Currency: India

(→Re. 1 notes) |

|||

| Line 139: | Line 139: | ||

Dec 27 2014 | Dec 27 2014 | ||

| − | ''' One rupee notes are set to make a comeback after two decades, although in a different colour. | + | ''' One rupee notes are set to make a comeback after two decades, although in a different colour. '''' |

Instead of the familiar indigo, the new Re 1 notes will be predominantly pink-green on the front and back in combination with others, a finance ministry notification said.Unlike other currency notes, the Re 1 notes will be issued by the government. As was the norm earlier, the Re 1 note will be signed by the finance secretary, while the Reserve Bank of India governor will continue to sign notes of all other denominations. | Instead of the familiar indigo, the new Re 1 notes will be predominantly pink-green on the front and back in combination with others, a finance ministry notification said.Unlike other currency notes, the Re 1 notes will be issued by the government. As was the norm earlier, the Re 1 note will be signed by the finance secretary, while the Reserve Bank of India governor will continue to sign notes of all other denominations. | ||

| Line 146: | Line 146: | ||

Over the last few years, the government and the RBI have focused on coins for smaller denominations and discontinued Re 1 and Rs 2 notes citing the high cost involved and the clogging of presses. But the decision to go back to Re 1 notes came as a surprise. | Over the last few years, the government and the RBI have focused on coins for smaller denominations and discontinued Re 1 and Rs 2 notes citing the high cost involved and the clogging of presses. But the decision to go back to Re 1 notes came as a surprise. | ||

| + | |||

=2011, 2015: long winning streaks= | =2011, 2015: long winning streaks= | ||

[http://epaperbeta.timesofindia.com//Article.aspx?eid=31808&articlexml=Res-longest-run-of-gains-since-2011-25032015026023 ''The Times of India''] | [http://epaperbeta.timesofindia.com//Article.aspx?eid=31808&articlexml=Res-longest-run-of-gains-since-2011-25032015026023 ''The Times of India''] | ||

Revision as of 19:58, 18 July 2015

This is a collection of newspaper articles selected for the excellence of their content. |

