Tea cultivation, industry, trade: India

This is a collection of articles archived for the excellence of their content. |

Contents |

Production

All India

2013, 2014

Feb 21 2015

India's tea production witnessed a slight decline in 2014 when compared to the previous year. In 2014, India produced 1,185 million kg of tea against 1,200 million kg produced in 2013. Tea from the Assam Valley constitutes about 46% of the total tea produced in the country, the highest among India's three major tea producing regions. The Darjeeling and Nilgiris regions produced about 28% and 20% respectively of the total.

Darjeeling

2022, 2023

Uditprasanna Mukherjee, January 8, 2024: The Times of India

Darjeeling tea production falls 9% in 2023 to lowest level in 6 years

Kolkata : Darjeeling tea production is estimated to have declined to 6.1-6.3 million kg in 2023, which industry veterans said could be the lowest “normal year output” in over 50 years. Compared to 6.9 million kg in 2022, production is estimated to at least 9% lower.

Between January and November, production is estimated to have been around 6 million kg, data available with the Calcutta Tea Traders As sociation (CTTA) showed.

“Generally, December is a lean month for tea production. In 2022, it was only 60,000 kg in December. The December 2023 figures are yet to come but it will not make much difference,” CTTA secretary general Kalyan Sundaram said. The output in 2023 is expected to be the lowest since 3.2 million kg in 2017. “But 2017 was not a normal year. There was a strike that affected production,” said Sandip Mukherjee, adviser, Darjeeling Tea Association. What has come as a further blow is a decline in average price realisation during auctions.

Compared to 2022, prices fell 7.6% to Rs 315 a kg — the lowest since 2015, when it was Rs 290 a kg. Industry players, however, said the average realisation may not be the best indicator of how much producers are earning. “Of the total production, just a little over 20% is being auctioned, as most of the Darjeeling tea is sold privately. The total quantity offered in the auction was 1.5 mil lion kg,” said Sundaram.

Mukherjee credited the fall in production in 2023 to multiple factors. “Around 10 gardens in Darjeeling are closed, which could produce a million kg of tea... Due to a shortageof workers, tea plucking is affected,” he added. Rudra Chatterjee, managing director at Luxmi Tea, also blamed climate change for the fall and underlined the need to focus on quality enhancement. In the 1990s, annual production hovered around 11-12 million kg.

Consumption

Per capita consumption India and the world

See graphic.

Auctions

2016: Auctions go online

The Times of India, Jun 20 2016

Sovon Manna 150-year-old tradition bites the dust as auctions for the champagne of chais go online

Since the first public tea auction in India organized by R Thomas and Co at 2, Mission Row in the city's central business district on December 27, 1861, these informal gestures used in bids made for a quirky and fascinating convention called `outcry auction'.

Eight years ago, the auction of all teas except Darjeeling was moved online.But the priciest of Indian teas continued to stick to tradition because it was way too expensive to be bought and sold alongside humbler leaves.

The wooden, semi-oval gallery was always full of stylishly dressed buyers listening keenly to the auctioneer reeling out items from his Darjeeling catalogue. A chorus of humming sounds would then fill the air, trying to draw the auctioneer's attention. The bids and counter bids start pouring in and finally the bang of the hammer would seal it for the winning buyer.

This ritual will now go online. The `auto-bid' quotes can be keyed in for as many as eight lot sales in two minutes (manual auction sold in nearly double the time -2.2 lots per minute with each lot containing an average of 125kg of tea. Even one rupee above the second highest will be the final winning price. It's fair and transparent price discovery, says a top banker at the Bank of India, the official banker to the e-auction.

The industry still thinks that e-auction couldn't handle the huge price variations of Darjeeling in a short timeframe. “Darjeeling tea has so many varieties with so many nuances, specialties, flush dif ference. How will you determine the prices in a second?“ asks Bharat Arya, chairman of J Gokal, world's largest exporter of black tea.

Darjeeling tea has traditionally been sold in Kolkata, owing to the nearby port and the concentration of exporters' offices. “Auction volumes have seen a decline over the past decade, largely owing to producers directly accessing overseas buyers. Notwithstanding this, the vibrancy of the auction room has never been dampened,“ says Krishan Katiyal, chairman and managing director of J Thomas.

