The stock market: India

This is a collection of articles archived for the excellence of their content. Readers will be able to edit existing articles and post new articles directly |

Contents |

The 1960s to 2015: historical changes

Janakbhai: From GD Birla to JRD to Premji

Partha Sinha The Times of India Mar 05 2015

An investor's journey from the time when Indians could own foreign stocks -including Pakistani -and shares were bought for dividend yield, to the current future-prospects investment environment In the mid 1960s, a 10year-old boy would alight from a car in front of Bombay House -the Tata Group's headquarters here -and go in to attend AGMs of Tata companies. As instructed by family elders, Janak Mathuradas would sit quietly at the back and listen to J R D Tata, then chairman of the group, as he held forth on its prospects, current & future.Janak's routine was similar when it came to AGMs of Birla group companies, then headed by G D Birla. Today , Janak, 64, is known as one of the minority shareholders who persuaded Wipro chairman Azim Premji to not delist the company's FMCG business, so that old shareholders like him could continue to be part of the Wipro investor community . His ability to persuade Premji to change his mind comes from the long relationships investor families like his built with the old businesses of India. Like for other Dalal Street regulars of that time, for young Janak too, JRD was Tata Saheb and GD Birla was GD babu. Ratan Tata, who later succeeded JRD and was then an apprentice with Nelco, was Ratan seth. For Janak, three generations of whose family had invested in the stock market, AGMs and meeting with the Indian business blue blood was routine.

Encouraged by JRD, who wanted young people to enter the market, Janak tracked the companies his family invested in closely just as today's analysts do. His late father, Mathuradas Morarji, had taught him how to analyse balance sheets. Then, in 1977, on a circular ticket costing Rs 270, he travelled on the inaugural journey of the Mumbai-Kolkata Geetanjali Express to Tata Nagar (now Jharkhand) to see the Tata factories, then to Delhi to visit Escorts factory , from there to Poddar Mills in Jaipur, and from there to Gwalior Rayon in Gwalior, before returning to Mumbai 18 days later. This exposure at an early age helped him get into the family's investment business with a keen eye to differentiate a good stock from a bad one.

Sitting at his century-old Kalbadevi residence, Janak talked of his family's history and investment philosophy .They are natives of the Bet Dwarka island near Gujarat's Okha. In the 1870s, his greatgreat grandfather Hemraj Kanji travelled in bullock carts for two months to reach Mumbai to set up a textile business.

In the late 1800s, the family ventured into stocks. It has built a portfolio of companies from London, Burmah, Pakistan and Sri Lanka, in addition to domestic blue chips. “Today , our family is one of the oldest investors in some of the Tata companies,“ Janak said.

Through the years the family's approach has changed.“Earlier we were more interested in dividends yields on stocks,“ Janak said.

“Often a company with a face value of Rs 100 (which was usually the norm then), traded at Rs 40-50 and paid dividends of Rs 4-5. That gave us dividend yields of about 10% or more.Then we were not very interested in future prospects like today ,“ he said.

From the very beginning the family was careful about its interests as shareholders and never held back from speaking its mind to the managements.Right from the outset, the family never speculated, but went long-term. Janak said. “Earlier, for several years, I used work through the night to update our records of holdings and dividends received, and deposit the dividend warrants in banks in the morning so that we could quickly invest those funds in stocks,“ he said.“ We also bought stocks on borrowed money ,“ he added.

1990-2015: historical changes

In 25 years, from exclusive brokers' club to investor mkt

Partha Sinha The Times of India Mar 05 2015

On a day when Sensex hit 30,000 it's hard to remember that just 25 years ago, it was a mere three-digit number.Daily trading was then between 12 noon and 2pm and any of the top brokers facing funds crunch led to cancellation of the day's settlement! Trading was a lung-busting physical exercise under the open outcry system. IPO sizes ranged from a few lakhs to a maximum of Rs 3 crore. Compare that with the mammoth Rs 15,500 crore Coal India IPO in 2010. Vyaj badla, an indigenous form of futures trading that took place every Saturday , was part of the trading culture. Since 1990, Asia's oldest stock exchange has gone from being an exclusive brokers' club charging crores of rupees for admission to one that is fully corporatized.The change from open outcry system of trading in the ring, dematerialization of shares, clearing house for settlement within three days of trade and its competition with NSE, together have led to its transformation, Dalal Street veterans said. Today trading is online, faceless and smooth, with minimal of human intervention. Investors can trade on BSE from anywhere in the world. “The new system has taken the stock market to investors. While in the earlier system investors had to come to Dalal Street to trade and invest,“ said Arun Kejriwal, director of investment advisory KRIS.

However, the new system has its drawbacks too. For one, there's little personal interaction. Earlier, when about 7,0008,000 people traded in the ring, what is now the Convention Hall, understanding of the market didnt take much. One close look at a counter -the location where a particular blue chip stock was traded -and one got a fair idea of the trade's direction. “There were brokers who specialized in institutional trades, mainly on behalf of LIC and UTI, latter the original MF house from which UTIMF was carved out.

“If those brokers bought and sold, people said Sanstha lewal, Sanstha bechu (institutions buying, institutions selling),“ Kejriwal said. Due to the spread of the computer-based system, people have “lost the ability to understand the face behind the trade“, he said.At that time, companies going for listing got 120 days from the close of an IPO to list: 90 days for allotment and 30 more to list. Today , Sebi is contemplating cutting IPO time to just five days.

