Real estate: India

This is a collection of articles archived for the excellence of their content. Readers will be able to edit existing articles and post new articles directly |

Affordable housing

2017: 27% increase in new launches

Rakesh Malik, Affordable touches a new high, December 7, 2017: The Times of India

Incentives announced by the central government for the affordable segment have given a major boost to the realty sector

In the research report by a leading real estate research firm covering the top 8 cities of India, affordable housing sector has recorded a surge of 27 per cent in new units launched (y-oy). Post announcements by the government to incentivise affordable housing through industry status, many developers have shown interest in developing such projects. However, overall residential unit launches recorded a decline of 33 per cent, and were at approximately 60,000 units in the first three quarters of 2017 (January-September). Further, the first quarter of the year had the rollover challenges of demonetisation (November 2016) to grapple with, leaving many developers no choice but to defer their launch plans.

Affordable housing segment demonstrated strongest trends to record a 27 per cent increase in the new units launched in these cities. More than 26,000 new units have been launched in 2017 so far. Of the total new launches in affordable units, 40 per cent were in Mumbai (10,500 units), followed by Kolkata and Pune. All other categories have seen a decline with highend (-66 per cent) and luxury (-84 per cent) segments witnessing a significant drop in new launches.

With government of India’s focus on ‘Housing for All’, affordable housing segment is expected to continue its momentum. To ensure that the momentum continues, government could also explore adding a few incentives on land acquisition costs as land cost is the largest component of project costs.

FAST FACTS

>> Affordable housing refers to units measuring up to 30 square metres (in carpet area) within municipal limits of 4 metro cities such as Delhi, Chennai, Kolkata and Mumbai and 60 square metres (in carpet area) for all other locations

>> Values for mid-segment are for units in the range of ₹5-10 million, except Delhi -NCR and Mumbai where the range in mid segment housing is typically between ₹5-17 million (20 million for Mumbai).

>> High-end segment values are for units typically priced above ₹10 million, except for Delhi and Mumbai (where it is more than 17 million in Delhi and 20 million for Mumbai).

>> Top 8 cities include Ahmedabad, Bengaluru, Chennai, Delhi NCR, Hyderabad, Kolkata, Mumbai, Pune

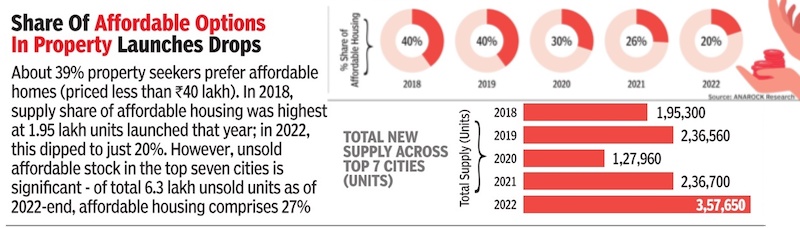

2018-22: New supply visa v affordable housing

From: February 22, 2023: The Times of India

See graphic:

2018-22: New supply visa v affordable housing in India

Apartment size

2015-20

From: January 23, 2021: The Times of India

See graphic:

The average Apartment size in India’s top 7 cities, 2015-20

Builders

Apartments

Number of bedrooms, 2019

See graphic:

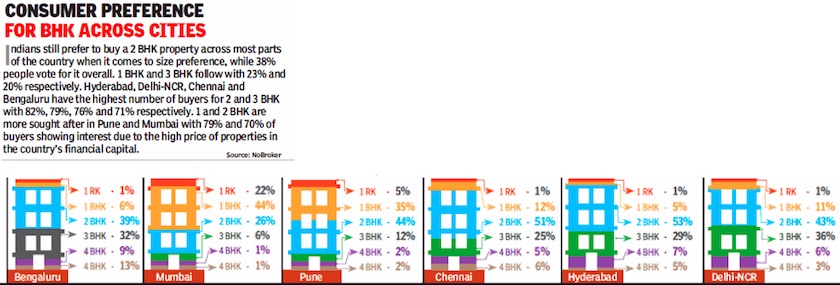

City- wise preferences for the number of bedrooms in an Apartment, presumably as in 2019

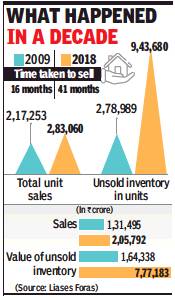

2012-19: consolidation

From: September 19, 2020: The Times of India

See graphic:

2012-19: consolidation of Builders, partly because of reforms.

Luring customers with incomplete facility liable to refund

AmitAnand Choudhary, Oct 29, 2022: The Times of India

New Delhi : It’s common for builders to advertise and sell dwelling units in their housing projects, claiming that the site would soon be connected with Metro or multi-lane roads. Now the NCDRC has warned that such builders will have to refund money to homebuyers if Metro or road link is not constructed by the authorities during the promised time-frame.

Natio nal Consumer Disputes Redressal Commission (NCDRC) has held that delay on the part of the civic authorities in constructing roads and providing water and electricity connections to a hous ing project could be a valid ground for the homebuyers to back out of a project and the builder is liable to refund the amount.

While adjudicating a refund claim of a homebuyer, a ben ch of Justice Ram Surat Ram Maurya and Inder Jit Singh accepted that builders are not responsible for construction of any development outside its property, which is to be done by state authorities, but said homebuyers, who invested money after getting influenced by such advertisements, could not be forced to suffer because of lack of facilities. In this case, the homebuyer had booked a flat in Godrej Summit housing project in Sector 104, Gurgaon in 2015 and had paid an initial amount of Rs 51. 36 lakh. The builder got the occupation certi ficate for the project in 2017 and offered possession to the buyer. But the buyer refused to pay rest of the instalment alleging that the builder failed to fulfil its promises and as the company cancelled the allotment and forfeited the earnest money of Rs 46. 94 lakh, he approached NCDRC through his lawyer Piyush Singh, seeking refund of the amount.

Singh said the builder had pr omised a 24-meter road connecting the housing project to Dwarka Expressway but it was not constructed and there were inadequate utilities like regular water (supplied by tankers) and electricity (through generators) supplies.

The company, on the other hand, submitted that it cannot do any construction outside the project and it was the job of the government authorities. It also contended that the 24-metre road connecting Sector 104 Gurgaon (project site) with Dwarka Expressway was projected by the government authorities in its plans and it did not mislead the buyers.

Taking into account the way in which the proposed 24-metre road, a key feature of the project, was portrayed in the advertisements/brochure of the builder and the buyers’ agreements, the Commission said it was certainly an important factor for the prospective purchasers to book units in the project believing that such a connectivit y would exist when it is completed.

Buying and selling

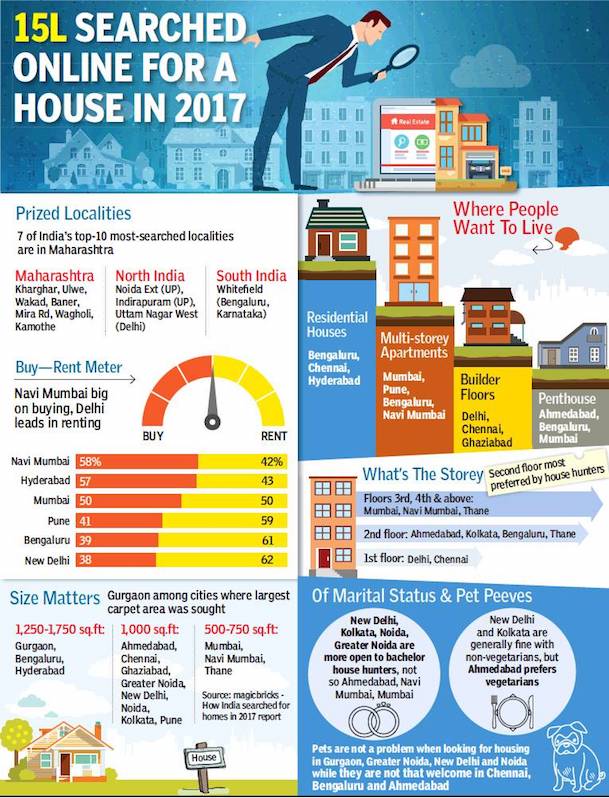

Economics of buying vs. renting, 2017

See graphic:

Economics of buying and selling, city-wise, 2017

City – wise comparisons

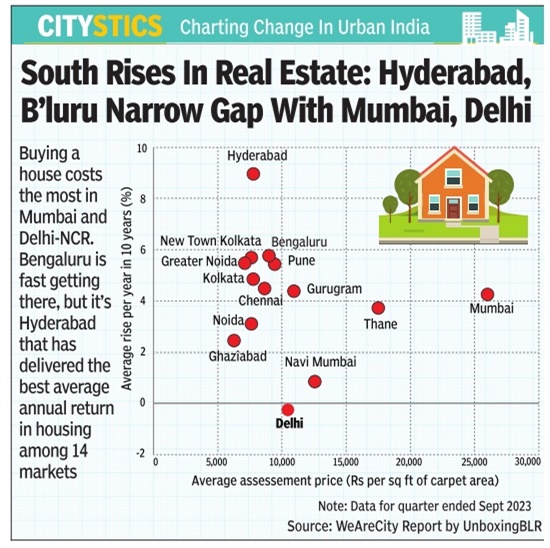

Average assessment price (Rs per sq ft of carpet area) in the metros

2023

From: April 28, 2025: The Times of India

See graphic:

Average assessment price (Rs per sq ft of carpet area) of real estate in the Indian metros in 2023

Residential property

2020- 2024

Sep 5, 2024: The Times of India

New Delhi : Amid the boom in real estate demand and rising prices, Chennai, Ahmedabad and Kolkata have emerged as the most affordable metros for residential investments. Mumbai Metropolitan Region and Delhi are the least affordable, according to a Magicbricks report. While household incomes across the top 10 cities have increased at a compounded annual growth rate (CAGR) of 5.4% between 2020 and 2024, property prices have surged 9.3% (CAGR) in this period, which has weakened affordability.

