Real estate: India

(→2017/ Delhi 7, Mumbai 16 on world’s costliest office list) |

(→Occupancy costs (cost purchasing/ hiring real estate)) |

||

| Line 171: | Line 171: | ||

Now builders, who want to use farmers' land for their projects, will have to sign a transferable development rights (TDR) agreement.“This will ensure that far mers or landowners will get the market price from the builder for their land. The government will be a facilitator as the custodian of farmers' interests. The TDR certificate will be valid for two years from the date of issuance,“ said Khattar. | Now builders, who want to use farmers' land for their projects, will have to sign a transferable development rights (TDR) agreement.“This will ensure that far mers or landowners will get the market price from the builder for their land. The government will be a facilitator as the custodian of farmers' interests. The TDR certificate will be valid for two years from the date of issuance,“ said Khattar. | ||

| − | =Occupancy costs (cost purchasing/ hiring real estate) = | + | =Occupancy costs, office space (cost purchasing/ hiring real estate) = |

[[File: NOIDA, The market rates of apartments per sq. ft. in 2011 and 2016; and circle rates 2016.jpg| NOIDA, The market rates of apartments per sq. ft. in 2011 and 2016; and circle rates 2016; Graphic courtesy: [http://epaperbeta.timesofindia.com/Gallery.aspx?id=29_06_2016_006_020_011&type=P&artUrl=Will-UP-follow-Haryana-slash-circle-rates-29062016006020&eid=31808 The Times of India], June 29, 2016|frame|500px]] | [[File: NOIDA, The market rates of apartments per sq. ft. in 2011 and 2016; and circle rates 2016.jpg| NOIDA, The market rates of apartments per sq. ft. in 2011 and 2016; and circle rates 2016; Graphic courtesy: [http://epaperbeta.timesofindia.com/Gallery.aspx?id=29_06_2016_006_020_011&type=P&artUrl=Will-UP-follow-Haryana-slash-circle-rates-29062016006020&eid=31808 The Times of India], June 29, 2016|frame|500px]] | ||

Revision as of 07:41, 27 December 2017

This is a collection of articles archived for the excellence of their content. Readers will be able to edit existing articles and post new articles directly |

Affordable housing

2017: 27% increase in new launches

Rakesh Malik, Affordable touches a new high, December 7, 2017: The Times of India

Incentives announced by the central government for the affordable segment have given a major boost to the realty sector

In the research report by a leading real estate research firm covering the top 8 cities of India, affordable housing sector has recorded a surge of 27 per cent in new units launched (y-oy). Post announcements by the government to incentivise affordable housing through industry status, many developers have shown interest in developing such projects. However, overall residential unit launches recorded a decline of 33 per cent, and were at approximately 60,000 units in the first three quarters of 2017 (January-September). Further, the first quarter of the year had the rollover challenges of demonetisation (November 2016) to grapple with, leaving many developers no choice but to defer their launch plans.

Affordable housing segment demonstrated strongest trends to record a 27 per cent increase in the new units launched in these cities. More than 26,000 new units have been launched in 2017 so far. Of the total new launches in affordable units, 40 per cent were in Mumbai (10,500 units), followed by Kolkata and Pune. All other categories have seen a decline with highend (-66 per cent) and luxury (-84 per cent) segments witnessing a significant drop in new launches.

With government of India’s focus on ‘Housing for All’, affordable housing segment is expected to continue its momentum. To ensure that the momentum continues, government could also explore adding a few incentives on land acquisition costs as land cost is the largest component of project costs.

FAST FACTS

>> Affordable housing refers to units measuring up to 30 square metres (in carpet area) within municipal limits of 4 metro cities such as Delhi, Chennai, Kolkata and Mumbai and 60 square metres (in carpet area) for all other locations

>> Values for mid-segment are for units in the range of ₹5-10 million, except Delhi -NCR and Mumbai where the range in mid segment housing is typically between ₹5-17 million (20 million for Mumbai).

>> High-end segment values are for units typically priced above ₹10 million, except for Delhi and Mumbai (where it is more than 17 million in Delhi and 20 million for Mumbai).

>> Top 8 cities include Ahmedabad, Bengaluru, Chennai, Delhi NCR, Hyderabad, Kolkata, Mumbai, Pune

Buying and selling

Economics of buying vs. renting, 2017

See graphic.

House rents

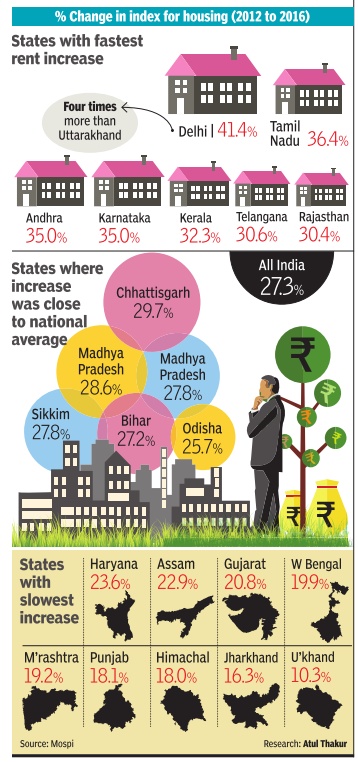

Change in rents, 2012-16

HOUSE RENTS HAVE RISEN THE MOST IN DELHI, LEAST IN UTTARAKHAND, Sep 17 2016 : The Times of India

Recently released data on consumer prices indicates that housing cost (a proxy for rent in CPI) recorded the highest increase in Delhi, while Uttarakhand saw the minimum rise among major states. This data is for the period between 2012, the base year of the current index, and August 2016, the month for which the latest data is available

See graphic.

ii) The rental yield in India and other countries; The Times of India, June 13, 2017

Investments

2017: Investment in 6 top cities doubles to $2.87 billion

From: Prabhakar Sinha, Realty investments up 100% in top 6 cities, says survey, October 31, 2017: The Times of India

Globally, Mumbai Moves To 81st Slot From 149th 2016

With favourable changes in the legislative environment, India's six major cities -Mumbai, Bengaluru, Pune, New Delhi, Chennai and Hyderabad -have recorded 100% increase in investments in real estate sector at $2.87 billion during July 2016-June 2017, according to a survey by Cushman and Wakefield.

