The Reserve Bank of India

This is a collection of articles archived for the excellence of their content. Readers will be able to edit existing articles and post new articles directly |

History

The Reserve Bank of India is the central bank of the country. Central banks are a relatively recent innovation and most central banks, as we know them today, were established around the early twentieth century.

The Reserve Bank of India was set up on the basis of the recommendations of the Hilton Young Commission. The Reserve Bank of India Act, 1934 (II of 1934) provides the statutory basis of the functioning of the Bank, which commenced operations on April 1, 1935.

The Bank was constituted to:

- Regulate the issue of banknotes

- Maintain reserves with a view to securing monetary stability and

- To operate the credit and currency system of the country to its advantage.

The Bank began its operations by taking over from the Government the functions so far being performed by the Controller of Currency and from the Imperial Bank of India, the management of Government accounts and public debt. The existing currency offices at Calcutta, Bombay, Madras, Rangoon, Karachi, Lahore and Cawnpore (Kanpur) became branches of the Issue Department. Offices of the Banking Department were established in Calcutta, Bombay, Madras, Delhi and Rangoon.

Burma (Myanmar) seceded from the Indian Union in 1937 but the Reserve Bank continued to act as the Central Bank for Burma till Japanese Occupation of Burma and later upto April, 1947. After the partition of India, the Reserve Bank served as the central bank of Pakistan upto June 1948 when the State Bank of Pakistan commenced operations. The Bank, which was originally set up as a shareholder's bank, was nationalised in 1949.

An interesting feature of the Reserve Bank of India was that at its very inception, the Bank was seen as playing a special role in the context of development, especially Agriculture. When India commenced its plan endeavours, the development role of the Bank came into focus, especially in the sixties when the Reserve Bank, in many ways, pioneered the concept and practise of using finance to catalyse development. The Bank was also instrumental in institutional development and helped set up insitutions like the Deposit Insurance and Credit Guarantee Corporation of India, the Unit Trust of India, the Industrial Development Bank of India, the National Bank of Agriculture and Rural Development, the Discount and Finance House of India etc. to build the financial infrastructure of the country.

With liberalisation, the Bank's focus has shifted back to core central banking functions like Monetary Policy, Bank Supervision and Regulation, and Overseeing the Payments System and onto developing the financial markets.

Which was India's first central bank?

The first central bank was the Imperial Bank of India formed in 1921 by merging the Presidency banks. The bank was further enlarged by the merger of several banks owned by princely states like Jaipur, Mysore and Patiala.

The Imperial Bank of India was supposed to perform three functions -commercial banking, central banking and banker of the government. By 1930, there were 1,258 banking institutions in the country registered under the Companies Act. Of these, the Imperial Bank was the most dominant.The global economy was passing through the Great Depression and this resulted in the failure of many banks in India as well. Various committees set up to study the Indian banking system recommend ed the formation of a central bank which was free from commercial banking. In most modern economies, central banks were formed largely to tackle the failure of unorganised banking by enforcing regulatory safeguards.

When was the Reserve Bank of India formed?

The bank was formed in 1935 by the Reserve Bank of India Act, 1934. The objectives included being the banker of the government and other banks, to maintain the exchange ratio and to regulate issue of bank notes. The overall objective of the bank was to secure monetary stability.

What are its current roles?

The bank formulates, implements and monitors India's monetary policy. It monitors and regulates the financial system through prescribing broad parameters of banking operations to ensure public confidence in the system and protect depositors' interests.The bank also manages foreign trade and monitors foreign exchange reserves. It is the only authority that has the right to issue or destroy currency .

How is the bank governed?

Like other central banks, the RBI too is an independent entity within the government.It is governed by a central board of directors appointed by the government according to the Reserve Bank of India Act. The board is appointed for four years with a governor and not more than four deputy governors as official directors. There are also 10 directors nominated by the government, two government officials and four directors -one each from local boards -who act as non-official directors.

Reserve Bank of India Act of 1934

What is Section 7 of the Reserve Bank of India Act of 1934

From: Mayur Shetty, Will govt invoke Sec 7 for 1st time if RBI logjam persists?, October 31, 2018: The Times of India

See graphic:

Sec 7 of the Reserve Bank of India Act of 1934

Sec 7 application considered in 2018, Oct

Is Said To Have Referred To The Law Recently

No government has invoked Section 7 of the Reserve Bank of India Act of 1934 in the central bank’s 83-year history.

It is seen as an instrument of last resort, a direct order from the government of the day to the central bank to carry out its wishes (see graphic, ‘In Public Interest’).

The Modi government, despite its growing frustration with the Urjit Patel-led RBI, has resisted suggestions that it invoke Section 7 to increase liquidity, ease pressure on banks and businesses, and boost economic growth. But there are indications that via recent communications, it has initiated a consultative process with the RBI in three areas of concern and while doing so, has mentioned Section 7 without actually invoking it.

Was fear of Section 7 behind RBI dy guv’s attack on govt?

The government is learned to have recently initiated a consultative process with the RBI in three areas of concern – power sector loans, ‘prompt corrective action’ (PCA), and special dispensation for micro-small and medium enterprises (MSMEs) – and while doing so, mentioned Section 7, without actually invoking it. The Section says, “The Central Government may from time to time give such directions to the Bank as it may, after consultation with the Governor of the Bank, consider necessary in the public interest.”

The government’s move is significant as such a consultative process could potentially lead to the government issuing directions should the logjam persist. The issue of invoking Section 7 first came up during a hearing before the Allahabad high court in a case filed by the Independent Power Producers challenging the RBI’s February 12 circular which did away with all restructuring schemes for loans in default. After the counsel for RBI pointed out that legally the government could issue directions to the central bank, the court in its ruling in August said such a move could be considered.

Historically, whenever governors have spoken about the independence of the central bank, they have never failed to point out that Section 7 has never been used.

A senior official in the government said there has so far been no move to invoke Section 7. Another person, when asked, said, “Communication between the government and the central bank is sacrosanct and cannot be disclosed.”

There is some speculation that it was the government’s mention of section 7 that was the trigger for deputy governor Viral Acharya’s outburst against the government last Friday. While he did not make any reference to the Section, he did speak about how the government could undermine the independence of the central bank by ‘blocking or opposing rule-based central banking policies and favouring instead discretionary or joint decisionmaking with direct government interventions’.

The government wants norms for non-performing assets in the power sector – which currently require companies to be referred to bankruptcy courts -- to be relaxed. Once admitted, the companies have to be either sold or liquidated.

Its concern about 'prompt corrective action' is that the classification of PCA has placed lending and expansion curbs on 11 public sector and one private bank, which it believes is choking fund flows to several sectors. The government has also been worried about the fate of MSMEs, and is keen that the definition of bad loans be softened.

A broader concern is about the liquidity situation which has taken a turn for the worse after a series of defaults by IL&FS in September. The defaults have had a cascading impact — MFs that had invested in IL&FS debt were hit, corporates who had put shortterm funds in MFs turned cautious, and the funds themselves turned cautious about putting money in financial companies.

Central board of directors

The Central Board

The Reserve Bank's affairs are governed by a central board of directors. The board is appointed by the Government of India in keeping with the Reserve Bank of India Act.

• Appointed/nominated for a period of four years

Constitution:

o Official Directors

♣ Full-time : Governor and not more than four Deputy Governors

o Non-Official Directors

♣ Nominated by Government: ten Directors from various fields and two government Official

♣ Others: four Directors - one each from four local boards

Functions : General superintendence and direction of the Bank's affairs

Local Boards

• One each for the four regions of the country in Mumbai, Calcutta, Chennai and New Delhi

Membership:

• consist of five members each

• appointed by the Central Government

• for a term of four years

Functions : To advise the Central Board on local matters and to represent territorial and economic interests of local cooperative and indigenous banks; to perform such other functions as delegated by Central Board from time to time.

Why RBI is not comfortable with active boards

From: Mayur Shetty, Why RBI is not comfortable with a more active board, November 6, 2018: The Times of India

Bizmen In Rule-Debating Role Raise Conflict Of Interest Issue

An active board seeking a say in bank regulation has thrown up questions about conflict of interest, given the presence of industrialists on the board of the Reserve Bank of India (RBI).

