Electoral bonds: India

This is a collection of articles archived for the excellence of their content. |

Allegations against the concept

Nov 28, 2019: The Times of India

How does the electoral bonds scheme work?

Electoral bonds were introduced through the Finance Act, 2017, ostensibly to increase transparency in political funding and reduce the role of black money.

Its critics argue that it has the opposite effect. The scheme allows individuals or corporates to buy these non-interestbearing bonds from the State Bank of India and then donate them to a political party or parties of their choice (provided the party has got over 1% of votes in the last elections to state assembly or Parliament that it contested), which they can then deposit in their SBI account designated for this purpose. The bonds are to be sold by SBI in 10-day windows four times a year with an additional 30 days being allowed in years when Lok Sabha polls are held.

Those buying the bonds can only pay for them by cheque or through digital transfers from KYC bank accounts. The bonds are available in denominations from Rs 1,000 to Rs 1 crore and there is no limit on how much an individual or corporate can buy or a party can receive.

What legislative changes were needed to introduce it?

Apart from the Finance Act, 2017, through which the scheme was introduced, it necessitated changes in the Reserve Bank of India Act, 1934, the Representation of People Act, 1951, the Income Tax Act, 1961, the Companies Act, 2013 and the Foreign Contribution (Regulation) Act, 2010. Each of these had to be amended to allow specific aspects of the scheme.

The RBI Act had to be amended to allow an entity other than the RBI or the Union government to issue bearer bonds. The RPA had to be amended because it stipulated that for every donation of above Rs 20,000 to a political party, the name of the person donating and the amount donated had to be disclosed. Since the idea behind electoral bonds was to let the donor remain anonymous, they had to be exempted from this stipulation.

The Companies Act had to be amended because it stipulated that no company could donate money to a political party exceeding 7.5% of its average net profit over the previous three financial years. This provision was dropped, which meant any company could donate any amount to a political party. Also, while the Act as it earlier stood mandated full disclosure of how much was donated to which party, the amended version merely says the company must disclose the total amount it has contributed during the year under this head.

The IT Act needed to be amended to allow anonymity of donors using electoral bonds. It also brought in a provision saying any donation beyond Rs 2,000 had to be through cheque, electronic transfer or electoral bonds.

The Foreign Contribution Act was amended with retrospective effect to define Indian arms of foreign firms as not being a “foreign source” of funding. Parties are prohibited from receiving funds from foreign sources.

Why is the scheme controversial?

Several aspects of it have given rise to controversy. First, it has been pointed out that the scheme is opaque to public scrutiny of who is funding which party. On the other hand, because each bond bears a unique identification number, the bank will know this. While the SBI is supposed to keep this strictly confidential except when asked for it by law enforcement agencies investigating crimes, critics have pointed out that government control over both SBI and these agencies means it is not unthinkable that the government of the day could learn about which corporate has donated to which party and how much.

Second, the bonds make it possible for foreign firms also to fund parties through their Indian arms, unlike in the past. Third, the removal of the ceiling on contributions under the Companies Act means that any firm can now donate to any extent. This, it has been pointed out, makes it possible for shell companies to be created for the sole purpose of funding parties.

Why has the controversy gained fresh life now?

RTI activists have detailed how the RBI and Election Commissions had serious reservations about the scheme but were ignored. While the fact of RBI and EC having objections was known earlier too, what the newly revealed documents show is that they had repeatedly raised these concerns with the government in writing before the scheme was launched. Another revelation is that a proposal to circulate a detailed draft of the scheme for comments from political parties was overruled.

The documents also show that bonds were allowed to be redeemed beyond the stipulated 15-day window in the build-up to the Karnataka assembly polls on the instructions of the PMO. The ostensible grounds for the violation was that donors and parties had been unclear whether the window was for 15 calendar days or 15 working days and hence a one-time exception should be made. Again, soon after the Karnataka polls, a party or parties were allowed to encash bonds sold in earlier tranches, the SBI being instructed by the government to encash them.

The documents showed how then junior finance minister Pon Radhakrishnan had misled Parliament by insisting that the EC had not raised any concerns on the scheme and internal notes on how he could be bailed out of a privilege action brought in by the Opposition. The Congress and other opposition parties have used these revelations and whatever data is available on funding through electoral bonds to raise the issue in Parliament. Analysis of 2017-18 data by the Association for Democratic Reforms (ADR) had shown that the BJP got 95% of all funding through these bonds.

What is the legal position?

The scheme has been challenged in the Supreme Court in writ petitions filed by the CPM and by ADR and Common Cause. The EC’s affidavit in the case has also shown that the Commission remains opposed to the scheme on the grounds that it makes political funding opaque. It has also said the scheme has the potential to allow infusion of black money through shell companies and to make parties vulnerable to foreign influence. In April this year, the SC had passed an interim order that all parties had to submit to the EC by May 30 (in sealed covers) details of bonds received by them till May 15. The case is ongoing.

‘Bonds offer anonymity, incentive to go cashless’

Nov 28, 2019: The Times of India

The electoral bond schemes, under attack from some opposition parties and activists, was envisaged to encourage political donors to move away from cash by offering anonymity as regards the recipient party when it came to entries in corporate account books, said government sources.

A senior official source said the electoral bond system is a determined effort to offer an alternative to cash or unaccounted donations even if it does not reveal information of the donor to the public. The bonds came about after efforts to get business donors to write out cheques failed to gain traction — because these would need to be recorded in company accounts.

Fear of political retribution saw corporates choosing the secretive and totally unaccounted cash route. Electoral bonds, on the other hand, are purchased by tax paid money and have a KYC mechanism. There is no name attached to the bonds which are redeemable in a particular bank account and are not transferable. They are valid only for 15 days. Bonds are an “effective” compromise, offering anonymity but encouraging clean money.

There is no bar on a corporate making a cheque donation if it so desires. The bonds are for those who worry about parties harbouring a grudge. Typically, the party in office gets higher donations. But this would be the case even if there were no electoral bonds and most big donors used the cash route.

Acceptance of electoral bonds is growing, as accounts by regional parties reveal, with outfits like BJD, Trinamool, Janata Dal (S), YSR Congress and TRS receiving substantial contributions. The attack on EBs is an effort to discredit a more transparent system and an advocacy to bring cash back, said sources. On allegations that RBI’s concerns were overridden in haste, the government has said between passage of the Finance Bill on March 31, 2017 to notification of the scheme on January 2, 2018, there were multiple interactions. The validity of the bonds was reduced from 30 to 15 days. The suggestion that bonds be issued only in electronic form was rejected on the ground that physical bonds will be more acceptable.

The Election Commission had not approved of bonds but the government felt, in its judgment, that it should go ahead with the scheme. In 12 tranches, more than Rs 6,000 crore have been issued. Bonds have security features to reduce chance of forgery like a random serial number invisible to the naked eye. The KYC process ensures shell companies cannot use this instrument and accounting entries must be recorded in books of political parties, ensuring an audit trail.

