Banking, India: I

(→Cash deposit machines (CDMs)) |

(→Banking robot) |

||

| Line 348: | Line 348: | ||

And what if a question stumps Lakshmi? "She then asks you to get in touch with the branch manager. But at the back-end, we will be collecting all the questions she was unable to answer and equip her with better data sets, so she can service customers. Today she can give real time updates of foreign exchange movement, current interest rates at banks for different asset classes like personal, educational, two-wheeler and home loans, possible charges on withdrawals or deposits. But going forward, she might be able to more than that," said its assembler Vijay V Shah of Coimbatore-based Vishnu Engineering. | And what if a question stumps Lakshmi? "She then asks you to get in touch with the branch manager. But at the back-end, we will be collecting all the questions she was unable to answer and equip her with better data sets, so she can service customers. Today she can give real time updates of foreign exchange movement, current interest rates at banks for different asset classes like personal, educational, two-wheeler and home loans, possible charges on withdrawals or deposits. But going forward, she might be able to more than that," said its assembler Vijay V Shah of Coimbatore-based Vishnu Engineering. | ||

| + | |||

| + | ==Cash deposit machines (CDMs)== | ||

| + | [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=Cash-deposit-machines-not-to-work-for-6-21112016021021 Mayur Shetty, Cash deposit machines not to work for 6 weeks, Nov 21 2016 : The Times of India] | ||

| + | [[File: What are Cash deposit machines (CDMs.jpg|What are Cash deposit machines (CDMs)? |frame|500px]] | ||

| + | |||

| + | |||

| + | Unlike ATMs, which can be recalibrated, CDMs, which identify and separate currency , are “taught“ to detect counterfeit notes by presenting different kinds of fakes. This may take several weeks, or even months. | ||

| + | |||

| + | To promote self-service and make available all banking services around the clock, banks have been installing CDMs and pass book printers in e-banking kiosks, in addition to ATMs. CDMs are distinct from ATMs that also accept cash deposits in envelopes, although they are operated in the same manner using a debit card. The advantage of a CDM is that all successful transactions are immediately credited to the customer's account. | ||

| + | |||

| + | According to Navroze Dastur, India MD & CEO of ATM maker NCR, ATM manufacturers require six weeks to tune the CDMs to accept new high-denomination notes and to identify fakes. | ||

| + | |||

| + | CDMs can count the notes, verify denomination, quality and authenticity and do everything that a bank teller can. “Before the CDMs starts accepting new currency , the developers need to come to India and programme the machines to identify the new notes. The bigger challenge is getting the machine to learn wat is a fake note,“ said Sunil Udupa, MD, Securens Systems, which offers ATM services to banks. Helping the machine identify fake currency notes requires samples of fake notes which are currently not there for the new notes, said Udupa. | ||

| + | |||

| + | There are close to 30,000 cash deposit machines in the country and they have made life easier for banks in accepting bulk deposits. These machines have been imported from international manufacturers -Wincor Nixdorf, NCR, Diebold and OKI. Their engineers will need to come and reset the machines. Until they are reconfigured, the machines can be used only for the Rs 50 and Rs 100 notes, which continue to be legal tender. | ||

| + | |||

| + | In the one week after the demonestisation of Re500 and Re1000 notes (on Nov 9 2016), SBI saw 45 lakh transactions at its 6,000 CDMs between November 10 and November 16, helping Rs 7,384 crore to be deposited. The total value of transactions in CDMs has been more than the Rs 3,565 crore the bank has seen in its ATM network. | ||

=Hall of shame= | =Hall of shame= | ||

Revision as of 20:02, 26 January 2017

This is a collection of articles archived for the excellence of their content. |

Contents |

History

The Times of India, Aug 22 2016

The Times of India

India's first joint stock bank was established in 1720 in Mumbai. This was followed by the setting up of a similar bank in Kolkata in 1770 and, later, in many other cities. Because of the growing need for modern banking services, of uniform currency to streamline foreign trade and to manage the remittances of British Army personnel and civil servants, three Presidency Banks were established in Mumbai, Kolkata and Chennai. Apart from normal banking, these banks could also issue currency until 1861.During the same period, there was a significant increase in privately-owned commercial banks and, by 1913, there were 56 commercial banks operating in India. The First World War and the Great Depression exposed the flaws of banking in India as many banks failed and the need for a cent ral bank to ensure regulatory safeguards was felt.

Nationalisation (1969) and political misuse

The Times of India, April 10, 2016

Banks will remain political fiefdoms till privatized Public sector banks are losing huge sums and running up gargantuan bad debts. Defaulters like Vijay Mallya, once politically powerful, are fleeing abroad. India's banking crisis is fundamentally political, not financial.

The left, predictably, blames wicked busi nessmen, saying the banking system has become a fiefdom of big business. Rubbish! The banks were indeed fiefdoms of big business before 1969. Then Indira Gandhi nationalized them to make them the fiefdoms of politicians. That's the root of today's crisis.

Indira and her socialist acolytes claimed bank nationalization was essential for the state to capture the commanding heights of the economy , and channel bank lending to top social priorities.Actually , she could have ordered private banks to lend to favoured sectors (as is done today) without nationalization.

Her real aim was to control all big finance, emasculating the businessmen and maharajas leading the Swatantra Party , the main opposition party after the 1967 election. She nullified the treaties Sardar Patel had signed with the princes to persuade them to accede to India in 1947. She abolished their privy purses and made them taxable, bankrupting them.

She raised income-tax rates to 97.75%, added a wealth tax of 3.5%, nationalized several other industries, and made it clear to businessmen that dissenters would be crushed. The ploy succeeded. The Swatantra Party collapsed, and businessmen crawled.

However, the poverty ratio did not fall at all after 1947 till 1983. Meanwhile, the population doubled, so the absolute number of poor doubled. That terrible human cost exposes the fraudulent intent and outcome of Indira's Garibi Hatao policies, spearheaded by bank nationalization.

Did nationalization spur lending to “the people“? As Orwell said, in socialism all are equal, but some are more equal than others. Most equal of all was Sanjay Gandhi, Indira's son, who sought unending loans for his dud car project. Anyone opposing Sanjay -including R K Hazari, deputy RBI governor, and R K Talwar, chairman of the State Bank of India -got marching orders. After that, bank chiefs obediently followed orders (official or unofficial) from top politicians. That's the genesis of today's bank misgovernance and losses. The economy has grown 50 times since, so the misgovernance and losses have risen too. But in essence, Vijay Mallya is simply a new avatar of Sanjay Gandhi.

