Private equity investments/ Venture Capital Funding in India

This is a collection of articles archived for the excellence of their content. |

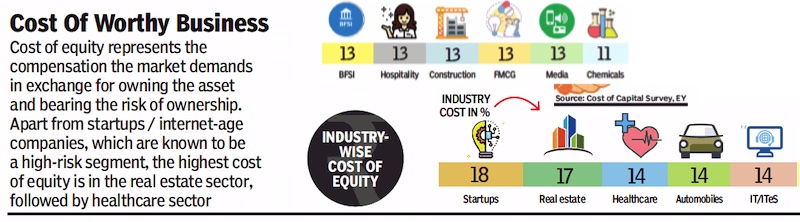

Cost of equity

Industry-wise, 2020

From: June 24, 2021: The Times of India

See graphic:

Cost of equity, Industry-wise, presumably as in 2020 and presumably in India

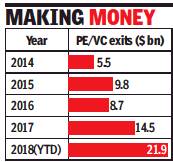

Exit of private equity/venture capital (PE/VC)

2014-18

From: Aparna Desikan, At $22bn, 2018 sees most exits by PE/VCs till date, September 8, 2018: The Times of India

Calender 2018 is turning out to be the biggest year for private equity/venture capital (PE/VC) exits. Driven by the Walmart-Flipkart deal, the year has so far seen nearly $22 billion worth of exits till date through more than 160 deals, according to data from research firm Venture Intelligence. While 2017 saw $14.5 billion for the whole year, previous years saw less than $10 billion.

Analysts point out that while the Flipkart deal contributed to a chunk of the deal size in terms of value, the mood among investors also favours exits. “IPOs, M&A exits and acqui-hires have contributed to the 165 deals so far. Among IPOs, the engineering firm Varroc went public where Tata Capital sold its entire stake in the company. AU finance saw Kedaara Capital and Warburg making a partial exit,” said Venture Intelligence MD Arun Natarajan.

With unicorns raising funds and consequently giving exits to smaller investors, there is an emergence of funds such as TR Capital and Madisson that concentrate mainly on secondary investments, paving the way for more exits. Fashion e-commerce player Nykaa saw TVS Capital sell its stake to Lighthouse Ventures in a Rs 113-crore deal and edtech startup Unacademy gave an exit with 150% internal returns to Waterbridge, which had invested $1 million in 2016.

Prime Venture Partners managing partner Sanjay Swamy said, “Additionally, investors from China and Japan entering the scene have increased the scope for early stage investors to see greater returns.”

And it is not just secondary and strategic investors that give profitable exits. Mature startups that acquire stakes for inorganic growth also have a role to play. Natarajan added even as exits remain on the higher side, the sentiment would be dependent on the behaviour of the Indian rupee and the public markets.

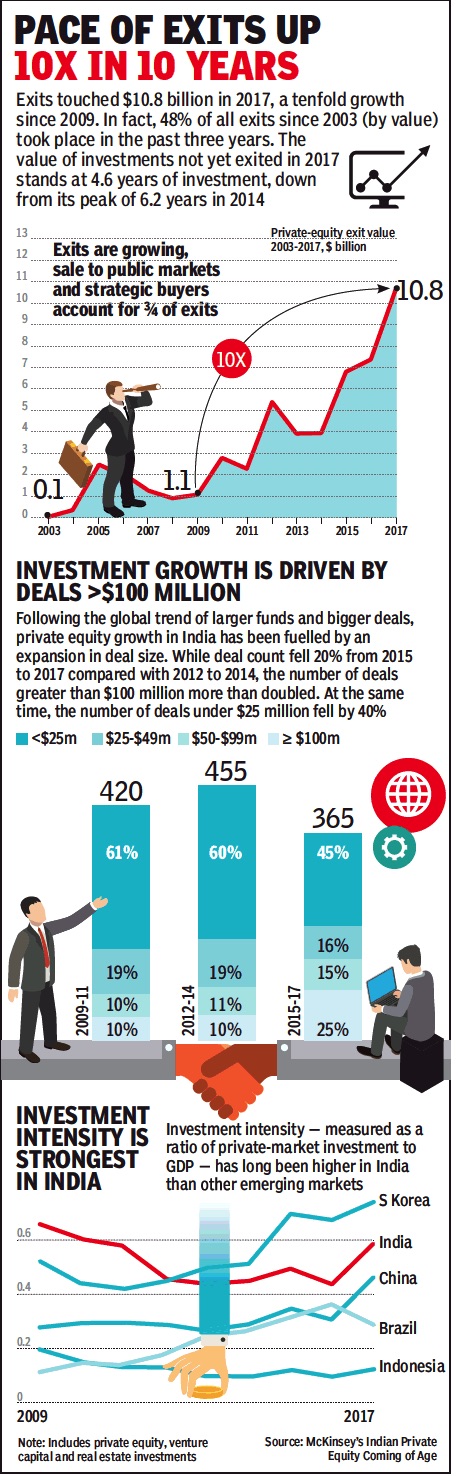

2009-17

Investment intensity in India and other emerging markets, 2009-17

From: December 2, 2018: The Times of India

See graphic:

Private equity growth, 2009-17, presumably in India

Investment intensity in India and other emerging markets, 2009-17

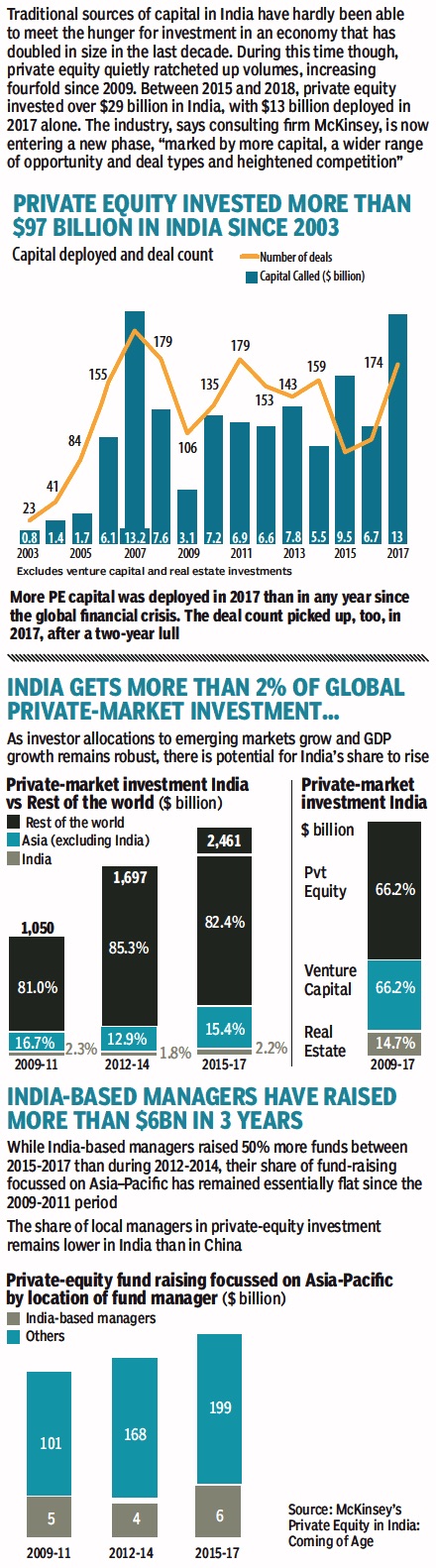

Private equity investments in India

2003-17

From: November 25, 2018: The Times of India

See graphic:

