Banking, India: I

(→2017) |

(→Fixed Deposits) |

||

| (198 intermediate revisions by 2 users not shown) | |||

| Line 11: | Line 11: | ||

| − | + | ||

| − | + | ||

=History= | =History= | ||

| − | ==1720== | + | ==AD 1720== |

[http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=A-bank-central-to-monetary-policy-22082016013031 ''The Times of India''], Aug 22 2016 | [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=A-bank-central-to-monetary-policy-22082016013031 ''The Times of India''], Aug 22 2016 | ||

[[File: Some banks, Net profit and gross NPA, 2014 and 2015.jpg|Some banks: Net profit and gross NPA, 2014 and 2015; Graphic courtesy: [http://epaperbeta.timesofindia.com/Gallery.aspx?id=29_07_2015_032_026_008&type=P&artUrl=Problem-known-no-one-fixing-it-Banker-29072015032026&eid=31808 ''The Times of India''], July 30, 2015|frame|500px]] | [[File: Some banks, Net profit and gross NPA, 2014 and 2015.jpg|Some banks: Net profit and gross NPA, 2014 and 2015; Graphic courtesy: [http://epaperbeta.timesofindia.com/Gallery.aspx?id=29_07_2015_032_026_008&type=P&artUrl=Problem-known-no-one-fixing-it-Banker-29072015032026&eid=31808 ''The Times of India''], July 30, 2015|frame|500px]] | ||

| Line 26: | Line 26: | ||

India's first joint stock bank was established in 1720 in Mumbai. This was followed by the setting up of a similar bank in Kolkata in 1770 and, later, in many other cities. Because of the growing need for modern banking services, of uniform currency to streamline foreign trade and to manage the remittances of British Army personnel and civil servants, three Presidency Banks were established in Mumbai, Kolkata and Chennai. Apart from normal banking, these banks could also issue currency until 1861.During the same period, there was a significant increase in privately-owned commercial banks and, by 1913, there were 56 commercial banks operating in India. The First World War and the Great Depression exposed the flaws of banking in India as many banks failed and the need for a cent ral bank to ensure regulatory safeguards was felt. | India's first joint stock bank was established in 1720 in Mumbai. This was followed by the setting up of a similar bank in Kolkata in 1770 and, later, in many other cities. Because of the growing need for modern banking services, of uniform currency to streamline foreign trade and to manage the remittances of British Army personnel and civil servants, three Presidency Banks were established in Mumbai, Kolkata and Chennai. Apart from normal banking, these banks could also issue currency until 1861.During the same period, there was a significant increase in privately-owned commercial banks and, by 1913, there were 56 commercial banks operating in India. The First World War and the Great Depression exposed the flaws of banking in India as many banks failed and the need for a cent ral bank to ensure regulatory safeguards was felt. | ||

| + | |||

| + | [[Category:Economy-Industry-Resources|BBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: I | ||

| + | BANKING, INDIA: I]] | ||

| + | [[Category:India|BBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: I | ||

| + | BANKING, INDIA: I]] | ||

| + | [[Category:Pages with broken file links|BANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: I | ||

| + | BANKING, INDIA: I]] | ||

==1969: Nationalisation and political misuse== | ==1969: Nationalisation and political misuse== | ||

| Line 59: | Line 66: | ||

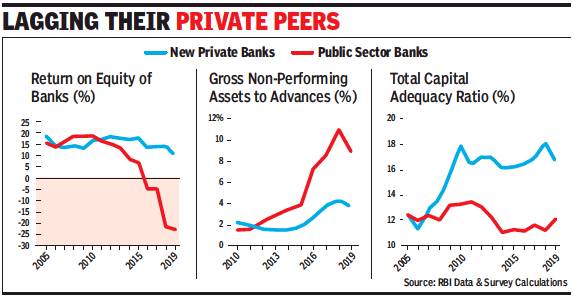

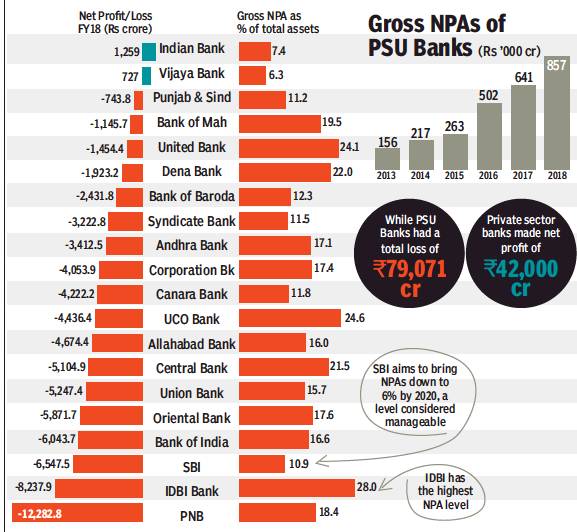

Private-sector banks (like ICICI Bank) have also been hit by bad loans in problem sectors like infrastructure and metals. But they avoided the worst loan proposals that nationalized banks happily accepted, with disastrous results. The private banks lent on commercial principles, not political orders. Probably bank privatization alone can ensure commercial discipline in future. But no political party wants that. | Private-sector banks (like ICICI Bank) have also been hit by bad loans in problem sectors like infrastructure and metals. But they avoided the worst loan proposals that nationalized banks happily accepted, with disastrous results. The private banks lent on commercial principles, not political orders. Probably bank privatization alone can ensure commercial discipline in future. But no political party wants that. | ||

| + | |||

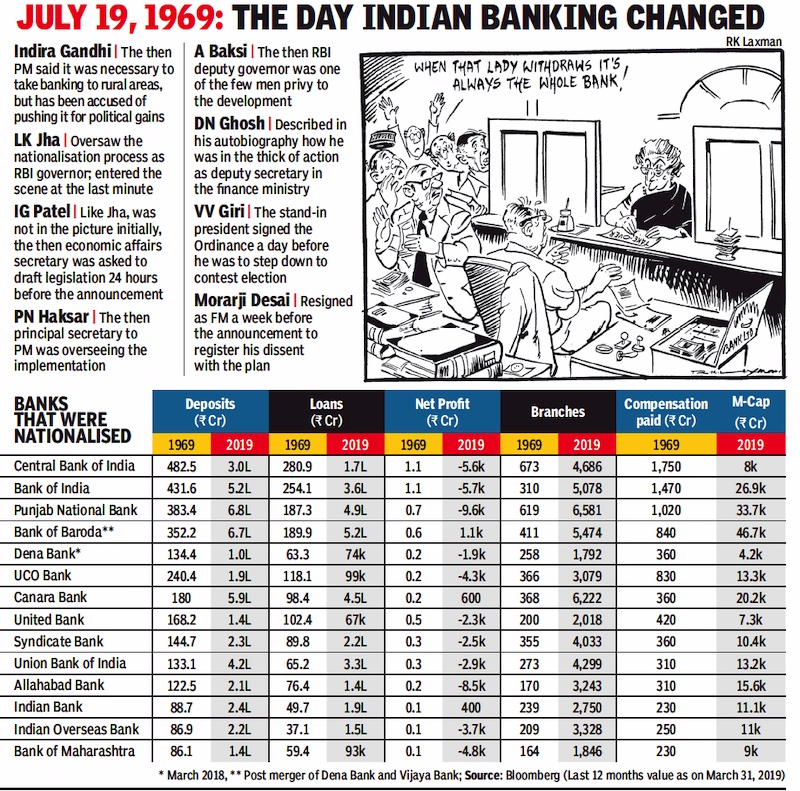

| + | ===19 July 1969=== | ||

| + | [[File: 19 July 1969- the events of the day; Nationalised banks in 1969 and 2019.jpg|19 July 1969- the events of the day <br/> Nationalised banks in 1969 and 2019 <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2019%2F07%2F19&entity=Ar02213&sk=A97EB0CF&mode=image July 19, 2019: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | See graphic, ‘19 July 1969: the events of the day <br/> Nationalised banks in 1969 and 2019. ’ | ||

| + | |||

| + | [[Category:Economy-Industry-Resources|BBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: I | ||

| + | BANKING, INDIA: I]] | ||

| + | [[Category:India|BBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: I | ||

| + | BANKING, INDIA: I]] | ||

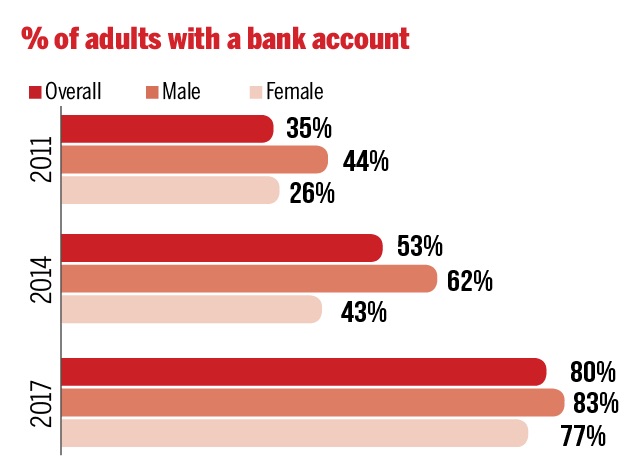

=Accounts, number of/ population covered= | =Accounts, number of/ population covered= | ||