Mumbai, with an investment of $1.75 billion from foreign as well as domestic private equity investors, has moved up to 81st position in the global survey on rankings of cities for attracting capital from 149th slot in 2016.Also, the financial capital has witnessed highest growth among the gateway cities of the world with 194% increase in investment from $594 million in the same period last year.

New York, with $51billion investment, continues to rule the rankings of cities on the basis of investments in real estate sector followed by Los Angeles ($39.1 billion), San Francisco ($32 billion) and London ($30 billion).Shanghai, which attracted $17.6 billion investment, is placed at 10th position.

The global property mar ket witnessed 4% rise in volume to $1.5 trillion during July 2016-June 2017. Cross border real estate investments constitute 75% of total volumes.

Of the total real estate investment received by various cities in India, the largest share of over 55% came in from the North America, while domestic and regional sources saw a decline in share of capital invested in In dia, said the report. Funds from Europe, which were conspicuous by their absence during last year, were seen contributing approximately 14% of the total investment.

India's current economic position and stability in political scenario have been instrumental in creating an investment-friendly environment in the country , said the report.

Among Indian cities, after Mumbai, Bengaluru attracted $300 million, followed by Chennai ($276 million) and New Delhi ($125 million).

Anshul Jain, country head and MD of Cushman and Wakefield India, said that current economic drivers are biased towards developed markets but Indian cities are performing ahead of expectations and are offering medium to long term growth potential in real estate.

Legal position and instruments

Homebuyers’ interests and the law

Jaypee: SC orders depositing of security against homebuyers’ investments

The Supreme Court assured that homebuyers' interest would be protected even if big creditors and realtors suffered, and ordered Jaiprakash Associates Ltd (JAL), the holding company of distressed Jaypee Infratech, to deposit Rs 2,000 crore in the apex court by October 27.

The SC told JAL's counsel, Rupinder Singh Suri, that the company could sell its land with the apex court's consent to generate Rs 2,000 crore, which would serve as security for the investments made by homebuyers in Jaypee Infratech's housing projects. The court directed JAL to deposit the money even though Jaypee Infratech (JIL), through P S Patwalia, said it had no money .

The court ordered the MD and directors of Jaypee Infratech and JAL not to leave India without its permission. Any person who was a director or managing director of JIL or JAL on the date of institution of insolvency proceedings (on August 9) against JIL as well as the present directorsmanaging director shall also not leave the country without prior permission of this court. The foregoing restraint shall not apply to nominee directors of lending institutions (IDBIICICISBI),“ a bench of Chief Justice Dipak Misra and Justices A M Khanwilkar and D Y Chandrachud said.

The court, right from the beginning, made it clear that homebuyers' interest was paramount and that it would do everything possible within the law to protect it.“We are not concerned whether the companies sink in Bay of Bengal or in Pacific Ocean. Homebuyers' interest must get protected at all costs,“ it said.

The Centre, through attorney general K K Venugopal, the interim resolution professional (IRP) appointed by the National Company Law Tribunal (NCLT) through additional solicitor general Tushar Mehta and IDBI Ltd through A M Singhvi said the SC's September 4 order staying the NCLT's in solvency proceedings amounted to handing over assets to Jaypee Infratech, the defaulter company .

Venugopal sought revival of the IRP to take control of Jaypee Infratech's assets and said the IRP alone could devise a plan in consultation with the committee of creditors to resuscitate the realtor and provide a mechanism for recovery of dues owed to creditors.

“Since we have a practical problem as the Insolvency and Bankruptcy Code, 2016 did not provide for homebuyers, the court could permit representative of homebuyers to be present in the meeting of the committee of creditors,“ he said.

The SC accepted the pro posal and nominated Shekhar Naphade and Shubhangi Tuli to be present in the meeting of the committee of creditors to safeguard the interest of homebuyers. It asked the IRP to submit an interim resolution scheme to the court in 45 days which shall include the interest of homebuyers apart from those of secured creditors like IDBI, SBI and other banking institutions.

“The IRP shall forthwith take over the management of JIL. The IRP shall formulate and submit an interim resolution plan within 45 days before this court. The interim resolution plan shall make all necessary provisions to protect the interests of homebuyers,“ it said.

Real Estate Investment Trusts (REIT)

Blackstone likely to be India's first listed on REIT

REITs are listed trusts holding income generating properties, earnings from which are distributed to shareholders. Market regulator Sebi came out with REIT guidelines [in 2014], helping real estate developers list their rent-yielding assets, and also providing large and small stock market investors with an inflation indexed product.

The world's largest private equity manager Blackstone Group, which is also the most prolific investor in Indian commercial properties, is finalizing plans to raise Rs 4,000 crore (about $600 million), through a listing of Real Estate Investment Trust (REIT) on the domestic stock exchanges, people directly familiar with the matter said. This will perhaps be India's first REIT listing and a test case for global investors who have poured big bucks into the country's rent-yielding commercial assets, especially tenanted office spaces.

Blackstone, through its joint ventures with Bangalore-based Embassy Group and Pune's Panchshil, is on the road to build 50 million sqft tenanted office buildings--of which 30 million are already leased--across top Indian cities. It could target a possible listing during the first quarter next calendar, though a decision on timing would be taken only after filing for permission with Sebi.

RERA at the Centre, and in Haryana and UP

From The Times of India

Luxury homes

The main markets in 2014

Bangalore No. 1 market in India for luxury homes

While Bangalore reports sales of close to 100 luxury units — including villas — on a quarterly basis, Mumbai and NCR, in comparison, see only around a dozen such sales.

Anshul Dhamija, TNN | Apr 20, 2014 The Times of India

BANGALORE: When it comes to luxury homes — units priced above Rs 5 crore — Bangalore is setting benchmarks to emerge as the country's top luxury home market, says a report by JLL India, an international property consultancy firm.

Quality of construction, design, ventilation, floor-to- ceiling height, amenities, floor plans, building elevation and configuration aspects are among the factors fuelling Bangalore's rise to the top, the report says.

Most importantly, pricing of luxury residential properties in the country's IT capital is seen to be far more reasonable and realistic than Mumbai and NCR, says JLL's report, shared exclusively with TOI.

