Information technology (IT) (business): India

This is a collection of articles archived for the excellence of their content. |

Attrition

2021- 23

See graphic:

Attrition in the stop 7 IT firms of India, 2021- 23

2024- 2025

Veena Mani, January 24, 2025: The Times of India

From: Veena Mani, January 24, 2025: The Times of India

Bengaluru : Some Indian IT firms have shown an uptick in attrition rates, signalling a moderate pickup in the demand environment and opportunities opening up for specialised roles.

HCLTech’s attrition rate inched up to 13.2% from 12.9% in the previous quarter and 12.8% in the year-ago period. “Our attrition stands at 13.2% on an LTM basis, slightly higher compared to the previous quarter, which is a natural consequence of the demand pickup,” its CEO C Vijayakumar said during the earnings call.

The company’s HR head, Ramachandran Sundararajan, said that the attrition rate would stabilise and conclude FY25 at 13.2%. HCL added 2,134 employees in the Dec quarter, taking the total head- count to 220,755.

Among these firms, Wipro records the highest attrition at 15.3%, showing an increase from 14.1% in the first quarter. Nevertheless, the company’s leadership indicates that new resignations are decreasing and expects the attrition rate to decline. TCS saw an increase in attrition to 13% in the December quarter from 12.1% in the June quarter. Infosys also wit- nessed a rise, with rates climbing from 12.7% at the year’s outset to 13.7% at the current level.

Quess Corp IT staffing CEO, Kapil Joshi, says the spike in attrition is due to demand reviving in retail, manufacturing, and the BFSI. “Attrition is expected to stabilise at 12-13% by FY26 as the sector adjusts to moderated demand and implements optimised workforce strategies,” Joshi estimates. Experis’ president, Sanju Ballurkar, indicates that whilst current attrition rates are rising, they remain lower than the 20% witnessed during the pandemic period, primarily due to increased demand for AI-related expertise. Industry analysts suggest that global capability centres’ competitive recruitment practices have influenced these patterns. NLB Services’ CEO, Sachin Alug, suggests that IT services organisations need to match GCCs’ career advancement opportunities to regain their competitive position. The Dec quarter saw headcount decline, with three of five IT firms reporting decreased numbers. The top five Indian IT companies recorded a collective reduction of 2,587 personnel, contrary to the Sept quarter’s addition of 15,033 staff.

Banking, financial services and insurance (BFSI)

2014: Wipro joins the league

Wipro breaks into BofA's IT vendor league

Shilpa Phadnis Bangalore:

TCS, Cognizant and Infosys have been major vendors to Bank of America (BofA), one of the world’s biggest IT outsourcers. Now, the trio will have to contend with Wipro too. The Azim Premji promoted company has become an empanelled IT vendor to compete for BofA’s future requests for proposal (RFPs), sources with knowledge of the development said.

Among its peers, Wipro has the lowest revenues (as a proportion of total revenues) coming from the banking, financial services and insurance (BFSI) vertical — it’s 27% compared to TCS and Cognizant’s 42%.

Among all verticals, BFSI is the biggest IT outsourcer.

Wipro is seen to be now trying to expand its BFSI exposure.

It won a $500-million IT deal from Citibank last year, and now will compete for BofA deals. The $89-billion BofA is the second largest bank holding company in the US by assets. Its 2008 acquisition of Merrill Lynch made it the world’s largest wealth management corporation and a major player in the investment banking market.

“Clearly, this (Wipro’s entry) will contribute to increased pricing pressure for incumbents such as Infosys. BofA, like other large banks, is looking to drive further cost savings out of its global services portfolio,” Peter Bendor-Samuel, CEO of USbased research firm Everest Group, said. Multiple sources told TOI that Wipro’s hunting team has been tirelessly pursuing the marquee US bank for the last 20-odd months.

“We have been watching Wipro’s moves and can identify three components of its Bank of America Merrill Lynch (BAML) strategy,” said Pareekh Jain, principal analyst in US-based research firm HfS Research. The first component, he said, is hiring BAML-experienced talent from competitors at all levels. Wipro hired Shaji Farooq from Infosys in 2012. Farooq was the head of financial services for Americas in Infosys and was also the leader of the BAML account team. Balaji Yellavalli, who was head of client servicing for US financial services and insurance with Infosys, joined Wipro in April as the global head of industry consulting and large deals for banking, capital markets and insurance.

Jain said the second component of the strategy was to enhance its BFSI capabilities.“Over the last two-year period, Wipro acquired Opus (a platform-based mortgage solutions provider), and invested in Opera Solutions (a data analytics firm in BFSI), and part nered with SOA Software.

Some of these companies were already working for Bank of America,” he said. The third component is aggressive communication of Wipro’s capabilities in BFSI.

When TOI spoke to Wipro BFSI head Shaji Farooq on whether it was competing for BofA contracts, he said, “I can’t comment on customer-specific things. I don’t think it’s even true.” Farooq said they are constantly looking to expand the customer base in areas where they don’t have a presence.

