Telecommunications, India: 1

This is a collection of articles archived for the excellence of their content. |

Business

2019: crisis threatens survival of most operators

Dec 25, 2019 The Times of India

NEW DELHI: From being the world's cheapest and fastest growing market, India's telecom sector is sputtering as it faces life-threatening liability running into billions of dollars, a crisis that may alter the character of an industry that has already seen a painful price war destroying profits and push several operators out of the market.

The Supreme Court order for including non-core revenue in telecom groups' gross adjusted revenue -- the figure on which the levies are charged -- revived the rivalry between the old operators and Mukesh Ambani's low-cost upstart Reliance Jio during 2019, but there are signs of a truce with the rival camps agreeing to raise tariffs and also favouring regulator's intervention in fixing floor or minimum tariffs.

"We have fundamentally gone from an all (mobile) voice (calling) network to a hybrid network (of voice and internet data), to soon an all data network," said Rajan Mathews, director general of Cellular Operators' Association of India (COAI).

And to survive, a floor price is needed quickly, before March 2020, he told PTI.

With 1 gigabyte (GB) of mobile data costing just $0.26 compared to $12.37 in the US and $6.66 in the UK, India in 2019 emerged as the nation with the cheapest telecom tariff in the world. It was also the fastest-growing telecom market.

But below the surface, a price war since the 2016 launch of Jio had ringed the sector hallow. And when on October 24, the Supreme Court, on a petition moved by the government, ordered payment of past dues according to its new definition of AGR, the country's second-biggest carrier Vodafone-Idea Ltd warned of shut down if no relief is given. The total dues for the industry ran into a whopping Rs 1.47 lakh crore.

For an industry that has come from 7-8 operators to just three private players and state-owned fourth operator, the warning by Vodafone-Idea sounded like a death knell.

The year saw resurfacing of a bitter war of words between the old and the new operator, and intense lobbying by telecom czar Sunil Bharti Mittal and billionaire Kumar Mangalam Birla of Vodafone-Idea.

Mittal and Birla had faced the brunt of brute competition unleashed by Ambani, as Jio ate into their user base and quickly grew to become the nation's biggest operator in terms of subscribers.

Airtel and Voda-Idea reported record financial losses but Jio continued to surprise the markets with astonishing profits through the year.

The representations to the government, worked. The government announced a two-year deferment on spectrum payments for the stressed telecom companies as it worked to avoid the sector becoming a monopoly, soon after the three operators signalled the end of price war by raising tariffs.

Mittal lobbied for regulator prescribing for a floor tariff for industry viability - an idea Jio had initially opposed on grounds that it would tantamount of giving up industry right of forbearance, Telecom Regulatory Authority of India (Trai) quickly moved in to float consultation paper to fixing minimum rates.

COAI - the association that represents Airtel and other operators - wants the regulator to bring floor prices for data at the earliest, before March, arguing that mature mobile market merits such safeguards for investors.

And shocking loss numbers only led the telecom industry to seek doing away with the "obsolete mechanism" of AGR, in the best-case scenario, and if not, certainly a redefinition.

The industry is also pinning its hopes on fixation of floor price by the regulator to put an end to the sustained hemorrhaging of players and has also urged the Finance Ministry to substantially cut levies to give the industry a fighting chance.

The industry body remains optimistic that a recent increase in tariffs won't take the sheen off data consumption; the hunger for data will increase as more and more Indians transact online, buy clothes and indulge in online shopping and simply binge-watch the latest shows on video-streaming platforms. Greater speeds, smarter phones would aid that process, it argues.

"Still, the floor price is certainly needed to bring certain discipline back into the marketplace. We have fundamentally gone from an all voice network to a hybrid network, to soon an all data network. In a voice network, the de facto floor was the interconnect charge, question is, in the new world of data what should it be," Mathews said.

Mittal whose company is in the midst of $3 billion dollar fund raising to help pay off AGR dues, has sought Trai's urgent intervention in the telecom sector saying, "We are unnecessarily killing this industry in a manner and way that is not conducive..."

He underlined the need for a balance between protecting investments and consumer interest.

Airtel posted a staggering Rs 23,045 crore net loss for the second quarter ended September 30, due to provisioning of Rs 28,450 crore in the aftermath of the SC ruling on statutory dues.

Both Airtel and Vodafone Idea have petitioned the government for relief in waiver of interest and penalty, which will halve the dues, and also filed a review petition in the Supreme Court.

The year, however, brought cheer to state-owned telecom companies MTNL and BSNL. The government recently approved a plum Rs 69,000 crore revival package for the two telcos that were in news over delay in salary payment for the most part of the year.

The revival package includes merging the two loss-making firms, monetizing their assets and giving VRS to employees so that the combined entity turns profitable in two years.

Nearly 92,700 employees of BSNL and MTNL have opted for voluntary retirement, which is expected to save about Rs 8,800 crore annually in salary bills for the debt-laden telecom companies.

CAG report: 2006-10

The Times of India, Mar 12, 2016

CAG: 6 telcos understated revenue by Rs 46,000 crore, govt lost Rs 12,490 crore

A Comptroller and Auditor General (CAG) report on the accounts of six private telecom operators, tabled in Parliament, blamed the department of telecom for the lack of monitoring that resulted in companies adopting "ingenious methods" to understate revenue by over Rs 46,000 crore, which resulted in a loss of around Rs 12,490 crore to the government. The auditor — as reported by TOI on March 9 — examined the accounts of six operators — Airtel, Tata, Reliance, Idea, Vodafone and Aircel — between 2006-07 and 2009-10, and found that Tata group and Reliance Communications were among the top defaulters, followed by Bharti Airtel. The three together caused a loss of Rs 10,000 crore to the exchequer. The CAG had been prevented from auditing these private service providers since 2009 after they moved different courts challenging its mandate. However, after the Supreme Court settled the issue in favour of CAG by an order of April 2014, these companies were compelled to share their accounts for inspection. During the period from when the accounts were examined, the private operators were in a revenue sharing arrangement with the government.

After a few years of reporting all income, some of these operators started shifting their profit to subsidiaries created for this purpose or adopting other measures to understate revenue. According to the CAG, Reliance Communications Ltd (RCL) understated revenue by over Rs 4,400 crore by entering into a separate arrangement with subsidiary Reliance Communications Infrastructure Ltd, and shifting all revenue on account of value added services into the accounts of RCIL instead of RCL, thus denying the government its share of Rs 520 crore during the period. "The government was deprived of a total revenue of Rs 12,488.93 crore on account of non-payment of licence fee of Rs 3,752 crore, spectrum usage charges of Rs 1,460 crore and interest of Rs 7,276 crore due from the six companies," CAG said.

The auditor said proper monitoring of Controller of Communication Accounts was required and the "DoT also needs to strengthen its internal audit mechanism to ensure that verification of deductions is checked regularly". The telecom firms had also not taken into account their income from interest, foreign exchange etc. "The companies were also reducing their revenues by adjusting bad debts," the CAG said, adding that infrastructure sharing revenue was an example of concealing revenue by recording it as reduction of expenditure.

"Another area for suppressing the revenues was transfer of assets by telecom companies to their subsidiaries at a value lower than market value or at nil value," a senior CAG official said. Companies were also found indulging in providing interest free loans to their subsidiaries.

‘Call drops’

From: Shweta Punj, MG Arun, July 27, 2015: India Today

See graphic:

How calls are made and how do they get dropped?

2015

Traffic channel (TCH) congestion, Immobile service and all routes busy- statistics, state wise-

Based on Index for Congestion Density- 2015

From: Shweta Punj, MG Arun, July 27, 2015: India Today

See graphic:

Call drop rates by different telecom networks across India, state-wise;

Traffic channel (TCH) congestion, Immobile service and all routes busy- statistics, state wise-

Based on Index for Congestion Density- 2015

2016: No cellular operator meets call-drop cutoff

The Times of India, June 2, 2016

Pankaj Doval

A survey conducted by telecom regulator Trai between May 3 and May 6 has pointed out that nearly all operators in the national capital have call drops beyond the stipulated benchmark of 2% of all calls. This finding of a 12city survey (results for the other cities will be released soon) comes amid protests by telcos against imposition of any penalty for call drops.They have even earned a reprieve from the apex court in this regard. Bharti Airtel, the leading company , saw a deterioration in services when its performance was compared to a similar survey conducted in January . The call drop rate rose to 3.3% on the 2G network (1.4% in January) and 2.2% on 3G (1.6%). Airtel claims it is working towards a voluntary benchmark of 1.5% to impro ve its services beyond Trai's mandate.

