The stock market: India

This is a collection of articles archived for the excellence of their content. Readers will be able to edit existing articles and post new articles directly |

Contents |

The 1960s to 2015: historical changes

Janakbhai: From GD Birla to JRD to Premji

Partha Sinha The Times of India Mar 05 2015

An investor's journey from the time when Indians could own foreign stocks -including Pakistani -and shares were bought for dividend yield, to the current future-prospects investment environment In the mid 1960s, a 10year-old boy would alight from a car in front of Bombay House -the Tata Group's headquarters here -and go in to attend AGMs of Tata companies. As instructed by family elders, Janak Mathuradas would sit quietly at the back and listen to J R D Tata, then chairman of the group, as he held forth on its prospects, current & future.Janak's routine was similar when it came to AGMs of Birla group companies, then headed by G D Birla. Today , Janak, 64, is known as one of the minority shareholders who persuaded Wipro chairman Azim Premji to not delist the company's FMCG business, so that old shareholders like him could continue to be part of the Wipro investor community . His ability to persuade Premji to change his mind comes from the long relationships investor families like his built with the old businesses of India. Like for other Dalal Street regulars of that time, for young Janak too, JRD was Tata Saheb and GD Birla was GD babu. Ratan Tata, who later succeeded JRD and was then an apprentice with Nelco, was Ratan seth. For Janak, three generations of whose family had invested in the stock market, AGMs and meeting with the Indian business blue blood was routine.

Encouraged by JRD, who wanted young people to enter the market, Janak tracked the companies his family invested in closely just as today's analysts do. His late father, Mathuradas Morarji, had taught him how to analyse balance sheets. Then, in 1977, on a circular ticket costing Rs 270, he travelled on the inaugural journey of the Mumbai-Kolkata Geetanjali Express to Tata Nagar (now Jharkhand) to see the Tata factories, then to Delhi to visit Escorts factory , from there to Poddar Mills in Jaipur, and from there to Gwalior Rayon in Gwalior, before returning to Mumbai 18 days later. This exposure at an early age helped him get into the family's investment business with a keen eye to differentiate a good stock from a bad one.

Sitting at his century-old Kalbadevi residence, Janak talked of his family's history and investment philosophy .They are natives of the Bet Dwarka island near Gujarat's Okha. In the 1870s, his greatgreat grandfather Hemraj Kanji travelled in bullock carts for two months to reach Mumbai to set up a textile business.

In the late 1800s, the family ventured into stocks. It has built a portfolio of companies from London, Burmah, Pakistan and Sri Lanka, in addition to domestic blue chips. “Today , our family is one of the oldest investors in some of the Tata companies,“ Janak said.

Through the years the family's approach has changed.“Earlier we were more interested in dividends yields on stocks,“ Janak said.

“Often a company with a face value of Rs 100 (which was usually the norm then), traded at Rs 40-50 and paid dividends of Rs 4-5. That gave us dividend yields of about 10% or more.Then we were not very interested in future prospects like today ,“ he said.

From the very beginning the family was careful about its interests as shareholders and never held back from speaking its mind to the managements.Right from the outset, the family never speculated, but went long-term. Janak said. “Earlier, for several years, I used work through the night to update our records of holdings and dividends received, and deposit the dividend warrants in banks in the morning so that we could quickly invest those funds in stocks,“ he said.“ We also bought stocks on borrowed money ,“ he added.

2002-13: rallies after steep falls

The Times of India, Sep 18 2015

Allirajan M

Markets see rallies post steep falls

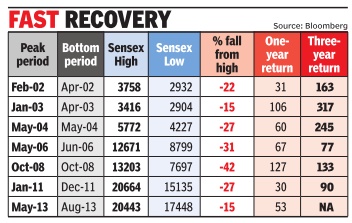

The markets are in a state of flux with global events depressing sentiments. But the benchmark sensex has recovered smartly after sudden sharp corrections in the past.The sensex has given annual returns of over 30% on an average after major market corrections in the last 14 years, data showed. In fact, the sensex surged 127%, its best ever show after a fall, in the recovery rally that followed the global financial crisis. The sensex hit a new low of 7697 points in October 2008 as the markets tanked in the aftermath of the global economic recession.But the index more than doubled in one year.

Similarly , the sensex, which lost over 29% from its peak in June 2006, soared 67% in the next one year, Bloomberg data showed. The markets saw a sharp downturn then due to the sell-off in global commodities and select emerging markets including India. But it took only 120 for the markets to regain their peak in 2006.