After Talwar's travails, pre-nationalization financial discipline was quickly destroyed. Loans were given to dud businesses and dud social projects (like loan melas to woo political vote banks). How many defaulters did nationalized banks remove from control of their businesses? Virtually none, since they had all bought political protection. Regional rural banks (RRBs) did indeed penetrate the countryside, a social plus. But they lost vast sums and had to be merged with the big banks.

By the early 1980s, the bad loans of banks exceeded their equity capital. Technically , they were bankrupt. But given government ownership, that was not even news. After all, public sector behemoths had always lost huge sums, and been replenished indefinitely by the taxpayer.

By the 1980s, nationalized banks were okaying highly inflated project costs that enabled promoters to skim off the excess. Banks “evergreened“ bad loans (renewing them indefinitely) instead of admitting they were unpayable, taking over the assets of borrowers and auctioning them. Unpaid and unpayable dues were listed as “receivables“. And all receivables, believe it or not, were classified as “income“, even though nothing was coming in.

Banking doyen Narayan Vaghul told me at the time that most bank profits were fictional, since they were based on receivables that were never received. On this fictional income the banks declared profits, and even paid corporate tax. And those that had no cash borrowed money to pay the taxes! That sad farce has continued ever since, in greater or lesser measure. Politicians have continued phoning bank managers.And at budget time finance ministers announce a host of schemes to be financed by the banks, a political diktat.

Governments have the right to lay down lending priorities.But bank funds are actually the resources of citizen savers, not the government. So, politicians should not force banks to hold loan melas for vote banks, or go easy on favoured borrowers.

Modi has brought in reforms aiming to provide more honest, independent bank chiefs and boards. This may improve matters.But the process is hardly foolproof, and can be reversed by a future government.

Private-sector banks (like ICICI Bank) have also been hit by bad loans in problem sectors like infrastructure and metals. But they avoided the worst loan proposals that nationalized banks happily accepted, with disastrous results. The private banks lent on commercial principles, not political orders. Probably bank privatization alone can ensure commercial discipline in future. But no political party wants that.

Laws, judgements

Bank guarantee can save property from attachment

The Times of India, Mar 02 2016

Lubna Kably

If there's a dispute over taxes, there's now a way for a company to prevent its property being attached. It can give a bank guarantee to the tax officer to prevent property, such as a factory, from being attached during the course of a tax assessment. The Budget proposals provide that a tax official can revoke an order for provisional attachment of the property if the taxpayer furnishes a bank guarantee equal to the fair market value of the property, or of an amount sufficient to protect the interests of the revenue authorities. Within 15 days of receipt of the bank guarantee, or within 45 days if the case has been referred to a valuation officer, the order for attaching the property is to be revoked. This proposal will come in force from June 1, 2016.

Business entities operating in India, often find that their property, such as an office or a factory building, is attached by the tax authorities during the course of assessment. For instance, operations froze at Nokia's manufacturing facility near Chennai after it was attached by tax authorities in 2013. More recently, when Vodafone received a fresh tax demand of Rs 14,200 crore, the notice also said that Vodafone's assets in India could be seized if the disputed demand was not paid.

A high-level committee led by Justice Easwar had pointed out that tax officials have the power to provisionally attach a taxpayer's assets, with the permission of higher level authorities, if it was necessary to protect the interests of the tax de partment. Such attachment is supposed to be temporary -six to 24 months. However, in many cases, the taxpayer files a writ, or approaches the Authority for Advance Ruling and obtains a stay on regular assessment. This prolongs the duration of the assessment and the property remains attached causing disruption in business operations.The Budget proposals have taken the recommendations of this committee into consideration.

“The move enabling taxpayers to furnish a bank guarantee will help business houses to continue with their operations. It is a businessfriendly proposal,“ says Gautam Nayak, tax partner, CNK & Associates.

Loans

5 business houses alone owe PSU banks Rs. 1.4 lakh crore

The Times of India, May 06 2016

Adani Group Has Debt Of Rs. 72,000 Crore'

Raising the issue of corporate loans in Rajya Sabha, JD(U) member Pavan Verma said the Adani group had a debt of Rs 72,000 crore -an amount equal to the total debt of farmers in the country. Verma said corporate houses owed about Rs 5 lakh crore to PSU banks and particularly referred to the Adani group, alleging that the company got “unimaginable“ favours. Raising the issue during zero hour, he contended that PSU banks were influenced to give loans to people who were not able to repay them.

“PSU banks are owed abo ut Rs 5 lakh crore by corporate houses and of this, roughly Rs 1.4 lakh crore are owed by just five companies, which include Lanco, GVK, Suzlon Energy , Hindustan Construction Company and a certain company called the Adani group and Adani Power,“ he said.

“I want a reply from the government, are they aware of this or are they not. And if they are aware, what are they doing in this matter. One company owes as much as all the farmers of India,“ he further said.

The amount owed by this group both in terms of its long-term and short-term debt was around Rs 72,000 crore, Verma said, claiming to be quoting from reports. He added that on Wednesday , it was mentioned that the entire amount owed by farmers as crop loans was Rs 72,000 crore.

“I don't know what is the relationship of this government with this business house. I don't even know if they know them, but the owner of this group (Gautam) Adani is seen everywhere the prime minister has gone, every country , China, the UK, the US, Europe, Japan,“ Verma said.

“This company has been given favours which are unimaginable. In Gujarat, their SEZ was approved in spite of the high court's strictures,“ he added.

When deputy chairman P J Kurien warned Verma against making allegations, the JD(U) member said, “I am giving you factual account. It is a high court judgment. It was left to the state government.The UPA government had not approved it and when this government came to power, it was approved.“

Verma said it did not matter if Adani group had the ability to pay this amount, but in the last 2-3 years, the company's net worth had gone up by 85%.

Defaulters and loans

Wilful defaulters:38% rise, 2012- 2015

The Times of India, May 04 2016

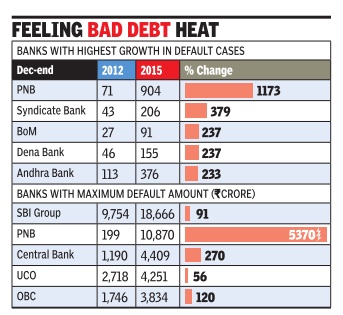

The number of wilful defaulters, who have not repaid their loans to public sector banks despite having the ability to do so, shot up by 38% to 7,686 at the end of December 2015, compared to 5,554 in December 2012, with lenders finally starting to issue the tag amid rising bad debt plaguing the Indian economy.