The January, 2018, notification provided for four tranches in a year apart from a special window for Lok Sabha elections. But assembly elections are staggered in an uneven fashion, and so it was felt that a special window be opened for state elections. Responding to the charge that the government incorrectly informed Parliament on the EC’s position on the bonds, the official said the original reply to the Rajya Sabha unstarred question number 830 dated December 18, 2018, was based on records available at the time. The minister concerned mentioned the reasons to the secretary general and the reply was modified through a correction.

The electoral bonds is a scheme formulated by the central government under the Act passed by Parliament. The government showed its commitment to clean electoral funding by changing laws as a required. Donors and donees are linked through branches of SBI. Previously, the mechanism of ‘pass through’ electoral trusts introduced by the UPA government had limited success.

The cities that the bonds come from

2018-23

Damini Nath, May 7, 2023: The Indian Express

Pointing to a concentration of political funding, five cities, Mumbai, Kolkata, Hyderabad, New Delhi and Chennai, accounted for nearly 90% of all electoral bonds sold so far, while the tech capital of India, Bengaluru, accounted for just over 2% of total sales, as per State Bank of India data accessed under the Right to Information Act by The Indian Express.

On May 4, SBI said that electoral bonds worth Rs 12,979.10 crore had been sold since the start of the scheme in 2018 until the most recent tranche, the 26th, of sales held in April.

In the same period, Rs 12,955.26 crore in electoral bonds had been encashed by political parties. The SBI reply to the RTI application stated that 25 political parties opened designated bank accounts with the bank to redeem these bonds under the scheme that enables anonymous political funding by Indian citizens and corporates.

Since 2017, the Supreme Court has been hearing a batch of petitions challenging the scheme’s validity on various grounds. The court is yet to decide whether the case should be sent to a Constitution Bench. As per the court’s automated listing system, the next hearing is scheduled for May 9.

Mumbai, the country’s financial capital, accounted for 26.16% of the total electoral bonds sold so far, the highest among the 29 SBI branches where the scheme is offered, with Rs 3,395.15 crore.

Kolkata, Hyderabad, New Delhi and Chennai rounded out the top five with Rs 2,704.62 crore (20.84%); Rs 2,418.81 crore (18.64%); Rs 1,847 crore (14.23%); and Rs 1,253.20 crore (9.66%) respectively in sales. Bengaluru, the capital of election-bound Karnataka, was in seventh place with Rs 266.90 crore in sales or 2.06% of the total, after Bhubaneswar that had Rs 407.26 crore or 3.14% of the sales.

While sale data shows that funding to parties is flowing mainly from five big cities, when it comes to redemption of the electoral bonds, the New Delhi branch of SBI is the preferred choice. Of the total amount of bonds redeemed so far, 64.55% or Rs 8,362.84 crore was encashed in New Delhi, where national parties are likely to have their accounts.

Hyderabad was a distant second with 12.37% (Rs.1,602.19 crore) followed by Kolkata in third place with 10.01% (1,297.44 crore), Bhubaneswar with 5.96% (Rs 771.50 crore) and Chennai with 5.11% (Rs.662.55 crore). Although Mumbai accounted for over 26% of all sales, it had only 1.51% of all electoral bonds redeemed.

The Electoral Bond Scheme was launched in January 2018 and the first tranche of sales was held in March that year. The scheme was initially introduced for a period of 10 days each in January, April, July and October and an additional 30-day period for a year with Lok Sabha elections. In November 2022, the Finance Ministry amended the scheme to allow another 15 days of sales in any year with an Assembly election.

To redeem electoral bonds, a party needs to have a designated bank account with one of the 29 authorised SBI branches and to open an account, the party needs to have secured at least 1% of the votes in the most recent Lok Sabha polls, or Assembly elections in case of a state party.

Since the scheme is meant for anonymous donations, the SBI does not disclose which party has an account in which branch.

2017-18: BJP gets 95% of the electoral bonds

Bharti Jain, December 1, 2018: The Times of India

From: Bharti Jain, December 1, 2018: The Times of India

While BJP walked away with 95% of the contributions made to political parties via electoral bonds in 2017-18, the first year of implementation of the scheme, contributions received by the party in excess of Rs 20,000 through cheque, bank draft, RTGS/NEFT and other banking modes during the year fell to Rs 438 crore from Rs 529 crore in 2016-17.

BJP declared a total income of Rs 1,027 crore for 2017-18, CPM Rs 104.8 crore, BSP Rs 51.7 crore, Trinamool Congress Rs 5.17 crore and CPI Rs 1.55 crore. Congress and NCP are yet to submit their annual audit reports to the Election Commission.

In 2016-17, BJP had declared an income of Rs 1,034 crore, CPM Rs 100 crore, BSP Rs 173 crore, Trinamool Congress Rs 6.09 crore and CPI Rs 2 crore. As per BJP’s audit report for 2017-18 submitted to the EC, the party encashed electoral bonds worth Rs 210 crore out of the total Rs 222 crore issued by banks in the year, covering only the first tranche relating to the period March 1-10, 2018.

However, there was a fall in ‘other contributions’ to BJP from Rs 922 crore in 2016-17 to Rs 714 crore in 2017-18 and also in total value of donations above Rs 20,000 received, from Rs 529 crore to Rs 438 crore. This is seen as an indication that corporate houses and major donors to the party may have chosen the electoral bonds route over making direct contributions that, if in excess of Rs 20,000, would require their details to be furnished by parties in contributions reports to the EC.

Association for Democratic Reforms founder Trilochan Sastry said compared to Rs 438 crore received by BJP in Rs 20,000-plus donations, voluntary contributions worth Rs 552 crore (58% of total contributions) to the party were from anonymous sources.

None of the other four national parties that have filed their annual audit accounts for 2017-18 — BSP, CPM, CPI and Trinamool Congress — declared any income through electoral bonds.

BJP’s annual audit report for 2017-18 submitted to the EC on November 24 showed a 45% jump in voluntary contributions received by the party as part of its Aajiwan Sahayog Nidhi scheme, under which individuals can make online donations.

Bharti Jain, Congress’ income plummets in 2017-18, January 19, 2019: The Times of India

Congress’ income fell to Rs 199 crore in 2017-18 from Rs 225 crore in 2016-17. A mere Rs 5 crore out of the Rs 199 crore came in the form of electoral bonds. The grand old party’s receipts were less than 20% of BJP’s total income of Rs 1,027 crore in the year, according to its annual audit report for 2017-18 submitted to the Election Commission.

While BJP cornered 95% of the share of the electoral bonds pie, having encashed bonds worth Rs 210 crore out of the total Rs 222 crore issued by banks in 2017-18 (covering only the first tranche relating to the period March 1-10, 2018), Congress has declared just Rs 5 crore income through these bonds.

Incidentally, none of the other five national parties declared any income from electoral bonds in their annual audit reports for 2017-18, which put CPM’s income at Rs 104.8 crore, BSP’s at Rs 51.7 crore, NCP at Rs 8.1 crore, Trinamool Congress at Rs 5.17 crore and CPI at Rs 1.55 crore.

