Remittances, outbound: India

(Created page with "{| Class="wikitable" |- |colspan="0"|<div style="font-size:100%"> This is a collection of articles archived for the excellence of their content.<br/> </div> |} [[Category:Ind...") |

|||

| Line 11: | Line 11: | ||

=Apr-Feb '16: surge in outbound remittances= | =Apr-Feb '16: surge in outbound remittances= | ||

[http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=High-outbound-flows-slow-deposit-growth-13042016030033 ''The Times of India''], Apr 13 2016 | [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=High-outbound-flows-slow-deposit-growth-13042016030033 ''The Times of India''], Apr 13 2016 | ||

| + | [[File: Forex remittances, outbound, from India, April 2015-February 2016.jpg|Forex remittances, outbound, from India, April 2015-February 2016; Graphic courtesy: [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=High-outbound-flows-slow-deposit-growth-13042016030033 ''The Times of India''], Apr 13 2016|frame|500px]] | ||

Mayur Shetty | Mayur Shetty | ||

| | ||

| + | |||

'''High outbound flows slow deposit growth''' | '''High outbound flows slow deposit growth''' | ||

Revision as of 08:31, 4 December 2016

This is a collection of articles archived for the excellence of their content. |

Apr-Feb '16: surge in outbound remittances

The Times of India, Apr 13 2016

Mayur Shetty

High outbound flows slow deposit growth

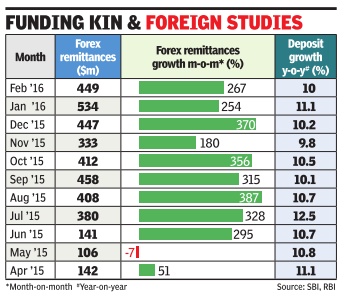

Indians Remit 3 Times More In Apr-Feb '16 Than Entire FY15 After RBI Doubles Cap

A surge in outbound remittances following a hike in the limit of money that Indians are allowed to send abroad could be one of the causes behind slower deposit growth. In FY15, the total amount sent out of the country was $1.3 billion. As against this, monthly remittances by Indians have been averaging nearly half a billion dollars.

Total outflows under the remittance scheme in FY16 (till February 2016) touched $3.8 billion as against $1.3 billion in the entire 2014-15 financial year . According to a research report by State Bank of India, the increasing outward fund transfers under the liberalized remittance scheme could be one of the reasons for the decline in deposits.

The limit for overseas remittance by an Indian was doubled to $2,50,000 from $1,25,000 on May 26, 2015. Soon after the limit was raised, there was a huge jump in outward remittance under this scheme.From $106 million in May 2015, the remittances reached $449 million in February 2016 -a jump of 324%.

The study shows that among the various categories under which overseas remittances have been distributed, “maintenance of close relatives“ and “studies abroad“ have shown a significant jump, signalling the increasing inclination of Indian parents to send their children overseas to study . “This should be a wake-up call for the government for building better institutions of education within the country . Another category that shows considerable jump is the `travels' component,“ said Soumya Kanti Mishra, chief economist, SBI, in a report.

According to Mitra, contrary to popular perception, high real interest rate is actually leading to lower deposit growth rate. While interest rates have come down, real interest rates have risen as the drop in inflation has been faster than the reduction in interest rates. Deposits with banks have remained sluggish with a growth of 9.9% in FY16 (till March 18, 2016 -a 53year low).

Mitra said that despite deposit rates coming down, the real return for bank customers has gone up due to lower inflation. The drop in nominal rates is causing people to spend more, rather than being encouraged to boost savings.

“The argument of mutual fund inflows acting as a drag on bank deposits is a false negative, as such cheques are actually written on banks in India and unlike the US, mutual funds in India cannot write cheques on their own,“ said Mitra.