| Line 87: | Line 104: | ||

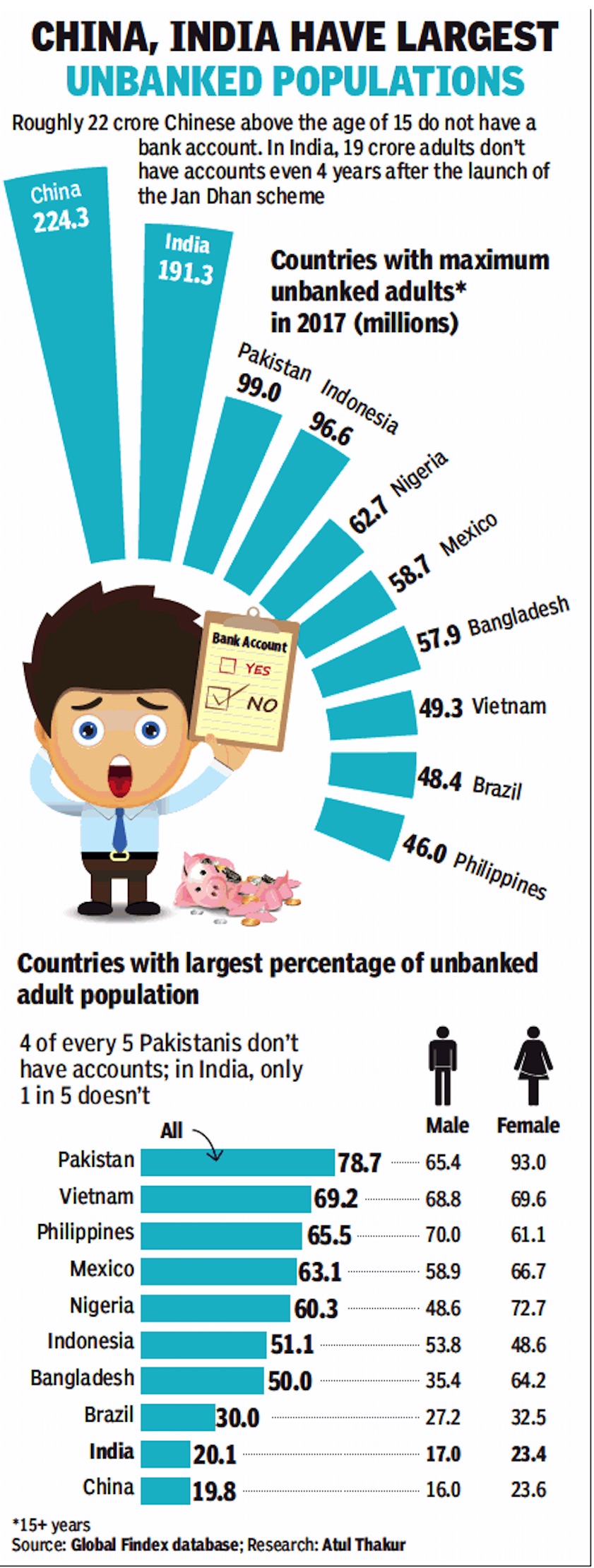

''Bangladesh, China, India, Pakistan vis-à-vis the world: <br/> i) The number of unbanked adults, and <br/> ii) The percentage of unbanked population, <br/> As in 2017'' | ''Bangladesh, China, India, Pakistan vis-à-vis the world: <br/> i) The number of unbanked adults, and <br/> ii) The percentage of unbanked population, <br/> As in 2017'' | ||

| + | |||

| + | ==State-wise contribution to banking business: 2018== | ||

| + | |||

| + | '''See graphic''' | ||

| + | |||

| + | ''The leading states’ contribution to the banking business in India, presumably as in 2018'' | ||

| + | |||

| + | ==2019, June== | ||

| + | [[File: 2019, June- Goods and services with highest inflation; States with highest inflation, 2019.jpg|2019, June- Goods and services with highest inflation <br/> States with highest inflation, 2019 <br/> From: [https://timesofindia.indiatimes.com/business/whats-putting-pressure-on-your-household-budget/articleshow/70288005.cms July 19, 2019: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | |||

| + | '''See graphic''': | ||

| + | |||

| + | '' 2019, June- Goods and services with highest inflation <br/> States with highest inflation, 2019 '' | ||

| + | |||

| + | [[Category:Economy-Industry-Resources|BBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: I | ||

| + | BANKING, INDIA: I]] | ||

| + | [[Category:India|BBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: I | ||

| + | BANKING, INDIA: I]] | ||

| + | [[Category:Pages with broken file links|BANKING, INDIA: IBANKING, INDIA: I | ||

| + | BANKING, INDIA: I]] | ||

| + | |||

| + | =Additional Tier 1 (AT1) bonds= | ||

| + | ==The basics, as in 2020 March== | ||

| + | [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2020%2F03%2F10&entity=Ar01715&sk=74BC8335&mode=text All you want to know about AT1 bonds, March 10, 2020: ''The Times of India''] | ||

| + | |||

| + | |||

| + | ''' What are AT1 bonds? ''' | ||

| + | |||

| + | Additional Tier 1 bonds, also called AT1in market parlance, are a kind of perpetual bonds without any expiry date that banks are allowed to issue to meet their longterm capital requirement. That’s why these bonds are treated as quasi-equity instruments under the law. RBI is the regulator for these bonds. | ||

| + | |||

| + | ''' Do these bonds pay interest? ''' | ||

| + | |||

| + | Yes. AT1 bonds are like any other bonds issued by banks and companies, which pay a fixed rate of interest at regular interval. Usually, these bonds pay a slightly higher rate of interest compared to similar, non-perpetual bonds. However, the issuing bank has no obligation to pay back the principal to investors. | ||

| + | |||

| + | ''' Are these bonds traded in the market? ''' | ||

| + | |||

| + | Yes. These bonds are listed and traded on the exchanges. So if an AT1 bond holder needs money, he can sell it in the market. | ||

| + | |||

| + | ''' How are AT1 bonds redeemed? ''' | ||

| + | |||

| + | Investors can not return these bonds to the issuing bank and get the money. This means there is no put option available to its holders. However, the issuing banks have the option to recall AT1 bonds issued by them (termed call option). They can go for a call option five years after these are issued and then every year at a pre-announced period. This way the issuing banks can give an exit option to AT1 bond holders. | ||

| + | |||

| + | ''' At present, what’s the total value of AT1 bonds in the market? ''' | ||

| + | |||

| + | According to a report by rating agency ICRA, nearly Rs 94,000 crore worth of AT1 bonds are currently issued by various banks. Of this, Rs 55,000 crore is from PSU banks, while the balance Rs 39,000 crore is by private lenders. | ||

| + | |||

| + | [[Category:Economy-Industry-Resources|BBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: I | ||

| + | BANKING, INDIA: I]] | ||

| + | [[Category:India|BBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: I | ||

| + | BANKING, INDIA: I]] | ||

| + | |||

| + | [[Category:Economy-Industry-Resources|BBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: I | ||

| + | BANKING, INDIA: I]] | ||

| + | [[Category:India|BBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: I | ||

| + | BANKING, INDIA: I]] | ||

| + | |||

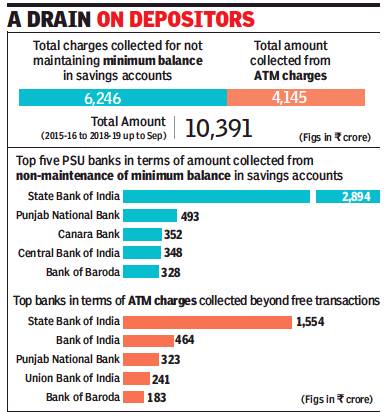

| + | =Administrative costs levied on customers= | ||

| + | ==2015-18: Charges For ATM Withdrawals, low minimum Balance== | ||

| + | [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2018%2F12%2F22&entity=Ar02501&sk=279A0583&mode=text PSU banks collected ₹10k cr from you in 3 and a half yrs, December 22, 2018: ''The Times of India''] | ||

| + | |||

| + | [[File: Charges levied by PSU banks for ATM Withdrawals, low minimum Balance, presumably as in 2015-18.jpg|Charges levied by PSU banks for ATM Withdrawals, low minimum Balance, presumably as in 2015-18 <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2018%2F12%2F22&entity=Ar02501&sk=279A0583&mode=text PSU banks collected ₹10k cr from you in 3 and a half yrs, December 22, 2018: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | ''Charged For ATM Withdrawals, Not Maintaining Min Balance'' | ||

| + | |||

| + | State-run banks have collected over Rs 10,000 crore from those who did not maintain minimum balance in their savings accounts and from charges levied on ATM withdrawals beyond the free transactions in the last nearly three and a half years, data submitted in Parliament showed. | ||

| + | |||

| + | According to a written reply to a Parliament question, the low monthly average balance was charged by SBI till 2012 but it stopped doing so till March 31, 2016 while other banks, including private banks, were charging as approved by their boards. SBI reintroduced the charge from April 1, 2017. | ||

| + | |||

| + | The minimum balance requirements were subsequently reduced from October 1, 2017. There is no minimum balance requirement for basic savings bank deposit accounts and Jan-Dhan accounts. | ||

| + | |||

| + | Apart from the over Rs 10,000 crore collected by staterun banks during the threeand-a-half-year period, private banks would also have collected a hefty amount. Data for private banks was not included in the numbers provided in the Parliament question. | ||

| + | |||

| + | The details emerged in a reply by the finance ministry to a question posed by Lok Sabha MP Dibyendu Adhikari on Tuesday. The ministry said the Reserve Bank of India (RBI) had permitted banks to fix charges on various services rendered by them, as approved by their boards. The banks are to ensure that the charges are reasonable and not out of line with the average cost of providing these services. | ||

| + | |||

| + | It also said, according to the RBI’s directions, a minimum of three free transactions at any other bank’s ATM at six metros — Mumbai, New Delhi, Chennai, Kolkata, Bengaluru and Hyderabad — and a minimum of five free ATM transactions at a bank’s own ATM at any other location is permitted during a month. | ||

| + | |||

| + | “Beyond this minimum number of free ATM transactions, banks have their boardapproved policy on charges from customers on ATM transactions subject to a cap of Rs 20 per transaction,” the ministry said in its reply. | ||

| + | |||

| + | The ministry also said public sector banks had informed that they do not have any plans to shut down their ATMs. This was in response to the question on whether the government proposes to withdraw 50% of total ATM services in the country by March 2019. | ||

=Administrative measures, initiatives, issues= | =Administrative measures, initiatives, issues= | ||

| Line 117: | Line 214: | ||

The RBI has sought cooperation from all members of public, institutions and others in keeping banknotes clean by not scribbling on them. | The RBI has sought cooperation from all members of public, institutions and others in keeping banknotes clean by not scribbling on them. | ||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

==Bank Board Bureau/ 2016== | ==Bank Board Bureau/ 2016== | ||

| Line 155: | Line 234: | ||

The bureau will have three ex-officio members and three expert members, in addition to the Chairman. | The bureau will have three ex-officio members and three expert members, in addition to the Chairman. | ||

| − | ==Selection process of Managing Directors of public-sector banks== | + | ==2016/ Selection process of Managing Directors of public-sector banks== |