The amount involved in these cases has shot up 2.4 times to Rs 66,190 crore, compared to around Rs 27,750 crore three years ago, the government informed Parliament.

Bankers, however, war ned that some of the banks may still have kept a few firms and their promoters out of the net. “Banks have not done a complete exercise to identify all wilful defaulters in line with RBI guidelines,“ said Deepak Narang, a former executive director of United Bank of India. No one certifies that all the wilful defaulters have been identified. There has been an increase in recent years but not all accounts have been identified,“ Narang said.

He furnished the exam ples of Indian Overseas Bank and United Bank, where the numbers of such defaulters have come down. “How is that possible when the NPA in the system is rising and banks are reporting losses?“ RBI rules require banks to declare a borrower `wilful defaulter' if it has defaulted in repayment despite having the capacity to honour the obligation. Similarly , a defaulter who has diverted or siphoned off the funds, or has disposed off fixed assets or immovable property , can be given the tag.“The default to be categorised as wilful must be intentional, deliberate and calculated,“ the guidelines say .

Under pressure from RBI to act against defaulters, banks have begun to crack the whip only in recent months.As a result, lenders such as PNB have seen a massive spurt in the number of wilful defaulters -from 71 to 904 in three years (see graphic). In value terms too, PNB tops the list in terms of the growth rate with the amount involved jumping from Rs 199 crore at the end of December 2012 to almost Rs 11,000 crore at the end of 2015. Indian Bank and Andhra Bank (over 7times each).

SBI and its associates, which account for nearly a quarter of banking business, are at top of the pile in terms of amount involved but their share is around 28%, compared to 35% at the Dec-end of 2012, indicating that nationalised banks have only now begun to take exercise seriously .

Riot defaulters exempt

The Times of India, May 03 2016

Defaults can't bar Guj riot-hit from special loans: HC

The Gujarat high court has held in a case that a bank cannot deny loan under special policy for 2002riot affected because the applicant had defaulted in payments earlier. The HC has asked the state government and Bank of India to extend loan to a 2002-riot affected trader from Bhavnagar, Usman Ghani Aadhiya, who had defaulted in an earlier loan from the same bank. The bank was refusing to pay him a fresh loan after riots on the ground of his earlier default.

Aadhiya had suffered damage of Rs 5.1lakh to his business in the riots and was thus entitled to a loan at 4% flat interest from a bank according to policy.The HC said it was not permissible for the bank to exclude him from extending the loan because he falls in the category of the riots affected.

Home Loans

Home loan closure checklist

The Times of India, Apr 18 2016

Home loan closure checklist

1 Refer to the `list of documents to submit' when making the application for a loan, and make sure that all the original documents are recovered.

2 Ensure that the documents are complete and received in good condition, in the pre sense of a bank official, before signing the acknowledgement.

3 Take an NOC from the lender, specifying the address of the property against which the loan was taken, name of the borrower and the loan account number.

4 Request the lender to inform CIBIL re garding the closure of the loan account.

The process should take about 30 days from the date of loan closure.

5 Ensure that any lien is removed after the clo sure of the loan. An existing lien will create problems during the sale of the property.

Loan defaulters’ rights

The Times of India, Apr 18 2016

PREETI KULKARNI

Five rights loan defaulters should know of

If you have defaulted on loan repayment and the bank wants to repossess your assets, all is not lost

If you have defaulted on a loan, the rules do not give the lender a complete walko ver. Keep the following points in mind if you find yourself in such a situation.

Right to ample notice

A default does not strip you of your rights.Banks have to follow process and give you time to repay dues before repossessing your assets to realise the arrears. Typically, banks initiate such proceedings under the Securitisation and Reconstruction of Financial Assets and Enforcement of Secu-rity Interests (Sarfaesi) Act. If the borrower's account is classified as a non-performing asset, where repayment is overdue by 90 days, the lender has to first issue a 60-day notice.

“If the borrower fails to repay within the notice period, the bank can go ahead with sale of assets. However, in order to sell, the bank has to serve another 30-day public notice mentioning the details of the sale,“ says banking and management consultant V.N.Kulkarni.

Right to ensure fair value

The lender starts the process of auctioning your property to recover dues if you fail to clear what you owe or respond during the 60-day notice period. However, before doing so, they will have to issue another notice specifying the fair value of the secured asset as assessed by the banks' valuers, along with details like reserve price, date and time of auction. “The borrower can object if the property is undervalued. He can justify his objection by conveying any better offer that he may have so that the bank can make a decision,“ says Kulkarni. In other words, you can look for prospective buyers on your own and introduce them to the lender if you think that the property can yield a better price.

Realise balance proceeds

Do not write off your asset mentally the moment it is repossessed. Keep track of the auc tion process. Lenders are required to refund any balance after recovering the dues, which s a real possibility given that property pric es can shoot up beyond the owed amount After recovering the dues and expenses of conducting the auction, the bank has to re und the remaining amount to the borrower as the money belongs to him,“ says Kulkarni

Right to be heard

During the notice period, you can make your representation to the authorised officer and put forth your objections to the repossession notice. “The officer has to reply within seven days, giving valid reasons if he rejects the representation and objections raised by the borrower,“ says Kulkarni.

Losses

2015: Crisis in the Banking sector

The Hindu, February 13, 2016

Banks, it is often said, are the fulcrum of a robust economy. Healthy banks are an essential prerequisite for placing the economy on a higher growth orbit. The banking scene in India, however, presents an absolutely scary picture. A combination of factors ranging from poor credit appraisal to political interference and mismanagement by borrowers have conspired to push the banking industry into a messy cobweb. Bank after bank, especially the government-owned, has come out with poor third-quarter results. The stressed assets (comprising gross non-performing assets plus written-off assets and restructured assets) account for 14.1 per cent of total bank loans as of September 2015, up from 13.6 per cent in March 2015. For public sector banks, the stressed assets were in the vicinity of 17 per cent at the end of September, while the figure for private sector banks stood at 6.7 per cent. The rising stress level, or increase in bad loans, has yielded a twin fallout — of declining profitability at banks and poor credit disbursal. The double effect is already telling on the economy in various ways. For long, banks have either managed to, or rather been allowed to, keep the stress invisible, giving the outside world very little clue as to the happenings inside the industry.

