Sovereign credit ratings: India

This is a collection of articles archived for the excellence of their content. |

Contents |

History

S&P

1990-2025

See graphic:

S&P sovereign rating for India, 1990-2025

2016

The Times of India

S&P: a stable BBB-

S&P retains India's credit ratings as stable, Nov 03 2016 : The Times of India

Says Unlikely To Upgrade For Two Years

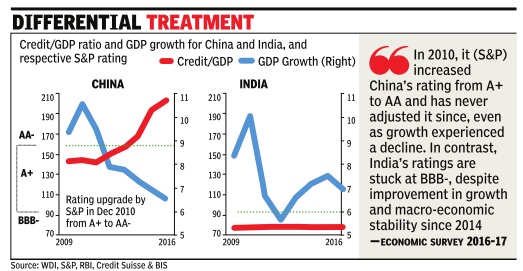

S&P has retained India's `BBB-' long-term sovereign credit ratings with a stable outlook but has said it is unlikely to upgrade the country's ratings in the next two years as public finances remain weak.

The government had made a strong pitch to global agencies to upgrade the country's ratings and pointed to the string of reform measures which had been unveiled.

“The stable outlook balances India's sound external position and inclusive policymaking tradition against the vulnerabilities stemming from its low per capita income and weak public finances,“ S&P said in a statement. “The outlook indicates that we do not expect to change our rating on India this year or next, based on our current set of forecasts.“ The BBB (-) is the lowest investment grade rating.

It said upward pressure on the ratings could build if the government's reforms markedly improve its general fiscal out-turns and the level of net general government debt, so that it falls below 60% of GDP .

“Downward pressure on the ratings could re-emerge if growth disappoints (perhaps as a result of stalling reforms); if, contrary to our expectations, the new monetary council is not effective in achieving its targets; or if the external liquidity position deteriorates more than we currently expect,“ the agency said.

But it said that India's governing parties have made progress in building consen sus on passage of laws to address long-standing impediments to the country's growth.“We believe these measures, supported by India's well-entrenched democracy , will promote greater economic flexibility and help redress public fi nances over time.“

S&P said a rating constraint is India's low GDP per capita, which the agency estimates at $1,700 in 2016. It expects the economy to grow by 7.9% in 2016 and 8% on average over 2016-2018.

How India lobbied Moody's for ratings upgrade, but failed

India criticised Moody's ratings methods and pushed aggressively for an upgrade, documents reviewed by Reuters show, but the U.S.-based agency declined to budge citing concerns over the country's debt levels and fragile banks.

Winning a better credit rating on India's sovereign debt would have been a much-needed endorsement of Prime Minister Narendra Modi's economic stewardship, helping to attract foreign investment and accelerate growth.

Since storming to power in 2014, Modi has unveiled measures to boost investment, cool inflation and narrow the fiscal and current account deficits, but his policies have not been rewarded with a ratings upgrade from any of the "big three" global ratings agencies, who say more is needed.

Previously unpublished correspondence between India's finance ministry and Moody's shows New Delhi failed to assuage the ratings agency's concerns about the cost of its debt burden and a banking sector weighed down by $136 billion in bad loans.

In letters and emails written in October, the finance ministry questioned Moody's methodology, saying it was not accounting for a steady decline in the India's debt burden in recent years. It said the agency ignored countries' levels of development when assessing their fiscal strength.

Rejecting those arguments, Moody's said India's debt situation was not as rosy as the government maintained and its banks were a cause for concern, the correspondence seen by Reuters showed.

Moody's and one of its lead sovereign analysts, Marie Diron, declined to comment on the correspondence, saying ratings deliberations were confidential. India's finance ministry did not respond to requests for comment.

Arvind Mayaram, a former chief finance ministry official, called the government's approach "completely unusual".

"There was no way pressure could be put on rating agencies," Mayaram told Reuters. "It's not done."

DEBT BURDEN, BAD LOANS

India has been the world's fastest growing major economy over the past two years, but that rapid expansion has done little to broaden the government's revenue base.

At nearly 21 percent of gross domestic product (GDP), India's revenues are lower than the 27.1 percent median for Baa-rated countries. India is rated at Baa3 by Moody's, the agency's lowest notch for debt considered investment grade.

A higher rating would signify to bond investors that India was more creditworthy and help to lower its borrowing costs.

While India's debt-to-GDP ratio has dropped to 66.7 percent from 79.5 percent in 2004-05, interest payments absorb more than a fifth of government revenues.