Property price to annual household income ratio (P/I Ratio) in India has increased from 6.6 in 2020 to 7.5 in 2024, higher than the globally accepted benchmarks of 5, the report said. The Mumbai Metropolitan Region (14.3) and Delhi (10.1) emerged as the least affordable, while Chennai, Kolkata and Ahmedabad (5) are among the most affordable cities for residential investments in 2024.

Not surprisingly, higher prices have meant greater EMI burden on home buyers. The EMI-to-monthly income ratio in India has risen from 46% in 2020 to 61% in 2024, indicating a rising burden on home buyers and reflecting affordability concerns nationwide, especially metros. The trend is more pronounced in MMR (116%), New Delhi (82%), Gurugram (61%) and Hyderabad (61%). In contrast, cities like Ahmedabad (41%), Chennai (41%) and Kolkata (47%) are relatively more affordable.

The report says the current situation is “likely to hit equilibrium conditions with market trends, indicating a deceleration in price growth due to an anticipated increase in residential supply.” Affordability indicates the proportion of property price to annual household income. If a city’s affordability is 3.7, the average property price in the city is 3.7 times the average annual household income.

Court decisions

Builder to pay principal + interest for non-delivery

Rebecca Samervel, August 30, 2020: The Times of India

The national consumer commission has ordered a builder to pay a compensation of Rs 47.6 lakh to a Navi Mumbai man in lieu of the Rs 8.2 lakh that he had paid for a 1000-sq-foot flat 25 years ago, but never received possession of. The commission on Friday said that the flat buyer, R K Singhal, was not only entitled to the 11% interest as awarded by the state consumer commission in 2015 (Rs 39.4 lakh) but also the principal amount of Rs 8.2 lakh.

“The appellant (Singhal) would be entitled to get Rs 47.6 lakh. The opposite party (Sudradh Constructions Pvt Ltd) is directed to pay this amount within a period of 45 days, failing which this amount will attract an interest at the rate of 6% per annum from the date of this order till actual payment,” the commission said.

Singhal moved the National Consumer Disputes Redressal Commission against Sudradh Constructions Pvt Ltd in 2015 after he was aggrieved with the state commission’s order. While the state commission had granted him the compensation, it did not accept his plea to take possession of the flat which was constructed in 2014. The national commission agreed with the state commission’s ruling that the man was not entitled to the flat as he had made that demand several years after he had filed the complaint in 2001.

Builder liable to pay damages for occupation cert delay: SC

Amit Anand Choudhary, January 12, 2022: The Times of India

NEW DELHI: In a relief to homebuyers who are forced to take possession of their flats and start living due to delay on part of the builder to get all clearances from the authorities, the Supreme Court on Tuesday held that it would amount to deficiency in services on the part of real estate company if it failed to get occupation certificate and homebuyers could seek compensation. A bench of Justices D Y Chandrachud and A S Bopanna said builders would be liable to refund the money if the homebuyers were forced to pay higher taxes and water charges arising from the lack of an occupancy certificate. It set aside the order of the National Consumer Disputes Redressal Commission which had turned down homebuyers’ plea against a builder and held they should approach against the authorities which are charging higher taxes.

The SC passed the order on a plea of Mumbai-based Samruddhi Co-operative Housing Society Ltd. Advocate Sunil Fernandes said homebuyers were living in the society for 25 years without occupation certificate and had to pay 25% higher property taxes and 50% higher water charges. The builder said the plea was barred by limitation as the cause of action arose in 1997 when they took possession but the complaint was filed 18 years later.

Delayed dues by builders: SC removes 8% interest cap

Amit Anand Choudhary, Nov 8, 2022: The Times of India

NEW DELHI: In a major blow to real estate companies in Noida and Greater Noida, the Supreme Court on Monday recalled its 2020 order by which interest rate to be charged by Noida and Greater Noida authorities was capped at 8% for delayed payment by builders who were charged in the range of 15-23% as per their agreement with authorities.

In a good news for authorities who were to lose Rs 7,500 crore due to cap on the interest rate, a bench of Chief Justice UU Lalit and Justice Ajay Rastogi recalled the order which would put financial burden on builders many of whom are finding it difficult to complete the project due to the fund crunch.

As per the terms of agreements between the builder and the authority the rate of interest for delayed payment come in the range of 15-23% but the apex court had capped it at 8% and linked it with SBI MCLR (Marginal Cost of Funds based Lending Rate) while hearing Amrapali case in June 2020. The court had said that there was a need to "give impetus" to the real estate sector and relief to builders, many of them struggling due to economic slowdown because of the pandemic.

According to the terms of agreements between the builder and the authority, the rate of interest for delayed payment comes in the range of 15-23% but the apex court had capped it at 8% and linked it with SBI’s MCLR (marginal cost of fundsbased lending rate) while hearing the Amrapali case in June 2020.

The court had said that there was a need to “give impetus” to the real estate sector and relief should be granted to builders as many of them were struggling to survive due to the slowdown in the economy and because of the Covid-19 pandemic.

It said that charging a reasonable rate of interest of 8% will enable them to invest the money to complete the housing projects. It had given the order on an application filed by Ace Group of Companies, which alleged that various projects were stalled and became dormant due to excessive lease rent, penalty and interest charged by authorities.

“Considering the current state of real estate, the projects are (at a) standstill, and in order to give impetus to such housing projects and mainly considering the plight of homebuyers and as pointed out by Noida and Greater Noida authorities that 114 plots were allotted from 2005 onwards, most of projects are incomplete; we direct that rate of interest on the outstanding premium and other dues to be realized in all such cases at the rate of 8% per annum and let the Noida and Greater Noida authorities do a restructuring of the repayment schedule so that the amount is paid,” the court had said.

The authorities, thereafter, immediately filed an application seeking recall of the order on the ground that they were not heard before the order was passed. They contended that the authorities would be “ruined” financially as they will end up losing around Rs 7,500 crore if the order is not recalled and it would lead to “unjust enrichment” of builders. According to their plea, Greater Noida was to lose around Rs 4,279 crore and Noida authority nearly Rs 3,266 crore.

The authorities contended that builders themselves demanded an interest rate around 20% compounded monthly from homebuyers for delay in payment and there was nothing wrong in their terms of agreement with the builders.

Delayed projects: consumer can claim refund even after being offered possession

Dipak Dash, June 14, 2024: The Times of India

New Delhi: National consumer forum has ordered a Delhi-based builder to refund Rs 1.4 crore with 12% interest to an aggrieved homebuyer for offering to deliver possession of an “incomplete” flat one year after the promised date.

Gurgaon-based Rameswar Dayal Gupta signed an Apartment Buyer’s Agreement (ABA) with Almond Infra build Ltd on Oct 29, 2013, for a flat, making an initial payment of Rs 16.4 lakh.

“The payment in terms of this order shall be paid within two months from today, failing which, the amount payable at the end of two months from the date of this order, shall carry interest @15% from the expiry of two months from date of this order till the actual date of payment,” National Consumer Disputes Redressal Commission (NCDRC) single member bench of Inderjit Singh ordered.

The builder assured possession by Apr 2017 but failed to meet the deadline. After paying Rs 48.6 lakh by Aug 23, 2014, Gupta discovered a high tension line passing through the tower of his booked flat.

Despite the builder's assurance that the line would be laid underground later, it didn't happen, leading Gupta to demand a refund.

The builder then proposed an alternative flat in a new tower, signing a new ABA with Gupta in Feb 2015, and promising handover by Aug 2018. However, it failed to fulfill this commitment, prompting Gupta to purchase a flat in Bangalore. Almond Infra build offered possession of the incomplete flat in Aug 2019, demanding Rs 18.3 lakh, which Gupta refused, seeking a refund instead.

Gupta then sought relief from the national consumer forum, which was objected by the builder.

NCDRC rejected the builder’s arguments against Gupta’s claims, asserting that an aggrieved buyer can seek a full refund of payment with 12% interest and terminate the contract in case of possession delay as per the ABA.

The commission ordered the builder to refund the entire principal amount of Rs 1.4 crore to the complainant, along with 12% interest and Rs 25,000 as litigation costs to the buyer, with the refund to be used first to repay any outstanding bank loans.

Flat owners can jointly exceed Rs 1 crore value

The Supreme Court has ruled that flat owners can join hands to directly approach the National Consumer Disputes Redressal Commission (NCDRC) against builders.

As per the Consumer Protection Act, a plea can be filed in NCDRC directly only if the cost involved is more than Rs 1 crore. Amrapali Sapphire Developers had cited this rule to plead that 43 flat buyers, who had together moved the apex consumer forum against it for delay in handing over possession, were disqualified from filing a joint plea.

On August 30, 2016, NCDRC member Justice V K Jain had ruled in favour of the flat owners, saying they could form an association to achieve the pecuniary limit of Rs 1 crore for approaching the NCDRC directly . The builder told the apex court bench of Justices Dipak Misra, A M Khanwilkar and M M Shantanagoudar that the cost of each flat was way below Rs 1 crore, thus the owners were individually ineligible to approach NCDRC directly . “By joining hands, they have shown that the cost of their flats was above Rs 1 crore to maintain their plea in NCDRC, which was against the rule,“ the builder's counsel said.

The SC's rejection of Am rapali Sapphire Developers' plea will come as a boon to middle-class flat owners.

