Walmart in India

This is a collection of articles archived for the excellence of their content. |

History

2018: On a selling spree globally, Walmart buys into India story

John Sarkar & Sidhartha, May 10, 2018: The Times of India

From: John Sarkar & Sidhartha, May 10, 2018: The Times of India

For Walmart India is the biggest bet internationally— it is selling majority stakes in its operations in Brazil and Argentina after having sold shares in a bank in Canada and restructured its UK operations.

It’s been a decade-long wait for the Beast of Bentoville to get a firm foothold in the Indian market, one of the top five consumer markets in the world. And there aren’t many left that have potential to become seriously large in the future. Several analysts believe Walmart may have overpaid but that will depend on how well it can integrate Flipkart’s operations with its global plans and what synergies can be brought about. “Amazon has put in $5 billion in India to build the business from the ground up and Walmart just paid more than triple that amount for Flipkart,” said the CEO of a large retailer.

But the headache may have just begun. After all, integration has often been a major irritant for Walmart with plans having gone awry in Germany, South Korea and, now in Brazil. Even in its home market, the US, Walmart has struggled with its online operations despite its $3 billion acquisition of internet retailer Jet.com. The company, which has been on a startup buying spree to boost its omni-channel ambitions, garners only around 3% of its total sales from online, according to Edleweiss Securities.

Sources said, Walmart’s strategy in India is clear: Quickly move into an area that Walmart understands best and where Flipkart is largely absent — grocery. While groceries contribute around 50% to Walmart’s global sales, the market for online groceries is expected to drive e-commerce growth over the next five years. After missing the bus in China, Walmart doesn’t want to miss out on the India opportunity, where e-commerce is projected to grow 4x (36%) faster than total retail over next five years driven by cheap data and smartphones.

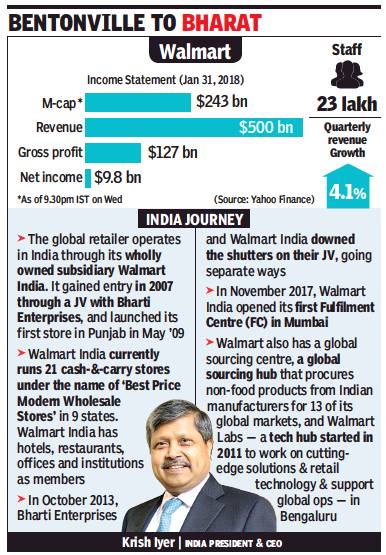

At the same time, the plan is to lower the share of mobile phones and electronics on Flipkart, categories that rank on top in terms of GMV, while focusing on building a network of cold chains and further strengthening the supply chain. Walmart may also try to also create synergies beween Flipkart and its cash-and-carry business run by Krish Iyer and his team.

Some Flipkart sellers may join Walmart supply chain

While Iyer will help continue to expand the wholesale footprint, Walmart will use Flipkart to take on Seattle-headquartered Amazon, which recently stepped into Walmart’s turf by making its omnichannel intent clear through its $13.7-billion acquisition of grocery chain Whole Foods.

Meanwhile in India, as Flipkart is strengthened and processes tweaked to ensure compliance with American laws, the back-end operations of both companies, including the technology platforms are proposed to be aligned. At the same time, some sellers on Flipkart may also become part of Walmart’s global supply chain and buyers from its Indian wholesale cash-and-carry stores may become sellers on the just-acquired marketplace.

Currently, Walmart’s B2B business in India generates 8% revenue through online sales.