[http://indianexpress.com/article/business/banking-and-finance/bank-board-bureau-begins-selection-of-psu-bank-mds-2825030/ ''The Indian Express''], May 30, 2016 | [http://indianexpress.com/article/business/banking-and-finance/bank-board-bureau-begins-selection-of-psu-bank-mds-2825030/ ''The Indian Express''], May 30, 2016 | ||

| Line 163: | Line 242: | ||

The body has conducted its maiden interviews for appointments of MDs & CEOs at three state-run banks and met as many 10 candidates who are currently serving as executive directors in various PSU banks, according to sources. One of the interviewees was earlier shunted out by the government from a large PSU bank in connection with a dubious loan to Atlas group, a Gulf-based jewellery chain. | The body has conducted its maiden interviews for appointments of MDs & CEOs at three state-run banks and met as many 10 candidates who are currently serving as executive directors in various PSU banks, according to sources. One of the interviewees was earlier shunted out by the government from a large PSU bank in connection with a dubious loan to Atlas group, a Gulf-based jewellery chain. | ||

| + | |||

| + | ==2018/ Asset Quality Review== | ||

| + | [https://indianexpress.com/article/business/banking-and-finance/rising-gross-npas-over-200-stressed-assets-under-regulatory-scanner-5283895/ George Mathew, Rising gross NPAs: Over 200 stressed assets under regulatory scanner, July 31, 2018: ''The Indian Express''] | ||

| + | |||

| + | |||

| + | The RBI has included several top business groups in the ongoing asset quality review which, based on the replies of the banks, could lead to bankruptcy proceedings in many cases. | ||

| + | |||

| + | The regulator has already sent letters to banks to gauge the level of action by lenders to clean up the banking system, said a banking source. Each bank is expected to clarify the position separately. “This could be the second major asset quality review after former RBI Governor Raghuram Rajan kicked off the first review in 2015,” said an official of a nationalised bank. | ||

| + | |||

| + | The RBI has included several top business groups in the ongoing asset quality review which, based on the replies of the banks, could lead to bankruptcy proceedings in many cases. Most of these accounts have already been declared as non-performing assets (NPAs) by banks. The RBI did not respond to emailed queries. | ||

| + | |||

| + | The RBI had initially sent a list of 12 defaulters for resolution under the Insolvency and Bankruptcy Code (IBC). Out of this, 11 accounts are in various stages of resolution at different benches of the National Company Law Tribunal (NCLT). Bankers are expecting over 50 per cent recovery from these accounts. | ||

| + | |||

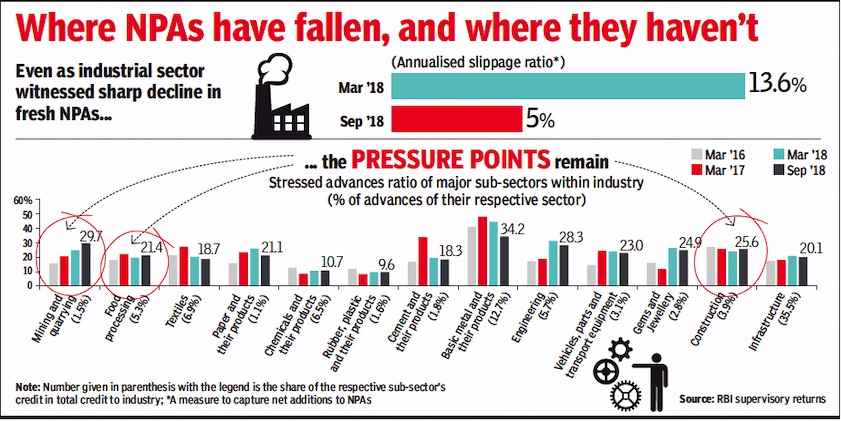

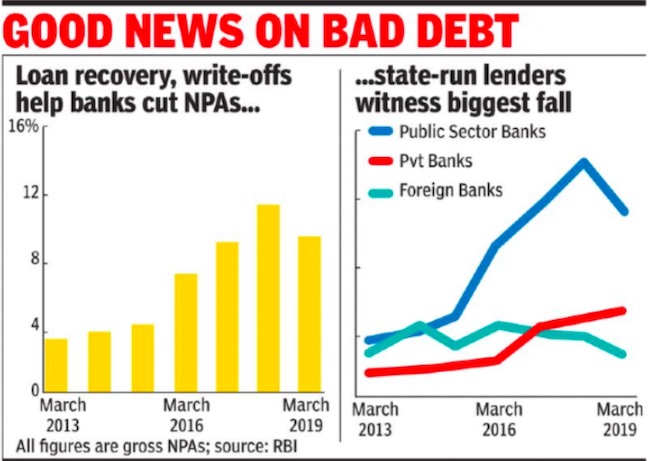

| + | The regulator subsequently sent another list of 28 stressed accounts for resolution. However, banks don’t expect more than 25-30 per cent from these accounts. Some of these accounts were evergreened — or fresh loans disbursed to repay old loans — by banks to prevent them being classified as bad loans. The fresh exercise by the RBI comes at a time when gross non-performing assets in the banking system has risen to around Rs 10.3 lakh crore, or 11.2 per cent of advances compared with Rs 8 lakh crore, or 9.5 per cent of advances, as on March 31, 2017. | ||

| + | |||

| + | In FY18, the banking system reported a net loss of Rs 40,000 crore because of the sharp rise in NPAs and the resulting increase in provisioning costs. In the previous fiscal, as much as Rs 5 lakh crore of bank loans slipped into the NPAs category, taking the total slippages in the past three fiscals to Rs 13.6 lakh crore, Crisil has said. | ||

| + | |||

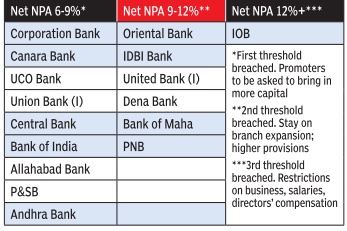

| + | In June, the RBI’s Financial Stability Report (FSR) warned that “the stress in the banking sector continues as gross NPA ratio rises further. Profitability of banks declined, partly reflecting increased provisioning”. RBI’s macro-stress tests indicated that under the baseline scenario of current macroeconomic outlook, gross NPA ratio of banks may rise from 11.6 per cent in March 2018 to 12.2 per cent by March 2019. | ||

| + | |||

| + | Nearly a dozen PSU banks are under the prompt corrective action (PCA) of the RBI. | ||

| + | |||

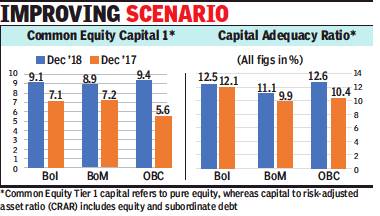

| + | ===2019: RBI removes BOI, BOM, OBC from PCA framework=== | ||

| + | [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2019%2F02%2F01&entity=Ar02501&sk=0A387A71&mode=text RBI lifts lending restrictions on three public sector banks, February 1, 2019: ''The Times of India''] | ||

| + | |||

| + | [[File: By 2018, Dec, the capital adequacy ratio and common equity capital of Bank of India, Bank of Maharashtra and Oriental Bank of Commerce had improved from Dec 2017.jpg|By 2018, Dec, the capital adequacy ratio and common equity capital of Bank of India, Bank of Maharashtra and Oriental Bank of Commerce had improved from Dec 2017 <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2019%2F02%2F01&entity=Ar02501&sk=0A387A71&mode=text RBI lifts lending restrictions on three public sector banks, February 1, 2019: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | ''Bank of India, Bank of Maharashtra, OBC Exit PCA Framework'' | ||

| + | |||

| + | The Reserve Bank of India (RBI) has removed Bank of India, Bank of Maharashtra and Oriental Bank of Commerce from its prompt corrective action (PCA) framework — a watch list for weak banks that placed lending restrictions on them. | ||

| + | |||

| + | “The RBI’s decision to remove the three banks from the PCA framework is on expected lines, given the sizeable capital infusion in these three during December 2018,” said Anil Gupta, sector head (financial sector ratings) at Icra. “The balance of the budgeted capital can support the exit of one or two more banks from the PCA framework if the government allocates higher capital to some of these lenders, like Corporation Bank,” he added. | ||

| + | |||

| + | Responding to the RBI action, BoM MD & CEO A S Rajeev said that the recent capital infusion of Rs 4,498 crore helped the bank improve its capital adequacy ratio to 11.05%. At the same time, the bank reduced its non-performing assets (NPAs) by 50% year-on-year. | ||

| + | |||

| + | The decision is understood to have been taken following a meeting of the board for financial supervision on Thursday. The board, chaired by governor Shaktikanta Das, reviewed the performance of all the 11 banks on the PCA list. | ||

| + | |||

| + | According to Gupta, although the three banks have exited PCA, the question remains whether negative return on asset continues to remain a PCA criteria? Following the RBI announcement, finance secretary Rajeev Kumar said in a tweet that this was an outcome of the government’s ‘4R’ strategy — recognition of stressed loans as default, recapitalisation of banks, resolution of bad loans, and reform of public sector. “Banks need to be more responsible, adopt high underwriting and risk management standards to avoid recurrence,” Kumar added. | ||

| + | |||

| + | The RBI’s move comes two days after a review meeting of banks with interim finance minister Piyush Goyal. In the meeting, Goyal informed banks that if they maintained the trend of improvement in performance, they would exit the PCA soon. | ||

| + | |||

| + | ==2018/ Inter-Creditor Agreement== | ||

| + | [https://economictimes.indiatimes.com/industry/banking/finance/banking/56-lenders-to-sign-inter-creditor-agreement-in-a-few-days/articleshow/64940424.cms Sangita Mehta, July 11, 2018: ''The Economic Times''] | ||

| + | |||

| + | [https://www.thehindu.com/opinion/editorial/cosmetic-repair/article24506004.ece July 25, 2018: ''The Hindu''] | ||

| + | |||

| + | |||

| + | The Reserve Bank of India has started a review of over 200 stressed assets of top business groups in the banking system to assess the provisioning level and classification of assets. | ||

| + | |||

| + | Over the past few years, Indian banks have been forced by the Reserve Bank of India to recognise troubled assets on their books, but their resolution has remained a challenge. | ||

| + | • Public sector, private sector and foreign banks signed an inter-creditor agreement to push for the speedy resolution of non-performing loans on their balance sheets. | ||

| + | |||

| + | • It is aimed at the resolution of loan accounts with a size of Rs 50 crore and above that are under the control of a group of lenders. | ||

| + | |||

| + | • It is a part of "Sashakt" plan approved by the government to address the problem of resolving bad loans. | ||

| + | |||

| + | |||

| + | As many as 56 lenders signed an inter-creditor agreement which will prohibit dissenting creditors from making an easy exit. | ||

| + | |||

| + | The agreement — based on a recommendation by the '''Sunil Mehta committee''' that looked into resolution of stressed assets — aims to deal with bad loans that banks must resolve before next month end under a February 12 RBI circular. Banks will have to refer unresolved loans to the bankruptcy court and they fear the asset value may erode if there are no buyers at bankruptcy court. | ||