The British influence on tea auction was there till the last day , says Arya. “Auctioneers were dressed in suits and ties. Buyers, too, maintained the bidding room decorum by sticking to Western or Indian formal attire. I have never seen people wear chappals in the auction room.“

The auctioneer always knew who wanted which lot, where to prod and poke, who were the natural competitors and so on. “The 8.30am to 6.30pm auction schedule has never been tedious or boring. Some below-the-belt humour, borderline bullying and verbal brickbats set the mood of the day. But it has always been a gentleman's game,“ Arya adds.

Till the 60s, the buyers and traders in the auction room were served drinks in the late afternoon. “Even till the 70s, we used to have lunch at the expense of auctioneers like J Thomas,“ he adds. Pradosh Kumar Sen, the past chairman of J Thomas, recalls a fascinating auction room drama starring himself. “ A powerful buyer once replied to my repeated price pleading with: `Don't beg'. I closed the catalogue and asked him to apologize. He had to say sorry and ironically he got the bid with two rupees more. I knocked the hammer but its head broke off and quite magically flew towards the same buyer and hit him. The whole room burst into laughter.“

Azam Monem, wholetime director at McLeod Russel, the largest producer of tea in the world, hopes that some physical auction will continue to happen, if only for the “very, very costly and exclusive variety“ of designer tea. “It is like auctioning rare paintings or a work of art. Remember, London tea market isn't done with physical auction yet,“ he says.

Environment, impact on

Plantations

August 12, 2023: The Times of India

What is the core of your research?

■ Across all my work on the tea industry, I am animated by very simple questions — what is a plantation? How did it come about? How does it persist? I answer these through ethnography and historiography. A plantation is inherently a construction of capital, power and the aim to convert landscapes into commodity bearing places. I look at the effects of that process on human beings and the environment. For Americans, the plantation has a very particular history — for many, it is part of a bygone era now. In South Asia though, this system of production persists as the primary way an important commodity like tea is produced. Hence, I also study the continuing infrastructure around plantations, from evaluations and auctions of tea to consumer desi res which perpetuate these.

Why is tea so central to your work?

■ I am intrigued by normal, everyday things that exist in our lives. I wanted to know the stories behind tea. That includes the lives of plantation labourers who, in Darjeeling, where I do much of my ethnographic study, consist largely of women. Darjeeling also produces some of the world’s most exclusive and expensive tea but I’ve earlier found some of its workers were among the worst paid in the global industry. I wanted to see how that paradox works.

Why do you refer to tea as a ‘hero crop’?

■ That term comes from corporate actors who are looking at both the future of the tea industry and ways to ameliorate some of the past that caused the plantation to emerge. Tea became a ‘hero crop’ as a means of washing away the plantation’s oppressive history — for this to happen, tea has to have no past. In the ‘hero crop’ discourse, the product can actually become an environmental boon, even though it uses a monocrop system.

What role does monocropping play in the Anthropocene?

■ One key fact to know here is that almost all the black tea we consume is produced on plantations — these were born of colonial control. The plantation and monocropping — or growing only one commodity crop like tea, cotton, sugar or rubber in different locations globally, depending on the ecological context — is directly linked to colonial conquest. Converting natural landscapes, frequently called ‘wild’ in colonial parlance, into spaces of such cultivation and knowability through monocropping came with imperialism. The environmental effects of that process are long-lasting and continually reinvent themselves. The expansion of palm oil now is a new iteration — its ark encompasses colonialism and state control. Discussing tea gardens, why do you write ‘labour is a collective ecological act’?

■ To think about labour as just something humans do overlooks how workers themselves think of this — the ‘collective ecological act’ idea studies how people work on things that work o n them. This looks at the relationality between humans and the environments where they work and how they see their own relationship with these places and plants. In plantations, that encompasses multiple activities and concerns, including what happens if a drought occurs or the monocrop itself starts growing less productive.

Can you tell us about your research on fair trade in tea?

■ In the early 2000s, the label of ‘fair trade’ was affixing itself to more and more products. There was a massive consumer upsurge for this, based also on a general understanding that such workers would make more money than non-certified ones, with consumers willing to pay more.

Fair trade historically has its roots in coffee — but the difference between coffee and tea is that the former is often based on cooperatives. These are not huge monocropping plantations but places where workers own their own land. In contrast, with most tea plantations, owners have to lease land from the state and workers have no rights to this. Yet, there is this expectation that goods like tea or chocolate should be fair trade as well. But how deep do these ideas of equity go beyond a label? Does this extend, for instance, to tea workers getting better wages or less pesticide-laden work conditions? I research this too.

Recently, the Anthropocene — the era of vast human impacts on Earth — has been dated as starting in 1950. How do you analyse this?