Responding to the SC ruling, Confederation of Real Estate Developers' Associations of India (Credai) president Getamber Anand, who is also CMD of ATS Infrastructure, said, “Such broad directives can be misused also. This will adversely affect the sector, which is already facing a tough time.“

NCDRC member Justice Jain had said, “Once it is accepted that a consumer complaint on behalf of more than one consumer can be filed by a recognised consumer association, it can hardly be disputed that it is the aggregate value of the services which has to be taken for the purpose of determining the pecuniary jurisdiction of the consumer forum before which the complaint is filed.“ Referring to the 43 flat owners' joint plea through an association, the NCDRC had said that if the aggregate value of services in respect of the flat buyers, on whose behalf this complaint was filed, was taken, then it exceeded Rs 1 crore and hence NCDRC has jurisdiction to entertain their plea.

Flats’ possession delayed: higher damages than offered in contract possible

Builders can’t hide behind the clause in the builder-buyer agreement to pay Rs 5 per sq feet per month as compensation for delay in handing over flats for “unreasonable” period and the buyers have the option to seek higher compensation after taking possession of the property or seek refund of the amount paid, the NCDRC has ordered.

“The compensation for delay (Rs 5 per sq ft per month) cannot be for an unreasonably protracted period or indefinite; at best it can be for a short period that would appear to be reasonable and would be acceptable as such to a reasonable man... To say that possession can be delayed indefinitely or unreasonably and a token compensation for delay can be paid indefinitely or for an unreasonably protracted period is erroneous. Indefinite or unreasonable delay with token compensation for delay cannot continue forever without limit (such situation would be absurd),” a bench of Dr S M Kantikar and Dinesh Singh of National Consumer Disputes Redressal Commission (NCDRC) said while pronouncing order against Emaar MGF.

The commission directed the builder to pay Rs 5 lakh compensation to one Govid Paul of Punjab over and above the refund amount for inordinate delay in handing over a flat. It imposed Rs 50,000 litigation cost on the builder as well.

Almost all buyer-builder agreements have this compensation clause of “Rs 5 per sq feet” for delay in completion, which put consumers in a disadvantageous position vis-a-vis builders.

Paul had signed an agreement with Emaar MGF in September 2011 for a property, which was to be handed over in 36 months. After a delay of about 20 months, Paul approached the state consumer commission of Chandigarh seeking refund of his payment and compensation for the delay. The commission ordered refund of Rs 38.9 lakh at 15% interest compounded quarterly and Rs Rs 3 lakh compensation. It directed the builder to pay Rs 25,000 to the flat buyer as cost of litigation. The builder challenged the order in the NCDRC. The national commission observed that the builder did not offer possession even 23 months after the matter reached the state consumer commission and “such delay in offering possession cannot be said to be reasonable or normal”.

The national commission said the consumer has the fundamental option to obtain possession of the unit and in addition seek just compensation under the Consumer Protection Act for unreasonable delay. He has the other option to claim refund of the principal amount; interest thereon; compensation; and cost of litigation.

Co-working, co-living spaces

See also Co-working spaces: India

As in 2018

From: July 1, 2019: The Times of India

See graphic, ' Co-working, co-living spaces in India, As in 2018 '

2017-19

Avik Das, Dec 8, 2019 Times of India

From: Avik Das, Dec 8, 2019 Times of India

India’s residential real estate market is facing its most prolonged slump in recent memory, but one segment, co-living, is having a moment, drawing considerable attention from investors. A clutch of firms is battling it out in this space, which is driven by the demand from migrant professionals who avoid house-hunting in a new city and prefer readily available furnished apartments with all facilities.

This generation relies on the rental economy for most of its requirements, and owning a property does not feature in its plans. Concerns about affordability, aversion to long commutes, and no fixed plan to stay/work in one city are among the factors behind this trend.

Co-living companies such as Zolo, Colive, Nestaway, Stanza Living and Oyo are trying to crack the segment, which is expected to register compound annual growth rate (CAGR) of 17% in the next five years and reach $14 billion in size. A report by independent property consultant JLL and the Federation of Indian Chambers of Commerce & Industry has made the projection.

Delhi-NCR will constitute nearly 40% of the potential market opportunity by 2023, followed by Mumbai at 25%. The realised demand in the top seven cities stood at about 94,000 beds last year, according to the report.

“People are willing to adopt the rental model till they settle down at about 35,” said Colive CEO Suresh Rangarajan. “These spaces have smaller private areas and larger common spaces, which helps them socialise and works on the economy of scale. For example, I can provide 60GB of internet for Rs 250. The same will cost at least Rs 1,000 if one were to buy the plan on their own.” Colive, which raised $9.2 million in Series A round led by property developer Salarpuria Sattva, has 20,000 beds across Bengaluru, Hyderabad and Chennai, and plans to scale it up to 60,000 in the next two years.

Co-living, or community living, is tenants sharing areas such as the kitchen and living room while having their private bedroom. These apartments are generally furnished and the operators provide all necessary amenities, including electricity, internet, food and laundry service. One key advantage is that people don’t have to pay huge deposits that most landlords demand. Nikhil Sikri, co-founder and CEO of Zolo, said co-living, as a concept, had existed in the form of PGs and other accommodation in India for many years, but the sector was getting recognition now because of the entry of formal players. Zolo has about 55,000 beds and it works with independent building owners, landholders and property developers like Ozone, Hiranandani and Shapoorji.

“When working with builders, we either lease out an entire tower or share the upside with them. Assured returns have prompted many builders to dabble in this market amid the slowdown in the real estate industry,” Sikri said.

Shared apartments are relatively cheaper. A Knight Frank research shows that a fully furnished residential unit in Koramangala, one of Bengaluru’s costliest micromarkets, commands a rent of Rs 27,000-35,000, while single occupancy co-living arrangement costs Rs 17,000. One can get a PG accommodation for a little less than Rs 16,000. At co-living facilities, the rent covers common-area maintenance charges, electricity/ water, housekeeping and internet. Meals are offered at an additional charge.

Companies claim such units have occupancy levels of nearly 90% and turn profitable within three to six months of operations. This has caught the attention of private equity and venture capital firms, which have made a series of investments in the sector in the past one year. Oyo’s expansion plan, with a target of 1 lakh beds, has the support of SoftBank and Airbnb, whereas Zolo is backed by Nexus Venture Partners and it is in talks with Credit Suisse to raise $100 million in Series B funding. Nestaway, which entered the segment earlier this year and hopes to have 20,000 beds, counts Goldman Sachs among its major investors. Student housing company Stanza Living has raised $70 million so far, and experts value the company at about $300 million.

Though the industry, involving formal players, is still in its early phases, operators usually use two models. They lease an entire apartment building and make a fixed monthly payment to the owners. Zolo and Oyo do this. Then there’s a revenue-sharing model, in which the operator acts as a go-between for the property owner and the tenant. The operator shares revenue, besides providing payment, vendor, design and sales services.

If the property owner invests in redesigning and furnishing the co-living space, the revenue sharing arrangement is 50:50. If the operator makes a capital investment for the same after leasing the property, the ratio changes to 70:30 in the operator’s favour. Sensing an opportunity, builders like Salarpuria Sattva, Embassy and Puravankara have entered the space.

Puravankara is in the process of setting up a co-living facility near Nirlon IT Park in Mumbai. Embassy is starting a new venture, Olive, with 20,000 beds, which will be set up on its existing land portfolio. It plans to have over 1 lakh owned and operated beds in five years. In Bengaluru, the facilities will come up on Outer Ring Road, close to Manyata Tech Park and Whitefield, the hub of multinationals.

“Our co-living spaces will be designed keeping in mind the evolving preferences and needs of the target customer base,” said Kahraman Yigit, co-founder of Embassy’s coliving business. Yigit worked at student living and co-living firms in Turkey.

Gaurav Sharma, principal at private equity firm Investcorp, which counts Zolo among its bets, said a developer looking to scale up coliving business should partner with an operator. “Most developers are regional and you cannot have a scaled-up play of you work alone. Operators can increase the yields of properties to the level of commercial ones, higher than 2-3% that a residential property commands.”

Financial crisis

2018>19: Realtors in bankruptcy court double

Avik Das1, Oct 9, 2019: The Times of India

From: Avik Das1, Oct 9, 2019: The Times of India

The number of property developers who have been dragged to the bankruptcy court has more than doubled in less than a year as a prolonged slump in sales and the ongoing liquidity crisis make things tough for many in the country.

For the period ended June 30, as many as 421 realtors were under the corporate insolvency resolution process (CIRP), up from 209 as of September 30 last year, data from Insolvency and Bankruptcy Board of India show (see graphic). Out of the 421 cases, 257 are ongoing while the remaining have been closed, which means these have been dissolved, withdrawn, or the firms faced liquidation. The number of ongoing cases will rise further unless the liquidity crisis is arrested, experts say. The numbers, second highest after the manufacturing sector, show the dismal state of the Indian residential market, which has been hammered for half a decade. Excess inventory initially caused a slowdown, and then the sector received a hammer blow from demonetisation, implementations of RERA and GST, and finally the IL&FS crisis, which stopped non-banking finance companies (NBFCs) from lending to real estate.

“Most developers who have been taken to court were running unsustainably. It was already a bad situation in the last 10 years where they were borrowing to pay the interest. The working capital requirement was funded by the lenders. With the NBFC crisis, the music has stopped,” Pankaj Kapoor, founder and managing director of real estate research firm Liases Foras, said.

Builders have been unable to complete projects in the absence of funds. Funding by NBFCs tanked 73% to $140 million in the first half of the year, compared to $520 million in the previous year, as the RBI tightened lending norms for such institutions and housing finance companies (HFCs) after the IL&FS debacle, according to data from property consultancy firm Anarock.