"Luxury properties in Bangalore are 20% to 30% cheaper. While luxury apartments that cost between Rs 6 crore and Rs 30 crore may seem exorbitant, they are in fact very reasonable when compared to the rates going in premium locations of established cities like Delhi and Mumbai," notes Om Ahuja, CEO-residential services, JLL India.

Citing research data, Ahuja adds: "A luxury apartment in Indiranagar or Koramangala is still an attainable reality with prices ranging from Rs 9,000 to Rs 12,000 per square foot. No other premium locations of other major Indian cities offer such prices in the luxury segment."

While Bangalore reports sales of close to 100 luxury units — including villas — on a quarterly basis, Mumbai and NCR, in comparison, see only around a dozen such sales.

Data shared by the consultancy firm LJ Hooker shows that Bangalore has around 5,400 luxury units under various stages of construction and planning.

After Mumbai and NCR, Bangalore is the third largest market for luxury property sales and product offerings. It is also the third largest real estate investment hub for high net-worth individuals (HNIs), but tops the list in terms of investments from NRIs looking at settling down in India.

While much of the city's luxury homes demand is fuelled by millionaires from the IT/ ITeS sectors, the demand is also being driven by Kolkata and Chennai-based HNIs. JLL estimates Bangalore to have over 10,000 dollar millionaires.

In terms of product, JLL reported that luxury residential offerings in Mumbai and NCR fall more or less in the vanilla category when compared to products in Bangalore. "In Mumbai and NCR, location aspects such as sea view or PIN code tend to define the flair and profile of a property far more than the positioning of the product in terms of luxury and design parameters," says Ahuja.

Demand across all metros for luxury residential products was subdued over three to four financial quarters, but has picked up in the past 60 days, say analysts tracking the real estate sector.

New Integrated Licencing Policy (NILP), 2015

The Times of India, Oct 24 2015

Manvir Saini

Haryana policy gives big housing a push

The Haryana government has reduced the minimum land requirement to build townships from 100 acres to 25 in its new integrated licencing policy (NILP), which it unveiled. The state expects the NILP to help energise the real estate market that has been going through a prolonged slump, particularly in NCR. The policy is applicable to high and hyper potential areas in NCR and the state capital region (SCR).

The lowering of the mi nimum land quantum for large housing projects to 25 acres also means acquisitions of this scale won't attract tough clauses of the Land Acquisition, Rehabilitation and Resettlement Act, which is applicable for acquisitions above 50 acres.

Only 12 housing project licences have been issued since the Manohar Lal Khattar-led BJP government took the reins of the Haryana government in October 2014.But the investment climate alone is not to be blamed for this. The state stopped issuing licences to builders in September 2014 when the model code of conduct for the assembly polls came into effect. The new government only resumed giving out housing licences in June.

The NILP will cover Gurgaon and Manesar, Faridabad, Ballabgarh, Sohna, So nipat, Kundli and Panchkula. The government expects it to generate a revenue of Rs 1.25 lakh crore. While unveiling the policy in Chandigarh, chief minister Khattar said he was hopeful that 2 lakh dwelling units under the affordable housing scheme would be built by 2020.

Besides bringing down the minimum area requirement for obtaining the licence, the NILP also plugs an illegal practice of developers signing memoranda of understanding (MoU) to fulfil the 100-acre cap. There had been instances in the past when builders have inked MoUs with landowners and apply for a licence.

Now builders, who want to use farmers' land for their projects, will have to sign a transferable development rights (TDR) agreement.“This will ensure that far mers or landowners will get the market price from the builder for their land. The government will be a facilitator as the custodian of farmers' interests. The TDR certificate will be valid for two years from the date of issuance,“ said Khattar.

Occupancy costs, office space (cost purchasing/ hiring real estate)

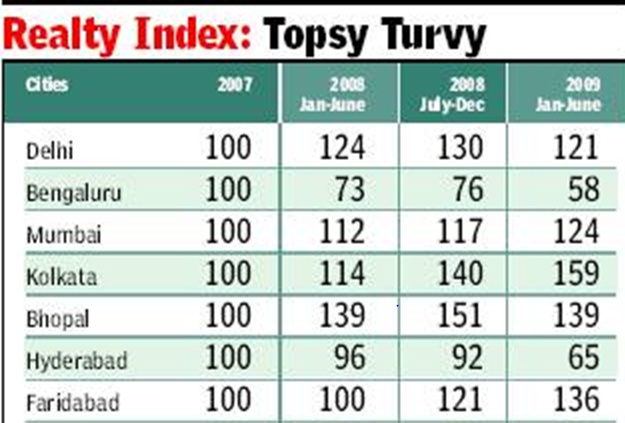

Realty index: 2007-2009

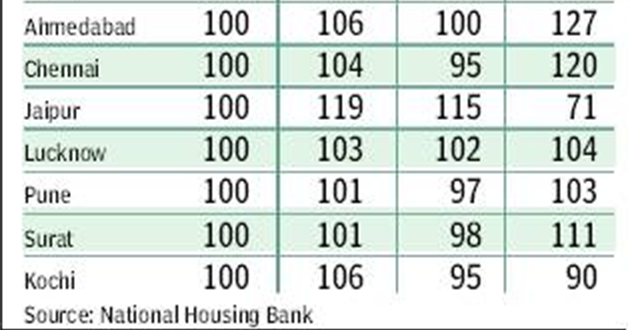

2013, NHB Residex

Office space: rents and occupancy costs, March 2013

‘CP world’s fifth costliest office mkt’

TIMES NEWS NETWORK

Delhi

Despite weakening demand for office space Connaught Place remains the fifth most expensive office market in the world.

In property consultant CBRE’s semi-annual Prime Office Occupancy Costs survey, CP has retained its earlier ranking in the list of the world’s 50 most expensive office markets. The latest survey provides data on office rents and occupancy costs as of March 2013 across 133 countries.

“Though demand for office space has reduced, occupancy costs remain high, especially in Connaught Place, due to limited supply in the near future,” said Anshuman Magazine, chairman and managing director, CBRE.

Downturn, around 2014

2016: Circle rates lowered

The Times of India, June 3, 2016

These are hard times for the real estate industry in NCR. One factor that has gnawed away at interest in buying or selling property is the unreasonable circle rates. While Gurgaon proposed a 15% cut [May 2016], circle rates there, and in most of Noida, are higher than the market rates, virtually slowing transactions to a trickle.