With Congress being the last national party to submit its annual audit report, the EC finally has details of electoral bonds receipts of all seven national parties.

Congress’ audit annual report has declared an expenditure at Rs 197 crore during the last financial year.

2017-18, poll bonds: BJP got Rs 210 crore, all others Rs 11 crore

BJP received Rs 997 crore and Rs 990 crore through donations in 2016-17 and 2017-18 respectively, five times more than what Congress received in the same period, the Election Commission told the Supreme Court on Thursday.

Appearing for the EC, senior advocate Rakesh Dwivedi gave the information to a bench of Chief Justice Ranjan Gogoi and Justices Deepak Gupta and Sanjiv Khanna while hearing a petition by Association for Democratic Reforms which sought transparency in anonymous donations through electoral bonds, alleging that at present they encouraged corruption and generated black money.

When petitioner’s counsel Prashant Bhushan argued that electoral bonds were designed to benefit corporate houses and industrialists who contributed handsomely yet anonymously to the ruling party to receive a quid pro quo and claimed that BJP received 95% of such donations, attorney general K K Venugopal said Bhushan was kite flying and questioned the basis of the information.

However, Dwivedi handed over to the bench a two-page note, which proved Bhushan right as far as BJP getting maximum donations was concerned as it showed that in the 2017-18 financial year, 520 bonds worth Rs 222 crore were issued by State Bank of India, of which 511 bonds worth Rs 221 crore were redeemed.

“BJP has shown a receipt of Rs 210 crore through electoral bonds (which is exactly 95% of the total amount redeemed by political parties),” the EC said. This means all other parties put together received a paltry Rs 11 crore as donation through electoral bonds as compared to Rs 210 crore by BJP during 2017-18,” Dwivedi said.

The EC, however, added, “A large portion of the funding of political parties in earlier years (90% in 2015-16 and 62% in 2016-17) was in cash donations of less than Rs 20,000. If a part of the cash donations is now received through electoral bonds, it would mean that clean, tax-paid money is being used for political funding.”

Total donations received by BJP in 2016-17 was Rs 997 crore. Of the total, the party declared Rs 529 crore before the EC which showed that it received Rs 468 crore in cash donations, each below Rs 20,000, from anonymous persons. In the same period, Congress received Rs 180 crore in donations of which Rs 138 crore was through small donations from anonymous persons.

In 2017-18, BJP received Rs 990 crore in donations of which Rs 342 crore was through small cash donations by anonymous persons and Rs 210 crore by way of electoral bonds. Congress, in the same period, received Rs 168 crore of which Rs 141.50 crore was through small donations from anonymous persons and Rs 5 crore through electoral bonds.

Arguing against any intervention of the SC at this stage in the working of electoral bonds, the AG said this was a device put in place by the government as a policy decision to curb role of black money in electoral politics. “Let the system work for some time and after elections, whosoever comes to power can review the scheme and bring in changes,” the AG said. The SC said it would give its decision on Friday on the necessity of passing any interim order.

2018-19: 5 parties received ₹587cr in poll bonds

Bharti Jain, Nov 28, 2019: The Times of India

From: With inputs from Bharti Jain, Nov 29, 2019: The Times of India

Even as Congress and some other opposition parties have slammed electoral bonds for being a non-transparent source of funding, annual audit reports filed by one national party and four state parties for 2018-19 have together accounted for bonds worth over Rs 587 crore. Also, a major part of their income through contributions and donations has come from bonds.

A look at audit reports for the last financial year made available by the Election Commission, which must mandatorily declare income from electoral bonds under a separate head, reveals that Biju Janata Dal received Rs 213.5 crore as contributions via electoral bonds route. This is the latest entry while TMC earned Rs 97.28 crore, Janata Dal (Secular) Rs 35.25 core, YSR Congress Party Rs 99.84 crore and Telangana Rashtriya Samithi (TRS) Rs 141.5 crore.

The EC website currently exhibits annual audit reports of only three of seven recognised national parties — TMC, BSP and CPM — and 22 other state parties. Of this, one national party and four state parties declared funding via electoral bonds. Interestingly, in all these cases, income from electoral bonds formed a dominant chunk of total contributions and donations.

For TMC, income from bonds formed 88% of the total contributions/donations/ grants received by it in 2018-19.

BJD so far has declared the highest receipts — Rs 213.5 crore — via bonds. This accounts for 88% of total contributions and donations worth Rs 242.86 crore received by the party in 2018-19. BJD, the ruling party in Odisha, faced both Lok Sabha and state assembly elections in April-May this year.

JD(S) has also reported 82% of its contributions through electoral bonds. For YSR Congress, bonds accounted for 55% of its total contributions for 2018-19. TRS reaped Rs 141.5 crore, or 77% of its total contributions worth Rs 182.67 crore, from bonds.

Over Rs 6,000 crore worth of bonds were issued in 2018-19. Some estimates suggest nearly Rs 4,500 crore bonds income may have landed in BJP’s kitty.

BJD so far has declared the highest receipts — Rs 213.5cr — via bonds. This accounts for 88% of the total contributions and donations worth Rs 242.86cr received by the party in 2018-19

2022-23

Bharti Jain, Nov 25, 2023: The Times of India

BRS got ₹529cr in poll bonds, DMK ₹185cr

BRS, which is in office in poll-bound Telangana, got Rs 529 crore in electoral bonds in 2022-23, while DMK’s and YSR Congress Party’s inflows were Rs 185 crore and Rs 52 crore, respectively, in the same period. BRS also received Rs 90 crore from Prudent Electoral Trust. Among national parties, AAP has declared total contributions of over Rs 31 crore.

BRS received ₹529cr via poll bonds in 2022-23, DMK ₹185cr, YSRC ₹52cr

New Delhi : Bharat Rashtra Samithi (BRS), which is in office in poll-bound Telangana, received contributions worth Rs 529 crore via the electoral bonds route in 2022-23, while DMK’s and YSR Congress Party’s inflows from bonds totalled Rs 185 crore and Rs 52 crore respectively in the same period.

As per contribution reports of 23 regional parties for the year 2022-23 — placed by EC in the public domain till Thursday — they together received over Rs 975 crore through contributions, of which almost 80% was from electoral bonds received by three parties, namely BRS, DMK and YSR Congress Party. BRS has declared the highest contribution receipts in excess of Rs 20,000 from individuals and businesses as well as electoral bonds. Electoral bonds contributed 77% (Rs 529 crore) of its total receipts of Rs 683 crore for the year 2022-23, while Rs 90 crore was routed through the Prudent Electoral Trust. Tamil Nadu’s ruling party DMK’s Rs 20,000-plus receipts in the last fiscal add up to Rs 192 crore, of which 96% has come from bonds. YSR Congress Party, meanwhile, has declared total contributions (of Rs 20,000 and above) worth Rs 68 crore in 2022-23, of which 76% flowed from bonds and Rs 16 crore from Prudent Electoral Trust. In 2021-22, BRS (then called Telangana Rashtra Samithi) had received Rs 153 crore from bonds, DMK Rs 306 crore and YSRCP Rs 60 crore.

