Electoral bonds: India

(Created page with "{| class="wikitable" |- |colspan="0"|<div style="font-size:100%"> This is a collection of articles archived for the excellence of their content.<br/> Additional information ma...") |

(→2017) |

||

| Line 60: | Line 60: | ||

=Supreme Court verdict of 2024 feb= | =Supreme Court verdict of 2024 feb= | ||

| − | |||

[https://indianexpress.com/article/india/supreme-court-electoral-bonds-9162593/ Ananthakrishnan G, Feb 16, 2024: ''The Indian Express''] | [https://indianexpress.com/article/india/supreme-court-electoral-bonds-9162593/ Ananthakrishnan G, Feb 16, 2024: ''The Indian Express''] | ||

| Line 115: | Line 114: | ||

In October last year, the bench began hearing arguments on the four petitions, including those filed by Congress leader Jaya Thakur, the Communist Party of India (Marxist) and the NGO Association for Democratic Reforms (ADR). | In October last year, the bench began hearing arguments on the four petitions, including those filed by Congress leader Jaya Thakur, the Communist Party of India (Marxist) and the NGO Association for Democratic Reforms (ADR). | ||

| + | |||

| + | [[Category:India|E | ||

| + | ELECTORAL BONDS: INDIA]] | ||

| + | [[Category:Pages with broken file links|ELECTORAL BONDS: INDIA]] | ||

| + | [[Category:Politics|E | ||

| + | ELECTORAL BONDS: INDIA]] | ||

Revision as of 08:08, 28 February 2024

This is a collection of articles archived for the excellence of their content. |

Contents |

The objections of the RBI and Election Commission

Udit Misra, Feb 16, 2024: The Indian Express

At the time it was being conceived, the electoral bonds scheme faced stiff challenges from two key institutions — the Reserve Bank of India (RBI) and the Election Commission of India (ECI). While both had differing concerns, prevention of money laundering was a common ground.

Such an amendment would enable “multiple non-sovereign entities to issue bearer instruments”. The RBI had argued that this proposal — to allow any other bank to issue EBs — “militated against RBI’s sole authority for issuing bearer instruments which has the potential of becoming currency”. RBI was of the opinion that if such EBs are issued in sizable quantities, they “can undermine the faith in banknotes issued by the Central Bank.

The RBI also noted that while the identity of the person or entity purchasing the bearer bond will be known because of the Know Your Customer requirement, the identities of the intervening persons/entities will not be known. “This would impact the principles of the Prevention of Money Laundering Act 2002,” it stated.

The RBI was of the opinion that the intention of introducing electoral bonds — that the electoral contributions be paid out of tax-paid money — can be accomplished by cheque, demand draft, and electronic and digital payments. “There is no special need for introducing a new bearer bond in the form of electoral bonds,” it stated.

As the discussions continued, the RBI persisted with its view that it should be the only authority to issue such bonds. In September 2017, when it was presented with the draft scheme, the RBI stated that permitting a commercial bank to issue bonds would “have an adverse impact on public perception about the scheme, as also the credibility of India’s financial system in general and the central bank in particular.” The RBI reiterated “the possibility of shell companies misusing bearer bonds for money laundering transactions”. It also warned that the “issuance of electoral bonds in the scrip form could also expose it to the risk of forgery and cross-border counterfeiting…”

What ECI said

The Election Commission’s main objection was that EBs would have a “serious impact on transparency of political finance/funding of political parties.” In May 2017, the ECI wrote to the Ministry of Law and Justice about the amendments to the IT Act, the Representation of the People Act, and Companies Act introduced by the Finance Act 2017.

In it, the ECI stated that “the Amendment which has been made” — that any donation received by a political party through electoral bond is out of the ambit of reporting under the Contribution Report as prescribed in the Representation of the People Act 1951 — “is a retrograde step as far as transparency of donations is concerned and this proviso needs to be withdrawn”.

Further, referring to the deletion of the provision in the Companies Act requiring companies to disclose particulars of the amount contributed to specific political parties, the ECI had recommended that “companies contributing to political parties must declare party-wise contributions in the profit and loss account to maintain transparency in the financial funding of political parties.”

The ECI had also recommended that “the earlier provision prescribing a cap on corporate funding be reintroduced because unlimited corporate funding would increase the use of black money for political funding through shell companies”.

Highlights

From: February 16, 2024: The Times of India

See graphic:

Electoral bonds: which party received how much money: 2017-23

The judgement explained

Dhananjay Mahapatra, February 16, 2024: The Times of India

From: Dhananjay Mahapatra, February 16, 2024: The Times of India

From: Dhananjay Mahapatra, February 16, 2024: The Times of India

New Delhi: Supreme Court struck down as unconstitutional the electoral bond scheme introduced by BJP govt in 2018 that allowed big-ticket anonymous corporate contributions to political parties. It directed State Bank of India to immediately stop issuing bonds and furnish up-to-date details of such contributions since April 2019 for publication on Election Commission’s website by March 13.