Close-rival Vodafone had a 2.8% call drop rate on its 2G network, though this came down from the 3.9% in the previous round. However, Vodafone's 3G was found to be well within the prescribed limits.

Idea Cellular, the third-largest company operating in the city, fared miserably on its 3G network with a rate of 6.2%.Calls on the 2G network were under the set limit.

“There has definitely been a degradation in quality of performance when it comes to call drops,“ Trai chairman RS Sharma said.

The Cellular Operators Association of India has in the past raised questions on the results of the surveys conducted by Trai. The operators, who blame the poor service to lack of permission to install additional cellular towers, have also questioned the manner in which the tests have been conducted by Trai. Officials of the telecom regulator now say they are looking at ways to fix accountability on the operators as their move to impose a penalty was not allowed by the apex court.

“We will come out with some remedial measures very soon,“ said Anil Kaushal, a member of Trai. The regulator will also write to the telecom ministry regarding some proposals that will give it teeth to impose financial penalties, Trai secretary Sudhir Gupta said. Telecom minister Ravi Shankar Prasad, who has been vocal about the need for improved telecom services, has already said the government will consider amendments to the Act governing Trai in order to give it penal powers.

The survey showed that state-run MTNL's network is in very poor condition. Call drops on MTNL's 2G network were at an extreme 10.4% while it was 8.2% on 3G. Anil Ambani's RCom had a poor 5.2% call drop rate on its 3G network, though it was at 1.4% on the 2G network.

Many independent analysts have said telcos are not ready to make requisite investments in upgrading their alreadychoked infrastructure, and this is one of the main reasons behind the poor services. Most of the telcos have, however, disagreed with the comments.

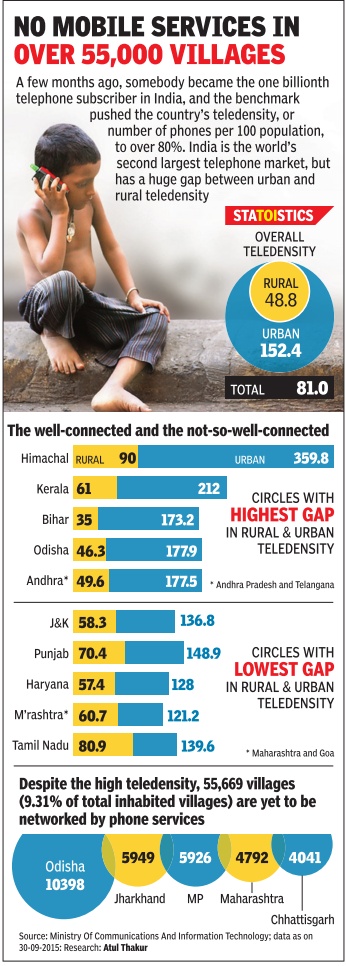

Coverage, tele-density

2014: 8.8% villages lack coverage

From January 5, 2017: The Times of India

See graphic:

Indian states with 1,000 villages or more that are not on a cellphone/ mobile network: 2014

2018: Poorer circles have more active users

From: July 26, 2019: The Times of India

See graphic:

The telecom ‘circles’ with the most active and least active users, presumably as in 2018.

Tele-density

2020

From: July 10, 2021: The Times of India

See graphic:

Tele-density in the Indian states, presumably as in 2020.

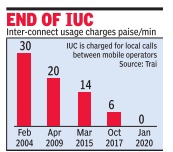

Inter-connect usage charges

30p in 2004> 6p in 2017

Mobile phone bills are set to come down further with the Telecom Regulatory Authority of India announcing a steep cut in charges that phone companies pay each other for connecting calls. Trai on Tuesday cut the inter-connect usage charges (IUC) to 6 paise per minute from 14 paise. While the new charges come into effect from October, the regulator has laid the roadmap to do away with the IUC altogether from January 1, 2020. TOI was the first to report on the impending IUC cut in its edition dated August 13.

“It has been observed that reducing termination rates (IUC) has benefited consumers and enhanced competition... The reduction in the mobile termination charge is likely to yield consumer benefits,“ Trai said. Older telecom operators such as Bharti Airtel, Vodafone and Idea Cellular have opposed cutting IUC and instead asked for it to be raised.

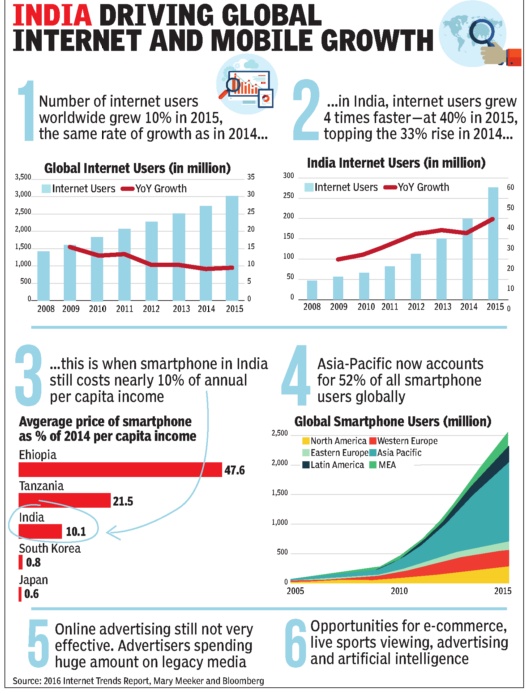

Data

2014-18: Indians use 8GB data/month

Sindhu Hariharan, August 22, 2019: The Times of India

Indian subscribers consumed almost 8GB (gigabytes) of mobile data per month in 2018 — a 75% increase from the previous year on the back of cheap tariffs and increasing 4G penetration.

India leads most major countries in wireless data consumption per subscriber per month, including the US, the UK, Singapore, Japan and South Korea. An average user in the US consumes around 4GB data on mobile devices per month, followed by South Korea (6GB), Japan (4.5GB), and Singapore (3GB).

A first-of-its-kind study by the Telecom Regulatory Authority of India (Trai) shows data usage on wireless devices has been on a steady rise, with 2017 being an inflection point. A Trai official said the growing relevance of mobile data prompted the study, based on data provided by telcos, and such a review will be done annually going forward.

Average cost of accessing the internet on your mobile has declined close to 40% from 2017 to 2018, and fell 96% from the cost in 2014.

Telcos’ revenue from data services grew 41% from Rs 38,882 crore in 2017 to Rs 54,671 crore in 2018. Average revenue has shown a mixed trend over last five years — falling in 2016 and 2017 and increasing thereafter. In case of individual telcos, for April-June, Airtel overtook peers Jio and Vodafone Idea in average revenue per user at Rs 127, compared to Jio’s Rs 122 and Vodafone’s Rs 108. Trai projects consumption of mobile data to increase by over 200% in the next two years. “The total estimated wireless data usage may reach 100 billion GB per annum by 2020.” The number of wireless data subscribers grew 36% from 424 million in 2017 to 578 million at the end of 2018. Indian mobile users consumed a total of 46,404GB of data in 2018 — up 131% from the previous year.

Without naming the operator, Trai also hinted at shake up in the telecom space after Jio’s entry.

2017: Indian telcos carry most data in world

Rachel Chitra and Ranjani Ayyar, March 31, 2018: The Times of India

From: Rachel Chitra and Ranjani Ayyar, March 31, 2018: The Times of India

When it comes to global internet traffic, India sees the heaviest data carried on its network after the country’s data usage grew five times in the last one year. The country’s network carries 2.1 exabytes of data per month (1 exabyte = 1 million terabytes) — way ahead of North America, European Union, Latin America (Latam), China, Eastern Europe and Middle East & Africa.