Moody's representatives, including Diron, visited North Block, the colonial sandstone building in the Indian capital that houses the finance ministry, on Sept. 21 for a discussion on a ratings review.

The atmosphere at the meeting with Economic Affairs Secretary Shaktikanta Das, one of the ministry's most senior officials, and his team was tense, according to an Indian official present, after Diron had told local media the previous day that a ratings upgrade for India was some years away.

On Sept. 30, Moody's explained its methodology to Indian officials in a teleconference.

LOBBYING FOR AN UPGRADE

Four days later, the finance ministry sent an email to Diron questioning Moody's metrics on fiscal strength. The government cited the examples of Japan and Portugal, which enjoy better ratings despite debts around twice the size of their economies.

"Given that countries are on different stages of economic and social development, should countries be benchmarked against a median or mean number (as is done by Moody's)" the email asked.

In India's case, "while the debt burden lowered significantly post 2004, this did not get reflected in the ratings", the ministry argued.

New Delhi urged Diron to look at improvements in the factors - better forex reserves and economic growth - that Moody's had considered when handing India its last ratings upgrade in 2004.

In a reply the next day, Diron said that, not only was India's debt burden high relative to other countries with the same credit rating, but its debt affordability was also low.

She added that a resolution to the banking sector's bad loan problems was "unlikely" in the near-term.

In a last-ditch effort on Oct. 27, Economic Affairs Secretary Das sent a six-page letter to Singapore-based Diron, addressed to Moody's New York headquarters.

Reiterating points on India's fiscal strength, Das asked Moody's for a "better appreciation of the factual position".

Das dismissed Moody's concerns on India's public finances as "unwarranted" and told the agency that there was "scope for further lowering" the political risk perception to "very low".

"In the light of stable external debt parameters and the slew of reforms introduced in the realm of foreign direct investment, you may like to reconsider your assessment on 'external vulnerability risk'," he wrote.

Moody's on Nov. 16 affirmed its Baa3 issuer rating for India, while maintaining a positive outlook, saying the government's efforts had not yet achieved conditions that would support an upgrade.

(Editing by Douglas Busvine and Alex Richardson)

2017

Moody's upgrades India's rating after 14 years

From: Mayur Shetty, Moody's upgrades India's rating citing government reforms, Nov 17, 2017: The Times of India

HIGHLIGHTS

The cost of international borrowing will now become cheaper for Indian government and Indian corporates

The move will also improve the sentiment in the equity markets

The upgrade comes as a major boost to govt which has been under fire for the fallout of GST and demonetisation

International rating agency Moody's has upgraded India's local and foreign currency issuer ratings to Baa2 from Baa3 and changed the outlook on the rating to stable from positive. The rating agency has cited+ the government's implementation of its reform programme which includes introduction of the Goods and Services Tax, Aadhaar system of biometric accounts and direct benefit transfer schemes and measures taken to address bad loans in the banking system.

The rating upgrade comes after a gap of 13 years - Moody's had last upgraded India's rating to 'Baa3' in 2004. Interestingly, the last upgrade also came under a NDA-regime led by Atal Behari Vajpayee.

The immediate impact of the rating upgrade is that the cost of international borrowing will become cheaper for Indian government and Indian corporates whose ratings are constrained by the sovereign rating. Issuers of lower rated paper have to pay higher rates to make up for the perceived credit risk. The move will also improve the sentiment in the equity markets.

" Moody's believes+ that those (reforms) implemented to date will advance the government's objective of improving the business climate, enhancing productivity, stimulating foreign and domestic investment, and ultimately fostering strong and sustainable growth. The reform program will thus complement the existing shock-absorbance capacity provided by India's strong growth potential and improving global competitiveness," the rating agency said in a statement today.

The upgrade comes as a major boost to the Narendra Modi government which has been under fire for the fallout of GST and demonetisation on business. "The decision to upgrade the ratings is underpinned by Moody's expectation that continued progress on economic and institutional reforms will, over time, enhance India's high growth potential and its large and stable financing base for government debt, and will likely contribute to a gradual decline in the general government debt burden over the medium term. In the meantime, while India's high debt burden remains a constraint on the country's credit profile, Moody's believes that the reforms put in place have reduced the risk of a sharp increase in debt, even in potential downside scenarios," said the rating agency in a statement.

Demonetisation which has been facing severe criticism after most of the currency was returned to banks has also been viewed positively by Moody's. "Government efforts to reduce corruption, formalize economic activity and improve tax collection and administration, including through demonetization and GST, both illustrate and should contribute to the further strengthening of India's institutions," the agency said.