Additionally, slow sales and a record unsold inventory reduced cash flow for developers. Housing sales contracted 20% in the third quarter across the top seven cities to 55,080 units, compared to the previous one. At the same time, inventory remained perched at 6.6 lakh units. “The liquidity crisis brought these builders down,” said Anarock chairman Anuj Puri.

While the government has instructed banks to organise loan melas to spur demand among consumers in agriculture, auto, home and education, it remains to be seen whether the ongoing festive season can result in a turnaround for builders. “The prolonged slowdown has led us to where we are. If things do not improve by January, we are in for a long winter,” Chintan Patel, partner, deal advisory - real estate & hospitality at KPMG in India, said.

2019: low profits, liquidity squeeze

Builders in top 8 cities owe lenders ₹4 lakh crore: Report, February 7, 2019: The Times of India

From: Builders in top 8 cities owe lenders ₹4 lakh crore: Report, February 7, 2019: The Times of India

‘Pre-Tax Earnings Of These Developers Barely ₹57,000 Cr/Yr’

Builders in top eight Indian cities owe banks and NBFCs Rs 4 lakh crore even as their total sales each year are worth just Rs 2.47 lakh crore. Real estate research institute Liases Foras, which based its report on a database of 11,000 developers, said it will take seven years to clear the outstanding amount based on current rate of earnings per year.

The annual EMI on this total loan is itself Rs 1.28 lakh crore. Moreover, the actual earnings of these developers (before interest and tax) are barely Rs 57,000 crore a year.

“IL&FS default and the ongoing speculation about DHFL have made industry stakeholders anxious yet again. Moved by the upheaval we have tried to gauge impact of the liquidity squeeze on the sector and developers,’’ said the report.

“The situation of developers is akin to an elephant in a well which is unable to come out on its own. Somebody needs to replenish the well. But can we find cheap capital to refill the well?” said Pankaj Kapoor, founder and MD of Liases Foras.

“The existing scenario signifies the industry is at an inflection point and is staring at long-due price correction in order to improve sales. But is there a scope to bring down prices?” he added.

The report said that if builders have to make a 15% profit, they have to increase their sales by 2.6 times the current levels to stay afloat.

The eight cities include Mumbai Metropolitan Region, National Capital Region, Pune, Hyderabad, Chennai, Banglaruru, Ahmedabad and Kolkata.

In the past decade, while value of sold stock increased 1.56 times, the value of unsold stock increased 4.72 times. In terms of units, volume of sales has gone up by 1.28 times, while inventory increased to 3.33 times between 2009 and 2018. In the same period, lending to the real estate sector has gone up from Rs 1.2 lakh crore to Rs 4 lakh crore.

“While debt has grown in a monumental manner and so has inventory, sales did not go up in the same proportion. Having borrowed money from different sources, new players kept coming in the market and kept adding housing stock into the market without any productivity. Since sales remained abysmal all this while, developers are finding it difficult to meet their debt obligations at this point,’’ said the report, released early this week.

The residential market generated Rs 2.40 lakh crore as yearly revenue in 2018. Of this, more than 80% of the entire business was cornered by the top eight cities (Rs 2.06 lakh crore as revenue).

“The total disposable inco-me of top 90 developers (including rental income from different properties) is Rs 23,564 crore, but the repaym-ent required is Rs 45,128 crore. Due to the gross mismatch, it seems current debt levels are not serviceable,” said the report.

House rents

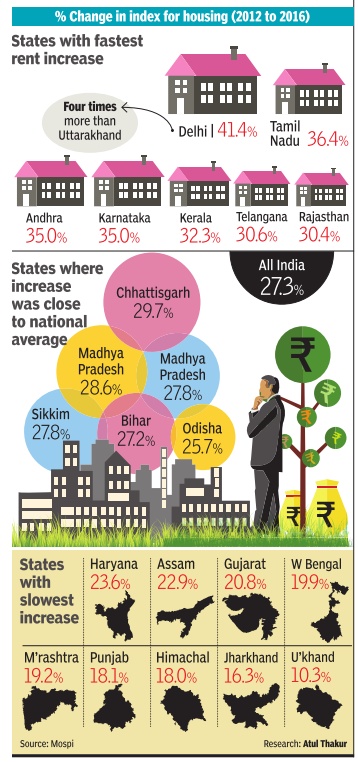

Change in rents, 2012-16

From: HOUSE RENTS HAVE RISEN THE MOST IN DELHI, LEAST IN UTTARAKHAND, Sep 17 2016 : The Times of India

HOUSE RENTS HAVE RISEN THE MOST IN DELHI, LEAST IN UTTARAKHAND, Sep 17 2016 : The Times of India

ii) The rental yield in India and other countries; The Times of India, June 13, 2017

See graphics:

Percentage change in index for housing rentals, 2012-16

The price of a 1300 sft flat in Indian metros and other countries and the rental yield in India and other countries

Recently released data on consumer prices indicates that housing cost (a proxy for rent in CPI) recorded the highest increase in Delhi, while Uttarakhand saw the minimum rise among major states. This data is for the period between 2012, the base year of the current index, and August 2016, the month for which the latest data is available

Old projects too under Rera: Gurgaon bench

The chairman of Haryana Rera’s Gurgaon bench has said the real estate law applies to all projects, irrespective of the date of completion. Which means, anyone with a grievance against a realtor can approach the Real Estate Regulatory Authority and the complaint will be taken up.

KK Khandelwal told TOI Rera can adjudicate in any dispute between a seller and a buyer in a real estate project, even if that project has received a completion certificate before the law came into effect on May 1, 2017.

Based on the central law, states have enacted and notified their own Rera rules. In Haryana — Gurgaon, in particular — buyers complained that developers were being let off the hook as the rules mentioned that those projects which had received completion certificates before May 1, 2017, would not come under the purview of Rera. The law also specifies the kind of projects that are covered — on a minimum plot size of 500 square meters and with more than eight units.

In this light, Khandelwal’s interpretation is significant, not only for homebuyers in Haryana but also other states who have had complaints about the scope of the real estate law. Haryana Rera’s other bench in Panchkula recently passed an order in favour of a buyer, Sanju Jain, who had filed a case against TDI Infrastructure for not fulfilling its sale agreement obligations. The developer had argued the project was completed before Rera came into effect and, therefore, did not come under its purview. But the Panchkula bench cited Section 11 of Rera to observe that a project’s promoter has to fulfill all sales agreement obligations, and nowhere is it mentioned in the Rera rules that only promoters of projects registered under Rera need to comply.

Housing: What Indians look for in a house

2019

From: Dec 27, 2019 The Times of India

See graphic:

What Indians look for in a house in 2019

Housing sales

2013-16: Metros

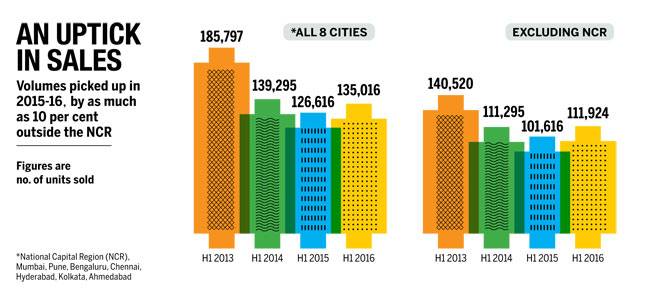

M.G.Arun & Shweta Punj , Realty Check "India Today" 28/11/2016 See graphic Housing sales in the Metros, 2013-16 Stagnant growth in Bengaluru

Sales & Growth: NCR ,Mumbai ,Pune ,Bengaluru ,Chennai ,Hyderabad ,Kolkata ,Ahmedabad

M.G.Arun Shweta Punj , Realty Check “India Today” 28/11/2016

See graphics

Housing sales in the Metros: volumes, 2013-16

Housing sales in the Metros: new launches, 2013-16

2013- 22

From: February 16, 2023: The Times of India

See graphic:

Residential units sold in India versus units launched, 2013- 22

2017

Housing sales down 26% in NCR in first half

Housing sales down 26% in NCR in first half of 2017|Jul 06 2017 : The Times of India (Delhi)

New Delhi PTI

Housing sales fell 26% in Delhi-NCR in the first half of 2017, as demand continued to be sluggish postdemonetisation, despite a price correction of 20% in the last 18 months, according to international property consultant Knight Frank.

Unsold housing stock in the Delhi-NCR property market stood at 1.8 lakh units -highest in the country -that will take developers four-anda-half years to sell. About 17,188 units were sold in the first half of 2017, compared to 23,092 units in H1 2016, Knight Frank India said. Housing sales did improve marginally by 2% from the previous six months, which saw lowest half yearly sales due to demonetisation move.

“NCR market continues to find newer depth and slide continues. NCR housing market is passing through the worst phase. No end to it,“ Knight Frank India Executive Director (Advisory , Retail and Hospitality) Ghulam Zia told reporters.

The consultant released latest report `India Real Estate Residential and Office' for January-June 2017 tracking eight top cities in the country.

On launches, Zia said it hit a “new low“ and fell by 73% in the first six months of this year at 4,800 units, 70% of which were below Rs 25 lakh, signalling shift towards affordable housing segment.

He attributed the fall in launches to demand slowdown and builders' focus on completing existing projects in view of the new Real Estate (Regulation and Development) Act.“Dwindling consumer confidence in the market courtesy delay in projects marred by litigations and poor connectivity in potential growth areas has slowed the market. That slowdown has restricted developers to launch new projects,“ the report said.

2017: Sales in Bengaluru, NCR Delhi, Chennai fell 26%, 6%, 20%

Prabhakar Sinha, ‘Demand poor, homes get cheaper’, January 11, 2018: The Times of India

From: Prabhakar Sinha, ‘Demand poor, homes get cheaper’, January 11, 2018: The Times of India

From: Prabhakar Sinha, ‘Demand poor, homes get cheaper’, January 11, 2018: The Times of India

NCR Sales Fell 6% In 2017, Says Report

Residential real estate prices fell across the country in 2017 due to demonetisation, the implementation of the Real Estate Regulation Act (RERA) and goods and services tax (GST).