While markets rallied se ven times in the bull phase of 2003-2008, there were several instances when they fell by more than 15%, which is typically considered a correction. However, in these cases market regained their previous peak within 3-5 months.

Sharp corrections (10%20%) are seen often within the structural uptrends seen in global as well as Indian equity markets, says Sunil Singhania, chief investment officer, equities, Reliance Capital Asset Management.

Data suggests that this is a typical characteristic of any bull market. Market move ment is not linear and corrections are inevitable in any bull run, he said. Correction in a bull market is an opportunity to build positions,Singhania said.

The performance of the sensex has been even more impressive over a three-year period after every major fall.The index has zoomed over 75% in all but one occasion in the three-year period that followed a sharp correction since 2001, Bloomberg data showed. It jumped 317% and 245% respectively over a three-year timeframe after the declines in April 2003 and May 2004. Markets usually bounce back as India is a growing economy , says G Chokka lingam, founder and mana ging director, Equinomics Research and Advisory . “We expect the markets to stabi lise and recover after the Fed (US Federal Reserve) anno unces its decision on rate hi kes,“ he says.

The sensex has lost over 12.5% since crossing the 30,000 mark for the first time ever on concerns that the slowdown in the Chinese economy would bring the stuttering global economic recovery to a halt. Market observers however believe that India's attractiveness has only increased as a result of global developments.

Prices of commodities have fallen considerably , which is a positive development for India, experts said. With crude oil prices hovering at around $48 per barrel amidst a weak demand outlook, current and fiscal deficit trending lower, subsidy burden falling, inflation at multi-year lows and a falling interest rate environment, India is in a sweet spot among emerging markets, they said.

1990-2015: historical changes

In 25 years, from exclusive brokers' club to investor mkt

Partha Sinha The Times of India Mar 05 2015

On a day when Sensex hit 30,000 it's hard to remember that just 25 years ago, it was a mere three-digit number.Daily trading was then between 12 noon and 2pm and any of the top brokers facing funds crunch led to cancellation of the day's settlement! Trading was a lung-busting physical exercise under the open outcry system. IPO sizes ranged from a few lakhs to a maximum of Rs 3 crore. Compare that with the mammoth Rs 15,500 crore Coal India IPO in 2010. Vyaj badla, an indigenous form of futures trading that took place every Saturday , was part of the trading culture. Since 1990, Asia's oldest stock exchange has gone from being an exclusive brokers' club charging crores of rupees for admission to one that is fully corporatized.The change from open outcry system of trading in the ring, dematerialization of shares, clearing house for settlement within three days of trade and its competition with NSE, together have led to its transformation, Dalal Street veterans said. Today trading is online, faceless and smooth, with minimal of human intervention. Investors can trade on BSE from anywhere in the world. “The new system has taken the stock market to investors. While in the earlier system investors had to come to Dalal Street to trade and invest,“ said Arun Kejriwal, director of investment advisory KRIS.

However, the new system has its drawbacks too. For one, there's little personal interaction. Earlier, when about 7,0008,000 people traded in the ring, what is now the Convention Hall, understanding of the market didnt take much. One close look at a counter -the location where a particular blue chip stock was traded -and one got a fair idea of the trade's direction. “There were brokers who specialized in institutional trades, mainly on behalf of LIC and UTI, latter the original MF house from which UTIMF was carved out.

“If those brokers bought and sold, people said Sanstha lewal, Sanstha bechu (institutions buying, institutions selling),“ Kejriwal said. Due to the spread of the computer-based system, people have “lost the ability to understand the face behind the trade“, he said.At that time, companies going for listing got 120 days from the close of an IPO to list: 90 days for allotment and 30 more to list. Today , Sebi is contemplating cutting IPO time to just five days.

2005-2015: Firms giving returns in excess of 1,000%

The Times of India, Jul 08 2015

Kalpesh Damor

Shares of these firms are worth over 1,000% of their 2005 value

Had you invested Rs 5,000 in 1,000 shares of Symphony Ltd in 2005, your investment today would have grown to Rs 18.85 lakh. The Ahmedabad-based air-cooler maker is one of the few Gujarat-based firms giving returns in excess of 1,000% to shareholders in the past decade. Symphony is leading the pack in terms of increase in share prices.

The stock of the company surged 36,934.38% to touch Rs 1,885.05 on July 7, 2015 from Rs 5.09 a share on January 3, 2005. The rapid rise has catapulted its promoter Achal Bakeri to the elite club of billion-dollar business men in India this year.

Other companies to have had a dream run on the bourses during the past decade include Cera Sanitaryware, Vadilal Industries and Hitachi Home and Life Solutions In dia. The share prices of these firms rose by 5,163.10%, 4,250.29% and 3,830% respectively since 2005.