A bench of CJI D Y Chandrachud and Justices Sanjiv Khanna, B R Gavai, J B Pardiwala and Manoj Misra unanimously rejected the central rationale of the electoral bond scheme — need to protect the identity of donors to save them from possible harassment — and ruled that voters could not be kept in the dark about huge donations to political parties when money played a significant role in elections.

The bench held that secret corporate funding of political parties, possibly for a quid pro quo, breached voters’ right to information, adversely impacted purity of free and fair elections and polluted democracy by disturbing political equality in polls. Amendments enacted to ensure the anonymity and non-disclosure were arbitrary, it ruled.

Though unanimous in their rejection of the bond scheme, the bench put across its stand through two separate but concurring verdicts — one written by the CJI and the other by Justice Khanna.

The order did not interfere with the existing scheme of al- lowing anonymous donations to political parties up to an amount of Rs 20,000 by any individual or company. Contributions through cheques, drafts and bank transfers by corporate entities and duly reflected in the party’s statement to EC would not be affected by this ruling, the court clarified. What it stopped was unli- mited anonymous contributions by companies. Apart from full disclosure, the court also brought back the 2013 cap of 7.5% of average net profit of acompany in the last three years on corporate donations. From 1985 to 2013, it was 5% of average net profit.

Justice Chandrachud, writing the judgment for himself and Justices Gavai, Pardiwala and Misra, and Justice Khanna in a concurring judgment invalidated the bond scheme and enabling amendments carried out in Finance Act, 2017, Representation of the People Act, Companies Act and Income Tax Act.

Supreme Court verdict of 2024 feb

Ananthakrishnan G, Feb 16, 2024: The Indian Express

Highlighting that “the information about funding to a political party is essential for a voter to exercise their freedom to vote in an effective manner”, a five-judge Constitution bench, headed by Chief Justice of India

D Y Chandrachud, said that changes made in the laws to implement the scheme were unconstitutional.

Holding the scheme “violative” of the constitutional right to freedom of speech and expression and right to information, the court did not agree with the Centre’s contention that it was meant to bring about transparency and curb black money in political funding.

In its two separate but unanimous verdicts spanning 232 pages, the court also directed the SBI, the authorised financial institution under the scheme, to submit by March 6 the details of electoral bonds purchased since April 12, 2019 till date to the Election Commission which will publish the information on its official website by March 13.

“SBI must disclose details of each electoral bond encashed by political parties which shall include the date of encashment and the denomination of the electoral bond,” the bench said.

On April 12, 2019, the SC, in an interim order, had asked political parties to submit details of donations via electoral bonds to the EC in a sealed cover to be kept in the safe custody of the commission till further orders.

The SC also directed that electoral bonds which are within the validity period of 15 days but have not been encashed by political parties shall be returned by the political party or the purchaser — depending on who is in possession of the bond — to the issuing bank which shall refund the amount to the purchaser’s account.

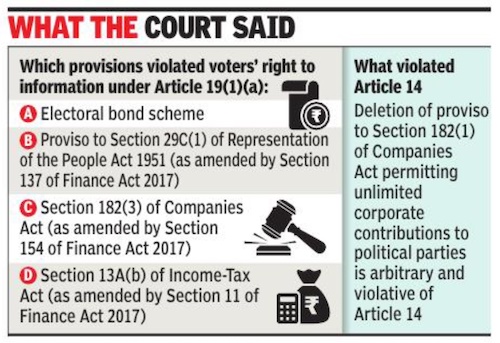

The bench, also comprising Justices Sanjiv Khanna, B R Gavai, J B Pardiwala and Manoj Misra, struck down a set of amendments. “The Electoral Bond Scheme, the proviso to Section 29C(1) of the Representation of the People Act, 1951 (as amended by Section 137 of the Finance Act 2017); Section 182(3) of the Companies Act (as amended by Section 154 of the Finance Act 2017); and Section 13A(b) (of the Income Tax Act) (as amended by Section 11 of the Finance Act 2017) are violative of Article 19(1)(a) and unconstitutional,” the bench said.

It held that “the deletion of the proviso to Section 182(1) of the Companies Act, permitting unlimited corporate funding to political parties is arbitrary and violative of Article 14”.