Private equity investments in India, 2003-17

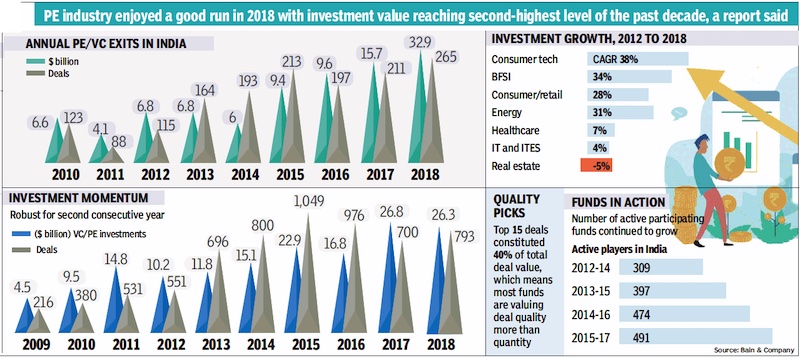

2009-18

From: May 19, 2019: The Times of India

From: May 19, 2019: The Times of India

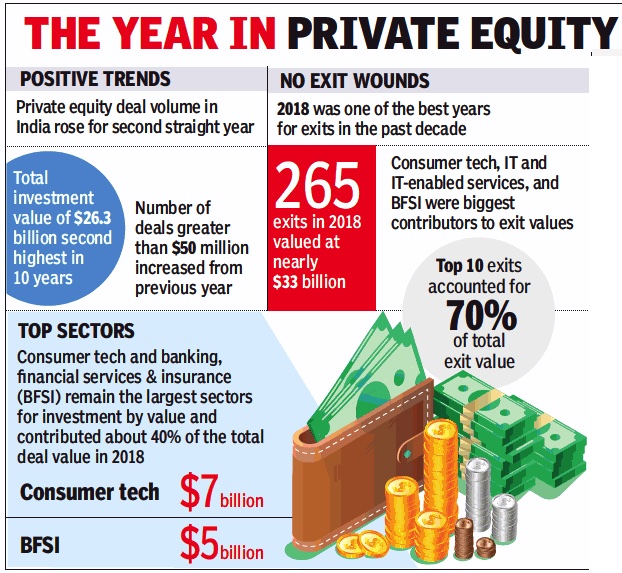

See graphics :

Private equity investments in India, 2018

Private equity investments in India, 2009-18

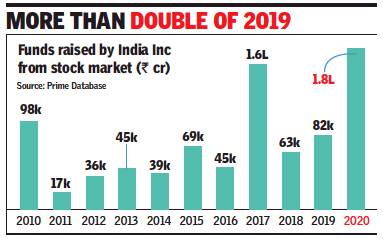

2010-20

From: December 29, 2020: The Times of India

See graphic:

Funds raised by India Inc from stock market (Rs. cr), 2010-20

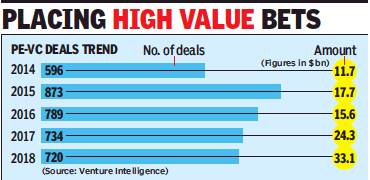

2014-18: Private equity-VC investments in India

From: Sindhu Hariharan, PE-VC fundings close ’18 at record high of $33bn, January 2, 2018: The Times of India

See graphic:

Private equity-VC investments in India, 2014-18

2015-18: Funding internet companies

From: January 12, 2019: The Times of India

From: January 12, 2019: The Times of India

See graphics:

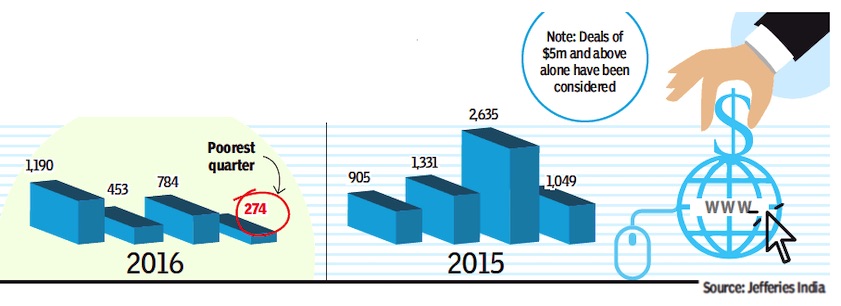

Private investments into internet companies in India, 2015-16

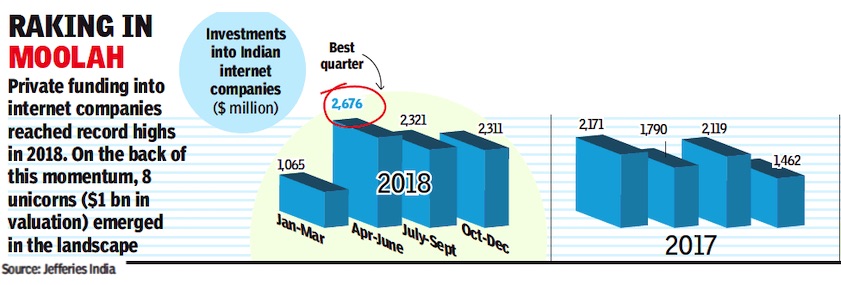

Private investments into internet companies in India, 2017-18

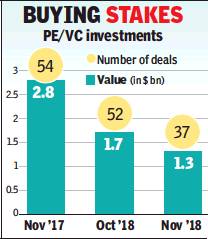

2017-19: Novembers

From: Dec 21, 2019 Times of India

There was a surge in private equity (PE) deal volume and value in November, the latter led by the $1-billion funding that Paytm received from T Rowe and others.

Grant Thornton’s monthly PE Dealtracker shows that there were 75 private equity deals worth $3 billion in the month. The investment value was an increase of close to seven times from November of last year. The volume jumped by 92%, continuing the upward trend witnessed in the previous four months and indicating an abundance of opportunities for PE players.