The entry of Jio has proved to be a game changer of sorts with average data consumption sky-rocketing and prices falling by more than half. “The key tussle between the top-three telecom operators has been for high ARPU (average revenue per user) data-using subscribers. This has resulted in data cost falling from Rs 12/GB to Rs 5/GB currently,” said Piyush Nahar, equity analyst, Jefferies. The price cuts are more visible in prepaid than in post-paid packs.

“This 60% cut in data prices has driven a sharp increase in volumes. Total data carried per month by the top four operators has increased five times over the past 12 months.We believe that this fight for data subscribers will continue and data prices may actually bottom out at a lower pricing,” Nahar added.

Airtel attributed this boom to digital consumption of social media, music, videos and more on smartphones. Data also showed this boom has led to the average Indian consuming four times more data in the last one year.

“Increasing penetration of high-speed 4G networks along with affordable smartphones and budgetfriendly data packs with large bundles of GBs is leading to a massive boom in data consumption in India. In fact, video is now touted as the new language of internet and is seeing the highest growth,” said a spokesperson from Airtel, which saw total data traffic on its mobile network grow by more than 550% to over 1 million TB during quarter ended Dec 2017.

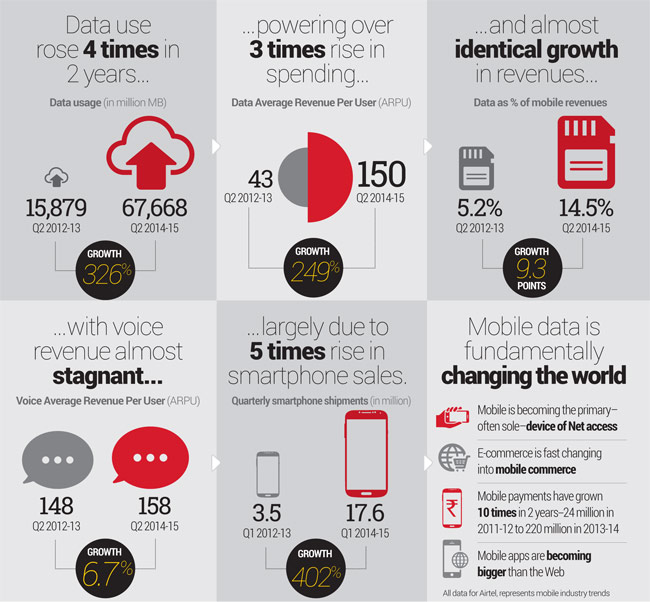

2016-18: voice usage and revenues

From: Sindhu Hariharan, Voice Calls Jump 70% In 2 Yrs Due To Cheaper Plans, January 24, 2019: The Times of India

Poor Connectivity For VoIP An Issue

At a time when users worldwide are getting on the data bandwagon and ditching voice calls for services such as WhatsApp, Indians continue their strong bond with phone calls.

Voice calls have seen a spike of almost 70% in the past two years, according to telecom regulator TRAI’s data. The average time spent on voice calls by a subscriber each month has increased steadily the quarter ended September 2016 to the September 2018 quarter (see graphic). Interestingly, consumers seem to be chatting away at the expense of the telecom operators. The average revenue each minute for telcos from voice calls has dipped in the same period.

Industry watchers TOI spoke to say a combination of cost-effectiveness and the Indian penchant for verbal communication has resulted in voice calls holding their ground in the country amid dwindling relevance globally. Further, with data itself not as strong and flawless as is needed for VoIP (Voice over Internet Protocol) calls, smartphone owners say they often rely on regular calls for a better experience.

“It is mainly a function of Indian consumer behaviour. People are used to the convenience of dialling a call, and a growing number of users are getting into the voice mode with the hindrance of cost also going away,” Faisal Kawoosa, founder of tech and telecom consulting firm techARC, said. He added that, with over 500 million feature phones in the Indian market, we cannot write off voice services in India yet.

The feature phone market is also growing. According to IDC, vendors in India shipped a total of 56 million feature phones in the fourth quarter of 2017, making it “the highest-ever shipments” in a single quarter, at a time when smartphone sales itself have been either flat or declining. Research firm Counterpoint notes that India accounted for almost 43% of the global feature phone shipments in the quarter on the back of devices by Reliance Industries’ Jio.

The socio-economic situation in India is also driving preference for voice calls. A recent survey by Pew Research Centre found that, despite the push for digital, only 25% of Indian adults use the internet or own a smartphone, compared with 96% in South Korea and 89% in the US.

Jigar Doshi, co-founder, Komparify.com, a comparison platform for mobile plans, says telcos making voice calls free has driven high adoption, making the operators re-look at the plans structure. “We have started seeing terms such as ‘not for commercial usage’ appearing prominently on plan descriptions in recent times,” Doshi says.

On the flip side, observers believe low prices of voice calls are also contributing to poor quality of call services and the infamous call drops.

Despite increasing adoption, Hemant Joshi, partner for technology, media and telecommunications at Deloitte India, says it is “very unlikely that voice services could be monetised by the operators”, given the fierce competition in the sector. Kawoosa adds revenue from data, too, is still a distant dream for telcos. “The data growth is artificial in a way, as it is not priced at what it deserves due to hyper competition.”

2018: Indians used 12 times more data than in 2015

February 28, 2019: The Times of India

From: February 28, 2019: The Times of India

From: February 28, 2019: The Times of India

From: February 28, 2019: The Times of India

From: February 28, 2019: The Times of India

See graphics:

Pan-India mobile data usage, in Petabytes (PB) per month, December: 2014- 2018

Average monthly 4G data consumption: 2015-18

Data traffic by content, presumably in 2018

Average mobile data usage per month (excluding Wi-Fi) vs broadband connection, presumably in 2018

4G traffic has more than doubled in 2018 compared with 2017 as data prices continue dropping and more consumers purchase 4G capable devices and migrate away from 3G and 2G networks. Despite low levels of mobile broadband penetration, India is a constantly growing market for mobile data connections with 4G. In 2018, the country had 432m 4G users downloading more than 10 GB of data on average per month.

2014-20: data usage per person rises 43 times

Chethan Kumar , June 7, 2021: The Times of India

As data grows cheaper by the day in India, its consumption grows in tandem at a phenomenal rate. Data usage per subscriber has jumped by around 43 times in just six years, while data cost decreased by 96% (24 times) compared with 2014.

Seven years ago, data usage per subscriber was 3.2GB while customers paid Rs 269 per GB. Comparatively, cost dipped to just Rs 10.9/GB in 2020, while data usage jumped to 141 GB/user. But not all data used is for surfing the internet. Data usage per subscriber in 2020 was 20% more as compared to 2019 as most regular officegoers, school kids and even some aspects of healthcare and several other sectors worked remotely. The cost of data decreased further by nearly 2% to Rs 10.9 from Rs 11.1 in the previous year, as per the latest data from the Telecom Regulatory Authority of India (Trai).

Data cost (to customer) in India is one of the cheapest in the world, Trai said. In the US it is Rs 531/GB, and in the UK it is Rs 286/GB. The global average is Rs 366/GB.

As first reported by TOI, the number of internet connections in India breached a significant milestone of 75 crore in 2020. Trai attributes the massive data boom to ‘4G’, which brought about a technological revolution.

Earlier, the data subscribed by a user was used purely for surfing while voice calls happened through a dedicated (radio frequency) channel established for the call. “Now, the calls we make use data, which has made it the primary source of revenue,” Lt Gen (retd) SP Kochhar, director general, Cellular Operators Association of India, told TOI.

2019: 11.7GB a month

Aparna Desikan, February 28, 2020: The Times of India

From: Aparna Desikan, February 28, 2020: The Times of India

Video consumption using 4G mobile technology drove data traffic in India last year, with an average 70 minutes a day spent on overthe-top (OTT) platforms on phones. Monthly data usage also grew to 11.7GB a month from 10GB in 2018.