Section 29C of the RPA as amended by the Finance Act 2017 stipulated that the political party need not disclose financial contributions received through electoral bonds. Section 13A of the IT Act as amended said that the political party does not have to maintain a record of contributions received through electoral bonds. Section 182 of the Companies Act 2013 was amended by the Finance Act 2017 by which the earlier requirement of disclosure of particulars of the amount contributed by companies to political parties in their profit and loss accounts was deleted and donors were only required to disclose the amount contributed without disclosing particulars about the political party to which the contribution was made.

The court did not agree with the Centre’s submission that the political party which receives the contribution does not know of the identity of the contributor as neither the bond would have their name nor could the bank disclose such details to the party.

The court argued that “de jure anonymity of the contributors does not translate to de facto anonymity.” Saying that the scheme is not fool-proof, the court said that there are “sufficient gaps” in the scheme which enable political parties to know who paid how much.

For example, Clause 12 of the scheme says the bond can be encashed only by the party by depositing it in the designated bank account. “The contributor could physically hand over the electoral bond to an office-bearer of the political party…or the contributor could after depositing the electoral bond disclose the particulars of the contribution to a member of the political party for them to cross-verify. …ninety four percent of the contributions through electoral bonds have been made in the denomination of one crore. Electoral bonds provide economically resourced contributors who already have a seat at the table selective anonymity vis-à-vis the public and not the political party,” the court said.

The government had argued that the scheme was intended to curb black money and ensure that contributions to parties flow through legitimate banking channels.

But the bench held that the scheme does not satisfy the least restrictive test necessary for imposing curbs under Article 19(2) on the right to information under Article 19(1)(a) of the Constitution. “The purpose of curbing black money is not traceable to any of the grounds in Article 19(2)”.

The court added that the scheme “is not the only means for curbing black money in Electoral Financing” and “there are other alternatives which substantially fulfil the purpose and impact the right to information minimally when compared to the impact of electoral bonds on the right to information”.

For contributions below Rs 20,000, electronic transfer is the “least restrictive” and “Electoral Trust” for amounts above that, it pointed out.

The bench held that “the right to informational privacy extends to financial contributions to political parties which is a facet of political affiliation” but added that “the Constitution does not establish a hierarchy between the right to information guaranteed under Article 19(1)(a) and the right to informational privacy to political affiliation, traceable to Articles 19(1)(a), 19(1)(b), 19(1)(c), and Article 21”.

The SC said, “we are unable to see how the disclosure of information about contributors to the political party to which the contribution is made would infringe political expression. .. Under the current Scheme, it is still open to the political party to coerce persons to contribute. Thus, the argument of the Union of India that the Electoral Bond Scheme protects the confidentiality of the contributor akin to the system of secret ballot is erroneous”.

On the amendment to Section 182 of the Companies Act permitting unlimited political contributions by companies as manifestly arbitrary, the SC said “the ability of a company to influence the electoral process through political contributions is much higher when compared to that of an individual.”

A company, the bench said, has a “much graver influence on the political process, both in terms of the quantum of money contributed to political parties and the purpose of making such contributions.” It added: “Contributions made by individuals has a degree of support or affiliation to a political association. However, contributions made by companies are purely business transactions, made with the intent of securing benefits in return. The amendment to Section 182 is manifestly arbitrary for treating political contributions by companies and individuals alike”. The apex court said, “Companies before the amendment to Section 182 could only contribute a certain percentage of the net aggregate profits. The provision classified between loss-making companies and profit-making companies for the purpose of political contribution and for good reason.. the underlying principle of this distinction was that it is more plausible that law-making companies will contribute to political parties with a quid pro and not for the purpose of income tax benefits”.

“The provision as amended by the Finance Act of 2017 does not recognise that the harm of contributions by loss-making companies in the form of quid pro quo is much higher. Thus the amendment…is manifestly arbitrary for not making a distinction between profit-making and loss-making companies for the purposes of political contribution”.

The court pointed out: “The purpose of Section 182 is to curb corruption and electoral financing. For instance, the purpose of banning a government company from contributing is to prevent such companies from entering the political fray. Amendment to Section 182 by permitting unlimited corporate contributions authorises unrestrained influence of companies in the electoral process. This is violative of the principle of free and fair elections and political equality captured in the value of one person, one vote.”

The verdict said financial contributions to political parties are usually made for two reasons — they may constitute an expression of support to the political party or the contribution may be based on a “quid pro quo”.

“The huge political contributions made by corporations and companies should not be allowed to conceal the reason for financial contributions made by another section of the population: a student, a daily wage worker, an artist, or a teacher. When the law permits political contributions and such contributions could be made as an expression of political support which would indicate the political affiliation of a person, it is the duty of the Constitution to protect them,” it said.

In October last year, the bench began hearing arguments on the four petitions, including those filed by Congress leader Jaya Thakur, the Communist Party of India (Marxist) and the NGO Association for Democratic Reforms (ADR).