Chief Executive Officers: India

This is a collection of articles archived for the excellence of their content. |

A: GLOBALLY

India-born CEOs of global corporate giants

The Times of India, August 15, 2016

From: Chidanand Rajghatta, Sep 3. 2022: The Times of India

From: Chidanand Rajghatta, Sep 3, 2022: The Times of India

An overview of CEOs

From: Chidanand Rajghatta, Mar 30, 2022: The Times of India

See graphic:

CEOs of India origin, as in 2022 March

10 Indian-origin CEOs 'ruling' the technology industry

Indians have played a key role in the success of technology powerhouses globally.

From Google to Microsoft, Cognizant to NetApp -- Indians run some of the world's biggest and best companies.

Photocopying major Xerox has named Infosys veteran and former iGate CEO Ashok Vemuri as CEO of its back-office outsourcing company.

Vemuri's elevation is another milestone for Indian-origin CEOs, of whom at least half a dozen are in Fortune 500 companies.

2020

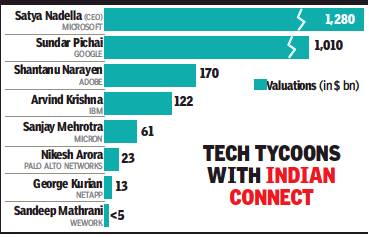

Indian-origin CEOs now lead tech companies that together command a market capitalisation of nearly $2.7 trillion. These include Satya Nadella of Microsoft, Sundar Pichai of Alphabet/Google, Shantanu Narayen of Adobe, Sanjay Mehrotra of Micron Technology, Nikesh Arora of Palo Alto Networks, and George Kurian of NetApp.

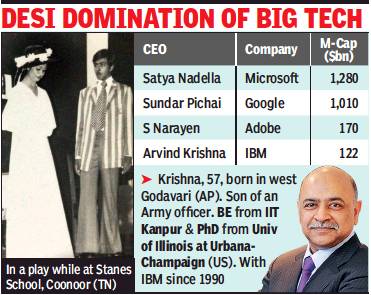

Krishna, son of Army officer Vinod Krishna, joined IBM in 1990, right after university, and is currently its senior vice-president for cloud and cognitive software, two of its biggest focus areas. He led the $34-billion acquisition of open source enterprise software firm Red Hat in 2018, the biggest deal in IBM’s history, on which a lot of its future rides.

2024 August

From: August 28, 2024: The Times of India

See graphic:

Some India-born CEOs of global corporate giants, as in 2024 August

Adobe: Shantanu Narayen

Born in Hyderabad, Shantanu Narayen joined Adobe in 1998 as the senior vice president of worldwide product research and became the COO in 2005 and CEO in 2007.

He holds a Bachelor in Science from Osmania University, an MBA from University of California, Berkley, and an MS from Bowling Green State University.

Narayen held product development roles at Apple and Silicon Graphics before co-founding photo-sharing startup Pictra. A chance encounter between Adobe and Pictra led to Narayen joining Adobe, where rose swiftly through the product ranks.

He was named among the world's best CEOs by Barron's MAgazine in 2016.

Albertsons: Vivek Sankaran

CEO of America’s 2nd largest supermarket chain

IIT degree and an MBA from a US business school, ,

Apple

2024 August

August 28, 2024: The Times of India

PIO Kevan Parekh to be Apple’s CFO from Jan 1

Apple has named Indianorigin executive Kevan Parekh as its chief financial officer as part of a planned succession plan. He succeeds Luca Maestri, who will transition from his role effective January 1, next year. Parekh, who is currently VP (financial planning and analysis), will become CFO & join the executive team, Apple said. Parekh has emerged as the latest addition to the growing roster of Indian-origin CFOs who are making their mark in global corporations. Tesla’s Vaibhav Taneja and Palo Alto Networks’ Dipak Golechha are among a growing tribe of such professionals who are taking the top finance roles in global firms.

Parekh joined Apple 11 yrs ago

Tesla’s Vaibhav Taneja and Palo Alto Networks’ Dipak Golechha are among a growing tribe of such professionals who are increasingly taking the top finance roles in global companies. Several Indian-origin CEOs are at the helm of big tech companies, a list that has grown over the years.

Kevan Parekh, who has been with Apple for 11 years, currently oversees financial planning and analysis, benefits finance, investor relations and market research. Previously, he managed the financial support for worldwide sales, retail and marketing finance, as well as product marketing, internet sales and services and engineering teams. He will join the company’s executive leadership team and report directly to CEO Tim Cook.

“For more than a decade, Kevan has been an indispensable member of Apple’s finance leadership team, and he understands the company inside and out. His sharp intellect, wise judgment, and financial brilliance make him the perfect choice to be Apple’s next CFO,” Cook said in a statement. Prior to his career at Apple, Parekh held various senior leadership positions at Thomson Reuters and General Motors. An alumnus of the University of Michigan and an MBA from the University of Chicago, Parekh has a strong educational background.

A Bloomberg report said Maestri has been grooming Parekh for the CFO role for several months. “I’m looking forward to the next stage of my time at Apple, and I have enormous confidence in Kevan as he prepares to take over the reins as CFO. He is truly exceptional, has a deep love for Apple and its mis- sion, and he embodies the leadership, judgment and values that are so important to this role,” Maestri said.

The rise of Indian-origin leaders within Apple’s ecosystem has been significant. With India becoming a bright spot for Apple, the Csuite presence of leaders of Indian descent has added more firepower to its leadership. A recent Bloomberg report said that Apple COO Jeff Williams’ deputy, Sabih Khan, is likely going to replace him. Khan, a 24-year Apple veteran, was named to the company’s executive team as senior vice-president of operations in 2019. The report also said that if Khan is promoted, “Priya Balasubramaniam is a nearlock to be Apple’s next senior vice-president of operations — and probably, one day, a future Apple COO”. A 23-year Apple veteran, Balasubramaniam has risen through the ranks to become vice president of operations in 2014.

Cognizant: Francisco D’Souza

Among the youngest CEOs in the software services sector, D'Souza is Cognizant's CEO and a member of the company's board of directors.

D'Souza joined Cognizant as a co-founder in 1994 and went on to become its CEO in the year 2007. During his tenure as CEO, Cognizant's employee base has grown from 55,000 to over 230,000.

The son of an Indian diplomat, D'Souza was born in Kenya. He holds a BBA from University of East Asia, Macau and an MBA from Carnegie Mellon University, Pittsburgh; D'Souza also serves on the board of General Electric as an independent director.

FedEx: Rajesh Subramaniam

Chidanand Rajghatta, March 30, 2022: The Times of India

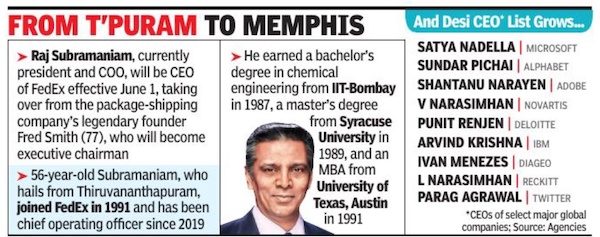

Washington: Corporate America has gone for another Indian-American with the IIT imprimatur to run one of its storied companies. Rajesh (‘Raj’) Subramaniam will lead FedEx, the global package and courier services company ranked 45th on the Fortune list, with $84 billion in revenues and 700 aircraft.

Subramaniam, 56, has a resume that is familiar in the US business scape — an IIT degree and an MBA from a US business school, much like his senior Vivek Sankaran, CEO of Albertsons, America’s 2nd largest supermarket chain, and his junior Sundar Pichai, who heads Alphabet.

Global Foundries: Sanjay Jha

Sanjay Jha took over as CEO of Global Foundries, a semiconductor foundry that produces chips for giants like AMD, Broadcom, Qualcomm, and STMicroelectronics, in January 2014; before that he has served as the CEO of Motorola Mobility and COO of Qualcomm.

He joined Motorola as co-CEO in 2008, while serving simultaneously as CEO of Motorola's Mobile Devices Business.

Prior to Motorola, Sanjay held multiple senior engineering and executive positions during his 14 years with Qualcomm, ultimately serving as Executive Vice President and Chief Operating Officer (COO) of Qualcomm Inc. from 2006 to 2008.

Jha was born in Bhagalpur, Bihar and holds a BS from University of Liverpool and PhD from University of Strathclyde.

Google: Sundar Pichai

India-born Sundar Pichai was named as Google CEO on August 10, 2015.

The 44-year-old head of Google was born in Chennai, Tamil Nadu and pursued education at IIT Kharagpur (B Tech), Stanford (MS) and Wharton (MBA); at Wharton, he was named a Siebel Scholar and Palmer Scholar.

He is responsible for the launch of the dominant Chrome web browser, and was previously the product head for Android, Chrome, Maps, and other popular Google products.

Harman: Dinesh Paliwal

Dinesh Paliwal is the president and CEO of Harman International, a premium audio gear brand that owns the likes of JBL, Becker, dbx, among others.

Born in Agra, Uttar Pradesh, Paliwal holds a BE from IIT Roorkee, and MS and MBA from Miami University.

Prior to joining Harman, he spent 22 years with ABB Group, where he last held the dual role of President of ABB Group with responsibility for the company's global P&L, and Chairman/CEO - ABB North America.

He serves on the board of Bristol-Myers Squibb, and previously served as the economic advisor to the governor of China's Guangdong province for three years.

Microsoft: Satya Nadella

After a 22-year stint with Microsoft, Nadella was appointed as the chief executive officer of the company in February 2014.

He previously held the position of executive vice president of Microsoft's Cloud and Enterprise group.

The Hyderabad-born 47-year-old has a BE from Manipal Institute of Technology, MS from University of Wisconsin-Milwaukee, and MBA from University of Chicago Booth School of Business.

NetApp: George Kurian

George Kurian became the CEO and president of storage and data management company NetApp in June 2015, after serving as its executive vice president of product operations for nearly two years. Prior to joining NetApp, George was vice president and general manager of the Application Networking and Switching Technology Group at Cisco Systems.

His diverse background also includes the role of vice president at Akamai Technologies, management consulting at McKinsey & Company, and leading Software Engineering and Product Management teams at Oracle Corporation.

Born in Kottayam district, Kerala, he pursued engineering at IIT-Madras, but left six months later to join Princeton University; he also holds an MBA degree from Stanford.

Nokia: Rajeev Suri

Rajeev Suri joined Nokia in 1995 and held various positions before being appointed as president and CEO in April 2014.

Suri's ascedancy to Nokia CEO's position came after Microsoft acquired Nokia's mobile phone business. Previously, he was the head of the company's global services.

Like Satya Nadella, Suri also holds a B-Tech from Manipal Institute of Technology, but holds no post graduate degrees.

2020: The Indian mafia?

