . If a Panama Company has been incorporated, typically the shares in the Indian company are held via an intermediary company in Mauritius, to avoid tax on capital gains.

As the ownership in some offshore companies is opaque, such as in Panama where bearer shares do not have the name of the shareholder, keeping track of such roundtripping is difficult for Indian regulatory authorities.

Have tax disclosure norms been strengthened?

For the first time, in respect of the financial year 2011-12, resident individuals had to file details of foreign assets in their income-tax returns, which included: bank accounts held in foreign countries (details of the bank, the account held and peak balance during the year); financial interest in a foreign entity (including the investments made); overseas immovable property , any other assets held outside India.

The disclosure details have been tightened with the income-tax returns for the financial year 2014-15 calling for disclosures in foreign trusts (even if the Indian resident taxpayer was a beneficiary or trustee).

Failure to furnish I-T returns or furnishing incorrect details entails significant penalty of up to Rs 10 lakh and imprisonment of up to seven years.

Funds remitted abroad

2009-2017, year-wise

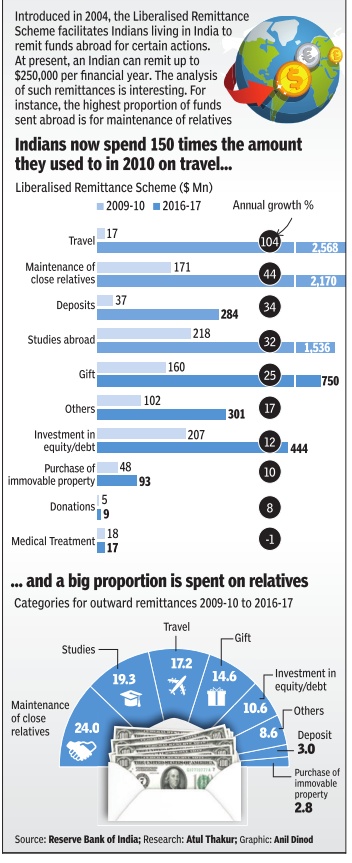

From: October 18, 2017: The Times of India

See graphic:

Money spent by Indians on travel, 2009-10-2016-17; categories for outward remittances, 2009-10-2016-17, year-wise

2013-18

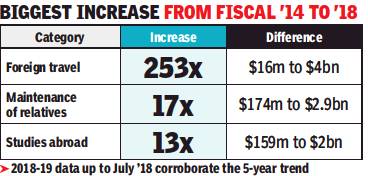

From: Mayur Shetty, Spends on foreign trips up 253x in 5 yrs, September 15, 2018: The Times of India

See graphic:

Outbound remittances from India, 2013-18

Apr-Feb 2016: surge in outbound remittances

The Times of India, Apr 13 2016

Mayur Shetty

High outbound flows slow deposit growth

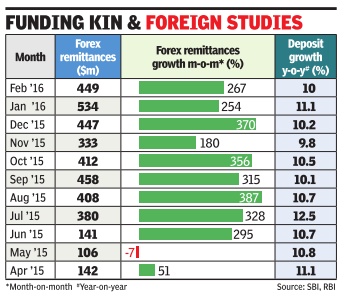

Indians Remit 3 Times More In Apr-Feb '16 Than Entire FY15 After RBI Doubles Cap

A surge in outbound remittances following a hike in the limit of money that Indians are allowed to send abroad could be one of the causes behind slower deposit growth. In FY15, the total amount sent out of the country was $1.3 billion. As against this, monthly remittances by Indians have been averaging nearly half a billion dollars.

Total outflows under the remittance scheme in FY16 (till February 2016) touched $3.8 billion as against $1.3 billion in the entire 2014-15 financial year . According to a research report by State Bank of India, the increasing outward fund transfers under the liberalized remittance scheme could be one of the reasons for the decline in deposits.

The limit for overseas remittance by an Indian was doubled to $2,50,000 from $1,25,000 on May 26, 2015. Soon after the limit was raised, there was a huge jump in outward remittance under this scheme.From $106 million in May 2015, the remittances reached $449 million in February 2016 -a jump of 324%.

The study shows that among the various categories under which overseas remittances have been distributed, “maintenance of close relatives“ and “studies abroad“ have shown a significant jump, signalling the increasing inclination of Indian parents to send their children overseas to study . “This should be a wake-up call for the government for building better institutions of education within the country . Another category that shows considerable jump is the `travels' component,“ said Soumya Kanti Mishra, chief economist, SBI, in a report.

According to Mitra, contrary to popular perception, high real interest rate is actually leading to lower deposit growth rate. While interest rates have come down, real interest rates have risen as the drop in inflation has been faster than the reduction in interest rates. Deposits with banks have remained sluggish with a growth of 9.9% in FY16 (till March 18, 2016 -a 53year low).

Mitra said that despite deposit rates coming down, the real return for bank customers has gone up due to lower inflation. The drop in nominal rates is causing people to spend more, rather than being encouraged to boost savings.