According to a Knight Frank report, prices fell by an average of 3% across cities, with Pune witnessing the highest decline, 7%, followed by Mumbai at 5% in 2017. Prices in the NCR, which had already fallen in the last six years, dropped another 2% on average.

The main reason for the fall is poor demand. Sales in Bengaluru, NCR Delhi and Chennai fell sharply — 26%, 6% and 20%, respectively. However, the Mumbai and Pune markets witnessed a slight upward movement. The report pointed out that as RERA had been implemented properly in Maharashtra, sales had picked up in Mumbai and Pune by 3% and 5%, respectively.

Because of slow sales, launches witnessed an unprecedented slowdown during the year. New launches fell by 56% in NCR Delhi and by 41% in Bengaluru. This has affected the sector badly.

NCR witnessed 6% lower sales at 37,653 units while prices fell by 2% due to a slowdown in demand and the impact of new realty law RERA and GST, said property consultant Knight Frank India.

The report also pointed out that that the share of affordable homes among new launches rose from 53% in 2016 to 83% in 2017, indicating developers' focus on properties within the Rs 50 lakh price bracket. The main reason for the launch of affordable housing is the huge demand in the segment and the subsidies under the Prime Minister Awas Yojana.

In fact, if compared to real estate activity in 2010, it is very bad. “By the end of 2017, the residential sector had shrunk to a fraction of its size in less than a decade. Nevertheless the nearstandstill triggered by the note ban seems to have tapered with time,” Knight Frank India chairman Shishir Baijal said.

In 2010, India had witnessed the launch of 4.80 lakh apartments; in 2017, the number is 1.03 lakh. At the same time, sales plummeted from 3.61 lakh apartments to 2.28 lakh.

However, RERA has provided a silver lining. “Select markets wherein Rera has matured have seen developers re-launch projects at attractive prices, which led to an uptick in sales in 2017... It’s a buyers’ market today and we hope the momentum holds steady...,” Baijal said.

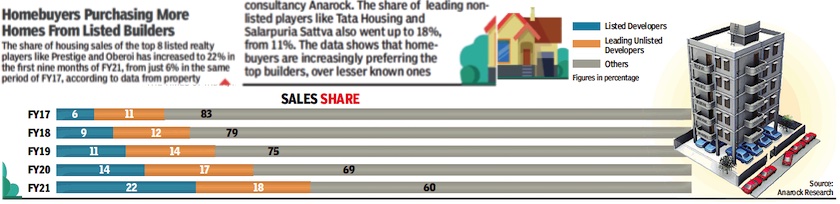

2017-21

Builders who are listed, unlisted

From: May 25, 2021: The Times of India

See graphic:

2017-21, Housing sales by Builders who are listed, unlisted

2018

Unsold flats

Prabhakar Sinha, At 1.5L, NCR records max number of unsold flats, March 6, 2018: The Times of India

From: Prabhakar Sinha, At 1.5L, NCR records max number of unsold flats, March 6, 2018: The Times of India

At 1,50,700, the national capital region (NCR) has the highest number of unsold residential units among the leading cities in the country, reveals a survey conducted by real estate consultancy firm JLL. Overall, these cities, including NCR, Mumbai, Bengaluru, Chennai, Kolkata and Pune, have an inventory of around 4.40 lakh unsold units.

While Chennai is on the top of the completed unsold housing units with around 8,500 units (around 20%) out of 42,600 unsold units, in NCR, only 6% — around 9,000 units — of the unsold units are ready.

The unsold inventory of completed units is estimated at 35,000 units in the top cities. Ramesh Nair, CEO & country head of JLL India, said a significant volume of unsold inventory would ensure that the capital values across most markets would stay buyer-friendly to ensure sales velocity.

With a slowdown in project launches in most markets, more unsold units are likely to get absorbed in the next few quarters. As a trend, end-users have been more inclined to buy a unit as it reaches closer to the date of completion. This has also incentivised the developers to complete a project to improve cash flow.

However, there are fewer buyers for incomplete projects, creating a downward bias in most markets. “From the beginning of 2016, the sector has witnessed changes like RERA, Demonetisation and GST, which have also led to a general slowdown in overall construction activities,” Nair said. Demands, too, have become slow following these changes. “We expect sales velocity to start picking pace in the second half of the year mostly on account of stable prices, making entry attractive,” he added.

In NCR, Noida and Greater Noida together contributed nearly 60% (around 90,000 units) of the total unsold inventory, mostly in incomplete projects. The survey said most of the sales are happening closer to completion, leaving only a minimum percentage of completed unsold inventory at only 5,600 units, 6.5% of total unsold inventory in the twin cities.

Gurgaon saw only limited unsold inventory — largely in incomplete projects at peripheral locations. At 850, less than 4% of the unsold units are ready.

In Greater Mumbai, Thane saw the lowest volume of unsold inventory with approximately 12,500 units — almost entirely under construction — and 163 in the completed category. Thane has been seeing strong traction among endusers due to high quality of construction, ease of commute and a general upgrade of social infrastructure which has been proportionate to the growth of the location, the report said.

Navi Mumbai, on the other hand, recorded over 24,000 unsold units, of which over 10% (2,650) are in the completed projects. Most of these projects are in the peripheral locations of Kharghar and Panvel, which are mostly investor-driven markets. Mumbai city has recorded close to 50,000 unsold units, mostly in the underconstruction projects. Around 150 units are complete but unsold.

Bengaluru, which recorded nearly 70,000 unsold units, has seen an influx of new launches in 2017 backed by a strong and stable economic condition. Even then, 13% of its completed units remain unsold.

2019

2019: 220 realty projects stalled in 5 cities

August 28, 2019: The Times of India

From: August 28, 2019: The Times of India

1.74L houses worth Rs 1.8Lcr stalled as 220 realty projects take a hit

As many as 220 projects — equaling 1.74 lakh homes worth Rs 1.8 lakh crore — are completely stalled in India’s top cities. Almost 66% of these (1.15 lakh homes costing Rs 1.1 lakh crore) have been sold to buyers who are now left in the lurch. These projects have absolutely no construction activity going on, with most being grounded due to either liquidity issues or litigations. Affected homebuyers now see a glimmer of hope with the Supreme Court’s intervention in the Amrapali case.

2019: 40% of mid-segment houses in top cities unsold

Chethan Kumar, Dec 13, 2019 Times of India

BENGALURU: With 40% of the affordable and mid-segment housing units in top eight cities and tier-II cities remaining unsold, industry observers foresee rental and student housing segments becoming the norm in the coming months even as liquidity crunch and uncertainties arising from growing unemployment continue to plague the residential segment.

Of the 4.6 lakh units supplied by realtors, including in the National Capital Region (NCR), Mumbai Metropolitan Region (MMR) and Bengaluru, 1.8 lakh units have not been absorbed, latest data from the Ministry of Finance shows. While the 4.6 lakh units together are worth Rs 3.3 lakh crore, the unsold 1.8 lakh properties are worth Rs 1.4 lakh crore, the ministry data quoting a study commissioned under the special window for affordable and middle-income housing, shows. These 4.6 lakh units were part of 2,202 housing projects.

Mumbai, B’luru worst

In terms of area, houses spread across 225 million square feet of the 582 million square feet remain unsold. And, a city-wise analysis shows that with 53% and 52% unsold units, MMR and Bengaluru, respectively, have the highest unabsorbed inventory, while NCR region has only 24% unsold units.

The NCR, MMR and Bengaluru together saw the maximum number of units supplied, accounting for 3.3 lakh of the total 4.6 lakh units put up in the market. And, together, they have more than 1.2 lakh of the 1.8 lakh unsold units (see graphic).

Other cities — Pune, Hyderabad, Chennai, Kolkata and Ahmedabad — have a higher percentage of unsold inventory, but the absolute numbers in these cities are not comparable with the big three. In the tier-II cities, more than 59,000 units were supplied, of which 32,989 have been absorbed, leaving another 26,390 units worth Rs 12,759 crore unsold.

Rental & student housing

Juggy Marwaha, executive managing director, Jones Lang LaSalle (JLL), said: “Honestly, things are not improving, although there are some data points showing that there are some green shoots visible. With the liquidity crisis and unemployment issue, the year is ending in a bad way. But this only a temporary situation as there is a huge demand for houses in this country.”

Further elaborating, Marwaha said that co-living, rental and student housing are a shining aspect of an otherwise gloomy residential segment. People are understanding the importance of these trends and are becoming aware that rental housing is the future. “We anticipate that more and more builders will look at this rather than sell in a depressed market,” he said.

JC Sharma, vice-chairman and MD, Sobha Limited, while arguing that no existing inventory would be suitable for such segments, said: “Future projects could specifically explore the rental and student housing segments which are catching up. Also, going by the data provided here, prima facie, it appears to also include projects that have approvals but are not yet complete.”

Time of consolidation

Shankar Shastri, national executive member, Confederation of Real Estate Developers Association of India (Credai), said: “A healthy inventory is always good, both for the industry and the consumer, so I don’t see this negatively.

However, it is generally preferred that we have about 30% more, but going by this data, which shows 40%, I suspect that it could also involve projects that aren’t complete.”

Marwaha said that even in the middle of the liquidity crisis and market apprehensions, those developers who managed to execute projects well have been able to sell. “So we will see a lot more consolidation in the future where the bigger firms will grow even bigger,” he said.

Both Sharma and Shastri echoed this view and said that there are several projects where bigger builders are taking over projects of smaller developers and in the future there may be more mergers too.