A BofA spokesperson denied Wipro had been accorded a ‘preferred vendor’ status, but said any vendor could bid for its projects. BofA has several IT services vendors. Last year, it signed a 12-year, $1.4-billion deal with GardaWorld, a global risk management and security services company to manage its cash processing and check imaging services

2020

From: March 5, 2021: The Times of India

See graphic:

The Big 4 and BFSI, as in 2020

Brand value

2022

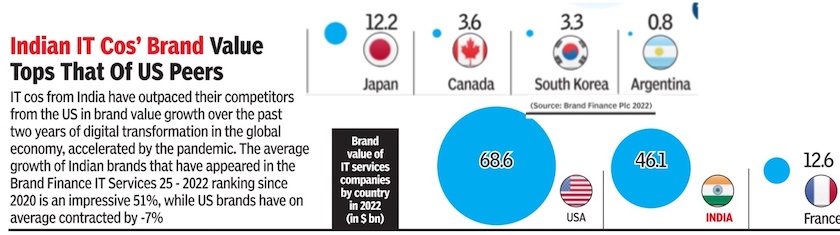

From: Feb 12, 2022: The Times of India

See graphic:

The Brand value in 2022 of IT companies from Argentina, Canada, France, Japan, S. Korea and the USA.

Countries that outsource work to India

2021

From: April 30, 2022: The Times of India

See graphic:

Countries that outsourced work to India, presumably in 2021

Employment

Employment generated by the sector

2025

Veena.Mani, Oct 17, 2025: The Times of India

From: Veena.Mani, Oct 17, 2025: The Times of India

Bengaluru : Indian IT is undergoing structural changes, reflected in shifting headcount trends and cautious hiring sentiment. As automation accelerates and AI increasingly drives efficiency, domain-specific skills are coming into sharper focus.

The top five Indian IT firms saw a net decline of 1,606 employees in the Sept quarter, compared to a net addition of 12,000 during the same period last fiscal year. The companies recorded a net addition of 3,800 in the June quarter and a reduction of 5,000 in the March quarter of FY25.

In the Sept quarter, barring TCS — which experienced a decline of nearly 20,000 — Infosys, Wipro, HCLTech, and Tech Mahindra collectively added a net total of 18,149 employees.

IT firms are increasingly facing twin challenges—rewiring their tech stacks to leverage AI for greater productivity while meaningfully scaling up, all amid ongoing customer pressure to deliver higher cost efficiency with fewer large deals. The lacklustre demand environment and cautious customer spend have shifted the sentiment from proactive campus hiring to a more calibrated, staggered approach. TCS’s headcount fell by nearly 20,000 employees in the Sept quarter, driven by planned layoffs, performance-related exits, resignations, and adjustments to bench policies affecting new hires. In its recent earnings conference call, its CHRO Sudeep Kunnumal said, “We are on a journey to build a stronger future for our associates, clients, and all other stakeholders. We will continue to nurture and recruit future relevant skills required for our growth across all markets. We will continue to be a net job creator.”

Neeti Sharma, CEO of Teamlease Digital, said India’s IT sector is undergoing a strategic recaliberation as firms streamline workforce structures and strengthen digital depth. “By investing in AI, automation, and upskilling, enterprises are fostering workforce agility—where skill intensity, not scale, defines future competitiveness.”

AI and cyber security

City-wise: 2025

From: July 4, 2025: The Times of India

See graphic:

Employment creation in AI and cyber security, City-wise: presumably as in 2023

Salaries

City-wise, 2025

From: July 4, 2025: The Times of India

See graphic:

Salaries of software engineers, City-wise: presumably as in 2022 or 2023

Exports

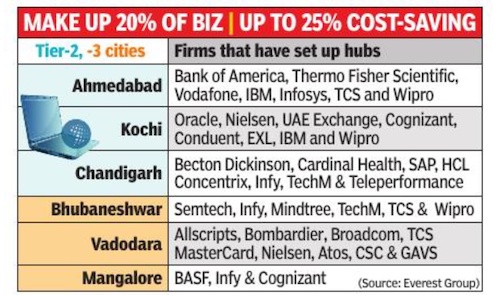

Shilpa Phadnis, Dec 8, 2022: The Times of India

From: Shilpa Phadnis, Dec 8, 2022: The Times of India

Bengaluru : Big cities in India account for the lion’s share of IT export services business. Now, tier-2 and -3 cities have also started morphing into global services delivery hubs. A report by US IT research advisory Everest Group has estimated that out of the $180-billion IT services exports revenue, about $36 billion was supported by tier-2 and -3 cities. This trend has been driven by the need for risk diversification, cost savings, access to untapped talent pool and lesser market congestion.

The report said that tier-2/3 centres are being leveraged as a spoke or satellite, and business continuity planning (BCP) location tosupport tier-1 hubs. While tier-1 hubs are primarily leveraged for scaled global services delivery, tier-2/3 centres cater to a mix of global and domestic operations. Tier-3 cities have the highest share for domestic services. The report highlights how tier-2 cities like Ahmedabad, Kochi, Coimbatore, Thiruvananthapuram and Indore are being leveraged to support application development and support services.

Many companies are setting up centres of excellence (CoEs) and innovation centres focusing on next-generation services such as AI and cybersecurity. While Bengaluru, Hyderabad, and Pune stood out as the most preferred locations for thiswork, tier-2/3 cities experienced an uptick with companies exploring these markets for untapped talent potential at moderate cost arbitrage over tier-1 hubs.

Tier-2 locations involve 10-15% lower cost of operations than tier-1 cities, they have a large untapped talent pool, and 10-15% lower attrition rates than in tier-1 cities, which translates into lower hiring and training costs. Tier-3 cities offer 20-25% cost savings over tier-1 cities.

However, these tier-2/3 centres have their own set of challenges. In tier-2 cities, scaling beyond 1,000-2,000 FTEs (full-time equivalents) is a challenge in some locations, and poor connectivity poses a downside. The majority of leadership talent needs to be relocated from tier-1 cities for the initial few years.

