Information technology (IT) (business): India

(→Business Process Outsourcing (BPO)) |

(→Jobs created in the USA) |

||

| Line 55: | Line 55: | ||

Accenture’s US headcount grew from 32,318 in fiscal 2008 to just 38,000 in fiscal 2012. The percentage of the company’s US headcount as part of the total headcount declined from 18.6% to 14.8% during the same period. However, between fiscal 2006 and fiscal 2013, JP Morgan estimates that Indian IT added 38,000 locals to its US workforce. | Accenture’s US headcount grew from 32,318 in fiscal 2008 to just 38,000 in fiscal 2012. The percentage of the company’s US headcount as part of the total headcount declined from 18.6% to 14.8% during the same period. However, between fiscal 2006 and fiscal 2013, JP Morgan estimates that Indian IT added 38,000 locals to its US workforce. | ||

| + | |||

| + | =Restrictions placed by various countries on Indian IT= | ||

| + | ==2017 survey== | ||

| + | [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=Not-only-US-others-restrict-IT-pros-too-15092017024039 Sidhartha, Not only US, others restrict IT pros too, Sep 15, 2017: The Times of India] | ||

| + | |||

| + | |||

| + | The woes of Indian information technology companies are not limited to the US and extend from Australia to Canada as they not only have to grapple with visa curbs but also obscure rules that are open to interpretation by local authorities. Following the concerns brought out by Nasscom in a study , the government has started flagging the hurdles, many of which are against the commitments given by these countries at the World Trade Organisation or in trade agreements with India. | ||

| + | |||

| + | The study has brought out the fact that there is no match between the commitments given and the visa issued. The report comes at a time when India is seeking a permanent agreement for trade facilitation in services. Separately , it is pushing for liberal rules in Asean and other countries such as China, Australia and New Zealand, under the regional comprehensive economic partnership agreement, which will create one of the world's largest free trade areas. These countries are, however, reluctant to ease the rules, but are seeking sharp duty cuts for goods imported into India. | ||

| + | |||

| + | What makes it easier for other countries not to honour their commitments is the absence of any clarity on the number of visas that they have agreed to.Pointing to the US, Nasscom has said that it is the only country that partially mentions the visa category , H1, under WTO's agreement on trade in services (GATS) but there is nothing on offer for the information, com munication and technology category . Then, there are other conditions such as high fees to dilute the commitments. | ||

| + | |||

| + | Some rules could even be tweaked by countries. For example, Indonesia had notified a rule allowing one visa for every 10 local workers hired. | ||

| + | |||

| + | Other complaints revolve around the duration of the visa and the time taken to issue it, which can be long, and can often come with quotas. What makes life more difficult for Indian workers is the fact that many countries have not signed (and some are reluctant) social security agreements which will allow for contributions to be transferred once the employee returns to India. | ||

| + | |||

| + | There are other issues which have stalled the Indian IT sector's expansion drive, such as outdated definitions, said a government official. For instance, there is very little clarity on the definitions of contractual service providers, independent professionals and inter-corporate transfers, which results in lack of confidence among companies. | ||

| + | |||

| + | The industry also has to deal with subjective and discretionary elements of the commitments that have been given, resulting in interpretations that are only meant to block access. | ||

[[Category:India|I]] | [[Category:India|I]] | ||

Revision as of 10:33, 16 September 2017

Contents |

Indian information technology (IT) companies

This is a newspaper article selected for the excellence of its content. |

Indian IT companies double market share in 6 years

Shilpa Phadnis, TNN, Mar 27, 2013

Angel Broking's report explains Indian companies' gains saying that although the labour cost advantage for Indian IT had been on a declining trend, there still was a comfortable 20-25% cost saving for clients along with availability of a young workforce.

Rapid growth after 2006-07

BANGALORE: Indian IT outsourcers have more than doubled their share in total worldwide IT spends since 2006-07, and the bigger Indian IT companies have outpaced their MNC counterparts over this period.

India IT companies accounted for $31 billion, or 4.8%, of the worldwide IT spending of $641 billion in 2006-07. This year, it is estimated to be $77 billion, or 9.8%, of the global spending of $785 billion, according to research by brokerage firm Angel Broking.

The top global IT outsourcers

The research also looks at 13 of the top global IT outsourcers - eight MNCs and five Indian - and finds that the Indian outsourcers' share in the total revenues of the 13 companies has risen from 7.7% in fiscal 2007 to 14.3% in fiscal 2012, and that of the MNCs has dipped correspondingly from 92.3% to 85.7%.

Angel Broking's report explains Indian companies' gains saying that although the labour cost advantage for Indian IT had been on a declining trend, there still was a comfortable 20-25% cost saving for clients along with availability of a young workforce.

Moving up the value chain

Pradeep Udhas, partner and head of IT/ITeS in consultancy firm KPMG India, said Indian companies had developed people capabilities and moved up the value chain to pitch for bigger contracts.

Previously, Indian players were grouped together based on low-cost offerings sans any differentiation. Companies like Accenture and IBM made a positive impact on business issues especially around strategy. But in the last few years, Indian IT companies are able to sell a differentiated proposition, deepening the client relationship," he said.