Shilpa Phadnis, India CEO mafia: Techies with a social heart, February 3, 2020: The Times of India

From: Shilpa Phadnis, India CEO mafia: Techies with a social heart, February 3, 2020: The Times of India

Some are beginning to call it the ‘India Mafia’, like the PayPal Mafia. The latter was used to describe the many former PayPal employees and founders who went on to found and develop other technology companies such as Tesla, LinkedIn, Palantir, SpaceX, YouTube, Yelp, and Yammer.

The India Mafia of Satya Nadella (chief of Microsoft), Sundar Pichai (Google), Shantanu Narayen (Adobe), Sanjay Mehrotra (Micron), Nikesh Arora (Palo Alto Networks), George Kurian (NetApp), and now Arvind Krishna (IBM) are all heading some of the biggest technology companies in the world. There are others too, like Thomas Kurian, CEO of Google Cloud, and Sanjay Poonen, COO of VMware. And of course, the latest appointment of Sandeep Mathrani at WeWork.

What makes Indians so good in technology leadership? Vivek Wadhwa, distinguished fellow at the Carnegie Mellon University’s college of engineering at Silicon Valley, says the combination of formidable technical abilities with strong business acumen and management skills have enabled Nadella and Pichai to build the most valuable companies in the world.

“But what people don’t realise is that they also have something which is usually missing in the tech world — a sense of humility and understanding of human needs. Too many of Silicon Valley’s leaders have grown up in its bubble, they are cut off from the realities of the world. They get lucky and begin to believe they are Gods. This is not a problem that Indiaborn leaders have,” he said.

Something similar was pointed out by The Wall Street Journal in 2015 when it quoted a then recent cross-cultural study from Southern New Hampshire University that examined managers from the US and India. The study found that more Indian managers achieved the highest ranking in terms of leadership traits. Indian managers, the study said, are future-oriented, and had a “paradoxical blend of genuine personal humility and intense professional will...These leaders achieved extraordinary results and built great organisations without much hoopla.” Vijay Govindarajan, Coxe Distinguished Professor at Tuck at Dartmouth, also says that to lead in today’s world, a CEO must embody ‘Social Heart, Business Mind’. Indian-Americans have the ability to cultivate this,” he says.

Indian CEOs are seen to have an uncanny ability to spot the “new” and turn disagreements and dissents within the firm into preparing it for the future. Nirmalya Kumar, Lee Kong Chian professor of marketing at Singapore Management University, calls it the “browning of the top management team”. Kumar says given the huge technology disruptions that are happening, companies are seeking CEOs who understand the evolving technological landscape and combine it with market insight. “It is easier to teach a technologist about markets and sales compared to bringing a marketing/sales person up to speed on technology. Previously, we needed CEOs with sales capability and an understanding of finance to compete in relatively undifferentiated, slow-moving markets,” he says. All of the India leaders built their careers as technologists, before getting into the sales and marketing side. Krishna, for instance, was a researcher for much of his career, and has co-authored 15 patents. Govindarajan says since every company is a digital company today, he expects more and more technologist CEOs, since domain knowledge is key for leading an enterprise.

Sandisk: Sanjay Mehrotra

Sanjay Mehrotra co-founded flash memory storage company SanDisk in 1988 and has been its CEO since January 2011.

He pursued bachelors and masters degrees at University of California, Berkley, and also went to Stanford for executive programme. Mehrotra holds several patents to his name.

Sony Pictures: Ravi Ahuja

Oct 2, 2024: The Times of India

Sony Pictures Entertainment said its chief executive, Tony Vinciquerra, will step down and be succeeded by the studio’s president and chief operating officer, Ravi Ahuja, in January. Ahuja, 53, came to Sony after a career in TV management at Fox networks and Walt Disney Co. At Sony, he’s overseen the production of award-winning series, including ‘The Crown’, ‘Better Call Saul’ and ‘The Last of Us’.

T-Mobile: Gopalan; Coors: Goyal

Chidanand Rajghatta TNN, Sep 23, 2025: The Times of India

Washington : At a time the Trump administration is virtually immobilising the movement of Indian students and professionals to America under pressure from MAGA hardliners, US telecom major T-Mobile rang a different tune on Monday, elevating Srinivas Gopalan, an alumnus of IIM Ahmedabad, to CEO.

Gopalan (55) will take over on Nov 1 from Mike Sievert, who has led the company since 2020 and is being promoted to vice-chairman.

Separately, the Chicagobased beverage company Molson Coors, the world’s fourth-largest beer maker behind Anheuser Busch, Heineken, and Carlsberg, promoted long-time insider Rahul Goyal to CEO.

The 49-year-old PIO is currently chief strategy officer and will succeed Gavin Hattersley as president and CEO effective Oct 1.

Xerox Business Services LLC: Ashok Vemuri

Xerox, the 110-year-old document technology company that over the years has come to symbolize everything associated with photocopying, named former iGate CEO Ashok Vemuri as the new CEO of its back-office outsourcing company.

Earlier this year, Xerox said that it would split into two separate companies -- one would focus on document technology, which would include Xerox's traditional printer and copier businesses, while the second company would focus on back-office outsourcing, payment processing and other technology-related services.

A former Infosys veteran, Vemuri became CEO of Xerox's business process outsourcing company after the separation of the company's two entities.

IBM: Arvind Krishna

Krishna to lead IBM, joins club of global Indian CEOs, February 1, 2020: The Times of India

From: Krishna to lead IBM, joins club of global Indian CEOs, February 1, 2020: The Times of India

IBM just added to the roster of Indian-origin executives leading some of the foremost technology companies in the world.

IIT-Kanpur alumnus Arvind Krishna, 57, will lead the 108-year-old US giant—which posted annual revenue of $80 billion in 2018—from April 6, when CEO Virginia Rometty steps down from that position. The company’s share price, which has been trending down since 2013 except for occasional spikes, rose by 5% in opening trade in the US following the announcement.

B: WITHIN INDIA

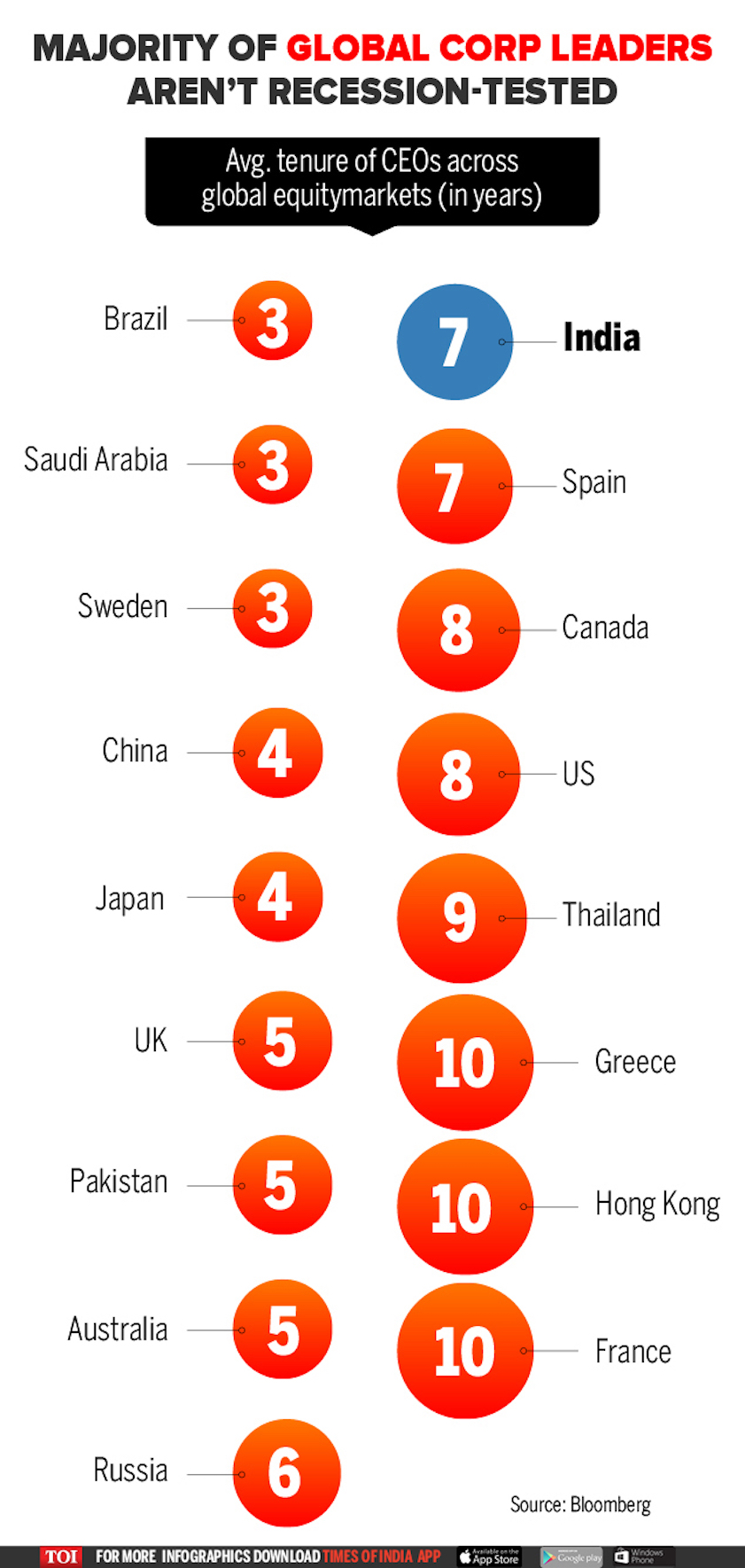

Average tenure

CEOs in India vis-à-vis other countries/ 2018

October 22, 2018: The Times of India

From: October 22, 2018: The Times of India

If you thought CEOs were the most prepared at handling the next economic catastrophe, think again: Most of them were not at the helm during the global financial crisis of 2008. In India the average tenure of CEO across equity markets is 7 years. Only Greece, Hong Kong and Thailand can barely boast a ten year track record.

CEO salaries

2012-2015: CEO salaries, a rise

The Times of India, Jun 06 2016

Namrata Singh & Shubham Mukherjee

Aurobindo gets best value from payout to CEO in 3 yrs

CEO salaries have seen a spike as the occupant of the corner office operates in a challenging VUCA world--volatility , uncertainty , complexity and ambiguity. With CEOs taking home large payouts, there has been a greater scrutiny over hisher performance. The scrutiny has moved from a simplistic calculation of the return on CEO pay over profits to a holistic view covering other key financial parameters. So, which Indian company got the best value for its payout to a CEO?

Aurobindo Pharma extracted the best value from the payout to its CEO, followed by Britannia Industries and Bharat Forge over a three-year period--2012-13 to 2014-15.

In a study commissioned by TOI to global staffing company Randstad, Aurobindo Pharma got an overall score of 386600 based on six parameters. The company paid its CEO, M Govindarajan, an average annual compensation of Rs 9.5 crore, which is above the average CEO salary during the period.