The Mobile Broadband India Traffic Report from Nokia said that 2019 saw a 47% yearon-year (YoY) increase in data traffic, 96% of which was constituted by 4G, up from 92% in 2018. Most telecom operators have switched off their 3G networks in big cities and the consequential impact saw 3G connections witnessing the highest-ever decline of 30% during 2019. In 2018, a mere 1% subscribers surrendered 3G connections.

Total data traffic grew by 44 times in 4 years and 2019 saw overall data subscribers grow to 600 million, the report added. The 4G device base grew in parallel by 1.5x, driven by the launch of a variety of models by brands’ aggressive pricing. Despite the growth registered, broadband penetration in India is at around 47%, which is significantly lower compared to China at 95%, and other European nations at 95-115% Nokia senior VP & head (India market) Sanjay Malik said, “We believe the migration of subscribers to 4G will continue to drive broadband growth in the country. The upcoming 4K/8K videos and Industry 4.0 solutions that promise to enhance productivity and bring down expenses for the industries across different verticals demand ultra-high speed and extremely low latency. Indian telcos will need to consider other connectivity solutions to leverage the new opportunities and to address the growing data consumption.”

2025: 36GB/ Highest in the world

Nov 21, 2025: The Times of India

At 36GB/mth, Indians are biggest data users: Report

TIMES NEWS NETWORK

New Delhi : Indians are the biggest consumers of mobile data in the world at an average of 36GB per user per month, ahead of even the mature economies such as the US, Western Europe, and China, as cheap internet tariffs and highly-affordable smartphones are fuelling demand. A strong content streaming ecosystem as well as video viewing on social media — both short-format as well as longer ones — are among reasons behind the rapid consumption

India’s current data usage is already much ahead of the global consumption, which is at 21GB per user per month . Western Europe is currently at 25GB (51GB by 2031), North America at 25GB (49GB), China at 23GB (42GB), and Latin America at 14GB (31GB).

Legal aspects/ Superior court judgements

Call registry/ do-not-call registry

SC reflects Times View on pesky calls

Suggests ‘Call Me’ Registry

Dhananjay Mahapatra | TNN From the Archives of ‘‘The Times of India’’: 2008

New Delhi: Those pesky calls may finally dry up. Reacting to a common complaint of millions, the Supreme Court on Thursday maintained that the year-old National Do-Not-Call Registry (NDNCR) has just not worked as telemarketers have continued to breach the citizen’s right to privacy, and suggested that NDNRC should be replaced by a “call registry” — that is, those wishing to receive telemarketers’ calls should register themselves for the purpose.

Remarkably, a little over eight months ago, this newspaper in its Times View had made precisely this suggestion. On the front page on November 18, 2007, we had said, ‘‘There’s a better way out of this mess than trying to make the do-not-call registry work — have a “call registry” instead. In other words, the default option should be that telemarketers cannot make unsolicited calls. Those who wish to receive calls can register themselves on the call register.’’

In response to the suggestion of a bench comprising Justices A K Mathur and Dalveer Bhandari, additional solicitor general Gopal Subramaniam said the Centre would consider it in all seriousness and get back to the court within six weeks. Subramaniam appeared to have been impressed by the suggestion, which he termed as ‘‘weighty’’.

On the issue of pesky calls, the SC has not just been concerned but proactive. Last year it had virtually forced the government to operationalize the “do-not-call registry” while dealing with a PIL filed by one Harsh Pathak accusing service providers of selling their data base to telemarketers who made unsolicited calls.

“In the last one year, we have experienced such calls galore. At least we are victims of it. A year back, you (the Centre) were not willing to implement the regulations. They were implemented after we threatened to do it through our order. After one year, we feel something more needs to be done,” the court said.

2008: SC asks govt to bar unregistered telemarketers from operating

From the Archives of ‘‘The Times of India’’: 2008

A year after the “do-notcall registry” got under way, nearly 8.3m cellphone users have registered

Yet pesky calls continue. It’s time to launch a new registry of people who wish to receive commercial calls, says the Supreme Court

Govt says it is difficult to take action against telemarketers not registered with DoT

Privacy: right is primary, SC

From the Archives of ‘‘The Times of India’’: 2008

New Delhi: The SC on Thursday maintained that the yearold ‘National Do-Not-Call Registry’ (NDNCR) has just not worked as telemarketers have continued to breach the citizen’s right to privacy.

‘‘It is time to rechristen the ‘Do-Not-Call Registry’ as ‘Call Receivers Registry’,’’ said the court and explained that those who registered in the latter would only be entitled to receive calls from telemarketers. “Persons interested in commercial calls must volunteer and get registered. Those who do not wish to register should not be disturbed,” it said.

Additional solicitor-general Gopal Subramaniam said the government was finding it difficult to take action against many telemarketers, who were not registered with the telecom department and continued to escape the rigours of the rule banning unsolicited commercial calls. On this, the SC directed the government to stop the operations of unregistered telemarketers right away. When the government informed the court that till date, nearly 8.3 million mobile phone subscribers have registered in NDNCR, it wondered how could these pesky calls be still so rampant and bother so many people.

Subramaniam said the government has control over registered telemarketers, who come under the purview of penal regulations for making unsolicited calls. So it was imperative that no telemarketer be allowed to operate unless it is registered, he said. Considering the impact of the SC’s views on their marketing strategy, banks and service providers were adequately represented before the court. Their counsel, senior advocates T R Andhyarjuna and C S Vaidyanathan, informed the SC that the position was not as bad as was being projected. Till date, about 13,600 telemarketing operators have registered with the government, they said. They relied on figures to argue that through telemarketing, a lot of business has come to people.

The court disagreed and asked: “For your business, do we have to suffer?” Vaidyanathan joined issue and said imposing a total ban on telemarketing would be at cross with the constitutional provision. But the SC rejected the argument, saying right to privacy always gets primacy.

Licence fee

2019: Telecom firms owe govt. over ₹92,642 cr

July 30, 2019: The Times of India

Telecom firms owe over ₹92k cr as licence fees: Centre tells SC

New Delhi:

Leading private telecom players like Bharti Airtel, Vodafone and stateowned MTNL and BSNL have a pending licence fee outstanding of over Rs 92,000 crore till date, the Centre has told the Supreme Court.

In an affidavit filed in the apex court, the department of telecom (DoT) said that, according to calculations, the total amount which has to be recovered from all the telecom firms accrues to Rs 92,642 crore as on date, it said.

According to the New Telecom Policy, telecom licencees are required to share a percentage of their adjusted gross revenue (AGR) with the government as annual licence fee (LF). In addition, mobile telephone operators were also required to pay spectrum usage charges (SUC) for the use of radio frequency spectrum allotted to them.

Telecom operators had moved the top court against the Telecom Disputes Settlement and Appellate Tribunal’s (TDSAT’s) order, which ruled that certain non-telecom revenues like rent, profit on sale of fixed assets, dividend and treasury income would be counted as AGR, on which licence fee would have to be paid to the gover nment.

The TDSAT order had exempted a large number of streams from the definition of AGR, like capital receipts, bad debt, distribution margins to dealers, forex fluctuations, sale of scrap and waiver of late fee.

The telecom tribunal also said revenue from miscellaneous income must be included while computing a carrier’s AGR, dealing a setback to telecom operators who would have to shell out more towards licence and spectrum usage fees. AGENCIES

SC asks them to pay ₹92,000cr to Centre

AmitAnand Choudhary , Oct 25, 2019: The Times of India

In a major blow to the telecom sector, the Supreme Court allowed the Centre to recover over Rs 92,000 crore from telecom companies as licence fee and penalty along with interest based on the revenue-sharing model for the gross revenue of Rs 14,98,181 crore earned by them during 2004-2015.

Under the revenue-sharing model introduced in 1999, telcos had to pay a certain portion of their adjusted gross revenue (AGR) as licence fee. Initially, 15% AGR was fixed as licence fee under revenue-sharing, which was reduced to 13% and then to 8% in 2013. The SC dismissed the plea of telcos, which contended that AGR, on the basis of which fee is paid by them to the Centre, should include only core telecom services and revenue from other sources should be excluded. It accepted the Centre’s contention that AGR should include dividends, handset sales, rent and profit from scrap sale, apart from revenue from services.