The property market in NCR is at its lowest ebb.Prices have either plateaued out or fallen over the past couple of years. Like any bear run, this ought to have got buyers looking for long-term returns interested. But that hasn't happened. As much as the trust-deficit has spooked in vestors, a devil hiding in the detail has further queered the sales pitch. It's called the circle rate.

By definition, circle rate is the minimum value at which a plot, house, apartment or commercial property can be sold.The rate is decided by a state's revenue department in consonance with market rates. But in hot property markets like Gurgaon and Noida, the circle rate has stopped keeping in touch with the market rate. So, while market rates depreciated due to bad buying sentiment, circle rates didn't.

What this created is an environment in which neither buyer nor seller is interested in making a transaction. Why?

Say an apartment's market price is Rs 1crore but its value, according to the circle rate, is Rs 1.5 crore. It means both the stamp duty the buyer has to pay to register the flat and the tax component of the seller will be calculated on Rs 1.5 crore, the circle rate. It's a transaction in which both parties lose.

Acknowledging this, the Gurgaon administration recently made the unprecedented proposal of cutting circle rates by a steep 15% for the 2016-17 fiscal year. The industry hopes the Delhi and UP governments will follow suit.Gurgaon divisional commissioner D Suresh said the proposal reflected the reality.

Unlike in Gurgaon, where circle rates were not revised for the last two years, Noida continued to raise them despite the gloom. Updesh Bharadwaj, a resident of Sector 72, owns a shop in a mall in Sector 18 that he wants to sell. “The market price of the shop is Rs 1.5 crore but it's Rs 2.5 crore as per the circle rate. I have been looking for a buyer for two years. But no one is interested because of the huge gap in rates,“ he said.

Gurgaon

And the gap in office realestate occupancy cost between central business districts (CBDs) such as Connaught Place and suburbs such as Gurgaon (ranked 72nd) stays wide.

Mumbai:

In Mumbai the occupancy costs in Nariman Point, the country’s first planned CBD, have reduced further. In the CBRE survey, Nariman Point dropped to 26th position at $90 per sq ft per annum. In December 2012, it had ranked 25th.

But the Bandra-Kurla Complex (BKC) retained its earlier ranking (11th) among expensive office markets, CBRE said.

CBRE analysts said the Mumbai CBD — including the micro markets of Nariman Point, Fort and Cuffe Parade — had seen office space absorption of only 8,000 to 10,000 sq ft during the quarter. Office rental values in these micro markets declined 3-4% sequentially in January-March, they said.

2014: NCR, Mumbai

Dec 31 2014

‘CP 6th costliest office location in world’

BKC and Nariman Point are among the top 50 costliest office spaces globally, according to CBRE’s survey released in December, 2014. BKC, which is the city’s alternative business district, retained its 16th rank, while Nariman Point is ranked 32nd on the top 50 list.

At nearly $160 per sq ft per annum, Delhi’s Central Business District (CBD) of Connaught Place bagged the sixth slot.

“London’s West End remained the world’s highestpriced office market, but Asia continued to dominate the world’s most expensive office locations, accounting for three of the top five markets,” said the CBRE report.

London West End’s overall prime occupancy costs of $274 per sq ft per year topped the “most expensive” list.

Hong Kong Central followed with total prime occupancy costs of $251 per sq ft, Beij ing’s Finance Street ($198 per sq ft), Beijing’s CBD ($189 per sq ft) and Moscow ($165 per sq ft) rounded out the top five.

“Although New Delhi’s Connaught Place moved up two places to the sixth spot on the global top 10 rankings over the first quarter of 2014, annual occupancy costs here remained stable because of rupee appreciation since the first quarter,“ said CBRE south Asia CMD Anshuman Magazine. Annual office occupancy costs in Gurgaon remained stable, while that of Nariman Point dropped by about 2% and BKC by about 6%. Bangalore’s CBD, which saw a nearly 9% drop, was among the top five global prime office markets to witness a decrease in yearly occupancy costs.

Global prime office occupancy costs rose 2.5% yearover-year, led by the Americas (up 4.1%) and Asia Pacific (up 2.8%).

2015-16 : Metros

2016: Khan Market no. 1 in India, no.29 in world

See graphic:

Most expensive retail spaces, city-wise, 2017

From: November 24, 2017: The Times of India

2016: Connaught Place, BandraKurla, Nariman Point most expensive

The Times of India, Jun 16, 2016

CP world's 7th costliest office space

Connaught Place has slipped one notch to become the world's seventh most costliest office destination, according to property consultant CBRE. Mumbai's BandraKurla Complex (BKC) is at the 19th position and Nariman Point at 34th, according to CBRE Research's Global Prime Office Occupancy Costs bi-annual survey .

“With annual occupancy cost of USD 149.71 per sq ft, New Delhi's Central Business District (CBD) of Connaught Place ranks as the seventh most expensive prime office market in the world,“ CBRE said in a statement.

Hong Kong (Central) became the highest-priced office market with an overall prime occupancy costs of USD 290 per sq ft per annum, followed by LondonCentral (West End) with annual occupancy cost of USD 262.29.

2017/Office rents: Mumbai, Delhi, Bengaluru among top 6, worldwide

HIGHLIGHTS

Office rents in Mumbai, Delhi, Bengaluru among top 6 globally, according to a study

Global price index that compares rental values of prime office spaces across 20 international markets rose by 1.2 per cent in the quarter

Bengaluru's office rents grew by 4 per cent- highest among key CBDs in India

Healthy surge in rentals across key business districts reinstated the growing prominence of Indian metrosHealthy surge in rentals across key business districts reinstated the growing prominence of Indian metros

MUMBAI: Healthy surge in rentals across key business districts reinstated the growing prominence of Indian metros including Mumbai, Bengaluru and New Delhi on the global map of high-rent yielding commercial spaces during April-June 2017, says Knight Frank in a recent study.

According to the report, the global price index that compares rental values of prime office spaces across 20 international markets rose by 1.2 per cent in the quarter.

"Prime business districts in the three Indian metros have seen robust rental growth courtesy strong demand and limited vacancies. This scenario is expected to remain for a year owing to a supply crunch of new office space," Knight Frank India Chief Economist and National Director-Research Samantak Das said.