The results for the study , `CEO Compensation & Company Performance', were based on six parameters -returns on compensation (profitCEO pay), change in revenue, operating margin, profit after tax, market capitalization and debt. For the study , the financial performance of BSE100 companies was analysed for the three-year period based on their annual reports. Idea Cellular , Bharat Petroleum, Axis Bank, HCL Technologies, State Bank of India, ICICI Bank and Lupin were the next on the top10 list which were able to maximize gains from CEO payouts. Randstad India MD & CEO Moorthy K Uppaluri said the current CEO compensation structure is set to undergo a paradigm shift with higher emphasis on performance-based pay and stock awards. “CEOs are increasingly accepting such results-driven compensation structures which are outcome based and linked to the company's success. The average CEO salary was Rs 7.6 crore in FY 2015, a17% increase over the previous year's average,“ said Uppaluri.

Britannia Industries, which came second with an overall score of 303, paid an average salary of around Rs 4.3 crore to CEO Varun Berry . Bharat Forge, third on the list with a score of 297, shelled out around Rs 13.2 crore as salary to its CMD B N Kalyani, while Aditya Birla Group company Idea Cellular , which ranked fourth, gave MD Himanshu Kapania around Rs 6.6 crore.

When contacted, Aurobindo Pharma declined to comment. Santrupt Misra, CEO, carbon black business & director , group HR, Aditya Birla Management Corporation, saidthe group does not judge leaders only in terms of financial performance but rather with a more comprehensive set of metrics that include qualitative aspects as well such as leadership and talent development, a strong customer and supplier connect and creating value for stakeholders.

For FY13-FY15, CEO compensation grew by 25%, while revenues increased by 14.6%, ebitda (earnings before interest, tax, depreciation & amortization) margins were flat at 0.3% growth and PAT was up by 12%. Marketcap for the companies grew by 42% while long-term debt on their books increased by16%.

Promoter-owned and run companies had on an average the highest CEO compensation, the study revealed. The average salary paid out to CEOs, for the period, was Rs 6.5 crore. PSUs offered the best return on CEO compensation given the low base of salaries.Nine out of the top 10 companies that offered the best PAT compensation multiple were PSUs. SBI, Coal India and ONGC were the top 3 companies on that parameter.

Harsh Goenka, chairman RPG Enterprises, says “how much is too much“ is currently engaging boards of many Indian companies. “Salaries of CEOs have increased exponentially but so has the complexity . A CEO today is not only a leader , but also astrategist, a tactician, a coach, a troubleshooter , a mediator , an innovator and much more. It is impossible to relate CEO salary with just PAT or one particular matrix, but a combination of them,“ he said.

However , one top CEO, who did not wish to be identified, said CEO pay is out of whack and more due diligence is required while fixing compensation.

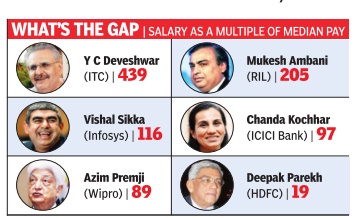

2014-15: CEO-median employee salary ratio

The Times of India, Jul 06 2015

Mukesh's pay 205-times RIL's median

Ratio Stands At 439 For ITC's Deveshwar, 89 For Wipro's Premji

Billionaire industrialist and India's richest man Mukesh Ambani has not taken a pay hike for seven years, but his salary is over 205-times that of the median employee remuneration at Reliance Industries (RIL). However, this ratio stands much higher at 439 times in case of ITC executive chairman Y C Deveshwar.

The same ratio stands much lower at 89-times in case of IT major Wipro's chairman and managing director Azim Premji, and just at 19-times for mortgage giant HDFC's chair a man Deepak Parekh for the latest fiscal 2014-15.

However, HDFC Bank's t MD Aditya Puri got a remuner p ation that was 117-times the t median employee pay at the bank, while for ICICI Bank 2 CEO Chanda Kochhar, it was 97 c times and at over 74 times for Axis Bank's managing director and CEO Shikha Sharma.

For IT giant Infosys' CEO Vishal Sikka, his pay was 116 times of the median employee pay at the company . The same ratio for HUL's CEO Sanjiv Mehta was 93 times, but much higher at 293 times for Vedanta Limited's chairman Navin Agarwal.

Listed companies have be gun disclosing these ratios, as also other comparisons such as salary hikes for the top management personnel and an average staff, for the first time pursuant to the new Companies Act and Sebi's latest Corporate Governance Code coming into force.

While a majority of the companies are still in the proc ess of disclosing these details, the disclosures made so far by the top companies show a wide variance in these ratios, while there is also a huge difference between the pay hike figures for the top management per sonnel and an average staff member in many cases.

However, there are a few cases where the increase in the median employee remunera tion is almost equal or even higher than the same for the CEOs and other key manage ment personnel.

In case of RIL, chairman and MD Mukesh Ambani has kept his salary capped at Rs 15 crore for seven years now, while the median remuneration of em ployees increased by 3.7% to Rs 7.29 lakh during 2014-15. The to tal remuneration of key mana gerial personnel, in fact, dipped by 1.9% to Rs 73.28 crore.

2014

Dec 26 2014

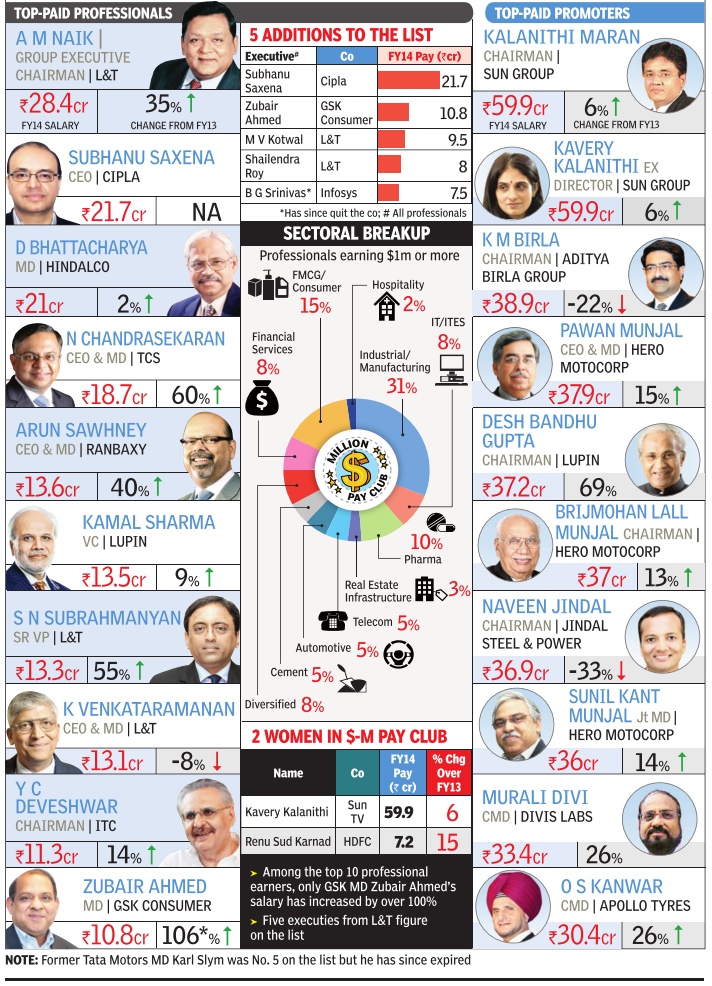

India Inc has 96 executives in the million-dollar pay club, a study of top salaries for 2013-14 commissioned by TOI has revealed. The number of professional CEOs in the club has increased from 34 during 2012-13 to 39, finds the study by global executive search firm EMA Partners. In case of promoter CEOs, the number went up marginally from 56 to 57. The study took into account executive compensation in excess of Rs 6 crore per annum for the top 200 listed companies and excluded stock options. Here are the highlights...

2016: CEO pay falls 15%, after years

The Times of India, May 28, 2016

A mere $19.3 million. That's how much compensation Wells Fargo's chief executive, John G Stumpf, was awarded last year, making him perfectly representative of the best-paid CEOs in the country.

Among the 200 highest-paid chief executives at American companies with annual revenue of at least $1 billion that filed proxies by April 30, the average pay was, give or take a few thousand dollars, equivalent to Stumpf's own: a cool $19.3 million.

Yet by the topsy-turvy standards of corporate pay, what's remarkable is not how big that number is, but how small. After years of steady increases, the average compensation among the top executives in 2015 was down 15% from the 2014 figure of $22.6 million, according to the Equilar 200 Highest-Paid CEO Rankings, conducted for The New York Times. By other measures, too, CEO compensation declined. Cash and stock awards, the main components of pay packages, fell last year. Among the companies in the rankings, the biggest pay package, worth $94.6 million, went to Dara Khosrowshahi of Expedia. That meant that for the first time since 2012 no company awarded its chief more than $100 million.

All of which raises a tantalizing prospect: Has executive pay finally peaked? Have the CEOs and the compensation committees that set their pay discovered something approaching modesty? Some experts say that is the case. "We're hearing a great deal more concern from compensation committee chairs about absolute pay," said Kenneth Daly, CEO of the National Association of Corporate Directors, a trade group for board members. What is certain is that last year's weak stock market pulled down the value of executive pay packages. After posting fairly consistent gains for years, the S&P 500-stock index and the Dow Jones industrial average each fell slightly in 2015. Because the average compensation package was 69% stock, lower share prices meant less pay for CEOs. But the relation between pay and performance remains tenuous at best. Several CEOs reaped huge windfalls, even while presiding over precipitous declines in total shareholder return. Take Philippe Dauman, chief of the media conglomerate Viacom. Dauman was awarded $54.1 million last year, a 22% raise from 2014. Over the year, Viacom shares plunged 43%.

Average 2016 salary Rs 20 cr, double of 2014

The Times of India, Aug 08 2016

Avg CEO pay at blue chips up 100% in 2 years

In a sharp jump, the average CEO salary at top listed companies in the private sector is approaching Rs 20 crore -double the level seen just two years ago at about Rs 10 crore. However, this remains less than one-sixth of the average CEO salaries at top listed companies in the US, which stood at close to $20 million (about Rs 130 crore) in 2015 despite a decline from 2014. In India, the average CEO salary at top private companies, on the other hand, is way above the Rs 25-30 lakh average that their public sector counterparts get.

An analysis of the CEO salaries for the financial year 2015-16 disclosed by the country's top listed companies, forming part of the stock market benchmark index sensex, shows that they paid an average overall remuneration of close to Rs 19 crore to their top executives.

This includes salary , commissions, allowances, value of all perquisites and Esops exercised during the year, among other benefits disclosed by the companies as part of the total remuneration to their top-paid executives which included executive chairpersons, CEOs or managing directors.

The analysis is based on the disclosures made by 20 out of the total 24 private sector companies on the sensex, as the remaining four are yet to disclose their figures. Among the six PSUs on the sen sex, the figure for 2015 16 is available only in case of SBI, whose chairperson Arund hati Bhattacharya got about Rs 31 lakh.