Vadodara-based Alembic Pharmaceuticals, Atul, Zydus Wellness and three-wheeler maker Atul Auto from Rajkot too have given an over 1,000% return to investors. Interestingly, the sensex has risen 321.78% till date from the 6,679.20 points it recorded on January 3, 2005.

Similarly , the price of gold, which averaged around Rs 7,000 per 10 grams in 2005, has increased to Rs 26,570 per 10 gram currently , offering a return of 279.57% in a decade.

Analysts opine that most of these companies innovated their products with time and aligned business strate gies in line with the growth in consumer demand.

“Companies like Symphony , Cera and Vadilal came up with new concepts that clicked, improving their sales and profit margins,“ said Nilesh Kotak, a stock analyst.

In fact, Gujarat-based small and medium-sized firms managed to offer bigger returns than larger players.

Zydus Wellness's focus on niche segment of wellness products and expanding its reach to new areas seems to have paid off. The company has witnessed 18 to 20% compounded annual growth over the past few years. Innovation in ice-cream products and diversification into frozen foods segments worked in favour of Vadilal Group.

2012-15: equity funds do well

Equities are the real gold over long term

Prashant Jain The Times of India Mar 05 2015

Einstein said, “Compound interest is the eighth wonder of the world. He, who understands it, earns it ... he who doesn't ... pays it“. This has been experi enced in India.At 17.1% CAGR, Rs 10,000 has become ~290 times in 36 years, while in gold at 10.4% CAGR, it has become ~35 times.

A difference of ~7% in returns over longer term (36 years) has resulted in 8x increase in wealth.

The average inflation over this period has been ~8% (CPI).Thus, gold has given returns that are close to inflation, thereby merely preserving the purchasing power. On the other hand, sensex has delivered nearly 9% excess returns over inflation. Over long periods, this has made a big difference.

The reason for this is simple. Equities over time grow in line with the growth of underlying businesses. As businesses comprise the economy , the nominal growth of the economy (real growth plus inflation) is a good proxy for the average growth in business es. The table gives the nominal growth rates of Indian economy over last 35 years.

The Indian economy has grown at a remarkably constant nominal growth of 15% per annum. No wonder that the sensex CAGR of 17.1% is close to 15% nominal GDP growth.

Who is smarter: FIIs or local investors?

In India, it is interesting to note that in the last 22 years or so that FII have been allowed to invest in stocks in India, the FII ownership has gone up from nil to 24% -roughly 1% per year. The sellers obviously have been domestic investors.

The dollars received by the locals from sale of their shares have been thus invested in gold.Gold, as pointed out earlier, has yielded near inflation (~10%) CAGR vs 17% CAGR for the sensex. In effects, domestic investors have been exchanging a ~17% CAGR asset for a ~10% CAGR one. This certainly is not a smart thing to do.

The way forward

Outlook for Indian economy and Indian equities is promising. India is one of the best placed among large economies in the world in terms of demographics, demand, growth. India is a key beneficiary of lower oil prices. The savings from lower oil prices are near 2% of GDP on run rate basis at current prices over CY13 average.

Apart from lower oil prices, a strong, growth-oriented government bodes well for economic growth and for businesses.Key decisions of new government so far give confidence that lower fiscal deficit is a priority and it should continue to fall.Equities are the real gold. Equities compound near nominal GDP growth rates whereas gold compounds near inflation.

2013: High index levels hide lurking weakness

Around 550 Stocks On The NSE Have Fallen By More Than Half between 2008 and 2013 Sign In | Join

TIMES NEWS NETWORK

The Times of India 2013/08/15

Though in 2013 the Nifty seemed to be holding up to 2008 levels, it was less reflective of the economy and the worsening macroeconomic situation. More than 550 stocks among the actively traded ones on the National Stock Exchange (NSE) have tumbled by more than half between 2008 and 2013.

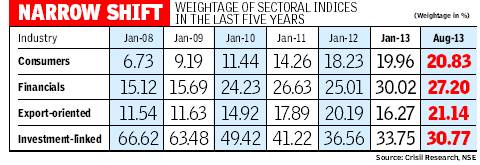

The price to book (P/B) valuation has dropped from 7.1 times in 2008 to 5.1 times in 2013 for Nifty firms. The changing dominance and outperformance by a few sectors such as consumer discretionary, private sector financial services companies and export-orientated sectors such as information technology (IT) and pharmaceuticals is holding key indices to almost levels seen in January 2008.