Unsold housing units in NCR and MMR

Dec 26, 2019: The Times of India

From: Dec 26, 2019: The Times of India

There are about 1.83 lakh unsold housing units in urban areas worth Rs 1.39 lakh crore and nearly 55% of them are in the National Capital Region (NCR) and Mumbai Metropolitan Region (MMR), government data showed.

The finance ministry had recently told Lok Sabha that the total unsold built-up area across major cities was close to 225 million sq feet and the value was pegged at nearly Rs 1.39 lakh crore. The MMR had the maximum unsold inventory of 51,721 units followed by the NCR, which had 49,027 unsold houses. Government data submitted to Lok Sabha also showed that the value of unsold units in Mumbai was substantially higher at Rs 61,451 crore as compared to the total value of unsold properties in the NCR pegged at Rs 33,990 crore.

In response to a question from BJP’s L S Tejasvi Surya, minister of state for finance Anurag Thakur had said as per a study commissioned by the investment manager of the first Alternative Investment Fund under the special window for affordable and middle-income housing, the number of stalled projects in the affordable and mid-income segment stood at 2,202.

The SBICAP study had estimated that nearly 4.58 lakh housing units were stalled.

Some of the reasons behind projects getting stalled have been the liquidity crunch and reports of developers diverting homebuyers’ payments to other projects. Some homebuyers have even stopped making payment since several projects have been stalled for years and some builders have gone bankrupt.

Investments

Institutional investments: 2009-2019

From: August 25, 2020: The Times of India

See graphic:

Institutional investments into Indian real estate (in $ bn), 2009-2019

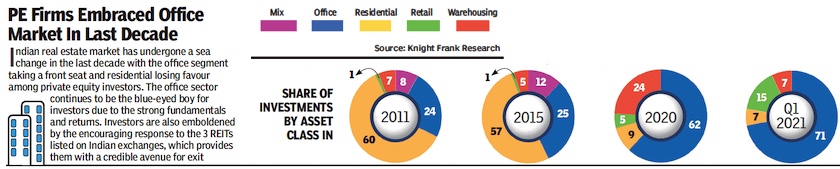

Investments by asset class: 2011-21

From: May 8, 2021: The Times of India

See graphic:

Investments in real estate by asset class: 2011-21

Investment in 6 top cities doubles to $2.87 billion: 2017:

From: Prabhakar Sinha, Realty investments up 100% in top 6 cities, says survey, October 31, 2017: The Times of India

Globally, Mumbai Moves To 81st Slot From 149th 2016

With favourable changes in the legislative environment, India's six major cities -Mumbai, Bengaluru, Pune, New Delhi, Chennai and Hyderabad -have recorded 100% increase in investments in real estate sector at $2.87 billion during July 2016-June 2017, according to a survey by Cushman and Wakefield.

Mumbai, with an investment of $1.75 billion from foreign as well as domestic private equity investors, has moved up to 81st position in the global survey on rankings of cities for attracting capital from 149th slot in 2016.Also, the financial capital has witnessed highest growth among the gateway cities of the world with 194% increase in investment from $594 million in the same period last year.

New York, with $51billion investment, continues to rule the rankings of cities on the basis of investments in real estate sector followed by Los Angeles ($39.1 billion), San Francisco ($32 billion) and London ($30 billion).Shanghai, which attracted $17.6 billion investment, is placed at 10th position.

The global property mar ket witnessed 4% rise in volume to $1.5 trillion during July 2016-June 2017. Cross border real estate investments constitute 75% of total volumes.

Of the total real estate investment received by various cities in India, the largest share of over 55% came in from the North America, while domestic and regional sources saw a decline in share of capital invested in In dia, said the report. Funds from Europe, which were conspicuous by their absence during last year, were seen contributing approximately 14% of the total investment.

India's current economic position and stability in political scenario have been instrumental in creating an investment-friendly environment in the country , said the report.

Among Indian cities, after Mumbai, Bengaluru attracted $300 million, followed by Chennai ($276 million) and New Delhi ($125 million).

Anshul Jain, country head and MD of Cushman and Wakefield India, said that current economic drivers are biased towards developed markets but Indian cities are performing ahead of expectations and are offering medium to long term growth potential in real estate.

PE flows into residential sector: 2013-18

Prabhakar Sinha, Residential sector sees highest PE flow in 10 qtrs, May 5, 2018: The Times of India

From: Prabhakar Sinha, Residential sector sees highest PE flow in 10 qtrs, May 5, 2018: The Times of India

Private equity investments in real estate sector surged 15% to Rs 16,530 crore ($2.6 billion) during the first quarter of 2018, eclipsing the inflows in the first quarters of last 11 years, according to a report by the global real estate consultancy Cushman & Wakefield. Only the December quarter of 2017 attracted higher PE investments at Rs 17,100 crore.

Private equity inflows into the residential sector more than doubled to Rs 8,518 crore in Q1, 2018, compared to same period last year, which is also the highest in last 10 quarters. The report attributed the surge in investor activity to government incentives in affordable housing. Mumbai accounted for approximately 19% of the total deals in the residential sector.

Anshul Jain, MD of Cushman and Wakefiled, said the strong inflows are a testimony to the attractiveness of the Indian real estate market for institutional investors. He said inflows into the realty sector may continue to rise over the next few years.

During Q1, 2018, office sector recorded PE inflows of Rs 6,100 crore ($940 million), a 40% decline from the corresponding quarter last year. The sharp fall in investments is due to the postponement of closure of certain notable transactions to forthcoming quarters, said the report.

Legal position and instruments

Land deals

August 21, 2023: The Times of India

From: August 21, 2023: The Times of India

Mumbai : As many as 59 separate land deals for over 2,018 acres have been closed across the country between January and August 2023, revealed data compiled by the Anarock Group. Of these, the Mumbai Metropolitan Region (MMR) recorded the highest number of transactions (17) cumulatively, accounting for just over 95 acres, earmarked for residential development.

In the corresponding period last year, about 51 land deals for around 1,438 acres were closed across various cities. “However, very few of these deals were for large land parcels,” said Anarock chairman Anuj Puri. “The three largest were in Ahmedabad for 740 acres, and one deal each in Ludhiana and Bengaluru for 300 plus acres each. In terms of deal numbers, residential real estate drew the highest.

In Mumbai, the largest deal was recorded in February 2023. The Bai Kabibai Hansraj Morarji Charity Trust sold 23 acres of land to Arogya Bharati Hospitals for 540 crore in Andheri (W). According to the Anarock report, of the 59 land deals closed in 2023 (January-August), approximately 38 deals for over 283 acres are proposed for residential development across the top 7 cities. Five deals are for 1,136 acres and are earmarked for township projects in cities like Chennai, Ahmedabad and Ludhiana.

Four deals are for over 62 acres and are meant for mixed-use developments in Noida, Gurugram, Pune and Bengaluru. Three separate land deals for over 154 acres are for plotted developments in cities like Chennai, Raigad and Gurugram. Three deals for around 16.5 acres are for commercial development in NCR cities—Delhi, Noida and Gurugram. One large deal for over 300 acres has been earmarked for manufacturing in Bengaluru.

In Mumbai, one hotel deal was registered on a 5.5-acre plot for Rs 71 crore while Bengaluru recorded the biggest deal for manufacturing on 300 acres. In terms of total land area transacted, Ahmedabad stood out with about 740 acres transacted so far this year.

Hyderabad recorded two separate deals for 18+ acres, accounting for just 1% of the total land transacted between January and August 2023. NCR sealed 13 separate transactions accounting for 4% of the total land transacted, for 89.82 acres. This includes nine deals for a total of 61.6 acres in Gurugram, three in Noida for 19+ acres, and one in Delhi for 9 acres. Pune saw five deals for approximately 44 acres.

Real Estate Investment Trusts (REIT)

Blackstone likely to be India's first listed on REIT

REITs are listed trusts holding income generating properties, earnings from which are distributed to shareholders. Market regulator Sebi came out with REIT guidelines [in 2014], helping real estate developers list their rent-yielding assets, and also providing large and small stock market investors with an inflation indexed product.

The world's largest private equity manager Blackstone Group, which is also the most prolific investor in Indian commercial properties, is finalizing plans to raise Rs 4,000 crore (about $600 million), through a listing of Real Estate Investment Trust (REIT) on the domestic stock exchanges, people directly familiar with the matter said. This will perhaps be India's first REIT listing and a test case for global investors who have poured big bucks into the country's rent-yielding commercial assets, especially tenanted office spaces.

Blackstone, through its joint ventures with Bangalore-based Embassy Group and Pune's Panchshil, is on the road to build 50 million sqft tenanted office buildings--of which 30 million are already leased--across top Indian cities. It could target a possible listing during the first quarter next calendar, though a decision on timing would be taken only after filing for permission with Sebi.

RERA at the Centre, and in Haryana and UP

From The Times of India

Luxury homes

The main markets in 2014

Bangalore No. 1 market in India for luxury homes

While Bangalore reports sales of close to 100 luxury units — including villas — on a quarterly basis, Mumbai and NCR, in comparison, see only around a dozen such sales.

Anshul Dhamija, TNN | Apr 20, 2014 The Times of India

BANGALORE: When it comes to luxury homes — units priced above Rs 5 crore — Bangalore is setting benchmarks to emerge as the country's top luxury home market, says a report by JLL India, an international property consultancy firm.

Quality of construction, design, ventilation, floor-to- ceiling height, amenities, floor plans, building elevation and configuration aspects are among the factors fuelling Bangalore's rise to the top, the report says.

Most importantly, pricing of luxury residential properties in the country's IT capital is seen to be far more reasonable and realistic than Mumbai and NCR, says JLL's report, shared exclusively with TOI.