Those at the lower end in terms of overall remuneration were mostly bankers and in cluded Axis Bank's Shikha Sharma (Rs 5.5 crore), ICICI Bank's Chanda Kochhar (Rs 6.6 crore) and HDFC Bank's Aditya Puri (Rs 9.7 crore). At HDFC, chairman Deepak Pa chairman Deepak Parekh was paid Rs 1.89 crore, while vice-chairman and CEO Keki Mistry got Rs 9.3 crore and MD Renu Sud Karnad got Rs 8.5 crore.The latest figures were not available for four companies -Sun Pharma, Maruti, Hero MotoCorp and Cipla.

2nd highest ratio to national per capita income

A new measure puts Indian CEOs ahead of Americans, Nov 26 2016 : BLOOMBERG

If your life's goal is to be a highly paid chief execu tive officer, the US is the place. But if your dream is just to be richer than society , South Africa and India are great bets too.

In either case, probably best to avoid Thailand, Poland and China.

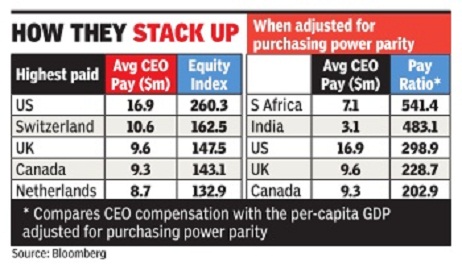

A Bloomberg ranking of CEO compensation at companies filling benchmark indexes in 25 of the world's largest economies shows the biggest paychecks -by far -are written in the US. Heads of S&P 500 businesses get pay packages averaging $16.9 million, about 2.6 times more than what their counterparts reap abroad. In second-place Switzerland, CEOs get 1.6 times the average.

In China, pay is 90% below the average -at least based on disclosures by companies in the Shanghai Shenzhen CSI 300 Index.They typically report annual compensation of about $640,000. But heads of stateowned companies, for example, enjoy valuable perks including housing and entertainment that sometimes go unmentioned in filings.

The deck gets shuffled a bit when CEO pay is compared to estimated income generated per person -a rough gauge of what chiefs get relative to the society where their companies are listed. That puts pay for CEOs in South Africa and India ahead of the US. There are myriad reasons behind the international disparities in packages.

One of most important is size. The US is home to many of the world's largest publicly traded corporations.

Cost of living explains some of it, too. It's much more expensive to live lavishly in North America and Western Europe than in places like Thailand, where CEOs take home roughly $60,000 -less than in every other nation ranked. In other cases, it's cultural. In Japan, big paychecks are typically taboobecause they're considered a sign of greed. And taxes and regulations matter.

In the US, businesses will at least be required to disclose more, comparing a CEO's pay with the median worker's starting in 2017.President-elect Donald Trump has vowed to issue a temporary moratorium on new regulations that aren't “compelled by Congress or public safety.“ Such comparisons aren't simple. Bloomberg's ranking of CEO pay against earnings across society bases income generated per person on gross domestic product per capita, adjusted for purchase-price parity . It's not a perfect measure: GDP measures just the value of goods and services produced, not how they were distributed.

The figures show that CEOs in South Africa and India take home more than the estimated income generated by an average worker -outearning their American colleagues on a relative basis.

Each country's compensation figure is based on the average CEO pay package for companies in one major stock index, weighted by market capitalization. The pay, disclosed in public filings, includes any salary , bonuses, value of perquisites and non-cash pay such as equity awards, deferred-compensation programs and pensions.

2016: 3PIOs among top 100;2 in top 10

Sources: The Times of India

1. The Times of India, Apr 29 2016

2. The Times of India, May 28, 2016

2 Indians among 10 highest paid CEOs

As many as three Indian origin persons have been named among the 100 highest-paid CEOs globally with PepsiCo's Indra Nooyi and LyondellBasell's Bhavesh V Patel making it to the top ten list compiled by Equilar.

Chemicals company LyondellBasell Industries' top executive Patel was ranked sixth on the list with a total compensation of $24.5 million, while Nooyi, the chief executive of PepsiCo, was ranked eighth on the list with a total pay of $22.2 million. Satya Nadella, the CEO of Microsoft, was ranked 26th on the list of 100 highestpaid CEOs with a total compensation of $18.3 million.

A mere $19.3 million. That's how much compensation Wells Fargo's chief executive, John G Stumpf, was awarded last year, making him perfectly representative of the best-paid CEOs in the country.

Among the 200 highest-paid chief executives at American companies with annual revenue of at least $1 billion that filed proxies by April 30, the average pay was, give or take a few thousand dollars, equivalent to Stumpf's own: a cool $19.3 million.

Yet by the topsy-turvy standards of corporate pay, what's remarkable is not how big that number is, but how small.

After years of steady increases, the average compensation among the top executives in 2015 was down 15% from the 2014 figure of $22.6 million, according to the Equilar 200 Highest-Paid CEO Rankings, conducted for The New York Times. By other measures, too, CEO compensation declined. Cash and stock awards, the main components of pay packages, fell last year. Among the companies in the rankings, the biggest pay package, worth $94.6 million, went to Dara Khosrowshahi of Expedia. That meant that for the first time since 2012 no company awarded its chief more than $100 million.

All of which raises a tantalizing prospect: Has executive pay finally peaked? Have the CEOs and the compensation committees that set their pay discovered something approaching modesty?

Some experts say that is the case. "We're hearing a great deal more concern from compensation committee chairs about absolute pay," said Kenneth Daly, CEO of the National Association of Corporate Directors, a trade group for board members. What is certain is that last year's weak stock market pulled down the value of executive pay packages. After posting fairly consistent gains for years, the S&P 500-stock index and the Dow Jones industrial average each fell slightly in 2015. Because the average compensation package was 69% stock, lower share prices meant less pay for CEOs.

But the relation between pay and performance remains tenuous at best. Several CEOs reaped huge windfalls, even while presiding over precipitous declines in total shareholder return. Take Philippe Dauman, chief of the media conglomerate Viacom. Dauman was awarded $54.1 million last year, a 22% raise from 2014. Over the year, Viacom shares plunged 43%.

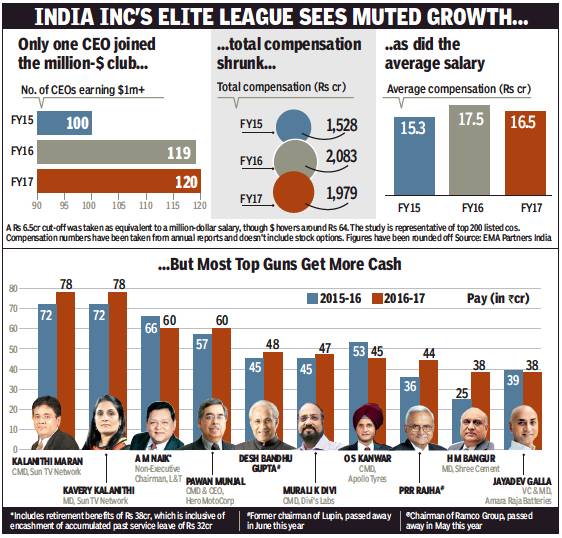

2016> 2017: fewer CEOs get pay increases

From: Namrata Singh, 51 Execs Get Over 10% Pay Hike In FY17 Against 72 In FY16, December 26, 2017: The Times of India

Slowdown restricts CEOs’ entry into million-$ club

A subdued economy has not only hit the man on the street but also top execs in the corner office by slowing their entry into the million-dollar salary club.

According to a study by EMA Partners, commissioned byTOI, only one executive was added to their list of CEOs who took home a million dollars (about Rs 6.5 crore) in compensation in 2016-17. Global executive search firm EMA Partners tracks the earnings of CEOs/ CXOs across top 200 listed companies in India for TOI. Over the last few years, there has been a steady rise in the membership of the elite club — from 94 in 2013-14 to 100 in FY15 to 119 in FY16. After growing at 6% and 19% respectively in the previous two fiscals, the pace has slowed in 2016-17 with the club expanding by just one more member to 120. The study does not include stock options and, thus, several CEOs who took home a fatter package on account of such perquisites do not figure in the list.

The total compensation of the elite club has come down from Rs 2,083 crore in 2016 to Rs 1,979 crore in 2017. It stood at Rs 1,528 crore in 2015. The average compensation (total sum of compensation divided by the number of executives in the million-dollar club), too, has fallen from Rs 17.5 crore in 2016 to Rs 16.5 crore in 2017. In 2015, the average compensation was around Rs 15 crore. According to the study, the average compensation is lower in 2017 as only 51executives got over 10% increase in salary against 72 in 2015-2016.

What are the reasons behind the muted membership rise in the elite club when the global growth outlook has improved and the India story remains intact? “The rise in compensation depends on several factors, including business growth, availability and competition for talent, internal leadership pipeline and, above all, the business impact. The core/manufacturing sector has gone through a bit of stress during the past year and this reflects in the overall muted compensation trend in that period,” said K Sudarshan, regional managing partner —Asia, EMA Partners. The overall CEO compensation is also a function of the profitability of the enterprise and the commissions/incentives paid out in lieu, he added. Sudarshan, however, sees this as a temporary phenomenon as growth and profitability numbers are kicking in this fiscal and he expects compensation to also keep pace with it.

Moreover, it’s a myth to believe that CEO compensation necessarily goes up every year, says Santrupt Misra, CEO, Carbon Black Business and director, group HR, Aditya Birla Group. “Some years may see a strong rise, while others may witness muted growth. The growth of the economy too can be a factor in the rate of compensation growth. Let’s also not forget that boards and shareholders nowadays keep a close watch on the CEO compensation, making it more aligned to the performance of the company.”

The study also establishes the trend of professional CEOs outnumbering promoter CEOs. Among the 120 CEOs in the million-dollar salary club, 61 are professional CEOs and 59 are promoters. Sudarshan said, “As we have seen, professional CEOs will continue to become more prominent and the tribe is set to expand as Indian businesses grow in scale and complexity.”

Leading the list of milliondollar salary CEOs, once again, are the Marans of Sun Group — Kalanithi Maran and Kavery Kalanithi — who drew a compensation of about Rs 78 crore each in 2016-17 (see graph). Former Infosys CEO Vishal Sikka, who catapulted into the top 10 of the club last year with a compensation of Rs 49 crore, is down to rank 54 this year with a Rs 12-crore package. Among the professional CEOs who marked their entry into the club this time are Guenter Butschek, CEO & MD, Tata Motors (around Rs 16 crore), Suresh Narayanan, CMD, Nestle India (Rs 9 crore) and Chanda Kochhar, MD & CEO, ICICI Bank (about Rs 8 crore). Among those who exited the club are Gautam Singhania, CMD, Raymond (approximately Rs 6 crore) and Ajit Gulabchand, CMD, HCC (around Rs 4 crore). T K Kurien, who retired as executive vice-chairman of Wipro on January 31, 2017, had a total compensation of Rs 9.7 crore from April 1, 2016 till the time he superannuated. However, he did not make it to the list this year because his compensation includes a stock option component of around Rs 5 crore.