HR policies

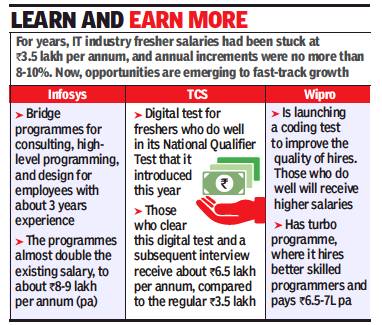

2018: salaries, increments, internal tests

From: Shilpa Phadnis & Avik Das, November 27, 2018: The Times of India

See graphic:

The HR policies of Infosys, TCS and Wipro regarding salaries, increments and internal tests/ as in 2018.

2018: staff bias suits

Most desi IT cos sued for staff bias in 2018, January 2, 2019: The Times of India

From: Most desi IT cos sued for staff bias in 2018, January 2, 2019: The Times of India

A recap of lawsuits filed in 2018 against IT services companies varied from employment discrimination to deficiency of services and class-action suits, besides a few going into arbitration. Some have settled out of court, but others are in no mood to give up yet.

Wipro, for instance, effected a $75-million settlement with its decade-old customer National Grid for release of all claims under a lawsuit the latter filed in a New York district court in 2017.

National Grid supplies energy to more than 20 million people through its networks in New York, Massachusetts, and Rhode Island. The electricity, natural gas, and clean energy delivery company had filed a lawsuit against Wipro, seeking damages of $140 million and additional costs related to an enterprise resource planning (ERP) implementation project.

Tata Consultancy Services won an employment discrimination case after a court in California acquitted the company of charges that it had bias towards Indian employees over US residents. Another oft-repeated accusation has been Indian firms abusing the H-1B visa process to bring Indians to the US rather than hire locals. In a similar case, a former HCL Technologies employee in the US filed a case against the company, alleging it promoted and chose H-1B visa holders to work on a project, who were mostly Indians.

Cognizant has been awarded a partial relief in a classaction lawsuit filed in the US against its CEO Francisco D’Souza, CFO Karen McLoughlin and former president Gordon Coburn on allegations of improper payments related to securing SEZ licences in India that were a possible violation of the Foreign Corrupt Practices Act (FCPA). The lawsuit said Cognizant signed agreements in 2015 to expand its global delivery centre in Coimbatore and Chennai, which could house 20,000 professionals. The lawsuit alleged payments were then booked as capital expenditures rather than operating expenses, disguising the payments and inflating the reported investments in SEZ facilities. In March last year, Cognizant said it had incurred $27 million in costs related to the FCPA investigation and related lawsuits.

US news website Axios reported that San Francisco-based Northgate Capital sued Tech Mahindra after the latter missed a payment schedule.

2018> 19: Attrition

Sindhu Hariharan, August 12, 2019: The Times of India

From: Sindhu Hariharan, August 12, 2019: The Times of India

Attrition rates at top-tier IT companies have peaked to a two-year high due to a shortage of suitable digital talent in India and on-site. The April-June quarter is traditionally a high-attrition period. But this year, rates have risen sharply in some companies (see graphic).

Infosys reported an attrition rate of over 23% in the recent quarter ended June — an increase of 300 basis points (100bps = 1 percentage point) from the preceding March quarter. Tech Mahindra’s attrition rate was up 21% from 19% in the year-ago period. At mid-tier IT firm L&T Infotech, the attrition rate of 18.3% was over 3 percentage points higher than the 15% in April-June 2018.

“Historically, when business was relatively stable, we used to have attrition of 13-15%. But today, we see a lot of disruptions happening, a lot of shortage of talent, a lot of new technologies coming into place, a lot of demand for skills,” Infosys COO Pravin Rao said in the earnings call. Infosys said a large part of its attrition was at the lower level and also included involuntary attrition. It added that it is working to correct this in the coming quarters.

Traditionally, employees leave for higher studies or collect bonuses and exit in this quarter. But constraint in supply of the right talent in both Indian and US markets is also leading to a rising churn at IT companies, industry trackers told TOI. “We continue to focus on our workforce strategy and management, such as the announced retention programme to recognise and retain our best talent,” Cognizant CFO Karen McLoughlin said.

“Attrition rates increased 20-400bps year-on-year in the quarter and are beyond the comfort range for many companies,” Kawaljeet Saluja of Kotak Institutional Equities wrote in a research note. Though IT companies maintain that this attrition is not impacting project execution, Saluja said it is leading to an increased reliance on sub-contractors to fulfil demand.

Prabhudas Lilladher analyst Aniket Pande said the tightening of H-1B visa norms has led to a talent crunch in the US, and with lesser opportunities for Indian staff to go on-site, voluntary attrition among freshers is also up. Even as net hiring went up across the board in the April-June quarter and utilisation remained stable at an average 80%, finding the right talent for new-age digital projects has been a challenge for IT players.

“Historically, when business was relatively stable, we used to have attrition of 13-15%. But today, we see a lot of disruptions happening, a lot of shortage of talent, a lot of new technologies coming into place, a lot of demand for skills,” Infosys COO Pravin Rao said in the earnings call. Infosys said a large part of its attrition was at the lower level and also included involuntary attrition. It added that it is working to correct this in the coming quarters.

Traditionally, employees leave for higher studies or collect bonuses and exit in this quarter. But constraint in supply of the right talent in both Indian and US markets is also leading to a rising churn at IT companies, industry trackers told TOI. “We continue to focus on our workforce strategy and management, such as the announced retention programme to recognise and retain our best talent,” Cognizant CFO Karen McLoughlin said.

