Shapoorji Pallonji

This is a collection of articles archived for the excellence of their content. |

Contents |

YEAR-WISE DEVELOPMENTS

Pallonji Shapoorji Mistry, 1929-2022

Reeba Zachariah, June 29, 2022: The Times of India

From: Reeba Zachariah, June 29, 2022: The Times of India

From: June 29, 2022: The Times of India

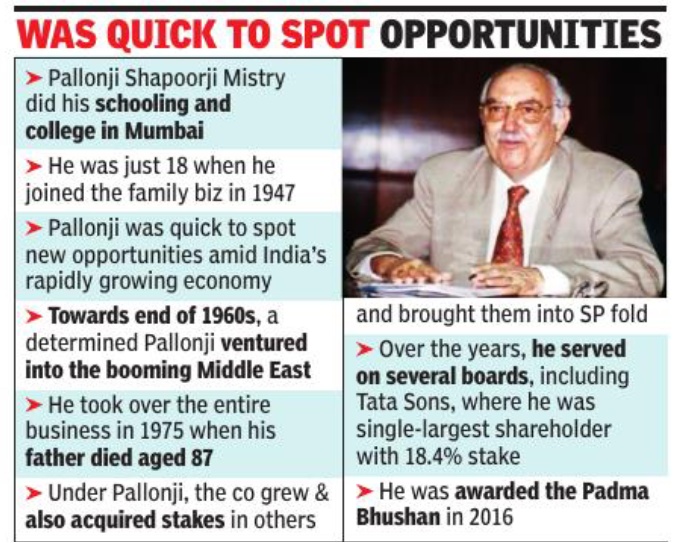

Mumbai: Pallonji Shapoorji Mistry, the India-born Irish business tycoon was the country’s oldest . Pallonji, the chairman of Shapoorji Pallonji (SP) Group which runs a sprawling construction business dating back over 150 years, was also the single-largest shareholder (18. 4%) of Tata Sons, the main investment entity of the $103-billion Tata Group. A low-profile philanthropist, he was awarded the coveted Padma Bhushan award in 2016 for contributions to Indian industry. He is survived by his wife Patsy, daughters Laila Rustom Jehangir & Aloo Noel Tata, sons Shapoor Mistry & Cyrus Mistry, and their families. Established in 1865, SP is known for iconic constructions like the Reserve Bank of India in Mumbai, the Presidential office in Ghana and the Palace of HM Sultan Qaboos bin Said al Said in Muscat. In fact, when the Muscat palace was opened for visitors in 1975, it was a significant stepping stone for both SP and India. SP not only became the first Indian construction company to have completed a project abroad, but it also opened doors for other Indian construction players. The Muscat palace provided a launching pad for SP to consolidate its presence in the Middle East and foray into Africa, where it execu- ted landmark projects such as the National Assembly of Gambia and the Ebene IT Park in Mauritius.

“Pallonji Mistry inherited a fortune from his father, which he multiplied manifold. He took SP beyond the shores of India to the Middle East, especially Muscat in Oman. He will be remembered as the man who not only built half of Bombay but also most of Muscat, including the Sultan’s palace,” said eminent lawyer and father-in-law of Cyrus Mistry, Iqbal Chagla.

Pallonji, born on June 1, 1929, completed his schooling and college education in Bombay (as it was then called) before joining the family business in 1947 at the age of 18, under the supervision of his father, Shapoorji Pallonji Mistry. He took over the reins of SP in 1975, after his father passed away. Pallonji expanded his empire by acquiring strategic stakes in other companies such as Sterling & Wilson, United Motors, Forbes Gokak and Afcons Infrast- ructure. He also served on the boards of Union Bank of India, W H Brady, The Associated Cement Companies (ACC), of which he was also chairman for several years, and Tata Sons. Pallonji was known as the ‘phantom of Bombay House’ for his inconspicuous but powerful presence at the Tata Group headquarters. He guarded his privacy zealously and was reluctant to give media interviews. A deeply religious and family man, friends and kin described Pallonji to be gracious, humble and charitable. Prominent cardiologist Dr Farokh E Udwadia, who knew Pallonji for 50 years as a friend and patient, said his demeanour was always self-effacing and gracious.

In 2006, along with his wife, Pallonji funded and set up a home for senior citizens of The B D Petit Parsee General Hospital, Mumbai. Pallonji gave up his Indian nationality and became an Irish citizen in 2003 through his long marriage to his Dublin-born wife.

Credit rating

2019, Nov: downgraded over debt

Nov 29, 2019: The Times of India

Shapoorji Pallonji and Company (SPCPL), part of the group which holds 18.4% in Tata Sons, has been downgraded by rating agency ICRA because of delay in reducing debt through equity infusion and asset sales. ICRA said that it has downgraded Rs 15,000 crore of nonfund-based limits and Rs 6,000 crore of fund-based limits to A+ from AA-. It has also lowered its rating on Rs 2,500 crore of commercial paper to A1 from A1+.

“The promoters have infused a total of Rs 2,270 crore in SPCPL during H1FY20, including Rs 1,900 crore from the proceeds of the Sterling & Wilson Solar (SWSL) initial public offering (IPO). However, contrary to ICRA expectations, the net debt levels have not come down because the same has been deployed to meet the funding requirements of several group companies, especially in the real estate business,” ICRA said.

SPCL has seen an increase in standalone debt on account of elongation in the working capital cycle given slow realisation of receivables and high inventory levels, especially for EPC projects from Andhra Pradesh government. “While the maturity profile of the debt has improved, with a significant reduction in short-term debt including commercial papers, it still remains exposed to high refinancing risk,” ICRA said.

Recently, SWSL promoters SPCPL and Khurshed Yazdi Daruvala sought from lenders a revised repayment schedule of the inter-corporate deposits (ICDs) due from their jointly held entities to SWSL. As part of the commitments made by the promoters during the IPO of SWSL, a portion of the net offer proceeds from the IPO were to be utilised for repayment of these ICDs.