2013

Chennai second among metros in mobile subscriber growth

Ishan Srivastava, TNN | Aug 27, 2013 The Times of India

CHENNAI added 82,296 mobile subscribers in July 2013, the second highest among four metros, according to the latest data released by Telecom Regulatory Authority of India (Trai). With this addition, total number of subscribers in Chennai has reached 1.15 crore. As per the 2011 census, Chennai has a population of 46 lakh.

Chennai's growth is second only to Delhi in that month, which added four lakh users on a subscriber base of 2.8 crore. Mumbai follows Chennai with 81,738 additions and Kolkata added 39,946 to its subscriber base.

Teledensity -- the number of mobile connections relative to population --crossed the 100% mark for the metros in 2009, implying that there were more mobile connections in these cities than the number of residents. The current teledensity in Chennai is nearly 200% or two mobile connections for every person, but the growth shows no signs of slowing down with constant monthly additions. For example, Chennai added 83,290 users in June and 70,444 in May.

Multi-SIM usage, increased migrant population and data consumption are seen as the main reasons driving growth. "A lot of these additions are 'passive' SIMs that people keep just to avail of offers or to enjoy better rates on particular routes and are not in regular use," said Sandip Biswas, director at Deloitte, a consultancy firm. "Operators don't mind it either and are happy with any increase in numbers in such a highly competitive market."

Also, a lot of usage of new SIMs is driven by data consumption where people buy SIMs to access internet on their media devices such as tablets in addition to the one they use for voice, said Milan Sheth, partner at consultancy firm EY.

However, some experts said that subscriber numbers have become less relevant now and what matters is how much data is being consumed by people and how much money is realised by telecom companies through it. "Inactive connections can be as high as 20%-30 % of total ," said Prashant Singhal, partner at EY and who tracks telecom sector.

… and Airtel

From: Dec 23, 2019 Times Of India

See graphic:

The revenues of the telco majors, 2018-19/ 20.

Feb 14 2015

Pankaj Doval

BSNL's share in mobile biz dips to single digit

Edged out by Airtel in broadband market

Jayanta Kumar was a harried customer of BSNL. A resident of Ghaziabad in the National Capital Region, he had been running from pillar to post just to get a bill for his landline and broadband connection, which was not delivered for six months.“Finally , I had to use my contacts to prompt them in generating a bill. Is this how you do business?“ says Kumar, who discontinued his BSNL connection and hopped on to a private operator. It's a sorry state of affairs at the telecom PSU that once was the backbone of the country's telecom infrastructure.The company has been in losses for the last many years. It appears to be stuck in a time warp as failure to keep pace with the highly competitive private operators and a general lackluster attitude of ground-level and managerial staff has seen its share in mobile subscribers narrow down to single digit, while Bharti Airtel has moved ahead and gained the top spot in broadband, according to numbers released by regulator Trai.

BSNL's share in the mobile phone market came down to 8.6% in 2014 against 11.6% in 2012. This happened even when the overall mobile subscriber base had grown from nearly 865 million in 2012 to 944 million at the end of last year.BSNL had losses of around Rs 7,000 crore in 2013-14.

BSNL old-timers blame the flight of customers to private players due to poor network quality brought on by delays in procurement of equipment. While BSNL's current CMD Anupam Shrivastava is hopeful of a turnaround on the back of a “renewed focus“ after the entry of the Modi government, not everyone is happy with the present situation.

R K Upadhyay , former CMD of BSNL, said he is surprised by the fall in the com pany's market share as most of the network expansion had been done. “We have network capacity and coverage to support growth. So, it is difficult to justify the fall in numbers,“ he told TOI.

Asked about the poor lastmile services, he did concede that the attitude of groundlevel and managerial staff needs to change. “There is a PSU hangover, and I cannot deny this. However, unlike the private operators, we cannot outsource our functions.With technology advancement, some of our existing staff may not be relevant today , but we cannot abandon them. They need to be paid till they serve.”

2014: An increasing use of data than voice calls

November 24, 2014

A Newsflicks study of the latest mobile phone user and revenue trends reveals we are talking more through data than voice.

RCom, Aircel dial merger/ 2016

New Entity Will Have Revenues Of $4Bn, 180M Subscribers

In the biggest telecom merger in India, Reliance Communications (RCom) and Aircel have agreed to combine their wireless operations, creating the country's fourth biggest player with revenues of $4 billion and a subscriber base of 180 million, after Bharti Airtel, Vodafone and Idea Cellular.In terms of subscribers, Bharti Airtel led the pack in sept 2016 with 250 million customers followed by Vodafone (200 million) and Idea Cellular (175 million).

The merger assumes significance in the telecom market where an intense competition following the entry of Reliance Jio is expected to trigger consolidation. RCom and Aircel will hold an equal stake of 50% in the combined entity , which plans to have a new brand name for its mobile phone services.

The Anil Ambani-led RCom and Aircel, in which Malaysia's Maxis is the largest shareholder, had been in negotiations since December 2016.

Maxis said that the merger and the further equity support reinforces its commitment to India. Maxis had invested Rs 35,000 crore ($5.2 billion) in Aircel, which was one of the largest foreign investments into India. The other shareholders of Aircel are United Telecom (including Saudi Telecom) and the Reddy family of Apollo Hospitals. RCom said that the partners are in talks with leading international investors to raise capital for the merged entity. RCom had recently acquired Russian conglomerate Sistema's local unit, which operated under the MTS brand, and as part of the latest deal Sistema holds 10% stake in the company .

September 2016: Landline connections

2017/ Vodafone- Idea merger: India’s no.1, world’s no.2

Partial retreat for Voda from losing mkt, sweet deal for Idea?, Mar 21 2017, The Times of India

Combined Co To Be Global No 2 In Subscribers

London-headquartered Vodafone and Kumar Birla-controlled Idea Cellular on Monday announced India Inc's biggest-ever merger to create the country's undispu ted leader in the world's second largest telecom market after China. The combined 394 million subscriber base of India's second and third largest telcos will eclipse Bharti Airtel's 270 million -and catapult the merged company to No 2 spot globally. It could also alter the landscape of an in dustry that's facing cut-throat competition from Mukesh Ambani's recently-launched Reliance Jio.

TOI was the first to write, in its edition of January 28, that Vodafone and Idea were in advanced discussions for a merger (there had been some speculation last year, also re ported by TOI, but nothing had come of it at the time).

The mega-merger will create a company that will be No. 1 or a strong No. 2 in all telecom circles except Jammu & Kashmir. Voda's 204 million subscribers and Idea's 190 million (at the end of 2016) will give them a combined market share of 35%. Aggregate revenues of over Rs 80,000 crore represent 42% of the national pie.

Vodafone's global CEO Vit torio Colao told TOI in a joint interview with Birla that the consolidation was driven primarily by the “arrival of data, which is very capital heavy and consumes a lot of spectrum“ along with reasons like synergy and cost savings. Although Vodafone will hold 45% and Idea Cellu lar 26% stake in the postmerger company , which is being valued at $23 billion, they will have equal voting rights (again, TOI had reported on Jan 28 that Idea was pressing for it). The combine the name and brand identity of which will be decided in due course will be jointly managed with three representatives each on a 12-member board. Birla will take over as chairman of the new entity upon the completion of the deal in 2018. While the two sides will together decide on the CEO, Idea's Himanshu Kapania is expected to steer the combined operations; the choice of chief financial officer will be Vodafone’s.

The transaction gives Idea the option to buy 9.5% stake in the new company over the next four years at Rs 130 per share. If Birla chooses not to exercise the option, Vodafone will sell down shares to equalize its shareholding with Idea. On January 30, two days after the TOI report, Vodafone and Idea had confirmed they were in talks. On Monday , they maintained that the merger would not breach subscriber and spectrum threshold limits in a big way (only in five circles, according to telecom analysts) as reported by this newspaper on January 28.