| + | |||

| + | The agreement says if 66 per cent of lenders by value agree to a resolution plan, it would be binding on all lenders. The dissenting creditors will, however, have the option to sell their loans to other lenders at a discount of 15 per cent to the liquidation value, or buy the entire portfolio paying 125 per cent of the value agreed under the debt resolution plan by other lenders. | ||

| + | |||

| + | The agreement says each resolution plan would be submitted to an overseeing committee comprising experts from the banking industry. For dissenting creditors, the agreement says the “lead bank has the right, but not the obligation, to arrange the buyout of the loan facilities at a value that is equal to 85 per cent of the liquidation or the resolution value —whichever is lower.” | ||

| + | |||

| + | However, “if the lead bank does not arrange for a buyout, the dissenting lenders shall have the right, but not the obligation, to arrange for buyout of the facilities of all the other lenders at a value that is equal to 125 per cent of the liquidation value or the resolution value — whichever is higher.” | ||

| + | |||

| + | Dissenting creditors can also exit by selling their loans to any entity at a price mutually arrived at between the lender and buyer. The agreement has a standstill clause wherein all lenders are barred from enforcing any legal action against the borrower for recovery of dues. During the standstill period, lenders are barred from transferring or assigning their loans to anyone except a bank or finance company. But it is not clear if a loan can be sold to an asset reconstruction company during that period. | ||

| + | |||

| + | The standstill provision will be operative for 180 days from the reference date — the RBI had asked lenders to resolve their restructured loans within 180 days beginning March 1 or refer those to the bankruptcy court. However, the provision would not prevent lenders from acting against borrowers or directors for criminal offence. Lenders are in the process of getting this inter-creditor agreement approved by their boards. | ||

| + | |||

| + | |||

| + | '''Benefits:''' | ||

| + | |||

| + | • Such an agreement may persuade banks to embark more quickly on a resolution plan for stressed assets. | ||

| + | |||

| + | • It is an improvement over the earlier model, which replied solely on the joint lenders' forum to arrive at a consensus among creditors. It is, in fact, logical for joint lenders who want to avoid a deadlock to agree on the ground rules of debt resolution prior to lending to any borrower. But the obligation on the lead lender to come up with a time-bound resolution plan can have unintended consequences. | ||

| + | |||

| + | |||

| + | '''Challenges:''' | ||

| + | |||

| + | • The biggest obstacle to bad loan resolution is the absence of buyers who can purchase stressed assets from banks, and the unwillingness of banks to sell their loans at a deep discount to their face value. Unless the government can solve this problem, the bad loan problem is likely to remain unresolved for some time to come. | ||

| + | |||

| + | ==Elected directors== | ||

| + | ===2019: RBI’s guidelines === | ||

| + | [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIM%2F2019%2F08%2F03&entity=Ar02105&sk=A0252E39&mode=text August 3, 2019: ''The Times of India''] | ||

| + | |||

| + | PSBs can’t push people of choice on their boards | ||

| + | |||

| + | Mumbai: | ||

| + | |||

| + | Public sector banks (PSBs) will not be able to manoeuvre people of their choice into board positions with the Reserve Bank of India (RBI) tightening fit and proper guidelines for the position of elected directors. The central bank on Friday came out with new master directions on fit and proper guidelines for elected directors on the board of PSBs. Elected representatives such as members of Parliament, or state legislature or municipal corporation or local bodies cannot be shareholder representatives on bank boards. | ||

| + | |||

| + | The rules explicitly bar board members of the RBI or any bank, financial institution, insurance company or bank holding company. The new rule also requires that the candidate should not have served on the board of a bank, financial institution or insurance company for six years. Individuals who are connected with hire purchasing, financing, money lending, investment, leasing or para banking activity are also not considered eligible, as also are stock brokers. | ||

| + | |||

| + | Shareholders of PSU banks are required to elect two to three directors, depending on the level of public shareholding. Although there are directors by investors, these board members have typically been chartered accountants or other professionals with business contacts with the banks. | ||

| + | |||

| + | To keep out political appointees, RBI requires all PSBs to have a nomination and remuneration committee (NRC) with at least three non-executive directors. Of these, half should be independent and should include at least one member from the risk management committee of the board to determine the ‘fit and proper’ status of candidates for the board. | ||

| + | |||

| + | [[Category:Economy-Industry-Resources|BBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: I | ||

| + | BANKING, INDIA: I]] | ||

| + | [[Category:India|BBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: I | ||

| + | BANKING, INDIA: I]] | ||

| + | [[Category:Pages with broken file links|BANKING, INDIA: IBANKING, INDIA: I | ||

| + | BANKING, INDIA: I]] | ||

| + | |||

| + | = Alternative lending= | ||

| + | ==2014-17== | ||

| + | [[File: Alternative lending deals, 2014-17- India overtakes China; India just behind US.jpg|Alternative lending deals, 2014-17 <br/> i) India overtakes China <br/> ii) India just behind US <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2018%2F08%2F05&entity=Ar01605&sk=4F3FB874&mode=image August 5, 2018: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | ''' See graphic ''': | ||

| + | |||

| + | '' Alternative lending deals, 2014-17 <br/> i) India overtakes China <br/> ii) India just behind US '' | ||

| + | |||

| + | =Borrowers= | ||

| + | ==Women borrowers/ 2021== | ||

| + | [https://timesofindia.indiatimes.com/india/women-are-proving-to-be-better-borrowers-data/articleshow/90088719.cms Prabhakar Sinha, March 9, 2022: ''The Times of India''] | ||

| + | |||

| + | |||

| + | NEW DELHI: Women are proving to be better borrowers since they display higher credit consciousness and better credit scores as compared to their male counterparts, a study by TransUnion CIBIL revealed. As of 2021, 53% of the 54 million women borrowers had a CIBIL score in the prime category (with credit scores of 731-770) and above compared to 47% for men. | ||

| + | |||

| + | The delinquency rate for women borrowers was pegged at 5.2% across retail credit products, compared to 6.9% for their male counterparts. | ||

| + | |||

| + | Besides, the report pointed out that women borrowers were increasing at a faster pace in recent years — 29% annually. They accounted for 29% of the borrowers, compared with a quarter of the borrowers in 2016. | ||

| + | |||

| + | The outstanding loan amount also increased at 20% compounded annually (CAGR) to Rs 12.4 lakh crore which is 23% of total outstanding retail credit balances in 2021 from Rs 5 lakh crore or 21% in 2016. | ||

| + | |||

| + | Banks see women as a huge target segment as credit penetration, despite doubling to 12% between 2016 and 2021, remained low. | ||

| + | |||

| + | The report also said that the growth in women borrowers has remained strong during the pandemic, with women borrowers showing a stronger growth at 11% compared to the 6% of male borrowers through 2021. TransUnion CIBIL insights also indicated the expansion in the footprint of women borrowers in the semi-urban and rural locations, with a CAGR of 21% between 2016 and 2021 as compared to 16% growth in metro and urban regions. | ||

| + | |||

| + | =Branches= | ||

| + | ==Rural/ 2011-21== | ||

| + | [[File: Private vis-à-vis PSU banks- Rural Branches, 2011-21.jpg| Private vis-à-vis PSU banks: Rural Branches/ 2011-21 <br/> From: [https://epaper.timesgroup.com/article-share?article=28_03_2022_015_002_cap_TOI March 28, 2022: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | '''See graphic''': | ||

| + | |||

| + | '' Private vis-à-vis PSU banks: Rural Branches/ 2011-21 '' | ||

| + | |||

| + | [[Category:Economy-Industry-Resources|BBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: I | ||

| + | BANKING, INDIA: I]] | ||

| + | [[Category:India|BBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: I | ||

| + | BANKING, INDIA: I]] | ||

| + | [[Category:Pages with broken file links|BANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: I | ||

| + | BANKING, INDIA: I]] | ||

| + | |||

| + | =CEOs’ turnover= | ||

| + | ==2008-18== | ||

| + | [https://timesofindia.indiatimes.com/business/india-business/govt-banks-see-higher-ceo-churn-than-pvt-sector-peers/articleshow/66893789.cms Govt banks see higher CEO churn than pvt sector peers, December 1, 2018: ''The Times of India''] | ||

| + | |||

| + | [[File: The turnover of the CEOs of selected public-sector and private banks, presumably as in 2008-18.jpg|The turnover of the CEOs of selected public-sector and private banks, presumably as in 2008-18 <br/> From: [https://timesofindia.indiatimes.com/business/india-business/govt-banks-see-higher-ceo-churn-than-pvt-sector-peers/articleshow/66893789.cms Govt banks see higher CEO churn than pvt sector peers, December 1, 2018: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | |||

| + | '''See graphic''': | ||

| + | |||

| + | ''The turnover of the CEOs of selected public-sector and private banks, presumably as in 2008-18'' | ||

| + | |||

| + | PSU banks have a higher turnover of CEOs compared to their private sector peers. In the last decade, five PSU banks have had six CEOs, meaning that the average tenure has been less than two years. Analysts say such quick changes impact governance and the ability of a bank to take strategic long-term initiatives. Bank chiefs are also unwilling to take decisions on tricky issues and are happy to kick the can down the road. | ||