Normally, political parties do not declare income from electoral bonds in their contributions reports, as that is not mandatory under Section 29C of Representation of the People Act, 1951. The total receipts from bonds must however be declared in the parties’ annual audit reports; though the source and amount of individual contributions through bonds are not required to be disclosed. Yet, BRS, YSRCP and DMK have voluntarily included information about their receipts from bonds in their latest contributions re ports filed with EC.

So far, contribution reports of only two national parties and 23 regional parties are available on the Election Commission’s website. Among the national parties, AAP has declared total contributions worth over Rs 31 crore. Bahujan Samaj Party, as usual, has declared nil contributions in excess of Rs 20,000 each.

Among the regional parties, Janata Dal (United)’s contribution receipts in excess of Rs 20,000 for the year 2022-23 totalled Rs 5.48 crore, TDP’s Rs 11.92 crore, Jannanyak Janata Party’s Rs 2.83 crore, Trinamool Congress’s Rs 2 crore, Shiromani Akali Dal’s Rs 1.4 crore, Maharashtra Navnirman Sena’s Rs 1.5 crore and Samajwadi Party’s Rs 26.9 lakh.

2017-24

March 16, 2024: The Times of India

New Delhi:From the time electoral bonds were introduced in 2017-18, BJP has received nearly 50% of the total funds from electoral bonds.

Data from Association of Democratic Reforms for 2017-18 & 2018-19 shows that BJP received Rs 1,450.9 crore and Rs 210 crore during the two years and if the amount is added to funds raised through electoral bonds during the period from Apr 12, 2019 to Jan 24, 2024 of Rs 6,060.5 crore, it adds to Rs 7,721.4 crore. This was nearly 50% of total amount so far of Rs 15,529 crore.

Congress received Rs 383.3 crore and Rs 5 crore during the two years and the total works out to Rs 1,810 crore till now, while TMC received Rs 97.3 crore during the two years. Adding that to the amount revealed in the SBI data, the total for the party works out to Rs 1,706.8 crore.

BJD, meanwhile, received Rs 213.5 crore in 2018-19 and nothing in 2017-18. The total amount for the party after Thursday’s data works out to Rs 989 crore. This analysis does not include data from April 1 2019 to April 11, 2019. This period, while merely 11 days, was a busy one for political funding coming just before the 2019 Lok Sabha elections and would have seen considerable cash flows.

The full details of which party has received how much through electoral bonds from the time of the scheme’s inception in 2017 to its being shut down by SC earlier this year will be available soon once Election Commission collates the data given to it by SBI with what it had given SC in a sealed envelope. TNN

2024: BJP got record ₹1.7k cr

Bharti Jain, January 28, 2025: The Times of India

From: Bharti Jain, January 28, 2025: The Times of India

New Delhi : BJP’s annual income rose 84% from Rs 2,360.8 crore in 2022-23 to Rs 4,340.5 crore in 2023-24, of which Rs 1,685.6 crore came through electoral bonds, as per the party’s latest annual audit report filed with EC. This is the highest-ever annual income or receipts from bonds declared by any party.

Congress’s income surged 170% to Rs 1,225 crore from Rs 452.4 crore over the same period. The main opposition party also recorded a steep 384% increase in its receipts via the bonds route, wh- ich rose to Rs 828.4 crore in FY24 from Rs 171 crore in FY23. Congress has the second highest income as well as receipts from bonds.

BJP’s expenditure up 62% in FY24, Congress’ by 120%

On both counts, Congress surpassed BRS, which declared a total income of Rs 685.5 crore, and Trinamool Congress that received Rs 612.4 crore in bonds in 2023-24.

On expenditure side, BJP’s total spend in the last financial year stood at Rs 2,211.7 crore, 62% more than Rs 1,361.7 crore it had declared in 2022-23. Of this, Rs 1,754 crore was spent on election & general propaganda.

Congress ran up an annual expenditure of Rs 1,025.2 crore in 2023-24, up 120% from Rs 467.1 crore in 2022-23. Nearly Rs 49.6 crore was spent by the party on Rahul Gandhi’s Bharat Jodo Nyay Yatra that took place between Jan 14 and March 16, 2024, as against Rs 71.8 crore spent on the 1st edition of Bharat Jodo Yatra from Sept 7, 2022 to Jan 30, 2023.

Of the total Rs 3,967 crore voluntary contributions declared by BJP in its 2023-24 audit report, those worth Rs 1,685.6 crore came from electoral bonds, Rs 236.3 crore from Aajiwan Sahayog Nidhi and Rs 2,042.7 crore from ‘other’ contributions. Individual donors contributed around Rs 240 crore to BJP, corporates Rs 1,890 crore, institutions and welfare bodies Rs 101.2 crore and others Rs 50 crore.

Congress’s total income for the last fiscal included Rs 113.4 crore received from individual donors; Rs 170 crore from corporate donors; Rs 6.4 crore from electoral trusts and foundations; Rs 828.4 crore from bonds; and Rs 11.4 crore ‘others’. It received an additional Rs 22 crore from fee and subscriptions, and collected Rs 58.5 crore from issuance of coupons and sale of publications.

BJP’s audit report for 2023-24 declares an election spend of Rs 1,195 crore on advertisement and publicity, Rs 196.8 crore on travelling and Rs 191 crore on assistance to candidates. As on March 31, 2024, BJP had Rs 109.2 crore as cash in hand, Rs 1,627.2 crore as balance with banks and Rs 5,377.3 crore in fixed deposits, as against Rs 42 crore as cash in hand, Rs 311 crore as bank balance & Rs 5,071.4 crore in fixed deposits on March 31, 2023.

Congress declared expenditure of Rs 4.9 crore on pre-poll surveys in 2023-24, down from 40.1 cr spent the previous year.

The objections of the RBI and Election Commission

2017

Udit Misra, Feb 16, 2024: The Indian Express

At the time it was being conceived, the electoral bonds scheme faced stiff challenges from two key institutions — the Reserve Bank of India (RBI) and the Election Commission of India (ECI). While both had differing concerns, prevention of money laundering was a common ground.

Such an amendment would enable “multiple non-sovereign entities to issue bearer instruments”. The RBI had argued that this proposal — to allow any other bank to issue EBs — “militated against RBI’s sole authority for issuing bearer instruments which has the potential of becoming currency”. RBI was of the opinion that if such EBs are issued in sizable quantities, they “can undermine the faith in banknotes issued by the Central Bank.

The RBI also noted that while the identity of the person or entity purchasing the bearer bond will be known because of the Know Your Customer requirement, the identities of the intervening persons/entities will not be known. “This would impact the principles of the Prevention of Money Laundering Act 2002,” it stated.

The RBI was of the opinion that the intention of introducing electoral bonds — that the electoral contributions be paid out of tax-paid money — can be accomplished by cheque, demand draft, and electronic and digital payments. “There is no special need for introducing a new bearer bond in the form of electoral bonds,” it stated.