The November deals included three valued at over $500 million and three deals with an estimated value of over $100 million each. In November last year, the number of deals had fallen sharply to 39 and they were totally valued at $448 million. The total PE activity yearto-date is $31.3 billion, compared to $18.4 billion in the same period last year.

Paytm’s funding was the largest raised by an Indian ecommerce company in 2019. Travel and logistics remained the favoured segment in the month, followed by fintech and retail, together forming 73% of the total startup volumes.

“PE/VC transactions for the month outweighed M&A transactions. Though consortium transactions and single PE transactions equalled in overall deal values, in volume terms 39 consortium transactions and 16 single transactions were reported. A majority of the single PE/ VC-backed transactions are control transactions and done with the objective of paring debt in the group companies owning these businesses and facilitating target companies expand their product portfolio and market reach,” said Pankaj Chopda, director at Grant Thornton India.

November also witnessed media & entertainment and pharma & biotech sectors attracting big cheques. The focus of the sectors was to pay off loans and to strengthen the balance sheet and provide growth capital to support organic and inorganic initiatives for the focus markets. Banking and IT sectors also attracted investors, recording five and four investments during the month respectively.

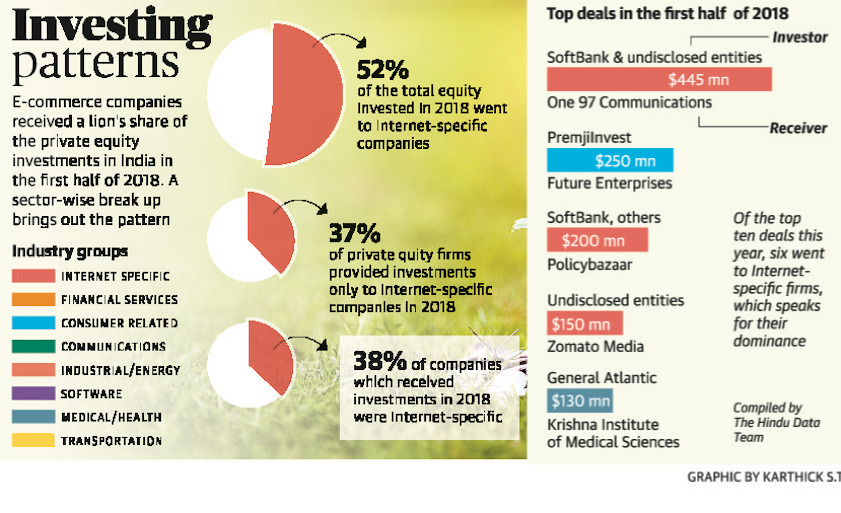

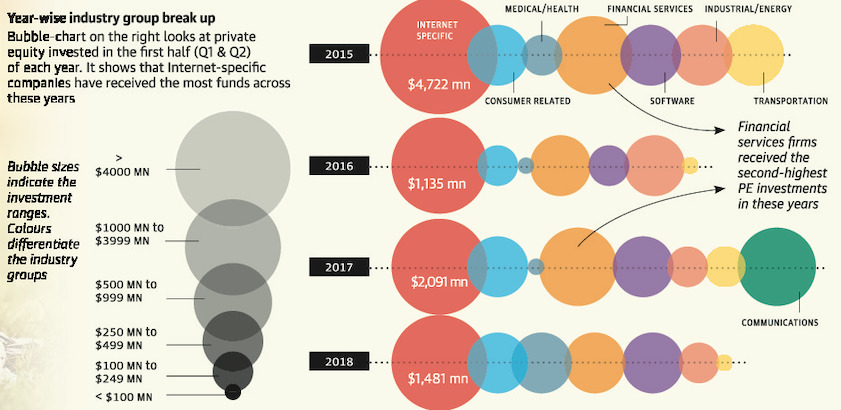

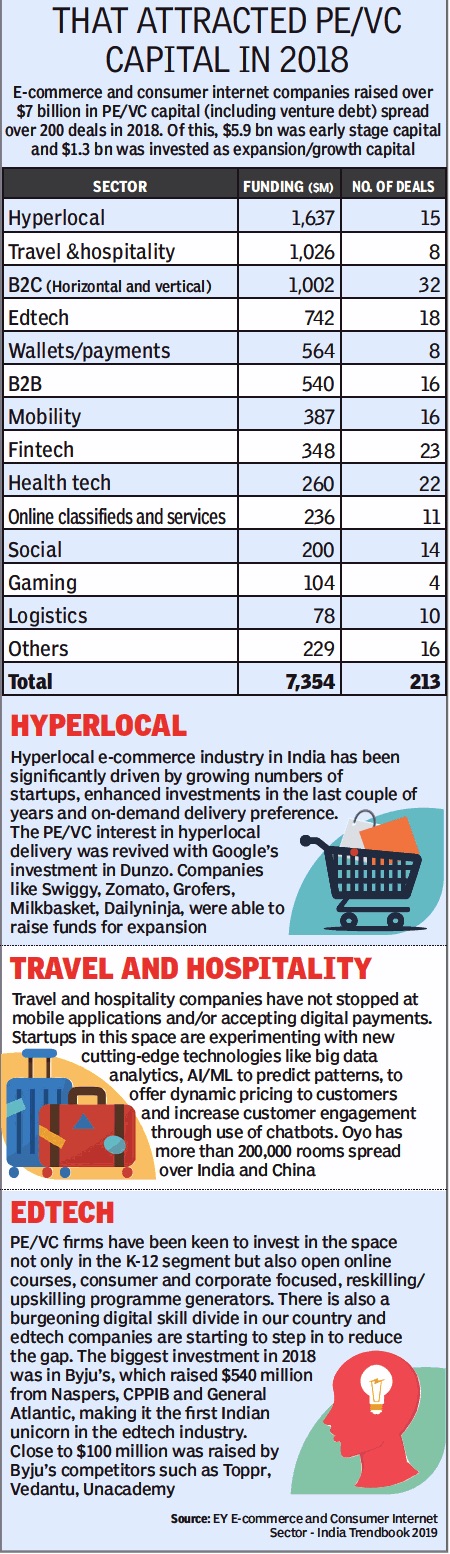

2018

From: July 16, 2019: The Hindu

From: July 16, 2019: The Hindu

Indian startups ended 2018 at an all-time high, as total value of Private Equity (PE) and Venture Capital (VC) investments in 2018 clocked a record amount of $33 billion.