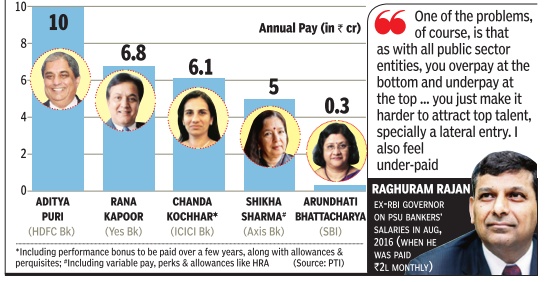

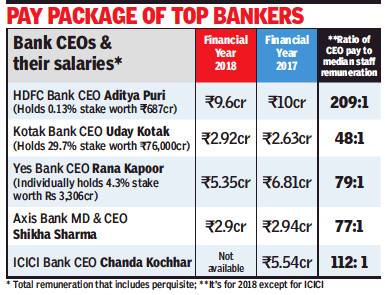

= CEOs’ salaries= | = CEOs’ salaries= | ||

| Line 223: | Line 459: | ||

ICICI Bank is yet to publish its annual report for FY18. The bank’s CEO Chanda Kochhar received total remuneration of 5.54 crore in FY17 which was 112 times the median. As compared to the private sector, public sector bank chiefs receive modest salaries. For instance, the chairman of SBI, the country’s largest bank, received compensation of Rs 14.25 lakh for the second-half of FY18 after he took charge mid-year. However, analysts point out that public sector banks have a higher wage to income ratio because of higher entry level salaries and also because private sector banks score higher in terms of productivity. | ICICI Bank is yet to publish its annual report for FY18. The bank’s CEO Chanda Kochhar received total remuneration of 5.54 crore in FY17 which was 112 times the median. As compared to the private sector, public sector bank chiefs receive modest salaries. For instance, the chairman of SBI, the country’s largest bank, received compensation of Rs 14.25 lakh for the second-half of FY18 after he took charge mid-year. However, analysts point out that public sector banks have a higher wage to income ratio because of higher entry level salaries and also because private sector banks score higher in terms of productivity. | ||

| + | |||

| + | ==2019: 50% of CEOs’ pay to be variable: RBI== | ||

| + | [https://timesofindia.indiatimes.com/business/india-business/50-of-bank-ceos-pay-to-be-variable-rbi/articleshow/71915077.cms Nov 5, 2019: ''The Times of India''] | ||

| + | |||

| + | |||

| + | 50% of bank CEOs’ pay to be variable: RBI | ||

| + | |||

| + | TIMES NEWS NETWORK | ||

| + | |||

| + | Mumbai: | ||

| + | |||

| + | Top executives in banks will have to receive half their salary in the form of variable pay which will be linked to their bank’s performance, according to new rules announced by the RBI on Monday. The variable pay itself will be capped at 300% of the fixed pay and will include equity compensation. | ||

| + | |||

| + | The inclusion of equity in variable pay and the cap on variable pay would mean that bonuses will be limited, and will include non-cash compensation. | ||

| + | |||

| + | The new guidelines announced by the central bank will be effective from April 1, 2020. These guidelines apply to private sector banks, local area banks, small finance banks and payment banks. They will also apply to multinational banks that have incorporated locally as wholly owned subsidiaries. | ||

| + | |||

| + | Besides chief executives, the restriction on salaries will apply to senior executives, including whole-time directors, and other employees who are risk-takers such as bond traders. RBI has said that if bonuses are paid in cash, at least half of the cash bonus should be deferred if the total amount is over Rs 25 lakh. | ||

| + | |||

| + | If the variable pay is up to 200% of the fixed pay, at least 50% of it must be non-cash, and if the variable pay is above 200%, 67% of it should be paid via non-cash instruments. | ||

| + | |||

| + | In addition to deferring the bonuses, RBI has asked banks to have ‘clawback’ clauses which enable them to recover past bonuses if the executive’s actions result in losses for the bank. The policies determining compensation will have to be laid out by the board of each bank. “The policy should cover all aspects of the compensation structure such as fixed pay, perquisites, performance bonus, guaranteed bonus (joining/sign-on bonus), severance package, share-linked instruments such as employee stock option plan (ESOPs), pension plan and gratuity taking into account these guidelines,” said RBI. | ||

| + | |||

| + | “Banks shall identify a representative set of situations in their compensation policies, which require them to invoke the clawback clauses that may be applicable on entire variable pay,” RBI said. | ||

| + | |||

| + | “The compensation practices were one of the important factors which contributed to the global financial crisis in 2008. Employees were often rewarded for increasing short-term profit without adequate recognition of the risks and long-term consequences that their activities posed to the organisations,” RBI said in its note to banks announcing the new rules. | ||

| + | |||

| + | According to RBI, it was these perverse incentives that amplified excessive risk-taking that severely threatened the global financial system. “The compensation issue has, therefore, been at the centre stage of regulatory reforms,” RBI said. | ||

| + | |||

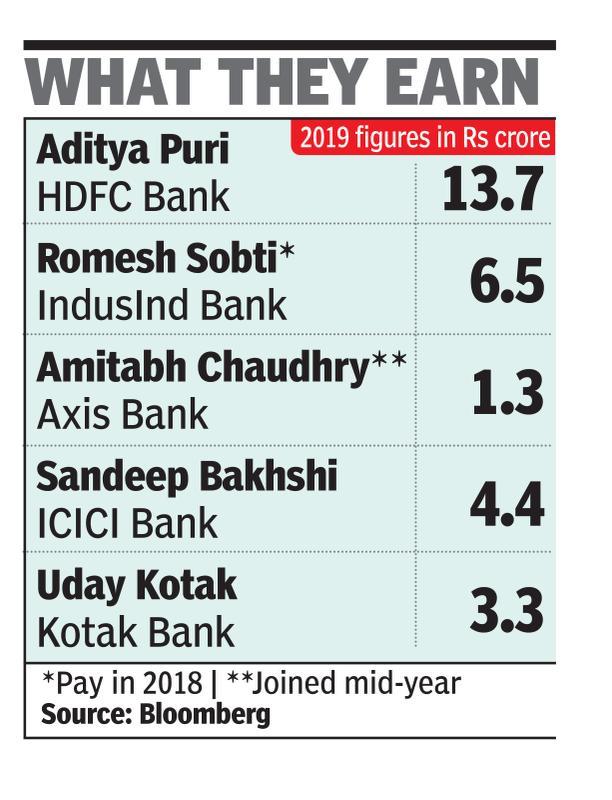

| + | ===2019=== | ||

| + | [[File: What bank CEOs earned in 2019.jpg|What bank CEOs earned in 2019 <br/> From: [https://timesofindia.indiatimes.com/business/india-business/50-of-bank-ceos-pay-to-be-variable-rbi/articleshow/71915077.cms Nov 5, 2019: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | '''See graphic''': | ||

| + | |||

| + | ''What bank CEOs earned in 2019'' | ||

| + | |||

| + | [[Category:Economy-Industry-Resources|BBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: I | ||

| + | BANKING, INDIA: I]] | ||

| + | [[Category:India|BBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: I | ||

| + | BANKING, INDIA: I]] | ||

| + | [[Category:Pages with broken file links|BANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: I | ||

| + | BANKING, INDIA: I]] | ||

| + | |||

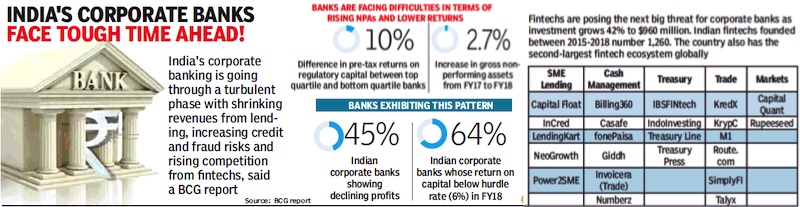

| + | =Corporate banking= | ||

| + | ==2016-18: PSBs lose ground == | ||

| + | [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2019%2F07%2F11&entity=Ar02013&sk=CF392E70&mode=text July 11, 2019: ''The Times of India''] | ||

| + | |||

| + | [[File: Corporate banking, 2016-18- the relative share of private banks, SBI, other government owned banks and foreign banks.jpg|Corporate banking, 2016-18: the relative share of private banks, SBI, other government owned banks and foreign banks. <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2019%2F07%2F11&entity=Ar02013&sk=CF392E70&mode=text July 11, 2019: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | Nationalised banks are losing market share to private banks not just in deposits and credit, they are also rapidly losing their position as lead bank — the lender which calls the shots in lending to businesses — in many corporate relationships. While most corporates have multiple banking relationships, they can have only one bank which sets the terms and conditions for credit facilities. | ||

| + | |||

| + | According to report by Greenwich associates, HDFC Bank and SBI top the list as lead bankers for corporates. Each of these two banks is used for corporate banking services by roughly three-quarters (75%) of large Indian companies. Close behind is ICICI Bank, with a market penetration score of 71%. These three banks also secure the top spots among middle-market banking companies, with HDFC Bank in first place and ICICI and SBI tied in the No. 2 spot. | ||

| + | |||

| + | The report said that weak balance sheets and other immediate challenges like bad loans are preventing PSU banks from making long-term IT investments, which are needed to compete for wholesale banking business in the future. This comes at a time when needs of businesses are getting more complex and they are looking for value-added services. The loss of lead bank status has implications for retail businesses as well as many private banks offer attractive ‘salary account’ schemes for corporates where they are lead banks. | ||

| + | |||

| + | Among foreign banks, Standard Chartered Bank and Citibank are tied with a market penetration of 51–54% among large Indian corporates, followed by HSBC at 50%. In the middle-market space, among foreign banks, HSBC ranks first, StanChart second and Citi a close third. | ||

| + | |||

| + | The nationalised banks (PSBs excluding SBI) have been losing marketshare because almost half of them were placed under prompt corrective action (PCA) by the RBI last year. | ||

| + | |||

| + | =Corruption/ vigilance cases= | ||

| + | ==2017-20== | ||

| + | [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2020%2F02%2F11&entity=Ar00304&sk=5095D300&mode=text Six bank chiefs facing CBI, ED probe, says govt, February 11, 2020: ''The Times of India''] | ||

| + | |||

| + | [[File: Cases registered against CEOs of commercial banks; Punished, convicted, 2017- January 2020.jpg|Cases registered against CEOs of commercial banks; Punished, convicted, 2017- January 2020 <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2020%2F02%2F11&entity=Ar00304&sk=5095D300&mode=text Six bank chiefs facing CBI, ED probe, says govt, February 11, 2020: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | The CBI and ED are investigating cases against half-a-dozen managing directors and CEOs of commercial banks, although no arrests have been made so far, the government informed Parliament. | ||

| + | |||

| + | Separately, the CBI has sought prosecution of over 800 PSB staff, including presidential appointees such as chairmen, MDs and executive directors of state-run entities since 2017. In 139 cases, the government had declined request for prosecution, the finance ministry said in LS. | ||

| + | |||

| + | The ministry, however, was silent on whether the probe involved serving or former top bankers. Apart from former ICICI Bank CEO and MD Chanda Kochhar, ex-PNB chief Usha Ananthasubramanian, United Bank’s former CMD Archana Bhargava and ex-UCO Bank boss Arun Kaul are among those facing investigation. An inquiry need not translate into prosecution. | ||

| + | |||

| + | “Through extensive reforms, change in credit culture has been instituted and controls have been tightened for every stakeholder in the financial system, which has enabled a tighter check on corruption and decline in occurrence of frauds,” the government said in the House. | ||

| + | |||

| + | [[Category:Economy-Industry-Resources|BBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: I | ||

| + | BANKING, INDIA: I]] | ||

| + | [[Category:India|BBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: I | ||

| + | BANKING, INDIA: I]] | ||

| + | [[Category:Pages with broken file links|BANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: I | ||

| + | BANKING, INDIA: I]] | ||

| + | |||

| + | = Cheque usage= | ||

| + | ==2019/ India lags most countries in reducing use== | ||

| + | [https://epaper.timesgroup.com/olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2019%2F06%2F05&entity=Ar02903&sk=F7FBDF6F&mode=text June 5, 2019: ''The Times of India''] | ||

| + | |||

| + | [[File: Weak spots, India's cheques, as in June 2019.jpg|Weak spots, India's cheques, as in June 2019 <br/> From: [https://epaper.timesgroup.com/olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2019%2F06%2F05&entity=Ar02903&sk=F7FBDF6F&mode=text June 5, 2019: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | |||