Contents |

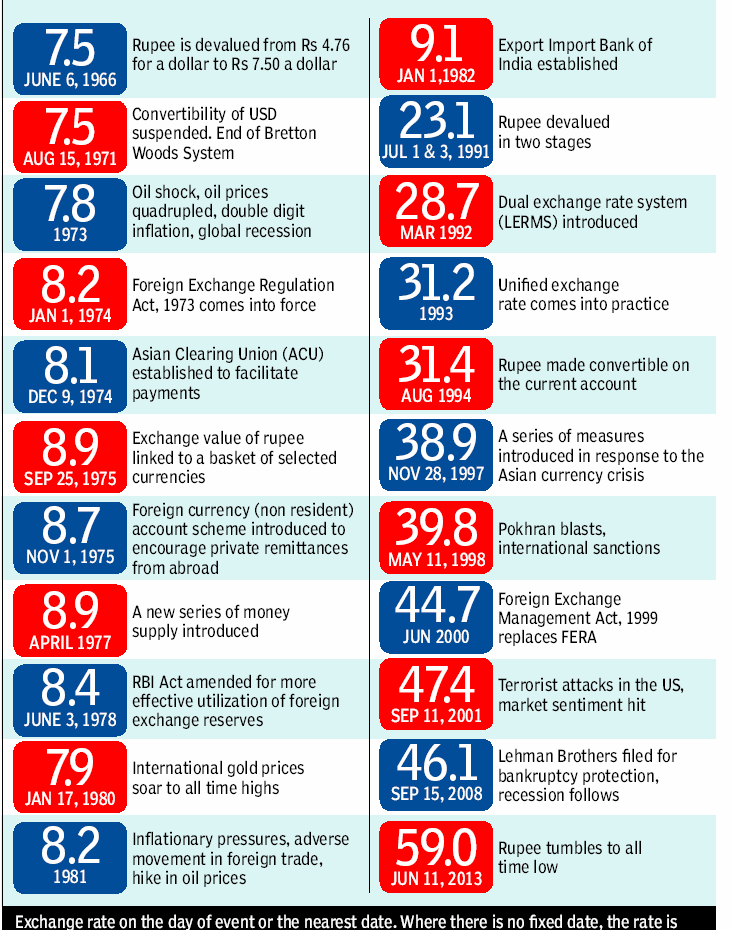

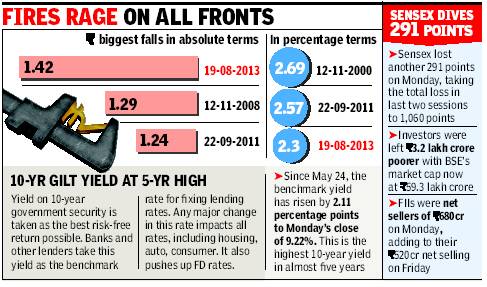

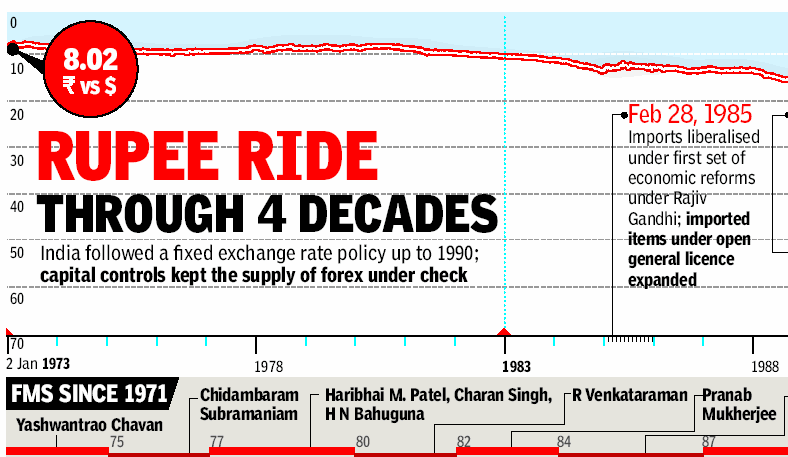

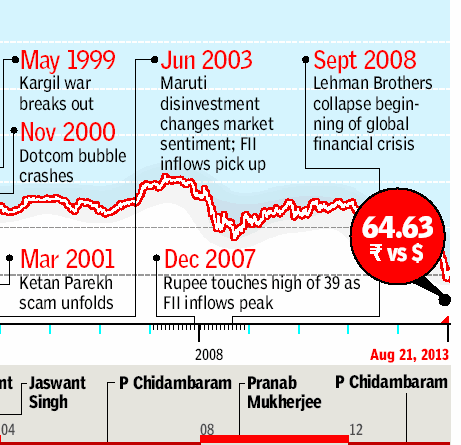

The steady depreciation of the rupee

See the accompanying chart

The Times of India 15 June 2013

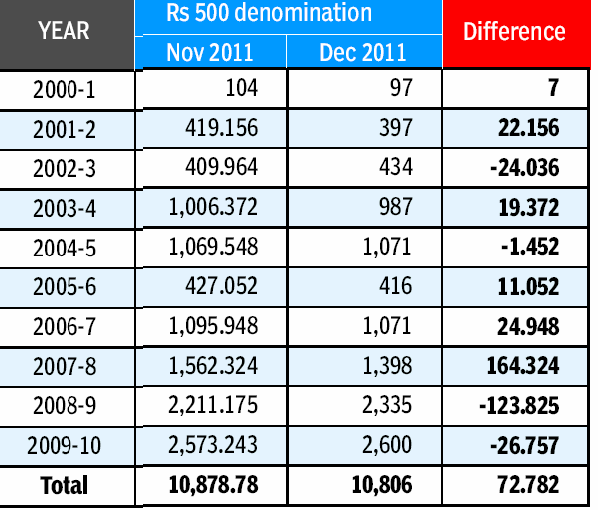

See Table 1

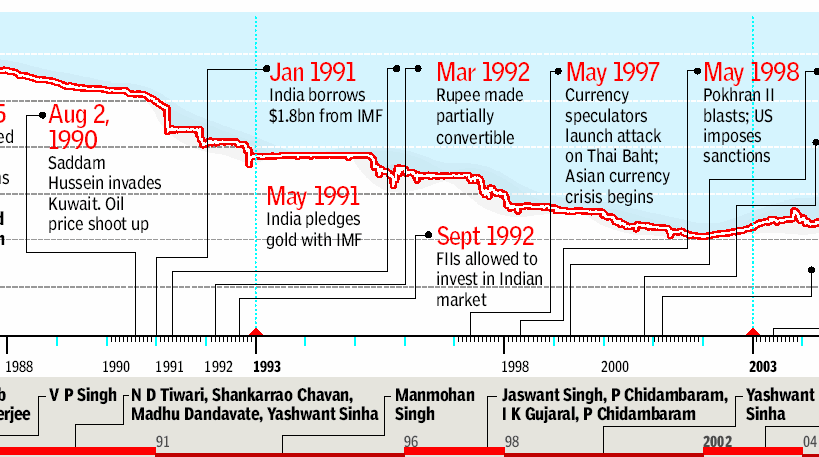

1993-2013: Movements of the rupee

Inflation, trade imbalance sink Re

Mayur Shetty The Times of India Mar 05 2015

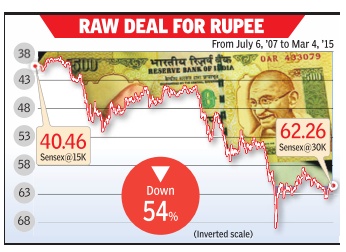

Growth Story Buoys Sensex Even As Currency Slips From Crisis To Crisis Historically the rupee has moved in tandem with the sensex. A surge in the equity index usually led to the domestic currency firming up against the dollar as foreign funds that drive up stocks also provide support to the rupee. Yet, despite foreign investment consistently rising, the rupee has sharply depreciated from its opening level of 32 against the dollar in 1993 -the year when it was allowed to float freely in terms of demand and supply . The answer to this behavior lies in India's higher inflation and trade deficit which has resulted in rupee finding a new floor every time there is a major global crisis.Here are some of them: Mexican crisis (August-December 1995): Triggered by risk averseness among global investors after Mexico's currency collapse, the rupee which was at 31.40 against the dollar in July `95 depreciated to 33.96 by end-September 1995 and further to 36.48 by end-January 1996. Although the fall was only five rupees it was sharp in percentage terms.Asian Currency Crisis (August '97-April '98): Much as Indian companies, banks and brokers tried to convince international investors that India was not a part of South East Asia, foreign institutional investors continued to stampede out of the country . The international sanctions after the nuclear tests known as Pokhran II did