Traditionally, the RBI board had a strong presence of eminent industrialists like Ratan Tata, N R Narayana Murthy and Azim Premji. It has also included chiefs of highly indebted groups like K P Singh of DLF and G M Rao of the GMR Group. However, there was never any conflict of interest as the minutiae of bank regulation or monetary policy never came up to the board. That’s because, until now, the RBI board only gave a broad direction that the central bank should take.

But in the October 23 board meeting, some directors are understood to have turned vocal on a few RBI regulations. According to a senior former central banker, there would be conflict of interest if these businessmen had advance information of RBI’s regulations. He was reacting to reports that some directors wanted the RBI central board to play a more active role and deliberate on regulations. There is talk of the board wanting to push through five decisions, which includes issues such as regulatory forbearance and allowing weak banks to lend, in the forthcoming RBI board meet on November 19.

Sources close to the central bank also point out that, unlike boards constituted under The Companies Act, the RBI Act 1934 grants the governor with powers that are concurrent with the board. They refer to clause 3 of the hotly debated Section 7 of the RBI Act. While the first clause confers powers on the government to give directions to the RBI, the third part indicates that the governor shares power.

This clause 3 states, “Save as otherwise provided in regulations made by the central board, the governor and in his absence the deputy governor nominated by him in this behalf, shall also have powers of general superintendence and direction of the affairs and the business of the bank, and may exercise all powers and do all acts and things which may be exercised or done by the bank.” A source said, “The choice of the words ‘shall also have powers’ indicates that these are concurrent with the board.”

According to sources, the powers of the governor are reiterated in the Reserve Bank of India, General Regulations, 1949, which also addresses the issue of conflict of interest between board decisions and individual interests of directors. “You can imagine what would happen if an issue like the February 12 circular on recognition of non-performing assets came up to a board that included owners of highly indebted companies,” a source said.

How other central banks function

From: Source: Central bank websites, agencies, WSJ, How other central banks function, October 30, 2018: The Times of India

The US Federal Reserve: Like other central banks, the Fed is an independent government agency. It is accountable to the public and the US Congress. Members of the board of governors are appointed for staggered 14-year terms and the board chair is appointed for a four-year term. Elected officials and members of the administration are not allowed to serve on the board. The Fed does not receive funding through the congressional budgetary process. The financial statements of the Federal Reserve Banks and the board of governors are audited annually by an independent, outside auditor.

The Bank of England (BoE): The BoE is owned by the UK government. It has specific statutory responsibilities for setting policy rates, carried out within a framework set by government but free from day-to-day political influence. Parliament gives specific goals and responsibilities. The government sets the target — which is 2%. A panel meets to agree interest rate decisions eight times a year. There are other panels on other issues, which ensures that the financial system is working properly to serve UK households and businesses. The BoE is answerable to both parliament and the public.

European Central Bank (ECB): It manages the euro and implements monetary and economic policy for the EU. Probably the most independent of central banks, the ECB charter prevents it from backing any government. However, it is criticised as being non-independent because it is at the mercy of the governments of Europe’s creditor countries.

Bank of Japan: It has a legal mandate to maintain price stability. The government is not allowed to sack the central bank governor or members of the board but parliamentarians have the right to appoint them. Bank regulation is done by the Financial Services Agency.

People’s Bank of China: The Chinese central bank is subservient to the communist party and its national objectives. It is responsible for mainlining growth, price stability, currency stability and health of financial sector.

Central Bank of Argentina: RBI deputy governor Viral Acharya used the example of the constitutional crisis in Argentina. The Cristina Fernandez-led government in 2010 attempted to raid the central bank’s reserves, resulting in bond yields shooting up and foreign investors exiting.

Turkey Central Bank: The sharp depreciation in emerging market currencies was seen to have been triggered by the fall in the Turkish lira. The collapse of the lira has been attributed to Turkish president Recep Tayyip Erdogan taking control of Central Bank of the Republic of Turkey and preventing it from raising rates.

The post of Governor

The Times of India, June 20, 2016

Who can be an RBI governor?

Unlike the appointment of fo ur deputy governors, there are no fixed rules. But most RBI governors have been civil servants (11), followed by economists (five). There has also been one banker, an insurance company executive and one RBI employee who have gone on to be the governor.

How are candidates selected?

In the past, candidates were shortlisted by the government, and the Prime Minister appointed the governor in consultation with the finance mi nister. On some oc casions, some of the candidates we re called for an in LEARNING formal interaction WITH THE TIMES with the finance mi nister (D Subbarao was appointed through this route) although the final decision was taken by the PM. Now, the government has tasked a committee headed by the Cabinet secretary to shortlist candidates and the final decision will be taken by PM Narendra Modi.

Is there an age cap or are some qualifications stipulated?

No, there is neither an age restriction nor qualifications are specified in the law. Governments have opted for those with understanding of overall economy , the financial sector as well as those familiar with th functioning of the government

What is the RBI governor' tenure?

The RBI Act allows the government to specify the term but the ? tenure cannot exceed five years, with a possibility of reappointe ment. In recent years, only S Venkitaramanan, who spent two years as RBI governor, has had a shorter stint than Raghus ram Rajan.

Selection of Governor, Dy. Governor

The Times of India, Jun 11 2016

Rajeev Deshpande

In a break from tradition, the government has tasked a selection committee headed by cabinet secretary P K Sinha with shortlisting candidates for Reserve Bank of India governor -a decision that was taken earlier by the Prime Minister in consultation with the finance minister. In the past, chiefs of other regulatory bodies -including insurance, pension and Sebi -have been shortlisted by search committees. But this will be the first time the RBI governor will be appointed similar ly, signalling a major shift in government stance and ending the special treatment given to central bank chiefs. The decision to route the RBI governor's appointment through the financial sector regulatory appointment search committee (FSRASC) seems intended to cool speculation over Raghuram Rajan being considered for a second term.

The FSRASC, set up in 2015, had interviewed candidates for Sebi chief. In February 2016, the government ignored its recommendation and reappointed U K Sinha for a year. A part from the cabinet secretary, the committe comprises additional principal secretary to PM P K Mishra, who is a permanent government nominee, and three outside experts -Rajiv Kumar of Centre for Policy Research, Manoj Panda of the Institute of Economic Growth and Bimal N Patel from Gujarat National Law University. A finance ministry representative will be a special invitee. The panel's recommendation will be sent to the appointments committee of cabinet headed by the PM, which will decide on the governor.

Going by the current thinking in official circles, a second term for Rajan could well be on the cards despite occasional reports that put him at cross-purposes with the government over issues like rate cuts or `Make in India'. At the same time, the government does not seem keen to imbue the appointment with a greater profile of attention. The committee route would be in sync with PM Narendra Modi's remark that the appointment is an “administrative decision“ that will be taken closer to September when Rajan's term ends.

The committee's recomendation for RBI deputy governor was a break from past practice as previously, the head of the regulatory body presided over the selection committee. This time around, the RBI governor was a member of the FSRASC.

The process of making top-level appointments to regulatory bodies has been problematic, with the choices often being seen to be politically influenced. Even with the committee-bound process, the choice for sensitive posts will no doubt be vetted by the political authority. But the decision to make FSRASC the recommending body that could well put up a single name instead of a short list for a regulator is aimed at reducing discretion and putting all such bodies on a par.

Salary and perquisites of RBI governors

2016: Urjit Patel’s package

December 4, 2016: The Times of India

RBI governor Urjit Patel gets Rs 2 lakh a month pay, no support staff at home

HIGHLIGHTS

RBI governor Urjit Patel gets a little over Rs 2 lakh as salary

RBI governor Urjit Patel gets a little over Rs 2 lakh as salary and has not been provided with any support staff at his residence, the central bank has said.

Patel, who took over as RBI Governor in September+ , is presently in possession of the bank's flat (Deputy Governor's flat) in Mumbai, it said. "No support staff has been provided to the present Governor, Urjit Patel at his residence. Two cars and two drivers have been provided to the present Governor," RBI said in reply to an RTI query.