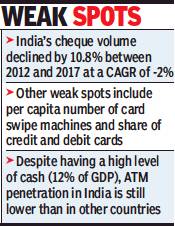

| + | India lags most countries in reducing cheque use | ||

| + | |||

| + | Mumbai: | ||

| + | |||

| + | India lags other countries in the shift to a more efficient electronic payment system from a costly cheque clearance. One reason for this is that a relatively lower number of people use the direct debit option to make recurrent payments and instead issue cheques every month. | ||

| + | A report by the RBI, which compares the country’s advancement in payment systems with others on various parameters, has identified several areas where India is in a weak spot. This includes per capita number of card swipe machines, the availability of a common card for transportation, share of debit and credit cards in payment systems. Despite having a high level of cash, the ATM penetration in India is still lower than in other countries. | ||

| + | |||

| + | One area where the country has made progress is reducing dependency on cash. India had a high cash in circulation at 12% of gross domestic product (GDP) with only Japan and Hong Kong being higher. Demonetisation and an active growth in GDP brought down the active cash in circulation as a percentage of GDP to 8.7% in 2016 which increased to 10.7% in 2017. | ||

| + | |||

| + | The report said that in most countries cheques have disappeared or are dying a slow death. India’s cheque volume declined by 10.8% between 2012 and 2017 at a compounded annual growth rate of -2% — the second slowest after Turkey. The US and Brazil, which had a higher volume of cheques in 2012, showed a sharper decline. “In India, the year-on-year growth in 2016 was 10%, which can be attributed to demonetisation where all modes of payment showed an increase. However, 2017 saw a small decline of 2.9% over the previous year,” the RBI said. | ||

| + | |||

| + | Ironically, India’s failure to move people away from cheques is also attributed to its success in cheque handling. India has an efficient T+1 settlement system (cheques are cleared in a day) and cheques processing is mechanised. Standardisation of cheque forms and cheque truncation system (CTS) enable the clearing to be done using an image of the cheque rather than moving it physically. | ||

| + | On the positive side, India is ahead of others in payment laws, regulation, customer safety and authentication standards. | ||

| + | |||

| + | [[Category:Economy-Industry-Resources|BBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: I | ||

| + | BANKING, INDIA: I]] | ||

| + | [[Category:India|BBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: I | ||

| + | BANKING, INDIA: I]] | ||

=Credit-deposit ratio= | =Credit-deposit ratio= | ||

| Line 242: | Line 583: | ||

Banks help convert people’s savings into investment, which in turn creates employment, income and assets. The process of conversion is called credit creation in which banks lend money to businessmen, farmers and consumers who need loans and are creditworthy. States with higher credit demand and more creditworthy people convert higher share of deposits into credit and have a high credit-deposit ratio. States with low credit-deposit ratios are those whose income, savings or both are higher than their investment needs — mostly the poor ones. India’s average credit-deposit ratio is 73.6 | Banks help convert people’s savings into investment, which in turn creates employment, income and assets. The process of conversion is called credit creation in which banks lend money to businessmen, farmers and consumers who need loans and are creditworthy. States with higher credit demand and more creditworthy people convert higher share of deposits into credit and have a high credit-deposit ratio. States with low credit-deposit ratios are those whose income, savings or both are higher than their investment needs — mostly the poor ones. India’s average credit-deposit ratio is 73.6 | ||

| + | |||

| + | ==2008-18== | ||

| + | [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2019%2F08%2F20&entity=Ar02208&sk=C8F626DF&mode=text August 20, 2019: ''The Times of India''] | ||

| + | |||

| + | [[File: Growth of aggregate deposits and bank credit, 2008-18.jpg|Growth of aggregate deposits and bank credit, 2008-18 <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2019%2F08%2F20&entity=Ar02208&sk=C8F626DF&mode=text August 20, 2019: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | Credit has to expand 18-20% for India to become $5tn eco | ||

| + | |||

| + | Required Growth Rate Was Last Achieved In Fiscal 2010-11 | ||

| + | |||

| + | TIMES NEWS NETWORK | ||

| + | |||

| + | Mumbai: | ||

| + | |||

| + | annual credit growth in the range of 18-20%. This kind of growth was last seen following the stimulus in FY11, when bank credit grew 21.5%. | ||

| + | |||

| + | In the case of new-to-credit borrowers, 59% of disbursement in these sectors came from NBFCs. | ||

| + | |||

| + | bankers say that there isn’t much of private investment demand and most of the credit demand is from retail and government investment in infrastructure. | ||

| + | |||

| + | According to Amitabh Chaudhry, MD & CEO of Axis Bank, all the high-frequency indicators point to things being tough. “Sales are down and working capital cycles are getting longer and bankers have to be cautious,” he said. The opportunities were largely among businesses that have managed to deleverage, he added. | ||

| + | |||

| + | In the last decade, credit growth ranged from a low of 8.2% in FY17 to 21.5% in FY11. The highest growth in bank credit after liberalisation was 37% in FY06. As on August 2, 2019, the year-on-year bank credit growth was 12%, while the year-to-date credit growth was negative. | ||

| + | |||

| + | [[Category:Economy-Industry-Resources|BBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: I | ||

| + | BANKING, INDIA: I]] | ||

| + | [[Category:India|BBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: I | ||

| + | BANKING, INDIA: I]] | ||

| + | [[Category:Pages with broken file links|BANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: I | ||

| + | BANKING, INDIA: I]] | ||

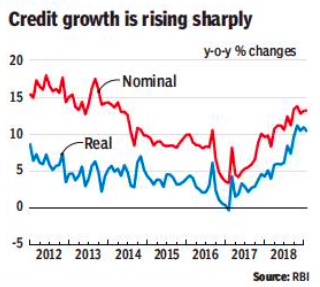

=Credit growth= | =Credit growth= | ||

| Line 263: | Line 634: | ||

The silver lining appears to be the gains to the government from demonetisation.“We continue to expect the Income Disclosure Scheme II to net around Rs 1 lakh crore of tax. At the same time, we have cut our estimate of RBI dividend from black cash money not returned to banks to Rs 50,000 crore from Rs 95,000 crore earlier with the bulk (of demonetized currencies) depositedexchanged,“ said Bank of America Merrill Lynch in a report. | The silver lining appears to be the gains to the government from demonetisation.“We continue to expect the Income Disclosure Scheme II to net around Rs 1 lakh crore of tax. At the same time, we have cut our estimate of RBI dividend from black cash money not returned to banks to Rs 50,000 crore from Rs 95,000 crore earlier with the bulk (of demonetized currencies) depositedexchanged,“ said Bank of America Merrill Lynch in a report. | ||

| + | |||

| + | ==2000-2020== | ||

| + | [[File: Credit and deposit growth in India, 2000-2020.jpg|Credit and deposit growth in India, 2000-2020. <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2020%2F08%2F17&entity=Ar01109&sk=716F87CF&mode=image August 17, 2020: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | '''See graphic''': | ||

| + | |||

| + | '' Credit and deposit growth in India, 2000-2020. '' | ||

| + | |||

| + | |||

| + | ==2012-18== | ||

| + | [[File: Share of credit growth, 2012-18.jpg|Share of credit growth, 2012-18 <br/> From: [https://epaper.timesgroup.com/olive/apa/timesofindia/SharedView.Article.aspx?href=TOIDEL%2F2019%2F05%2F22&id=Ar02506&sk=900EB13A&viewMode=text May 22, 2019: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | |||

| + | '''See graphic''': | ||

| + | |||

| + | '' Share of credit growth, 2012-18 '' | ||

| + | |||

| + | [[Category:Economy-Industry-Resources|BBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: I | ||

| + | BANKING, INDIA: I]] | ||

| + | [[Category:India|BBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: I | ||

| + | BANKING, INDIA: I]] | ||

| + | |||

| + | ==2017>2018: Consumer loan growth exceeds overall credit== | ||

| + | [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2019%2F03%2F29&entity=Ar02104&sk=52C03860&mode=text Consumer loans beat overall credit, March 29, 2019: ''The Times of India''] | ||

| + | |||

| + | [[File: Year-on-year growth of bank credit, as in December 2018..jpg|Year-on-year growth of bank credit, as in December 2018. <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2019%2F03%2F29&entity=Ar02104&sk=52C03860&mode=text Consumer loans beat overall credit, March 29, 2019: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | |||

| + | ''Unsecured Loans Grow Twice As Fast As Total Borrowing'' | ||

| + | |||

| + | Unsecured personal loans, which are availed for consumption, have emerged the fastest growing segment in bank lending. | ||

| + | |||

| + | According to borrower data analysed by TransUnion CIBIL, loans outstanding under credit cards, personal and consumer durable loans grew | ||

| + | |||

| + | 31.3% year-on-year as on December 2018. This is more than double the 15% year-on-year growth recorded by overall bank credit. | ||

| + | |||

| + | The TU CIBIL Industry Insights Report (IIR) shows consumer credit market continued to expand over the past year thanks to strong growth in these unsecured segments. As against this the secured lending category — loans against property (LAP), auto and housing — experienced more moderate total balance growth. But even these segments grew at a robust rate of 21.8%, 17.4% and 17.1%, respectively. | ||

| + | |||

| + | Also, while default rates remained relatively stable across most major consumer lending categories, loans against property have seen a 53-basis point rise in serious delinquencies. Auto loans have been an exception with serious delinquency rates dropping 116 basis points to 2.8%. Serious delinquency rates are measured as the percentage of loans that are overdue for 90 or more days. | ||

| + | |||

| + | “Consumer credit continues to be a key driver for the Indian economy. Although GDP growth has decelerated in recent quarters, the rate of overall consumer lending growth in India is still significantly higher than for most other major economies in the world,” said Yogendra Singh, vice-president of data science and analytics for TransUnion CIBIL. One reason for the sharp growth in this unsecured segment is the improved ability of lenders to provide loans for the non-salaried new-to-credit segment by using fresh data sources and analytical tools. | ||

