The stock market: India

(→See also) |

|||

| Line 10: | Line 10: | ||

[[Category:India|S]] | [[Category:India|S]] | ||

[[Category: Economy-Industry-Resources|S]] | [[Category: Economy-Industry-Resources|S]] | ||

| + | |||

| + | =The 1960s to 2015: historical changes= | ||

| + | |||

| + | ''' Janakbhai: From GD Birla to JRD to Premji ''' | ||

| + | |||

| + | Partha Sinha [http://epaperbeta.timesofindia.com//Article.aspx?eid=31808&articlexml=Janakbhai-From-GD-Birla-to-JRD-to-Premji-05032015014052 ''The Times of India''] Mar 05 2015 | ||

| + | |||

| + | An investor's journey from the time when Indians could own foreign stocks -including Pakistani -and shares were bought for dividend yield, to the current future-prospects investment environment | ||

| + | In the mid 1960s, a 10year-old boy would alight from a car in front of Bombay House -the Tata Group's headquarters here -and go in to attend AGMs of Tata companies. As instructed by family elders, Janak Mathuradas would sit quietly at the back and listen to J R D Tata, then chairman of the group, as he held forth on its prospects, current & future.Janak's routine was similar when it came to AGMs of Birla group companies, then headed by G D Birla. | ||

| + | Today , Janak, 64, is known as one of the minority shareholders who persuaded Wipro chairman Azim Premji to not delist the company's FMCG business, so that old shareholders like him could continue to be part of the Wipro investor community . His ability to persuade Premji to change his mind comes from the long relationships investor families like his built with the old businesses of India. Like for other Dalal Street regulars of that time, for young Janak too, JRD was Tata Saheb and GD Birla was GD babu. Ratan Tata, who later succeeded JRD and was then an apprentice with Nelco, was Ratan seth. For Janak, three generations of whose family had invested in the stock market, AGMs and meeting with the Indian business blue blood was routine. | ||

| + | |||

| + | Encouraged by JRD, who wanted young people to enter the market, Janak tracked the companies his family invested in closely just as today's analysts do. His late father, Mathuradas Morarji, had taught him how to analyse balance sheets. Then, in 1977, on a circular ticket costing Rs 270, he travelled on the inaugural journey of the Mumbai-Kolkata Geetanjali Express to Tata Nagar (now Jharkhand) to see the Tata factories, then to Delhi to visit Escorts factory , from there to Poddar Mills in Jaipur, and from there to Gwalior Rayon in Gwalior, before returning to Mumbai 18 days later. This exposure at an early age helped him get into the family's investment business with a keen eye to differentiate a good stock from a bad one. | ||

| + | |||

| + | Sitting at his century-old Kalbadevi residence, Janak talked of his family's history and investment philosophy .They are natives of the Bet Dwarka island near Gujarat's Okha. In the 1870s, his greatgreat grandfather Hemraj Kanji travelled in bullock carts for two months to reach Mumbai to set up a textile business. | ||

| + | |||

| + | In the late 1800s, the family ventured into stocks. It has built a portfolio of companies from London, Burmah, Pakistan and Sri Lanka, in addition to domestic blue chips. “Today , our family is one of the oldest investors in some of the Tata companies,“ Janak said. | ||

| + | |||

| + | Through the years the family's approach has changed.“Earlier we were more interested in dividends yields on stocks,“ Janak said. | ||

| + | |||

| + | “Often a company with a face value of Rs 100 (which was usually the norm then), traded at Rs 40-50 and paid dividends of Rs 4-5. That gave us dividend yields of about 10% or more.Then we were not very interested in future prospects like today ,“ he said. | ||

| + | |||

| + | From the very beginning the family was careful about its interests as shareholders and never held back from speaking its mind to the managements.Right from the outset, the family never speculated, but went long-term. Janak said. “Earlier, for several years, I used work through the night to update our records of holdings and dividends received, and deposit the dividend warrants in banks in the morning so that we could quickly invest those funds in stocks,“ he said.“ We also bought stocks on borrowed money ,“ he added. | ||

| + | |||

=2013: High index levels hide lurking weakness= | =2013: High index levels hide lurking weakness= | ||

Revision as of 21:12, 14 March 2015

This is a collection of articles archived for the excellence of their content. Readers will be able to edit existing articles and post new articles directly |

The 1960s to 2015: historical changes

Janakbhai: From GD Birla to JRD to Premji

Partha Sinha The Times of India Mar 05 2015

An investor's journey from the time when Indians could own foreign stocks -including Pakistani -and shares were bought for dividend yield, to the current future-prospects investment environment In the mid 1960s, a 10year-old boy would alight from a car in front of Bombay House -the Tata Group's headquarters here -and go in to attend AGMs of Tata companies. As instructed by family elders, Janak Mathuradas would sit quietly at the back and listen to J R D Tata, then chairman of the group, as he held forth on its prospects, current & future.Janak's routine was similar when it came to AGMs of Birla group companies, then headed by G D Birla. Today , Janak, 64, is known as one of the minority shareholders who persuaded Wipro chairman Azim Premji to not delist the company's FMCG business, so that old shareholders like him could continue to be part of the Wipro investor community . His ability to persuade Premji to change his mind comes from the long relationships investor families like his built with the old businesses of India. Like for other Dalal Street regulars of that time, for young Janak too, JRD was Tata Saheb and GD Birla was GD babu. Ratan Tata, who later succeeded JRD and was then an apprentice with Nelco, was Ratan seth. For Janak, three generations of whose family had invested in the stock market, AGMs and meeting with the Indian business blue blood was routine.