not help. Te rupee exchange rate which was 35.92 in August `'97 worsened to 42.76 against the dollar in August'98.Dotcom bust and 911 attacks (2000-2001): India saw a surge in technology stocks due to the increased business arising out of Y2K. While the dotcom bust weakened the rupee in 2000, the `risk-off' situation following the 911 attacks in New York sent the rupee into a free fall. It weakened from 43.64 per US dollar during April 2000 to 48.43 on September 17.Lehman Brothers collapse and Global Financial Crisis (2008): The rupee witnessed its longest steady spell in the run up to the global financial crisis and was trading around Rs 48 levels. After the crisis the currency breached the level of Rs.50 per dollar on October 27, 2008. The fall would have been sharper had the RBI not spent $18.7 billion worth dollars to support the rupee.US Sovereign downgrade (August 2011): In August 2011 S&P downgraded the US following a political deadlock which blocked funds to the government. But instead of the dollar weakening it was the rupee which lost as global investors sought refuge in US treasury bills.Grexit & Eurozone crises (2011-12): Portugal, Ireland, Greece and Spain formed the PIGS whose governments found it difficult to meet their debt obligations. Greece came close to defaulting and exiting the European Union. The resultant volatility saw the rupee weaken to 54.24 against the dollar during this period but regained its losses the next year.US Taper Tantrums: In May 2013 chief of US Fed Ben Bernanke said that he was considering tapering back the Fed's $70 billion a month liquidity infusion through buyback of bond and mortgage backed securities. When the US Fed sneezes, world markets catch a cold. The rupee fell the sharpest among emerging economies due to India's gigantic current account deficit. Between May 22, 2013 & August 30, 2013, the currency fell 15.5% against the US Dollar.