Perhaps in a bid to bring about near-parity between the two, the merger excludes the Vodafone's 42% interest in Indus Towers while valuing the British telecom giant unlisted Indian subsidiary at $12.4 billion (Rs 82,000 crore), but includes Mumbai-listed Idea's 11% stake in Indus in its $10.8 billion (72,000 crore) valuation.Analysts viewed the deal making as a strategic retreat for Vodafone from a lossmaking market where it has written off $9 billion till date. Jio's freebies have pushed incumbents into a corner with Bharti Airtel, Vodafone and Idea posting quarterly losses.

In 2007, Vodafone stepped into Indian market when it paid Hutchison Whampoa $11 billion for controlling stake, and later coughed up another $5.5 billion to buy out the 33% held by the Ruias of Essar. Vodafone has since invested billions in multi ple rounds of spectrum auctions even as competition ate into pricing power in what was once hailed as one of the world's most promising telecom markets. Losses from the Indian business have weighed down Vodafone's global results in the recent past and prompted its CEO to consider `de-consolidation’.

The merger will also strengthen Birla's hand in a bruising war , providing him a leadership platform and a bigger balance sheet to take on rivals, including Jio. Idea shares have been beaten down until the merger speculation gained credence as it was considered to be the weakest among the top three to face the Jio onslaught. Idea shares gyrated wildly rising 15% in morning trade but subsequently declined10% indicating investor apathy with the deal construct. Both Vodafone and Idea played down the market volatility stating it would take markets “a while to digest details of a complex transaction“.

“For Idea shareholders and lenders who have supported us thus far, this transaction is highly accretive, and Idea and Vodafone will together create a very valuable company given our complementary strengths,“ Birla said. “The combined company will have the scale required to ensure sustainable consumer choice in a competitive market and to expand new technologies that have the potential to transform daily life,“ Colao added.

2017/ Market controlled by local heavyweights

India's Big Club helms telecom story , Mar 21, 2017: The Times of India

India's telecom market is firmly in control of local heavyweights -Kumar Mangalam Birla, Sunil Mittal and Mukesh Ambani -after foreign players retreat from a sector with over a billion subscribers.

Though Vodafone CEO Vittorio Colao emphasised the company wasn't exiting India, it was clearly “deconsolidating“ the troubled Indian business from its global footprint. Recent M&A deals have seen Norwe gian giant Telenor selling out to Bharti Airtel and Malaysian telco Aircel and Russian operator Sistema folding into Anil Ambani's Reliance Communications.

Japan's NTT DoCoMo decided to exit an under-perfor ming joint venture with Tata Teleservices, while Bahrain Telecommunications (Batelco) snapped ties with C Sivasankaran's S Tel and UAE's Etisalat exited the country after the spectrum auction scandal, which erupted six years ago.

Singapore Telecommunications (SingTel), remains a large but passive shareholder in Bharti Airtel. Then there were others like Australia's Telstra and South African major MTN calling off India plans, following the spectrum controversy and intense market competition.

“Don't expect any reduction in the market competition in medium term, as large telcos would continue to keep the intensity high. However, in the long term this consolidation would restore some pricing power and give better bargaining terms with vendors and suppliers.The industry will be left with five major players namely -Vodafone-Idea, Bharti Airtel, Reliance Jio, RCom-Aircel-Sistema and BSNL plus MTNL,“ Harsh Jagnani, VP, sector head, Icra, said.

2017: profits, revenues plunge

MG Arun , Race to the bottom “India Today” 23/10/2017

The Rs 1.5 lakh crore Indian mobile telephony sector is going through one of its toughest phases since the 2G spectrum scam that rocked it at the start of the decade. At a time when a wave of consolidation has swept the industry following the launch of Reliance Jio, the industry's pricing power has been falling continuously, with prices of data crashing 67 per cent over the past six months. This is bad news for the sector, where companies have already been grappling with falling revenues ever since the Mukesh Ambani-led Jio unleashed a price war offering its services practically for free till April this year. The profits of market leader Airtel, with a 34 per cent revenue market share, plunged 72 per cent to Rs 373.4 crore in the last quarter of 2016-17 as it slashed tariffs to retain customers, while Vodafone India's operating profit for the financial year fell over 10 per cent. According to CLSA, a brokerage firm, India's mobile industry revenue fell for the first time in FY 2016-17 to Rs 1.88 lakh crore and will decline further to Rs 1.84 lakh crore this fiscal.

Besides the squeeze in revenue, telecom service providers have also had to cough up high fees for procuring licences, pay spectrum usage charges to the government every year and instalments towards auction payments to the government every year as a percentage of their adjusted gross revenue. While the adjusted gross revenue grew a mere 6.8 per cent in fiscal 2016, payout to the government rose by 24 per cent. Reports say the telecom industry has bought spectrum worth Rs 3.45 lakh crore since 2010, partly on upfront payment and the rest on deferred payment till 2028-29. With the Idea-Vodafone merger, Tata's reported plan to exit the telecom business and the now-aborted attempt by Reliance Communications, led by Mukesh's brother Anil Ambani, to merge its telecom business with Aircel to pare debt, the sector is in the midst of a major churn. While the industry is steeped in Rs 5 lakh crore debt, Tata Teleservices alone has a debt amounting to Rs 34,000 crore and Reliance Communications, Rs 25,000 crore. The shakeout in the sector is impacting jobs, worsening an already grim scenario. While winding up Tata Teleservices would result in 5,000 jobs being lost, RCom has laid off some 1,200 people. Both Idea and Vodafone are planning to lay off staff by the thousands by the time their merger comes through. Overall, the telecom industry is set to lose around 150,000 jobs as it struggles to contain costs in an increasingly challenging environment. "The price war for data subscribers has dented the bottomlines of wireless telecom service providers, yet none of them is likely to pull a punch," says a Crisil report.

If anything, competition will only heat up further given that market leadership is critical to the business. "It offers many advantages once the dust settles, as is borne out by profitability trends across the world. The leader typically commands a premium with higher average revenue per user (ARPU), a larger share of premium subscribers and relatively lower churn," adds the report. But till the entire process of consolidation plays out, telcos will continue to be in deep trouble.

2017: Indians get most spam in the world

Himanshi Dhawan|Indians get most spam calls in the world|Jul 16 2017 : The Times of India (Delhi)

You're not imagining it. Spam calls are on the ri se. A study of 20 count ries has revealed that Indians received the most number of spam calls in 2017.

Research by Truecaller, an app which has over 250 mil lion users globally , showed that an Indian smartphone user received over 22 spam calls a month, or almost a call a day. The US and Brazil came in second with over 20 calls per user each month.

The report says that over half of India's spam calls (54%) originate from telecom operators. “Many of these operators are seeking to provide special offers for free data, or unlimited calls. Which doesn't sound so bad, until you get bombarded by them.“

Nuisance calls -including unwanted, harassment and pranks -stake claim to 20% of the calls. Among the other spam calls Indians receive are 13% from telemarke ters, 9% from financial services while 3% are related to insurance and scams.

This is despite the fact that India's regulatory system includes a do-not-disturb (DND) registry as well as an unsolicited commercial communication regulation. Other countries are not much better off either. Unwanted calls to Americans have risen sharply by 20% in the last two months. Telecom operators are the top spammers (33%) in Brazil, with calls seeking to provide special offers for data and calling plans. The second biggest spammers in Brazil are debt collectors, though sometimes these calls can be fraudsters pretending to collect money for illegitimate reasons.

Chile, South Africa and Mexico are next among spam-plagued countries. The data for the report was aggregated anonymously from incoming calls that were either marked as spam by users or had automatically been flagged by Truecaller.

The country's two corporate goliaths were in the past engaged in a cold war when they were on opposite sides. The Tata Group and RIL haven't had much business connections in the past and even restricted recruiting employees from each other. The last decade's telecom battles saw Tatas and Ambanis pitched on opposite sides.