The Reserve Bank of India under Raghuram Rajan’s stewardship, however, has decided to clean up banks’ books rather than letting them camouflage the real picture. “There are two polar approaches to loan stress,” he said at the CII Banking Summit in Mumbai this week. “One is to apply band-aids to keep the loan current, and hope that time and growth will set the project back on track. Sometimes this works. But most of the time, the low growth that precipitated the stress persists. The fresh lending intended to keep the original loan current grows. Facing large and potentially un-payable debt, the promoter loses interest, does little to fix existing problems, and the project goes into further losses.” Indeed, legacy problems should be given a burial, and should not be allowed to persist. So hinting, Dr. Rajan articulated the need for surgical action to retrieve the health of the industry.

Forcing banks to recognise a problem is one thing, and finding a viable long-term solution to it is quite another. That requires not just holistic thinking but an out-of-the-box approach as well, especially in the evolving global context. A meaningful fix can happen only if banks are given functional autonomy at various levels. Restricted freedom inevitably leads to a blame game, making it even more difficult to fix responsibility. The concept of arm’s- length relationship especially needs to be clearly defined and implemented in letter and spirit in the banking industry. It is not just about how much money the Central government will freshly pump into stressed banks. The litmus test for the government lies in its ability, and capacity, to let go of control. The banking system indeed needs a change in the way it is managed.

Loss in scams: 2011-15

Mar 27 2015

In four years, Rs 25 banks lost Rs 12k cr to fraudsters

Chethan Kumar

Twenty-five nationalized banks have lost Rs 12,620 crore to frauds in the last four financial years, according to documents obtained from the finance ministry. Of these, Rs 2,060.75 crore were lost by five banks headquartered in Karnataka alone -Canara Bank, Vijaya Bank, Corporation Bank, Syndicate Bank and State Bank of Mysore. The documents revealed that there have been 4,845 cases of bank frauds over this period. Finance ministry sources said in most cases bank staff either connive with the fraudsters or are negligent.

The latest instance surfaced on Wednesday when the CBI registered a case against an Ahmedabad-based telecom company and its directors following a joint complaint from State Bank of India, Vijaya Bank and Canara Bank. “It is alleged that expressing urgency , the company promoter got Rs 40.4 crore released from the three banks even though some documentation was pending. He disappeared after seeking time until August 31, 2013, to repay the loan,“ the CBI said in a statement.

Among the documents the promoter submitted were letters of credit (LCs), which turned out to be fake. A term loan of Rs 86 crore was also released to this firm, which too was allegedly siphoned off. There is an estimated total loss of Rs 126.4 crore to the banks.

In another case, the CBI on Thursday arrested a former managing director of a Bhopal-based private firm, who was absconding in a case relating to alleged loss of Rs 3.63 crore to State Bank of Indore.He conspired with bank officials to obtain credit facilities on the basis of fake collateral during 2003-2004.

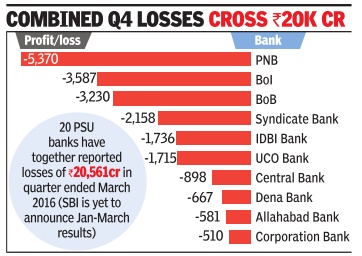

Q4/ 2016: High losses

The Times of India, May 19 2016

PNB Q4 loss highest by an Indian bank

Following a RBI-driven clean-up programme, PNB joins scores of other lenders which have reported losses, including Corporation Bank, which reported a loss of Rs 511 crore for the March quarter. The Delhi-headquartered lender had reported a steep fall in profit during the October-December quarter but had avoided loss that several other players, in cluding Bank of Baroda and Bank of India, registered.With annual loss a shade under Rs 4,000 crore, PNB lags Bank of Baroda, which has been in the red for two straight quarters.

So far in January-March quarter, public sector banks have together reported losses of around Rs 14,000 crore.

On the positive side, there are fewer restructured loans that are turning into NPAs, which are loans that remain unpaid for 90 days. But, banks have to deal with a huge pile of bad debt which doubled to Rs 55,818 crore at the end of March from the level a year ago.

Indian banks have seen their NPAs surge as companies in several sectors such as steel and textiles have witnessed pressure of imports, especially from China. In the infrastructure space, several corporate groups are facing stress as projects have not taken off due to regulatory factors. Although the government has been trying to resolve these cases, there has been limited success. In addition, several companies are still dealing with over-capacity as rural demand remains weak.

Money lost to theft and fraud

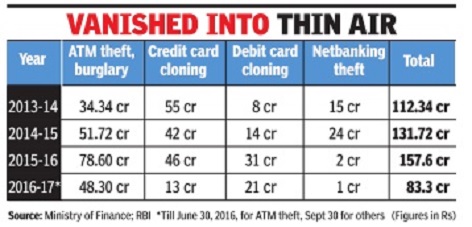

Between April 2013 and November 2016, the country's top 51 banks lost Rs 485 crore to theft.

More than 24 lakh people, or roughly 22% of Delhi's population, could have withdrawn Rs 2,000 using this much cash. Documents obtained from the Union finance ministry show that Rs 212 crore was lost to 2,492 cases of robbery , theft and burglary at ATMs. Another Rs 156 crore and Rs 74 crore were lost to credit card and debit card cloning, respectively , while Rs 42 crore was lost to netbanking fraud.

The number of thefts from ATM kiosks has been increasing every year. In 2015-16, 922 cases of theft totalling Rs 78.6 crore were reported, an increase from 698 cases (totalling Rs 51.7 crore) in the previous year.There were 596 cases (totalling Rs 34.34 crore) in 2013-14. The first quarter of 2016-17 has wit nessed 276 cases involving a theft of Rs 48.3 crore.

A major factor for the rising number is that the ecosystem lacks experts to deal with ATM thefts and other cases of technology-related fraud in the financial sector.

“Not all banks have forensic or technology experts.Plus, there is no coordination.Banks must make use of experts from Nasscom and the Centre, while police across the country need to get updated,“ said IPS officer P Harishekaran. Between 2013-14 and the second quarter of 2016-17, there have been 30,259 cases of credit card cloning costing Rs 156 crore. There were 12,033 cases of debit card cloning costing Rs 74 crore in the period.Another Rs 42 crore was lost in 559 cases of netbanking fraud in the same period.