As per the report, sustained interest from the IT/ITes sector pushed rents in Bengaluru's business district by four per cent- the highest among other key CBDs in India.

Other established business districts such as the Connaught Place in Delhi also saw a 2.2 per cent climb in rentals, courtesy a lull in supply of new office spaces and dwindling vacancies, it said.

The Bandra Kurla Complex in Mumbai, recorded a quarter-on-quarter increase of 2 per cent in rents in April-June 2017. Vacancy levels here, however, got a boost with a fresh office supply of around 530,000 sqft in the last quarter.

"Despite the global pressures on the IT/ITes sector triggered by automation and limitation in demand for business the technology-driven Bengaluru market has performed well and it expected to do even better. But prime office assets in Mumbai and Delhi are likely to see a slower growth trajectory having already scaled high-rental values," he added.

According to it, Phnom Penh in Cambodia topped the chart this quarter with 4.2 per cent increase, Bangkok (Thailand) the erstwhile topper saw its first decline this quarter in close to three years.

JLL's report, 2017/ Delhi 7, Mumbai 16 on world’s costliest office list

Delhi 7th, Mum 16th on world’s costliest premium office list, December 25, 2017: The Times of India

From: Delhi 7th, Mum 16th on world’s costliest premium office list, December 25, 2017: The Times of India

Delhi rentals are higher than cities like LosAngeles, Singapore, Paris, Seoul, Sydney, Frankfurt, Chicago and Toronto. However, Mumbai figures among the world’s most expensive locations for premium office rents, according to JLL’s latest report. While Delhi is ranked at number seven, Mumbai is ranked 16 on the list of the world’s most expensive locations for premium office rents.

The findings reveal that the mostexpensive premium office rent in the world is in Hong Kong, followed by New York, London, Beijing, Silicon Valley, Beijing again (another financial district), Delhi, Shenzen and Tokyo.

“Regionally, cities across Asia-Pacific are home to the world’s most expensive premium office spaces at an average of $111per square ft per year, which is higher than America’s ($85 psft per year) and EMEA (Europe, Middle East and Africa) at $78 psft per year,” said the report by JLL, a leading professional services firm that specializes in real estate and investment management.

Hong Kong’s Central continues to be the world’s most expensive office sub-market. “Most striking is the differential that has emerged between Hong Kong and the next most expensive cities, withcostsfor premium office space now in excess of 50% than either London or New York,” itsaid. “At$300 psft per year, total rents here set corporateoccupiers backby 70% more than for comparable buildings in New York’s Midtown or London’s West End. While six sub-markets from Asia figure in the top-10, economicdiversity also means it offers some of the world’s most competitively priced premium space, with Kuala Lumpur, Manila and Bangkok comprising the top three most affordable premium office locations.”

Premium office rent refers to the ‘top achievable’ in units with area of over 10,000 sq ft in the premium building of the premier office district of each city. The third edition of JLL’s Premium Office Rent Tracker (PORT) compares occupancy costs for premium office buildings across a broad range of major cities. PORT includes the key elements of occupancy costs—net effective rent, service charges and government tax on rent. Occupancy costs for premium buildings have continued to rise in major office markets over a year, despite many being in a latecycle phase. Costs grew by an average of 4% during 2017.

2017/ Rs 50 crore, biggest residential deal in Bengaluru

HIGHLIGHTS

Embassy Group has sold an apartment for Rs 50 crore to chairman and chief executive of engineering outsourcing company Quest Global.

Bollywood actress Deepika Padukone and some of the Infosys co-founders were among the first to invest in these branded residences.

The Embassy Group has sold an apartment for Rs 50 crore to Ajit Prabhu, chairman and chief executive of engineering outsourcing company Quest Global, making it the biggest residential deal in Bengaluru, according to people familiar with the matter.

Prabhu has bought the 16,000-sqft apartment in Embassy One, near Hebbal, which houses a 230-room Four Seasons luxury hotel, 110 Four Seasons-branded residences, 150,000 sqft of office space and 60,000 sqft of retail space. The per-sqft rate for the apartment works out to about Rs 31,000. Last year, Flipkart's Binny Bansal acquired a 10,000-sqft home in Koramangala III Block -a coveted neighborhood of self-made billionaires -for Rs 32 crore.

Prabhu, who grew up in Hubballi, divides his time between Singapore and India. He will own the yet-to-be customized apartment on the top of the South Tower, and it's the 30th floor. The first 21 floors will be dedicated to the Four Seasons hotel, and the rest will be serviced residences. Bollywood actress Deepika Padukone and some of the Infosys co-founders were among the first to invest in these branded residences. Embassy confirmed the deal, but declined to confirm the buyer. Prabhu could not be immediately reached for comment. "Sales like this bring a great sense of confidence in the market," Reeza Sebastian, head of Embassy residential marketing and sales, told.

The 1-million-sqft project, previously called City View, was originally owned by Goldman Sachs (73%) and Dayanand Pai's Century Real Estate Holdings (26%). The investment bank entered into a conditional agreement to sell it to RMZ a few years ago, but failed following opposition from its minority shareholder.

Embassy, led by its flamboyant billionaire promoter Jitu Virwani, stepped in and bought the entire project for Rs 605 crore. During this period of uncertainty, the project was hobbled by delays and ran the risk of being classified as a nonperforming asset by the State Bank of India (SBI).

Prabhu, who has made 75% of the payment, is expected to move in once the apartment is ready by the middle of 2018. Sebastian said the company has sold about 52% of the apartments. The residences will have concierge services, 24 hour valet parking, and residents will enjoy the hotel's paid services such as room service, limousines and apartment-cleaning.

2017, April-June: Housing prices increased in 36 out of 50 cities

Housing prices up in 36 of 50 cities, finds study, December 16, 2017: The Times of India

Housing prices increased in 36 cities during April-June 2017 out of 50 major citieswithVizag recording the maximum annual appreciation of nearly 16% while Delhi saw 8.1% rise, according to NHB.

The National Housing Bank (NHB) Housing Price Index (HPIs) tracks the movement in prices of residential properties on a quarterly basis, taking 2012-13 as the base year. “HPI recorded an overall increase in 36 cities, decrease in 13 cities and no change in 1 city on Y-o-Y basis,” NHB said in a statement.