The bank was asked to provide details of remuneration given to former RBI governor Raghuram Rajan+ and incumbent Patel. For the month of October — the first full month Patel was in office as Governor — Patel got Rs 2.09 lakh as his salary, the same amount drawn by Rajan as his August's salary. Rajan demitted office on September 4, and was given Rs 27,933 as remuneration for four days.

Rajan assumed the charge of RBI Governor from September 5, 2013 at a monthly salary of Rs 1.69 lakh. His salary was revised to Rs 1.78 lakh and Rs 1.87 lakh respectively during 2014 and March 2015. His salary was hiked to Rs 2.09 lakh from Rs 2.04 lakh in January 2016, the RTI reply said.

Rajan was provided with three cars and four drivers. "One caretaker and nine maintenance attendants were posted as supporting staff in the bungalow provided by the bank to the former Governor Raghuram Rajan at Mumbai," RBI said.

The Centre has recently declined to share details on appointment of Patel and other candidates shortlisted for the top post in the central bank saying these are "cabinet papers" and cannot be made public. Patel was on August 20 named as RBI's Governor to succeed Rajan.

2017, pay hike: Rs 2.5 lakh/month

RBI governor's pay hiked to Rs 2.5L per mth, April 3, 2017: The Times of India

RBI governor Urjit Patel and his deputies have got a big pay hike with the government more than doubling their basic salary to Rs 2.5 lakh and Rs 2.25 lakh per month, respectively .

The “basic pay of the governor and deputy governors“ have been revised retrospectively with effect from January 1, 2016 and marks a huge jump from Rs 90,000 basic pay so far drawn by the Governor and Rs 80,000 for his deputies. Still, their salaries are much lower than the top executives of various banks regulated by the RBI.The RBI, however, did not disclose the new gross pay for Patel and his deputies following the revision in basic pay.

Governors of the Reserve Bank of India

1935- 2013: complete list

The Times of India 2013/08/07

Duvvuri Subbarao: 2008-2013

Subbarao, man who fell into cauldron of woes

Surojit Gupta | TNN

The Times of India 2013/08/07

New Delhi: For Duvvuri Subbarao it was baptism by fire when he took over the reins of the Reserve Bank of India nearly five years ago.

As soon as he stepped into the corner office at the central bank headquarters in Mumbai’s Mint Road, a tsunami struck the global financial system. The force of the 2008 global financial meltdown meant that RBI had to call on all its resources to shield the economy from being brutalized.

Subbarao, a mild-mannered former civil servant, remained unfazed. With the government, he scripted a recovery process stabilizing the economy, helping it weather the storm better than some of its peers.

But this was short-lived. The economy was buffeted by stubborn inflation, including double-digit food inflation, prompting the central bank to focus on taming prices. It raised rates furiously, almost 13 times, to throttle inflation.

Of late, frosty ties between RBI and the finance ministry have dominated discussions. Critics slammed the policy to tackle inflation while the government sometimes expressed disappointment. Finance minister P Chidambaram, who is careful with words, appeared disappointed as RBI left interest rates unchanged.

“Growth is as much a challenge as inflation. If the government has to walk alone to face the challenge of growth then we will walk alone,” Chidambaram said highlighting the need for an inflation-growth balance.

Adding to Subbarao’s problems, the fiscal situation deteriorated. Growth slowed. Scandals and policy missteps, such as retrospective taxes forced investors to the sidelines. Subbarao bravely continued calling for action on the fiscal front to enable him to slash interest rates. That didn’t happen until Chidambaram stepped in as finance minister in September. His reform initiatives helped restore the health of public finances. RBI obliged with a rate cut. But this came with a caveat on the ch a l l e n g e s on the prices front.

As things appeared to settle down, the crisis on the currency front emerged, prompting RBI to work towards taming the volatile forex market.

Some economists said the RBI under Subbarao misjudged the signals. “You cannot separate two or three issues, one of which is that when it comes to inflation and growth, both monetary and fiscal policies matter. In my assessment, the country had the most unfortunate fiscal policies compounded by the most unfortunate monetary policy,” economist Surjit Bhalla said. “The RBI misjudged the economy, determinant of inflation, determination of growth and determinant of the exchange rate.”

He said the RBI under Subbarao had misjudged food inflation and hiked rates. “What could’ve been a virtuous cycle has been turned into a vicious cycle,” Bhalla said. Not all would agree with such a harsh summation.

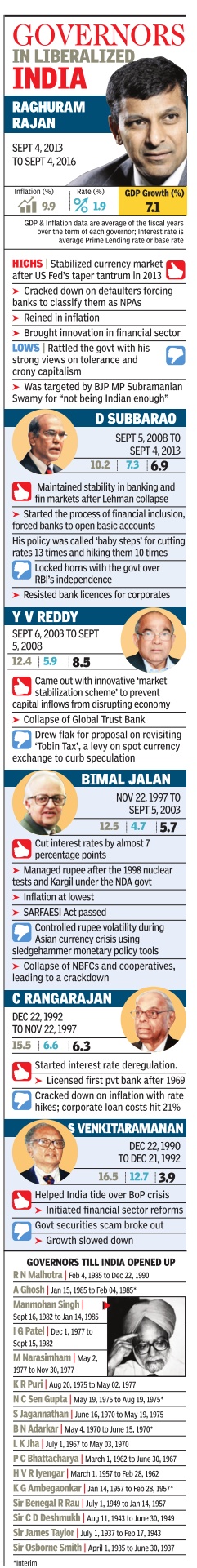

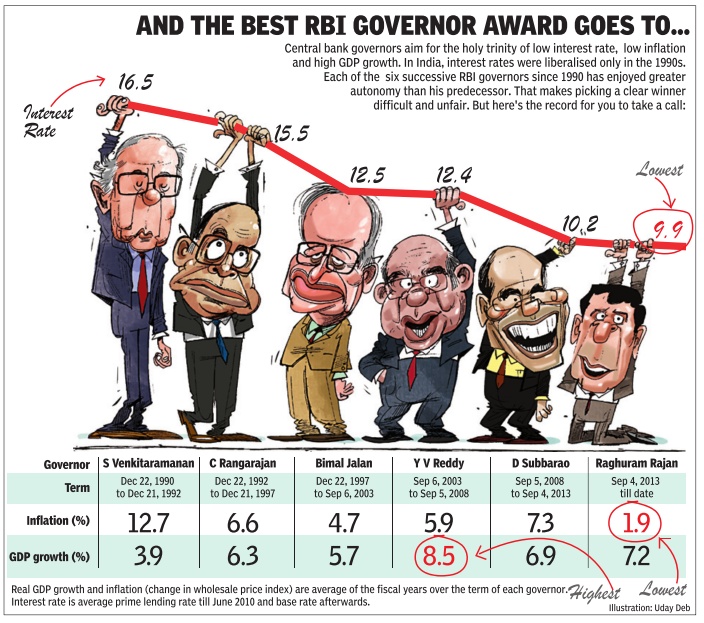

Raghuram Rajan

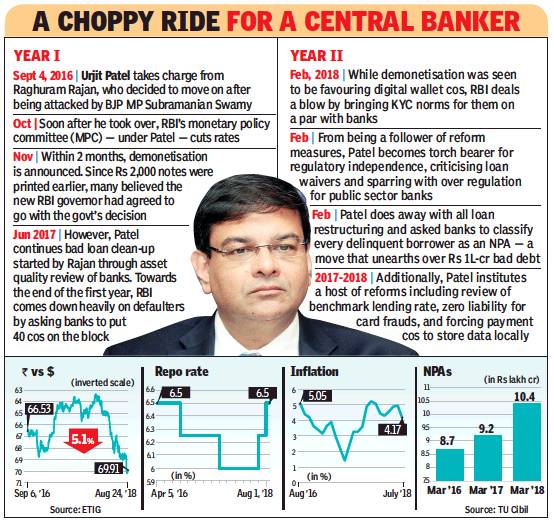

Urjit Patel

2016-18

From: Mayur Shetty, After 2 years as RBI governor, Patel nears bad debt endgame, August 26, 2018: The Times of India

When Urjit Patel was appointed the 24th governor of the Reserve Bank of India (RBI) in August 2016, TOI had cautioned those who saw him as a pro-administration governor, pointing out that he was an inflation hawk.

