Singhania, business family

This is a collection of articles archived for the excellence of their content. |

Contents |

Property dispute

SC bench meets on Sunday, upholds arbitration award

A property dispute between family members of a big business house got an extraordinary hearing in the Supreme Court on Sunday , which under CJI J S Khehar has time and again refused early hearing to pensioners and other property litigants.

Holdign that litigative character of corporate houses run like “wild tiger“ which should be tamed soon, Justices Misra and A M Khanwilkar held a special Sunday bench to adjudicate a dispute in the Singhania group and directed Raymond owner Vijaypat Singhania and his son Gautam to hand over their luxury Juhu bungalow to the family's Kolkata branch, as per a 2008 arbitration award. Three Singhania family oups Mumbai, Kolkata groups Mumbai, Kolkata and Kanpur have been locked in prolonged litigation over shares in ancest ral property despite the arbitration award splitting it three-ways. As per the award, the Kan pur group was to hand over possession of four properties to Vijaypat-led Mumbai group, which in turn was to hand over the Juhu bungalow to the Kolkata group.

But Vijaypat refused to part with the bungalow saying he had not got his share of property from the Kanpur group.

The court passed an interim order directing the Kolkata group to deposit Rs 20 crore with the SC registry and asked the Mumbai group to hand over the Juhu bungalow, worth Rs 90 crore, to the Kolkata group by May 6. The bench passed the order on an appeal filed by Gautam Singhania, challenging a Bombay high court order directing him to vacate the bungalow.

Counsel for the Kolkata group, said their client was only interested in taking over the Juhu property and argued that the Mumbai group could not simply refuse to give it.

They said the Kolkata group had already deposited Rs 46 crore as per the settlement, hence there was no justification in it being denied possession of the Juhu bungalow.

The court also issued notice to the Kanpur group and posted the case for hearing on May 8. It directed transfer of execution proceedings pending before the court of district judge in Kanpur to itself.

Raymond

2018: Vijaypat Singhania sacked as chairman-emeritus

Singhania Sr out of Raymond, October 18, 2018: The Times of India

Board Sacks Vijaypat As Chairman-Emeritus

Vijaypat Singhania, the man who spearheaded textiles major Raymond and who has been in a bitter feud with his son Gautam, was sacked from the company as its chairman-emeritus.

Singhania was removed from the board of the company under section 167 of the Companies Act.

The section deals with disqualification or vacation of a director of a company for being absent from “all the meetings of the board of directors held during a period of 12 months with or without seeking leave of absence of the board”. He was removed on January 24.

Raymond insiders said Singhania senior was sent notices for board meetings, but he did not attend any of them. He was removed from the directorship only after giving him a notice and following the due process of the law.

The feud: 2007-2018

Vijaypat Singhania thought he was keeping his billion-dollar textile empire in the family when he gifted control of the Raymond Group to his son Gautam three years ago.

But their relationship has disintegrated spectacularly since, with the father accusing the son of cheating him out of a exclusive apartment and of unceremoniously kicking him out of the company offices.

Vijaypat now bitterly regrets his decision, which he claims was made because of "emotional blackmail", marking the latest in a long long line of high-profile family feuds to scar corporate India.

The 80-year-old transformed a small textile business into a household name in India, and the Raymond Group today claims to be the world's biggest producer of high-quality worsted wool suits.

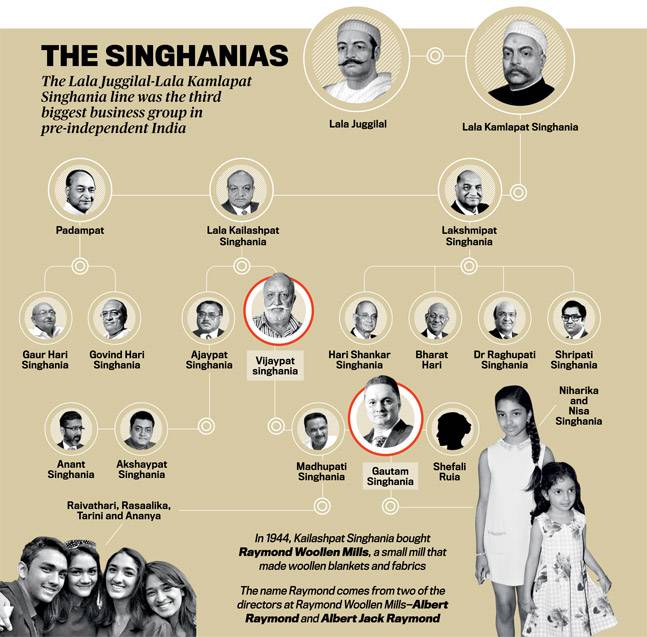

It is yet another success story for one of South Asia's great entrepreneurial families -- different branches of the Singhania family have interests in cement, dairy and tech.

India ranks third in the world for the number of family owned conglomerates, behind China and the United States, according to a recent Credit Suisse report.