==2015-18, Jan: high growth, though from low base (in 2018)== | ==2015-18, Jan: high growth, though from low base (in 2018)== | ||

| Line 315: | Line 727: | ||

“With asset quality pressures, banks -especially the weaker public sector banks (PSBs) -have been reporting a continuous degrowth in their net interest income (NII) over the five consecutive quarters of Q3FY2016 to Q3FY2017, mainly on account of slower credit growth and reversal of interest income recognised on NPAs“ ratings agency ICRA said in a report. | “With asset quality pressures, banks -especially the weaker public sector banks (PSBs) -have been reporting a continuous degrowth in their net interest income (NII) over the five consecutive quarters of Q3FY2016 to Q3FY2017, mainly on account of slower credit growth and reversal of interest income recognised on NPAs“ ratings agency ICRA said in a report. | ||

| + | |||

| + | |||

| + | ==Credit growth, sector-wise: 2016-17== | ||

| + | [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=Home-loans-biggest-driver-of-credit-growth-02052017017009 Mayur Shetty, Home loans biggest driver of credit growth, May 2, 2017: The Times of India] | ||

| + | |||

| + | [[File: Changing market share, 2012-17.jpg|Changing market share, 2012-17; [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=Home-loans-biggest-driver-of-credit-growth-02052017017009 Mayur Shetty, Home loans biggest driver of credit growth, May 2, 2017: The Times of India]|frame|500px]] | ||

| + | |||

| + | '''Grow 16% Over Five Years As Loans To Corp Slow To 6.7%''' | ||

| + | |||

| + | Over the last five years home loans have recorded the highest compounded annual growth rate (CAGR) of over 16% and now account for over 12% of all bank credit.Overall credit to industry during the same period has slowed to single digits at 6.7% after a negative growth this year.Though the share of loans to industry in March 2017 were still hight at 37.5%. | ||

| + | |||

| + | According to data on sector credit released by the RBI, bank credit to industry as on March 31, 2017 stood at Rs 26.77 lakh crore which is 2% lower than outstanding bank credit of Rs 27.30 lakh crore as on end-March 2016. This has resulted in the slowest growth in bank credit in decades. | ||

| + | |||

| + | The main driver of bank credit in 2016-17 has been home loans which stood at Rs 8.60 lakh crore, 15% higher than Rs 7.46 lakh crore as on endMarch 2016. The share of housing which was 9.26% on March 2012 has been rising over the years. The last time bank credit to housing was in double digits was in 2009, when the government introduced special schemes to boost demand in the wake of the global financial crisis. “Between FY12-FY16 bank credit registered double digit growth, barring in FY15 when credit grew by 9%. However, growth in bank credit slowed to 5% in FY17. The slowdown has mainly been on account of banks stressed with bad loans, stagnant corporate investment environment and some migra tion to the debt market,“ said Madan Sabnavis, chief economist, CARE Ratings. | ||

| + | |||

| + | The slowdown in lending to industry is largely because of PSBs which have reduced their exposure to corporates.After home loans, credit card outstandings are the fastest growing segment which have grown at a CAGR of 20% over the last five years. However, they account for less than 1% of bank credit and are one of the smallest components of lending to the personal segment -smaller than education and auto loans. | ||

==December 22, 2017: Bank credit growth in double digits== | ==December 22, 2017: Bank credit growth in double digits== | ||

| Line 355: | Line 783: | ||

Since the change of management at IDBI Bank, which saw M K Jain take over as managing director, the public sector lender has focused on cutting costs and selling non-core assets, including real estate, which is also part of the plan charted out by the finance ministry. | Since the change of management at IDBI Bank, which saw M K Jain take over as managing director, the public sector lender has focused on cutting costs and selling non-core assets, including real estate, which is also part of the plan charted out by the finance ministry. | ||

| + | |||

| + | ==2017-18: At 83%, consumer durables loans grew most== | ||

| + | [https://timesofindia.indiatimes.com/business/india-business/at-83-consumer-durables-loans-grow-most-in-fy18/articleshow/64770350.cms At 83%, consumer durables loans grow most in FY18, June 28, 2018: ''The Times of India''] | ||

| + | |||

| + | [[File: Retail credit in 2017-18.jpg|Retail credit in 2017-18 <br/> From: [https://timesofindia.indiatimes.com/business/india-business/at-83-consumer-durables-loans-grow-most-in-fy18/articleshow/64770350.cms At 83%, consumer durables loans grow most in FY18, June 28, 2018: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | |||

| + | The number of borrowers with consumer durable loans grew 83% to 1.95 crore in the 12 months ended March 2018 — the fastest expansion rate among all retail loans, followed by credit cards (28%) and personal loans (27%). Bankers say that the increase in retail borrowers is due to the use of credit scoring and analytics, which has helped take retail loans to new-to-credit customers. | ||

| + | |||

| + | According to a TransUnion (TU) Cibil report, total outstanding retail advances as of March 2018 increased 25% from March 2017. The number of outstanding accounts increased by more than 32% over the same period. “The number of live accounts rose considerably across all major credit types over the past year. The average balance per borrower grew at more modest levels,” said TU Cibil vice-president (research and consulting) Yogendra Singh. | ||

| + | |||

| + | Lenders like HDFC Bank and ICICI Bank are using analytics to enable customers avail of pre-approved loans online. Non-bank lenders like Bajaj Finance have developed online systems that enable loans to be cleared at retail outlets within minutes. E-commerce companies are partnering lenders to offer goods on equated monthly instalments (EMIs). In many consumer durables, the manufacturers are providing interest subvention, enabling customers to buy on credit without interest cost. | ||

| + | |||

| + | There are currently nearly 9 crore retail loan accounts across various segments such as auto, consumer durables, home loans, personal loans, credit cards and loans against property. Many borrowers have multiple loans. TU Cibil’s analytics show that nearly 15 crore Indian consumers who are not currently borrowers can be eligible for retail credit. | ||

| + | |||

| + | Another positive development is that while lenders are seeking lower income borrowers, delinquency has not gone up. Delinquency rates — 90 or more days past due (DPD) — for major retail lending products declined or remained relatively stable over the year ended March 2018. The quality of auto loan portfolio improved with delinquency rates falling by 83 basis points (100bps = 1 percentage point) to 2.78% in the first quarter. | ||

| + | |||

| + | The rising share of retail loans has implications for lenders. Very few banks are geared to tap the potential in retail lending. As a result, non-banking finance companies (NBFCs) contribute a significant chunk of retail loans. According to a report by ratings agency ICRA, retail-focused NBFCs (or retail-NBFCs) — with an estimated portfolio size of Rs 7.5 lakh crore in FY18 — will require Rs 3.8-4 lakh crore fresh debt in FY19 to support 20% growth. | ||

| + | |||

| + | Much of the growth in consumer durable loans has been driven by issuing higher volumes of smaller ticket loans. Consequently, the average loan per consumer declined by 5.7% over the year ended March 2018 to Rs 10,382. | ||

| + | |||

| + | The number of live credit card accounts stood at 3.26 crore as of March 2018 — an increase of 28% over the same period last year. Outstanding balance on credit cards increased by 43% to Rs 75,100 crore during the same period. Over the past two years, and particularly following the demonetisation event in November 2016, the number of credit card accounts had increased by nearly 50%, while the number of consumers with a card account has expanded as well. Consumer usage of those credit cards has also increased. The average credit card balance per borrower rose 12% to Rs 35,495 as of March 2018. “It is anticipated that the trend of increasing adoption of digital transaction channels should continue to act as a tailwind for future card growth,” said TU Cibil in its report.Personal loans saw similar growth dynamics, with the number of live consumers increasing 27% to 1.2 crore in the year ended March 2018, while aggregate balances increased 49% to Rs 2.7 lakh crore. | ||

| + | |||

| + | While retail loans are growing, delinquencies in these accounts are not. The delinquency rate for consumer durable loans (after 90 days) declined by 43bps year-over-year to reach 0.89% at the end of Q1, while the delinquency rate for personal loans dropped 19bps over the year to 0.52%. The credit card 90+ day delinquency rate increased modestly — by 9bps — to 1.70% in March 2018 but remains essentially unchanged from the level two years prior in March 2016. | ||

| + | |||

| + | ==2018> 2019== | ||

| + | [https://timesofindia.indiatimes.com/business/non-food-credit-rose-13-in-january-2019/articleshow/68213304.cms March 1, 2019: ''The Times of India''] | ||

| + | |||

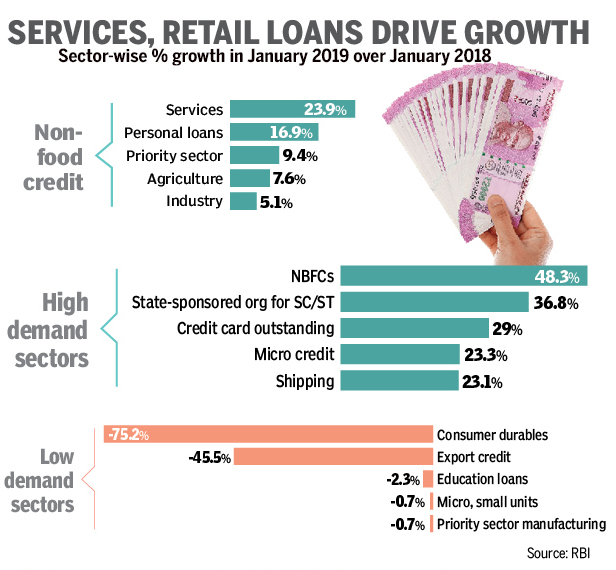

| + | [[File: Growth of credit, Jan 2018- Jan 2019.jpg|Growth of credit, Jan 2018> Jan 2019 <br/> From: [https://timesofindia.indiatimes.com/business/non-food-credit-rose-13-in-january-2019/articleshow/68213304.cms March 1, 2019: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | '''See graphic''': | ||

| + | |||

| + | ''Growth of credit, Jan 2018> Jan 2019'' | ||

| + | |||

| + | Non-food credit increased 13.1 percent in January 2019 compared to 9.5 percent in January 2018, RBI data shows. Services and retail segments were the driving force behind this double-digit growth. While the services sector grew a whopping 23.9%, personal loans too showed a double-digit growth. Industry, on the other hand, saw a mere 5% increase. | ||