As he completes two years in office next week (he took over from the previous RBI governor Raghuram Rajan on September 4, 2016), Patel has demonstrated that he is no pushover. Whether it is interest rates, non-performing assets (NPAs) or the issue of public sector bank regulation — Patel has not shied away from locking horns with the government.

While his first year as the head of the central bank was overshadowed by the events following demonetisation, Patel’s tenacity came to light during his second year. That was when the RBI asked lenders to take the who’s who of India Inc to court and sell their businesses under the newly-introduced Insolvency and Bankruptcy Code. These included corporate groups like Essar, Videocon and Bhushan Steel.

Patel’s obduracy, insisting that lenders stick to the letter for classifying loans as bad, has frustrated senior bureaucrats and politicians. Government officials point out that even public sector companies fail to make timely payments. However, for those who have been paying attention to Patel, this tough stance should not come as a surprise.

A year ago in a speech titled ‘Resolution of stressed assets: Towards the endgame’, Patel had highlighted the challenges ahead, “We all must realise that it will be a long haul before the intended objectives are fully achieved... but as long as the endgame is a desirable goal, these should be worth it for placing the private economy structurally on a path of sustained growth.”

When it comes to setting of interest rates, the central bank is perhaps more independent under Patel then it was ever before. This is because Patel’s regime in the RBI coincided with the constitution of the monetary policy committee (MPC), which had a mandated objective to keep inflation at around 4%. Incidentally, the MPC was constituted based on recommendations made by a committee headed by Patel as deputy governor.

Patel’s second year saw increased friction with the finance ministry following the Punjab National Bank scam. Soon after news of the scam broke, FM Arun Jaitley lashed out at the central bank, stating that while politicians are accountable, regulators (meaning the RBI) are not.

Patel’s comeback was equally strong. In one of his rare speeches, the governor said, “Success has many fathers, failures none. Hence, there has been the usual blame game, passing the buck, and a tonne of honking.” He then listed seven legislative provisions that ensured the RBI did not have much of a say in public sector banks. The finance ministry’s pointed rebuttal brought to light the stress in the relationship.

Patel, whose signatures appear in more currency notes than any other RBI governor, is the most low-profile central banker with only eight public speeches in two years. The final year of his term, being an election year, will be even more crucial as it will also bring him into the stressed loan endgame that he speaks about.

Balance sheet

2013-18

From: Pradeep Thakur, In last 5 yrs, RBI transferred 75% of its income as surplus, November 20, 2018: The Times of India

The Reserve Bank of India (RBI) transferred around Rs 2.5 lakh crore to the government during the last five years, which was around 75% of the central bank’s income.

While analysing the government’s finance account last year, the Comptroller and Auditor General studied RBI’s income, expenditure and surplus transferred to the Centre between 2013-14 and 2017-18 and found that out of its income of Rs 3.3 lakh crore, the central bank had transferred Rs 2.48 lakh crore. The highest payout was in 2015-16, when 83% of the RBI’s income was transferred to the Centre as surplus.

RBI’s reserves have been a bone of contention, with the government keen to increase the payout. What has added to the discord in recent years is the Economic Survey pointing out that RBI has higher reserves than other central banks.

In the recent past, RBI has been transferring surplus of around Rs 65,000 crore annually to the government, barring 2017 when its expenditure more than doubled to Rs 31,000 crore. Till 2016-17, the RBI’s expenditure remained below Rs 15,000 crore but shot up due to higher cost of printing currency notes at the time of demonetisation.

In a speech last month, RBI deputy governor Viral Acharya had hit out at the government for seeking higher dividend and cited the example of Argentina, where a similar development took place eight years ago, to argue that the central bank’s autonomy should not be compromised. The issue was one of the key agenda items at the marathon board meeting of the RBI.

Dividends

2017: Demonetisation, printing of currency: RBI halves dividend

Mayur Shetty, RBI halves dividend to govt to Rs 31k cr, August 11, 2017: The Times of India

Demonetisation, Printing Of Currency Take A Toll

In a surprise announcement, the RBI said that it has halved its dividend payment to the government to Rs 30,659 crore for 2016-17 from nearly Rs 66,000 crore in each of the previous two years. The lower dividend is due to huge expenses borne by the RBI by way of interest payment to banks as part of its liquidity management exercise and in printing notes following demonetisation.

The dividend amount was decided by the central board of directors, which met to finalise accounts for the year ended June 2016.The board would have also finalised how the central bank deals with the demonetised currency notes that were not turned in before June 2017. However, the RBI is yet to divulge details on whether it has extinguished the currency which has not been deposited.

The halving of dividend will hurt the government's finances. “The lower amount will be a concern since the government's non-tax receipts will be affected. In the Budget, it was assumed that around Rs 75,000 crore would come from RBI, public sector banks (PSBs) and financial institutions compared with a little over Rs 76,000 cr in FY17,“ said Madan Sabnavis, chief economist, CARE Ratings. According to Sabnavis, as PSBs are unlikely to do better than last year and the RBI will be transferring a smaller amount, this will impact the fiscal deficit numbers.“If other conditions remain unchanged, the fiscal deficit can increase from 3.2% to 3.4% this year,“ he added.

Devendra Kumar Pant, chief economist, India Ratings, said the drop in dividend is due to lower earnings due to reverse repo transactions (where the RBI borrows from banks) and high costs incurred in printing of notes. Besides this, the appreciation of the domestic currency vis-a-vis the US dollar led to lower returns in rupee terms. “Firstquarter direct tax collections, if continued in the fiscal, will provide some buffer for central government deficit,“ he added.

The minister of state for finance Arun Meghwal had earlier said that it costs between Rs 2.87 and Rs 3.09 to print the new Rs 500 note and Rs 3.54-3.77 for a Rs 2,000 note. Given these numbers, it would have cost the RBI over Rs 13,000 crore to print fresh currency notes during demonetisation. This is almost thrice the Rs 3,421 crore the RBI spent on printing notes in the previous year. According to economists, when the macro fundamentals are so und, the RBI ends up with weak earnings and, conversely, when the country's fundamentals are under strain, the central bank generates exceptional gains. This is because at times of stress, the RBI tightens liquidity and makes windfall profits lending to banks at high rates.But when the rupee is strengthening, the central bank loses money by buying a falling dollar. The biggest cost to the RBI by far, when the country is facing a problem of plenty, is the cost of impounding surplus liquidity. Banks are sitting on sur plus funds due to absence of credit demand. Soumya Kanti Ghosh, chief economist, SBI, said, “Credit growth has decelerated by Rs 1.5 lakh crore in current fiscal -a historic low.“ He added that given surplus funds, SBI, Axis Bank and Bank of Baroda have reduced the savings bank rate to keep the lending rate low.

Since November, banks have been awash with surplus liquidity thanks to cash being deposited with them.While most of these were slowly withdrawn, a large chunk continued to remain with banks. According to dealers, the surplus liquidity with banks has risen to Rs 3 lakh crore as compared to the RBI's target range of Rs 1 lakh crore.

2016> 2018

At ₹50,000cr, RBI gives govt 63% more dividend, August 9, 2018: The Times of India

The RBI has transferred a surplus of Rs 50,000 crore to the central government, which is 63% more than last year’s dividend of Rs 30,659 crore. This payout is also 91% of the Rs 54,817-crore dividend income that the government budgeted from the RBI, nationalised banks and other financial institutions in its Budget 2018.

It is likely that the central bank would have generated a higher surplus arising out of foreign exchange operations. The RBI has sold foreign currency assets worth over $20 billion this year, which is reflected in the decline in forex reserves from nearly $400 billion on March 30, 2018 to around $379 billion. The foreign currency assets sold were worth Rs 1.40 lakh crore and would have added to the RBI’s rupee balance sheet and enabled it to pay a higher dividend.