As the discussions continued, the RBI persisted with its view that it should be the only authority to issue such bonds. In September 2017, when it was presented with the draft scheme, the RBI stated that permitting a commercial bank to issue bonds would “have an adverse impact on public perception about the scheme, as also the credibility of India’s financial system in general and the central bank in particular.” The RBI reiterated “the possibility of shell companies misusing bearer bonds for money laundering transactions”. It also warned that the “issuance of electoral bonds in the scrip form could also expose it to the risk of forgery and cross-border counterfeiting…”

What ECI said

The Election Commission’s main objection was that EBs would have a “serious impact on transparency of political finance/funding of political parties.” In May 2017, the ECI wrote to the Ministry of Law and Justice about the amendments to the IT Act, the Representation of the People Act, and Companies Act introduced by the Finance Act 2017.

In it, the ECI stated that “the Amendment which has been made” — that any donation received by a political party through electoral bond is out of the ambit of reporting under the Contribution Report as prescribed in the Representation of the People Act 1951 — “is a retrograde step as far as transparency of donations is concerned and this proviso needs to be withdrawn”.

Further, referring to the deletion of the provision in the Companies Act requiring companies to disclose particulars of the amount contributed to specific political parties, the ECI had recommended that “companies contributing to political parties must declare party-wise contributions in the profit and loss account to maintain transparency in the financial funding of political parties.”

The ECI had also recommended that “the earlier provision prescribing a cap on corporate funding be reintroduced because unlimited corporate funding would increase the use of black money for political funding through shell companies”.

Highlights

From: February 16, 2024: The Times of India

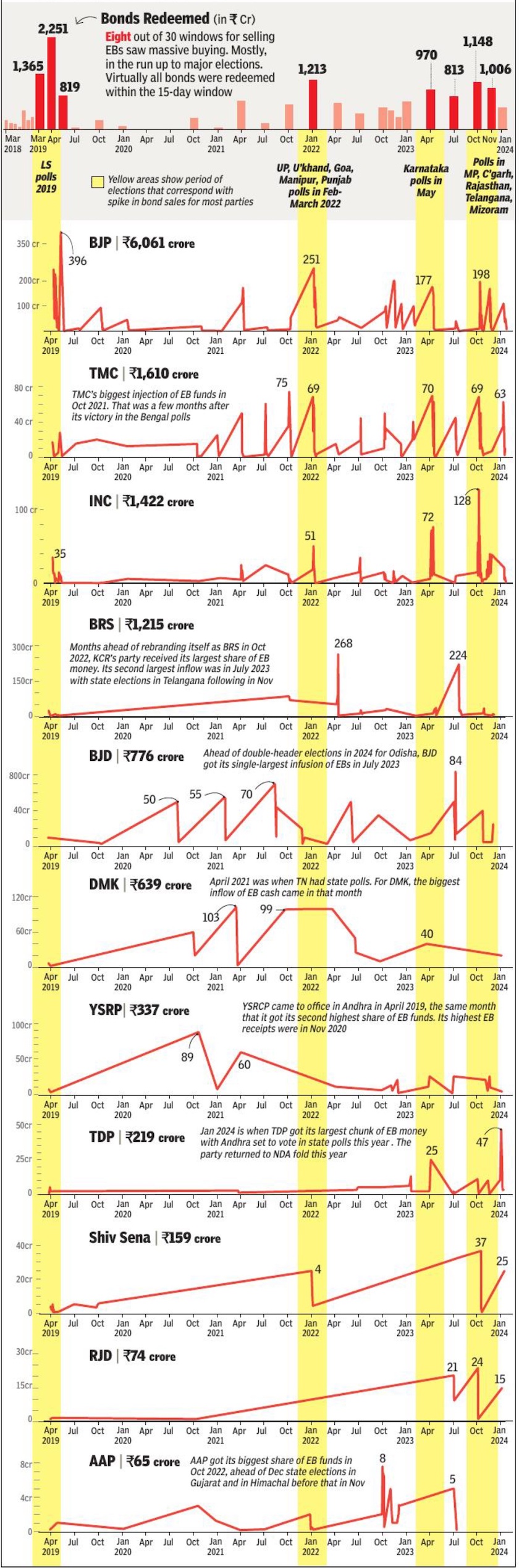

See graphic:

Electoral bonds: which party received how much money: 2017-23

2019 April to 2024 Feb

The main donors and recipients

Donations of ₹20 crore and above

March 22, 2024: The Times of India

From: March 22, 2024: The Times of India

From: March 22, 2024: The Times of India

See graphics:

Top donors to major parties, as in March 2024

Of over 1,200 companies and individuals who bought electoral bonds, here is the list of those who contributed Rs 20 cr and above

The Election Commission on Thursday released data that cleared the air on who funded which party for Rs 12,146 crore worth of electoral bonds, or about 74% of the total issued, based on information provided to it by SBI following a Supreme Court order.

The data showed that the biggest donors to BJP, which got about half of the amounts raised through EBs, were Hyderabad-based Megha Engineering & Infrastructure (Rs 584 crore), Qwik Supply Chain (Rs 375cr), mining and metals giant Vedanta Ltd (Rs 230cr) and Bharti Airtel (Rs 183cr). For Congress, the biggest chunks came from Vedanta (Rs 125cr), MKJ Enterprises and associated firms (Rs 120cr) and Western UP Power Transmission Co (Rs 110cr), part of Megha group. While nine separate entities contributed more than Rs 100cr to BJP and another 11 gave between Rs 50cr and Rs 100cr, Congress had just three that donated over Rs 100cr and another three in the Rs 50-100cr range. Trinamool, the third largest recipient of EB funds, had lottery major Future Gaming and Hotel Services as its biggest benefactor (Rs 542cr) and Haldia Energy of the RPG Sanjeev Goenka group as the next biggest with Rs 281cr.

The biggest donor, Future Gaming gave the biggest portion of its largesse to regional parties like Trinamool (Rs 542cr), DMK (Rs 503cr) and Jagan Mohan Reddy’s YSRCP (Rs 154cr), but also gave BJP Rs 100cr and Congress Rs 50cr.

The second biggest donor, Megha Engineering, gave BJP Rs 584cr, followed by BRS (Rs 195cr) and DMK (Rs 85cr). Qwik Supply was the third biggest donor and has been linked to Reliance with one of its directors identifying himself as head of accounts (consolidation) at RIL and another holding directorships in a number of group companies. Reliance, however, has stated that Qwik is not a subsidiary. The firm gave Rs 375 crore of its total of Rs 410 crore to BJP, with the rest going to Shiv Sena (Rs 25cr) and NCP (Rs 10cr).

The data for which donor and recipient could be matched was for bonds that had been bought on or after April 12, 2019. SC had ordered SBI to put out donor and recipient details only for the period starting from this date.