Depreciation: 2000-13

The rupee under various finance ministers

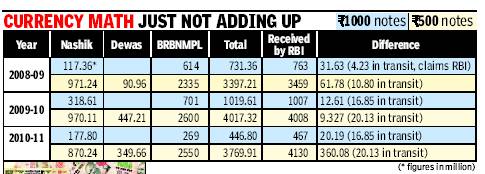

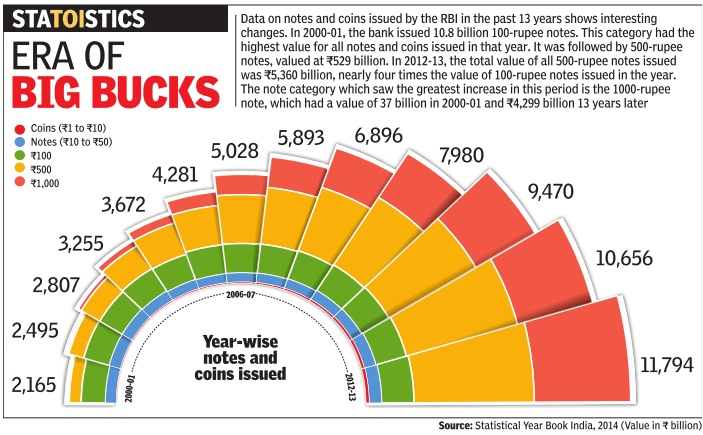

Unaccounted for rupees in circulation

Millions of notes not printed in mints land in RBI vaults

Bank, Press Records Don’t Tally

Hemali Chhapia TNN

The Times of India 2013/08/04

Mumbai: Millions of currency notes worth hundreds of crores of rupees that have apparently never been printed at our nation’s mints have mysteriously made it to the vaults of the Reserve Bank of India over the years.

A series of RTI applications reveal that while the mismatch between currency bills printed and those transported to the RBI is seen across denominations, it is more pronounced in the case of higher value notes — those of Rs 1,000 and Rs 500.

Take the Rs 1,000 notes. The redesigned bill was introduced in October 2000. Ever since, the two authorized mints — Bharatiya Reserve Bank Note Mudran Private Limited, Bangalore, and Currency Note Press, Nashik — have printed a total of 4,452.3 million bills. But RBI records show that it has received 4,462 million notes, an excess of 9.7 million notes. That means the RBI has received Rs 970 crore more than what was actually printed.

WHAT THE RBI SPOKESPERSON SAYS

You have collected the data of printing from the press and the supply received from RBI. You cannot do that because there are a lot of logistics involved. Numbers must be compared from the one source; either you take RBI numbers or the printing presses’ numbers. You cannot mix and match.

An aggregate discrepancy of Rs 4,608 crore

In 2006-07 the number of 1000-rupee notes received by the RBI was 589 million. (The number of such notes printed that year was 591m.)

While this closes the difference between what was printed and what was received to a considerable extent, there still remains a discrepancy of about Rs 72 crore for the period in question, which the bank has attributed to “rounding off”.

