Rubber: India

This is a collection of articles archived for the excellence of their content. |

Contents |

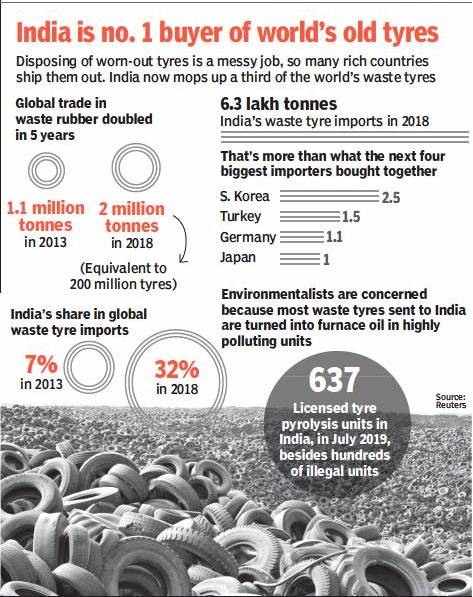

Imports

Waste rubber

2018

Oct 27, 2019: The Times of India

From: Oct 27, 2019: The Times of India

4.2 million sheep slaughtered in Europe between the years 1150 and 1850 to make parchment for writing. In a way, the widespread use of paper has spared the lives of many millions of calves, goats and sheep.

Rubber sector in India

2016, June: Rubber sector in for new crisis in Kerala

The Hindu, June 27, 2016

T. Nandakumar

Centre lowers import tariff for a slew of rubber products under trade pact with Malaysia

The rubber economy in Kerala is heading for a new crisis, with the Centre slashing the import tariff for a slew of rubber products.

In a notification issued on June 21, 2016, the Central Board of Excise and Customs had provided deeper tariff concessions for goods imported under the India-Malaysia Comprehensive Economic Cooperation Agreement (IMCECA). Official sources said the revised tariff would lead to a spree of imports, flooding the market with cheap goods from Malaysia.

According to the notification, the import tariff for new and retreaded tyres for cars, buses, and lorries will be brought down to five per cent from June 30, while that for aircraft tyres and agricultural and construction machinery has been done away with.

The other zero tariff items listed in the notification include sheath contraceptives, surgical gloves, floor coverings, erasers, hard rubber products, synthetic rubber of various types, waste and scrap rubber, camel back strips for retreading rubber, tubes, pipes and hoses, and conveyor belts.

Industry observers said the tariff reduction would have serious repercussions for a State like Kerala. “It has the potential to cripple the domestic rubber industry and push rubber farmers into a deeper crisis” said an official.

Greater risk

“The tariff cut represents a danger signal for Kerala,” said K.N. Harilal, Professor, Centre for Development Studies. “It is clear that the ASEAN Free Trade Area (AFTA) was only the tip of the iceberg. By signing free trade agreements with individual countries, we have exposed ourselves to greater risk.”

He said the latest tariff cut would trigger stronger demands from Indian manufacturers for a level playing field, by allowing the import of natural rubber at zero tariff.

K. Krishnankutty, MLA, who had chaired the expert committee for the preparation of Kerala’s agricultural policy, said the situation highlighted the failure of successive governments to check the import of cash crops such as rubber and coconut.

“Kerala can cite livelihood issues to get rubber listed as a sensitive item, failing which the State will be left to grapple with a series of crises triggered by FTAs,” he said.

2022: the crisis continues

U. Hiran, Sep 10, 2022: The Hindu

Growers allege official apathy in checking the slide

The wide belt of rubber plantations that has taken over the tropical hills of the State are now giving nightmares to growers.

With the price of natural rubber in a free fall, about 12 lakh small-scale rubber farmers in Kerala, the country’s rubber heartland, are counting their losses since the last couple of months. With the impact of the falling prices beginning to reflect in their daily lives as well as the local economy, the growers are up in arms against the authorities for their perceived delay in checking the slide.

The price of latex has fallen below ₹120 while that of rubber sheets to ₹150 from ₹180 just ahead of the Ukraine-Russia war. Compounding their fears, reports of a recession afflicting large parts of Europe too have begun to emerge.

“The falling prices have come as a double whammy to the sector, plagued by an unprecedented rise in input costs. About 60% of the rubber plantations in the State are due for replanting and if no action is coming forth at this point, this will only exacerbate the situation,” says Babu Joseph, General Secretary, National Consortium of Regional Federations of Rubber Producer Societies India.

Among the key demands of the farmers include raising the import duties for latex and compound rubber. They are also demanding raising the replanting subsidy in Kerala, which remains at ₹25,000 per ha, and the support price of the crop under the price stabilisation scheme to ₹200 from ₹170.