No donor-to-party data for 26% of EB amount (2018-19 bonds)

March 22, 2024: The Times of India

Who bought electoral bonds for whom — that is the question. But answers are available only for EBs purchased after April 12, 2019, although GOI notified the EB scheme on Jan 2, 2018, and the first tranche of EBs were sold between March 1and March 10, 2018.

Why? Because SC said so —but there’s a twist. The 5-judge constitution bench held that since its first interim order on ADR’s petition was passed on April 19, 2019, full disclosure should be mandated for bonds purchased after that date. The court said: “Changing the cut-off date, after the pronouncement of the judgment, would be akin to reviewing our own decision, which we will not do in these proceedings.”

However, data for EB donors and amounts are available for the period starting April 12, 2019. So, SC’s April 19, 2019 cut-off is now moot. Between March 1, 2018 and April 11, 2019, Rs 3,691.9cr worth of EBs were donated to various parties. This is 22.4% of the total of Rs 16,479cr. Another Rs 623.2cr worth of bonds were encashed by parties after April 12, 2019, but purchased by donors prior to that date. Hence, there are no donor details available for th- ese too. Thus, for a total of Rs 4,315.1cr of bonds, donor and recipient cannot be matched. That is 26.2% of the total. So, we have no info on who gave how much to whom for a little over a quarter of the value of EBs. That a few parties like DMK have disclosed a full list of donors doesn’t help in shedding much light — all of DMK’s EBs, for example, were bought after April 11, 2019.

Launch Of EBs

EBs had a life of only 15 days during which they could be used for making donation only to parties registered under Section 29A of Representation of the Peoples Act,1951, and which secured not less than 1% of votes polled in the last general election to Lok Sabha or a legislative assembly. The bonds were available for purchase for a period of 10 days each in Jan, April, July and Oct, and as specified by govt. An additional period of 30 days could be specified by the Centre in a year general elections (LS or assembly) were held.

EBs were a bearer instrument in the nature of a promissory note and an interest-free banking instrument. A citizen of India or a body incorporated in the country was eligible to purchase the bond.

The bonds were issued and could be purchased for any value, in multiples of Rs 1,000, Rs 10,000, Rs 1 lakh, Rs 10 lakh and Rs 1cr from the specified branches of SBI.

A purchaser was allowed to buy only after fulfilling the prevailing KYC (know your customer) norms and by making payment from a bank account. It did not carry the name of the payee.

Which party received how many funds and when?

2018-2024

March 22, 2024: The Times of India

From: March 22, 2024: The Times of India

Only donors can explain when and why they decide to contribute to a party. Biggies like BJP, Trinamool, and Congress saw inflows of EB money around polls with intermittent spikes. For smaller parties, too, highest contributions often coincided with approaching state elections or following triumphant campaigns. The charts on party donations below track the period from April 2019. However, parties would have received more since the inception of the scheme in March 2018

The party-wise donations of the major donors

From: March 22, 2024: The Times of India

From: March 22, 2024: The Times of India

See graphics:

The party-wise donations of the major donors-1

The party-wise donations of the major donors-2

60-odd firms set up after EB scheme was rolled out gave ₹250cr to parties

March 23, 2024: The Times of India

From: March 23, 2024: The Times of India

Over 60 companies that were set up after the announcement of the electoral bond scheme in early 2017 gave close to Rs 250 crore to political parties through the bonds. Of this, more than Rs 100 crore or over 40% went to BJP, while BRS was the second largest recipient with Rs 61 crore or about a fourth of this money. Together BJP and BRS encashed bonds worth Rs 162.2 crore from these firms, which translates to over 65% of the donations they made.

Congress was third in the list encashing bonds worth Rs 32 crore while TDP and Trinamool were fourth and fifth each getting bonds valued at about Rs 13 crore. Apart from them, RJD, DMK, Shivsena and BJD in that order all got bonds valued at Rs 5 crore or more from this fledgling companies. The scheme was first announced in the 2017-18 Budget speech, but the first bonds were issued in March 2018. Prior to 2017, the Companies Act, 2013 allowed a company to donate only up to 7.5% of its average profit for the three previous years. By this yardstick, many of these companies incorporated from 2017 onwards would not have been eligible for political donations. The govt amended the law to lift this restriction on the companies.

With the cap of 7.5% of average profits for three years removed, some companies donated a significant proportion of their profits or even more than the profit and even some that were making losses donated to parties through electoral bonds. The amendements also allowed companies to donate within the same year of being incorporated, which would not have been possible earlier.

For instance, Tsharks Overseas Education Consultants and Tsharks Infra Developers Private Limited, which donated Rs 4 crore and Rs 3.5 crore to BRS, were incorporated in 2023. Similarly, HH Iron and Steel Private Limited, incorporated in 2018, made a combined profit of Rs 5.6 crore in the three years between 2019-20 and 2021-22 but donated Rs 15 crore to BJP and Rs 5 cr to BJD.

Overall, six of these relatively new companies donated more than Rs 10 crore each through electoral bonds. LCC Projects Private Limited leads the list with Rs 31.5 crore and is followed by Aparna Farms, Askus Logistics and HH Iron and steel, each donating more than Rs 20 crore.

Parties that received no funding: the Left, BSP

March 23, 2024: The Times of India

From: March 23, 2024: The Times of India

What is this “share of lawmakers” being referred to? Since bonds are meant not just to fund Lok Sabha polls but also assembly elections, we looked at the combined performance of each party at both levels starting with the 2019 LS polls. For this, we converted MLA seats into equivalents of MP seats. For instance, Delhi has seven Lok Sabha MPs and 70 MLAs. Thus, each MLA corresponds to a tenth of an MP. AAP’s 62 MLAs in the Delhi assembly would, therefore, translate into just over six MPs. In Maharashtra, the ratio of MLAs to MPs is six, in Nagaland 60, so those were applied to MLAs from those states. We then totalled up the MPs and ‘MP equivalents’ for each party to calculate its share of total lawmakers and compared this with its share of the total money raised through bonds.

Among the regional parties, DMK and YSRCP, despite being major recipients of bond funds, have actually got less than their ‘fair’ share and AAP has got a lot less, as have Shiv Sena, NCP, RJD and JD(U). BRS, to be fair, had a significantly higher share of lawmakers prior to the 2023 assembly polls, but even that can only partially explain the yawning gap between its weight in the electoral polity and its share in bonds.

At the other end of the spectrum among those who got some funds from bonds is JD(U), which won 16 Lok Sabha seats and 57 MLA seats, totalling up to the equivalent of 24 MPs or 2.2% of lawmakers. But its share of bonds was a mere 0.1% or Rs 24 crore, a reflection undoubtedly of Bihar’s poor economic standing. The high strike rate of Andhra Pradeshand Telangana-based regional parties may be the flip side of this, reflecting the relative prosperity of the state.

There are, of course, a whole lot of parties that collectively account for 7.6% of lawmakers but have received no funding through EBs. These include the Left and BSP, besides a host of smaller parties. While some like the CPM refused to accept EBs, others may have not found willing donors.