■ People can choose any applicable geological date but in my view, the Anthropocene starts much earlier — it’s actually pre-Industrial Revolution and lies in the massive scale of environment al change wrought by colonial control on Earth. These huge ecological changes have legacies which cannot be rolled back. The concept of the Anthropocene should highlight the impacts humans have had on social systems, environments and ecologies which are practically impossible to overturn — the plantation is one such change. The impossibility of taking back all the changes such a production system made — think about the histories of plantation slavery, for instance — is very important to consider when we discuss the Anthropocene.

The Nilgiris

2018, 19: poor monsoon affects production

Aparna Desikan, July 6, 2019: The Times of India

From: Aparna Desikan, July 6, 2019: The Times of India

From: Aparna Desikan, July 6, 2019: The Times of India

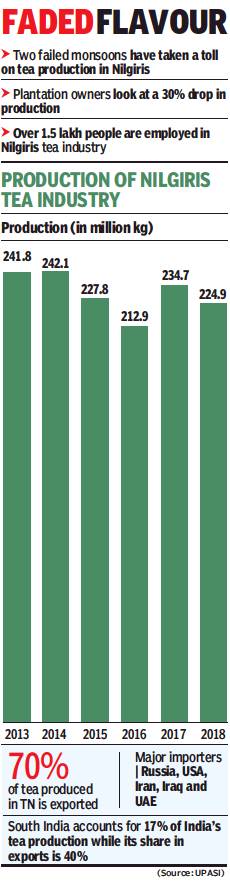

If you are a tea connoisseur and indulge in the Nilgiris cuppa in the mornings, you may notice that it is lacking its usual punch. Owing to a poor monsoon in 2018 and a delayed monsoon this year, the Ooty and Coonoor, Nilgiris tea plantation owners are staring at an irreparable drop in quality and quantity of tea production this year.

Data collected by the United Planters Association of South India (UPASI) shows a 12.2% drop of 7.4 million kilograms in January-April compared to the same period in 2018. The month of May saw a drop of 3.5 million kg (30%) of tea compared to last year. The highest fall was recorded in the first three months of the year, which saw a 10%-30% drop in production owing to a deficient northeast monsoon.

“We lost out on the peak season from April-June and recovering from such a dip in production is difficult. This is the second consecutive year where the production levels have gone down,” said Sanjith R, head, commodities, UPASI.

Vinod Jayachandran, a plantation owner from Coonoor who supplies to Homedale estates, adds the monsoon failure this year, led to more than a 40% year-on-year drop in cultivation. “Last year, the rainfall was not as deficient. This year, it is sunny and dry, besides, labour costs are high. It is becoming difficult to ensure a good business,” he added.

The plantations took a beating in production last year too. 2018 saw a production of 224.9 million kg, almost a 10 million kg drop from 2017. Nair predicted a similar trend this year. “There was a revival in 2017 after a fall in production in 2015, but things started going downhill again,” he said.

And it’s not just quantity, poor and untimely rain affected quality as well. Having lost out on rain at the optimum crop yielding time – April to June – the crops are not of the best quality, say experts. Also, if it rains during harvest time workers will not be able to venture out, which further leads to a drop in quality. South India accounts for roughly 17% of Indian tea production while its share in exports is nearly 40%. Manufacturers are apprehensive that the quality will affect prices. Chenkesh H, a plantation owner of High Hill Teas, Kotagiri said the demand from factories is 10% lower than last year because of poor quality. “In recent auctions, the prices were down and may drop further. A part of it can be attributed to low quality and the remaining because of the India-Iran tensions. Iran is one of the major exporters of orthodox tea,” said Senthil Gundan, an estate owner.

Weekly auction prices also fell from April to June (week ending June 22) by ₹9 on an average. According to data from the Tea Board of India, while the price in Coonoor fell from ₹98.62 to ₹90.68, Coimbatore saw a drop from ₹108 to ₹98 and Cochin saw a fall from ₹122 to ₹113. Another blow to the quality of tea is the shutdown of factories in the Nilgiris belt because of adulteration. In the past six months, two factories were shut down. In December, an unlicensed factory was sealed in Gudalur (one of the prominent tea cultivating areas) and consignments were seized in March and May as they contained adulterants. A small-time tea farmer who did not want to be named added that such adulteration might hamper their reputation and trade.

With a two-year drop in production, plantation owners are staring at a 30% drop in turnover. UPASI’s Sanjith adds that while the impact is seasonal, the effect would be higher on the planters but there should not be a long-term change in the job demand or exports. “This year, from January to April, exports were marginally higher than last year. However, we can manage to meet the demand,” he added.

