Radhakishan Damani

This is a collection of articles archived for the excellence of their content. |

A backgrounder

R Damani Is Worth Almost Rs 36,000 Crore

A reticent stock broker-turned-entrepreneur who had refused to participate in the tech boom in the early 2000s and instead launched a nondescript retail store in Mumbai, emerged as the heady toast of Dalal Street.

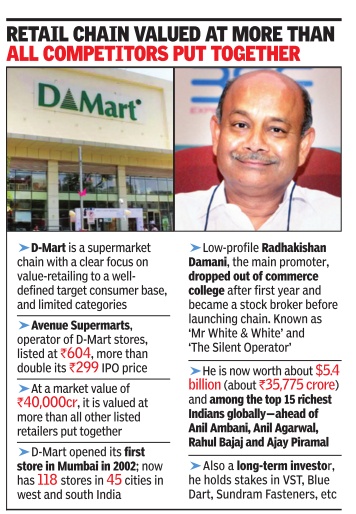

In the wake of Avenue Supermarts, operators of DMart stores, listing at a valuation of over $6 billion (almost Rs 40,000 crore), its main promoter, Radhakishan Damani -often referred to as Mr White & White (for his all-white attire) and The Silent Operator (for his reclusive nature)--found himself worth more than such long-time Indian billionaires as Anil Ambani, Ajay Piramal and Rahul Bajaj.

The 61-year-old Damani, along with his family , holds 82% in the retail chain which is now worth a little over $5 billion (Rs 33,125 crore). In addition, he holds equity stakes in VST Industries, Blue Dart, Sundram Fasteners, TV18 and 3M India, valued at $400 million (Rs 2,650 crore). Together with his ownership of D-Mart, Damani, a resi dent of Altamount Road in south Mumbai, is worth about $5.4 billion (Rs 35,775 crore), which going by the latest Forbes list puts him among top 15 Indian billionaires globally .

After listing at Rs 604, more than double its IPO price of Rs 299, Avenue rose still further to close at Rs 641.

Stunningly , D-Mart is now worth substantially more than the combined Rs 24,000 crore market capitalisation of BSE-listed peers Future Retail, Trent, V-Mart Retail, Shopper's Stop and Provogue. Unlike many high-profile retail chains, D-Mart has focused on value-retailing, limited its range of categories, and located itself mostly in suburbs and non-metros. Radhakishan Damani, whose family was in the ball bearings business, dropped out of commerce college after his first year. He entered the stock market as a broker and trader in the late 1980s and was frequently seen in the BSE's erstwhile trading rink. But outside the market he was barely known, unlike the widely feted `Warren Buffett of India', Rakesh Jhunjhunwala. When it came to making money on the market, the Street always looked up to Jhunjhunwala. But that may now change, a veteran of the Street said.

The media-shy Damani is also known for being a tenacious fighter. About two decades ago, he took ITC head-on for control of Hyderabad-based VST, the makers of Charminar. His 25% stake in the cigarette company , acquired at a cost of about Rs 63 crore, is now worth about Rs 1,200 crore.A few years ago, when DHL, the owners of Blue Dart, offered to sell shares in its In dian subsidiary at much less than the then market price, causing investors to panic, it was Damani, operating from the shadows, who assured investors about the stock's long-term value. He now holds 3.4% in the courier company , worth about Rs 400 crore.

Dalal Street veterans like Alok Churiwala, Deven Choksey , Dharmesh Mehta and Arun Kejriwal variously describe `Radhakishanji' the soft-spoken investor as “brilliant“ and “a legend on the Street“.

As a rookie broker in late 1980s-early 90s, Churiwala would often see Damani “floating across the trading floor with cool composure“, while for Choksey it was Damani's sharp analysis that caught the attention of many . Damani withdrew from active trading after vyaj badla (a form of financing) was replaced by derivatives in the early-to-mid 2000s, and refocused his energies on long-term investing. It was around that time that he also launched his first entrepreneurial venture in the form of D-Mart.

See also

Radhakishan Damani