“The argument of mutual fund inflows acting as a drag on bank deposits is a false negative, as such cheques are actually written on banks in India and unlike the US, mutual funds in India cannot write cheques on their own,“ said Mitra.

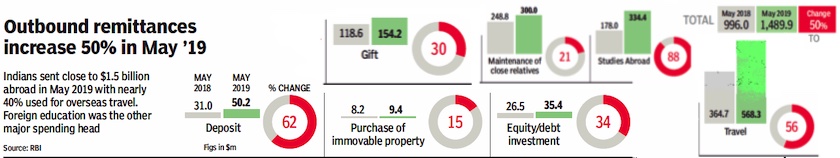

2018, May> 2019, May

From: August 6, 2019: The Times of India

See graphic, ‘ Outbound remittances from India: 2018, May> 2019, May ’

2019-23

From: Nov 20, 2023: The Times of India

See graphic:

Outward remittances from India in August and September 2023

2020- 2024

Mayur Shetty, May 22, 2024: The Times of India

From: Mayur Shetty, May 22, 2024: The Times of India

Mumbai : Indians spent a record $31.7 billion overseas under the liberalised remittance scheme in FY24, an increase of nearly 17% over the $27.1 billion recorded in FY23. The rise has been despite the imposition of tax collection at source. However, data analysis shows that the monthly average spending fell after the imposition of TCS in Oct 2023.

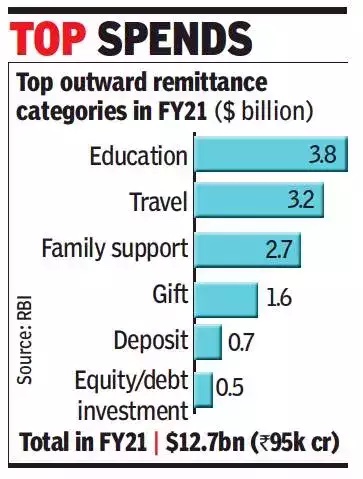

The annual data for remittances shows that Indians have taken to overseas travel with a vengeance, spending $17 billion on it in FY24 — an increase of more than 24.5% over the $13.6 billion in the previous year. The share of international travel in spending under the LRS has risen to 53.6% in FY24 from 37% in FY20 before the onset of the pandemic. In FY21, international travel spending had dipped to $3.2 billion due to restrictions on mobility.

On the other hand, the share of remittance going towards education abroad has steadily declined. In FY21, remittance for education was 30% largely because travel was subdued during the pandemic. The share fell to 26% after travel restrictions were lifted in FY22. Spending on education dipped in FY23 in absolute terms to $3.4 billion from $5.2 billion in the year before, resulting in the share of overall spend falling to 12%. In FY24, spending on studies abroad was flat at nearly $3.5 billion even as travel spending soared. As a result of lesser spending on fees, studies abroad is no longer the second-biggest category in forex spends. Indians have spent more on maintaining relatives abroad ($4.6 billion) than on fees.

2014- 2024

From: George Mathew, July 1, 2024: The Indian Express

See graphic:

Travel and remittances, 2014-24

2009-24

From: August 7, 2025: The Times of India

See graphic:

Outward remittances from India, 2009- 2024

Outward remittance norms

The remittance limit: 2015

Buying a house overseas easier now

Mumbai TIMES NEWS NETWORK The Times of India Feb 04 2015

RBI Increases Forex Remittance Limit To $250,000Year As Reserves Swell

Buying a house overseas, which used to be the preserve of the super rich, has now become a lot easier for wealthy Indians with the Reserve Bank of India doubling the foreign exchange remittance limit to $250,000 per individual per year. In other words, a family of four can remit $1 million (equivalent of Rs 6.2 crore) every year to purchase assets overseas. With this move, the rupee has become almost fully convertible for most Indians. The funds remitted overseas can be used for almost any activity barring a few such as speculation in exchanges, funding terror groups or for remittances to Bhutan, Nepal, Mauritius and Pakistan.

According to Bank of India chairperson V R Iyer, the increase in the liberalized remittance scheme to $2.5 lakh reflects the confidence of the regulator in consistency in foreign inflows.

RBI governor Raghuram Rajan said on Tuesday the foreign currency remittance limit was relaxed following a review of the external sector outlook and as a further exer cise in macro prudential management. The central bank also said that it will ask the government to subsume under this limit various remit tances that an individual is allowed under the Foreign Exchange Management Act, which include donations, gift remittances and exchange facilities for those seeking employment overseas and for maintenance of close relatives abroad. Until now, this facility was in addition to remittance limits already available for private travel, business travel, studies, medical treatment, etc as described in Schedule III of Foreign Exchange Management (Current Account Transactions) Rules, 2000.