2018

Rs40,000 for Golden Needles of Arunachal

Prabin Kalita, Arunachal bursts onto world tea map August 24, 2018: The Times of India

Produce Goes For Record ₹40,000/Kg

The Guwahati Tea Auction Centre (GTAC), for the second time in less than a month, fetched a world record price — Rs 40,000 — for 1kg of Golden Needles tea variety produced by the Donyi Polo Tea Estate in Arunachal Pradesh.

On July 24, the auction centre fetched a price of Rs 39,001 for 1kg of specialty boutique quality orthodox tea from the Manohari Tea Estate in Assam’s Dibrugarh district.

“On Thursday, the GTAC broke its own world auction record when Golden Needles of the Donyi Polo Tea Estate was sold at Rs 40000 per kg through pan India auction (Sale No.

34) by Contemporary Tea Brokers,” sources said.

The tea was sold to Assam Tea Traders, which is one of the oldest tea shops in Guwahati. The owner of Assam Tea Traders, Lalit Kumar Jalan, said, “There is a rising demand for good tea and we are selling specialty tea regularly. This Golden Needles will be sold through Absolutetea.in, an online platform.” The Golden Needles tea is made with only newly sprouted tips. The Yunnan province in China, which is just across Arunachal border in its east, is known as the cradle of ‘gold tip teas’. This variety of tea has small buds which are carefully plucked and the leaves, which have a golden coating, are soft and velvety. The liquor of this special tea is sweet to taste and also has a rich aroma.

“It took lot of effort to make this type of tea. Earlier, the Silver Needles white tea had fetched Rs 17,001 per kg. Such type of teas can be made only when natural forces align with precise tea-making skills,” Donyi Polo Tea Estate manager Manoj Kumar said. Specialty teas are encouraging more and more buyers and producers to come together, GTAC secretary Dinesh Bihani said. “We hope that these specialty teas will make us achieve our past glory on the world map. We are thankful to those producers who make great efforts to make such fine quality tea and also buyers who are buying and selling them to tea lovers,” he added.

Donyi Polo estate’s Pekoe White, another variety of tea developed in China, is made from the youngest and most tender handpicked leaf tips and buds that give a silver colour brew. This variety was sold for Rs 12,001 per kg at the GTAC in 2017.

2024 ELEVATING BRANDING, QUALITY

Shantha Thiagarajan, April 21, 2024: The Times of India

He completed his engineering and even took on a job in information technology. But C Vignesh knew his real passion didn’t lie inside a code but at the bottom of a cup. Which is why a few years into his job, the 35-year-old from the village of Kasolai quit to follow his dream of becoming a tea maker. “I never felt tech was my calling,” he says. “I kept returning to my childhood fascination for tea making.”

Luckily for him, the industry too was on the lookout for entrepreneurs who could be trained in the art and craft of tea-making.

With conventional training centres such as ITI lacking certified programmes related to tea making — a trade integral to the economy of the Nilgiris — Indcoserve, the apex body of 16 industrial cooperative (Indco) tea factories in the Nilgiris, took up the task of skilling 40 people every year for three years. “It’s part of central govt programme ‘Skills Strengthening for Industrial Value Enhancement’ (STRIVE),” says Supriya Sahu, CEO of Indcoserve and additional chief secretary, environment, climate change, and forest department. “The Nilgiris tea industry is faced with several challenges from limited public awareness about tea, shortage of manpower and logistical resources, to lack of coordination between departments.”

Indcoserve is the only tea industry cluster in the country to be selected for the three-year central programme funded by World Bank and has plans to introduce 120 certified skilled people in the field of tea trade in three years. “We’ve developed a syllabus involving experts and formed a certificate course which has been approved by the Agriculture Skill Council of India,” says Sahu. Two courses – ‘tea maker’ and ‘tea factory assistant’ – were prepared by Indcoserve. “The first batch of 40 has been undergoing training for the past six months.”

Sahu says the trainees are from diverse backgrounds and age groups, the youngest being a 19-year-old college student. Computer science graduate R Jagadish, a resident of Kalinganatti village, says he signed up as he always wanted to own a tea manufacturing factory. “There was no technical course to gain the ‘know-how’ of tea making and that’s what stopped me from taking that first step. When I learnt there is a govt-backed course, I immediately applied.”