Data from research firm Venture Intelligence showed a 36% increase in PE-VC investments during 2018 across 720 deals, compared to $24.3 billion invested across 734 deals in 2017. The country’s startup ecosystem entered a state of maturity in 2018 as investors were more selective with deals, but made higher value bets. There were 81 investments valued at $100 million or more in 2018, making up 77% of the total value. This tally stood at just 47 transactions in 2017. Among these 81 deals, 40 were larger than $200 million each, compared to just 30 such investments in the year-ago period, according to Venture Intelligence data.

The eventful year also saw eight startups across the B2C and B2B sectors — such as Oyo, PolicyBazaar, Swiggy, Byjus, BillDesk, Freshworks and others — enter the elite unicorn club. While historically, deal announcements are subdued at the year-end, Venture Intelligence data showed that December 2018 alone saw 43 deals valued at $3.2 billion, almost double the value of investments raised in the same period last year.

“The midyear Walmart-Flipkart deal clearly re-energised international investors’ appetite for mega bets in Indian internet and mobile companies,” Ärun Natarajan, founder, Venture Intelligence, said. “This has helped offset slowdown in investments in sectors like financial services, manufacturing and infrastructure towards the year end triggered by nervousness in the public markets and the IL&FS scare,” he added.

The year brought about an inflection point for the PE-VC industry in terms of exits as well. Value of exits achieved by investors during the year stood at $25.4 billion- a 78% increase from the exits clocked in 2017.

In line with previous years, IT and IT-enabled services companies accounted for close to 33% of the investment pie, thanks to Swiggy’s $1 billion raise in December from Naspers and others, and Oyo closing a $1 billion raise from SoftBank Vision Fund and others.

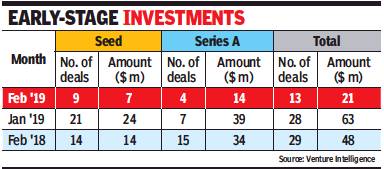

2018> 2019 Feb

Sindhu Hariharan, PE, VC funding up 14% on big-ticket push, March 5, 2019: The Times of India

From: Sindhu Hariharan, PE, VC funding up 14% on big-ticket push, March 5, 2019: The Times of India

Big-ticket deals in energy and infrastructure helped private investments hold their ground in February despite volatility in public markets, even as early-stage investments continued to lag.

Private equity (PE) and venture capital (VC) investments grew 14% in February to $1.96 billion worth of transactions across 38 deals, data from research firm Venture Intelligence said. Sequentially, PE-VC deals amounted to $1.71 billion from 56 deals in the previous month of January. High-value growth capital infusion in Greenko Energy, Aadhar Housing Finance, Ayana Renewable Power and others helped increase the investment value by 40% compared to February 2018, even as deal count fell 38% from the 62 investments recorded in the year-ago period.

“Private investments in February emerged as a positive ‘surprise’ given the volatility in the public markets,” Venture Intelligence founder Arun Natarajan said. “It is nice to see significant PE investments go into the energy and infrastructure space as we get closer to the elections.” Hyderabad-based energy firm Greenko Group picked up $550 million from sovereign funds GIC Holdings of Singapore and UAE’s Abu Dhabi Investment Authority (ADIA). Blackstone’s investment of close to $385 million in Aadhar Housing Finance, giving the PE firm 100% stake in the NBFC, also aided total growth.

Early-stage startups, however, continued to feel the pinch, as total value of seed and series-A investments declined 56% from the same month last year, and deal counts almost halved. Nine seed-stage deals and four series-A investments of $7 million and $14 million, respectively, were recorded in February.

Regulatory hurdles such as the angel tax and the overall investment climate among the angel investment community continues to impact seed and early-stage capital flow, Natarajan said. “Bigger, but fewer cheques being written for both startups and scale-ups indicates investors are getting more selective,” he added.

AI legal startup SpotDraft’s seed funding of $1.5 million from 021 Capital and other angels, and $4.5 million in series-A round raised by banking tech startup Open Financial Technologies from Beenext, 3ONE4 Capital and others were some of the top early-stage deals. Others in this segment included a $1-million pre-series-A round raised by fintech startup HomeCapital from Astarc Ventures and others.

Sequoia Capital’s open market stake sale in Ujjivan Financial Services worth $17 million, and SaaS startup Indix’s acquisition by US-based Avalara were a few significant exits. Among internet and digital enterprises, foodtech unicorn Zomato’s raise of $40 million in a round led by US-based Glade Brook Capital, $35 million raised by logistics tech startup Rivigo from Warburg Pincus and SAIF Partners, and $9.8-million funding by VC firm A91 Partners in beauty ecommerce entity Sugar Cosmetics were a few top deals.

Sector-wise

From: March 17, 2019: The Times of India

See graphic:

Major sectors that attracted PE, VC capital in 2018

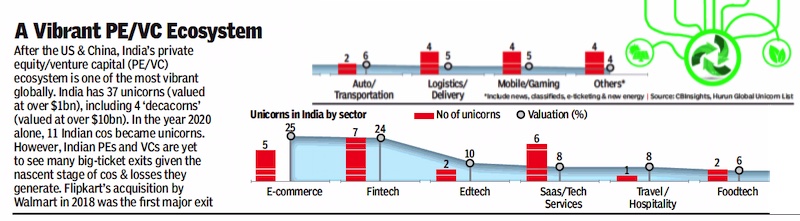

2019; 2017-19

Sindhu Hariharan, Dec 30, 2019 The Times Of India

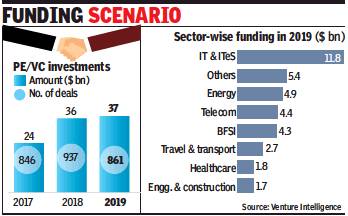

Amid turbulent times for the private equity (PE) and venture capital (VC) world in the US and China, 2019 was a recordsetting year for investments through this route in India. PE/VC investment activity (excluding real estate) rose to the highest ever level of $37 billion from 861 transactions this year on the back of large-ticket infrastructure deals, according to data from research firm Venture Intelligence “The fact that the PE investment tally of 2019 outdid the previous high of 2018 — despite uncertainties on the economic, political and global trade fronts during the year — is very encouraging,” Venture Intelligence founder Arun Natarajan said. But global and domestic slowdown will make investors cautious in 2020, he anticipates.

As many as 74 high-value deals worth $100 million or more were clocked in the year, accounting for 74% of the total value in the period.

Of these, there were five $1 billion+ investments, and 40 were larger than $200 million each, Venture Intelligence data shows. The year gave rise to nine new unicorns in the India startup world — Delhivery, Dream11, Bigbasket, Rivigo, Druva Software, Icertis, Citius Tech, Ola Electric and Lenskart.