BJP has 50.1% share of EBs, 46.2% of elected reps; TMC 10.4% & 4.9%

To what extent do funds received via electoral bonds by parties reflect their electoral performance? In some cases, quite well in others not at all, an analysis of elections and bond data shows. Among the two biggest national parties, BJP’s share of bonds (50.1%) was a little more than its share of elected representatives (46.2%), while Congress got less (11.8%) through EBs than what would correspond to its performance in the last round of LS and assembly polls (12.7%).

The biggest differences between the two shares were for regional parties, in particular for BRS, TMC and BJD, all of which had a much larger share of bond funds than of elected lawmakers. BRS had a 0.8% share in lawmakers but an 8.5% share in bond funds. Trinamool’s 10.4% share in bonds was out of proportion to its share of 4.9% in lawmakers. Similarly, BJD got 6.2% of the total money raised through bonds with just 2.6% of lawmakers.

Bharti Jain, January 21, 2025: The Times of India

From: Bharti Jain, January 21, 2025: The Times of India

New Delhi : Regional parties received the lion’s share of their donations in 2023-24 via electoral bonds before they were scrapped by Supreme Court on Feb 15, 2024, as per annual audit reports filed by them with Election Commission.

Trinamool Congress received Rs 612.4 crore between March 31, 2023 and Feb 15, 2024, followed by BRS with bonds receipts worth Rs 495.5 crore, BJD at Rs 245.5 crore, TDP’s at Rs 174.1 crore, YSR Congress Party’s at Rs 121.5 crore, DMK’s at Rs 60 crore, JMM’s at Rs 11.5 crore, and Sikkim Democratic Front’s at Rs 5.5 crore.

While 95% of TMC’s total income was from bonds, it was 72% for BRS, 82% for BJD, 61% for TDP, 64% for YSRCP, 33% for DMK, 73% for JMM.

Details

Bharti Jain, Jan 21, 2025: The Times of India

New Delhi : Among the four national parties whose annual audit reports for 2023-24 are available on the Election Commission’s website, only AAP has declared contributions via electoral bonds, albeit under the broader category of receipts through electoral bonds/electoral trusts. However, since AAP’s contribution report for 2023-24 did not declare any donation from electoral trusts, it may be safe to assume that the entire Rs 10.1 crore shown under the ‘donations from bonds/ trusts’ head has flown from bonds. This constitutes over 44% of the total income declared by AAP in 2023-24. A comparison of annual audit reports for 2023-24 and 2022-23 shows an 88% jump in TMC’s receipts from electoral bonds, 61% rise for BJD, 133% for YSRCP, 412% for TDP and 858% for JMM. SDF did not declare any donations through bonds in 2022-23. However, DMK’s funding through the electoral bonds route fell by 67% in 2023-24 as compared to the previous year, as did that of BRS by 6.3%.

As regards to the total income declared by the four national parties — BSP, AAP, CPM and National People’s Party (NPP) — for the year 2023-24, BSP’s was the highest at Rs 64.8 crore (up from Rs 29.3 crore in 2022-23), followed by AAP at Rs 22.7 crore (down from Rs 85.2 crore), NPP at Rs 22.4 lakh (down from Rs 7.6 crore) and CPM a t Rs 16.8 lakh (up from Rs 14.2 lakh). The total expenditure declared by BSP for the last fiscal is Rs 43.2 crore, by AAP Rs 34.1 crore, by NPP Rs 1.1 crore, and by CPM Rs 12.7 lakh.

Among the regional par- ties, BRS has declared the highest income at Rs 685.5 crore in 2023-24 (down from Rs 737.7 crore in 2022-23) followed by TMC at Rs 646.4 crore (up from Rs 333.4 crore), BJD a t Rs 297.8 crore (up from Rs 181 crore), TDP at Rs 285.1 crore (up from Rs 64 crore), YSRCP at Rs 191 crore (up from Rs 74.8 crore), DMK at Rs 181 crore (down from Rs 214.3 crore), Samajwadi Party at Rs 26.1 crore (down from Rs 32.9 crore), CPI Rs 19.5 crore (up from Rs 15.3 crore), JMM Rs 15.8 crore (up from Rs 2.7 crore). YSRCP incurred an expenditure of Rs 295.8 crore in 2023-24, BRS Rs 254.9 crore, TMC Rs 231.5 crore, DMK Rs 200 crore, TDP Rs 121.1 crore, BJD Rs 44 crore, SP Rs 39.4 crore and CPI Rs 13.8 crore.

Supreme Court verdict of 2024 feb

Ananthakrishnan G, Feb 16, 2024: The Indian Express

Highlighting that “the information about funding to a political party is essential for a voter to exercise their freedom to vote in an effective manner”, a five-judge Constitution bench, headed by Chief Justice of India

D Y Chandrachud, said that changes made in the laws to implement the scheme were unconstitutional.

Holding the scheme “violative” of the constitutional right to freedom of speech and expression and right to information, the court did not agree with the Centre’s contention that it was meant to bring about transparency and curb black money in political funding.

In its two separate but unanimous verdicts spanning 232 pages, the court also directed the SBI, the authorised financial institution under the scheme, to submit by March 6 the details of electoral bonds purchased since April 12, 2019 till date to the Election Commission which will publish the information on its official website by March 13.

“SBI must disclose details of each electoral bond encashed by political parties which shall include the date of encashment and the denomination of the electoral bond,” the bench said.

On April 12, 2019, the SC, in an interim order, had asked political parties to submit details of donations via electoral bonds to the EC in a sealed cover to be kept in the safe custody of the commission till further orders.

The SC also directed that electoral bonds which are within the validity period of 15 days but have not been encashed by political parties shall be returned by the political party or the purchaser — depending on who is in possession of the bond — to the issuing bank which shall refund the amount to the purchaser’s account.

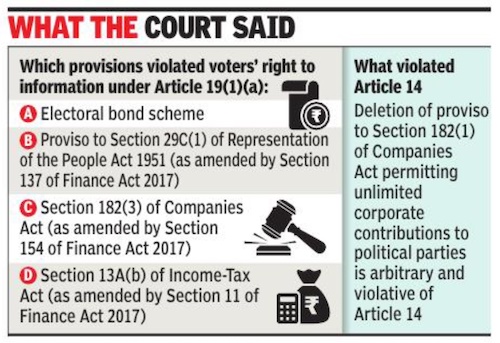

The bench, also comprising Justices Sanjiv Khanna, B R Gavai, J B Pardiwala and Manoj Misra, struck down a set of amendments. “The Electoral Bond Scheme, the proviso to Section 29C(1) of the Representation of the People Act, 1951 (as amended by Section 137 of the Finance Act 2017); Section 182(3) of the Companies Act (as amended by Section 154 of the Finance Act 2017); and Section 13A(b) (of the Income Tax Act) (as amended by Section 11 of the Finance Act 2017) are violative of Article 19(1)(a) and unconstitutional,” the bench said.

It held that “the deletion of the proviso to Section 182(1) of the Companies Act, permitting unlimited corporate funding to political parties is arbitrary and violative of Article 14”.