Jagadish is planning to set up a micro tea factory as he owns nine acres of a “chemical-free tea garden”. “The course involves fieldwork, manufacturing techniques from choosing leaves, so you learn everything from scratch. For example, I have learnt that if you want quality in a mini factory, large quantities will not work. But quality tea, even of a small quantity, fetches a good price. It’s all in the processing.”

The trainee tea makers and assistants are also exposed to the marketing of tea through auction centres and retail sale markets. The syllabus of the certified one-year courses in both options also includes techniques of tea testing and tasting. Union ministry of skill development and entrepreneurship has sanctioned ₹1 crore for the project and offers trainees a stipend according to their educational qualification with a maximum of ₹9,000 per month. Candidates also get bus fare and insurance cover during the course period. K Amuthan who worked 10 years in hospitality returned to his hometown Gudalur in the Nilgiris to pursue something related to the sector. “I never imagined I would become a tea maker. The theory classes, field experience and practical training at the factories are helpful in gaining complete knowledge about the process,” he says. “All the students are sent to Indco factories in the district for practical and theory classes. Experts in the tea industry are engaged in teaching the trainees,” says Shankar Narayanan, general manager of Indcoserve. “There is a dearth of skilled young manpower in the tea sector. Indco tea factories will have good technical resources. This is going to be a game-changer when it comes to processing and quality of Nilgiris tea,” says Sahu. For Vignesh, it has been six months since he joined the programme. “My first fascination was with the aroma you get when you cross a tea factory. Now I understand the reason for the aroma is the weathering of green leaf tea at a perfect temperature.”

Like weathering, Vignesh has learned many other techniques of tea making, including the right utilisation of electricity, during the training period. His technical knowledge as an engineer helps him too, for instance, the concept of data structure in tea processing.

Asked what difference he would make in the industry, Vignesh says, “As every trainer says, good leaves make good tea, good tea fetches a better price and good standards pave the way for goodwill. Hence, I would follow this to pay a good rate to the farmers to make their lives better.”

Prices fetched

2018: ₹700/ kilo for Halmari estate’s CTC

Sovon Manna, April 26, 2018: The Times of India

Assam’s Halmari estate created a world record on Tuesday by fetching Rs 700 a kilo for its CTC tea in the pan-India e-auction. The last global-best price for CTC tea was fetched by a second flush variety from the same garden at Rs 600 per kg on July 14, 2016.

On April 22, 2018; Sale No. 17, auctioned by Kolkata-based J Thomas & Co, renowned south Kolkata retailer Mahabodhi Tea House bought 307.8 kg of first flush Halmari Broken Orange Pekoe (BOP) at Rs 700 per kg. Industry experts believe this variety can command a price of Rs 1,000-Rs 1,200 per kilo in the retail market.

2018: Manohari tea estate, Dibrugarh gets Rs 39,001 per kg

Prabin Kalita, At ₹39,000/kg, Assam tea price hits record high, July 25, 2018: The Times of India

Tea auction in the state reached a new high when a brew from the Manohari tea estate in Dibrugarh district fetched Rs 39,001 per kg. It was a world record for the special boutique quality orthodox tea under the pan-India auction system, the Guwahati Tea Auction Centre said.

“This is the highest price any tea has fetched in any auction centre around the world. This will encourage other quality tea makers. Our centre has emerged as a hub for speciality tea,” said secretary of Guwahati Tea Auction Buyers Association, Dinesh Bihani. The record was made when a line of Manohari Gold Tea fetched the record price and was bought by Contemporary Brokers, which sold it to Saurabh Tea Traders of Guwahati for their upcountry buyers in Delhi and Ahmedabad.

Revenues generated

2020: China, India, Brazil, UK

From: June 2, 2021: The Times of India

See graphic:

2020: Revenues generated from tea in China, India, Brazil, UK

Sales (within India)

From: Namrata Singh & Reeba Zachariah, After 8 years, HUL brew beats Tata Tea, April 9, 2018: The Times of India

Regains Value Leadership, But Tatas Ahead In Volumes

In an interesting tussle for a higher share of the cuppa, Hindustan Unilever (HUL) has regained value leadership in tea from Tata Global Beverages after eight long years. Tata Global, however, continues to lead the market in volumes.

In 2017, HUL’s share in tea inched up to 21.2% from 20% in 2016, while Tata Global’s share slipped to 21% from 21.4% in the same period, said industry sources quoting Nielsen data. In the three months ended January 2018, HUL had a higher share of a little over 21% as compared to Tata Global’s 20.6% share. In volumes, however, Tata Global’s all-India share of about 20% is ahead of HUL’s 17% (see graphic). Value is based on sales while volume is the total quantum sold.