“Attrition rates increased 20-400bps year-on-year in the quarter and are beyond the comfort range for many companies,” Kawaljeet Saluja of Kotak Institutional Equities wrote in a research note. Though IT companies maintain that this attrition is not impacting project execution, Saluja said it is leading to an increased reliance on sub-contractors to fulfil demand.

Prabhudas Lilladher analyst Aniket Pande said the tightening of H-1B visa norms has led to a talent crunch in the US, and with lesser opportunities for Indian staff to go on-site, voluntary attrition among freshers is also up. Even as net hiring went up across the board in the April-June quarter and utilisation remained stable at an average 80%, finding the right talent for new-age digital projects has been a challenge for IT players.

Information Technology, India and the world

2013: Global rank of India’s biggest IT services providers

TCS joins top 10 global IT services cos club

Shilpa Phadnis, Bangalore:TNN Apr 22 2014 The Times of India

The country's largest IT services provider, Tata Consultancy Services (TCS), has broken into the league of top 10 global IT services companies, moving from the 13th position in 2012 to the 10th spot in 2013. Twelve years ago, when TCS' revenues were about $1 billion, then CEO S Ramadorai had laid out a vision to be among the top 10 by 2010. It's taken a little longer, partly because of the global financial slump of 2008-09, but the company has now got there, and considering the pace at which it is growing compared to its global counterparts, the ranking could get better fairly quickly in the years to come.

“Talk to any incumbent western service provider today , and the one making them all tremble from the sub-continent is TCS,“ writes Jamie Snowdon, executive VP of research operations at HfS Research, the consultancy firm that compiled the ranking.

TCS is estimated to have IT services revenues of $10.1 billion (out of its total revenues of about $12.5 billion). IBM ($54.4 billion), Fujitsu ($32.1 billion), Hewlett-Packard ($29.2 billion) and Accenture ($25.4 billion) lead the list. The research compares IT services, and excludes other areas such as BPO, R&D services and software/hardware products. And it uses figures for the four quarters of calendar year 2013. TCS rose to the 10th spot displacing Montreal-based IT services firm CGI.

India-based companies Cognizant, Infosys, Wipro and HCL are at the 15th, 18th, 20th and 25th positions, respectively , all of them rising by one to three spots compared to 2012. HfS Research believes that Cognizant could be in the top 10 in the next 2-3 years, may be at the expense of US IT company CSC. CSC's revenues last year had dropped compared to the year before.

On TCS, HfS says its aggressive targeting of renewals and new business, particularly in continental Europe, was an im portant factor in driving its assault on the leaders.

TCS, it said, is frequently seen as being the most flexible service provider on pricing and terms, and has a developing reputation for winning any deal anywhere in the world at any price, if it really wants.

“The firm is increasingly being perceived by many today as an alternative provider to the Western Tier 1s, that can come in and fix messy contracts and implementations; it has shown an appetite and willingness pick up a lot of the low-margin, low value work that seemingly every Western Tier 1 wants out of and make the deals profitable and leverageable across clients,“ said Phil Fersht, CEO of HfS. TCS also has an extraordinary profit margin, something that's normally difficult to achieve in conjunction with high revenue growth. TNN

Salaries

2022

From: June 25, 2025: The Times of India

See graphic:

The average salary of a software engineer in Bengaluru and elsewhere in the world in 2022

Jobs created in India

Business Process Outsourcing (BPO)

India Today.in , Backroom Badshahs “India Today” 15/12/2016

As more and more universities began producing graduates for what was a relatively small job market till the 1990s, the arrival of Business Process Outsourcing (BPO) led to a louder hum of India's economic engine. With offshore companies handing out their backroom jobs to newly created 'offshore' subsidiaries, services such as these were in high demand. This spawned enterprises like GE Capital International Services-now a distinct entity called Genpact-and many others as well, and offered the burgeoning Indian middle class the kind of secure and aspirational jobs for which they had once relied on the government. The industry has grown rapidly, also leading to the growth of BPO training and recruitment agencies, as well as ancillary service providers such as security and facilities management companies. In recent years, most Indian BPOs, including small- and mid-sized players have been setting up 'onshore' presences in the markets they serve too. The global BPO industry is estimated to be worth about $150 billion, of which the offshore BPO industry is estimated to be some $11.4 billion. Though India has only about a six per cent share of the total industry, it has a commanding 63 per cent share of the offshore component.

2017: a decline in employee count

From: Avik Das & Shilpa Phadnis, Major IT cos reduce employee strength, November 2, 2017: The Times of India

Headcount At Top 6 Industry Leaders Drops By 4,157 In First 6 Mths Of Fiscal

The $156-billion Indian IT industry, often called the biggest job creator in the organised sector, is seeing a tectonic shift in recruitment.

For the first six months of the fiscal, Cognizant, Infosys, Wipro and Tech Mahindra have all seen their employee strength actually decline -quite sharply in Cognizant's case (by over 5,000). TCS and HCL Technologies are the only exceptions among India's top six IT companies, but even TCS' addition is a fraction of what it did in the first six months of the previous fiscal. The headcount of all of the six companies put together dropped by 4,157 in the first six months of this fiscal, compared to an increase of almost 60,000 in the same period last year.

“The industry is standing at a crossroads. The journey toward digitisation and automation provides a plethora of opportunities, but with the same token also a myriad of challenges. Hiring for some of the Indian majors has not only decelerated, but for the first time we have seen a decrease of headcount,“ Tom Reuner, SVP of intelligent automation and IT services at IT consulting firm HfS Research, said.