Sectorally, infrastructure-oriented deals — including those in energy, transport, engineering/construction, etc — grew their share to 40% of the investment pie in 2019, recording $14.7 billion across 74 deals, compared to 20% share in 2018. The energy industry was led by Brookfield’s investment in Reliance Pipeline for over $1.8 billion. The Canadian investor, investing around $3.6 billion to acquire Reliance Jio’s tower infrastructure, was the top deal of the year.

IT & ITeS made up 32% of the investments ($11.8 billion across 493 deals), a marginal rise from the previous year. Paytm’s new top-up raise of $1 billion from Alibaba, SoftBank and others, towards end of 2019, was a top tech bet. Citius Tech’s $880-million raise from PE firm Baring Asia and others gave a boost to the enterprise software space.

2020

Partha Sinha, December 29, 2020: The Times of India

The onset of the pandemic and a sharp slide in the stock market in the early months of 2020 notwithstanding, companies raised a record amount of money through equity and quasi-equity routes this year.

Nearly Rs 1.8 lakh crore was raised during the year through a combination of initial public offerings (IPOs), qualified institutional placements (QIPs), offers for sale (OFSs) and follow-on public offerings (FPOs), data published by Prime Database showed. The year’s figure is higher than the Rs 1.6 lakh crore raised in 2017 and more than double the Rs 82,241-crore amount for 2019.

According to Pranav Haldea, MD, Prime Database Group, contrary to the despondency witnessed due to the pandemic, 15 mainboard IPOs came to the market. These collectively raised a little over Rs 26,600 crore — more than double the Rs 12,362 crore raised through 16 IPOs in 2019. Strong retail participation in the IPOs, huge listing gains and highestever amount raised through QIPs and InvITs/ReITs were the other key highlights of the year, Haldea said.

Top merchant bankers said that the fund-raisings during the year could be divided into two distinct parts. First till August, when companies mostly took the secondary offering route. Then several IPOs hit the market since September, starting with Happiest Minds Technologies. Between March and August, only one IPO — by Rossari Biotech — was closed successfully.

Soon after the pandemic set in, swift actions by governments and central banks to pump in a record amount of liquidity at ultra-low interest rates gave investors the confidence to buy into risky assets, including equities. “Capital markets rebounded faster than anticipated after the outbreak of the pandemic. Leading corporates like Reliance Industries, HDFC, ICICI Bank, Kotak Bank and Axis Bank, among others, were in the forefront raising large sized follow-on equity,” V Jayasankar, senior executive director & head of equity capital markets, Kotak Mahindra Capital, said.

On the other side, during the initial months of the pandemic, companies also recognised the looming uncertainty and “moved rapidly to raise defensive capital with differing objectives — deleveraging capital, insurance capital, confidence capital, opportunistic capital — to deal with nearterm uncertainty,” said Ravi Kapoor, head of corporate & investment banking, Citi India.

2021: Record $38bn private investor exits due to IPOs

Sindhu Hariharan, January 4, 2022: The Times of India

Chennai: Private equity and venture capital (PE-VC) investor exits hit a record high in 2021 at $38.7 billion across 270 deals due to a blockbuster year for public markets and hectic consolidation activity among digital enterprises.

The previous record was in 2018, when the Walmart-Flipkart deal had lifted exit value to around $26 billion. Exits by value grew fivefold from $7 billion in 2020 and the number of exits jumped 72% from 157 in 2020, according to data from Venture Intelligence, an agency that collates developments in this segment.

Many marquee investors with long-term bets in India clocked double-digit returns last year, analysts said. The increased number of exits in 2021 is likely to have a domino effect as LPs (limited partnerships) flush with funds will reinvest actively into the ecosystem, they added.

Venture Intelligence data showed that exits via strategic sales stood at $14.5 billion, up from $1.6 billion in 2020. About $11-billion worth secondary sales were made compared to $1.4 billion in 2020. Public market sales zoomed to $12 billion. With digital transformation taking centre stage in 2021, Hitachi’s acquisition of tech engineering services firm GlobalLogic for over $8 billion was the biggest exit of the year. PE major Carlyle’s move to acquire over 90% stake in IT solutions firm Hexaware for $3 billion was another large tech deal giving exit to Baring Asia. Fintech firm PayU’s acquisition of payment gateway BillDesk was another large deal offering billions in exits to General Atlantic, Temasek, Clearstone, TA Associates, and others.

Arun Natarajan, founder and MD, Venture Intelligence, said that the quantum of secondary sales, where both parties involved are large PE firms indicates the maturity of the ecosystem. “The IPOs, along with a string of successful liquidity events via secondary deals and strategic M&A will help establish the Indian PE-VC asset class on a firm footing on the global stage,” he added.

In terms of investments, PE-VC firms invested a record $63 billion (across 1,202 deals) in 2021 — a 57% rise over the $39.9 billion (across 913 deals) invested in the previous year.

Returns on exited investments

8% in 2006–2008; 22% in 2012–2014

Sindhu Hariharan, PEs’ returns jump to 22% from 8% in 5 yrs, December 4, 2018: The Times of India

From: Sindhu Hariharan, PEs’ returns jump to 22% from 8% in 5 yrs, December 4, 2018: The Times of India

Buyout Deals Most Rewarding, Finds Study

As optimism grows about the Indian alternate investment landscape, the country’s private equity (PE) industry is getting more rewarding for investors, a report has said. More specifically, PE investments in the last five years have fetched higher returns than ones made earlier.

“Average returns on exited investments have risen from 8% from the 2006–2008 vintage to 22% in the 2012–2014 vintage,” says the ‘Indian Private Equity: Coming Of Age’ report by McKinsey, which analyses a dollar internal rate of return (IRR) for a sample of 654 PE exits between 2003 and 2017.

The report also notes that buyout strategies (a deal in which majority ownership is acquired) earned the best returns for PE players with median returns at 21%. “Several private equity firms shifted focus from minority positions to buyouts, where they have greater control of strategy and talent as well as influence on the manner and timing of exits,” the report says. From 2015 to 2017, almost a quarter of total PE investments were in buyouts — up sevenfold in value from the 2009-2011 period.

Consumer goods, financial services, healthcare, IT/BPO, machinery & industrials and telecom collectively accounted for 83% of total PE investment from 2015 to 2017, compared to 44% share during the 2009-2011 period. Sectors that contributed the most to improving returns were financial services, consumer goods and machinery products as median returns in these were in the 15-21% range, with telecom pulling down performance for PE investors by recording a 3% median IRR.

The study also observes a trend of out-performance among companies backed by PE capital. In a reinforcement of the industry’s hunt for “alpha” ventures, the report says businesses with PE backing grew faster than industry averages, raising revenue and profit on an average 27% faster than their peers.