“Police can only conduct post-theft investigation; the onus on prevention is completely on the banks, and there needs to be special risk-management teams and experts working round the clock to protect data,“ cyber expert Mirza Faizan Asad said. Experts also point out that dependence on foreign equipment should be reduced, and the banking sector should procure Indian products to be ensure data safety.

Market capitalization

2014

Nationalised and private banks, total bank deposits

19 nationalized lenders' combined m-cap less than HDFC Bank's Rs 2.64L cr

Mayur Shetty The Times of India Feb 03 2015

Investors Lose Interest In PSBs As Bad Loans Rise

The 19 nationalized banks in India account for almost half of the total bank deposits in the country as against private banks, which together have an 18.7% share. However, the surge in bad loans among public sector banks (PSBs) and the technology gap they have vis-à-vis their private peers has resulted in these lenders losing investor interest. As a result, the Rs 2.39 crore combined market capitalization of the nationalized banks is less than the Rs 2.64 lakh crore market capitalization of HDFC Bank the most valuable pri vate lender.

The nationalized banks exclude market leader, SBI which has a market cap of Rs 2.43 lakh crore. But even if the market capitalization of the 19 nationalized banks and the SBI were to be added together, it would still be less than the combined market capitalization of HDFC Bank and ICICI Bank as per Friday's closing prices. In cidentally, SBI is the only public sector lender with a market cap of over Rs 1 lakh crore. The next public sector bank is Bank of Baroda, which is a distant second in the public sector with a market capitalization of Rs 46,985 crore.

While the nationalized banks are being shunned by investors, the new generation private banks have been hit ting new highs on the back of new initiatives, which include digital technology . Besides HDFC Bank and ICICI Bank, two other private lenders have crossed the Rs 1 lakh crore mark. Kotak Mahindra Bank, which has been rallying after its recent inorganic initiatives -acquisition of ING Vysya and a deal to pick up stake in MCX -was worth Rs 1.02 lakh crore on Friday.

What the valuations mean is that the markets are discounting the market share of public sector banks in loans, their real estate assets worth thousands of crores and their customer base which accounts for almost the entire working class population of the country. Analysts say the main reason for despondency in PSU bank stocks is their disproportionate share in bad loans.

Here is what research firm Emkay Global Financial Services said about Bank of Baroda – a better performing public sector bank. “We expect the weak asset quality to persist.

While capitalization is better than peers, weak return ratios coupled with higher Basel III requirement will pose a challenge in the medium term unless there is sharp recovery. Also, capital infusion by the government, if below book value, would contain RoE improvement.”

Most NBFCs don't seek bank licence

Chennai: Several non-banking finance companies, including the Shriram Group, have stayed away from applying for a differentiated banking licence, as a January 1 clarification issued from the RBI forbids both NBFC and bank's co-existence.

The first set of guidelines dated November 27, 2014 for a differentiated bank licence, there was no explicit exclusion for NBFCs to co-exist along with these banks. The only inference was with respect to guidelines which dealt with financial and non-financial activity of the promoters, which was expected to be ring-fenced. These restrictions, according to sources in Shriram Group, vitiates the level-playing field between banks and NBFCs and also between existing banks and new ones, since the existing banks in several promoter groups like HSBC, HDFC, Federal Bank, Kotak are operating their NBFCs.

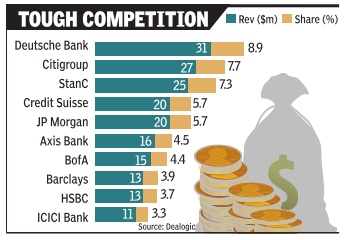

2014: Deutsche is no. 1

The Times of India Dec 22, 2014

Reeba Zachariah & Boby Kurian

Deutsche Bank has emerged as India's top dealmaker by fees earned during 2014. The European giant grossed $31 million in investment banking revenue, moving up from the fifth position it held in the previous calendar, according to Dealogic data.Wall Street biggie Citigroup retained the second position collecting $27 million in a year when i-banking fees declined nearly 13% from $398 million to $347 million.

Deutsche, which had a good run in equity and debt market deals, has an 8.9% share. Citigroup, ahead in M&A deals, staked claim to 7.7% share of the fee pool. The overall i-banking revenue slipped despite a pickup in the capital market activity as many private investments and certain M&A deals in emerging sectors like consumer internet were struck without advisers.

Standard Chartered Bank, with $25 million and 7.3% share, came third -up from sixth place last time -after advising M&A deals such as United Spirits' divestment of Whyte & Mackay , sale of Neotel by Tata Communications and Wilmar's stake purchase in Shree Renuka Sugars. Credit Suisse and JP Morgan were neck and neck, clocking $20 million in fees with 5.7% share each, while Axis Bank came in sixth with 4.5% share.

The big bankers said the street activity was set for a boost in the New Year. “As in vestment picks up, the requirement for new money and desire to access new capital pools will increase, which could trigger supply of issuances,“ said Amit Bordia, MD & head of corporate finance, Deutsche Bank.

I-banking fee charts are important, and closely monitored, as they usually set the tone for bonus payouts announced in January after the Christmas-New Year holidays. Within the total wallet, debt instruments brought in the highest revenue at $156 million followed by M&A with $112 million and equity capital issuances $78 million.

“2014 saw a pickup in capital market activity, especially qualified institutional placements and M&A transactions, in the latter half. This resulted in a concomitant increase in fee pool, moderated down by the fact that some deals have not had advisers,” said T V Raghunath, MD & CEO, Kotak Investment Banking. M&A and equity market deals increased to $47 billion and $11 billion respectively in the current calendar from $32 billion and nearly $10 billion in 2013.

Debt market deals, however, declined from almost $58 billion to $40 billion. The traditional i-banking fees do not count syndicated lending revenue, in which State Bank of India (SBI) has a lion's share with $83 million in earnings.

But, according to bankers, their bonus payouts were getting de-linked from fees earned in recent years. “Unlike the region, where marquee deals will dictate bonus numbers -no such luck in India. Neither league table rankings nor being one of the top fee generators will have any material effect on year-end numbers, which will be flat to down with the occasional outliers,” said Sourabh Chattopadhyay , partner, Wellesley Partners, a Hong Kong-based recruitment firm focused on financial services sector.