On the fiscal front, efforts to improve transparency and accountability, including through adoption of a new Fiscal Responsibility and Budget Management (FRBM) Act, are expected to enhance India's fiscal policy framework and strengthen policy credibility. The other reforms which have helped in the upgrade are the legislation towards fiscal responsibility and the shift to a monetary policy committee for interest rate setting.

"Adoption of a flexible inflation targeting regime and the formation of a Monetary Policy Committee (MPC) have already enhanced the transparency and efficiency of monetary policy in India. Inflation has declined markedly and foreign exchange reserves have increased to all-time highs, creating significant policy buffers to absorb potential shocks," Moody's said

Why Moody’s improved its ratings

November 19, 2017: The Times of India

Why, amidst so much controversy and bad news, is Moody’s smiling? Because a rating agency cares little about one-off events like demonetisation and GST, or other shortterm phenomena. Moody’s assesses the ability of a country or company to service its debts in the medium to long run. This means focusing on fundamentals and sustainability. And here India looks good.

The fiscal deficit has fallen, slowly but steadily, from 6.7% of GDP in 2009-10 to a projected 3.2% this year. The RBI, which once printed money merrily to accommodate reckless government spending, is now established as an independent body with a mind of its own. Monetary policy now focuses almost single-mindedly on keeping inflation around 4%, and has achieved that target. The current account deficit, which had soared to over 4% of GDP in 2013-14, declined to 1.1% in 2015-16 and 0.7% in 2016-17. Warning: the deficit jumped up to 2.4% in the first quarter, but Moody’s clearly sees this as a blip, not a trend. Foreign exchange reserves have soared to $400 billion, strengthening India’s ability to withstand future shocks. In sum, India’s macroeconomic indicators are looking strong and sustainable.

Rating agencies also assess policies and reforms. Narendra Modi has (except for demonetisation) proved to be an incrementalist, not a radical reformer. Yet enough incremental steps can add up to something substantial over several years. Direct benefit transfers in lieu of subsidies look the way forward, notwithstanding many glitches in the use of Aadhaar. Public sector banks are finally getting recapitalised and capable of lending freely. The insolvency and resolution laws seem likely to finally end the practice of crooked or inefficient promoters being bailed out forever with public money. Electricity and all-weather roads finally look like reaching virtually every village and household. Broadband is finally penetrating the countryside, and has the potential to revolutionise productivity and payments.

Yet many problems remain. Most disturbing is the lack of formal job creation, which was supposed to be Modi’s key election plank. Companies cannot get workers with the requisite skills. A terrible educational system is creating millions of useless graduates with high expectations, whom employers find unemployable. India’s much-trumpeted demographic dividend is not accruing because tens of millions of women have withdrawn from the workforce, so the proportion of workers in the population has not risen as expected. Irrigation and rail projects started a decade ago are nowhere near completion.

All government services — police, courts, schools, colleges, health centres and general administration — remain lousy and substantially corrupt. Modi shows no interest at all in much-needed administrative reform.

The problem of bad debts of banks has soared to heights unimaginable five years ago. Exports have stagnated for three years, and recent signs of dynamism have not been sustained despite a global economic recovery that should have stoked an export boom. One major textile exporter says the new GST regime has greatly cut effective subsidies for garment exports, and if unremedied will kill hundreds of factories and make 50 lakh people unemployed. The gaurakshak movement has not only sparked tragic lynchings but shrunk animal supplies to slaughterhouses, hitting beef and leather exports.

Moody’s is right to say India can safely service its medium to long-run debts. But this does not guarantee a sustainable return to tiger economy status. That requires much greater reform.

Initiatives in India leading to upgrade

5 things that led to Moody’s upgrading India’s ratings, November 17, 2017: The Times of India

HIGHLIGHTS

Ratings agency Moody's has upgraded India's ranking for the first time in 14 years. Here is a rundown of the major initiatives taken which led to the development

International ratings agency Moody's upgraded India's local and foreign currency issuer ratings t+ o Baa2 from Baa3 and changed the outlook on the rating to 'stable' from 'positive'. The upgrade, which is the first in 14 years has come on the back of a number of steps taken by the government on the economic front. Here is a look at five factors which led to Moody's thumbs up to PM Modi and his team:

1) Wide ranging reforms: The Narendra Modi-led government has been pro-active in bringing in a slew of dynamic reforms in a bid to boost the Indian economy. Amid conflicting views on demonetisation and GST (goods and services tax), Moody's has given a thumbs up to the two economic reforms. "Government efforts to reduce corruption, formalize economic activity and improve tax collection and administration, including through demonetization and GST, both illustrate and should contribute to the further strengthening of India's institutions," the agency said in its report.