EY India partner and national leader for PE services, Vivek Soni, believes there is a high degree of correlation between fund managers closing follow-on funds and industry performance. “Those general partners (GPs) that are able to deliver returns will find it easier to raise follow-on funds, and this along with increasing numbers of total funds under management with GPs is an indication of improving returns,” he says.

“The growing pace of exits in the last few years with sustained growth is a big positive as Limited Partners previously cited the lack of exits as perhaps the biggest issue faced by them when investing into India,” says IVCA chairman and Tata Opportunities Fund managing partner Padmanabh Sinha. “The fact that exits are being achieved through a balanced mix of capital markets, strategic sales and sales to financial sponsors is also reassuring the availability of multiple exit options,” he adds.

For instance, industry watchers see recent exits’ track record of PE firms like Chrys Capital and Kedaara Capital as indicators of improving performance. Further, a fund-raise of around $600 million by True North Capital (one of the country’s earliest homegrown PE funds) for its latest Fund VI also supports the trend.

However, accessing performance data on PE and VC funds continues to be a challenge as regulations on disclosing returns are not too well developed. EY’s Soni considers the space to be “evolving” in that aspect, and says the trait of “survivor bias” currently characterising the space could change as the market matures.

Sector-wise

Hospitals: 2019-23

Rupali Mukherjee, January 1, 2024: The Times of India

Hospitals see 15x surge in PE-VC funds in 4 yrs

Investors Bet On Growing Demand After Covid

New Delhi : Investor interest in hospitals peaked this year with investments by private equity (PE) and venture capital (VC) firms rising by over 15 times to cross Rs 30,000 crore over a 4-year period from Rs 1,921 crore in pre-Covid 2019. This comes even as there is a slowdown in overall funding globally, with PE and VC investments declining 38% in India in 2023, the latest data from research firm Venture Intelligence showed.

The hospital sector was red hot this year, with large hospital chains such as Manipal and Max attracting bulge-bracket investment firms as demand for private healthcare surged post the pandemic. Other growth drivers include a growing ageing population, an increase in lifestyle ailments and rising incomes, which whetted investor appetite with PE firms snapping up established hospital groups and even single specialty hospitals.

“Covid 19 exposed the massive demand-supply gap in India’s healthcare delivery ecosystem and scarcity in motion on all fronts. All formats of healthcare delivery chains, whether multi-speci ality, single speciality, day care specialities, have shown tremendous appetite to grow and scale either through the organic or consolidation route. These potential industry tailwinds, growth of health insurance as a payor and the evolution of tier 2 cities as future growth markets have created a strong private equity interest in the sector which has also been matched by the strong demand for hospital stocks in public markets. As one of the fastest growing sectors in one of the fastest growing economies of the globe, we will continue to see phenomenal interest by private equity players in India’s healthcare ecosystem,” Vishal Bali, executive chairman of PE fund, Asia Healthcare Holdings, told TOI. The year witnessed 13 deals, marked by the $2.4-billion Manipal-Temasek mega deal, with Singapore’s sovereign wealth fund increasing its stake in Manipal Hospitals to 59% from 18%. Anot her big investment was Rs 5,775 crore by Blackstone in Care Hospitals.

“Merger and acquisitions (M&As) is the hottest segment of healthcare today. Finally, global PE firms are making a difference by investing and acquiring large network hospitals. A homogeneous network is of great attraction, and those of size and scale are attracting a premium. Hence, potential values have increased significantly,” Kannan Ramesh, senior partner Somerset Indus Healthcare fund, said.

Unicorns

2020

From: February 5, 2021: The Times of India

See graphic:

Indians Unicorns in 2020

B

Venture Capital Funding: India

India’s place in the world

2014: among world's top 3

Shilpa Phadnis

Jan 22 2015

India among world's top 3 VC destinations

India received the third highest venture capital funding ($4.6 billion) in the world in 2014, after US ($58.9 billion) and China ($8.9 billion). Bengaluru was fifth in a list of cities globally, an indication of the growing vibrancy of its startup ecosystem. San Francisco, one of three American cities in the top 5, led the list with $13 billion of VC investments, followed by Beijing ($6.4 billion), New York ($5.7 billion), Palo Alto ($3.2 billion) and Bengaluru ($2.6 billion). The list has been put together by Crunchbase, a global startup ecosystem database. Ravi Gururaj, chairman of the Nasscom Product Council, said India enjoyed a record crop of VC investments in the second half of 2014 and the wave was showing no sign of slowing down.

“This was kicked off by the historic election results which boosted investor confidence tremendously ,“ Gururaj said. “Additionally, private equity investors worldwide, particularly those that missed out on the meteoric rise in Chinese startup valuations, flocked to high performing Indian consumer startups determined not to miss out on a fast ride on the `India Startup Express'.“ Sanjeev Aggarwal, cofounder of Helion Ven ture Partners, said Bengaluru's lead position was because of its ability to attract tech talent. “The virtuous cycle kicked in with Infosys and Wipro, followed by global captives coming in large numbers.Engineers employed with companies like Google and Yahoo wanted to experiment with new ideas, and that has spawned a startup culture. Mobile apps and cloud have reduced entry barriers to build companies,“ he said. CrunchBase does not give a breakup of the investments in each city. In Bengaluru's case, a significant portion of the $2.6 billion would likely be on account of Flipkart's two rounds of funding that happened last year. The e-commerce company received an estimated $1.7 billion.

Parag Dhol, managing director of Inventus Advisors India, believes Bengaluru's startup ecosystem is beginning to have a multiplier effect. “You have an ecosystem where companies have gone public, there are good product startups, and new age entrepreneurs are turning into angels. In that sense, success begets success.Venture capitalists are looking at India with a fresh set of eyes,“ he saidAggarwal noted that capital was going particularly to the leaders who are building companies in large underserved markets, companies like Flipkart, Snapdeal and Ola. “Investors are paying a leadership premium,“ he said. Japanese internet giant Softbank invested $627 million in Snapdeal and $210 million in Ola Cabs in 2014.

China vis-à-vis India

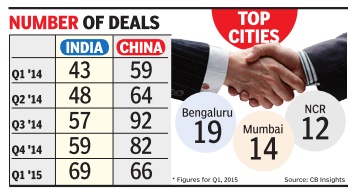

First quarter of 2015

The Times of India, May 02 2015

Anand J & Shilpa Phadnis

But dragon still dominates in total funding

India tops China in No. of tech VC deals

In a sign of the rising opportunities in India, the country outpaced China in the number of deals struck by venture capital (VC) funds in the first quarter of 2015. India saw 69 deals happening in the first quarter as against China's 66, according to a report by CB Insights, a New York-based firm that tracks VC funding. India saw the most deal growth among Asian countries, at 60% compared to the first quarter of 2014, when the number of deals stood at 43.