China, for instance, saw its i- banking revenue top $5 billion 2014.

2015: 3 Indian banks in top 5

The Times of India Jan 11 2016

Reeba Zachariah & Boby Kurian

TNN

The merger advisory units of Axis Bank, Kotak Mahindra Bank and ICICI Bank have made it to the list of top five dealmakers by fees earned during 2015, a Dealogic report has revealed. This marks the return of Indian tigers, overtaken by American and European investment banks since mid-2000s.

Axis rose from No. 4 in 2014 to No. 2, grossing $25 million in investment banking revenue and garnering nearly 8% of the total fee pool last year. Kotak Mahindra, which didn't even figure in the top 10 list of 2014, came third with earnings of $17 million. ICICI, with $15 million in revenue, moved three ranks up from 2014 to bag the fifth spot last year.

JM Financial had topped Bloomberg's merger and acquisition (M&A) chart by the size of the deals advised during the previous calendar year.

The investment banking revenue compiled by Dealogic comprises fees earned from M&A advisory , debt deals and equity transactions. Despite the strong showing by domestic dealmakers, Citigroup earned most fees, which was pegged at $32 million last year. Citi, with 10% share of the fee pool, was active in technology and consumer internet deals as startups gathered heft and deals got bigger, attracting the attention of foreign investment banks.

The total wallet of India's investment banking industry shrunk to $329 million last calendar compared to $408 million in 2014. M&A brought the highest revenue of $137 million, followed by $100 million fetched by debt deals and $92 million by equity issuances.

“Domestic banks have far superior execution capabilities and ear to the ground, reflecting on the performance of every deal this year and have hence beaten foreign banks,“ said Dharmesh Mehta, MD & CEO, Axis Capital, the M&A advisory arm of Axis Bank.

Besides Citi, the only other foreign bank in the top five list was JP Morgan, which jumped from the sixth position in 2014 to the fourth, garnering $15 million in fees last year. 2014's topper Deutsche Bank tumbled to the eighth position.

Sourabh Chattopadhyay , country head, Wellesley Partners, a Hong Kong-based placement firm focused on the financial services industry , said, “The underlying stories from last year's performance by foreign banks include Citigroup's re-emergence to the top, the continuing capital market success of Morgan Stanley and Credit Suisse's performance despite losing key senior members. There is measured optimism for 2016 as selective upgrading has picked up“.

Technology

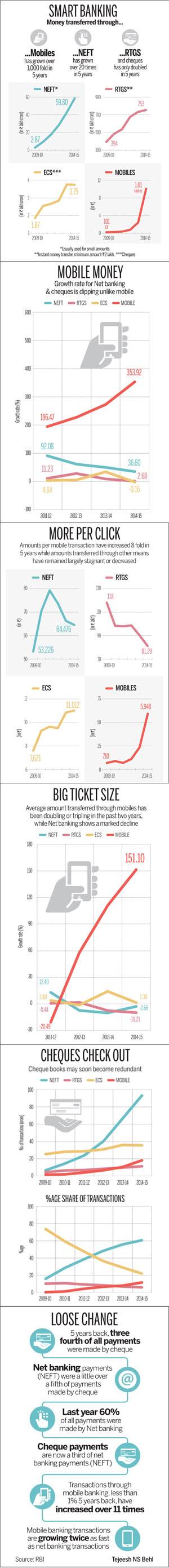

Mobile banking transactions

The Economic Times, Mar 22, 2016

Mayur Shetty

Top 5 banks generate 92% of mobile banking value

Mobile banking penetration in India is concentrated among customers of five banks. According to data released by the Reserve Bank of India, the top five banks account for more than 92% of the entire value of mobile banking transactions in the country.

State Bank of India leads the pack with 36% market share, followed by ICICI Bank (21.5%), HDFC Bank (17.8%), Axis Bank (12.8%) and Kotak Bank (4.7%). These banks have managed to increase the number of mobile transactions by being proactive in development of mobile apps and making mobile banking feature-rich.

According to Deepak Sharma, head of digital banking at Kotak Mahindra Bank, his customers are leapfrogging to mobile banking directly from branch banking without using the browser. "Around 35% of our online banking customers are coming in from their mobile phones without having used net banking," he said. As against its market share of 1.4% of deposits, the bank has over 4.5% share of mobile banking. He said that online has already become the primary channel for most of the customers in the bank.

"Overall, 60% of fixed deposits have moved online. But if you look at only retail, nearly 80% of FDs are opened online," said Sharma. He added that it was largely bu sinesses that were obtaining fixed deposits in the branch.

"In terms of number of logins, mobile banking had overtaken net banking more than six months ago. Now mobile banking is ahead of net banking in terms of transactions as well," said Sharma. He said that the fastest growing segment is online recharge, which is driving transactions.

"We are now getting more and more categories online, like bill pay and IPO subscription. We are also seeing systematic investment plans (SIPs) gaining traction. We feel that any simple product that is easy to start, liquidate and monitor will pick up online," said Sharma.

In terms of volumes, the top five banks account for more than 85% of all mobile banking transactions. While the banks are the same as the toppers in transaction value, the rankings and consequent market shares vary slightly for volumes.State Bank of India again led the pack with a 38.5% market share, followed by ICICI Bank at 17.7%, Axis (15.3%), HDFC Bank (9.9%) and Kotak Bank (4.3%).

Banking robot

Rachel Chitra | TNN | Nov 11, 2016,Lakshmi, country’s first banking robot, makes debut in Chennai

CHENNAI: Endearing, interactive and superfast with data, India's first banking robot Lakshmi made her debut on Thursday in the city. Launched by the Kumbakonam-based City Union Bank, the artificial intelligence powered robot will be the first on-site bank helper.

Top private lender HDFC Bank, which is also experimenting with robots to answer customer queries, is testing its humanoid at its innovation lab. Lakshmi, which took more than six months to develop, can answer intelligently on more than 125 subjects.

Want to know your account balance? Interest rates on home loans? Deferred payments or possible charges to be incurred on fixed deposit closure? Lakshmi can answer it all. "Apart from answering generic questions, we have also programmed it to connect to the core banking solution. If a customer wants to know his bank account details or transaction history, the robot can flash the answer on its display," said N Kamakodi, MD and CEO, City Union Bank.

