Private equity investments/ Venture Capital Funding in India

This is a collection of articles archived for the excellence of their content. |

Contents |

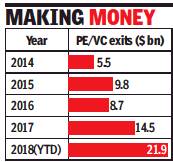

Exit of private equity/venture capital (PE/VC)

2014-18

From: Aparna Desikan, At $22bn, 2018 sees most exits by PE/VCs till date, September 8, 2018: The Times of India

Calender 2018 is turning out to be the biggest year for private equity/venture capital (PE/VC) exits. Driven by the Walmart-Flipkart deal, the year has so far seen nearly $22 billion worth of exits till date through more than 160 deals, according to data from research firm Venture Intelligence. While 2017 saw $14.5 billion for the whole year, previous years saw less than $10 billion.

Analysts point out that while the Flipkart deal contributed to a chunk of the deal size in terms of value, the mood among investors also favours exits. “IPOs, M&A exits and acqui-hires have contributed to the 165 deals so far. Among IPOs, the engineering firm Varroc went public where Tata Capital sold its entire stake in the company. AU finance saw Kedaara Capital and Warburg making a partial exit,” said Venture Intelligence MD Arun Natarajan.

With unicorns raising funds and consequently giving exits to smaller investors, there is an emergence of funds such as TR Capital and Madisson that concentrate mainly on secondary investments, paving the way for more exits. Fashion e-commerce player Nykaa saw TVS Capital sell its stake to Lighthouse Ventures in a Rs 113-crore deal and edtech startup Unacademy gave an exit with 150% internal returns to Waterbridge, which had invested $1 million in 2016.

Prime Venture Partners managing partner Sanjay Swamy said, “Additionally, investors from China and Japan entering the scene have increased the scope for early stage investors to see greater returns.”

And it is not just secondary and strategic investors that give profitable exits. Mature startups that acquire stakes for inorganic growth also have a role to play. Natarajan added even as exits remain on the higher side, the sentiment would be dependent on the behaviour of the Indian rupee and the public markets.

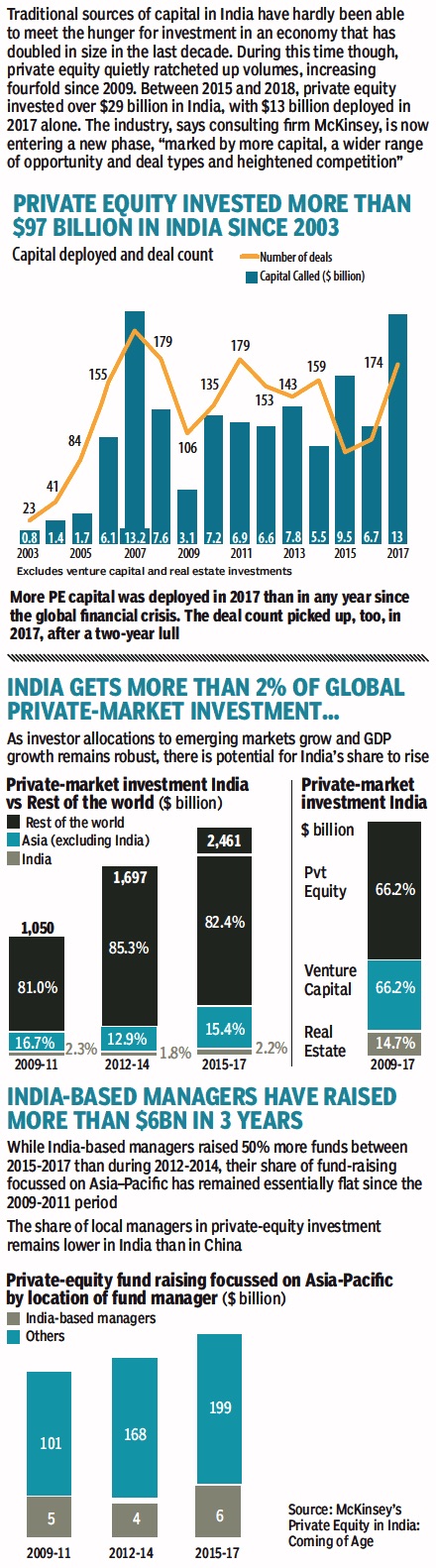

Private equity investments in India

2003-17

From: November 25, 2018: The Times of India

See graphic:

Private equity investments in India, 2003-17

See also

Financial Secrecy Index and India

Foreign currency inflows, outflows: India

Foreign Direct Investment (FDI): India

Foreign exchange reserves: India

Foreign Institutional Investment (FII): India

Foreign Portfolio Investors (FPI): India