Several factors are at work. Automation is making thousands of entry-level jobs redundant. Companies are improving their employee-utilisation levels, and keeping fewer people on the bench. In the traditional spaces of application development & maintenance, and infrastructure maintenance, growth is down. And while companies are looking to hire people with specialised skill sets in newer areas such as data science, machine learning, artificial intelligence and internetof-things, the growth rate in these spaces and the nature of the business do not necessitate large-scale hiring. Peter Bendor Samuel of outsourcing research firm Everest Group told TOI, “The employment picture in Indian IT is changing rapidly. The intake of new campus hires in the Indian IT industry is dramatically down and looks to continue to fall. The industry will continue to be a great place for engineers with the right skills in AI, automation, and other digital skills that are in high demand. However, for those individuals who have traditional IT skills, the picture changes dramatically.“

Following Infosys' second quarter results, CFO M D Ranganath said the decline in headcount was because of higher utilisation and productivity improvements.Wipro president and chief human resources officer Saurabh Govil said last month the industry has moved away from headcountlinked growth. “We have improved our utilisation....We are focusing on re-training our existing people,“ he said.

Industry body Nasscom had projected that the industry would add 1.3-1.5 lakh jobs in the current fiscal. Looks like that can at best be a gross hiring figure. Excluding those who voluntarily exit the industry or are asked to go, it appears that if there is some overall increase in headcount in the industry , it will be quite modest.

Jobs created in the USA

Desi IT creates more jobs in US than American peers

Shilpa Phadnis TNN

The Times of India 2013/07/25

Bangalore: Indian IT companies have a better track record of creating jobs in the US over the past several years compared to their American peers like IBM and Accenture, notes a recent report by brokerage firm JP Morgan.

Since 2005-06, Indian IT companies are estimated to have added 30,000-40,000 jobs in the US, excluding green card holders.

Poor job creation by IBM and Accenture

But IBM has reduced its workforce in the US, and Accenture’s addition to its US workforce has been marginal IBM’s US headcount is estimated at 91,000 for 2012, down sharply from 133,789 in 2005, as per data put together by IBM’s employee union Alliance@IBM (the company itself stopped giving a geographic breakup of its employee strength in 2010).

In contrast, IBM added 1 lakh people in the last seven years, but all of it overseas. Its headcount in India rose from 36,000 in 2005 to an estimated 135,000 in 2012. Some believe it might be closer to 150,000 now. “India continues to remain a primary destination for global delivery and it’s not surprising to know that US companies are adding headcount here,” says Siddharth Pai, partner and president of Asia Pacific in advisory firm Information Services Group (ISG). “IBM’s focus seems more on margins in the face of stagnant top-line trends; workforce re-organization towards offshore/ lower-cost markets (such as India) and away from the US is perhaps one way of accomplishing this,” write Viju K George and Amit Sharma of JP Morgan.

Accenture’s US headcount grew from 32,318 in fiscal 2008 to just 38,000 in fiscal 2012. The percentage of the company’s US headcount as part of the total headcount declined from 18.6% to 14.8% during the same period. However, between fiscal 2006 and fiscal 2013, JP Morgan estimates that Indian IT added 38,000 locals to its US workforce.

IT companies with highest number of approved H-1B visa petitions/ 2017

April 26, 2018: The Times of India

H-1B visa approvals for Indian IT companies drop by 43% between 2015-17, claims a report from US think tank National Foundation for American Policy (NFAP). Wonder which were the companies that had maximum number of approved H-1B visa petitions during the fiscal year 2017? US Citizenship and Immigration Services' (USCIS) website lists companies on the basis of 'total number of approved petitions'. The data also shows average salary offered by these companies. This average salary is based on data reported by the petitioner in the petition and may include part-time employment.

Here are the 40 companies with highest number of approved H-1B visa petitions during the fiscal year 2017.

1. Cognizant Technology Solutions U.S. Corporation: Total number of approved petitions stood at 28,908; average salary: $85,429