Section 29C of the RPA as amended by the Finance Act 2017 stipulated that the political party need not disclose financial contributions received through electoral bonds. Section 13A of the IT Act as amended said that the political party does not have to maintain a record of contributions received through electoral bonds. Section 182 of the Companies Act 2013 was amended by the Finance Act 2017 by which the earlier requirement of disclosure of particulars of the amount contributed by companies to political parties in their profit and loss accounts was deleted and donors were only required to disclose the amount contributed without disclosing particulars about the political party to which the contribution was made.

The court did not agree with the Centre’s submission that the political party which receives the contribution does not know of the identity of the contributor as neither the bond would have their name nor could the bank disclose such details to the party.

The court argued that “de jure anonymity of the contributors does not translate to de facto anonymity.” Saying that the scheme is not fool-proof, the court said that there are “sufficient gaps” in the scheme which enable political parties to know who paid how much.

For example, Clause 12 of the scheme says the bond can be encashed only by the party by depositing it in the designated bank account. “The contributor could physically hand over the electoral bond to an office-bearer of the political party…or the contributor could after depositing the electoral bond disclose the particulars of the contribution to a member of the political party for them to cross-verify. …ninety four percent of the contributions through electoral bonds have been made in the denomination of one crore. Electoral bonds provide economically resourced contributors who already have a seat at the table selective anonymity vis-à-vis the public and not the political party,” the court said.

The government had argued that the scheme was intended to curb black money and ensure that contributions to parties flow through legitimate banking channels.

But the bench held that the scheme does not satisfy the least restrictive test necessary for imposing curbs under Article 19(2) on the right to information under Article 19(1)(a) of the Constitution. “The purpose of curbing black money is not traceable to any of the grounds in Article 19(2)”.

The court added that the scheme “is not the only means for curbing black money in Electoral Financing” and “there are other alternatives which substantially fulfil the purpose and impact the right to information minimally when compared to the impact of electoral bonds on the right to information”.

For contributions below Rs 20,000, electronic transfer is the “least restrictive” and “Electoral Trust” for amounts above that, it pointed out.

The bench held that “the right to informational privacy extends to financial contributions to political parties which is a facet of political affiliation” but added that “the Constitution does not establish a hierarchy between the right to information guaranteed under Article 19(1)(a) and the right to informational privacy to political affiliation, traceable to Articles 19(1)(a), 19(1)(b), 19(1)(c), and Article 21”.

The SC said, “we are unable to see how the disclosure of information about contributors to the political party to which the contribution is made would infringe political expression. .. Under the current Scheme, it is still open to the political party to coerce persons to contribute. Thus, the argument of the Union of India that the Electoral Bond Scheme protects the confidentiality of the contributor akin to the system of secret ballot is erroneous”.

On the amendment to Section 182 of the Companies Act permitting unlimited political contributions by companies as manifestly arbitrary, the SC said “the ability of a company to influence the electoral process through political contributions is much higher when compared to that of an individual.”

A company, the bench said, has a “much graver influence on the political process, both in terms of the quantum of money contributed to political parties and the purpose of making such contributions.” It added: “Contributions made by individuals has a degree of support or affiliation to a political association. However, contributions made by companies are purely business transactions, made with the intent of securing benefits in return. The amendment to Section 182 is manifestly arbitrary for treating political contributions by companies and individuals alike”. The apex court said, “Companies before the amendment to Section 182 could only contribute a certain percentage of the net aggregate profits. The provision classified between loss-making companies and profit-making companies for the purpose of political contribution and for good reason.. the underlying principle of this distinction was that it is more plausible that law-making companies will contribute to political parties with a quid pro and not for the purpose of income tax benefits”.

“The provision as amended by the Finance Act of 2017 does not recognise that the harm of contributions by loss-making companies in the form of quid pro quo is much higher. Thus the amendment…is manifestly arbitrary for not making a distinction between profit-making and loss-making companies for the purposes of political contribution”.

The court pointed out: “The purpose of Section 182 is to curb corruption and electoral financing. For instance, the purpose of banning a government company from contributing is to prevent such companies from entering the political fray. Amendment to Section 182 by permitting unlimited corporate contributions authorises unrestrained influence of companies in the electoral process. This is violative of the principle of free and fair elections and political equality captured in the value of one person, one vote.”

The verdict said financial contributions to political parties are usually made for two reasons — they may constitute an expression of support to the political party or the contribution may be based on a “quid pro quo”.

“The huge political contributions made by corporations and companies should not be allowed to conceal the reason for financial contributions made by another section of the population: a student, a daily wage worker, an artist, or a teacher. When the law permits political contributions and such contributions could be made as an expression of political support which would indicate the political affiliation of a person, it is the duty of the Constitution to protect them,” it said.

In October last year, the bench began hearing arguments on the four petitions, including those filed by Congress leader Jaya Thakur, the Communist Party of India (Marxist) and the NGO Association for Democratic Reforms (ADR).

The judgement explained

Dhananjay Mahapatra, February 16, 2024: The Times of India

From: Dhananjay Mahapatra, February 16, 2024: The Times of India

From: Dhananjay Mahapatra, February 16, 2024: The Times of India

New Delhi: Supreme Court struck down as unconstitutional the electoral bond scheme introduced by BJP govt in 2018 that allowed big-ticket anonymous corporate contributions to political parties. It directed State Bank of India to immediately stop issuing bonds and furnish up-to-date details of such contributions since April 2019 for publication on Election Commission’s website by March 13.

A bench of CJI D Y Chandrachud and Justices Sanjiv Khanna, B R Gavai, J B Pardiwala and Manoj Misra unanimously rejected the central rationale of the electoral bond scheme — need to protect the identity of donors to save them from possible harassment — and ruled that voters could not be kept in the dark about huge donations to political parties when money played a significant role in elections.

The bench held that secret corporate funding of political parties, possibly for a quid pro quo, breached voters’ right to information, adversely impacted purity of free and fair elections and polluted democracy by disturbing political equality in polls. Amendments enacted to ensure the anonymity and non-disclosure were arbitrary, it ruled.

Though unanimous in their rejection of the bond scheme, the bench put across its stand through two separate but concurring verdicts — one written by the CJI and the other by Justice Khanna.

The order did not interfere with the existing scheme of al- lowing anonymous donations to political parties up to an amount of Rs 20,000 by any individual or company. Contributions through cheques, drafts and bank transfers by corporate entities and duly reflected in the party’s statement to EC would not be affected by this ruling, the court clarified. What it stopped was unli- mited anonymous contributions by companies. Apart from full disclosure, the court also brought back the 2013 cap of 7.5% of average net profit of acompany in the last three years on corporate donations. From 1985 to 2013, it was 5% of average net profit.

Justice Chandrachud, writing the judgment for himself and Justices Gavai, Pardiwala and Misra, and Justice Khanna in a concurring judgment invalidated the bond scheme and enabling amendments carried out in Finance Act, 2017, Representation of the People Act, Companies Act and Income Tax Act.