Wills: India

This is a collection of articles archived for the excellence of their content. |

Contents |

Online wills

HIGHLIGHTS

Bengaluru-based LegalDesk.com launched its online will product this year and has had more than 200 people log on to draft wills in the last six months.

Most of the users of this product are between 45 and 70 years of age.

It has also partnered with old age homes to encourage seniors to write wills.

Founder and CEO of Vakilsearch Hrishikesh Datar said the number of will-related enquires had doubled every two years from around 200 in 2012 to 409 in 2014, 863 in 2016 and over 900 enquires this year. "Every four seconds, a person dies without a will. A decade or more is spent before their loved ones can benefit from their assets. People put it off because it is an uncomfortable topic," said Datar. Vakilsearch, an online platform for lawyers and CAs, sells a will-writing kit, Right Will, on Amazon for Rs 400, which contains a document with tips to write a practice will, a final will and a white envelope to store it in.

Most people think a will needs to be executed on stamp paper, which is incorrect. "Our objective is to help people prepare, sign and seal their will in 10 minutes over a cup of tea," said Datar. Bengaluru-based LegalDesk.com launched its online will product this year and has had more than 200 people log on to draft wills in the last six months. Most users are between 45 and 70 years of age. It has also partnered with old age homes to encourage seniors to write wills.

"Wills are like medical insurance. Every family should draft one, particularly when the senior-most member or breadwinner crosses 40 years," said Jatin Popat, founder, Willjini, a Mumbai-based startup. Organisations like HDFC Securities, CDSL, Corporation Bank and Muthoot Securities have partnered with Willjini to offer online wills as a value-add product for customers. Industrialists, family businesses and high net-worth individuals were the primary takers for wills earlier, said Popat. Now, he sees an increasing number of middle and upper middle-class customers seeking help to draw up wills.

Popat of Willjini says over 30% of his clients prefer to sit with a lawyer and draft a will. "Those who go online are looking for a hassle-free way that gives them privacy. In cases of divorce, adoption or loss of a spouse, they want to understand the implications before drafting the will," said Popat.

Getting a standard will drafted and executed can cost anywhere from a couple of hundred to Rs 5,000. While LegalDesk.com charges Rs 3,500-Rs 4,000, ezeewill (NSDL's online will product in partnership with Warmond Trustees and Executors) charges Rs 4,000-Rs 60,000, depending on whether you draft the will online, over phone/email, visit the lawyer's office or have a legal expert come home. While online options offer a quick way of having a will in place, lawyers add that these might be useful only for those who are looking for something basic.

Many put off drafting a will because they have their spouse or a parent listed as nominee for bank accounts or insurance policies. It is a misconception to think that a nominee is the inheritor, said Gaurav Chatterjee, partner, Kocchar & Co. "A nominee is a person who is authorised to operate/manage the account/assets of the deceased on behalf of the legal heirs but legally, the inheritor could be some other person or group of persons," he said.

Writing a will

Mistakes to avoid

RIJU MEHTA, April 30, 2018: The Times of India

From: RIJU MEHTA, April 30, 2018: The Times of India

Where there’s a will, there’s usually someone ready to contest it. Where there’s none, someone is ready to fight over the inheritance anyway. Does this mean writing a will is an exercise in futility? “No, it is not. While law allows a person to voice concern over a person’s inheritance, if a will is made properly, the objection can be dismissed easily,” says Rohan Mahajan, Founder & CEO, LawRato. A will reduces expense, effort and paperwork, not to mention disputes within the family. While writing the will itself is a simple task, it is best to do it under legal supervision, consulting a lawyer or online will-makers. “This is because on your own, you are likely to overlook many details that can result in legal battles,” says Raj Lakhotia, Founder, Dilsewill, an online will-maker.

1 Not having a will

This is the biggest mistake and a step that needs to be taken as soon as you hit your 50s, or earlier if you have multiple assets and properties.

More time and higher expenses: In the absence of a will, legal heirs are forced to spend large sums to acquire mandatory documents like a succession certificate or letter of administration, in order to transfer titles, cash, investments, assets or properties, not to mention paying prohibitive lawyers’ fees. A succession certificate is required in the case of a movable property, while the letter of administration is needed in the case of an immovable property. While having nominees helps with the immediate transfer of cash and certain movable assets, you need the legal documents because a nominee is only a caretaker of assets and will have to pass these on to the legal heirs.