"Luxury properties in Bangalore are 20% to 30% cheaper. While luxury apartments that cost between Rs 6 crore and Rs 30 crore may seem exorbitant, they are in fact very reasonable when compared to the rates going in premium locations of established cities like Delhi and Mumbai," notes Om Ahuja, CEO-residential services, JLL India.

Citing research data, Ahuja adds: "A luxury apartment in Indiranagar or Koramangala is still an attainable reality with prices ranging from Rs 9,000 to Rs 12,000 per square foot. No other premium locations of other major Indian cities offer such prices in the luxury segment."

While Bangalore reports sales of close to 100 luxury units — including villas — on a quarterly basis, Mumbai and NCR, in comparison, see only around a dozen such sales.

Data shared by the consultancy firm LJ Hooker shows that Bangalore has around 5,400 luxury units under various stages of construction and planning.

After Mumbai and NCR, Bangalore is the third largest market for luxury property sales and product offerings. It is also the third largest real estate investment hub for high net-worth individuals (HNIs), but tops the list in terms of investments from NRIs looking at settling down in India.

While much of the city's luxury homes demand is fuelled by millionaires from the IT/ ITeS sectors, the demand is also being driven by Kolkata and Chennai-based HNIs. JLL estimates Bangalore to have over 10,000 dollar millionaires.

In terms of product, JLL reported that luxury residential offerings in Mumbai and NCR fall more or less in the vanilla category when compared to products in Bangalore. "In Mumbai and NCR, location aspects such as sea view or PIN code tend to define the flair and profile of a property far more than the positioning of the product in terms of luxury and design parameters," says Ahuja.

Demand across all metros for luxury residential products was subdued over three to four financial quarters, but has picked up in the past 60 days, say analysts tracking the real estate sector.

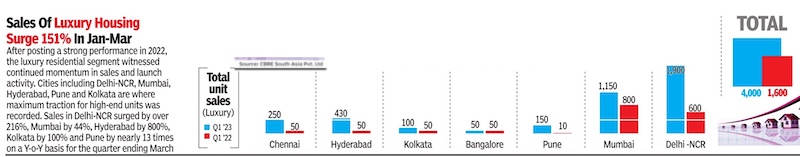

Sales, 2022- 23

From: June 7, 2023: The Times of India

See graphic:

Luxury housing, total unit sales, Q1 2022- Q1 2023

New Integrated Licencing Policy (NILP), 2015

The Times of India, Oct 24 2015

Manvir Saini

Haryana policy gives big housing a push

The Haryana government has reduced the minimum land requirement to build townships from 100 acres to 25 in its new integrated licencing policy (NILP), which it unveiled. The state expects the NILP to help energise the real estate market that has been going through a prolonged slump, particularly in NCR. The policy is applicable to high and hyper potential areas in NCR and the state capital region (SCR).

The lowering of the mi nimum land quantum for large housing projects to 25 acres also means acquisitions of this scale won't attract tough clauses of the Land Acquisition, Rehabilitation and Resettlement Act, which is applicable for acquisitions above 50 acres.

Only 12 housing project licences have been issued since the Manohar Lal Khattar-led BJP government took the reins of the Haryana government in October 2014.But the investment climate alone is not to be blamed for this. The state stopped issuing licences to builders in September 2014 when the model code of conduct for the assembly polls came into effect. The new government only resumed giving out housing licences in June.

The NILP will cover Gurgaon and Manesar, Faridabad, Ballabgarh, Sohna, So nipat, Kundli and Panchkula. The government expects it to generate a revenue of Rs 1.25 lakh crore. While unveiling the policy in Chandigarh, chief minister Khattar said he was hopeful that 2 lakh dwelling units under the affordable housing scheme would be built by 2020.

Besides bringing down the minimum area requirement for obtaining the licence, the NILP also plugs an illegal practice of developers signing memoranda of understanding (MoU) to fulfil the 100-acre cap. There had been instances in the past when builders have inked MoUs with landowners and apply for a licence.

Now builders, who want to use farmers' land for their projects, will have to sign a transferable development rights (TDR) agreement.“This will ensure that far mers or landowners will get the market price from the builder for their land. The government will be a facilitator as the custodian of farmers' interests. The TDR certificate will be valid for two years from the date of issuance,“ said Khattar.

NRIs, investment in property by

City-wise, 2022

Sudipta Sengupta, Dec 5, 2022: The Times of India

HYDERABAD: Edging out top cities to emerge as the top destination for property investment among NRIs adds another feather in Hyderabad's cap. According to Anarock's findings, while until 2021, Bengaluru, Pune and Chennai were the top picks of most NRI homebuyers, Hyderabad managed to edge all of them out to emerge as the number 1 city in India, in NRI investments in 2022.

In the early months of the year, the city walked away with 22% of this market share, the survey showed, followed by NCR at 20%. Bengaluru stood third at 18%.

Local industry players say many with jobs overseas are now picking up office spaces and open plots, as an investment option, pushing the NRI investment quotient of developers by 15% to 20%. "From 15% until last year, my client base of buyers living outside India has grown to 30%. Though the ticket size of these purchases starts around 1 crore, majority fall in the 2 crore to 2.5 crore bracket," said a builder with projects along the IT corridor.

And while US still walks away from the lion's share, NRIs from Canada, the UK, Europe, Middle East and various Asian countries too are seen parking their money here. The investments, some say, are as high as 10 crore.

"Hyderabad has been doing very well commercially. In fact, it has positioned itself as one of the most active commercial markets in south India. Not surprising then that NRIs are looking to capitalise on this market, especially considering the depreciating value of rupee," said Prashant Thakur, senior director and head (research), Anarock Group. "Factors such as proactive governance, robust infrastructure, ease of doing business and quick approvals have also placed the spotlight on Hyderabad's office market," he added.

The lucrative returns are another reason. "I bought an apartment in Gachibowli last year for 1.2 crore and the value of it has already appreciated by 30%. Now, my friends and I are planning to buy some plots along the Srisailam highway," said Manish Sinha an IT professional who moved to the US in 2019 after working in Hyderabad for seven years.

Office space

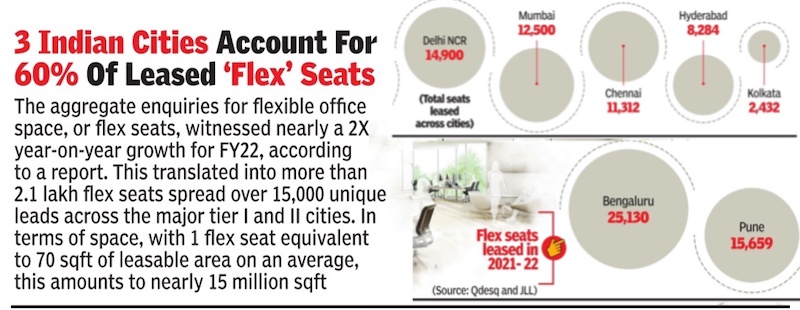

Flexible office space

2022

From: June 27, 2022: The Times of India

See graphic:

Flexible office space in India, city-wise, 2022

Vacancies, city-wise

2021

From: June 25, 2022: The Times of India

See graphic:

Office space, Vacancies, city-wise: 2021

Office space: occupancy costs (cost of purchasing/ hiring real estate)

Realty index: 2007-2009

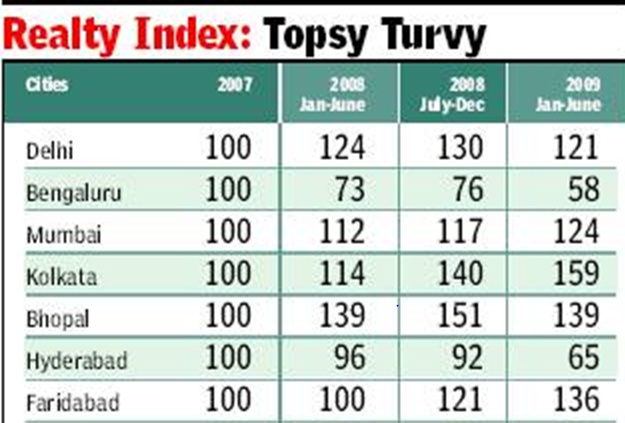

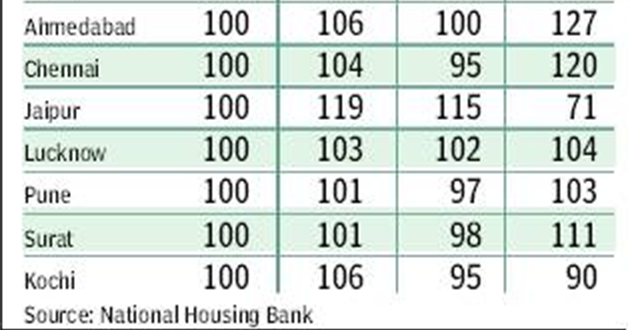

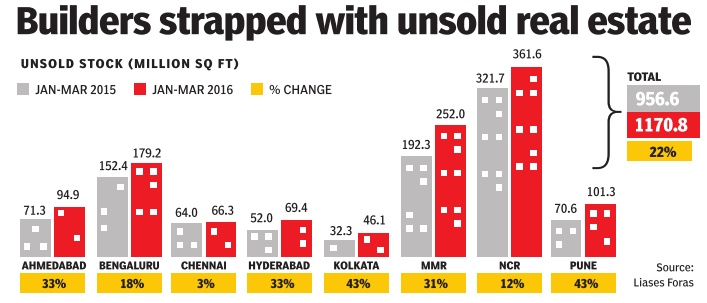

See the graphics

Unsold stock of real estate in India, 2015-Mar 2016

Realty index, 2007-09 A

Realty index, 2007-09 B

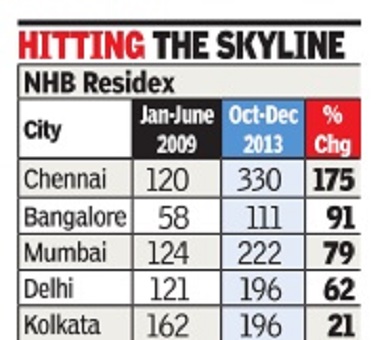

2013, NHB Residex

See the graphic, NHB Residex, 2009-13

Office space: rents and occupancy costs, March 2013

‘CP world’s fifth costliest office mkt’

TIMES NEWS NETWORK

Delhi

Despite weakening demand for office space Connaught Place remains the fifth most expensive office market in the world.