When contacted, an HUL spokesperson said, “Our tea business continues to deliver double-digit growth and we gained market leadership in this category at the end of last year.”

A multi-pronged strategy appears to have worked for HUL in clawing back value leadership in tea. While premium brand Brooke Bond Taj Mahal continues to promote Indian classical music, HUL’s flagship brand Brooke Bond Red Label has been on an inclusiveness drive. It has conducted bold social experiments and sponsored India’s first transgender music band.

Apart from the consumer engagement and communication strategy by its brands, its ‘Winning in Many Indias’ framework has been effectively leveraged in the tea category by executing national equities locally. “As such, the product mix of our national brands is customised to meet local tastes,” said the HUL spokesperson.

A Tata Global spokesperson maintained that the company retains a clear volume leadership at the all-India level “by a significant margin”. “In terms of value market share too, we are very close to HUL. Tata Global is the leader in volume market share as well as value in north & east zones — two of the biggest tea-consuming zones — despite aggressive price cuts by HUL. In west zone, Tata Global is at a similar level to HUL in both volume and value market share,” said the spokesperson.

Tata Global is also promoting the premium end of the market through new launches like Teaveda and accelerating growth in the green tea portfolio. In addition, it wants to build an innovation pipeline as well as invest in core brands across the tea portfolio.

Exports

2020

Sovon Manna, March 5, 2021: The Times of India

India, the world’s second largest tea producer, saw tea exports fall by about 18% or 44 million kg (mkg) to 208mkg in 2020 compared to 252mkg in the previous year, according to industry sources. However, Kenya, the country’s toughest competitor in tea exports, saw its exports increase by 22mkg to 519mkg in 2020.

The global tea export market too shrunk by 76mkg to1,824mkg in the pandemic-hit year . According to the latest available data, in 2020, India lost 21mkg business in Iran, one of its top destinations, and 9mkg in Russia, while it gained marginally in Poland, Afghanistan and Saudi Arabia. Meanwhile, Kenya gained from India’s loss and captured 85% of the Pakistan market.

Experts said the primary reason behind India’s shortfall in tea exports was the strict lockdown, which led to skiffing of overgrown leaves across tea estates. “It resulted in an average year-on-year crop loss of 10%, which affected exports of tea,” said Atul Asthana, MD and CEO, Goodricke Group.

Types of tea

White tea

Efforts in Idukki

Giji K.Raman, White tea enthusiasts can breathe easy, June 8, 2017: The Hindu

White tea made of silver needle; silver needle, the naturally dried bud plucked from tea plant; single bud being plucked from tea plants at Valakode, near Upputhara, in Idukki district.

Idukki farmer is making efforts to make it available in the country

A small-scale farmer in a remote hill area in Kerala is attempting to break the monopoly of China in white tea market.

White tea enthusiasts in India can breathe easy, as Mohan K. Sebastian has joined hands with a government-sponsored unit at Parappu here to make the tea available in the country.

White tea is made from silver needle (unfurled bud) and is considered the most virgin and pure tea the world over.

In his organic tea garden, Mr. Sebastian takes care to pick the unfurled buds by hand to make white tea. To make white tea, plants are given special care and no pesticide is used. Buds are hand-plucked and dried using net to avoid direct sunlight.

“Now, there are various grades accorded to factory-made green tea. However, there is no sub-grading for white tea as it is the ultimate in teas,” Mr. Sebastian says.

‘One leaf and bud’ norm for plucking is followed for green tea, which is second in status in the industry. White tea is the king of teas. Its processing is so sublime that the juice in the silver needle is kept in itself while drying in the minimum natural temperature without pressure.

White tea was once considered royal and brewed for consumption of kings and their guests.

“In India, it is confined to celebrities and for royal guests on occasions,” says Mr. Sebastian, whose farm is at Valakode, a suburban area of tea estates. The United Planters’ Association of Southern India had grown plants for silver needle on an experimental basis at Coonoor and Darjeeling. However, a steady market is essential for commercial cultivation.

White tea was first produced in the Fuding area of Fujian province in China and its exports began in 1890. “One year - tea, two year - medicine, seven year - treasure,” a Chinese saying on white tea goes.

As the tea ages, the percentage of flavonoid will increase. It is the flavonoid that lends quality and flavour to the tea. It is considered an anti-oxidant and can clear oxygen-free radicals in body. It prevents cells from deterioration and ageing.