China was still ahead of India in terms of deal value at $2.99 billion. India's funding stood at $1.35 billion. For India, this was a rise of 225% over the same quarter of the previous year. Both countries reported a drop in the quantum of money raised from the last quarter of 2014. Japan saw 28 startup deals by VCs during the first quarter.Overall the top 3 countries in Asia accounted for 66% of all deals to VC-backed tech companies in Asia in Q1 of 2015.

Sunil Rao, country head of the startup programme in Google India, said India is on the same trajectory that China was in 2007-08 with respect to the number of startups emerging from the country and the number of internet users. “The country will reach 500 million nternet users in two-three years and the gap won't be much now . Even the GDP growth rates are around the ame levels,“ he noted.

According to the CB Insights, Chinese startups consti uted 12 of the top 15 startup deals in Asia while India star ups constituted the rest. For he first time, India has raised more than $1 billion for three consecutive quarters. Rao said China would continue to see arger valuations as it is a much arger market.

Mohan Kumar, partner, Norwest Venture Partners, said one quarter is too early to say anything about a trend. “Hav ng said that, China has recorded $3 billion in annual investment in the last five years.There are a few positives on he Indian side with the economy picking up steam. If we can eplicate China's growth in the last decade by growing at 10%, the catch-up could be possible in a few years. We have to give it 3-4 quarters before saying India is beginning to outshine China,“ he said.

Sequoia Capital was the most active investor in India in the quarter, the CB Insights report said. The VC firm participated in three of the six largest deals of the quarter FreeCharge, CarDekho, and NewsHunt. Tiger Global Management was the second most active investor, with multiple early-stage deals to companies including Grofers, News in Shorts, and MoonFrog Labs.“After a big Q4 2014 which featured six $500-million plus rounds, Asian VC-backed tech companies came slightly back down to earth, raising $4.8 billion on 247 deals. The funding total is still the second highest total since 2013, up 95% versus the same quarter a year prior,“ the report said.

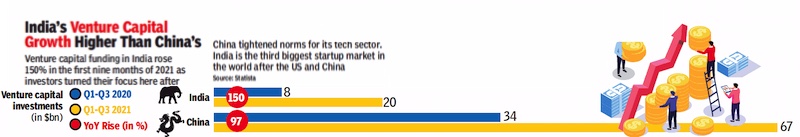

2020> 2021

From: Nov 25, 2021: The Times of India

See graphic:

Venture capital in China vis-à-vis India, 2020> 2021

Regions that attract Venture capital funds

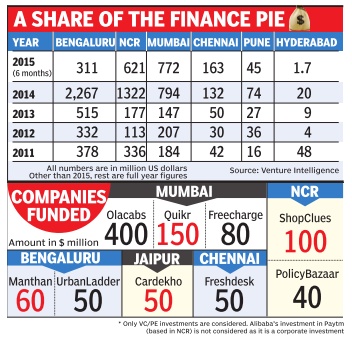

Mumbai and NCR ahead of Bangalore

The Times of India, Jul 10 2015

Anand J

Mumbai, NCR beat B'luru in VC funding

For the first time since 2011, Bengaluru has been surpassed by both the national capital region (NCR) and Mumbai in attracting venture capital (VC) funding. Data for the first six months of the year compiled by Venture Intelligence, a firm that tracks funding, finds that Bengaluru attracted $311 million in VC funds, while Mumbai received $772 million and NCR $621 million. The second half of the year tends to attract more VC funding, and a few big rounds could change this order. But the interesting thing is that Mumbai has received in the six months of this year as much funding as in the whole of last year, and Chennai has already received much more.

“Most big ecosystems have multiple hubs,“ said Rajesh Sawhney , founder and CEO, GSF Accelerator. While the US has strong centres like New York, Boston, Austin, Seattle and Atlanta, besides Silicon Valley, China has Shanghai, Beijing and Shenzhen, he said. The data is based on the cities that companies are registered in. Ola and Quikr are registered in Mumbai, but have moved their headquarters to Bengaluru. The two ventures were the biggest fund raisers in the first half, with Ola raising $400 million and Quikr raising $150 million. If headquarters and where the CEO sits are taken as the basis for the data, Bengaluru still remains on top.

NCR has been a big base for multinational companies, and its big consumer market has created large consumer internet companies like Snapdeal, Paytm and Zomato. “NCR has a good balance, with talent that has good IT product experience, and the city is not expensive like Mumbai. Apart from the Powai area near Mumbai, it is difficult to find hardcore technology talent in Mumbai,“ said T C Meenakshisundaram, founder and MD of IDG Ven tures, a venture capital firm.

Snapdeal opened a technology centre in Bengaluru this year. “At scale, companies will find even NCR to be talentcrunched. You won't find Bengaluru firms opening technology centres in NCR,“ said Meenakshisundaram, adding that Bengaluru will remain the Silicon Valley of India. Last year, the amount Bengaluru attracted was almost double that of NCR and thrice that of Mumbai. Chennai, Pune and Hyderabad were the other cities that attracted sizeable VC funds, but were almost one-fifth or onesixth for most years from 2011.

Pranay Chulet, CEO and co-founder, Quikr, an online classifieds portal that is valued at more than a billion dollars and which moved to Bengaluru six months ago, said, “Moving to Bengaluru was the right thing to do, and that is blindingly clear to us now.“

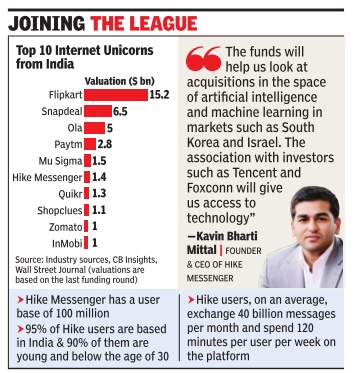

The unicorn club

2016

The Times of India, August 17, 2016

The unicorn club in India includes the likes of e-commerce biggies Flipkart and Snapdeal, taxi aggregator Ola, Paytm, data cruncher Mu Sigma and mobile ad network InMobi. When contacted by TOI, Quikr founder Pranay Chulet, an IIT-Delhi and IIMCalcutta alumnus, did not offer any comments on the secondary round in the company . However, private equity firm Kinnevik said in a statement while announcing its quarterly results that it had invested $20 million as a secondary share purchase in Quikr, making it the largest shareholder in the company . It has so far invested about $84 million controlling an 18% stake in the company . The secondary share transactions in July valued Quikr at $900 million, according to Kinnevik.

Amid all the cash burn and eye-popping valuations, early investors in India's bur geoning e-commerce sector are beginning to book profits.Exits of early investors via secondary transactions is a healthy trend considering most VCs have found very few exits in India.