In central Travancore, where political discourses are inextricably linked to fortunes of the plantation sector, the matter has assumed new proportions with the leading yet warring factions of the Kerala Congress jumping in. While Jose K. Mani, chairman of the Kerala Congress (M) has urged the State government to hike the support price to ₹200, P.C. Thomas, working chairman of the Kerala Congress, called for constitution of a special fund to support the growers.

Sources in the Rubber Board say the prices could not have reached this low had the domestic industry cooperated. “The manufacturing decline in China owing to its zero-COVID strategy has also coincided with high production of natural rubber in that country. The Indian industry too took advantage of this situation and are now sitting on a huge buffer stock,” says an official.

Taking a serious view of the situation, the board is working on some plans for market intervention, which is expected to be announced later next week, he says.

2023: and continues…

Jaikrishnan Nair, January 8, 2023: The Times of India

From: Jaikrishnan Nair, January 8, 2023: The Times of India

In the 1970s, when Kottayam was still a sleepy town, it boasted the Planters Club. Hundreds of acres of paddy fields and coconut groves on the surrounding hillsides had been converted to rubber plantations and the resulting latex boom had spawned scores of crorepatis, seemingly overnight. Each rubber estate had the mandatory mansion and its share of the latest convertibles, but the rubber farmers needed a collective status symbol. Planters Club was the answer.

Less than 50 years later, planters are part of the club in name only. Planters Club these days is the haunt of migrants working in and around the town, and its decline mirrors the trajectory of Kerala’s rubber story.

Stalled Engine Of Growth

Rubber cultivation was a crucial factor in the development of many Kerala districts, especially Kottayam, Pathanamthitta, Idukki and Ernakulam. Small towns sprouted in this region, new business ventures related to rubber started and there was prosperity all over. Even small planters thrived in the boom. Pius Scaria, a planter in Kanjirappally near Kottayam, says planters were held in awe “in the ’70s, ’80s and even the ’90s”. They were rolling in money: “They used to be the first to buy any luxury car that was launched”. Nobody from a planter’s family worked a job outside, “It was considered shameful. ”

But things changed as the price of rubber fell steadily over the past few years. From Rs 270 in 2014, the average price of 1kg natural rubber had fallen to Rs 142. 5 by December 2022. It came down more than 20% in a year, from Rs 182. 8 in 2021.

With prices falling, costs rising and new crop diseases arising amid climate change, the stakeholders are in real trouble. On top of that, the Centre’s rumoured move to scrap the Rubber Act and the Rubber Boardhas them worried.

These days, at least one person from most planter families would be a nurse working abroad, or a government employee or a blue-collar worker in the Middle East, Scaria says. Many farmers have sold parts of their plantations to send their children abroad. “In some cases the entire family has emigrated. ”

Plantations ‘Unviable’

Babu Joseph, general secretary of National Consortium of Regional Federations of Rubber Producer Societies in India, says the Land Reforms Act that limited the land holding of farmers is making plantations unviable. A farmer can hold a maximum of 15 acres, so his two sons inherit only 7. 5 acres each. “Now the profit gets divided between two families and finances are hit. This is one of the reasons for rubber plantations becoming less profitable. ”

Then there’s the paltrysubsidy. While salaries have been going up, farmers still get a subsidy of Rs 25,000 per hectare for planting and replanting rubber. “This is hardly sufficient as one rubber sapling now costs Rs 100,” Joseph says, adding that there’s no replanting in 70% of Kerala plantations due to the low subsidy.

Aby Iype, another rubberfarmer, says while they are tackling climate change and labour shortages, unrestricted imports of compound rubber have driven prices down.

Some of the Rubber Board’s schemes have also been scrapped and the Board’s future looks doubtful, Joseph says. “Rubber was considered an essential raw material equal to steel and iron, which made Nehru start the Rubber Board. Now the farmers are afraid the Centre is planning to shut down the Board and repeal the Rubber Act. ”

Hot Political Issue

Rumours about the Board started after the Union commerce ministry recently called a meeting to seek stakeholders’ views on a Niti Aayog recommendation. “Niti Aayog had voiced an opinion that there is no need for (rubber) regulations and the promotion can be done by the state government or by the industry bodies,” says K N Raghavan, executive director of Rubber Board, adding that the stakeholders demanded the Board and the Act should continue unchanged.

The rubber sector is currently regulated by the Rubber Act, 1947, but the Centre has drafted the Rubber (promotion and development) Bill 2022 that could replace it. Falling rubber prices have already become a political issue in Kerala with the opposition demanding a minimum support price of Rs 250 per kg for natural rubber – something the incumbent LDF had promised in its election manifesto in 2021.