Cognizant

This is a collection of articles archived for the excellence of their content. |

Contents |

CEOs

Compensation: 2007-17

Shilpa Phadnis , Oct 9, 2019: The Times of India

From: Shilpa Phadnis , Oct 9, 2019: The Times of India

Francisco D’Souza, who stepped down as Cognizant CEO earlier this year, realised $191.4 million in total compensation during his tenure as CEO from 2007, a majority of which came in the form of stocks and options, according to a blog post by US compensation research firm Equilar.

The figure is substantially more than the $104.3 million reported in the summary compensation table of Cognizant’s annual proxy statements for D’Souza. The difference arises mainly because of the good performance of the stock during the period.

Disclosed equity values are made as of the grant date, while the realised values are made as of the company’s most recent fiscal year-end (the end of the evaluation period). So, when the stocks previously granted vest, and if the stock value is higher at that point, the realised pay rises.

Alex Knowlton, senior research analyst at Equilar, noted that 2016 saw the largest disparity between reported and realised pay, with the realised total for the year nearly four times the amount of the reported pay in the summary compensation table.

In 2016, D’Souza’s realised pay was $32.9 million, while the reported pay was $8.3 million. The realised pay was higher than the reported pay in every year barring in the second year of his CEO tenure — 2008.

D’Souza had a phenomenal tenure as CEO, during which time the company’s revenue crossed those of Wipro and Infosys. During the period, the stock price trended upwards quite sharply, reaching a peak in March 2018. His compensation would have been heavily tied to performance, and consequently, the stock grants would have been significant. It’s likely that through much of his tenure, he would have earned most of his realisable pay.

2019: Change of guard

Cognizant names Voda exec as CEO, February 7, 2019: The Times of India

From: Cognizant names Voda exec as CEO, February 7, 2019: The Times of India

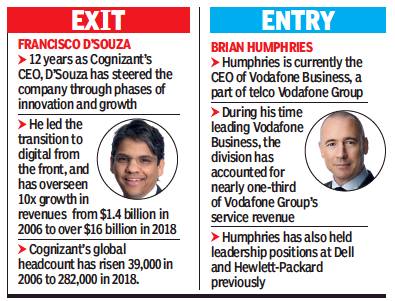

Ending months of speculation, Cognizant appointed Brian Humphries as its new CEO. Humphries, whose appointment takes effect on April 1, is currently the CEO of Vodafone Business.

Humphries’ appointment brings to end the 12-year reign of co-founder Francisco D’Souza as the company’s CEO, who will now serve as executive vice-chairman till June to facilitate the transition. D’Souza piloted the company during the turmoil of 2008 and helped Cognizant beat rivals, including Infosys and Wipro. In an unexpected development, the company’s president Rajeev Mehta, seen as second-in-command after D’Souza, is also stepping down effective April 1.

Humphries will be Cognizant’s first non-founder CEO and the telecom sector executive has been responsible for Vodafone’s mobility business as well as its more tech-heavy Internet of Things, cloud-hosting, carrier services and security solutions verticals.

However, Humphries is no stranger to the technology sector, and has held previous leadership positions at global tech firms Dell and Hewlett-Packard. “Cognizant is renowned for being laser-focused on its clients’ needs, developing business solutions and services that help clients position their companies for the future,” Humphries said.

Raj Mehta’s sudden exit spurred speculation that he might have been peeved at not being elevated to the corner office. The management increased his compensation significantly last year when nearly $9 million worth stock options were offered and also a $1.3-million cash bonus.

Flashpoints

Ex-COO to pay $50k fine in 2016 bribery case

Shilpa Phadnis, Sep 16, 2019: The Times of India

Former Cognizant COO Sridhar Thiruvengadam has agreed to pay a civil penalty of $50,000 following a Securities and Exchange Commission (SEC) order that found that four company executives, including the former, authorised a bribe payment in a video-conference, which violated the Foreign Corrupt Practices Act (FCPA).

The case relates to Cognizant’s 2.7-million-sqft KITS campus on Old Mahabalipuram Road in Chennai that planned to employ 17,500 people. A senior government official of Tamil Nadu demanded a $2-million bribe from the construction firm responsible for the campus. The bribery exposed Cognizant to civil and criminal liability with the company paying $25 million in penalties as well as incurring $79 million more in costs related to its internal investigation.

The SEC order said Thiruvengadam devised a scheme to cover it up in the company’s books. Thiruvengadam was Cognizant’s COO from late 2013 until he was placed on administrative leave in late 2016. Cognizant accepted Thiruvengadam’s resignation last year. The SEC order states that Thiruvengadam later helped to conceal the payment by signing false sub-certifications. It found that Thiruvengadam violated the FCPA’s internal accounting controls and record-keeping provisions. “Without admitting or denying the findings, Thiruvengadam agreed to pay a civil penalty of $50,000,” the order said.