Public sector banks have not distributed any dividend to the government as all but two of them have reported losses. However, insurance companies would have made some payment to the government. Earlier in March, the RBI paid an interim dividend of Rs 10,000 crore at the insistence of the Centre to support fiscal position.

“The central board of directors of the RBI, at its meeting held on August 8, approved the transfer of surplus amounting to Rs 500 billion (Rs 50,000 crore) for the year ended June 30, 2018 to the government,” the central bank said in a statement.

Unlike other financial institutions, the RBI follows a July-June financial year. The dividend payout had shrunk last year as the RBI had to spend a lot of money in printing of new currency notes following demonetisation in November 2016.

Gold reserves

Purchases in 2009, 2018

RBI boosts forex kitty with first gold buy in 9 years, September 4, 2018: The Times of India

The Reserve Bank of India (RBI) has bought nearly 8.5 tonnes of gold in financial year 2017-18, the first purchase of yellow metal by the central bank in almost nine years, a report said.

The RBI held just over 566 tonnes of gold as on June 30, 2018, compared with 558 tonnes as on June 30, 2017, according to the central bank’s latest annual report for 2017-18.

The central bank had last purchased gold in November 2009, when it had bought 200 tonnes of yellow metal from the International Monetary Fund (IMF).

Of over 566 tonnes of gold reserves, about 292 tonnes is held as backing for notes and is shown as an asset of the issue department, and the balance 274 tonnes is treated as an asset of the banking department.

The value of gold held as asset of banking department rose by 11.1% to Rs 69,674 crore as on June 30, 2018, from Rs 62,702 crore as on June 30, 2017.

This increase was primarily on account of depreciation of rupee as against the dollar and the addition of nearly 8.5 tonnes of gold during the year, the RBI’s annual report said.

Government- RBI relations

Why govts want central banks on their side

November 5, 2018: The Times of India

Why govts want central banks on their side

A country's central bank and its government may not always see eye to eye — the latest rift between the RBI and the Centre is a case in point. But what makes a central bank essential to a country's economy, and what kind of power does it enjoy?

Can an economy work without a central bank?

Considering the influence of central banks in today’s age, this is a difficult question to answer. Many countries have witnessed a constant tussle between the elected government and their central bank but no modern government has been able to either abolish or significantly curtail the power of their central bank. In the absence of such a bank it is difficult to imagine how a reliable payments system, a stable currency and controlled inflation level could be maintained.

What is the role of a central bank?

Among the important roles of a central bank is to control the cost of money by changing interest rates. This role itself gives it immense power to stimulate or slow the economy. Apart from this, the central banks — in our case Reserve Bank of India — formulate, implement and monitor the country’s monetary policy. It monitors the financial system by prescribing broad parameters of banking operations to ensure the public has confidence in the system and protects depositors’ interest.

The bank also monitors foreign exchange reserves. It is the only authority that has the right to issue or destroy currency in circulation. The central bank also does merchant banking for the government as well as other banks.

How independent is the RBI?

Like other central banks, RBI is an independent entity within the government. It is governed by a central board of directors appointed by the government according to the Reserve Bank of India Act. The board is appointed for four years with a governor and up to four deputy governors. There are 10 other directors nominated by the government, two government officials and four non-official directors from local boards. There are also four local boards in Mumbai, Kolkata, Chennai and New Delhi to advise the central board on local matters. Local board members are nominated by

Where is the most powerful central bank?

While it controls the world’s largest economy, US's Federal Reserve Bank also issues treasury bills to raise money to finance spending. These US securities are bought by other nations and their value is based on the price of the US dollar. If the Fed lowers interest rate and makes dollar cheaper to borrow, the pinch will be felt by all other economies. Similarly, a stronger dollar will benefit countries that hold US securities.

1935-2016: Govt. vs. the RBI

Govt vs RBI: Top FinMin man mocks dy governor, November 3, 2018: The Times of India

From: Govt vs RBI: Top FinMin man mocks dy governor, November 3, 2018: The Times of India

Another DG Gives Speech Attacking Centre On Lending

Hostilities between the Modi government and the Reserve Bank of India remained at heightened levels with a top bureaucrat taking to social media on Friday morning to mock a recent speech of deputy governor Viral Acharya. Hours later, the RBI uploaded a speech another deputy governor, N S Vishwanathan, gave at XLRI Jamshedpur earlier this week. In his speech, Vishwanathan attacked the government’s arguments for easing capital requirements, saying that it would result in banks being strong only in a “make-believe” manner.

Economic affairs secretary Subhas Chandra Garg, the finance ministry’s point person for managing ties with the RBI, fired the first salvo when he took aim at Acharya’s comment that “governments that do not respect central bank independence will sooner or later incur the wrath of financial markets”.

RBI dy guv against govt’s bid to push bank credit

Rupee trading at less than 73 to a dollar, Brent crude below $73 a barrel, markets up by over 4% during the week and bond yields below 7.8%. Wrath of the markets?” economic affairs secretary Subhas Chandra Garg tweeted on Friday.

Ironically, Garg’s very public dig at governor Urjit Patel’s hand-picked deputy came just two days after the finance ministry issued a carefully-worded statement that among other things signaled its displeasure with the RBI for airing its differences with the government.

Vishwanathan, who unlike Acharya is a career central banker, appeared to be at odds with the government’s push to accelerate bank credit when he indicated that higher growth in lending was not desirable. “It may be noticed that in the past, high levels of credit growth due to ‘supply push’ have resulted in high corporate leverage and consequent NPAs in the banking system,” he said.

“We must guard against any push for dilution of standards in the name of aligning them with international benchmarks because that will be cherry-picking and will result in our banks being strong in a make-believe sense and not in reality.” This appeared to be a response to financial services secretary Rajiv Kumar’s statement last week that minimum common equity (CET) Tier I ratio as prescribed by RBI stands at 5.5% as against 4.5% under Basel III norms. A relaxation of the capital requirement to Basel III levels would enable bank to lend up to Rs 6 lakh more.

But, according to the deputy governor, current levels of provisions maintained by banks may not be enough to cover the expected losses due to defaults, and hence adequate buffers must be built to absorb the expected losses which are under-provided. Vishwanathan said that bank credit was already growing at 14% year on year in line with GDP growth. Within this, bank loans to NBFC during this period grew 48.3%.

According to Vishwanathan, international capital norms have been designed based on internationally observed recovery rates. However, the loss given defaults are far more than those observed internationally. He also shot down arguments that some defaults are caused by external circumstances and that regulations should treat them differently based on the reasons behind them. “This is a fallacy. There are two issues here: recognition and resolution. The recognition of default or accounting for deterioration in the quality of asset should be independent of the reasons for such default or deterioration.”

1956-57: Pt. Nehru vs. Sir Rau

Sidhartha, November 5, 2018: The Times of India

The traditionally fraught nature of government-RBI relations goes back to the early days of the central bank when Sir John Osborne Smith resigned his governorship in 1937 following differences with the colonial government over interest and exchange rates.

But it is Jawaharlal Nehru’s stormy exchanges with Sir Benegal Rama Rau, leading to his resignation as RBI governor, that has tickled the interest of people in the finance ministry – and may provide them with an effective counter to the Rahul Gandhi-led Congress’s attack on the government for undermining the autonomy of the central bank.

Rau, a civil servant, was the fourth governor of RBI and quit in January 1957 after seven and a half years in the saddle when Nehru sided with finance minister TT Krishnamachari and made it clear that RBI was part of “the various activities of the government”.

Rau had accused TTK of “rude behaviour” over differences that began over a Budget proposal. TTK had referred to RBI as a “section” of the finance ministry and described it as “reserved”, as well as expressed doubts in Parliament “as to whether it is capable of doing any thinking”.

In a letter to Rau, India’s first Prime Minister and Rahul Gandhi’s great-grandfather, wrote: “It (RBI) has to advise government, but it also has to keep in line with government.” He suggested the governor could resign if he thought that it was not possible to continue; Rau put in his papers a few days later.

Nehru said it would be “completely absurd” if the central bank followed a different policy because it did not agree with the government’s objectives or its methods.