Investment-linked sectors such as materials, industrials, energy, utilities and telecom dominated the Nifty with a weightage of 66% in January 2008, data compiled by ratings agency Crisil showed. The weightage of any company/sector in the index is determined by the relative (to other companies/ sectors) free-float market capitalisation of the constituents.

The 2013 slowdown has resulted in poor performance of these sectors, shrinking valuation multiples resulting in a steep drop in the stock prices thereby lowering their cumulative weightage to 31% in July 2013. The aggregate earnings of companies in these sectors remained almost flat during the period.

As many as 22 out of 27 companies in these sectors (among 2008 Nifty constituents) gave negative returns. On the valuation side, the weighted average P/B multiple of companies shrank from 7.3 times in 2008 to 1.7 times in 2013.

Strong financial performance and increase in valuations of consumption and export-orientated sectors led to rebalancing of the weightage in their favour. These performing sectors, which include IT and pharma companies, now command 65% weightage in the index compared to 29% in 2008. Consumer-orientated sectors and private sector financial services firms have benefited from the consumption boom and government policies while IT and pharma have gained from the recovery in the global economy and weakening rupee. Among the biggest gainers of the pack are Lupin (599%) and Sun Pharmaceutical Industries (372%). During the past five years, aggregate PAT (profit after tax) of the companies in these performing sectors has grown at a CAGR (compounded annual growth rate) of 21.9%.

Along with reconstitution of the Nifty, the concentration of top-10 stocks too has changed—it is at a five-year high of 59.1% now compared to 53.3% in January 2008. Further, six companies, which were part of the top-10 list in 2008, have now been replaced.

2012-15: The most rewarding stocks

Mar 19 2015

Reeba Zachariah & Partha Sinha

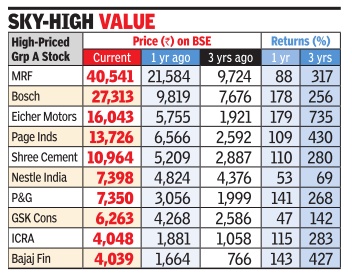

Offer gains up to 430% on BSE in 3 years, outperform Sensex that rose 63%

Their prices may appear intimidating, but don't be deceived. Some of the costliest shares on the bourses have also been the most rewarding over the past few years. For instance, an MRF share, the most expensive Indian stock, will lighten your wallet by about Rs 40,500. That kind of money could buy you an iPhone 6 or, even better, 15 grams of 22-carat gold. Although the steep price has often made retail investors wary of buying the stock, the Chennai-based tyre-maker has appreciated by an eye-popping 317% in the last three years. So, someone who bought 10 MRF shares at Rs 9,724 apiece in mid-March 2012 would be richer by nearly Rs 3.1 lakh today. Automotive component gi ant Bosch's stock, the second most expensive one now , stands at over Rs 27,000, up 256% in the last three years.

Eicher Motors, the third most expensive BSE stock, currently costs a little over Rs 16,000, rising nine times over three years from Rs 1,921 on March 19, 2012. Page Industries, the Indian franchise of Jockey International, is priced at a little over Rs 13,700 while Shree Cement is trading at near the Rs 11,000 level. Globally , the most expensive stock is Berkshire Hathaway , costing about $2,20,500 (around Rs 1.38 crore at current exchange rate).

Some of these “pricey“ stocks have even outperformed he sensex, which has given re urns of 31.5% in the past year and 63% in three years. So should you overcome the wariness and bet on such shares? “A stock, just because it is expensive, is not an avoidable one.Often the stock is expensive because of its high quality ,“ said Dipen Shah, Kotak Securities private client group research head. “ A retail investor should be aware of the underlying fundamentals of expensive stocks.

f it is really of high quality and s growing fast, it will remain expensive and may provide re urns over the longer term,“ Shah said.

Interestingly , a look at the public shareholding patterns of these stocks reveals that in most of these companies, the shares are highly concentrated with institutional investors such as mutual funds and insurance companies. In Bosch, other than the promoters and institutions, public shareholders hold just about 10%, while in Page Industries public shareholding is just below the double-digit mark.

“Though the value is high, these shares have low trading activity and are largely preferred by institutional investors,“ said Jagannadham Thunuguntla, Karvy Stock Broking fundamental research head.“Retail investors prefer shares with twoor three-digit denominations. But they shouldn't depend on denominations and should look at the underlying factors such as price-earnings ratio that one can get from these stocks,“ Thunuguntla said.

See also

Sensex <> The stock market: India <> Mutual Funds: India <> Rupee: India <> Gold in the Indian economy