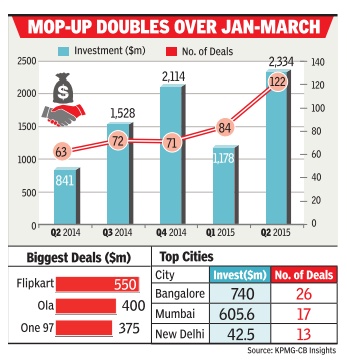

In April 2015, Kinnevik had invested $40 million, which was part of the $150-million funding led by Tiger Global. All told, Quikr has raised $350 million in capital (excluding the latest secondary round), and competes directly with OLX, which is backed by the South African internet and media giant Naspers. Financing in venture capital-backed companies in India soared to a total of $2.3 billion in the second quarter of this year, doubling from the January-March period, as earlyto-late stage investors continued to pour top dollar in the country's fast-growing emerging businesses. In this period, as many as 122 companies raised new financing rounds with the big-hitting hedge funds and other crossover investors propping up valuations in a heated tech market.

Bangalore-based companies raised $740 million across 26 deals, largely anchored by Flipkart's $550-million financing round, while Mumbai was second raising $605.6 million across 17 deals, including Ola's $400 million round led by DST Global, said a report by New York-based VC tracker CB Insights in partnership with KPMG.

“This is a banner quarter in India for both deals and dollars. Deals were up 94% and total investment was up 178% versus the same quarter a year prior. Tech made up almost 80% of all the VC-backed activity in India, including 9 of the 10 largest deals. Moving forward, we expect similar ranges for India. Funding will most certainly stay above $1 billion per quarter; however, megarounds like those seen in the past three months (four deals of $100 million and more) will dictate if quarterly funding reaches $2 billion or more,“ said CB Insights' Michael Dempsey .“We also expect to see the most active investors in Asia continue to invest heavily in India. A mix of traditional VC money , along with hedge funds, private equity investors and corporates like Tencent and Alibaba, helped funding shore up in Asia and India.“

In the three months ended June, Asian VC-backed companies, led by the likes of Flipkart, Ola and Korea's Coupang, collectively raised $10.1 billion across 313 deals, highlighting the fund-raising prowess of these Asian startups. Sequoia Capital India along with SAIF Partners topped as the two most active VC funds in all of Asia in the second quarter, according to the report.

“Up until a year ago, most of the large-scale funding was done by the bigger horizontal ecommerce players. But now we are seeing hyper growth in several segments like on-demand services in travel, food, real estate, classifieds and payments.This second wave of funding interest beyond e-commerce in different sectors shows the depth of the ecosystem,“ Google India managing director Rajan Anandan told TOI.

YEAR-WISE STATISTICS

1998-2014

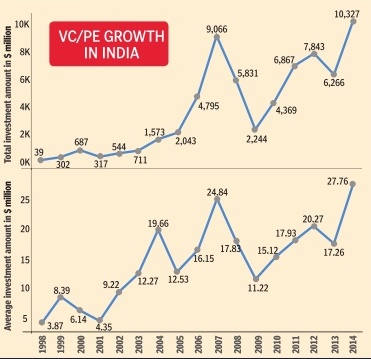

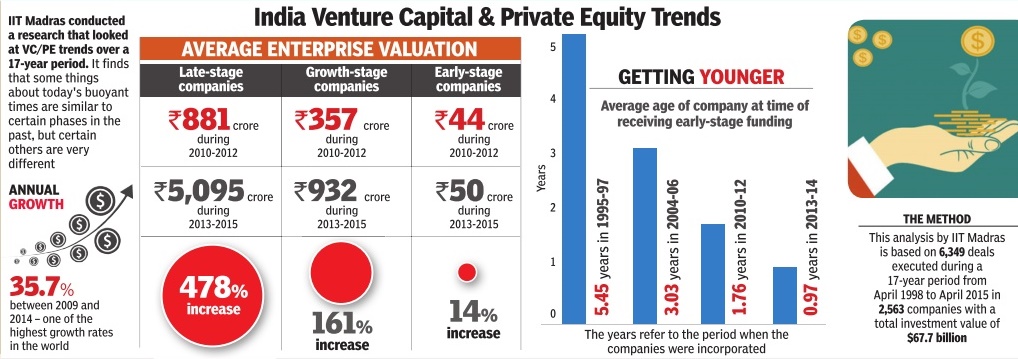

See the graphics,

' Venture capital/ private equity growth in India, 1998-2014; Average enterprise valuation '

' Venture capital/ private equity growth in India, 1998-2014; Average enterprise valuation2 '

April-June 2015

The Times of India, Jul 23 2015

Samidha Sharma & Anand J

VC-backed cos raise $2.3bn in Apr-June

Kinnevik, Falcon, Coatue participate in secondary round '

Online classifieds major Quikr is close to joining the elite group of tech companies valued at a billion dollars, also called unicorns, after it recently completed a $60-million secondary round. Existing Swedish investor Kinnevik and two new investors -hedge fund Falcon Edge and Coatue Management -participated in the latest round, valuing Quikr at $900 million.

Early investors in Quikr -including Matrix Venture Partners, Nokia Growth Partners, Norwest Venture Partners, Warburg Pincus and Omidyar Network -have part sold shares fetching them handsome returns, sources close to the development said. A secondary sale is when an existing investor sells shares to a new one or the promoter at the company's current valuation. The money does not come into the company's coffers.

2019> 2020

From: April 30, 2020: The Times of India

See graphic:

PE/ VC investments in India, 2019> 2020

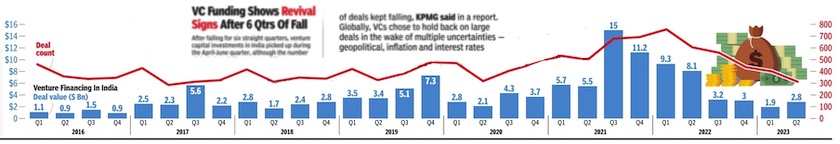

2016-2023

From: July 28, 2023: The Times of India

See graphic:

Venture financing in India, 2016-23

See also

Digital health technologies: India

Financial Secrecy Index and India

Foreign currency inflows, outflows: India

Foreign Direct Investment (FDI): India

Foreign exchange reserves: India

Foreign Institutional Investment (FII): India

Foreign Portfolio Investors (FPI): India

Private equity investments in India, this page includes statistics that club PE/ VC capital together

See also

Financial Secrecy Index and India

Foreign currency inflows, outflows: India

Foreign Direct Investment (FDI): India

Foreign exchange reserves: India

Foreign Institutional Investment (FII): India

Foreign Portfolio Investors (FPI): India

Private equity investments in India, this page includes statistics that club PE/ VC capital together