Undesirable distribution of assets: A will helps decide which asset you want to give to which heir, in what proportion. Without one, you have no power over who inherits your assets and the court follows the succession acts as per your religion. For instance, Hindus, Buddhists, Jains and Sikhs are governed by the Hindu Succession Act, 1956, and Hindu Succession (Amendment) Act 2005.

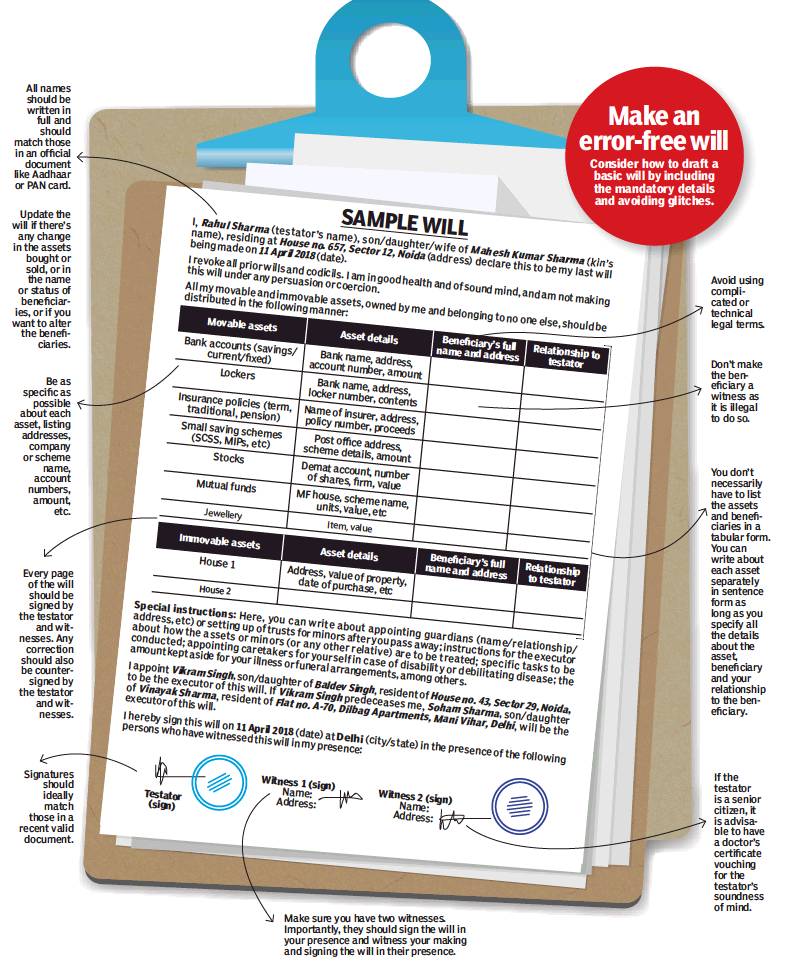

2 Drafting incorrectly

You can draft the will either on your own, through a lawyer, or via any of the online will-makers. If any detail is not precise or you get it wrong, the will can be easily contested in court. Make sure you enter the personal details, including name, address, place and date; put in the full name and relationship of beneficiaries; mention the assets precisely; have it done in the presence of two witnesses; and sign it along with the witnesses and their details. “The most important aspect of a will is a valid signature of the person making it. Since a will can be written on a blank paper, the signature is the only authentic detail,” says Mahajan.

Equally important are the three declarations—that you are revoking all earlier wills, that you are of sound mind, and that you are not making the will under any pressure. If a person is old, attach a doctor’s certificate certifying his sanity. You could also register the will, as it offers a degree of authenticity since it has been approved by a government official. Remember, that a registered will can be as easily challenged as a non-registered will. “Registering minimises the grounds on which a will can be challenged. Since soundness of mind, forged signatures and drafting under coercion are common grounds for challenging a will, a visit to the registrar and being photographed bring down the possibility of it being contested on these grounds,” says Jasmeet Singh, Advocate, Delhi High Court.

3 Not being specific

“Make your will as specific as possible. Mention each bank account, locker number, or property details,” says Singh. List all your assets, movable and immovable, in detail. For investments and insurance, list the scheme name, number, financial institution and insurer, along with the addresses. For more than one property, distinguish each one clearly by listing dates of purchase, addresses, etc. As for heirs, don’t forget to mention the full name, your relationship with him, and the assets you want to give.