AM Naik, who retired as executive chairman of Larsen & Toubro in September 2017, on the other hand, took home a retirement benefit component of Rs 38 crore (which includes encashment of accumulated past service leave of Rs 32 crore) which boosted his total income to about Rs 60 crore (excluding stock option perquisites), aiding his inclusion in the million-dollar club this year. Naik’s basic salary was just around Rs 3 crore in fiscal year 2017.

Most founders earn more from equity appreciation than salary and requisite commissions. According to the study, Mukesh Ambani’s compensation this year remained the same as that in 2015-16 at Rs 15 crore, while Anand Mahindra’s package rose to around Rs 8 crore from Rs 7 crore. Kumar Mangalam Birla figured in the top 20 with a compensation of Rs 38 crore, which is down from Rs 43 crore last year.

Average CEO salary in India is said to be lower than comparable companies in the West in absolute terms. “Many Indians are succeeding as CEOs of global companies, giving credence to country’s talent and ability. The question to ask would be whether Indian CEOs leading global businesses will be compensated on a par with colleagues in the West and at what stage of economic growth are we likely to see it happening,” Misra said. He believes compensation issues, particularly the executive & CEO package, are often oversimplified in popular discourse.

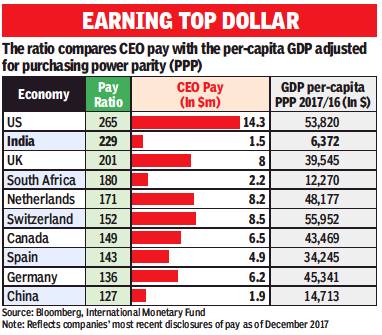

2017: CEOs in India get 229x average worker’s pay

CEOs in India get 229x avg worker’s pay, December 29, 2017: The Times of India

From: CEOs in India get 229x avg worker’s pay, December 29, 2017: The Times of India

Chief executive officers in the US are paid much better than their peers abroad, and the gap between their compensation and that of average American workers is wider than in other countries. CEOs of the biggest publicly-traded US companies averaged $14.3 million in annual pay, more than double that of their Canadian counterparts and 10 times greater than those in India, according to a Bloomberg analysis that used benchmark stock indexes in 22 nations.

CEOs of companies listed in India’s sensex index still earn 229 times more than the average worker there, the second-biggest gap worldwide after the US ratio of 265, according to a separate Bloomberg ranking. Norway and Austria have among the smallest margins. CEOs of companies in the Norwegian OBX index got on average $1.28 million, roughly equal to the income generated by 20 people.

A company listed on a US exchange must disclose the ratio between a CEO’s compensation and the pay of its median worker for any fiscal year starting on or after January 1, 2017. Peter Simon, a German lawmaker in the European parliament, proposed a similar ratio for banks, aiming to bring executive pay to a “more appropriate level”.

There are myriad reasons for compensation discrepancies between executives. The US is home to several of the world’s largest corporations, which tend to pay more. Cost of living is often higher in North America and Western Europe than some parts of Asia. And even the mere disclosure of detailed figures can push pay higher as boards set CEOs’ compensation in line with their peers, said Tim Quigley, associate professor of management at the University of Georgia.

Each country’s compensation figure is based on the average CEO pay package for companies in one major stock index, weighted by market capitalisation.

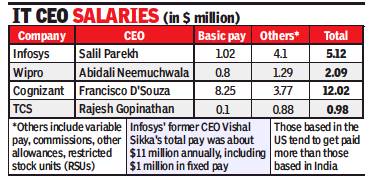

IT sector

2018: Infosys and other IT giants’ CEOs

Infy to pay CEO much less than Sikka, January 5, 2018: The Times of India

From: Infy to pay CEO much less than Sikka, January 5, 2018: The Times of India

Infosys will pay about Rs 32.5 crore (approximately $5.12 million) every year to its new chief executive Salil Parekh, subject to his achieving laiddown milestones. That’s significantly lower than the $11 million that former CEO Vishal Sikka was eligible to.

Some of that difference perhaps arises because Sikka was based in the US, while Parekh will be stationed in Bengaluru. But it is also likely a reflection of the unhappiness expressed by the company’s promoters, notably N R Narayana Murthy, on Sikka’s compensation.

Parekh, a former Capgemini executive, will be paid an annual fixed salary of Rs 6.50 crore and a variable portion of Rs 9.75 crore. The latter will be “subject to the company’s achievement of certain milestones as determined by the board or its committee, in its sole discretion, from time to time,” Infosys said in a filing with the BSE late on Wednesday.

In addition, the 53-year old executive is also eligible for an annual equity grant of restricted stock units (RSUs) worth Rs 3.25 crore for three years and an annual performance equity grant of RSUs worth Rs 13 crore upon completing three years in 2021 subject to achieving certain milestones. He will also be paid a one-time Rs 9.75 crore in stocks.

Sikka, who joined as the first non-founder CEO in August 2014, had a fixed compensation of $3 million, while the remaining $8 million was variable. In his last full year (2016-17), he received only $3.68 million of variable pay because the company did not meet the laid-down milestones.

“The flamboyant western salary and private jet use of Sikka created a major perception issue for Infosys internally. Parekh’s salary seems lower than most of his peers, which is understandable considering this is his first CEO gig,” Phil Fersht, CEO of HfS Research said.

“In reality, Parekh can still make a lot of money from stock and performance, so this is much more about perception than anything else — appeasing Narayana Murthy and the Indian IT aristocracy that Infosys will not behave like a Silicon Valley firm ever again,” he said.

Cognizant’s Francisco D’Souza, who is based in the US, received a compensation of $12 million (Rs 76.1 crore) for the year ended December 2016, while TCS’ Rajesh Gopinathan was paid Rs 6.22 crore before he became the CEO. Wipro’s Abidali Neemuchwala, who is based in the US, was paid about Rs 13.3 crore ($2.09 million) for 2016-17.

Dan Marcec, director, content & communications at compensation research firm Equilar, said US tech companies tend to pay their executives more in stock and options than other US companies. According to Equilar’s annual CEO pay report, technology CEOs received the lowest proportion of their total pay from base salary.

2023 -24

Shilpa Phadnis & Veena Mani TNN, August 13, 2024: The Times of India

From: Shilpa Phadnis & Veena Mani TNN, August 13, 2024: The Times of India

Bengaluru : The disparity between CEO and employee compensation in the IT industry continues to expand. Data from the past five years for select large companies shows that only IBM has seen a narrowing of the gap between CEO pay and the median employee remuneration. Accenture, Infosys, Wipro, and HCL have experienced a widening of this gap, reflecting the sharp increase in CEO compensation and particularly the value of their stock grants.

The issue has received little attention from shareholders in India. Infosys founder NR Narayana Murthy has previously indicated that a fair CEO remuneration would be about 25 to 40 times that of the lowest level employee. But in his own company now, CEO Salil Parekh’s compensation is nearly 700 times that of the median remuneration in the company (compared to that of the lowest level employee, it would be significantly more). And that figure has risen sharply since 2019.

Wipro has witnessed a substantial increase in the remuneration of the CEO compared to that of its employees. Former Wipro CEO Thierry Delaporte’s compensation was $20 million, which meant his salary was 1,702 times more than that of the median remuneration of Rs 9.8 lakh in the 2023-24 financial year.

Within a single year, the ratio between HCL CEO C Vijayakumar compensation and the median employee remuneration widened to 707 in 2023-24, from 253:1.

Accenture chief executive officer Julie Sweet’s compensation in the 2023 fiscal was $31.5 million, 633 times that of the median salary of an Accenture employee, which was $49,842. This median salary was actually lower than the $50,512 in the 2019 fiscal. A report by executive intelligence platform Equilar finds that the median S&P 500 (largest listed companies in the US) employee earned $81,467 in 2023, a 5.2% increase from 2022. Due to CEO pay increasing at a higher rate than the median employee, the CEO pay ratio increased from 185 in 2022 to 196 in 2023.

The report also noted that stock awards accounted for approximately 70% of total CEO compensation in 2023. The median value of stock awards increased by 10.7% to $9.4 million in 2023, significantly contributing to the overall rise in total compensation.

In India, disclosure of pay ratios was mandated by the Ministry of Corporate Affairs (MCA) in 2014. However, the regulations do not specify a computation methodology, allowing companies to use their own discretion in arriving at these numbers. Shri- ram Subramanian, founder and MD of proxy advisory firm InGovern Research Services, says that over the past 10-15 years, these IT services firms have become large global companies. “Hence talent at senior levels becomes benchmarked to global levels, thus ensuring compensation is also benchmarked to global levels and growing at a rate greater than the rate at which the company grows. However, since the number of entry level employees has increased significantly, the compensation at entry levels has not increased. This is the main reason why the pay ratio will keep increasing. Shareholders are more interested in CEO compensation being largely variable and linked to performance metrics.”

Subramanian also noted that the Occupy Wall Street movement in the US in 2008 saw the demand for disclosure of pay ratios. “In the US, labour unions and other organisations use this data for corrective bargaining. In India these numbers have not found significance or usefulness anywhere.”

Phil Fersht, chief executive officer of IT research and advisory HfS Research, says that leadership in IT services firms is increasingly becoming a critical differentiating factor, particularly at the CEO level and the CEO’s direct reports.

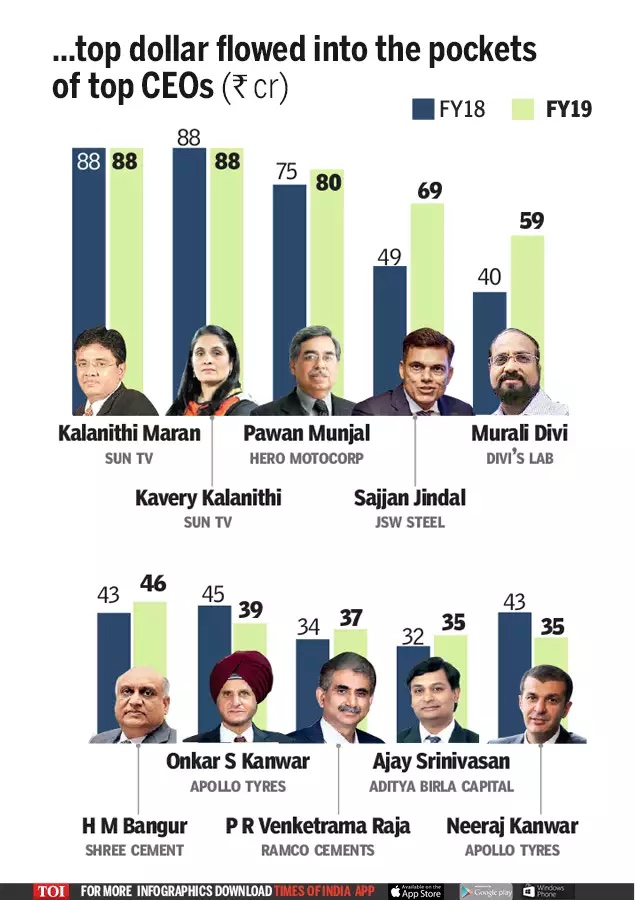

2018: top CEOs get a raise

From: Namrata Singh, Million-$ club CEOs get a raise after 2017 pay decline, December 27, 2018: The Times of India

76 Execs See Over 10% Hike In FY18 Against 51 In FY17

The occupants of the corner office at India Inc earning top dollars have reasons to cheer. Not only has the milliondollar salary club added new members, but the overall compensation too has seen a rise this year.