This started changing with Tata Trusts and Reliance Foundation collaborating in areas such as highspeed connectivity and cancer care. More recently , Tata bagged the Jamshedpur franchise of Indian Soccer League---a men's professional football league co-managed by RIL.

From The Times of India

See graphic, 'The market share, no. of subscribers, and profit-loss-debt in the Indian telecommunication industry, May 2017'

2018-19: Jio ahead of Voda-Idea

Pankaj Doval, July 27, 2019: The Times of India

Number of subscribers,

Revenues,

Revenue per user.

From: Pankaj Doval, July 27, 2019: The Times of India

Less than three years after making a re-entry into the telecom business, Mukesh Ambani’s Reliance Jio has emerged as the country’s largest mobile operator, edging out Vodafone-Idea from the top position. Jio has made more revenue than Vodafone-Idea in April-June quarter.

Jio had started operations in September 2016 and finished quarter ending June 30, 2019 with a subscriber base of 33.1 crore. Compared to this, Vodafone-Idea had 32 crore users in the same period as it continued to shed low-spending customers as part of a new business strategy. For the new 4G-only telecom entrant — which had moved ahead of Bharti Airtel in March this year — the growth has been swift and profitable, despite its charge being led by dirt-cheap tariffs and free voice calling.

Vodafone-Idea had come into existence a year ago after the merger of Vodafone India and Idea Cellular. It had over 42 crore subscribers then and was hoping to challenge Jio by synergising business operations and spendings. However, the new company seems to be going through tough times. As far as Jio is concerned, Ambani has made it clear that aggressive posturing will continue. He has said that the company plans a high-pitched expansion beyond traditional mobile business and will become a stronger digital player in areas such as financial services, entertainment, commerce, healthcare, agriculture, and education.

“Jio management is focused on giving unmatched digital experience at most affordable price to every citizen, and accordingly expanding the network capacity and coverage to keep pace with demand,” Ambani said.

For Jio’s rivals, going remains tough. Airtel, which has now become the country’s third-biggest operator against its long-held top position, is struggling to get back into profitability. Vodafone-Idea said on Friday that its April-June loss stood at Rs 4,874 crore against a loss of Rs 4,882 crore in Q4 2018-19. “We are delivering on our strategy, although benefits are not yet visible in topline… We are well on track to deliver synergy targets by Q1 of 2020-21,” Balesh Sharma, CEO of Vodafone-Idea, said.

Q1 of FY19 and 20

From: August 16, 2019: The Times of India

' See graphic ‘:

Rel Jio, Voda-Idea and Airtel in Q1 of FY19 and FY20: Number of subscribers

SIM cards

SC: Link SIMs to users' Aadhaar IDs

Dhananjay Mahapatra, Link SIMs to users' Aadhaar IDs: Court, Feb 7, 2017: The Times of India

The Supreme Court directed the Union government to register identity details of all 105 crore mobile phone users by linking their SIM cards to their Aadhaar number.

While giving this direction to the Centre, a bench of Chief Justice J S Khehar and Justice N V Ramana commended advocate Ashok Dhamija for filing the PIL on behalf of NGO `Lokniti Foundation' seeking 100% verification of cell phone subscribers with regard to their identity and address by linking their phone numbers to their Aadhaar cards.

Attorney general Mukul Rohatgi said the Union government was agreeable to the idea. “But the task is gigantic as more than 90% of the 105 crore subscribers are using prepaid SIM cards. These SIM cards get recharged at roadside kiosks, making it difficult to register them,“ he added.

The bench said, “The gov ernment has to devise a method. The person who comes for recharge of the phone should be given a form to give his details including Aadhaar number. He should submit the filled form the next time he goes for recharge. You can give him more time. May be three or four recharges before he furnishes the details. But make it mandatory that he must furnish details or else there would be no recharge of prepaid SIMs.“

The AG said, “Taking coercive measures immediately could be difficult. After demonetisation,cell phones are used for several activities. How long it would take to register each and every cell phone user is difficult to estimate.“ The bench would have none of it and told the AG that the government may take one year to complete the task but it has to do it.When the AG said the government would put in place an effective mechanism to register details of all subscribers, the bench disposed of the petition saying it would be done not later than one year.

Spam calls

2019/ India drops to 5th spot

Sindhu Hariharan, Dec 4, 2019 Times of India

Top spammers in India, 2019

From: Sindhu Hariharan, Dec 4, 2019 Times of India

From: Dec 5, 2019: The Times of India

See graphics:

Top countries affected by spam calls;

Top spammers in India, 2019

Spam calls and texts received in India and comparable countries in 2019.

India may have improved three positions in the list of most spammed countries, but mobile users here still receive almost 26 spam calls every month.

India dropped to the fifth spot in Truecaller’s annual global study of spam calls (from being second last year) but spam calls grew 15% from the previous year. The improvement was due to a relative increase in spam faced by other markets and not by reducing instances of its own spam, Truecaller data showed. Brazil remained the most spammed country for the second year in a row. “It’s good to know that India dropped lower in ranks, but the fact remains that the spam volume is still going up by a large margin,” Truecaller MD Sandeep Patil told TOI. With a monthly active user (MAUs) base of around 140-145 million, India is our largest market globally, he added. Globally, Truecaller has approx 195 million MAUs.

Telecom operators continued to be top spammers for Indian mobile users with 67% calls (90% last year) received for upselling of various offers and reminders.

With the rise of mobile payment systems and a growing middle class and cheap phone calls, 2019 saw more banks and fintechs spam users with marketing calls, holding 10% and 17% shares respectively.

One out of three women in India also received sexual harassment or inappropriate calls and SMS on a regular basis, Truecaller said, as ascertained by user categorisation and survey. Truecaller also looked at global levels of spam SMS this year and found it to be an emerging market phenomenon. India ranked eighth, and users received an average 61 spam SMS every month.

Spectrum access and investment: India and the world

2011, 2015

From: Shweta Punj, MG Arun, July 27, 2015: India Today

See graphic:

The quantum of spectrum available with Indian operators as compared to the rest of the world, 2015; Investment in infrastructure- 2011-15, year-wise

Speed

2017: Access to 4G, speed

See graphic:

Performance of mobile networks according to internet speed, India and the world

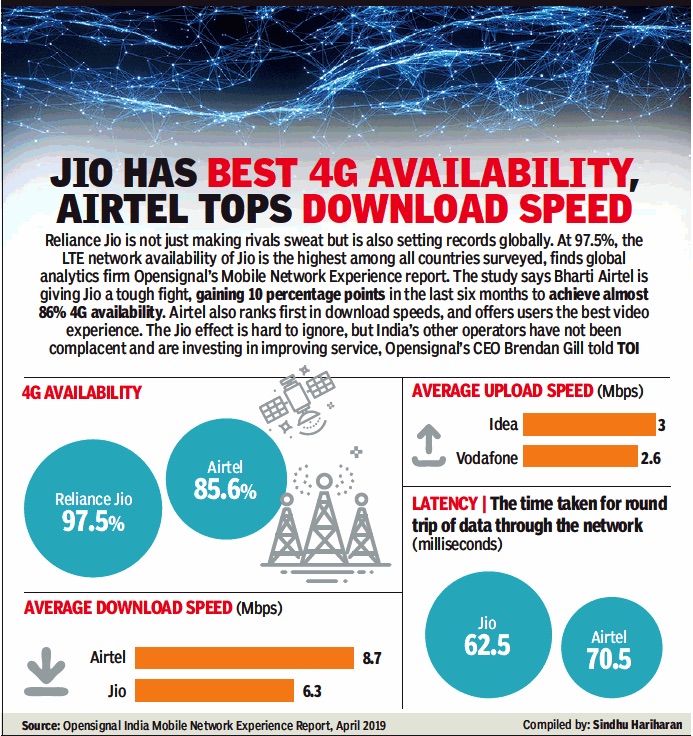

2019: Indian operators’ speed, 4G, latency

From: April 17, 2019: The Times of India

See graphic:

2019: The performance of Indian telecom operators on speed, 4G and latency.