Another conscientious issue of linking Aadhaar to direct benefit transfer (DBT) schemes also got a pat on the back from the ratings agency as it listed the move as 'a system intended to reduce informality in the economy.'

2) Steps taken to strengthen banks: Another area where the government has actively intervened is in energising banks which have long been reeling under the pressure of bad loans. The government has introduced the Insolvency and Bankruptcy Code (IBC) to effectively fight the menace of bad loans. As a result the Reserve Bank of India (RBI) has so far identified 41 accounts (12 in June and 29 in August) which are stressed and on the verge of becoming Non-Performing Assets (NPAs). The RBI is, in fact, likely to come up with a fresh list of around 50 loan accounts in addition to the existing ones, according to reports. Last month, the government had announced a Rs 2.11-lakh crore recapitalisation package for public sector banks which is expected to boost their lending capabilities and drive private investment which has reportedly dried up.

On the fiscal front, efforts to improve transparency and accountability, including through adoption of a new Fiscal Responsibility and Budget Management (FRBM) Act, are expected to enhance India's fiscal policy framework and strengthen policy credibility. Moody's took notice of the move as it commented,"Adoption of a flexible inflation targeting regime and the formation of a Monetary Policy Committee (MPC) have already enhanced the transparency and efficiency of monetary policy in India. Inflation has declined markedly and foreign exchange reserves have increased to all-time highs, creating significant policy buffers to absorb potential shocks."

3) Promising macros: Despite the GDP (gross domestic product) growth rate taking a beating and dipping to a 3-year low of 5.7 per cent in the second quarter of 2017, various rating agencies including Moody's have predicted that a recovery is on the cards. Moody's expects GDP growth to moderate to 6.7 per cent in the fiscal year ending in March 2018. However, the ratings agency opines that as the disruption fades, assisted by recent government measures to support SMEs (Small and Medium Enterprises) and exporters with GST compliance, real GDP growth will rise to 7.5 per cent next fiscal, with similarly robust levels of growth from FY 2019 onward. "Longer term, India's growth potential is significantly higher than most other Baa-rated sovereigns," Moody's noted.

4) Foreign investments: India's foreign exchange (forex) reserves have shot up impressively as it currently hovers around $400 billion up from $359 billion in October last year. Driven by both FPIs (Foreign Portfolio Investment) in equity and bond markets and FDIs (Foreign Direct Invetment), the rupee has strengthened. The Moody's upgrade is expected to provide a fillip on this front as it will further encourage foreign investments.

"Reforms implemented to date will advance the government's objective of improving the business climate, enhancing productivity, stimulating foreign and domestic investment, and ultimately fostering strong and sustainable growth," the Moody's report stated.

5) Ease of Doing Business: Although not directly linked to FRiday's upgrade, it would be important to note that last month, India jumped 30 places to get the 100th slot in the World Bank's report on Ease of Doing Business. Shortly after that, the government revealed that it has chalked out more than 200 reforms including doing away with a number of 'archaic laws' to break into the top 50 bracket. Moody's echoed the aim of these initiatives saying in its report, " The reform program will (thus) complement the existing shock-absorbance capacity provided by India's strong growth potential and improving global competitiveness,"

Moody’s: health of banking system makes economy vulnerable

Bad loans in banks could trigger downgrade, November 18, 2017: The Times of India

From: Bad loans in banks could trigger downgrade, November 18, 2017: The Times of India

Bad loans in banks could be the weak spot in India’s economy and could risk triggering a future downgrade. Besides the standard risks to the economy arising out of fiscal slippage and from global volatility, Moody’s has cited health of the banking system as vulnerability for the economy.

According to Moody’s, recapitalization of PSU banks and proactive steps to resolve bad loans are beginning to address a key weakness in India’s sovereign credit profile. SBI chairman Rajnish Kumar said that large NPA accounts referred to the National Company Law Tribunal in July would come up for resolution in January 2018.

Bankers, however, say that since these are the first transactions the bankruptcy process is likely to get tested. Most bankers feel that bad loans will start declining only from the next financial year. Banks are also reluctant to take more defaulters to the National Company Law Tribunal as regulations require that they make 50% provisions on loans in respect of which bankruptcy proceedings have been initiated. There have been reports that the government may force banks to initiate insolvency proceedings against more borrowers.