After a muted growth last year, the number of executives earning a million dollars in salary (about Rs 6.5 crore) rose to 124 in FY18 from 120, with total compensation jumping 9% to Rs 2,158 crore. According to a study of top 200 listed firms by EMA Partners, commissioned by TOI, the elite club saw a larger number of CEOs/executives — 76 — receiving an over 10% salary jump as compared to 51 last year. The total compensation had declined by 5% to Rs 1,979 crore in FY17.

The study, which is based on compensation numbers in annual reports, took the conversion rate of the rupee to the

US dollar at Rs 65. The study covers commissions earned in FY18, but not stock options. An equal number of professional CEOs and promoter CEOs figure in this year’s list, unlike in the past when the former had a bigger presence.

AM Naik, who retired as L&T chairman last year, tops the elite list with a compensation of around Rs 89 crore, beating the Marans (Kalanithi and Kavery Kalanithi), the promoters of Sun Group, by more than a crore. According to L&T’s balance sheet, Naik earned a little under Rs 3 crore in salary in 2017-18 and a commission of about Rs 9 crore. Retirement benefits of about Rs 78 crore, which include encashment of accumulated leave of Rs 19 crore, a gratuity of Rs 55 crore and pension of Rs 1.5 crore, bolstered his compensation. JSW Group chairman Sajjan Jindal, whose compensation has more than doubled to Rs 49 crore, has stormed into the top 10.

“Overall CEO compensation continued to maintain its upward momentum as Indian businesses grow in scale and complexity. Indian businesses are quickly catching up or, in some cases, have surpassed their global peers in terms of CEO compensation and are looking to attract the best global talent. We expect this trend to accelerate in the coming years,” said K Sudarshan, regional managing partner (Asia), EMA Partners.

Commenting on his compensation, Naik said, “It cannot be reckoned as a recurring remuneration since it includes retirement benefits and perquisite value of employee stock options granted in the past. As a company, we are very conscious that increments are linked to profits. We see the profit growth and then decide on increments. There’s a nomination and remuneration committee of four directors which decides remuneration for directors. Corporate HR, on the other hand, proposes increments for all other employees.” Naik said it is logical to have a correlation in the growth of company profits and the growth in the compensation of the CEOs. L&T’s profits rose 22% year-on-year to Rs 7,370 crore in 2017-18.

Some of the new entrants to the club are P R Venketrama Raja, CMD, Ramco Cements, who earned about Rs 34 crore, Rajesh Gopinathan, CEO & MD of TCS, with earnings of around Rs 12 crore, and N Ganapathy Subramaniam, COO of TCS, who got Rs 9 crore during the year.

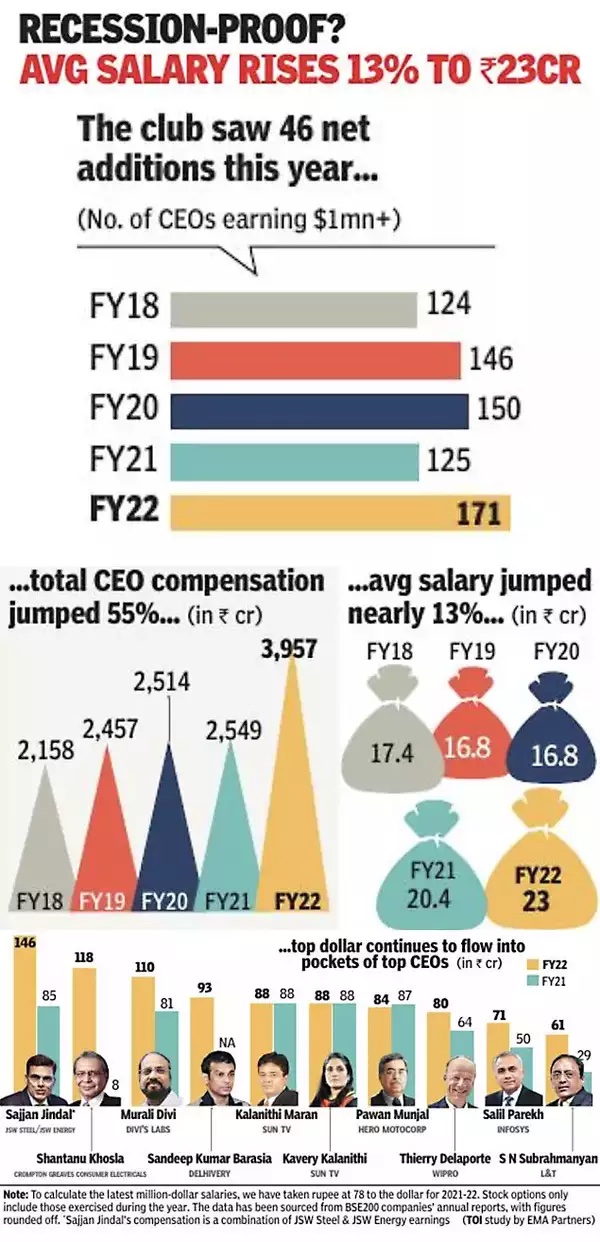

2018- 22

Namrata Singh, Dec 5, 2022: The Times of India

From: Namrata Singh, Dec 5, 2022: The Times of India

Mumbai: C-suite executives may have never seen such a rush for membership to their elite club during a challenging environment.

In a year of unprecedented inflation, a black swan event that triggered geopolitical uncertainty and a weakening rupee, the number of CEO/CXOs earning a million-dollar salary (over Rs 7.8 crore with the rupee pegged at 78/$) increased by 37% in FY22 from the previous fiscal. FY22 saw the entry of 46 new members to the club (from 125 to 171), a study conducted for TOI by EMA Partners, a global executive advisory firm, showed (see graphic). In the FY21 study, membership in this club had shrunk by 17% (from 150 to 125). The positive outcome this year is perhaps an indication of the turnaround after a two-year hiatus due to the pandemic.

C-suite executives’ total compensation has gone up 55% to Rs 3,957 crore, with the average salary at about Rs 23 crore. The growth refers to the percentage change in total package of the million-dollar club as compared to the data mentioned in TOI in the previous year’s study. The top 10 is led by Sajjan Jindal, whose total compensation from JSW Steel and JSW Energy — the two group companies where he is CMD — is Rs 146 crore, up 72% from Rs 85 crore in FY21. Jindal took home a greater chunk from his flagship company JSW Steel, where the total compensation is about Rs 135 crore in FY22. This includes a profit-linked commission of about Rs 122 crore.

Others in the top 10 include Wipro’s Thierry Delaporte, Infosys’s Salil Parekh, Hero MotoCorp’s Pawan Munjal, L&T’s S N Subrahmanyan and Delhivery’s Sandeep Kumar Barasia, bringing in a great degree of sectoral diversity to the club, ranging from manufacturing/infrastructure, automobiles, consumer electronics to IT, media, pharma, and startups.

EMA Partners India MD K Sudarshan said, “Senior executive compensation is largely ‘recession-proof’. Over the years, Indian businesses have scaled and many of them now have a global footprint and are being run by seasoned global executives. We can say that many Indian companies are able to compete well in the global market for talent.”

In FY21, when the elite club had 125 members, the rupee was taken at 74 against the dollar. An over 5% depreciation of the rupee compared to the previous year’s figure has not halted the rising curve.

What’s noticeable is that stock-related compensation now forms a substantial part of the overall package. Barasia, the MD & chief business officer of Delhivery, which is the first listed startup to make an entry into the club, earned a compensation of about Rs 93 crore, which includes perquisite value on the exercise of stock options of nearly Rs 64 crore.

Crompton Greaves Consumer Electricals MD Shantanu Khosla’s compensation at about Rs 118 crore got boosted by Rs 107 crore in stock options that he exercised during the financial year. L&T’s Subrahmanyan’s pay more than doubled to Rs 61 crore, boosted by nearly Rs 30 crore through the same method. Further, the Rs 71-crore salary of Infosys’s Parekh includes Rs 52-crore perquisites on account of stock options exercised.

The top 10 is equally represented by professional and promoter CEOs. Overall, professional CEOs, at 101, have clearly outpaced promoter CEOs, at 70 this year. The study found that the compensation of C-suite executives who figure in the club is up nearly 91%, while that of promoter CEOs has increased 26%.

Other than Kavery Kalanithi of Sun TV Network, gender diversity in the top 10, however, remains skewed towards male CEOs. In the overall club too, women’s representation among CXOs is just 6%.

Prabir Jha, founder & CEO of Prabir Jha People Advisory, who believes CEO salaries are not always recession-proof, said, “The growing proportion of stock in the reward mix is both right and prudent. CEOs are expected to take a strategic view of things and create longitudinal value. If their strategy choice plays out well in its design and execution, it is only fair to have a share of the rewards. And the better the market capitalisation, the better the CEO stock value. So investor interests and executive interests are better aligned. Also, the market then pays for the rewards, not the company. It is a more sensible cost structuring of executive compensation.”

According to Sudarshan, “It is fair to say that professionals are well rewarded for the value they create for their businesses and shareholders. Perhaps, The only downside to high compensation for professionals is that there will be no big incentive for them to set up something new from scratch on their own. high compensation is often a ‘disincentive’ for entrepreneurship.”

Leading an organisation in a BANI (brittle, anxious, non-linear, and incomprehensible) world is not easy. “Increasingly, the challenges of weathering turbulence have become very exacting for the C-suite, especially the CEO. The reward payout is in recognition of this navigation. The survival and sustainability of companies are at risk. And the appropriate leadership has become almost non-negotiable,” Jha said.