Siddharth Pai, partner & MD of outsourcing advisory firm ISG, noted that not just Indian, even other regional IT players were steadily winning market share. "Companies like Xchanging and Atos are chipping away market share from MNCs with their specialized offerings," he said.

Angel Broking expects Indian IT companies to continue gaining share "going forward", but Pai strikes a note of caution. He said offshore services driven by labour arbitrage had a limited play.

Jobs created in India

Business Process Outsourcing (BPO)

India Today.in , Backroom Badshahs “India Today” 15/12/2016

As more and more universities began producing graduates for what was a relatively small job market till the 1990s, the arrival of Business Process Outsourcing (BPO) led to a louder hum of India's economic engine. With offshore companies handing out their backroom jobs to newly created 'offshore' subsidiaries, services such as these were in high demand. This spawned enterprises like GE Capital International Services-now a distinct entity called Genpact-and many others as well, and offered the burgeoning Indian middle class the kind of secure and aspirational jobs for which they had once relied on the government. The industry has grown rapidly, also leading to the growth of BPO training and recruitment agencies, as well as ancillary service providers such as security and facilities management companies. In recent years, most Indian BPOs, including small- and mid-sized players have been setting up 'onshore' presences in the markets they serve too. The global BPO industry is estimated to be worth about $150 billion, of which the offshore BPO industry is estimated to be some $11.4 billion. Though India has only about a six per cent share of the total industry, it has a commanding 63 per cent share of the offshore component.

Jobs created in the USA

Desi IT creates more jobs in US than American peers

Shilpa Phadnis TNN

The Times of India 2013/07/25

Bangalore: Indian IT companies have a better track record of creating jobs in the US over the past several years compared to their American peers like IBM and Accenture, notes a recent report by brokerage firm JP Morgan.

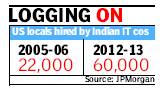

Since 2005-06, Indian IT companies are estimated to have added 30,000-40,000 jobs in the US, excluding green card holders.

Poor job creation by IBM and Accenture

But IBM has reduced its workforce in the US, and Accenture’s addition to its US workforce has been marginal IBM’s US headcount is estimated at 91,000 for 2012, down sharply from 133,789 in 2005, as per data put together by IBM’s employee union Alliance@IBM (the company itself stopped giving a geographic breakup of its employee strength in 2010).

In contrast, IBM added 1 lakh people in the last seven years, but all of it overseas. Its headcount in India rose from 36,000 in 2005 to an estimated 135,000 in 2012. Some believe it might be closer to 150,000 now. “India continues to remain a primary destination for global delivery and it’s not surprising to know that US companies are adding headcount here,” says Siddharth Pai, partner and president of Asia Pacific in advisory firm Information Services Group (ISG). “IBM’s focus seems more on margins in the face of stagnant top-line trends; workforce re-organization towards offshore/ lower-cost markets (such as India) and away from the US is perhaps one way of accomplishing this,” write Viju K George and Amit Sharma of JP Morgan.

Accenture’s US headcount grew from 32,318 in fiscal 2008 to just 38,000 in fiscal 2012. The percentage of the company’s US headcount as part of the total headcount declined from 18.6% to 14.8% during the same period. However, between fiscal 2006 and fiscal 2013, JP Morgan estimates that Indian IT added 38,000 locals to its US workforce.

Restrictions placed by various countries on Indian IT

2017 survey

Sidhartha, Not only US, others restrict IT pros too, Sep 15, 2017: The Times of India

The woes of Indian information technology companies are not limited to the US and extend from Australia to Canada as they not only have to grapple with visa curbs but also obscure rules that are open to interpretation by local authorities. Following the concerns brought out by Nasscom in a study , the government has started flagging the hurdles, many of which are against the commitments given by these countries at the World Trade Organisation or in trade agreements with India.

The study has brought out the fact that there is no match between the commitments given and the visa issued. The report comes at a time when India is seeking a permanent agreement for trade facilitation in services. Separately , it is pushing for liberal rules in Asean and other countries such as China, Australia and New Zealand, under the regional comprehensive economic partnership agreement, which will create one of the world's largest free trade areas. These countries are, however, reluctant to ease the rules, but are seeking sharp duty cuts for goods imported into India.

What makes it easier for other countries not to honour their commitments is the absence of any clarity on the number of visas that they have agreed to.Pointing to the US, Nasscom has said that it is the only country that partially mentions the visa category , H1, under WTO's agreement on trade in services (GATS) but there is nothing on offer for the information, com munication and technology category . Then, there are other conditions such as high fees to dilute the commitments.

Some rules could even be tweaked by countries. For example, Indonesia had notified a rule allowing one visa for every 10 local workers hired.

Other complaints revolve around the duration of the visa and the time taken to issue it, which can be long, and can often come with quotas. What makes life more difficult for Indian workers is the fact that many countries have not signed (and some are reluctant) social security agreements which will allow for contributions to be transferred once the employee returns to India.

There are other issues which have stalled the Indian IT sector's expansion drive, such as outdated definitions, said a government official. For instance, there is very little clarity on the definitions of contractual service providers, independent professionals and inter-corporate transfers, which results in lack of confidence among companies.

The industry also has to deal with subjective and discretionary elements of the commitments that have been given, resulting in interpretations that are only meant to block access.