Besides having to make high provisions, if banks do not get acceptable bids during the insolvency process, they would be required to initiate liquidation proceedings. If this happens banks might be required to make massive write- down of their loans.

The third uncertainty is over bank mergers. According to market players, investors are reluctant to make big bets on bank stocks over fears that government may decide to merge weak banks with some strong banks. Given that public sector banks do not have the flexibility to clean up their books there is fear that merger with a weak bank would hurt the stronger bank.

“While the capital injection will modestly increase the government’s debt burden in the near term (by about 0.8% of GDP over two years), it should enable banks to move forward with the resolution of NPLs through comprehensive write-downs of impaired loans and increase lending gradually,” Moody’s said.

According to Care Ratings, gross NPAs of 36 top banks have increased from Rs 2.94 lakh crore in March 2015 to Rs 3.32 lakh crore in Sept 2015 and then sharply to Rs 8.38 lakh crore in Sept 2017.

“The next two quarters would be crucial from the point of view of NPAs as it is still not clear whether or not they have been fully recognized and provided for. Private Banks too have witnessed an increase in their NPA ratios and the final picture will emerge by March 2018,” said Madan Sabnavis, chief economist, Care ratings in a report on Friday.

According to Bloomberg data, Indian companies and banks have sold $12.5 billion of foreign-currency bonds so far this year with a fourth of them coming from banks. Bankers said that the upgrade would also draw more investors into these bonds as the earlier rating was the lowest above-investment grade. Many pension funds, which are mandated to invest in only investment-grade securities, avoid bonds that are at the edge of investment grade.

SBI chief economist Soumya Kanti Ghosh said, “The ratings upgrade will have a profound impact on bond yields and lift the morose sentiments in the bond market, apart from impacting the movements in the domestic currency. The greatest irony is that despite India’s improved fundamentals, bond yields have moved in a contrarian direction. For example, if we compare India’s bond yield from the levels of 2008, it is highest among select economies. India’s bond yields are around 170 bps higher than the 2008 level.”

S&P, 2017: BBB- with a "stable" outlook

HIGHLIGHTS

S&P said the growth will remain strong and the country will maintain sound external accounts position, among others

India's growth, it said, is among the fastest of all investment-grade sovereigns, and projected real GDP expansion to average 7.6% over 2017-2020

Rating agency Standard & Poor's (S&P) highlighted India's growth prospects in the coming years even as it kept its sovereign ratings unchanged at 'BBB-minus' with a 'stable' outlook. The global ratings agency said that India's stable outlook reflects that growth will remain strong+ over the next two years and the country will maintain sound external accounts position, among others.

Here are the key takeways from the agency's ratings:

1. S&P said it welcomed the government reforms, including the GST rollout and a planned Rs 2.11 lakh crore ($32 billion) capital infusion into its struggling PSU banks, while predicting the country's economy would "grow robustly" in 2018-2020.

2. It said one-off factors like the GST, hailed as biggest tax reform in the country, and demonetisation have led to some quarterly cooling in the high growth figures but the medium-term outlook for growth remains favourable.

3. The growth outlook is supported by rising private consumption, an ambitious public infrastructure investment programme and a bank restructuring plan that should help revive investment.

4. Public sector-led infrastructure investment, notably in road and rail sectors, will also stimulate economic activity while private consumption will remain robust.

5. S&P said the Narendra Modi government has managed to pass a number of reforms to address long-standing impediments to the country's growth.

6. India's growth, it said, is among the fastest of all investment-grade sovereigns, and projected real GDP expansion to average 7.6 per cent over 2017-2020.

S&P ratings comes days after Moody's Investors Service raised India's sovereign rating for the first time in over 13 years on growth prospects boosted by continued economic and institutional reforms.

Elaborating on S&P maintaining status quo in its ratings, economic affairs secretary Subhash Chandra Garg said the agency chose to play cautious and hoped that the reforms will reflect in a ratings upgrade next year.

2018

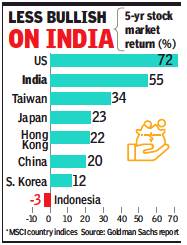

Goldman Sachs cuts India ratings after 5 years

From: The Times of India

Goldman Sachs cut India’s ratings to ‘marketweight’ from ‘overweight’ citing expensive market valuations, expected economic slowdown and risks related to the ensuing Lok Sabha polls in less than a year. This downgrade by the foreign-broking major comes after it was bullish on India for almost the whole duration of Prime Minister Narendra Modi’s government, during which the leading benchmarks nearly doubled. Analysts at Goldman Sachs have put in a NSE Nifty target of 12,000 in a year, compared to its Monday close of 11,378, a gain of 5.5%.