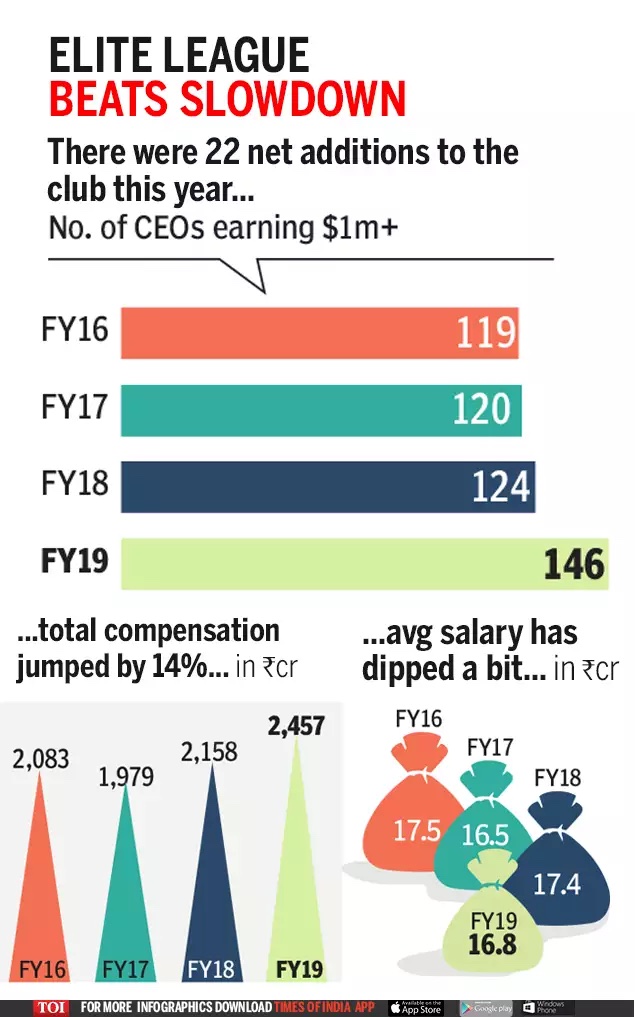

2019: 22 more CEOs earn $1 million+

Namrata Singh, Dec 11, 2019: The Times of India

From: Namrata Singh, Dec 11, 2019: The Times of India

From: Namrata Singh, Dec 11, 2019: The Times of India

MUMBAI: The economy may be slowing down, but not the entry into the ‘million dollar CEO club’, which saw a record 22 new members in FY19.

The number of CEOs earning a million-dollar (Rs 7 crore) salary annually surged to 146 from 124 in the previous year — an 18% jump. This is by far the best fiscal for the elite club in the last four years despite the falling rupee. The club with 119 members in FY16 had seen a marginal membership growth till FY18.

According to the annual study of CEO/CXO compensation in BSE 200 companies by EMA Partners, commissioned by TOI, the overall pay of the million dollar CEO club increased 14% to Rs 2,457 crore from last year’s Rs 2,158 crore, with the average CEO package at Rs 16.8 crore. For the study this year, the value of the rupee to the US dollar was taken at Rs 70. In the previous year, the threshold to the club was Rs 6.5 crore (the rupee to the dollar was pegged at Rs 65). So the cut-off in annual compensation — Rs 7 crore — required to figure in the elite million dollar CEO club got tougher this year.

The club features prominent promoter and professional CEOs such as Sun Group chairman Kalanithi Maran, who leads the group with a compensation of about Rs 88 crore, Hero MotoCorp CMD Pawan Munjal (Rs 80 crore), JSW Steel chairman Sajjan Jindal (Rs 69 crore), Larsen & Toubro CEO & MD S N Subrahmanyan (Rs 27 crore), Indiabulls Housing Finance VC & MD Gagan Banga (Rs 16 crore), Nestle India CMD Suresh Narayanan (Rs 11 crore), Marico MD & CEO Saugata Gupta (Rs 9 crore), among others.

Among the new entrants to the club, Infosys CEO Salil Parekh received the biggest jump of over 300% in compensation to Rs 17 crore in 2018-19, from about Rs 4 crore in the previous fiscal.

Professional CEOs (85 of them) have clearly outpaced promoter CEOs (61), and this gap has only widened over the years. “Hiring a good CEO in India just got tougher as India Inc sees more exit barriers in place now in the form of short-term and long-term compensation,” said EMA Partners regional managing partner (Asia) K Sudarshan. He added that the numbers have risen in line with the deepening market.

Although the economy is facing a slowdown, Sudarshan said its effects will be more visible in terms of bonuses and commissions payable to CEOs. In any case, these are numbers for FY19, and the real impact of a slowdown will be seen in CEO salaries of FY20.

Over the last few years, CEO salaries have come up for criticism in certain sections of society. Some leaders of India Inc have seen their annual compensations remain unchanged this year, such as the Marans, while for others it has come down, like in the case of Onkar Kanwar of Apollo Tyres. However, experts believe with growing demands on CEOs, the salary paid to the occupants of the corner office is justified.

Nestle India CMD Suresh Narayanan, who is credited with bringing Maggi out of the crisis it faced a few years ago, said he does not entirely work for the salary that he earns.

“It’s not that this (compensation) is going to influence the way in which I contribute. When you reach the level of a CEO, there are other reasons that inspire you to work. To me, pay has to reflect the skills to manage the complexity, the challenges, the accountability and the responsibility that a person carries,” he said.

Narayanan said in the Indian context, the governance responsibilities in a publicly-listed company are quite high and thus if a CEO is being remunerated in consonance with the expectations of an organisation, then it is fair to give him/her whatever is deemed to be fair by that organisation.

“Ultimately, you want CEOs to add value as well. One of the measures is the share price that they deliver for investors. Those who have delivered strongly on that at least have added value to somebody rather than just taking a salary. If the principles of accountability, responsibility, skill, talent and value addition are counted in and then people are paid, it’s fine,” said Narayanan.

Concurring with Narayanan,Marico MD & CEO Saugata Gupta said it’s not the money that attracts people to the post. “I want to leave a legacy behind. What drives me is the sheer adrenaline and the new learnings one gathers in this journey as CEO,” he said. Experts said if one were to look at broad benchmarking in the global context, the expectation from an emerging market player is high growth, and that clearly justifies the compensation CEOs get in India.

Sudarshan said the numbers no longer raise eyebrows and any attempt to stifle or muzzle compensation is not in the best interests of the organisation and its shareholders. What is a matter of concern for India Inc is the number of women at the top. Women CEOs form only 2% of the million dollar CEO list this year. “This continues to be a grave challenge and we are seeing that many companies are proactively taking steps to ensure diversity at all levels and we will hopefully see a big difference over a period of time. There’s no magic bullet for this issue,” said Sudarshan.

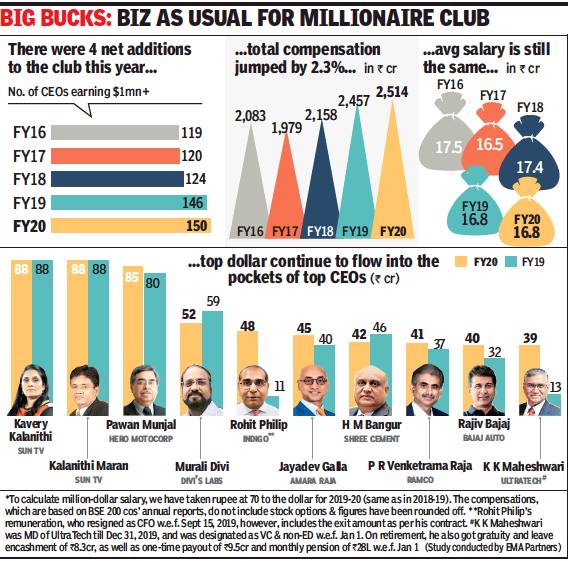

2020: a 7% rise

Namrata Singh, November 28, 2020: The Times of India

From: Namrata Singh, November 28, 2020: The Times of India

Professional CEOs got a raise in 2019-20 even as average salaries of their promoter counterparts dropped due to the slowdown before the pandemic. However, promoter CEOs, on an average, took home a 62% higher compensation than their professional counterparts.

According to the ‘milliondollar CEO club’ study by EMA Partners, commissioned by TOI, the average salaries of professional CEOs rose 6.5% to Rs 13 crore in 2019-20 and that of their promoter counterparts declined by about 9% to Rs 21 crore. The study is based on a sample of BSE 200 companies and it does not include stock options. Since the study takes into account compensation details in balance sheets for 2019-20, it excludes the trends that may have shaped CXO (including CFO) compensation following Covid.

The number of CXOs earning a million dollars (Rs 7 crore*) has inched up to 150 from 146 last year. The club is led by the Marans (Kalanithi Maran and Kavery Kalanithi) with a compensation of Rs 87.5 crore, which has remained unchanged (see graphic). Ofthe total, 81 are professional CEOs and 69 are promoters. Overall professional compensation has increased by 1.5%, while promoter compensation has risen by nearly 3%.

EMA Partners India MD K Sudarshan said, “The trend indicates that promoter CEOs have taken a larger hit on their compensation notwithstanding potential dividend earnings out of their businesses as shareholders. On the other hand, we have seen an increase in the overall compensation for professional CEOs. We believe this anomaly will see a gradual correction.”

Compensation of promoters like Sajjan Jindal of JSW plunged by nearly 44% to Rs 39 crore in 2019-20. Rajiv Bajaj of Bajaj Auto saw an over 23% jump in his compensation to nearly Rs 40 crore. Among professional CEOs, compensation of Hindalco MD Satish Pai rose 11% during the year to Rs 32 crore. Hindustan Unilever CMD Sanjiv Mehta’s salary rose about 24% to over Rs 16 crore. The remuneration of Rs 48 crore paid to Rohit Philip, who resigned from the post of CFO at IndiGo’s parent InterGlobe Aviation effective from September 15, 2019, however, includes the exit amount under his contract, which is why Philip’s compensation has more than trebled, catapulting him to the top 10 this year.

Kansai Nerolac Paints VC & MD H M Bharuka said, “If India has to grow, the number of million-dollar CXOs has to increase considerably.” Bharuka, who is also part of the club, said incentives are commensurate with the size, scale, complexities, spread and responsibilities. “The scrutiny, responsibilities and stress which a modern-day CXO faces have been going up. While there are teams to handle specific roles, the buck stops at the CXO’s desk.”

The gap between the average salaries of promoter (Rs 23 crore in FY19) and professional CEOs (Rs 12 crore, also FY19), which was nearly double, has reduced to 62% in FY20. Bharuka said there is no difference in the role of professional and promoter CEOs in terms of responsibilities. Therefore, compensation of a promoter CEO in comparison to a professional CEO should not be very high just because of ownership, he added.

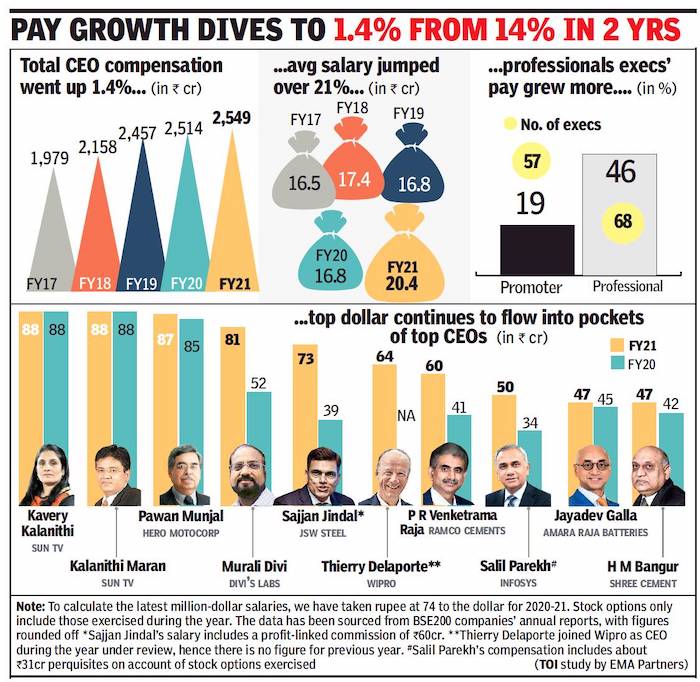

2020-21

Namrata Singh, Dec 22, 2021: The Times of India

From: Namrata Singh, Dec 22, 2021: The Times of India

Membership to the elite “million-dollar CEO club” shrank by nearly 17% in FY21 even as the average take-home of C-suite executives shot up.