Encouraged by JRD, who wanted young people to enter the market, Janak tracked the companies his family invested in closely just as today's analysts do. His late father, Mathuradas Morarji, had taught him how to analyse balance sheets. Then, in 1977, on a circular ticket costing Rs 270, he travelled on the inaugural journey of the Mumbai-Kolkata Geetanjali Express to Tata Nagar (now Jharkhand) to see the Tata factories, then to Delhi to visit Escorts factory , from there to Poddar Mills in Jaipur, and from there to Gwalior Rayon in Gwalior, before returning to Mumbai 18 days later. This exposure at an early age helped him get into the family's investment business with a keen eye to differentiate a good stock from a bad one.

Sitting at his century-old Kalbadevi residence, Janak talked of his family's history and investment philosophy .They are natives of the Bet Dwarka island near Gujarat's Okha. In the 1870s, his greatgreat grandfather Hemraj Kanji travelled in bullock carts for two months to reach Mumbai to set up a textile business.

In the late 1800s, the family ventured into stocks. It has built a portfolio of companies from London, Burmah, Pakistan and Sri Lanka, in addition to domestic blue chips. “Today , our family is one of the oldest investors in some of the Tata companies,“ Janak said.

Through the years the family's approach has changed.“Earlier we were more interested in dividends yields on stocks,“ Janak said.

“Often a company with a face value of Rs 100 (which was usually the norm then), traded at Rs 40-50 and paid dividends of Rs 4-5. That gave us dividend yields of about 10% or more.Then we were not very interested in future prospects like today ,“ he said.

From the very beginning the family was careful about its interests as shareholders and never held back from speaking its mind to the managements.Right from the outset, the family never speculated, but went long-term. Janak said. “Earlier, for several years, I used work through the night to update our records of holdings and dividends received, and deposit the dividend warrants in banks in the morning so that we could quickly invest those funds in stocks,“ he said.“ We also bought stocks on borrowed money ,“ he added.

2013: High index levels hide lurking weakness

Around 550 Stocks On The NSE Have Fallen By More Than Half between 2008 and 2013

TIMES NEWS NETWORK

The Times of India 2013/08/15

Though in 2013 the Nifty seemed to be holding up to 2008 levels, it was less reflective of the economy and the worsening macroeconomic situation. More than 550 stocks among the actively traded ones on the National Stock Exchange (NSE) have tumbled by more than half between 2008 and 2013.

The price to book (P/B) valuation has dropped from 7.1 times in 2008 to 5.1 times in 2013 for Nifty firms. The changing dominance and outperformance by a few sectors such as consumer discretionary, private sector financial services companies and export-orientated sectors such as information technology (IT) and pharmaceuticals is holding key indices to almost levels seen in January 2008.

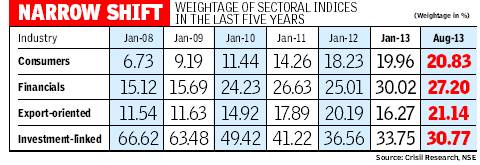

Investment-linked sectors such as materials, industrials, energy, utilities and telecom dominated the Nifty with a weightage of 66% in January 2008, data compiled by ratings agency Crisil showed. The weightage of any company/sector in the index is determined by the relative (to other companies/ sectors) free-float market capitalisation of the constituents.

The 2013 slowdown has resulted in poor performance of these sectors, shrinking valuation multiples resulting in a steep drop in the stock prices thereby lowering their cumulative weightage to 31% in July 2013. The aggregate earnings of companies in these sectors remained almost flat during the period.

As many as 22 out of 27 companies in these sectors (among 2008 Nifty constituents) gave negative returns. On the valuation side, the weighted average P/B multiple of companies shrank from 7.3 times in 2008 to 1.7 times in 2013.

Strong financial performance and increase in valuations of consumption and export-orientated sectors led to rebalancing of the weightage in their favour. These performing sectors, which include IT and pharma companies, now command 65% weightage in the index compared to 29% in 2008. Consumer-orientated sectors and private sector financial services firms have benefited from the consumption boom and government policies while IT and pharma have gained from the recovery in the global economy and weakening rupee. Among the biggest gainers of the pack are Lupin (599%) and Sun Pharmaceutical Industries (372%). During the past five years, aggregate PAT (profit after tax) of the companies in these performing sectors has grown at a CAGR (compounded annual growth rate) of 21.9%.

Along with reconstitution of the Nifty, the concentration of top-10 stocks too has changed—it is at a five-year high of 59.1% now compared to 53.3% in January 2008. Further, six companies, which were part of the top-10 list in 2008, have now been replaced.

See also

Sensex <> The stock market: India <> Mutual Funds: India <> Rupee: India <> Gold in the Indian economy