“We have been strategically overweight on India since March 2014 as we expected pro-growth government policies and structural reforms to drive a pickup in economic growth and a recovery in corporate profits. While earnings have improved, Indian equities have almost doubled over the past five years and outperformed the region in dollar terms,” the report said. “Given elevated valuations and the recent strong performance, we believe the risk/reward for Indian equities is less favourable at current levels and we lower our investment view from overweight to marketweight,” the report said.

Analysts at the foreign brokerage have listed five reasons for the downgrade. These include stretched valuations, macro headwinds, corporate earnings ‘catch up’ priced in, slowdown in domestic flows and event risk. Indian equities are the most expensive in Asia, trading at a record 58% premium to the region. At these levels, equities have historically posted negative returns over the next three to six months, the report said.

2019

Why Moody's cut India's outlook to negative

Nov 8, 2019: The Times of India

Key Highlights

This cut in ratings comes almost after two years when the global ratings major had upgraded India’s sovereign ratings

India’s ratings was upgraded to Baa2 from Baa3 in 2017 citing progress on 'economic and institutional reforms’ by the Narendra Modi government

NEW DELHI: Global ratings major Moody's Investors Service on Friday changed the outlook on India’s ratings to ‘negative’ from ‘stable’ citing rising risk of slowdown in economic growth as prospects of reforms in the medium term has dimmed while stress in the financial sector has increased.

Moody’s, however, affirmed the Baa2 foreign-currency and local currency long-term issuer ratings for India. Baa2 is the second-lowest investment grade score.

This cut in ratings comes almost after two years when it had upgraded India’s sovereign ratings. India’s ratings was upgraded to Baa2 from Baa3 in 2017 citing progress on 'economic and institutional reforms’ by the Narendra Modi government.

“Moody's decision to change the outlook to negative reflects increasing risks that economic growth will remain materially lower than in the past, partly reflecting lower government and policy effectiveness at addressing long-standing economic and institutional weaknesses than Moody's had previously estimated, leading to a gradual rise in the debt burden from already high levels,” it said in a release.

Top reasons for the cut in India's outlook:

- Moody's projected fiscal deficit of 3.7 per cent of gross domestic product (GDP) in the year through March 2020, a breach of the government's target of 3.3 per cent, as slower growth and a surprise corporate-tax cut curbs revenue.

- India's growth outlook has deteriorated sharply this year, with a crunch that started out in the non-banking financial institutions (NBFIs) spreading to retail businesses, car makers, home sales and heavy industries.

- Moody's said the outlook partly reflects government and policy ineffectiveness in addressing economic weakness, which led to an increase in debt burden which is already at high levels.

- India's economy grew by 5 per cent between April and June, its weakest pace since 2013, as consumer demand and government spending slowed amid global trade frictions.

What will be the impact?

The cut in India's outlook is the first step towards an investment downgrade. It brings India just a notch above the investment grade country rating which implies that an actual downgrade can lead to massive foreign fund outflows.

To avoid the scenario, the Centre must address fiscal deficit concerns.

How the government responded:

Giving a strong response, the government said that the fundamentals of the economy remain quite robust and series of reforms undertaken recently would stimulate investments.

The finance ministry, in a statement, sought to counter the lowering of the outlook by Moody's, saying, "India's relative standing remains unaffected."

"Government of India has also proactively taken policy decisions in response to the global slowdown. These measures would lead to a positive outlook on India and would attract capital flows and stimulate investments," it said.

More measures to kickstart economy on the cards?

The lowering of outlook will put additional pressure on finance minister Nirmala Sitharaman to take more measures to kickstart the economy. With her maiden Budget for 2019-20 seemingly failing to address the widening problems in the economy, she took to announcing measures aimed at reversing the slowdown within a month of Parliament approving her Budget.

The measures include a package for the real estate and the automobile sector as also slashing of corporate income taxes for domestic companies to 22 per cent from 30 per cent previously. Also, the Reserve Bank of India has already cut interest rates five times this year, though lenders have not passed on that easing to customers.

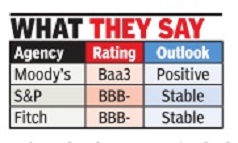

What other international rating agencies say:

Fitch Ratings and S&P Global Ratings -- the other two international rating agencies -- still hold India's outlook at stable.