And with more than its fair share of power struggles and a new generation itching to take control, some analysts say the country needs more global corporate standards to better govern such businesses.

It may help avoid the kind of sparring that happened in the Ambani family.

Mukesh Ambani, currently Asia's richest man, fought with his brother Anil for years over the Reliance conglomerate after their father Dhirubhai died without leaving a will.

Hostilities were far more intense between liquor and property baron Ponty Chadha and his brother Hardeep, who killed each other in a 2012 shootout as they fought over their company.

And assault accusations have flown between billionaires Shivinder and Malvinder Singh as they battle for the family pharmaceutical empire.

Vijaypat Singhania's troubles started after he handed over his 37-per cent controlling stake in 2015.

Under a 2007 agreement to settle a separate family tussle, Vijaypat says he was supposed to receive an apartment in the Singhania family's 36-storey JK House in the upmarket Malabar Hill area of Mumbai, India's financial capital.

The price agreed was far below the market value of the flat -- which is in the tens of millions of dollars -- and Gautam advised the Raymond board against selling a valuable company asset.

As the feud escalated, the board also took away Vijaypat's "chairman emeritus" title, accusing him of using abusive language in letters to the company. And he claims he was physically removed from his office and his possessions -- including a Padma Bhushan, one of the country's top civilian honours -- were stolen.

Vijaypat, who says he has not spoken to his son in two years, now plans to test a recent court ruling that allows parents to take back gifted property from their children under a 2007 law if they do not have their basic needs met.

He describes handing Raymond over to Gautam as "the height of stupidity", and the start of a campaign to oust him from the 93-year-old business he once helmed.

"I would advise parents everywhere not to make the mistake of giving away all your savings to your children during your lifetime," said the elder Singhania, an accomplished aviator who in 2005 set the world record for the highest flight in a hot air balloon.

But Gautam has said he was simply doing his job.

"It was the right thing to do. My responsibility as a son is different from as chairman of Raymond. Here is a board member (Vijaypat) who is using his position of the board to take company assets," Gautam told the Economic Times last year.

"I am the victim. What have I done wrong?"

Raymond Group has apparently not suffered from the dispute. It reported a 50-percent profit rise for the second quarter of 2018, recently opened a major factory in Ethiopia, and is now exporting to more than 55 countries.

India's corporate family quarrels need to be addressed, according to Pranav Sayta, a partner at the Ernst and Young consultants.

"The business environment today is far more complex and the stakes are much higher," he said.

"Culturally too, youngsters today are more impatient and they want to have a say in the business affairs. Some global best practices have not been implemented fully in India," particularly on separating ownership from management, he added.

And as was the case with the Ambanis and the Chadhas, succession and family politics are often at the core of these bitter disputes.

"Family feuds were always there but in light of these factors their probability has gone up several notches now," said Sayta. "The need to adopt best practices and put in place a clear and robust succession plan is more critical today."

A new style of management made all the difference at Raymond, Gautam Singhania claims.

"The whole game for me changed when I took shareholding control from my father," he told the Economic Times.

"I could take a lot of decisions to enhance growth which I was not able to do earlier."

2018: Gautam Singhania resigns as Raymond Apparel chairman

November 14, 2018: The Times of India

Gautam Hari Singhania has resigned as Raymond Apparel chairman to demonstrate "the spirit of good governance" and ensure that the business is "run professionally", the company said in a statement to the exchanges. However, Singhania continues to be on the board of Raymond Apparel.

The company has appointed Nirvik Singh as the non-executive chairman and Anshu Sarin has non-executive director along with Gautam Trivedi, who has joined as an independent director.

Commenting on the new appointments, Singhania said; "I have always believed in setting the highest standard of governance and have always advocated to run the business professionally. I am delighted that Nirvik Singh has been appointed as the non-executive chairman of Raymond Apparel Limited and I am sure that the company will benefit tremendously under his able leadership. I also welcome Anshu Sarin and Gautam Trivedi as new board members of Raymond Apparel Limited."

Offerings of Raymond Apparel include Park Avenue, Color Plus, Parx and Raymond Ready to Wear.

Nirvik has 27 years of experience in marketing and communications and is currently the chairman and CEO, Asia Pacific, Middle East, and Africa of Grey Group Asia Pacific. He started his career with Lipton India, a Unilever company and became the head of Grey Group India at the age of 33.

He joined the board of Raymond Apparel in July 2011 and has since remained as an independent director on the board.

Anshu is the chief executive officer of Berggruen Hotels and plays a central role in growing and expanding the Keys Hotels business across India. A Hotel Management graduate from IHM Pusa, she holds an EMBA degree from SP Jain Institute. She has previously worked with the Taj Group of Hotels and Kingfisher Airlines, in a career spanning nearly two decades.

Gautam is the co-founder and managing partner of Nepean Capital. He has over 26 years of experience in the Indian and Asian financial industry. He was the CEO of Religare Capital Markets, one of India's leading mid and small cap focused investment banks.