“You have laid stress on the autonomy of the RBI. Certainly it is autonomous, but it is also subject to the central government’s directions…. Monetary policies must necessarily depend upon the larger policies which a government pursues. It is in the ambit of those larger policies that the RBI can advise. It cannot challenge the main objectives and policies of government,” asserted Nehru.

“When you talked to me I pointed out to you that it was for the central government to lay down policies and the RBI could not obviously have policies contrary to those of the central government. You agreed with this. And yet I find in your memorandum a different point of view,” he added.

The RBI believed that TTK’s Budget proposal would effectively push up interest rates and forwarded a resolution of the central board. “The board requests the government to consult RBI in advance on all matters which significantly affect the monetary structure and policy,” the board said on December 12, 1956.

The same day, Nehru wrote to the governor pulling him up for his “improper approach” which was seen to be “agitational” against the Centre.

A fortnight later, Rau responded to Nehru’s letter saying that despite differences on several issues, nothing had leaked out from RBI. He then wrote that the government could reject RBI’s advice though it should be given an opportunity to place all facts and its view before a decision was taken on “technical and sometimes complicated monetary issues”.

The then governor also took “strong exception” to some of Nehru’s comments on not supporting government policies and said the consultations over the Budget proposal were inadequate.

In the Budget, the government had proposed to increase the stamp duty on an instrument used by lenders to get loans at a discount to RBI’s key policy rate – the bank rate. RBI argued that the higher stamp duty, which it said was decided without prior consultation, would push up the bank rate by half a percentage point.

Parallels are being drawn between the developments six decades ago and the current power tussle between the Centre and RBI – although in that instance, the central bank had gone out on a limb to criticise a Budget proposal whereas it’s the government that is now unhappy with the RBI for not taking on board its concerns about the economy.

While most governments and the central bank have had differences over issues ranging from interest rates to regulations, the current rift has widened to an extent that the finance ministry has sought formal consultations with the governor in what is one step short of invoking Section 7 of the RBI Act, a provision that has never been used.

The government has been pushing RBI to address its concerns related to providing support to non-banking finance companies, ravaged by the impact of defaults by IL&FS, in addition to addressing the credit needs of small businesses and reviewing the prompt corrective action (PCA) framework dealing with weak banks.

2014, PM Manmohan Singh: Governor must heed govt

Guv must heed govt, Manmohan said in ’14, November 7, 2018: The Times of India

The dynamic between the RBI and the government is one of give and take but if the finance minister insists on a certain course of action, his view will need to prevail, former PM Manmohan Singh has said in his daughter Daman Singh’s book “Strictly Personal: Manmohan and Gursharan”.

Recalling his tenure at the central bank, Singh says, “There is always give and take. I had to take the government into confidence. The governor of the Reserve Bank is not superior to the finance minister. And if the finance minister insists, I don’t see that the governor can refuse, unless he is willing to give up his job.”

Singh’s comments in the 2014 book are significant in the context of tensions between the Centre and RBI governor Urjit Patel amid heated commentary on the autonomy of the central bank. Singh says that after recording a divergent point of view, the governor can insist on directions from the government which would then need to be followed.

Singh speaks of Caparo, tension with then FM Pranab Mukherjee

Singh speaks of tensions with then finance minister Pranab Mukherjee over the move of the Londonbased Caparo group, in which business magnate Swraj Paul and his family held a majority share, to buy shares of Escorts Group. The UK-based business initiated the purchase of shares even before the RBI granted it permission. The RBI informed the government that it intended to reject Caparo’s application.

The book notes that the government of the day, however, did not have any misgivings and asked the RBI to grant permission, which it did. The matter went to court and the Supreme Court finally held the government’s order to the RBI and the permission granted by the central bank to be valid.

Asked about the case, Singh says, “Well, it was a situation that brought me in conflict with the government. I have given the view of the Reserve Bank, but said the government could always overrule it. This was a government scheme... Ultimately, it was resolved by the government giving a directive to the RBI.”

Singh makes it clear that the government would have liked the RBI to have acted on its own with regard to the application under a portfolio investment scheme for NRIs. But he said the RBI did not act until the explicit approval of the Cabinet Committee on Political Affairs was conveyed to the central bank. In a second case the book refers to, Singh had strong reservations over the application of the Bank of Credit and Commerce International to open a couple of branches in India. Permission was almost granted when Charan Singh was PM and was finally cleared by the Congress government in 1983.

The government, unhappy with the RBI’s power to issue bank licences, sought to take these powers away. “I sent my letter of resignation to Pranab Mukherjee and the PM. Later, I managed to persuade Mrs Gandhi that the Cabinet decision was not proper... they dropped the idea,” Singh says.

10 flash points between Govt., RBI: 2017-18

2019, Nov: The RBI’s Central board of directors

From: Sidhartha & Mayur Shetty November 19, 2018: The Times of India

From: October 30, 2018: The Times of India

From: October 30, 2018: The Times of India

See graphics:

2017, 2018: tensions between the Government and the RBI under Patel, a chronology

2019, Nov: The RBI’s Central board of directors

10 flash points between Govt., RBI- 2017-18- Part I

10 flash points between Govt., RBI- 2017-18- Part II

Points of friction

‘Guv Patel, Team Not Happy With An Assertive Board’

The Modi government was driven to consider the extreme step of invoking the never-before-used Section 7 of the RBI Act by central bank governor Urjit Patel’s reluctance to engage with stakeholders, according to highly placed sources in New Delhi. “He was scarce and unavailable to bankers, industry and market players even on matters of pressing concern. We were left with no choice. It was the only way we could bring the central bank to the table,” one person close to the development told TOI.

This confirms TOI’s exclusive report of Monday that tensions between the Patel-led RBI and the government had “come to a head” because the two were not only not able to see eye-to-eye on a host of issues, there had also “been an almost complete breakdown in communication” between them.

RBI didn’t make public decisions taken at last board meeting

The move could be significant as a consultative process sets the stage for a government to issue directions to the RBI if there is no agreement,” the report added.

No government has invoked Section 7 of the Reserve Bank of India Act of 1934 in the central bank’s 83-year history. The Section says, “The central government may from time to time give such directions to the bank as it may, after consultation with the governor of the bank, consider necessary in public interest.”

The Section 7 reference to RBI was the first formal step towards discussing a troika of concerns with RBI — credit flow, liquidity, and problems facing medium and small businesses — failing which the central bank would have to face the “legal instrument of last resort”, which would be tantamount to a vote of no-confidence in the gover nor.

On Wednesday the finance ministry issued a carefully-worded statement saying the government and the RBI should be “guided by public interest and the requirements of the Indian economy”.

The government had hoped that RBI would go by the board’s collective view instead of the governor and his deputies charting the course of the financial sector by themselves. But the central bank — which also doubles up as regulator for banks and some market segments — did not seem to go by the view of the directors. Among the 18 directors on the central board, 11 are independent, with five RBI officials and two finance ministry bureaucrats making up the complete cast.

At last week’s board meeting, it was decided that four decisions that had been taken would be made public. However, RBI, which it now appears, had reluctantly acquiesced into the majority decision, decided otherwise and made no disclosure about the “unanimous” calls. The radio silence came as a surprise because the directors had left the meeting convinced that RBI officials were on the same page.

At the marathon meeting, which had over 20 items on the agenda, the RBI brass had suggested that the issues that could not be decided, would be taken up at next meeting. The meeting was to be held post-Diwali. Accordingly, Patel verged on announcing a specific date but was stalled in his tracks by a top RBI official, who suggested that it was time to wrap up. Thus, the date remained undecided.

In fact, RBI’s announcement of November 19 as the date when the board would meet next, came only after some independent directors, frustrated by the delay, forced the management on Wednesday to take a decision, said sources. While the government has faced flak for nominating S Gurumurthy and Satish Marathe on RBI’s central board, as well as removing Nachiket Mor, people close to the decision said the move was necessary and aimed at turning it from merely being a rubber stamp to a body which could hold its own while engaging with the bank leadership.