How markets reacted:

Equity indices were off to a slow start on Friday with the benchmark BSE sensex sliding nearly 150 points and the broader NSE Nifty trading below the 12,000-mark.

(With PTI inputs)

2020

Moody’s downgrades India after 22 years

Moody’s downgrades India rating for 1st time in 22 yrs, June 2, 2020: The Times of India

Cites Low Growth, Slow Reforms Among Reasons

Global ratings agency Moody’s Investors Service downgraded India’s sovereign rating to the lowest investment grade, saying the country’s policymaking institutions would be challenged in enacting and implementing policies that mitigate the risks of a sustained period of low growth, significant further deterioration in government’s fiscal position and stress in financial sector.

The downgrade by Moody’s comes 22 years after it lowered India’s rating on June 19, 1998 in the aftermath of the country’s nuclear tests. The lowering of the rating — from Baa2 to Baa3 — brings it on a par with S&P and Fitch which rate India at BBB (minus), the lowest investment grade.

Moody’s action may put pressure on rupee

The downgrade comes against the deterioration in the country’s growth prospects as the national lockdown unveiled to stem the spread of the Covid-19 pandemic has stalled economic activity. This has also choked revenues, including those from GST prompting the government to raise its market borrowing sharply which economists say will widen its fiscal deficit to around 5.5% of gross domestic product. Moody’s action is likely to put pressure on the rupee, raise borrowing costs and dampen investor sentiment which is already stretched due to the impact of the pandemic on all major global economies.

“While today’s action is taken in the context of the pandemic, it was not driven by the impact of the pandemic. Rather, the pandemic amplifies vulnerabilities in India’s credit profile that were present and building prior to the shock, and which motivated the assignment of a negative outlook last year,” the agency said.

“Slow reform momentum and constrained policy effectiveness have contributed to a prolonged period of slow growth, compared to India’s potential, that started before the pandemic and that Moody’s expects will continue well beyond it,” Moody’s said. The agency said GDP growth has declined from a high of 8.3% in fiscal 2016 (ending March 2017) to 4.2% in fiscal 2019 and expects India’s GDP to contract by 4.0% in fiscal 2020 due to the shock from the coronavirus pandemic and related lockdown measures, followed by 8.7% growth in fiscal 2021 and closer to 6.0% thereafter.

It said that thereafter and over the longer term, growth rates are likely to be materially lower than in the past.

2021

S&P: lowest for investment BBB(-)

July 14, 2021: The Times of India

From: July 14, 2021: The Times of India

Global ratings agency Standard & Poor’s (S&P) affirmed its rating for India’s long-term foreign currency and local currency sovereign credit at the lowest investment grade and retained the outlook as stable, saying the economy will recover following the resolution of the Covid-19 pandemic, and that the country’s strong external settings will act as a buffer against financial strains despite elevated government funding needs over the next 24 months.

This is the 14th consecutive year when S&P has affirmed India’s rating at the lowest investment grade.

The agency retained the long-term rating at BBB(-). The latest statement from S&P ends anxiety over the sovereign ratings running the risk of being downgraded, following the expansion of spending to help the economy recover from the impact of the Covid-19 pandemic.

Explaining the rationale for its decision, the agency said that the sovereign credit ratings on India reflect the economy’s above-average longterm real GDP growth, sound external profile, and evolving monetary settings. “These strengths are balanced against vulnerabilities stemming from the country’s low per capita income and weak fiscal settings, including consistently elevated general government deficits and indebtedness,” the agency said.

2023

Moody’s affirms Baa3, flags curbs on dissent

August 19, 2023: The Times of India

Global ratings agency Moody’s Investors Service affirmed India’s sovereign rating at Baa3 and retained the outlook as stable. It said the rating and outlook take into account a curtailment of civil society and political dissent, compounded by rising domestic political risk.

Details

August 19, 2023: The Times of India

New Delhi : Global ratings agency Moody’s Investors Service on Friday affirmed India’s sovereign rating at Baa3 and retained the outlook as stable, citing the country’s strong growth and strengthening financial sector. The agency said that the Baa3 rating and stable outlook take into account a curtailment of civil society and political dissent, compounded by rising domestic political risk.

“The affirmation and stable outlook are driven by Moody’s view that India’s economy is likely to continue to grow rapidly by international standards, although potential growth has come down in the past 7-10 years,” the agency said.