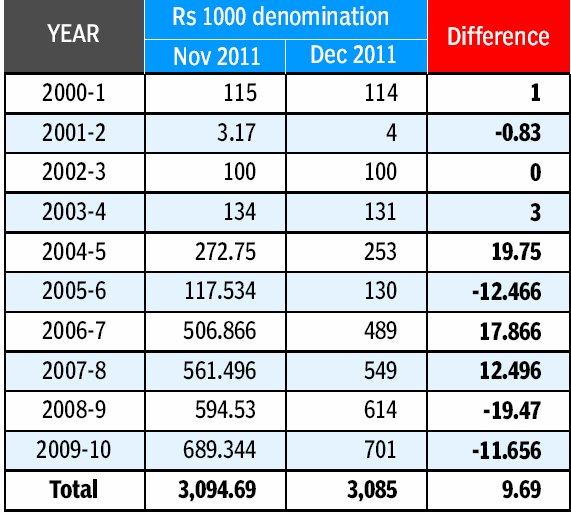

However, there is a large discrepancy between the numbers provided by the Bharatiya Reserve Bank Note Mudran, RBI’s wholly owned subsidiary, in its response to two similar queries just a month and a half apart under the Right to Information Act. A response dated November 10, 2011 to a query indicates the total count of Rs 500 notes printed between 2000-01 and 2009-10 as 10,878m while another response dated December 24, 2011 shows 10,806 m notes were printed—a difference of 72.782m notes valued at over Rs 3,639 crore (see Tables 3a-c).

Similarly, there is a difference in the case of currency notes of Rs 1000 denomination. The November response indicates the total number of Rs 1000 notes printed between 2000-01 and 2009-2010 as 3094.69m while the December response places it at 3,085m—a difference of 9.69m notes valued at Rs 969 crore (see Tables 3a-c).

The aggregate discrepancy—Rs 500 and Rs 1,000 notes—between the two RTI responses is a significant Rs 4,608 crore.

Rupee symbol

Rupee becomes only 5th currency to get a symbol Design By IIT Grad Cleared By Cabinet

New Delhi: In keeping with India’s growing economic might and its status as a major investment destination, the hitherto humble rupee is all set to get a distinct identity in the form of a new symbol. The Union Cabinet on Thursday gave its approval to the symbol which combines the Roman letter ‘R’ with the Devnagri ‘Ra’.

The symbol will catapult the rupee into the company of four ‘elite’ currencies which have similarly distinct identities — the US dollar, euro, yen and British pound.

The symbol has been designed by D Udaya Kumar, an IIT Bombay post-graduate, who has just joined as a teacher at IIT Guwahati. Kumar will receive a prize money of Rs 2.5 lakh for his efforts. The symbol will standardize the expression for the Indian rupee in different languages, both within and outside the country.

‘‘It’s a big statement on the Indian currency. It would distinguish the rupee from those countries whose currencies are also designated as rupee or rupiah, such as Pakistan, Nepal, Sri Lanka and Indonesia,’’ I&B minister Ambika Soni said after the Cabinet meeting. The symbol, she added, would reflect the strength and robustness of the Indian economy.

Till now, the Indian currency was simply denoted by Rs or INR. Kumar’s symbol was chosen after a public competition was held among resident Indian citizens inviting entries for a symbol which ‘‘reflects and captures the Indian ethos and culture’’.

Over 3,000 entries were received. These were evaluated by a jury headed by the RBI deputy governor, which included experts from reputed art and design institutes.

‘‘The entries were presented to the jury in such a manner that the identity of the competitors was not revealed to the jury members. The jury selected five final entries and also gave its evaluation of these five entries to the government to take a final decision,’’ said Soni. Re symbol to be adopted in 6 mths New Delhi: The new symbol for the rupee, cleared by Cabinet on Thursday, will not be printed or embossed on currency notes or coins, but it would be included in the ‘Unicode Standard’ and major scripts of the world to ensure that it is easily displayed and printed in the electronic and print media.

Unicode is an international standard that allows text data to be interchanged globally without conflict. After incorporation in the global and Indian codes, the symbol will be used by all individuals and entities within and outside the country.

The symbol will be adopted in a span of six months in the country, and within 18 to 24 months globally, Soni said, adding that it will feature on computer keyboards and software for worldwide use.

‘‘It is a perfect blend of Indian and Roman letters — capital ‘R’ and Devanagri ‘Ra’ which represents rupaiah — to appeal to international and Indian audiences. My design is based on the tricolour, with two lines at the top and white space in between,’’ Kumar told a news agency.