Tariffs

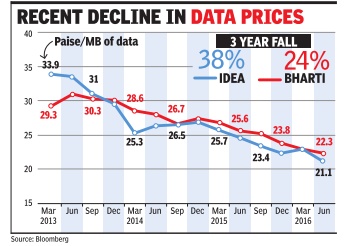

2013-16: decline in data prices

See graphic:

Decline in data prices, between 2013 and 2016

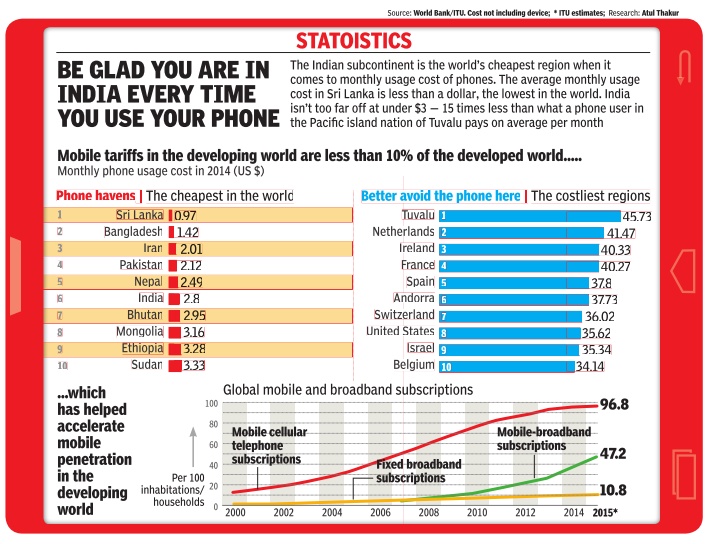

2014, monthly phone usage cost: Bangladesh, Bhutan, India, Pakistan and Sri Lanka

See graphic:

Mobile tariffs and monthly phone usage cost in 2014 in Bangladesh, Bhutan, India, Pakistan and Sri Lanka, compared with other countries

2016, %age of revenue from service: Airtel, Vodafone and Idea

See graphic:

Voice vs data, %age of revenue from service, for Airtel, Vodafone and Idea, August 2016

2018: India has cheapest mobile data in world

Sindhu Hariharan, India’s mobile data is cheapest globally, March 7, 2019: The Times of India

From: Sindhu Hariharan, India’s mobile data is cheapest globally, March 7, 2019: The Times of India

1GB Costs $0.26

Half Of Top 20 Plans In Asia

A large data-hungry base of smartphone users and a fierce price war between the country’s telcos has made India home to the cheapest mobile data price in the world.

One gigabyte (1GB) of data costs $0.26 in India, compared to an average $6.66 in the UK and $12.37 in the US, finds a global analysis of mobile data prices by UK-based price comparison portal Cable. It compared data from 6,313 mobile data plans in 230 countries between October and November 2018 for the study.

For instance, there is a 97% difference in the price of 1GB of data between India and the US, while the gap in the 2018 edition of the Big Mac index (a quirky measure of purchasing power parity between nations using the price of McDonald’s Big Mac burgers) between the two countries is far narrower at 54%.

Asia makes up half of the top 20 cheapest mobile data prices in the world, with the average price of 1GB less than a dollar in Sri Lanka, Mongolia, Myanmar and Bangladesh. On the other hand, Zimbabwe is the most expensive country for mobile data as 1GB there costs $75.2, the survey said.

“A country whose young population has a particularly high technological awareness, India offers a vibrant smartphone market, with strong adoption and many competitors. Data, therefore, is quite staggeringly cheap,” Dan Howdle, consumer telecom analyst at Cable-.co.uk, said.

Without specifying why India ranks first, the study said the cheapest countries either have “excellent mobile and fixed broadband infrastructure”, or have a large user base reliant on mobile data. The large cost differential for mobile internet between India and other countries is primarily driven by a crowded and competitive telecom sector and is not just a factor of purchasing power.

“We can see a significant drop in the price of mobile internet after the entry of Jio as the telco aggressively priced its data on the back of a stronger 4G infrastructure,” Ankit Chhajer, co-founder of tariffs comparison startup Komparify.

As for the trajectory of data tariffs, Rajan S Mathews, DG of Cellular Operators Association of India (COAI), noted that pricing has largely been stable recently, and there may not be any noticeable hikes in the near future.

2022: India 3rd cheapest

From: January 11, 2023: The Times of India

See graphic:

The average cost of one gigabyte of mobile data, presumably in 2022, in India and comparable countries

Towers and the law

SC shuts down tower because man claims it gave him cancer

First In Country To Be Closed On Individual's Plea

A 42-year-old domestic help will go down in history as the man who persuaded the Supreme Court to shut down a mobile phone tower on the ground that its electromagnetic radiation afflicted him with cancer.

Last year, Harish Chand Tiwari, who works at the residence of Prakash Sharma in the Dal Bazar area of Gwalior, moved the SC through advocate Nivedita Sharma, complaining that a BSNL tower illegally installed on a neighbour's rooftop in 2002 had exposed him to harmful radiation 24x7 for the last 14 years.

The order is likely to fur ther fuel the debate over the effects of radiation from mobile phone towers with a section of activists feeling vindicated while the government argues there is no evidence to prove that the waves cause cancer.

Radiation from the BSNL tower, less than 50 metres from the house where he worked, afflicted him with Hodgkin's Lymphoma caused by continuo us and prolonged exposure to radiation, Tiwari complained.

In a recent order, a bench of Justices Ranjan Gogoi and Navin Sinha said, “We direct that the particular mobile tower shall be deactivated by BSNL within seven days from today .“

The tower will be the first to be closed on an individual's petition alleging harmful radiation. The SC, which began he aring the issue relating to radiation from cell towers from March 18 last year, had asked the parties to file additional documents to show that radiation from such towers were harmful to humans and animals. Private petitioners have been predicting disastrous consequences in the future. Activists have alleged that radiation from mushrooming mobile phone towers have caused sparrows, crows and bees to vanish. But the Cellular Operators Association of India and the Union government have vehemently denied the allegations and said such fears were unfounded and that no scientific study had conclusively linked mobile phone tower radiation to cancer or vanishing of sparrows, crows and bees.

The department of telecom (DoT) in its affidavit before the SC in October last year had said that of the over 12 lakh mobile phone towers in the country , it had tested 3.30 lakh towers. It said only 212 towers were found exceeding radiation limits and they were fined Rs 10 lakh. It said so far Rs 10 crore was collect ed from different cellular op erators as penalty .

DoT had relied upon a World Health Organisation (WHO) report as well as over 25,000 articles in the past 30 years to say that there was no confirmation of “any health consequences from exposure to low level electro magnetic fields“.

In 2014, a parliamentary committee had recom mended to the Union government to carry out a scientific study by a reputed govern ment agency on im pact of telecommunication and mobile phone towers and handsets on humans. Private petitioners had alleged that no such study had been un dertaken. But the DoT had informed the court that the Centre had constituted an expert committee to study the possible impact of elec tromagnetic field radiation on living beings.

5G

Launched in 2022

Pankaj Doval, Oct 2, 2022: The Times of India

New Delhi : India took a mega generational leap in mobile telephony as the ball was set rolling for the launch of 5G network with Prime Minister Narendra Modi – who inaugurated the services – promising a leg-up in economic activities and citizen empowerment through the high-speed network that boasts of minimum speeds of at least 100 Mbps.

India now joins a select set of countries that offer 5G telephony and these include the US, Korea, UK, Japan, China, and nations across Europe. While Airtel has launched the service in eight cities, Jio willbegin from Diwali and Vodafone Idea is also gearing up.

Modi, who launched the services at the annual India Mobile Congress (IMC) in the presence of industry leaders such as Reliance Industries chairman Mukesh Ambani, Airtel chief Sunil Mittal and Vodafone Idea promoter Kumar Mangalam Birla, said that 5G – while being transformative for the industry and enterprises – will lead to empowerment of the poor in rural and semi-urban areas through efficiencies in areas such as education and health.

See also

Telecommunications, India: 1