| + | |||

| + | === Jun 2018> Sept 2019=== | ||

| + | [[File: Growth of credit, Jun 2018- Sept 2019.jpg| Growth of credit, Jun 2018> Sept 2019 <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2019%2F12%2F05&entity=Ar02107&sk=ED1D2C97&mode=image Dec 5, 2019: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | |||

| + | '''See graphic''': | ||

| + | |||

| + | '' Growth of credit, Jun 2018> Sept 2019 '' | ||

| + | |||

| + | [[Category:Economy-Industry-Resources|BBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: I | ||

| + | BANKING, INDIA: I]] | ||

| + | [[Category:India|BBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: I | ||

| + | BANKING, INDIA: I]] | ||

| + | [[Category:Pages with broken file links|BANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: I | ||

| + | BANKING, INDIA: I]] | ||

| + | |||

| + | ==2018 Jun- 2020 Jul== | ||

| + | [[File: Credit and deposit growth in India, 2018 Jun- 2020 Jul.jpg| Credit and deposit growth in India, 2018 Jun- 2020 Jul <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2020%2F07%2F29&entity=Ar01615&sk=95878489&mode=image July 29, 2020: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | '''See graphic''': | ||

| + | |||

| + | '' Credit and deposit growth in India, 2018 Jun- 2020 Jul '' | ||

| + | |||

| + | ==2018 Sept-2021 March == | ||

| + | [[File: Bank credit growth in India, 2018 Sept-2021 March.jpg|Bank credit growth in India, 2018 Sept-2021 March <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL/2021/04/15&entity=Ar01905&sk=981D1548&mode=image April 15, 2021: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | '''See graphic''': | ||

| + | |||

| + | '' Bank credit growth in India, 2018 Sept-2021 March ‘' | ||

| + | |||

| + | ==2020- 2023 March== | ||

| + | [[File: Credit growth credit 2 deposit ratio trend in Indian banks, 2020- 2023 March.jpg| Credit growth credit 2 deposit ratio trend in Indian banks, 2020- 2023 March <br/> From: [https://epaper.timesgroup.com/article-share?article=19_04_2023_019_013_cap_TOI April 19, 2023: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | '''See graphic''': | ||

| + | |||

| + | '' Credit growth credit 2 deposit ratio trend in Indian banks, 2020- 2023 March '' | ||

| + | |||

| + | [[Category:Economy-Industry-Resources|BBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: I | ||

| + | BANKING, INDIA: I]] | ||

| + | [[Category:India|BBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: I | ||

| + | BANKING, INDIA: I]] | ||

| + | [[Category:Pages with broken file links|BANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: IBANKING, INDIA: I | ||

| + | BANKING, INDIA: I]] | ||

| + | |||

| + | =Deposit rates= | ||

| + | ==2019, June to Nov== | ||

| + | [[File: Indian banks’ deposit rates- 2019, June to Nov.jpg| Indian banks’ deposit rates: 2019, June to Nov <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2019%2F12%2F11&entity=Ar02105&sk=6C033A53&mode=image Dec 11, 2019: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | '''See graphic''': | ||

| + | |||

| + | '' Indian banks’ deposit rates: 2019, June to Nov '' | ||

=Deposits= | =Deposits= | ||

| + | ==1997-2022== | ||

| + | [https://timesofindia.indiatimes.com/city/mumbai/bank-deposits-touch-record-rs-200l-cr-indian-news/articleshow/106744774.cms Mayur Shetty, January 12, 2024: ''The Times of India''] | ||

| + | |||

| + | [[File: Growth rate, 1997- 2022.jpg|Growth rate, 1997- 2022 <br/> From: [https://timesofindia.indiatimes.com/city/mumbai/bank-deposits-touch-record-rs-200l-cr-indian-news/articleshow/106744774.cms Mayur Shetty, January 12, 2024: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | '''Bank deposits touch record ₹200L cr, double from 2016''' | ||

| + | |||

| + | Mayur.Shetty@timesgroup.com

| ||

| + | |||

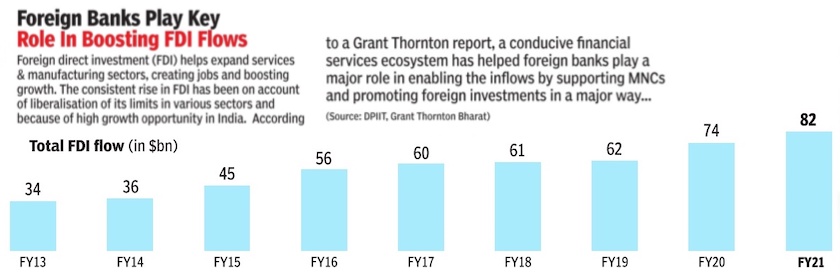

| + | Mumbai : Banks ended 2023 on a high note with their deposits crossing the Rs 200-lakh-crore milestone. Total deposits with the banking sector have doubled from Rs 100 lakh crore in September 2016, reflecting a compound annual growth rate of around 9.5%. While this is the fastest rate at which banks have added Rs 100 lakh crore to their deposit base, the rate of growth has slowed down compared to earlier. | ||

| + | |||

| + |

According to RBI data, bank deposits stood at Rs 200.8 lakh crore as of December 29 — an increase of 13.2% from the year-ago period. Of this, Rs 176 lakh crore was in term deposits and the rest in current and savings account. Bank advances stood at Rs 159.6 crore, which is 20% more than December 2022 levels. | ||

| + | |||

| + |

In recent years, there has been a marked shift of house hold savings to mutual funds. In 2023, the mutual fund industry added a record Rs 10 lakh crore to its total assets under management, taking the cumulative tally past the Rs 50-lakh mark — which is a fourth of total bank deposits. In 2003, while bank deposits stood at Rs 12.6 lakh crore, mutual funds had an AUM of only Rs 1.2 lakh crore. | ||

| + | |||

| + |

Bank deposits have witnessed significant growth over the years. Starting at Rs 5.1 lakh crore in 1997, they doubled to Rs 10 lakh crore by June 2001. Then, the deposit base doubled again to Rs 20 lakh crore by March 2006. The fastest doubling occurred between March 2006 and July 2009, when deposits reached Rs 40 lakh crore. | ||

| + | |||

| + | ==2007-17: share of urban, rural areas, and metros== | ||

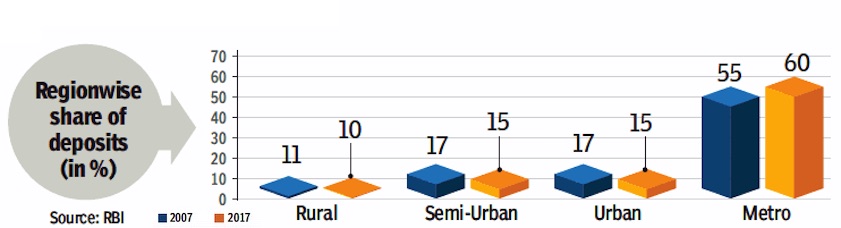

| + | [[File: Region-wise share of accounts- the share of urban and rural areas, and metros- 2007 and 2017.jpg|Region-wise share of accounts- the share of urban and rural areas, and metros- 2007 and 2017 <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2018%2F11%2F13&entity=Ar01901&sk=F508CEE4&mode=image&fbclid=IwAR1dajG7BlSc9hq85nb73MMb9yicDnW5LNYdCJdvCfskCLOOltkobZXvM9s November 13, 2018: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | [[File: Region-wise share of deposits- the share of urban and rural areas, and metros- 2007 and 2017.jpg|Region-wise share of deposits- the share of urban and rural areas, and metros- 2007 and 2017 <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2018%2F11%2F13&entity=Ar01901&sk=F508CEE4&mode=image&fbclid=IwAR1dajG7BlSc9hq85nb73MMb9yicDnW5LNYdCJdvCfskCLOOltkobZXvM9s November 13, 2018: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | '''See graphics''': | ||

| + | |||

| + | ''Region-wise share of accounts- the share of urban and rural areas, and metros- 2007 and 2017'' | ||

| + | |||

| + | ''Region-wise share of deposits- the share of urban and rural areas, and metros- 2007 and 2017'' | ||

| + | |||

==2016: Share of households increases, govt's dips== | ==2016: Share of households increases, govt's dips== | ||

[http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=Share-of-households-in-FY16-deposits-increases-govts-27122016021016 Share of households in FY16 deposits increases, govt's dips, December 27, 2016: The Times of India] | [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=Share-of-households-in-FY16-deposits-increases-govts-27122016021016 Share of households in FY16 deposits increases, govt's dips, December 27, 2016: The Times of India] | ||

| Line 368: | Line 910: | ||

The RBI on Monday released the data on composition and institutional ownership pattern of deposits with sche Source: RBI duled commercial banks (SCBs) as on March 31, 2016. Households continue to own the majority of deposits with their share rising to 61.5% from 60.1% earlier. The government sector and the private corporate sector followed, contributing 12.8% and 10.8%, respectively. A majority (63.8%) of deposits were term deposits. | The RBI on Monday released the data on composition and institutional ownership pattern of deposits with sche Source: RBI duled commercial banks (SCBs) as on March 31, 2016. Households continue to own the majority of deposits with their share rising to 61.5% from 60.1% earlier. The government sector and the private corporate sector followed, contributing 12.8% and 10.8%, respectively. A majority (63.8%) of deposits were term deposits. | ||

| + | |||

| + | ==Women depositors== | ||

| + | ===2029-20=== | ||

| + | [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2020%2F12%2F14&entity=Ar00306&sk=CF4B0B84&mode=text Ambika Pandit, December 14, 2020: ''The Times of India''] | ||

| + | |||

| + | The number of bank accounts that women not only hold but also operate themselves has increased dramatically over the past five years, data from the 5th National Family Health Survey (2019-20) shows. | ||

| + | |||

| + | In 10 states and union territories, 80-90% of women account holders run their accounts themselves. | ||

| + | Even in Nagaland, which is at the bottom of the 22 states and Union territories covered by the NFHS, 63.7% of women account holders operate their own accounts. The change since NFHS-4 in 2015-16 is significant. | ||

| + | |||

| + | |||

| + | ''' 76.7% of Bihar women operate bank a/cs now, up from 26.4% ''' | ||

| + | |||

| + | In Bihar, for instance, the number of women operating their bank accounts rose from 26.4% to 76.7%. In Karnataka, from 59.4% to 88.7%. In Assam, from 45.4% to 78.5%, and in Gujarat from 48.6% to 70%. | ||

| + | |||