2. Tata Consultancy Services Limited: Total number of approved petitions stood at 14,697; average salary: $73,505

3. Infosys Limited: Total number of approved petitions stood at 13,408; average salary: $85,717

4. Wipro Limited: Total number of approved petitions stood at 6,529; average salary: $75,082

5. Deloitte Consulting LLP: Total number of approved petitions stood at 6,027; average salary: $106,797

6. Accenture LLP: Total number of approved petitions stood at 5,070; average salary: $83,573

7. Tech Mahindra (Americas), Inc: Total number of approved petitions stood at 4,931; average salary: $78,443

8. Amazon.com Corporate LLC: Total number of approved petitions stood at 4,767; average salary: $118,637

9. HCL Technologies Limited: Total number of approved petitions stood at 4,392; average salary: $87,978

10. Microsoft Corporation: Total number of approved petitions stood at 4,069; average salary: $130,259

11. Capgemini America, Inc: Total number of approved petitions stood at 3,580; average salary: $84,667

12. IBM India Private Limited: Total number of approved petitions stood at 3,000; average salary: $79,916

13. Google Inc: Total number of approved petitions stood at 2,986; average salary: $134,419

14. Intel Corporation: Total number of approved petitions stood at 2,625; average salary: $104,691

15. Syntel Consulting Inc: Total number of approved petitions stood at 2,119; average salary: $70,258

16. Apple Inc: Total number of approved petitions stood at 2,055; average salary: $142,974

17. Larsen & Toubro Infotech Limited: Total number of approved petitions stood at 1,864; average salary: $78,737

18. Cisco Systems, Inc: Total number of approved petitions stood at 1,587; average salary: $128,389

19. Facebook, Inc: Total number of approved petitions stood at 1,566; average salary: $144,812

20. Oracle America, Inc: Total number of approved petitions stood at 1,546; average salary: $123,049

21. L&T Technology Services Ltd: Total number of approved petitions stood at 1,481; average salary: $68,437

22. Deloitte & Touche LLP: Total number of approved petitions stood at 1,410; average salary: $87,820

23. Mphasis Corporation: Total number of approved petitions stood at 1,410; average salary: $84,081

24. UST Global Inc: Total number of approved petitions stood at 1,059; average salary: $71,332

25. IBM Corporation: Total number of approved petitions stood at 1,051; average salary: $120,308

26. Mindtree Limited: Total number of approved petitions stood at 967; average salary: $75,677

27. Hexaware Technologies Limited: Total number of approved petitions stood at 955; average salary: $78,938

28. Qualcomm Technologies Inc: Total number of approved petitions stood at 921; average salary: $117,872

29. NTT Data Inc: Total number of approved petitions stood at 806; average salary: $90,213

30. Synechron Inc: Total number of approved petitions stood at 761; average salary: $86,764

31. Virtusa Corporation: Total number of approved petitions stood at 736 ; average salary: $99,525

32. Capital One Services, LLC: Total number of approved petitions stood at 690; average salary: $109,860

33. Cummins Inc: Total number of approved petitions stood at 686; average salary: $87,998

34. Salesforce.com: Total number of approved petitions stood at 650; average salary: $141,444

35. eBay Inc: Total number of approved petitions stood at 588; average salary: $146,400

36. VMware Inc: Total number of approved petitions stood at 565; average salary: $134,205

37. LinkedIn Corporation: Total number of approved petitions stood at 516; average salary: $150,406

38. PayPal Inc: Total number of approved petitions stood at 512; average salary: $138,286

2017-19

Shilpa Phadnis, April 24, 2019: The Times of India

From: Shilpa Phadnis, April 24, 2019: The Times of India

Indian IT firms are building up a high-performance sales force in the US, all the way up to the front-line sales reps who have the chops to hunt for new pursuits. The hustler’s playbook carries the mandate of farming target accounts, prospecting and creating a sales pipeline aligned to US customers.

In a move to accelerate its localisation efforts, Infosys and Wipro have hired 10,000 and 6,000 people respectively in the US over the last three years. TCS has added 17,000 people in the US in the last five years. These numbers include 600 sales personnel at Infosys and Wipro each in the US over the last three years, who are tasked with adding new customers to its rosters and mining large accounts effectively. Sources told TOI that TCS has a robust account management team in the US that doubles up as sales team and maintains a lean model onsite. Unlike other IT firms, which have a defined sales structure in the US, TCS has a sizeable account pursuit team based in India too. TCS and Infosys declined to comment on the story. Infosys, for instance, has doubled its large deal wins to $6.28 billion in the financial year 2018-19 compared to the previous one. In the March quarter alone, it signed $1.57 billion worth of large deals. Though TCS has championed the art of getting invited to multi-billion dollar deals, Infosys has seen some green shoots in other large deals in the last few quarters as custodians of managing client relationships effectively. Phil Fersht, CEO of HfS Research, attributes the new spate of large deal signings to a change in focus to invest in clients in its chosen verticals when it can grow longterm and the perception of stability from clients. These sales personnel based in the US are dooropeners who not only track lead identification and pursuits, but are responsible for region-based aggregate revenue/margin numbers. These sales personnel in the US come with an average salary of $175,000-$200,000 plus commissions based on accrued revenues, sources said. The fixed plus variable ratio comes in different sizes—70:30 or 60:40 ratios.

But the challenges have grown with customers embracing newer digital technologies. “People want to move away from mainframes but a large part of BFSI is tied to it. Moving to the cloud is one thing, but the modernization of applications is a big thing,” said a sales executive on the condition of anonymity. Besides the large deal bonus, the salesman’s fortunes are tied to actual revenues and not just booking targets. “You can’t just match the target price. You have to factor the transition cost and get the math right because the mismatch can be glaring when the delivery team gets down to brass-tacks when they provision for resources,” he said.

Wipro CEO Abidali Neemuchwala said the firm invested in honing digital capabilities three years ago, that includes significant investments in sales and consulting capabilities. “They can command a premium price and create downstream work,” he said. The firm runs a programme called Prism to encourage high-performance delivery leads to cross over to the sales organisation. There are over 100 senior delivery personnel who have moved to sales in Wipro. “Hunters are not driven by hierarchy. They have a complete list of must-have accounts to go after and are paid commission in commensurate with the deals they bring to the table. Wipro has 200 hunters and most of them are based in the US,” said its president and chief human resources officer Saurabh Govil.

The increase in IT Companies' market share 2007-12

IT Companies 2013

Indian IT companies double market share in 6 years

Shilpa Phadnis, TNN, Mar 27, 2013

Angel Broking's report explains Indian companies' gains saying that although the labour cost advantage for Indian IT had been on a declining trend, there still was a comfortable 20-25% cost saving for clients along with availability of a young workforce.

Rapid growth after 2006-07

BANGALORE: Indian IT outsourcers have more than doubled their share in total worldwide IT spends since 2006-07, and the bigger Indian IT companies have outpaced their MNC counterparts over this period.

India IT companies accounted for $31 billion, or 4.8%, of the worldwide IT spending of $641 billion in 2006-07. This year, it is estimated to be $77 billion, or 9.8%, of the global spending of $785 billion, according to research by brokerage firm Angel Broking.