The Baa3 is the lowest investment grade rating. S&P and Fitch also have a similar rating for India with a stable outlook. The action by ratings agencies will help add to positive sentiment and reduce the cost of borrowing for firms.

“High GDP growth will contribute to gradually rising income levels and overall economic resilience. In turn, this will support gradual fiscal consolidation and government debt stabilisation, albeit at high levels,” said Moody’s.

It said it expects India’s economic growth to outpa ce all other G20 economies through at least the next two years, driven by domestic demand. Moody’s said the government’s ongoing emphasis on infrastructure development has led to tangible improvements in logistics performance and the quality of trade and transport-related infrastructure.

Moody’s said the central bank’s prompt policy tigh tening has led to a fall in headline inflation. The agency said the curtailment of civil society and political dissent, compounded by rising sectarian tensions, support a weaker assessment of political risk and the quality of institutions. It said that the recent event illustrative of these trends is the eruption of unrest in the north-eastern state of Manipur that has led to at least 150 deaths since May 2023, and underpinned a no confidence vote on Prime Minister Narendra Modi in August, although this was ultimately unsuccessful.

“Although elevated political polarisation is unlikely to lead to a material destabilisation of government, rising domestic political tensions suggest an ongoing risk of populist policies — including at the regional and local government levels — amid the prevalence of social risks,” said the agency.

Nomura

Sep 28, 2023: The Times of India

MUMBAI: Japan's Nomura Group became the latest global financial major to upgrade India's ratings to 'overweight' from 'neutral' on the back of strong macro-economic fundamentals and the expected benefits accruing to it from the 'China plus one' policy.

Analysts at Nomura believe there could be some cyclical slowdown in the next few months, but that won't alter the "structural attractiveness" of India as a long-term investment destination.

Last month, Morgan Stanley - another global financial powerhouse - upgraded India to the 'overweight' category, giving it the top rating among Asian emerging markets. Its analysts had noted that a long upward cycle in India was starting while the same was ending in China. Of the 27 countries tracked by Morgan Stanley's Asia strategists, India rose to number 1 from number 6 earlier. In June this year, Goldman Sachs, another financial major, also upgraded India to an 'overweight' status.

Nomura analysts said India is a "large-liquid market and a counterweight to north Asia if slowdown in the West occurs and China continues to disappoint on recovery". "(It's) home to a number of high quality, growth stocks albeit expensive (but are) less exposed to global trade slowdown," the report noted. For these analysts, another positive for the Indian market is how, despite high interest rates, corporate earnings are being revised upwards and domestic flows are still holding up well.

"We see recent softness driven by higher oil prices as an opportunity to raise exposure. While this weakness may persist in the near term, thus presenting even better timing, we think the window of opportunity might not be open for too long," the report said.

The report also noted some concerns that could affect the stock market in the coming months. China rotation, risk of politicking, stretched government finances raises risk of populism/higher taxes/lower government capex especially going into national elections in May 2024, vulnerable to pullbacks given stretched absolute/relative valuations in a scenario of global 'risk off' although we expect India underperformance to be transitory.

In Nomura's model portfolio for Asiz ex-Japan, it has frontline stocks like ICICI Bank, Axis Bank, L&T, Reliance, ITC and Mahindra.

2025

S&P Global upgrades to BBB

August 15, 2025: The Times of India

Ratings agency S&P Global on Thursday raised India’s sovereign rating after an 18-year gap, citing robust growth and fiscal consolidation. A rating of BBB, which is investment grade, indicates “adequate capacity to meet financial commitments, but more subject to adverse economic conditions”.

The upgrade comes in the wake of comments by US President Donald Trump referring to India as a “dead economy”. The agency said the 50%US tariffs would have an “overall marginal” impact and will not derail long-term growth prospects. S&P is the second agency after DBRS to upgrade India this year.

S&P ups ratings of 10 banks

S&P ups ratings of 10 banks, NBFCs on growth prospects

New Delhi : S&P Global Ratings on Friday upgraded ratings of top 10 financial institutions, including SBI, HDFC Bank and Tata Capital, a day after the US-based agency raised India’s sovereign credit rating. “India’s financial institutions will continue to ride the country’s good economic growth momentum. These entities will benefit from their domestic focus and structural improvements in the system such as in the recovery of bad loans,” S&P said. S&P has raised long-term issuer credit ratings on seven Indian banks — SBI, ICICI Bank, HDFC Bank, Axis Bank Ltd, Kotak Mahindra Bank, Union Bank of India, and Indian Bank — and three NBFCs.