All the eight Tier-1 cities witnessed a rise in indices on Y-o-Y basis with Delhi witnessing a 8.1% risefollowed by Chennai (7.4%) and Pune (6%). Of the 36 cities showing increasing trend, NHB said that the significant rise was witnessed in Vizag (15.7%), Kochi (12.8%), Faridabad

(11.7%), Surat (11.2%), Howrah

(10.2%), Raipur (9.6%) and Nagpur (9.4%).

Marginal rise in index was witnessed in Noida (0.9%), Ludhiana (1.4%) and Vasai-Virar (1.6%), while index remained stable in Greater Noida. Among the 13 cities witnessing a fall in index, Bhiwadi (-10.6%), Coimbatore (-6.6%), Chandigarh (-5.9%) and Ranchi (-5.9%) observed significant decline, the statement said.

Meanwhile, NHB’s Housing Price Index (HPI) at market prices for under-construction propertiesincreasedin 25 cities, decrease in 17 cities and no change in 5 cities on Y- O-Y basis, at the end of the quarter April-June, 2017.

Of the 25 cities showing increase in index, significant rise was witnessed in Lucknow (7.8%), Indore (7.5%), Bhubaneswar (7.5%), Guwahati (7.4%), Chandigarh

(6.6%), Raipur (6.6%) and Surat (5%).

Marginal increase in index was witnessed in 4 cities viz, Bhiwadi (0.9%), Howrah (0.8%), Navi Mumbai (0.8%) and Bidhan Nagar (0.7%). Index remained stable in 5 cities namely Ghaziabad, Kalyan Dombivali, Mira Bhayander, Pune and Vasai Virar.

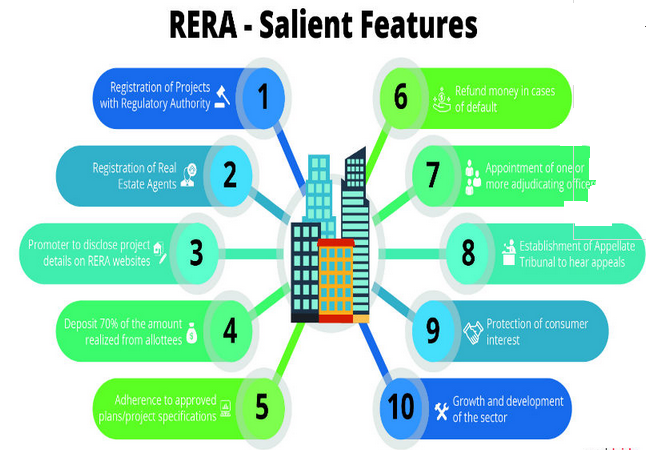

Real Estate (Regulation & Development) Act

2016: Some states dilute provisions, give builders exemptions

Dipak Dash, UP, Gujarat dilute new realty law, Nov 04 2016 : The Times of India

Make It Builder-Friendly By Giving Exemptions To Ongoing Projects

States led by UP and Gujarat have begun diluting provisions of the Real Estate (Regulation & Development) Act, which notify the rules for regulation of the sector. Both states have let off most ongoing real estate projects which have been delayed for long and remain a worry for thousands of home buyers awaiting delivery .

While UP has come up with four exemptions to exclude incomplete projects from the category of “ongoing projects“, Gujarat has exempted all projects launched before notification of the rules. This means such projects won't have to be registered with the real estate regulator in these states.

On the contrary , the law enacted by the Centre earlier this year provides for manda tory registration of all “ongoing projects“ that have not received completion certificate. “The central law, which is binding on all states, does not differentiate between ongoing and future projects for registration. However, it provides for registration of incomplete projects within three months from the commencement of the Act,“ said an official here.

The norms notified by UP excluded projects in which services had been handed over to the local authority for maintenance, common areas and facilities that had been handed over to RWAs for maintenance and where development work had been completed and sale and lease deeds of 60% houses execu ted. “This dilutes norms laid down in the law and will help builders avoid the mandatory regulatory provisions,“ the central government official said.

Defending their move, a Gujarat government official said, “We have notified the rules primarily for setting up the regulator ahead of the October 31 deadline. Once the operative part of the law comes into effect, we may revisit the norms“.

But central government sources said states must notify specific rules in compliance with the law and it wouldn't take not more than a couple of days to make all provisions operative.

On its part, the Uttar Pradesh government has also provided a handle for developers to retain some land in their projects under the guise of commercial activity rather than hand over such land to house owners.

While the central law clearly says that all community and commercial facilities in a project will be treated as common areas, rules notified by UP says, “Community and commercial facilities shall include only those facilities, which have been provided as common areas.“

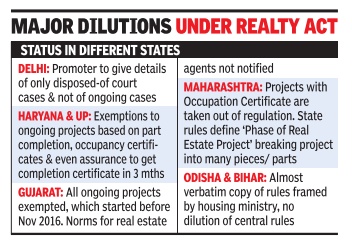

2017: States dilute rules

Dipak Dash, States & UTs dilute RERA to favour realtors, May 1, 2017: The Times of India

The Union housing ministry may claim that implementation of the real estate regulation law, popularly called RERA, will usher in a new era for home buyers, but the rules put forward by states have diluted many provisions, keeping most of the ongoing projects outside the ambit of the law that would come into effect.

States such as Odisha and Bihar have notified rules that are completely in sync with the one notified by the Union housing and poverty alleviation ministry . But in contrast, Haryana's draft rules, notified last week, have completely left out disclosures by builders on the sanctioned plan, layout and specifications at the time of booking with all subsequent changes till date.“This omission will give legal colour to all unilateral changes done by builders and will give them an escape route to avoid paying compensation to home buyers,“ said Abhay Upadhyay , president of Fight for RERA, the nationwide home buyers' body which campaigned for the law.

Similarly , in Maharashtra, a provision has been included to allow builders to ta ke out or divest from a project after occupancy certificate has been issued. This means, the builder can pull out its entire investment before completion of common areas, facilities and amenities.

In UP, the norms related to compounding of offences have been diluted as no specific amount has been mentioned. “There is provision for `up to' (a certain amount), which means it may even be zero. This will encourage corruption as quantum of money to be paid will be at the discretion of the authority,“ Upadhyay said.