Sensitive financial information like account details are displayed discreetly on the robot's screen and not voiced. "Lakshmi only talks out loud on generic subjects. If you visited our branch with your girlfriend, she won't embarrass you by showing your low account balance," joked its CEO.

Lakshmi, who currently speaks in English, gestures, turns around and engages in a very life-like manner in conversations. Unlike most robots her speech is not formal, but more relaxed and casual. "Since its artificial intelligence, the robot is constantly learning from customers - the more interactions it has with customers the better it gets," said a bank executive.

And what if a question stumps Lakshmi? "She then asks you to get in touch with the branch manager. But at the back-end, we will be collecting all the questions she was unable to answer and equip her with better data sets, so she can service customers. Today she can give real time updates of foreign exchange movement, current interest rates at banks for different asset classes like personal, educational, two-wheeler and home loans, possible charges on withdrawals or deposits. But going forward, she might be able to more than that," said its assembler Vijay V Shah of Coimbatore-based Vishnu Engineering.

Cash deposit machines (CDMs)

Mayur Shetty, Cash deposit machines not to work for 6 weeks, Nov 21 2016 : The Times of India

Unlike ATMs, which can be recalibrated, CDMs, which identify and separate currency , are “taught“ to detect counterfeit notes by presenting different kinds of fakes. This may take several weeks, or even months.

To promote self-service and make available all banking services around the clock, banks have been installing CDMs and pass book printers in e-banking kiosks, in addition to ATMs. CDMs are distinct from ATMs that also accept cash deposits in envelopes, although they are operated in the same manner using a debit card. The advantage of a CDM is that all successful transactions are immediately credited to the customer's account.

According to Navroze Dastur, India MD & CEO of ATM maker NCR, ATM manufacturers require six weeks to tune the CDMs to accept new high-denomination notes and to identify fakes.

CDMs can count the notes, verify denomination, quality and authenticity and do everything that a bank teller can. “Before the CDMs starts accepting new currency , the developers need to come to India and programme the machines to identify the new notes. The bigger challenge is getting the machine to learn wat is a fake note,“ said Sunil Udupa, MD, Securens Systems, which offers ATM services to banks. Helping the machine identify fake currency notes requires samples of fake notes which are currently not there for the new notes, said Udupa.

There are close to 30,000 cash deposit machines in the country and they have made life easier for banks in accepting bulk deposits. These machines have been imported from international manufacturers -Wincor Nixdorf, NCR, Diebold and OKI. Their engineers will need to come and reset the machines. Until they are reconfigured, the machines can be used only for the Rs 50 and Rs 100 notes, which continue to be legal tender.

In the one week after the demonestisation of Re500 and Re1000 notes (on Nov 9 2016), SBI saw 45 lakh transactions at its 6,000 CDMs between November 10 and November 16, helping Rs 7,384 crore to be deposited. The total value of transactions in CDMs has been more than the Rs 3,565 crore the bank has seen in its ATM network.

Hall of shame

SBI funds bomb-makers

The Times of India, Jun 20, 2016

Top bank in `Hall of Shame' for funding bomb-makers

SBI has been named in a “Hall of Shame“ list of 158 banking and financial institutions globally that have invested billions of dollars in companies making cluster bombs. SBI is the only Indian entity on the list, which includes JP Morgan, Barclays, Bank of America and Credit Suisse that invested over $28 billion in seven producers of cluster munitions between June 2012 and April 2016, according to Dutch campaign group PAX.PAX said the Convention on Cluster Munitions bans use, production of cluster munitions. This convention was signed by 94 countries. The maximum number of 74 banks are from the US, followed by China (29).

SBI has been included in the list because of its exposure to Orbital ATK, a USbased company specialising in space and rocket systems.

“SBI has made $87 million available to the companies on the red flag list since June 2012,“ PAX said. “ SBI always works in accordance with local laws and regulations,“ a bank spokesman said.

Administrative measures, initiatives

RBI’s asset quality review under Raghuram Rajan: 2015

The Times of India, June 19, 2016

A few years down the line several of the current bank chiefs would probably remember Raghuram Rajan for one thing eating into their annual bonuses. ICICI Bank has already announced that its top management won't receive performance bonus for 201516. PSU bank chiefs too are expected to miss the annual pay-out as soaring bad debts have hit the financial performance of lenders.

Just when data showed promise of the economy stabilising, the RBI started what's come to be known as asset quality review, a term that most bankers dread.While annual inspection of banks was the norm, RBI has now opted to ask banks to classify several loans as non-performing assets (NPA), which in normal course would have been treated as “standard“.

Classifying a loan as an NPA or a sub-standard asset means that banks have to set aside more funds to cover for potential losses due to nonpayment of dues. The result is for everyone to see: NPAs of Indian banks shot up to a little under Rs 6 lakh crore as each lender was handed a list of companies where funds had to be set aside, called provisioning in banking parlance. Even loans which were restructured were to be monitored strictly and funds set aside for a year.

As a result, against cumulative profits of close to Rs 31,000 crore in 2014-15, state-run lenders ran up losses of almost Rs 18,000 crore as bank after bank reported record losses. Some of the large private banks, such as ICICI Bank, man aged to stay profitable but saw a steep decline in profit.

But the hit is not just for banks, it also impacts India Inc. Companies that get the NPA tag would be choked of funding, a move that will impact economic revival as these entities would be unable to add more capacity to their factories.

Unified Payment System/ UPI

The Times of India, August 26, 2016

Mayur Shetty

The RBI has cleared a Unified Payment System a platform which links bank account numbers to virtual payment addresses (aliases). The UPI-enabled app in effect turns your smartphone into a bank and has come as a boost to a cashless economy .

Just as an ATM of one bank can be used to access accounts in all banks in the network, any UPI-enabled app can be used to log into one's accounts in other banks. Second, the interface overcomes one of the biggest pain points in sending money online -that of knowing 15-digit account numbers and an 11digit IFSC code (used to identify bank branches). Instead of account details, the receiver has to merely share an alias like xyz@axisbank. The UPI makes use of the existing Immediate Payment System (IMPS) which allows funds transfer using bank account number, an IFSC code and other credentials.

“Real-time sending and receiving money through a mobile application at such a scale on interoperable basis has not been attempted anywhere else in the world. The UPI app will be made available on Google Play Store by banks,“ NPCI managing director and CEO A P Hota said here on Thursday .