This was a significant turn. For over the years, it was the Central Committee of the Board which had become the “real” decisionmaking body with the board starving itself of powers to regulate by delegating those to the CCB.

The sudden power shift, with the board asserting itself and demanding a say, does not seem to have gone down well with the RBI brass, prompting howls of protest about government interference, said a top official who has been watching the evolving dynamics on Mint Road.

Sources said that at the last board meeting, financial services secretary Rajiv Kumar made a detailed presentation on the need to align Indian standards with global norms instead of stiffening them unnecessarily. The suggestion was an attempt to convince RBI to tweak its rules for capital and PCA. There were also complaints about liquidity shortage and Gurumurthy flagged the concern about inadequate fund availability for small businesses.

While most of the board, including corporate sector representatives agreed with the view, RBI representatives, supported by some of the independent directors, did not agree.

2017, 2018: tensions under Patel

In New Delhi and Mumbai’s corridors of power and money, the growing schism between the government and the RBI, and particularly its governor Urjit Patel, has been the subject of much talk since the early months of this year.

During this time, not only have the two not seen eye-to-eye on a host of issues, there has been an almost complete breakdown in communication between the government and RBI.

The simmering differences have now come to a head with RBI’s deputy governor Viral Acharya – who is widely seen to have been brought in by Patel from his professorial position in New York University – on Friday clearly hinting at government interference and emphasising the need for autonomy (TOI had front-paged his remarks in its October 27 edition).

The tension has triggered fevered speculation about Patel’s fate. Not only does he appear highly unlikely to get an extension beyond the threeyear term that ends next September, questions have arisen over his continuance. Patel did not respond to a message from TOI.

Some people in the NDA government have gone so far as to acknowledge in private that “even Raghuram Rajan was better than this” — and Patel’s predecessor didn’t leave on the best of terms.

Govt, RBI clashes on at least 6 issues in ’18 alone

A person in the NDA government told TOI a few months ago, “After Rajan, it’ll look bad if Patel is asked to go.” And people who have a sense of Patel’s thinking say that he knows the government won’t keep him on beyond his current term, so he doesn’t really care about being in its good books.

In 2018 alone, there have been at least half-a-dozen issues on which the two have taken opposing stands. While the spat began with the government unhappy with the inflation-focused RBI for not cutting interest rates – and even raising them – it spilled over into regulation, something the central bank believes is its exclusive domain.

RBI’s February 12 circular on classification of non-performing assets and norms of loan restructuring was the next flashpoint. The government saw it as overly harsh, and indeed it drove all but two staterun lenders into the red.

Around the same time, as the Nirav Modi fraud broke, the government hit out at RBI on supervision, drawing an almost-immediate rebuttal with Patel seeking more powers to oversee public sector banks so that they are at par with their private sector peers.

In addition, the government has been insisting that RBI step in to provide relief to non-banking finance companies (NBFCs), which are grappling with a cash crunch after IL&FS defaulted on repayments. The central bank has refused to play ball.

What has also irked the central bank brass is the way in which Nachiket Mor was removed from the RBI board more than two years before his term was to end without formally informing him. Mor’s removal was seen to be linked to his vocal opposition to the government's demand for a higher dividend.

In his strongly worded speech late last week, RBI deputy governor Viral Acharya said, "Governments that do not respect central bank independence will sooner or later incur the wrath of financial markets, ignite economic fire, and come to rue the day they undermined an important regulatory institution".

Patel is said to have virtually been incommunicado for the past three days, heightening suspense ahead of Monday's meeting of the RBI board, the second such interaction in less than a week. Last week’s meeting was stormy by most accounts with recently-nominated director and SJM activist S Gurumurthy seeking RBI’s intervention to help small businesses, while government nominees made a detailed presentation on the need to bring capital norms in line with global standards instead of making them stiffer. The change is seen to be crucial to get weak banks that are now under RBI’s prompt corrective action out of the classification. This would lift some of the curbs on their lending and expansion.

In remarks made on Saturday that were seen to be in response to Acharya’s, although he didn’t name RBI, finance minister Arun Jaitley said regulators need to have wide-ranging high quality discussion with all stakeholders. “I think, for any regulatory mechanism, stakeholder consultation has to be of a very high quality, which will probably lead to a revisiting of traditional thoughts and opinions. And that’s why, (when) several regulators now publish their approach papers or tentative drafts, they hold hearings, meet individuals, meet groups of stakeholders together and improve upon what’s being said.”

A separate payments regulator has been another friction point with RBI stating its position publicly on why it did not support the move. In fact, it went to the extent of releasing its dissent note on a separate regulator on its website.

People in the government said the tension should not be seen through a government versus regulator prism. They argued that the onus of taking the board along rests with the governor.

They also denied it was trying to encroach on RBI’s turf, but added that institutional autonomy should be a means for achieving faster growth rather than an end in itself.

Issues

2016/ Questions Post-Demonetisation

Usha Thorat , The promise to pay the bearer “India Today” 15/12/2016

"The RBI's responsibility is to ensure enough clean currency notes in the denominations required for day-to-day transactions in all parts of the country," said former deputy governor of the Reserve Bank of India,Usha Thorat.

There are many questions people are asking on the demonetisation move and the currency situation in the country. Some of the top-of-the-mind ones are quoted below, and these are my answers:

How does the RBI decide how much currency to print? What say does the Centre have in such a decision?

The RBI's responsibility is to ensure enough clean currency notes in the denominations required for day-to-day transactions in all parts of the country. The RBI makes an annual assessment of the demand for currency. Currently, currency constitutes about 12 per cent of GDP. Hence if the pace of digitisation is the same as the growth in GDP, currency demand should be at least equal to GDP growth (in nominal terms) unless we are pushing for a higher pace of digitisation. Also, seasonal factors affect currency demand-we witness higher demand during harvesting time, festival time and even election time. Finally, there is replacement demand, i.e., soiled notes have to be taken out, and good, clean notes put back in circulation. After making the estimate and deciding on the denomination-wise requirement, indents are placed with the note presses. This exercise is done in consultation with the Government of India.

Why couldn't the RBI have printed notes faster? If the Indian presses couldn't cope with the print load, why not do it abroad?

The trade-off is between ensuring secrecy and having sufficient time to print and stock for remonetisation. The reports seem to suggest that 2 billion notes of Rs 2,000 were got ready prior to announcement. Against notes in circulation of over 15 billion pieces of Rs 500 and 6 billion of Rs 1,000, the annual supply from both the presses together was one-third in each of these two denominations in the past two years. Since the announcement, it is presumed the note printing presses have stepped up production of the Rs 500 and Rs 100 notes. Importing notes to remonetise could be thought of, but the capacity to print currency notes globally is limited and restricted to a few companies. Further, there would be considerable lead time involved. It may not serve the purpose.

What was the total cash in circulation prior to demonetisation? What was the amount held as cash reserve ratio (CRR) by banks and the RBI? And who holds it, and is it held in the form of cash?

Prior to demonetisation, currency or cash in circulation (as on November 4) was Rs 17.7 lakh crore; as on November 25, the figure dropped by Rs 6.1 lakh crore to Rs 11.6 lakh crore. Currency in circulation is a liability of the RBI. It is held either by the public or by banks that have some currency in their vaults; the latter forms a very tiny part of currency in circulation. Banks do not hold cash reserves in the form of currency-these are held as deposits with the RBI and are reflected as liabilities on the RBI balance sheet.

How does the RBI invest its reserves? What does it do with the profit it generates from this?

The RBI earns income from its investments in various assets. The major component of the RBI's assets-roughly 72 per cent-represents the foreign currency assets held in permitted investments abroad. Gold constitutes four per cent of the RBI's assets while Government of India securities account for 22 per cent. In 2015-16, the RBI income was Rs 80,870 crore, of which Rs 74,924 crore was interest income. Interest on foreign securities accounted for 32.5 per cent of interest income and that on government securities 57.5 per cent. Section 47 of the RBI Act states that after making provisions for bad/doubtful debts, depreciation in assets, contribution to the staff and superannuation fund and for all matters for which provisions are to be made by or under the Act or that are usually provided by bankers, the balance of the bank's profits is to be paid to the Central government. Printing of currency notes, employee costs and agency charges (paid to banks to conduct government business) accounted for 84 per cent of RBI expenditure in 2015-16. The surplus profits transferred to the government for the year was Rs 65,876 crore and represented 99.99 per cent of gross income less expenditure.