4 Not updating the will

If there is any alteration in the status of assets or heirs, you should draft another will to incorporate the changes. Any lifestage development, such as the birth of a child, marriage or divorce, will call for a redistribution of assets. If any asset has been sold or new ones bought, these will have to be removed or included. All you have to do is to draft a new will, including a declaration that it is your final will and revoking all previous wills and codicils. Also register the updated will, though it doesn’t mean that the unregistered will shall not be considered by the court. As per law, the last drawn will is considered whether registered or not.

5 Wrong executor

A common mistake is appointing relatives or friends in the same age bracket, or minor children, as executors. “Ensure that the executor is the best choice for the time-consuming and complex job. He/she must be trustworthy, know about your wishes, and work according to your will, not his own,” says Mahajan. To ensure objectivity, you could also get a thirdparty administrator for a nominal sum.

6 Gifting while alive

Gifting assets during one’s lifetime may not be a good idea. “If you gift an asset while you are still alive, it will be immune to challenge. But it can also make old people vulnerable because once the property is in the hands of children, they can ill-treat parents,” says Singh. If, instead, it is willed to the child, the balance of power remains with parents. “If you give away everything, how will you live?” asks Lakhotia.

“Before you decide to gift, know the difference between a gift deed, and a will. A will, be it registered or not, is revocable during the lifetime of the testator. On the other hand, a gift deed, once executed, is irrevocable,” says Mahajan. As for tax, any gift to specified relatives is exempt from tax in the hands of the receiver. In case of an immovable property given as gift to specified relatives, it will invite stamp duty.

7 Neglecting illness

It is important to make provisions in the will in case you suffer from a terminal illness, disability or are in a coma. Mention who will take charge of your estate and financial affairs, and if you have kids, who will be their guardian. You could even appoint a power of attorney or set up a trust to handle your affairs. You can now also pen down a living will, as per a recent Supreme Court ruling. You can decide the particular line of treatment or its withdrawal, if you want, by appointing an executor to take the health-related decisions on your behalf.

Living wills

2021: registration an arduous task despite SC guidelines

Ambika Pandit, February 22, 2021: The Times of India

A retired professor of anatomy based in Mumbai in her 70s, Dr Lopa Mehta drafted her “living will”—an advance directive on end of life treatment in 2019. But she is still unable to get it registered despite guidelines that are part of the Supreme Court’s 2018 landmark judgment on passive euthanasia and living will.

It turns out that authorities and those keen on registering a living will are both struggling in the absence of standard procedures at the central or state level to implement the SC guidelines. The practical difficulties have triggered a demand from stakeholders for a comprehensive law on end of life care.

Declaring the right to die with dignity as a fundamental right, the SC recognised the legality of advance directives (living wills) and the withholding and withdrawing of life-sustaining treatment from terminally ill patients.

In a recent report, Vidhi Centre for Policy Research notes that executing the directives before the judicial magistrate first class and a threetiered process of approvals for actual decision-making are extremely arduous. “As a result, very few people have successfully executed advance directives,” points out senior resident fellow from ‘Vidhi’ Dr Dhvani Mehta.

A Chandigarh couple, Dina Nath Jauhar (73) and wife Adarsh Jauhar (66), both professors, made news in December 2019 by making living wills through the district court. Jauhar shares that it was not at all easy to get there. It took him over nine months to get to the stage where the will was registered.

To address these concerns, Vidhi and the End of Life Care in India Task Force (‘ELICIT’) have come together to put out a model legal framework on end of life care in India in the form of a bill. They now plan to reach out to central and state governments and parliamentarians to advocate for a law.

The framework lays down ways to simplify protocols for end of life decision-making and safeguards like introducing the concept of end of life care committee at large hospitals to audit all decisions.

Buoyed by the 2018 SC judgement, when Lopa Mehta approached the concerned metropolitan magistrate’s court the following year in Mumbai to register her will, authorities said they have no specific directions or procedures in place to register the will.

Her case is part of the application for clarification filed by the Indian Society of Critical Care Medicine in the Supreme Court, as an example of the difficulties in implementing the Court’s guidelines. Hearing the matter, in January 2020, the SC directed the Centre to convene a meeting of stakeholders to reach a consensus regarding modifications to its guidelines.

Meanwhile, leading hospitals such as AIIMS, New Delhi have framed their own internal policies and the Indian Council of Medical Research (ICMR) has developed guidelines for health professionals on “Do Not Attempt Resuscitation Orders”.