A lawsuit filed by a group of investors on July 27 had put the spotlight on two of its former top executives — former president Gordon Coburn and former chief legal officer Steven E Schwartz. Coburn and Schwartz channelled payments to L&T, the construction company responsible for the KITS campus.

The lawsuit alleged that to disguise Cognizant’s repayment to L&T of the bribes the latter paid to government officials, Schwartz and Coburn agreed that L&T would submit many fraudulent change order requests at the end of the project totalling $2 million. TOI has seen a copy of the order that said Cognizant engaged the contracting firm to build the facility and obtain all necessary government permits.

Growth

2010-18/ 19

Shilpa Phadnis, May 7, 2019: The Times of India

From: Shilpa Phadnis, May 7, 2019: The Times of India

Cognizant was once the toast of Wall Street, the poster boy of IT outsourcing. It had a revenue CAGR of 48% between 2004 and 2008, and 28% between 2009 and 2013, far ahead of TCS, Infosys and Wipro. Even in 2014 and 2015, it grew 16% and 21% respectively, with the others nowhere close, except TCS in 2014. Even during the global financial crisis of 2009, when Indian IT went for the first time into flat and negative territory, Cognizant grew at 16%.

The first sign that something had changed came in 2016, when growth suddenly slumped to 8.6%. And it remained thereabouts for the next two years. And now, the company’s new CEO, Brian Humphries, says growth is expected to be between 3.6% and 5.1% this year. Investors were clearly shocked.

The share price on the Nasdaq plummeted by 11% on Friday and on Monday, it was down 0.2% in initial trading. A Bloomberg report said Cognizant had neared a dubious milestone after “a disappointing forecast led at least nine analysts to cut their ratings on the stock, approaching the most downgrades in a single day this century.” It said that with at least 33 analysts covering the stock on Wall Street, there could be more downgrades still to come for Cognizant.

Two things happened around 2016 that might provide a clue to this collapse. That was the year when Cognizant, partly under pressure from activist investor Elliott Management – which owned 4% of the company’s shares – changed its strategy on margins. It was also the year when it was hit by a serious bribery scandal in India. It appears that these issues became too much to handle for former CEO Francisco D’Souza and his team that had led the company through those years of searing growth. Cognizant always had much lower margins than Indian peers TCS and Infosys. It said this was because it was investing more in the business, and it was this investment that enabled it to grow so fast. Sometime in 2015-2016 it decided it must raise margins.

In August 2017, in an interaction with TOI, D’Souza said: “We thought it was very important to shift the focus of the company and our messaging and value proposition to investors from industry leading growth to high quality sustainable growth. We have reached a point now where we think it is important not just to be focused on growth for the sake of growth and to really be thoughtful about what are the growth opportunities to go after and how we go after them so that the growth is sustainable longer.”

Elliott, he indicated, had suggested an acceleration of this move. A letter Elliott wrote in 2016 said its value enhancement plan calls for a 23% adjusted operating margin in 2018, compared to a 19.7% margin in 2015.

Bert Hochfeld, CEO of Ticker Target Investments, told TOI last year that Elliott got involved in Cognizant because the company was not being well run. But Elliott’s plan didn’t mesh well with the culture at Cognizant, he said, and they were unable to do what they needed to do. “I am not sure that Elliott had some specific knowledge/ understanding that its strategy would challenge the growth potential of Cognizant, although that might be the case. But I have watched Elliott for some years and their propensity to trade and to take profits is very high, and that would be what I think happened. No more and no less,” he said, when asked whether Elliott’s roadmap posed challenges to its revenue growth.

Phil Fersht, CEO of HFS Research, said Cognizant’s previous strength was being a threat to the likes of Accenture with its digital strategy, but “with the impact of Elliott, the firm struggled to make investments to keep up and the leadership appeared tired and burned out in recent times.” “You had a CEO focused on EPS and dealing with activist investors just at a time when they needed to be focused on external wins instead of internal politics,” said Ray Wang, CEO of Constellation Research.

The other huge distraction was the bribery case. The company voluntarily disclosed that it had started an internal investigation into whether certain payments relating to facilities in India were made improperly, and in possible violation of the US Foreign Corrupt Practices Act and other applicable laws. On the same day, the company announced the resignation of president Gordon Coburn. Criminal charges were filed against Coburn and former chief legal officer Steven Schwartz by US prosecutors in what was said to be a $2 million bribery of Tamil Nadu government officials to get building permits for a campus in Chennai.

The company spent at least $60 million dollars investigating the case, and it paid a fine of $28 million to US authorities to settle the case. Multiple heads are said to have rolled, including in Chennai, the company’s delivery headquarters.

“The bottom line is morale at Cognizant is awful now,” said Wang. And it could get worse before it gets better. Humphries has indicated he wants more efficiency on the delivery side, and that will include another round of layoffs.

See also

Cognizant