Even the urban development ministry has allowed relaxation in Delhi, where rules specify that promoters need to provide details of only those court cases which have been disposed of during the last five years. This is despite the housing ministry clearly stating that builders need to provide details of all pending cases.

Till Saturday , 13 states and Union territories had notified their final rules. “With many states intentionally keeping most of the ongoing projects out of RERA's coverage, there will be little relief for lakhs of home buyers,“ Upadhyay said.

Real Estate Regulation Law: 10% interest rate for delayed housing projects

Prabhakar Sinha, RERA pushes for 10% interest clause, May 5, 2017: The Times of India

No Registration Of Project Unless Builder Agrees To Pay Penalty At This Rate

Buyers of delayed housing projects will get interest on the invested amount for the delay period at the Real Estate Regulatory Authority's (RERA) prescribed rate as against Rs 5 per sq feet to Rs 10 per sq feet contracted in the sales agreement, said chairman of Madhya Pradesh RERA Anthony de Sa.RERA's prescribed rate comes out to be 10% at present.

Meanwhile, developers have not been barred from advertising and marketing existing projects, said regulators and officials of MP, Punjab, Haryana and Delhi. Dispelling builders' doubts, officials said they need to apply for registration for ongoing projects only by July 31.

Additional chief secretary of housing urban development, Punjab, Vini Mahajan, who has also been appointed as the interim regulatory authority under RERA, while addressing a conference organised by FICCI, clarified that the existing projects need not wait for registration to advertise. They can continue all their activities as usual. However, those projects for which application for registration is not made even by July 31 to the regulatory authority cannot market their projects. “So far, 14 states and UTs have implemented this law. There are 14 more states which are in process of notifying the rules. We hope that they will do it soon,“ said joint secretary of housing ministry Rajiv Ranjan Mishra at the FICCI conference.

Anthony de Sa said that delayed ongoing housing projects will be registered with RERA only if the deve loper is ready to pay the buyer interest at the authority's prescribed rate, which is 2 percentage points above SBI's MCLR (marginal cost of fund based lending rate), and not the contractual rates of Rs 5 per sq ft to Rs 10 per sq ft which builders had accepted to pay when the sales agreement was signed.

At present, as SBI's MCLR is 8%, developers will have to pay 10% interest on the paid amount to the buyers. At the same time, buyers will also pay the same interest at 10% on delayed pay ment of their dues and not the penal rates of 12% to 18% as mentioned in the sales agreement.

Member of RERA Haryana committee and chief town planner of Haryana government Dilbag Singh Sihag, who is entrusted with the responsibility of finalising the RERA Rules for the state, said justice demands for the same interest rate to be paid by developers as they are charging buyers on delayed payment on outstanding dues.

Normally , developers charge a high rate of 12% to 18% while they pay only Rs 5 per sq feet to Rs 10 per sq feet on a project which costs Rs 4,000 to Rs 5,000 per sq feet. Sihag said this mismatch can be resolved by asking both parties to pay the RERA prescribed rates. He, however, added that no final view has been taken so far.

Mahajan said that existing buyers will get respite under RERA, clarifying that the authority is bound by the act and rules while taking the decision.

So, it can only enforce the contract signed between buyers and developers in light of RERA rules, which cannot go beyond the act.

Developers of delayed ongoing projects will get one more chance to regularize them. Regulators said that while registering ongoing projects, developers can set their own deadline to complete them. The deadline, however, should be reasonable. Anthony de Sa said that if a project was launched eight years back and the developer returns for registration seeking another four years for completion, it cannot be granted. There is no hard or fast rule to fix the deadline, which will depend on the existing condition and stage of implementation of the project.

But once the developer has given the deadline to complete the project and is unable to meet it, the regulator will take a very harsh view -he will either have to return the money to the buyers with interest or face consequences, including even a jail term, said Sihag.

RERA will help facilitate completion of projects so that all buyers can be satisfied. Only if developers are unable to achieve this goal will the regulators take stern action.

RERA compliance: a checklist

The Real Estate (Regulation and Development) Act, 2016 (RERA) came into force on May 1, 2017 in the entire country. Since then there has been confusion and buyers find it difficult to make a decision. Many buyers are baffled on how to ascertain if their projects are RERA-compliant or not.

One such buyer Baladhitya wonders, "Will RERA bring any hope for home buyers? I am looking for properties for my own use, should I wait for some more time?"

On May 1, 2017 Maharashtra notified the Act. The state launched its website and uploaded all relevant details as per the state's RERA rules. The law mandates that once a project is registered, the developer will have to upload project details on the RERA website and provide updates on construction progress, commencement, occupation and other certificates before the flats are handed over to buyers.

"The situation is one where the positive aspects are apparent, and yet, there is an element of 'wait and watch' on the part of both home seekers as well as developers. RERA is a reality and has to be accepted. For stakeholders in real estate, the post-RERA necessary changes are being implemented. These are early days and we should see things firming up in the next few weeks," says Dr Niranjan Hiranandani, co-founder & chairman, Hiranandani Group.

If you are a confused buyer and want to know whether your project is RERA compliant or not then you can check the following before you park your hard-earned money.

Legal Title

You need to check that your developer has the legal title of the land on which the development is proposed, or has legally valid documents with authentication of the title if such a land is owned by another person. RERA has done away with the age-old practice where someone without having a legal title would sell to home buyers. Now buyers have to be cautious and see whether the project they are buying is RERA-compliant or not.

Detail of encumbrances

Is the land free from all encumbrances? Check the details of the encumbrances on such a land, including any rights, title, interest or name of any party in or over such land along with details.

Possession Date

RERA mandates that all projects have to be delivered as per the possession date mentioned by the developer. So, don't forget to check the time period within which he promises to complete the project or its phase. With RERA becoming a reality, it is important for developers to prepare for the changes promptly. "We believe that improved project planning will help developers avoid delays and manage project funds efficiently. It would be prudent to hire planning professionals to ensure timely project completion. Making such preparations early should give developers an edge over rivals and boost buyer's trust," said Surabhi Arora, Senior Associate Director, Research, Colliers International India.

Escrow Account

Seventy per cent of the amounts realised for real estate projects from allottees, from time to time, shall be deposited in a separate account. This account has to be maintained in a scheduled bank to cover the cost of construction and other costs related to construction. This means that the developer has to use the money for the same project for which the funds have been collected. If your developer has deposited the money it means he is willing to complete and deliver the project on time.