An improvement in the country’s foreign exchange re serves has emboldened the RBI to increase the limit. Announcing his policy , Rajan said the following the drop in oil prices the current account deficit has been comfortably financed by net capital inflows, mainly in the form of buoyant portfolio flows and supported by foreign direct investment inflows and external commercial borrowings.

“Accordingly, there was accretion to India’s foreign exchange reserves to the tune of $6.8 billion in Q3,” said Rajan. The sensex fell 122 points on Tuesday to close at 29,000 because of RBI’s decision to maintain status quo on rates and a sell-off in PSu banks due to worsening asset quality. FII selling added to the slide, dealers said.

The day’s session started on a better note with the index opening about 100 points higher. After the RBI said that it was keeping the key policy rates unchanged due to lack of data since its last rate cut, the index started giving up gains and at one point was down over 200 points.

In volatile trades, finally the index closed 0.4% lower with banking and financial services sector stocks among the top laggards.

While FIIs were net sellers in the stock market, in the debt segment they got more freedom to invest in the government securities market. In its policy, RBI allowed foreign investors to plough back their interest earnings from gilts into the same instrument, in effect increasing their exposure limit in government securities.

With the current FII gilt limit at $30 billion, at the current gilt yield, foreign investors can invest an additional $2.5 billion in gilts next year, bond dealers pointed out. This will also help in government’s debt auction by channelizing more funds into the gilt market, they said.

2015:Overseas house purchases

Feb 05 2015

RBI's new remittance norm: No tax breaks may hit overseas home buys

Lubna Kably

The Reserve Bank of India's (RBI's) recent move, which doubled overseas remittances for individuals up to $2,50,000 (Rs 1.5 crore) per individual per year, may tempt many to buy property overseas. Today , property prices in Dubai and some areas in the United States are attractive for Indian investors.A cursory glance at a few international property portals shows that a one-bedroom house in Dubai costs upwards of 9,50,000 UAE dirhams, or Rs 1.5 crore approximately . In Boston, USA, a similar-sized flat is available for $1,50,000 (upwards of Rs 90 lakh). These prices fall well within the now enhanced permissible remittance figures. However, tax professionals caution that buyers who wish to sell their house property or other assets in India (for instance, a shop or even jewellery) and reinvest the long-term capital gains in a residential property overseas should note that tax exemptions are no longer available for such reinvestments.

Sections 54 and 54F, which earlier permitted investors to claim a capital gains tax exemption even if the reinvestment was in a house property overseas, was amended by last year's Budget -effective from April 1, 2014.

Prior to this amendment, section 54 provided that, where capital gains arise from the transfer of a residential house (held for three years or more) and the tax payer reinvests the capital gains in a new residential house whether by way of purchase or construction within a certain period, the capital gains to the extent re-invested would be exempt.

Section 54F provided for similar exemptions for long term capital gains arising on sale of assets other than a residential property .

Thus, earlier, there was no explicit bar on capital gains being denied if the capital gains were re-invested in a residential house overseas. “Even tax tribunals had upheld the tax benefits in cases where re-investments were made in a house overseas. For instance, in the case of Vinay Mishra, a tax payer who had reinvested in a house property in Singapore, the Bangalore tax tribunal had held that the claim under section 54 could not be rejected. It had also added that the tax payer had not violated the law by purchasing the new house in Singapore utilizing the consideration on sale of his residential house in India. Subsequently, the Chennai tax tribunal also took a similar view. However, the amendment to the tax law by the Finance Act, 2014, has overturned these decisions,“ explains Sonu Iyer, tax partner at EY.

The Finance Bill, 2014 (providing for tax provisions applicable for the financial year April 1, 2014 to March 31, 2015) was tabled in the Parliament on July 10, 2014. As of this date, RBI's liberalized remittance scheme prohibited individuals from remitting money overseas for purchase of property .Thus, the amendment in the Income Tax Act of prohibiting capital gains exemption on reinvestment in a house property overseas had little or no adverse impact.

“With the RBI now doubling the remittance figure, and overseas property proving to be attractive, investors are hoping for a tax break. The forthcoming Budget should consider this issue and re-introduce tax breaks on reinvestment in a house property overseas,“ says Naushad Panjwani, senior executive director, Knight Frank India.

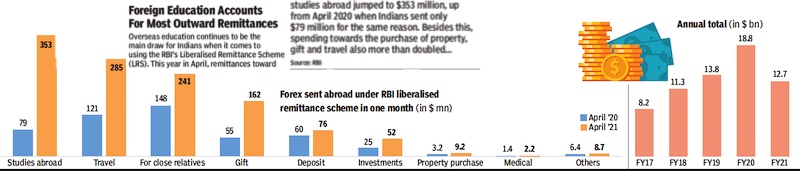

Where the remittances go…

2020, 2021

From: August 2, 2021: The Times of India

See graphic:

The reasons why Indians remitted/ sent money abroad in 2020, 2021

See also

Remittances, outbound: India

Remittances: South Asia: Has more details on outbound remittances from India