Tractors: India

This is a collection of articles archived for the excellence of their content. |

Contents |

Sales

2013-17: high growth, 2018-19: slump

Nandini Sen Gupta, March 29, 2020: The Times of India

After 4 years of sales surge, tractor industry hits a bump

Chennai: After more than four years of double-digit sales growth, the tractor industry is facing some bumpy roads. Data compiled by the Tractor Manufacturers’ Association (TMA) showed that the total industry production has seen a sharp decline from January to February this year. In January 2019, total production was 73,295 units while total domestic sales were 57,488 units and exports were 6,527 units. In February 2019, total production came down to 59,604 units, a drop of nearly 19%, while total sales were 54,281 units and exports were 6,721 units. “With a CAGR of 16% in the last 4 years, the tractor industry has grown from over 5 lakh units in FY16 to almost 8 lakh units in FY19. With this as a backdrop, we expect a single digit industry growth in FY20,” said Rajesh Jejurikar, president, farm equipment sector, Mahindra & Mahindra. According to CRISIL Research, domestic tractor sales is expected to close FY19 with a 10%-12% rise to just short of 8 lakh units.

“Tractor demand has been subdued in the last 4 months. The major state registering double digit decline is Maharashtra on account of erratic monsoons and subsidy issues. States like Tamil Nadu, Telangana and Punjab have not been able to catch up with the industry momentum,” added Raman Mittal, executive director, Sonalika Group. In the coming year, with the effect of farm loan waivers in many of the states, increase in MSP and the ease of finance availability, he added, will drive sales increase in northern and southern states while a marginal increase is expected from eastern western states.

Analysts are divided on whether the industry is witnessing a temporary blip or there’s a demand dunk just round the corner. In its latest report, Reliance Securities says, “The tractor industry is expected to take a pause in FY20E and would undergo cyclical downturn in FY21E. Further, extended winter in 2019 may lead to delayed monsoon this time, which may have negative impact on the agrarian output in FY20E and resultantly would impact the tractor volume across regions in FY20E. Though non agri usage of tractors would drive the volume to some extent, it would not be sufficient to compensate the expected fall in agri-driven tractor demand,” said the report. Though not as negative in outlook, a CRISIL Research report said, “Given the high base, growth in fiscal 2020 is seen coming off a notch, though it could still be a respectable 6%-8%. A normal monsoon could ensure growth of 4%-6%, while various state and central government schemes — if executed well — could add 1-3%.”

2016, ’17

From: October 16, 2017: The Times of India

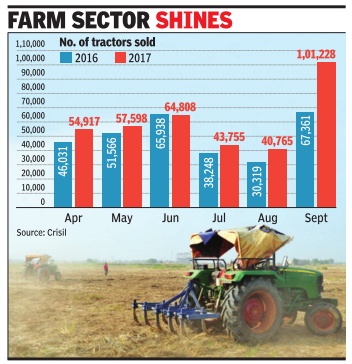

See graphic:

Number of tractors sold, April-September, 2016-17

2019, 20

From: Nandini Sen Gupta, Tractor companies boost output as September sales surge 80%, October 4, 2020: The Times of India

CHENNAI: Tractor is the only segment of the automotive market that has seen double digit sales growth since July, with September retails up 80% year-onyear. As a result, tractor companies are ramping up production capacity hoping that this sales spike will continue beyond the festival and harvest season.

While there are no indications about setting up new factories just yet, companies like Mahindra, Escorts and Sonalika are increasing shifts and clearing supply chain snags to hit 100% utilisation both for domestic and export sales.

“For 18 months, tractor factories were working on a single or 1.5 shifts at best because of demand slowdown. With the numbers picking up, factories are moving to two or three shifts to hit 100% capacity utilisation. The capacity is currently 9.5 lakh units on a two-shift basis but we can also go to three shifts if the demand holds up,” said Tractor Manufacturers Association president T R Kesavan.

A survey by ICRA showed that just 10-12% of those who purchased tractors opted for the loan moratorium as opposed to 75% truck and bus buyers. Tractor financing also picked up because financiers are wary of truck and bus loans, said ICRA VP Shamsher Dewan.