2012-15: equity funds do well

Equities are the real gold over long term

Prashant Jain The Times of India Mar 05 2015

Einstein said, “Compound interest is the eighth wonder of the world. He, who understands it, earns it ... he who doesn't ... pays it“. This has been experi enced in India.At 17.1% CAGR, Rs 10,000 has become ~290 times in 36 years, while in gold at 10.4% CAGR, it has become ~35 times.

A difference of ~7% in returns over longer term (36 years) has resulted in 8x increase in wealth.

The average inflation over this period has been ~8% (CPI).Thus, gold has given returns that are close to inflation, thereby merely preserving the purchasing power. On the other hand, sensex has delivered nearly 9% excess returns over inflation. Over long periods, this has made a big difference.

The reason for this is simple. Equities over time grow in line with the growth of underlying businesses. As businesses comprise the economy , the nominal growth of the economy (real growth plus inflation) is a good proxy for the average growth in business es. The table gives the nominal growth rates of Indian economy over last 35 years.

The Indian economy has grown at a remarkably constant nominal growth of 15% per annum. No wonder that the sensex CAGR of 17.1% is close to 15% nominal GDP growth.

Who is smarter: FIIs or local investors?

In India, it is interesting to note that in the last 22 years or so that FII have been allowed to invest in stocks in India, the FII ownership has gone up from nil to 24% -roughly 1% per year. The sellers obviously have been domestic investors.

The dollars received by the locals from sale of their shares have been thus invested in gold.Gold, as pointed out earlier, has yielded near inflation (~10%) CAGR vs 17% CAGR for the sensex. In effects, domestic investors have been exchanging a ~17% CAGR asset for a ~10% CAGR one. This certainly is not a smart thing to do.

The way forward

Outlook for Indian economy and Indian equities is promising. India is one of the best placed among large economies in the world in terms of demographics, demand, growth. India is a key beneficiary of lower oil prices. The savings from lower oil prices are near 2% of GDP on run rate basis at current prices over CY13 average.

Apart from lower oil prices, a strong, growth-oriented government bodes well for economic growth and for businesses.Key decisions of new government so far give confidence that lower fiscal deficit is a priority and it should continue to fall.Equities are the real gold. Equities compound near nominal GDP growth rates whereas gold compounds near inflation.

2013: High index levels hide lurking weakness

Around 550 Stocks On The NSE Have Fallen By More Than Half between 2008 and 2013 Sign In | Join

TIMES NEWS NETWORK

The Times of India 2013/08/15

Though in 2013 the Nifty seemed to be holding up to 2008 levels, it was less reflective of the economy and the worsening macroeconomic situation. More than 550 stocks among the actively traded ones on the National Stock Exchange (NSE) have tumbled by more than half between 2008 and 2013.

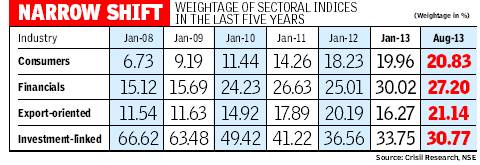

The price to book (P/B) valuation has dropped from 7.1 times in 2008 to 5.1 times in 2013 for Nifty firms. The changing dominance and outperformance by a few sectors such as consumer discretionary, private sector financial services companies and export-orientated sectors such as information technology (IT) and pharmaceuticals is holding key indices to almost levels seen in January 2008.

Investment-linked sectors such as materials, industrials, energy, utilities and telecom dominated the Nifty with a weightage of 66% in January 2008, data compiled by ratings agency Crisil showed. The weightage of any company/sector in the index is determined by the relative (to other companies/ sectors) free-float market capitalisation of the constituents.

The 2013 slowdown has resulted in poor performance of these sectors, shrinking valuation multiples resulting in a steep drop in the stock prices thereby lowering their cumulative weightage to 31% in July 2013. The aggregate earnings of companies in these sectors remained almost flat during the period.

As many as 22 out of 27 companies in these sectors (among 2008 Nifty constituents) gave negative returns. On the valuation side, the weighted average P/B multiple of companies shrank from 7.3 times in 2008 to 1.7 times in 2013.

Strong financial performance and increase in valuations of consumption and export-orientated sectors led to rebalancing of the weightage in their favour. These performing sectors, which include IT and pharma companies, now command 65% weightage in the index compared to 29% in 2008. Consumer-orientated sectors and private sector financial services firms have benefited from the consumption boom and government policies while IT and pharma have gained from the recovery in the global economy and weakening rupee. Among the biggest gainers of the pack are Lupin (599%) and Sun Pharmaceutical Industries (372%). During the past five years, aggregate PAT (profit after tax) of the companies in these performing sectors has grown at a CAGR (compounded annual growth rate) of 21.9%.

Along with reconstitution of the Nifty, the concentration of top-10 stocks too has changed—it is at a five-year high of 59.1% now compared to 53.3% in January 2008. Further, six companies, which were part of the top-10 list in 2008, have now been replaced.

See also

Sensex <> The stock market: India <> Mutual Funds: India <> Rupee: India <> Gold in the Indian economy