At the end of the demonetisation drive, what happens to the extinguished cash? Does it hand over this money to the GoI to spend as it wishes or retain it as profit after lessing the cost to print new notes?

At the end of the demonetisation drive, the currency notes returned to the RBI will be shredded, presumably after checking for fakes. The RBI's supply of notes to the public may or may not be equal to what was in circulation before the November 8 measure. While restrictions cannot be placed indefinitely on cash, temporary limits can be justified citing the time taken to print the required amount of currency. Regarding the RBI's liability on demonetised notes that have not been exchanged/deposited in bank accounts, the central bank governor, in a recent press conference, stated that it continues in the bank's balance sheet as of now. This is because the last date for surrender at the RBI counter has not yet been notified (March 31 was mentioned as a date in the PM's speech). There is a view that the RBI's liability ceases only when the last date for exchange at the bank's counter is notified through a legislative process. At such a juncture, to the extent liabilities are extinguished, assets could be contracted through retirement of government debt held by RBI and/or creating a reserve at the bank to the same extent. It may not be prudent to transfer the amount to the government without assessing the macroeconomic implications, and the monetary conditions required, for achieving the inflation target set by the RBI.

Are the new currency notes harder to counterfeit?

One of the objectives of demonetisation is to guard against counterfeiting. Several security features are built into the notes to prevent counterfeiting. The government has announced that the new notes contain several new features that were not there earlier and would be difficult to forge. Other measures taken by the RBI to enable detection of forged notes are to improve awareness among the lay public on how to detect forged notes and to encourage shops and retail outlets to instal note-sorting machines. All banks are mandated to sort out the notes received by them over the counter through a note sorting machine that can detect forgery and ensure that they issue only genuine notes back into circulation.

Usha Thorat is a former deputy governor of the Reserve Bank of India

Monetary Policy Committee, 2016

The Hindu, June 28, 2016

The Centre brought the Monetary Policy Committee (MPC) one step closer to reality by notifying the changes made to the Reserve Bank of India (RBI) Act in June 2016.

The six-member Committee — tasked with bringing “value and transparency to monetary policy decisions” — will comprise three members from RBI, including the Governor, who will be the ex-officio chairperson, a Deputy Governor and one officer of the central bank.

Composition

The other three members will be appointed by the Centre on the recommendations of a search-cum-selection committee to be headed by the Cabinet Secretary.

“These three members of MPC will be experts in the field of economics or banking or finance or monetary policy and will be appointed for a period of four years and shall not be eligible for re-appointment,” according to the statement.

The Committee is to meet four times a year and make public its decisions following each meeting.

Policy reviews

2014: RBI shifts to bi-monthly policy review

TIMES NEWS NETWORK

Mumbai: The Reserve Bank of India will shift to a system of announcing its policy statement bi-monthly with the first such policy being announced on April 1, 2014. Bankers widely expect RBI to hold on to rates given that pressure on inflation is easing and the rupee has also been firming up.

Until the mid-90s, RBI had only two monetary policy reviews a year. After Bimal Jalan took charge as governor in 1997, he introduced quarterly reviews. His successor Y V Reddy introduced a mid-quarter review, which resulted in an announcement every 45 days.

A panel headed by RBI deputy governor Urjit Patel had recommended that the central bank monetary policy committee meet every two months to review rates.

Reserves

What is the appropriate level of reserves?

November 16, 2018: The Times of India

HOW MUCH RESERVES ARE ENOUGH FOR RBI?

RBI has accused the govt of trying to raid its coffers to bolster its revenues, which is one of the flashpoints in high-profile turf battle. The finance ministry has rejected the claim and suggested that there is a need to discuss how much capital RBI needs to deal with contingencies

Clarification

The Centre clarified that it wasn’t going to raid Reserve Bank of India’s reserves for Rs 3.6 lakh crore of ‘free money’ but it also said that it was in discussion to fix ‘appropriate economic capital framework’ of the central bank

Conditions apply

The framework the government is talking about is basically about how much capital RBI needs for its operations and how much of the surplus it should pass on to the government. This essentially means that Centre may not have asked for a specific amount (Rs 3.6 lakh crore) but it wants to ‘fix’ the process and that may end up giving it even more than that

Why fix?

The government believes that RBI is sitting on much higher reserves than it actually needs to tide over financial emergencies that India may face. Some central banks around the world (like US and UK) keep 13% to 14% of their assets as a reserve, compared to RBI’s 27% and some (like Russia) more than that. Each central bank assesses its risk and reserve requirements according to its past experience and future likelihood of the scale and kind of crisis

Old problem

Economists in the past have argued for RBI releasing ‘extra’ capital that can be put to productive use by the government. Former chief economic adviser Arvind Subramanian had argued for it (he had mentioned Rs 4 lakh crore). The Malegam Committee estimated the excess (in 2013) at Rs 1.49 lakh crore

How much?

RBI’s held total assets worth Rs 36.17 lakh crore on June 30 on its balance sheet. At 27% of this, the central bank would have around Rs 9.7 lakh crore as reserves. If it were to bring it down to 14% as the government probably wants, it would be left with about Rs 5 lakh crore. That means an excess capital of Rs 4.7 lakh crore to be handed over to the government

Why now?

With a general election looming early next year, analysts believe the cash-strapped government is trying to stimulate the economy with a big public spending spree to woo voters, says a report

What next?

The RBI governor, Urjit Patel, some say, has two options: to agree to his employer (the government) or leave the job. RBI deputy governor, in his (now controversial) speech, had referred to the resignation of Argentina’s central bank head for a similar reason of refusing government’s order to transfer the central bank’s reserve to pay foreign debt

As in 2018, Mar

From: Mayur Shetty, RBI saves its current reserves, but govt expects more next year, November 20, 2018: The Times of India

The Reserve Bank of India (RBI) has managed to protect its Rs 9.7-lakh-crore reserve kitty with its board agreeing to have a panel determine how much capital it needs to maintain and how much can be distributed from future surplus to the government. The Centre has also not lost as prospects of a higher share of future surplus allows it to budget for a larger chunk of revenues from the central bank in its ‘Vote on Account’ for next year.

“The RBI board decided to constitute an expert committee to examine the Economic Capital Framework (ECF), the membership and terms of reference of which will be jointly determined by the government and the RBI,” the central bank said in a statement.

The ECF refers to a formula for deciding the capital adequacy ratio for RBI. This is a positive development for those fearing that the government will tap into existing reserves of the central bank.

Of the existing reserves, a bulk of the funds are in contingency funds and in revaluation reserves. The contingency reserves, by definition, cannot be touched except in a crisis. To tap revaluation reserves, the RBI will have to sell assets and shrink its balance sheet. This will upset the money supply in the economy. Even if the to-be-constituted committee recommends higher transfers to government, it will result in lesser accretion to reserves and will not deplete the RBI’s balance sheet.

It was earlier speculated that the Centre might press for the RBI transferring a third of its Rs 9.7-lakh-crore total reserves to the government. The speculation was based on some reports stating that RBI holds over Rs 3 lakh crore of surplus reserves.

A higher surplus transfer for 2018-19 is likely because the central bank’s earnings are expected to be much more robust than 2017-18. In the current fiscal, the RBI has been intervening heavily in the foreign exchange and bond markets. The central bank’s earnings soar whenever there is forex volatility as it ends up making profits while selling dollars. For 2017-18, the RBI transferred a dividend of Rs 50,000 crore to the government.

Former governor Raghuram Rajan had proposed a formula-based model for fund transfer to the government. He had also warned against liquidating assets to transfer funds to government, stating that to neutralise the impact, the RBI would have to conduct money market operations by selling bonds. If the government had to issue fresh bonds in order to receive money from the central bank, it would be in the same position as before.