The top global IT outsourcers

The research also looks at 13 of the top global IT outsourcers - eight MNCs and five Indian - and finds that the Indian outsourcers' share in the total revenues of the 13 companies has risen from 7.7% in fiscal 2007 to 14.3% in fiscal 2012, and that of the MNCs has dipped correspondingly from 92.3% to 85.7%.

Angel Broking's report explains Indian companies' gains saying that although the labour cost advantage for Indian IT had been on a declining trend, there still was a comfortable 20-25% cost saving for clients along with availability of a young workforce.

Moving up the value chain

Pradeep Udhas, partner and head of IT/ITeS in consultancy firm KPMG India, said Indian companies had developed people capabilities and moved up the value chain to pitch for bigger contracts.

Previously, Indian players were grouped together based on low-cost offerings sans any differentiation. Companies like Accenture and IBM made a positive impact on business issues especially around strategy. But in the last few years, Indian IT companies are able to sell a differentiated proposition, deepening the client relationship," he said.

Siddharth Pai, partner & MD of outsourcing advisory firm ISG, noted that not just Indian, even other regional IT players were steadily winning market share. "Companies like Xchanging and Atos are chipping away market share from MNCs with their specialized offerings," he said.

Angel Broking expects Indian IT companies to continue gaining share "going forward", but Pai strikes a note of caution. He said offshore services driven by labour arbitrage had a limited play.

2017-18: IT cos invest more in Europe

i) Revenue growth (% constant currency, 2017-18);

ii) Major centres established in 2017

From: Shilpa Phadnis & Avik Das , IT cos invest more in Europe for business & tech talent, March 31, 2018: The Times of India

20 Development Centres Established By Major Cos In Past Yr

With European companies outsourcing more even as Trump raises barriers in the US, large Indian and MNC IT services firms are strengthening their capabilities in Europe. A number of development centres have come up over the past year especially in Central and Eastern Europe. This is both to cater to clients in Europe, as also to tap into the pockets of engineering and tech talent in countries like Poland, Romania, Bulgaria, Hungary and Ireland. The talent is technically very good – though the numbers aren’t as large as in India and the US – and they bring necessary language skills.

Eastern Europe has traditionally been strong in engineering, science and math skills. A Medium post by Ewa Treitz, partner at Black Pearls VC, said 200,000 students graduate in engineering and sciences every year from the universities in the Central and Eastern European countries that are part of the European Union. This talent is hard to ignore when tech firms look for talent in emerging technologies like AI, big data, analytics, app development, augmented reality and virtual reality.

In the last one year alone, at least 20 development centres have sprung up in countries like Poland, Romania, Bulgaria, Hungary, Austria and Ireland. Last April, Infosys added its newest facility in Karlovac in Croatia. The centre will service clients in the Nordics, but the focus would be on consolidating consulting, IT and engineering skills in power generation, and design and development of large gas and steam turbines.

Accenture set up a centre in Riga in Latvia with more than 170 professionals with expertise in Oracle technologies to serve new and existing clients in the Nordic and Baltic region. Wipro set up a specialized automotive centre of excellence (CoE) in Timisoara, Romania, hiring engineering graduates from top universities to work across technology domains such as in-vehicle infotainment, cluster display, telematics, connected cars and advanced driver assistance systems. Wipro already has 1,200 employees in Romania servicing 30 clients in retail and healthcare.

Peter Bendor-Samuel, CEO of IT consulting firm Everest Group, said there has been a long-standing trend to build out IT capacity in eastern Europe. “In fact, there are many very successful European IT firms such as Epam and Luxoft who differentiate themselves through their eastern Europe operations. There are several factors driving this investment. The traditional motivations are proximity and language skills. Both are increasingly important as the industry moves away from a factory orientation into a more intimate DevOps structure,” he said.

DevOps is a new agile way of software development that allows for delivery of applications and the improvement of these products at high velocity. Europe’s traditional reluctance to outsourcing also appears to be changing.

Rahul Singh, president of financial services in HCL Technologies, which set up a centre in Ireland last year, said that in the past, European companies would not move some of the work out of the continent, and would not give these to outsourced service providers. “But now, customers trust us as transformative partners,” he said. Today, HCL has 4,500 employees in Europe. For the past several quarters, IT firms’ European business has been growing substantially faster than the US business. In the third quarter of this fiscal, Europe grew year-on-year by 5.9% and US by a mere 0.7% in constant currency for Infosys. The corresponding figures for Wipro were 7.9% and 0.6%.

TCS’s growth in recent quarters has been led by Continental Europe. It grew 22.3% in the December quarter. In a recent management commentary, CEO Rajesh Gopinathan said the firm’s Europe performance is encouraging and is happening across a wide spectrum, both from a vertical industry perspective as well as from a region perspective. “If you look at the deals that we won, you will see a very good spectrum of deals in Europe. From a region perspective also, we have been strong in the Nordics and the Benelux region, and that continues to do well, Germany is performing very well for us, and even markets like France are coming back to double-digit growth now. Europe is a broad-based story,” he said.

Europe accounts for about a quarter of Indian IT firms' revenues, while the US is about 50% to 60%. This difference will narrow if the current trends persist.

2018, April: Market capitalisation, revenue

Shilpa Phadnis, TCS is now valued more than Accenture, April 24, 2018: The Times of India

From: Shilpa Phadnis, TCS is now valued more than Accenture, April 24, 2018: The Times of India

TCS not only touched $100 billion in market capitalisation on Monday, but it also overtook the m-cap of Accenture, a company with a revenue that is almost twice that of TCS.