In property consultant CBRE’s semi-annual Prime Office Occupancy Costs survey, CP has retained its earlier ranking in the list of the world’s 50 most expensive office markets. The latest survey provides data on office rents and occupancy costs as of March 2013 across 133 countries.

“Though demand for office space has reduced, occupancy costs remain high, especially in Connaught Place, due to limited supply in the near future,” said Anshuman Magazine, chairman and managing director, CBRE.

Downturn, around 2014

2016: Circle rates lowered

The Times of India, June 3, 2016

These are hard times for the real estate industry in NCR. One factor that has gnawed away at interest in buying or selling property is the unreasonable circle rates. While Gurgaon proposed a 15% cut [May 2016], circle rates there, and in most of Noida, are higher than the market rates, virtually slowing transactions to a trickle.

The property market in NCR is at its lowest ebb.Prices have either plateaued out or fallen over the past couple of years. Like any bear run, this ought to have got buyers looking for long-term returns interested. But that hasn't happened. As much as the trust-deficit has spooked in vestors, a devil hiding in the detail has further queered the sales pitch. It's called the circle rate.

By definition, circle rate is the minimum value at which a plot, house, apartment or commercial property can be sold.The rate is decided by a state's revenue department in consonance with market rates. But in hot property markets like Gurgaon and Noida, the circle rate has stopped keeping in touch with the market rate. So, while market rates depreciated due to bad buying sentiment, circle rates didn't.

What this created is an environment in which neither buyer nor seller is interested in making a transaction. Why?

Say an apartment's market price is Rs 1crore but its value, according to the circle rate, is Rs 1.5 crore. It means both the stamp duty the buyer has to pay to register the flat and the tax component of the seller will be calculated on Rs 1.5 crore, the circle rate. It's a transaction in which both parties lose.

Acknowledging this, the Gurgaon administration recently made the unprecedented proposal of cutting circle rates by a steep 15% for the 2016-17 fiscal year. The industry hopes the Delhi and UP governments will follow suit.Gurgaon divisional commissioner D Suresh said the proposal reflected the reality.

Unlike in Gurgaon, where circle rates were not revised for the last two years, Noida continued to raise them despite the gloom. Updesh Bharadwaj, a resident of Sector 72, owns a shop in a mall in Sector 18 that he wants to sell. “The market price of the shop is Rs 1.5 crore but it's Rs 2.5 crore as per the circle rate. I have been looking for a buyer for two years. But no one is interested because of the huge gap in rates,“ he said.

Gurgaon

And the gap in office realestate occupancy cost between central business districts (CBDs) such as Connaught Place and suburbs such as Gurgaon (ranked 72nd) stays wide.

Mumbai:

In Mumbai the occupancy costs in Nariman Point, the country’s first planned CBD, have reduced further. In the CBRE survey, Nariman Point dropped to 26th position at $90 per sq ft per annum. In December 2012, it had ranked 25th.

But the Bandra-Kurla Complex (BKC) retained its earlier ranking (11th) among expensive office markets, CBRE said.

CBRE analysts said the Mumbai CBD — including the micro markets of Nariman Point, Fort and Cuffe Parade — had seen office space absorption of only 8,000 to 10,000 sq ft during the quarter. Office rental values in these micro markets declined 3-4% sequentially in January-March, they said.

2014: NCR, Mumbai

Dec 31 2014

‘CP 6th costliest office location in world’

BKC and Nariman Point are among the top 50 costliest office spaces globally, according to CBRE’s survey released in December, 2014. BKC, which is the city’s alternative business district, retained its 16th rank, while Nariman Point is ranked 32nd on the top 50 list.

At nearly $160 per sq ft per annum, Delhi’s Central Business District (CBD) of Connaught Place bagged the sixth slot.

“London’s West End remained the world’s highestpriced office market, but Asia continued to dominate the world’s most expensive office locations, accounting for three of the top five markets,” said the CBRE report.

London West End’s overall prime occupancy costs of $274 per sq ft per year topped the “most expensive” list.

Hong Kong Central followed with total prime occupancy costs of $251 per sq ft, Beij ing’s Finance Street ($198 per sq ft), Beijing’s CBD ($189 per sq ft) and Moscow ($165 per sq ft) rounded out the top five.

“Although New Delhi’s Connaught Place moved up two places to the sixth spot on the global top 10 rankings over the first quarter of 2014, annual occupancy costs here remained stable because of rupee appreciation since the first quarter,“ said CBRE south Asia CMD Anshuman Magazine. Annual office occupancy costs in Gurgaon remained stable, while that of Nariman Point dropped by about 2% and BKC by about 6%. Bangalore’s CBD, which saw a nearly 9% drop, was among the top five global prime office markets to witness a decrease in yearly occupancy costs.

Global prime office occupancy costs rose 2.5% yearover-year, led by the Americas (up 4.1%) and Asia Pacific (up 2.8%).

2015-16 : In the Metros

See graphics:

Property prices in Bengaluru, Chennai in 2015 and 2016

Property prices in Delhi/ NCR, Kolkata, Mumbai in 2015 and 2016

2016: Khan Market no. 1 in India, no.29 in world

From: November 24, 2017: The Times of India

See graphic:

Most expensive retail spaces, city-wise, 2017

2016: Connaught Place, BandraKurla, Nariman Point most expensive

The Times of India, Jun 16, 2016

CP world's 7th costliest office space

Connaught Place has slipped one notch to become the world's seventh most costliest office destination, according to property consultant CBRE. Mumbai's BandraKurla Complex (BKC) is at the 19th position and Nariman Point at 34th, according to CBRE Research's Global Prime Office Occupancy Costs bi-annual survey .

“With annual occupancy cost of USD 149.71 per sq ft, New Delhi's Central Business District (CBD) of Connaught Place ranks as the seventh most expensive prime office market in the world,“ CBRE said in a statement.

Hong Kong (Central) became the highest-priced office market with an overall prime occupancy costs of USD 290 per sq ft per annum, followed by LondonCentral (West End) with annual occupancy cost of USD 262.29.

2017/ Office rents, Indian cities

Knight Frank, 2017, Office rents: Mumbai, Delhi, Bengaluru among top 6

HIGHLIGHTS

Office rents in Mumbai, Delhi, Bengaluru among top 6 globally, according to a study

Global price index that compares rental values of prime office spaces across 20 international markets rose by 1.2 per cent in the quarter

Bengaluru's office rents grew by 4 per cent- highest among key CBDs in India

Healthy surge in rentals across key business districts reinstated the growing prominence of Indian metrosHealthy surge in rentals across key business districts reinstated the growing prominence of Indian metros

MUMBAI: Healthy surge in rentals across key business districts reinstated the growing prominence of Indian metros including Mumbai, Bengaluru and New Delhi on the global map of high-rent yielding commercial spaces during April-June 2017, says Knight Frank in a recent study.

According to the report, the global price index that compares rental values of prime office spaces across 20 international markets rose by 1.2 per cent in the quarter.

"Prime business districts in the three Indian metros have seen robust rental growth courtesy strong demand and limited vacancies. This scenario is expected to remain for a year owing to a supply crunch of new office space," Knight Frank India Chief Economist and National Director-Research Samantak Das said.

As per the report, sustained interest from the IT/ITes sector pushed rents in Bengaluru's business district by four per cent- the highest among other key CBDs in India.

Other established business districts such as the Connaught Place in Delhi also saw a 2.2 per cent climb in rentals, courtesy a lull in supply of new office spaces and dwindling vacancies, it said.

The Bandra Kurla Complex in Mumbai, recorded a quarter-on-quarter increase of 2 per cent in rents in April-June 2017. Vacancy levels here, however, got a boost with a fresh office supply of around 530,000 sqft in the last quarter.

"Despite the global pressures on the IT/ITes sector triggered by automation and limitation in demand for business the technology-driven Bengaluru market has performed well and it expected to do even better. But prime office assets in Mumbai and Delhi are likely to see a slower growth trajectory having already scaled high-rental values," he added.

According to it, Phnom Penh in Cambodia topped the chart this quarter with 4.2 per cent increase, Bangkok (Thailand) the erstwhile topper saw its first decline this quarter in close to three years.

JLL's report, 2017/ Delhi 7, Mumbai 16 on world’s costliest office list

Delhi 7th, Mum 16th on world’s costliest premium office list, December 25, 2017: The Times of India

From: Delhi 7th, Mum 16th on world’s costliest premium office list, December 25, 2017: The Times of India

Delhi rentals are higher than cities like LosAngeles, Singapore, Paris, Seoul, Sydney, Frankfurt, Chicago and Toronto. However, Mumbai figures among the world’s most expensive locations for premium office rents, according to JLL’s latest report. While Delhi is ranked at number seven, Mumbai is ranked 16 on the list of the world’s most expensive locations for premium office rents.

The findings reveal that the mostexpensive premium office rent in the world is in Hong Kong, followed by New York, London, Beijing, Silicon Valley, Beijing again (another financial district), Delhi, Shenzen and Tokyo.