Twenty-one banks will go live over the next couple of days. But the country's largest bank, SBI, has expressed concerns and has kept it on hold until it gets more clarity from the National Payments Corporation of India (NPCI), the umbrella organisation for retail payment systems in India. Of the 21 banks, eight banks have gone live.

“Our app is still under development. We have raised some security concerns on the registration process and transactions being timed out. The NPCI has not yet come back.We will be ready by Septemberend. But the decision to join will depend on NPCI coming back to us with clarifications,“ said Manju Agarwal, deputy MD, SBI. HDFC Bank too is working on its application and expects to be ready in three weeks. ICICI Bank has announced that it will integrate its iMobile and Pockets app with UPI in the next few days. iMobile is for the bank's customers, while Pockets is an app with a prepaid instrument available to anyone who downloads it.

Kotak Mahindra Bank has decided to play it safe and provide a separate application for UPI. “We are in process of development and certification of UPI-enabled app. We will launch a new app which will be UPI-enabled in 4-6 weeks. “ said Deepak Sharma, chief digital officer, Kotak Mahindra Bank.

Bank Board Bureau/ 2016

The Hindu, February 29, 2016

Prime Minister Narendra Modi approved the setting up of the Bank Board Bureau with former Comptroller and Auditor-General of India Vinod Rai as its first Chairman.

The Bureau is mandated to play a critical role in reforming the troubled public sector banks by recommending appointments to leadership positions and boards in those banks and advise them on ways to raise funds and how to go ahead with mergers and acquisitions.

“With a view to improve the governance of public sector banks, the government had decided to set up an autonomous Bank Board Bureau. The bureau will recommend for selection the heads of public sector banks and financial institutions and help banks in developing strategies and capital raising plans,” the government said in a release.

The bureau was announced in August 2015 as part of the seven-point Indradhanush plan to revamp these banks. It will constantly engage with the boards of all 22 public sector banks to formulate appropriate strategies for their growth and development.

The bureau, led by Mr Rai, will select the heads of public sector banks (even from the private sector, if need be) and aid them in formulating strategies to raise additional capital. It will select and appoint non-executive chairmen and non-official directors.

The non-performing assets of public sector banks are estimated at almost Rs. 4 lakh crore, and they need to raise capital of Rs. 2.4 lakh crore by 2018 to conform to Basel-III capital requirement norms, according to the government.

While some questions have been raised on Mr. Rai's appointment as a CAG cannot hold a government office post-retirement, former senior civil servants say the role is advisory in nature and a part-time position. The government release said the appointments have been made for a period of two years.

The bureau will have three ex-officio members and three expert members, in addition to the Chairman.

Selection process of Managing Directors of public-sector banks

The Indian Express, May 30, 2016

George Mathew

The Bank Board Bureau (BBB), set up by the government in February 2016, has kicked off the selection process of managing directors and CEOs of public sector banks.

The body has conducted its maiden interviews for appointments of MDs & CEOs at three state-run banks and met as many 10 candidates who are currently serving as executive directors in various PSU banks, according to sources. One of the interviewees was earlier shunted out by the government from a large PSU bank in connection with a dubious loan to Atlas group, a Gulf-based jewellery chain.

Banking frauds

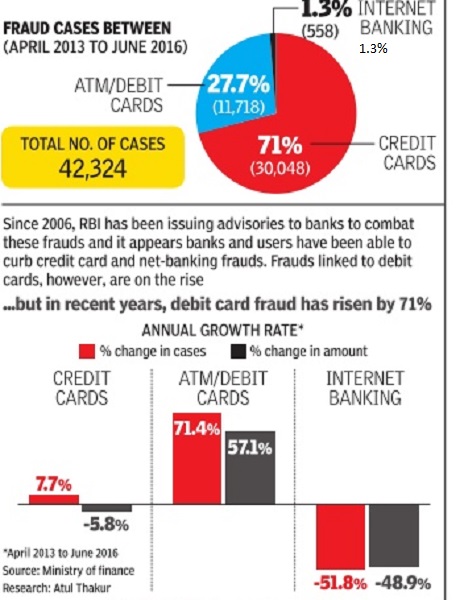

Out of over 40,000 cases of fraudulent use reported in 2013-16, more than 70% had to do with credit cards. Net banking accounted for only a miniscule 1.3% of the cases

The Times of India

See graphic.

Jan Dhan

Abuse of its liberal terms leads to calls for strictness

The Jan Dhan [‘the common man’s wealth’] scheme is part of the NDA government's plan to provide banking facilities to the poor and encourage savings, and allows customers to open accounts with zero balance. Normal savings accounts involve conditions like an opening sum and minimum balance.

With more people using Jan Dhan accounts in the wake of the demonetisation drive, bankers are weighing the need to convert the accounts into normal savings bank accounts.

After concerns were raised about the reported misuse of Jan Dhan accounts amid the ongoing crackdown on black money, economic affairs secretary Shaktikanta Das announced on Tuesday a Rs 50,000 limit on annual cash deposits in the accounts, after which the source of funds would be verified.

Following the announcement, bankers are re-examining the threshold they set for converting Jan Dhan accounts into normal savings accounts. The earlier limit was Rs 1 lakh a year, which banks will now have to bring down to Rs 50,000.

“Jan Dhan accounts require minimum know-your-customer (KYC) documentation. If someone tries to deposit over Rs 50,000, or the earlier limit of Rs 1 lakh, we cannot send them back. We only ask for more KYC details and convert it into a full-fledged savings account with all the charges applicable,“ said Rakesh Sharma, chairman, Canara Bank. “We cannot deny any customer the right to deposit their own money,“ Sharma added.

Officials at SBI branches in Tirunelveli and Nellore said that they had spotted about a dozen cases of deposits beyond Rs 1lakh in Jan Dhan accounts. “We asked the customers to fulfil KYC requirements and then accepted the deposits. We believed these unorganised workers, retail vendors and petty shop owners were genuine customers. Then again, even if they were to deposit Rs 2 lakh, and that was their income, it is well within their taxable limit,“ said an SBI official.

“...It is important to remember that Jan Dhan accounts are primarily for financial inclusion. And if there are customers who want to deposit more money , they can when they fulfil our conditions,“ said K Venkataraman, CEO, Karur Vysya Bank.

See also

And the list is growing…

Banking, India: II (government data)

Banking, India: I