Rod Bourgeois, head of research in US-based DeepDive Equity Research, said that the root driver of TCS’ success is that it has built a position as the low-cost value player at scale — backed by the execution ability to maintain low costs while still delivering quality work.

Phil Fersht, CEO of IT research firm HfS, said TCS has developed a very strong culture to win any deal in the world it wants. Peter Bendor-Samuel, CEO of IT consulting firm Everest Group, however, wonders if TCS’ valuation premium would persist over next few years.

Tata Sons chairman N Chandrasekaran said, “It is a very proud moment for all of us. TCS has been able to create value consistently by making right investments not only in terms of technology, but also in terms of creating capabilities, building leadership and talent, seeding new markets and developing scalable world-class solutions.”

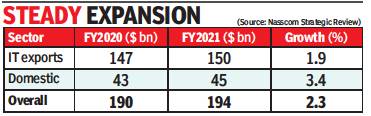

2020, 2021

February 16, 2021: The Times of India

From: February 16, 2021: The Times of India

IT industry to grow 2.3% to $194bn in FY21: Nasscom

Bengaluru:

The year has been marred by pandemic-related sharp declines in growth across industries. One major exception is India’s IT-ITeS sector. It is expected to grow by 2.3% to $194 billion in the 2020-21 financial year, according to estimates by Nasscom. The industry body, however, did not disclose the constant currency growth number, which was 8.4% last year.

Nasscom’s strategic review for the year showed that IT exports would touch $150 billion this year — 1.9% growth over last year. The sector added 1.3 lakh employees during the same period, taking the total base of knowledge workers to 4.4 million. IT services grew 2.7% to $99 billion, while BPM grew 2.3% to $38 billion, and engineering R&D degrew 0.2% to $31 billion.

The Indian tech sector contributed 8% to the national GDP, with 52% share in services exports, and 50% in total FDI (based on inflows for the period April to September 2020). “We have added $4 billion to the industry (this year). Indian IT sector continues to be a net hirer. A lot of these hires were in jobs that were being created due to the adoption of newer technologies and not in the traditional jobs,” said Nasscom president Debjani Ghosh. She said digital revenue was 28-30% of industry revenue, or $50-53 billion, growing 5x the overall services growth rate.

The Nasscom report said enterprises are re-balancing their technology spends to prioritise digitisation. “There’s a shift to offshore and work-from-anywhere models since the pandemic,” said Nasscom chief strategy officer Sangeeta Gupta. The industry, she said, saw a shift towards more outcome-based pricing.

The attrition rate dropped by 50% in the second-half of the 2020 calendar year compared to the first half. “Continental Europe and Apac have emerged as one of the strongest growth geographies in the 2021 fiscal. BFSI & healthcare were key growth verticals during the year,” Gupta said.

Deal value for cloud was up 80% in the first half this fiscal compared to the same period last year. Digitally skilled IT workforce now comprises 26% of the overall employee strength, up from just 8% three years ago, with most focusing on cloud computing and data analytics. “Digital transformation is the top-most priority for global corporations and in a highly connected world that will remain largely contactless for an extended period, there are shifts in business models, customer experience, operations, and employee experience,” said Nasscom chairman U B Pravin Rao.

Profits, revenues, cash flows of IT companies

2019-2024

From: Shilpa Phadnis & Veena Mani TNN, March 14, 2025: The Times of India

See graphic:

Cash flows in India’s top 5 IT companies, 2019-2024

Restrictions placed by various countries on Indian IT

2017 survey

Sidhartha, Not only US, others restrict IT pros too, Sep 15, 2017: The Times of India

The woes of Indian information technology companies are not limited to the US and extend from Australia to Canada as they not only have to grapple with visa curbs but also obscure rules that are open to interpretation by local authorities. Following the concerns brought out by Nasscom in a study , the government has started flagging the hurdles, many of which are against the commitments given by these countries at the World Trade Organisation or in trade agreements with India.

The study has brought out the fact that there is no match between the commitments given and the visa issued. The report comes at a time when India is seeking a permanent agreement for trade facilitation in services. Separately , it is pushing for liberal rules in Asean and other countries such as China, Australia and New Zealand, under the regional comprehensive economic partnership agreement, which will create one of the world's largest free trade areas. These countries are, however, reluctant to ease the rules, but are seeking sharp duty cuts for goods imported into India.

What makes it easier for other countries not to honour their commitments is the absence of any clarity on the number of visas that they have agreed to.Pointing to the US, Nasscom has said that it is the only country that partially mentions the visa category , H1, under WTO's agreement on trade in services (GATS) but there is nothing on offer for the information, com munication and technology category . Then, there are other conditions such as high fees to dilute the commitments.

Some rules could even be tweaked by countries. For example, Indonesia had notified a rule allowing one visa for every 10 local workers hired.

Other complaints revolve around the duration of the visa and the time taken to issue it, which can be long, and can often come with quotas. What makes life more difficult for Indian workers is the fact that many countries have not signed (and some are reluctant) social security agreements which will allow for contributions to be transferred once the employee returns to India.

There are other issues which have stalled the Indian IT sector's expansion drive, such as outdated definitions, said a government official. For instance, there is very little clarity on the definitions of contractual service providers, independent professionals and inter-corporate transfers, which results in lack of confidence among companies.

The industry also has to deal with subjective and discretionary elements of the commitments that have been given, resulting in interpretations that are only meant to block access.

Software as a service

Implementation delays, cost of: 2024

From: March 6, 2025: The Times of India

See graphic:

The cost of Implementation delays in Software as a service in India: 2024