Applicability of RERA

Rera is applicable to ongoing projects: HC

Builders Can Get More Time In Rare Cases

In a victory for home buyers, the Bombay high court has upheld the constitutional validity of the Real Estate (Regulation and Development) Act (Rera) and its applicability to ongoing projects across states. The law intends to make homebuying a transparent and speedy transaction with powers of redressal.

The judgment, however, offered a breather to builders too. It expanded powers under Rera to grant more time in exceptional cases to a builder to complete a project. The additional time is meant to be granted in compelling circumstances on a case-by-case basis.

A division bench of Justices Naresh Patil and R G Ketkar gave separate but concurrent findings. The extension would go beyond the statutory one-year extension after the deadline for completion, which the Act requires the project’s promoter to mention during registration.

The pronouncement is the first such verdict in the country on challenges raised by builders in various HCs. The Supreme Court had tasked the Bombay HC in September to set the path.

RERA arbitration panels

2017: Maharashtra first to form conciliation committee

Nauzer Bharucha, Maha first state to form RERA arbitration panel, Sep 18, 2017: The Times of India

Maharashtra will be the first state in the country to form a conciliation committee under the new Real Estate (Regulation and Development) Act, comprising a panel representing builders and consumer groups to arbitrate complaints.

It will mediate between the two parties and help resolve issues so they can avoid taking the dispute before the housing regulator.Only in case the dispute is not settled can the party lodge a complaint with the state regulator.

“The panel should start functioning in the next three months,“ said state RERA chairman Gautam Chatterjee, adding that it would help build trust between purchasers and developers. Last week, leading developers and consumer activists met state RERA officials to iron out the committee's operations. “Talks have progressed very well,“ said consumer activist Shirish Deshpande of Mumbai Grahak Panchayat (MGP). “MGP is presently in consultation with organisations representing developers like Naredco and Credai-MCHI to work out the conciliation scheme on which an enabling provision exists in the RERA Act,“ he said.

Deshpande said the proposed scheme will be an Alternate Disputes Redressal mechanism to facilitate “settlements between aggrieved homebuyers and builders without having to resort to... litigation“. Officials said the conciliation can only be initiated when both the complainant and builder willingly agree to it.

Developer Rajan Bandelkar, vice-president of Nared kar, vice-president of Naredco, said majority of the disputes are minor and can be resolved through mediation. The draft scheme envisages two panels of conciliators one will be of builders in which a total of ten persons will be nominated by Naredco, Credai-MCHI.On the other panel, MGP will nominate 10 members.

“Since it will be a mutual settlement and will be authenticated by MahaRERA, it will have sanctity , authenticity and finality,“ said Deshpande.Experts said this will reduce the pressure on MahaRERA as well as consumer courts.Officials said most of the over 13,300 projects registered in the state are ongoing ones and only 450 are new projects.

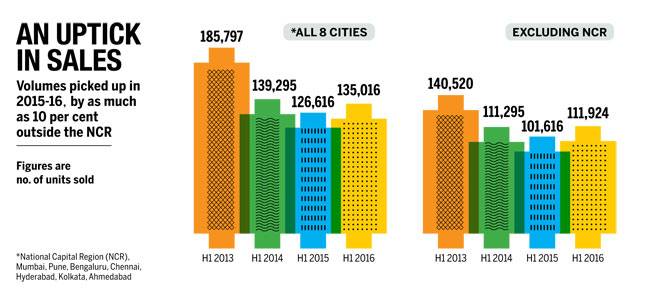

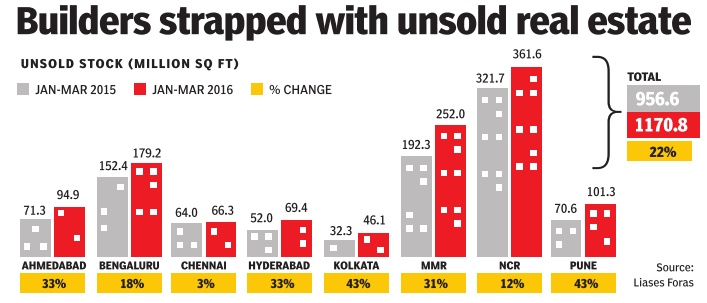

YEAR-WISE TRENDS

2013-16/ Stagnant growth in Bengaluru

M.G.Arun & Shweta Punj , Realty Check "India Today" 28/11/2016

See graphic

Sales & Growth: NCR ,Mumbai ,Pune ,Bengaluru ,Chennai ,Hyderabad ,Kolkata ,Ahmedabad

M.G.Arun Shweta Punj , Realty Check “India Today” 28/11/2016

See graphic

2017

Housing sales down 26% in NCR in first half

Housing sales down 26% in NCR in first half of 2017|Jul 06 2017 : The Times of India (Delhi)

New Delhi PTI Housing sales fell 26% in Delhi-NCR in the first half of 2017, as demand continued to be sluggish postdemonetisation, despite a price correction of 20% in the last 18 months, according to international property consultant Knight Frank.

Unsold housing stock in the Delhi-NCR property market stood at 1.8 lakh units -highest in the country -that will take developers four-anda-half years to sell. About 17,188 units were sold in the first half of 2017, compared to 23,092 units in H1 2016, Knight Frank India said. Housing sales did improve marginally by 2% from the previous six months, which saw lowest half yearly sales due to demonetisation move.

“NCR market continues to find newer depth and slide continues. NCR housing market is passing through the worst phase. No end to it,“ Knight Frank India Executive Director (Advisory , Retail and Hospitality) Ghulam Zia told reporters.

The consultant released latest report `India Real Estate Residential and Office' for January-June 2017 tracking eight top cities in the country.

On launches, Zia said it hit a “new low“ and fell by 73% in the first six months of this year at 4,800 units, 70% of which were below Rs 25 lakh, signalling shift towards affordable housing segment.

He attributed the fall in launches to demand slowdown and builders' focus on completing existing projects in view of the new Real Estate (Regulation and Development) Act.“Dwindling consumer confidence in the market courtesy delay in projects marred by litigations and poor connectivity in potential growth areas has slowed the market. That slowdown has restricted developers to launch new projects,“ the report said.