The number of CEO/ CXOs in the million-dollar salary bracket (over Rs 7.4 crore) dropped to 125 in 2020-21 from 150 a year ago, while the average salary jumped by over 21% to Rs 20.4 crore (Rs 16.8 crore in FY20).

According to TOI’s “million-dollar salary” study conducted by EMA Partners, the total compensation earned by 125 top executives increased by just 1.4% to Rs 2,549 crore in 2020-21. The study is based on annual reports of BSE 200 companies. Based on TOI’s previous studies, the growth in total compensation has come down since FY19, when it witnessed a near-14% jump, to around 2% in FY20.

However, average salaries have been on the rise. In FY20, average salary growth was muted at 0.4%, while in FY19 it dipped by 3%.

One of the reasons for the shrinking of the elite club is the weakening of the rupee against the dollar. The rupee has depreciated nearly 6% against the dollar since a year ago, ending FY21 at just over Rs 73. To calculate the million-dollar salaries, the rupee was taken at 74 to the dollar. This set a Rs 7.4-crore annual compensation as the cutoff to be included in the “million-dollar salary club”. In FY20, the rupee was at 70 against the dollar, when the elite club had 150 members.

The club of professional CXOs at 68 continues to outpace that led by promoters, which is at 57.

‘Most businesses have bounced back smartly’

The gap between the growth in compensation earned by promoter CXOs and professional CXOs too has widened. In the year under review, while professional CXOs saw a 6.4% growth in compensation, promoter CXOs took a hit as their total compensation declined by 2.3% in FY21. Among promoter CEOs, Kavery and Kalanithi Maran of Sun TV lead the list this year as well with a compensation of about Rs 88 crore each. Sajjan Jindal is back in the top 10 with a compensation of Rs 73 crore, which includes a profit-linked commission of Rs 60 crore.

EMA Partners India MD K Sudarshan said, “Despite the pandemic, which raged through 2020-21, most businesses have bounced back smartly and companies have posted impressive numbers. Companies have also witnessed depressed costs due to various cost-control measures through the year. Consequently, we have not seen any significant change in CEO compensation, which has seen a slight increase when compared to the previous year. As has been the trend, in line with the growing scale of businesses, we continue to see more professionals in the mix who are now earning top-dollar compensation in line with their global peers.”

Some executives who retired and exited the club are former HDFC Bank MD Aditya Puri and former Asian Paints MD & CEO KBS Anand. New entrants to the club include Thierry Delaporte, who took over as the CEO of Wipro in 2020 with a compensation of Rs 64 crore, which takes him straight to the top 10; Pratik Pota of Jubilant FoodWorks (Rs 12 crore); Sunil D’Souza of Tata Consumer Products (Rs 10 crore); and Samina Hamied of Cipla (Rs 8 crore). Some like Salil Parekh of Infosys have made it to the top 10 with a 45% jump in compensation to about Rs 50 crore as it includes Rs 31 crore of stock options exercised during the year.

Sudarshan said he expects to see a growing number of professional managers dominating this list even as handson business promoter managers continue to feature as their businesses gain scale. "Shareholders and watchdogs are closely watching CEO compensation than ever before. Boards will tread with caution and keep overall shareholder interests in mind and CEO performance in listed businesses will come under increased scrutiny," said Sudarshan. In the million-dollar salary club, 28 CXOs are from the pharmaceuticals sector; 19 are from industrial/manufacturing (down from 33 a year ago); 16 are from diversified conglomerates, 14 are from automotive (down from 17), 13 are from financial services, 10 from consumer/FMCG and 10 from IT/ITEs.

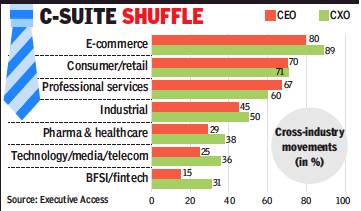

Cross-industry hiring

2018: highest in e-commerce, retail

Namrata Singh, Cross-industry CEO hiring max in e-tail, February 16, 2019: The Times of India

From: Namrata Singh, Cross-industry CEO hiring max in e-tail, February 16, 2019: The Times of India

Core Expertise No Longer Key For Leader: Study

In 2018, a good 40% of CEO placements were cross-industry hires, while the number was even higher among CXOs at 43%. Today, hiring CEOs/CXOs doesn’t warrant core industry experience in many organisations. This trend also demonstrates the growing demand for contrarians who can bring in fresh perspectives, keeping in view the manifold increase in the threat for disruption of most businesses.

These observations were drawn from a research project undertaken exclusively for TOI by Executive Access to study the statistical trends of movements of over 220 CEOs and CXOs across industries in the last year.

While the trend of crosshiring has been amply established, it is more pronounced in industries like e-commerce, consumer/retail and professional services. Cross-industry movement percentages of CEOs in these industries is 80%, 70% and 67%, respectively. A similar trend is seen even in CXO hiring in these three industries.

Executive Access (India) MD Ronesh Puri said, “There’s a churn happening across different industries but it is very high in e-commerce where there is a constant fear of consolidation. The burnout here also is high.” Being a young industry, cross-sector hiring is being fuelled by the necessity to fill from other industries.

Bigbasket head (HR) and adviser to the Fundamentum fund for entrepreneurs, Hari T N, said new-age startups in ecommerce and consumer internet are disrupting existing business models. “Smart executives from outside the industry are best at spotting innovation opportunities and creating disruption better than those from within the industry. This is because those from within the industry come with baggage, blind spots and constrained thinking. Therefore, when disruption and innovation is critical for success, it is a better bet to hire someone smart from outside the industry who comes with an open mind and unconstrained thinking,” said Hari.

However, Hari added when one wants to expand an existing market or grow a mature company, executives from within the industry may have an edge.

On the other hand, the appetite for cross-industry hiring in industries like pharma/healthcare (29%), core technology companies (25%) and banking, financial services & insurance (BFSI - 15%) are relatively low. The niche nature of most areas of these businesses and the requirement for higher technical specificity in these industries could be driving this conservative trend.

Consulting, on the other hand, takes sector specialists, which leads to higher incidence of cross-hiring. PwC India leader (people & organisation) Chaitali Mukherjee said, “Industries are evolving rapidly and their very reason for existence is changing. Hence, organisations are keen to get an ‘outside-in’ perspective, since problems are now cutting across industries.”

In industrial sectors, the trend of cross-hiring is gaining momentum. Executive Access sees cross-industry hiring picking up pace in the coming months. The change could be substantive even in other areas, including diversity cross-industry hiring, which currently is a mere 10%. “Now the confidence levels of people moving has risen. During our placements, we realised two out of three candidates want to move to another industry,” said Puri.

Mukherjee said leaders of the future are not going to be leaders on account of their industry expertise. Going forward, she said, the ability of the leaders to practise ‘disruptive envisioning’ and ‘multi-dimensional sense-making’ that gets them to think of non-linear problems, in a bold and disruptive manner by connecting discrete and unconnected data points, will be their reason for being reckoned as leaders.

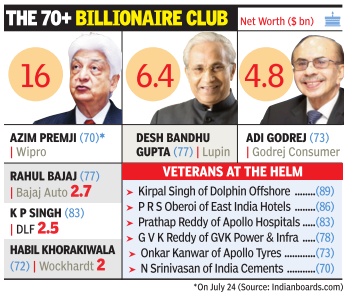

Extensions after age 70

Jul 08 2015

Reeba Zachariah & Boby Kurian

Super rich don't want to retire

Wipro's Premji, Lupin's Gupta Among 234 Seeking Extension As New Cos Act Caps Age Of Those In Executive Role At 70

About half a dozen billionaires are among the 234 business leaders who are seeking extension of the retirement age, which has been fixed at 70 years under the revamped Companies Act for those serving in a listed company in an executive role. Wipro boss Azim Premji, who turns 70 on July 24, is seeking a two-year extension as executive chairman and managing director at the company's annual general meeting slated for July 22. With a net worth estimated at over $16 billion, Premji, India's third richest man, emerges the most influential India Inc name seeking continuation of employment under a more stringent Act.

Pharma major Lupin's Desh Bandhu Gupta, with a net worth of $6.4 billion, is another billionaire seeking extension as executive chairman for five years through a special resolution at the company's July 23 AGM. “The new Act requires a proper justification and a special resolution with 75% voting in favour to continue with executive powers beyond 70. An age limit was deemed fit since significant public capital is parked with the country's largely promoter-driven companies,“ said Sai Venkateshwaran, partner and head of accounting advisory services at KPMG. This applies to those with executive functions and not independent directors.

Premji's desire to not hang up his boots is putting the spotlight on the so-called `Club of 70s', which includes the likes of Adi Godrej, KP Singh (of DLF), who have all got extensions under the previous Act to continue to lead their companies.

Wockhardt's Habil Khoraki wala, with a promoter stake worth $2 billion, also sought a similar continuation earlier this year. Adi Godrej continues to steer his family's interest, estimated at $4.8 billion, in Godrej Consumer Products as does K P Singh with a $2.5-billion stake in DLF . Kirpal Singh, 89, who heads Dolphin Offshore Enterprises as chairman, is the oldest executive head currently . Other veterans include P R S Oberoi (86) of EIH and C Prathap Reddy (83) of Apollo Hospitals Enterprises.

Most of them control a signif icant block of shares, giving them enough comfort to seek extensions even under the stringent, new rules. Premji and DLF's Singh control around 74% shares each in their companies, while Godrej has 63% and Lupin's Gupta 46%. L&T Group executive chairman A M Naik, probably the mostinfluential professional executive head past his retirement age, sought continuation under the old rules and has two more years at the helm unless he seeks another extension.

Wipro's special resolution recalls how Premji, who joined the business in the 1960s, turned a $2-million business into a $7.5-billion entity and India's third largest software exporter.While Premji's extension is set to sail through in the upcoming shareholder meeting, there have been minority investor rebellions against older executive heads in some of the lesserknown listed companies.

Some minority shareholders of Ultramarine & Pigments have written to the company that its executive chairman R Sampath, who is past 70, should step down. But the company said it has robust legal advice stating no requirement for a fresh ratification until Sampath's current tenure under the old Act ends.

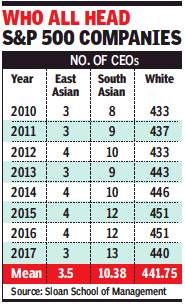

Why South Asians pip East Asians to top roles

MIT, Columbia, Michigan study/ 2020

July 8, 2020: The Times of India