After encoding of the symbol in the Unicode Standard and National Standard, NASSCOM will approach software development companies for incorporating the rupee symbol in their operative software, as a new programme or as an update, to enable computer users worldwide to use the symbol even if it is not embedded on the keyboards (much like the way Euro symbol is used even though it is not embedded in the keyboards in use in India).

MAKING A MARK

The new symbol blends the Devnagri ‘Ra’ and Roman ‘R’. Its design is based on the tricolour, says creator D Udaya Kumar

3rd most counterfeited currency in Switzerland

In Switzerland: Most counterfeited currency after US Dollar and Euro

Rupee third on fake foreign currency list in Switzerland

The number of fake Indian rupee notes found in Switzerland during 2013 stood at 403 — the third highest for any foreign currency.

PTI | Jul 20, 2014

NEW DELHI/BERNE: As a debate continues on alleged black money of Indians in Swiss banks, the authorities in Switzerland have come across a significant quantum of fake Indian rupee notes in their country — the third highest for any foreign currency after Euro and the US dollar.

According to the latest counterfeit currency statistics released by Switzerland's Federal Office of Police (Fedpol), the number of fake Euro notes seized in the year 2013 stood at 2,394, while there were 1,101 fake US dollar bills.

The number of fake Indian rupee notes found in Switzerland during 2013 stood at 403 — the third highest for any foreign currency. This included 380 fake Rs 500 notes and another 23 counterfeit Rs 1,000 notes.

However, the numbers have declined considerably since 2012 when Fedpol found as many as 2,624 fake rupee notes — the second highest among foreign currencies after 5,284 counterfeit US dollar notes at that time. The number of fake Euro notes was third highest during that year at 2,084.

The number of fake Swiss franc notes stood at 4,309 during 2012, but was higher than any foreign currency in 2013 at 3,729, as per details compiled by the Fedpol's Counterfeit Currency Unit.

Among other counterfeit foreign currencies found during 2013, there were 99 fake British pound notes, 71 South African rand notes, 34 Deutsche Mark notes (German currency officially in circulation from 1948 till 2002 when Euro was introduced), 23 Chinese yuan notes and ten Canadian dollar.

The number of any other fake foreign currency notes was in single-digits.

Re. 1 notes

Dec 27 2014

One rupee notes are set to make a comeback after two decades, although in a different colour. '

Instead of the familiar indigo, the new Re 1 notes will be predominantly pink-green on the front and back in combination with others, a finance ministry notification said.Unlike other currency notes, the Re 1 notes will be issued by the government. As was the norm earlier, the Re 1 note will be signed by the finance secretary, while the Reserve Bank of India governor will continue to sign notes of all other denominations.

“It contains the words `Bharat Sarkar' above the words `Government of India' with the year 2015 on the representation of the Re 1 coin with the rupee symbol having floral design and the surrounding design has a picture of `Sagar Samrat', the oil exploration platform and with the authentic rendering of value in fifteen Indian languages in the language panel with the year's figure on the centre bottom in international number,“ the notification said. Other currency notes have RBI printed on them.

Over the last few years, the government and the RBI have focused on coins for smaller denominations and discontinued Re 1 and Rs 2 notes citing the high cost involved and the clogging of presses. But the decision to go back to Re 1 notes came as a surprise.

2011, 2015: long winning streaks

Mar 25 2015

Re's longest run of gains since 2011

The rupee inched up on 24 March 2015 by 3 paise against the American currency to end at 62.25, extending its winning streak to the seventh straight session -the longest string of gains since June 2011. The rupee opened higher at 62.20 per dollar as against 23 March 2015 closing level of 62.28 per dollar at the Interbank Foreign Exchange (Forex) Market. It then firmed up further to 62.14 per dollar on initial selling of the greenback by banks and exporters in view of sustained capital inflows.

Expectations that the US Federal Reserve will not tighten its monetary policy until the second half of the year has helped emerging market currencies like rupee to gain.

In the Asian market, the euro fell against the dollar and the yen.

See also

Sensex <> The stock market: India <> Mutual Funds: India <> Rupee: India <> Gold in the Indian economy