Property Tax: India

These are newspaper articles selected for the excellence of their content.

|

Contents |

Property tax issues: 2015

Union Budget 2015: The nuts and bolts of property tax

The Times of India Mar 1, 2015

TAKING A HOUSING LOAN

Typically, the longer the loan tenure, the lower is the monthly EMI but higher is the interest outgo. The Reserve Bank of India (RBI) has prohibited banks from levying any foreclosure charges if you pay off the loan prior to its tenure. Once you have the loan in hand, you will be paying a periodical interest and also repaying the principal — in tranches. The I-T law provides for benefits in both instances.

Tax Benefits on interest paid:

Interest payable on 'self-occupied' property is subject to a maximum deduction of Rs 2 lakh under the head 'Income from house property'. Even a loan taken from an employer, friend or private lender is eligible for such a deduction. Booking an apartment which is under construction is sometimes cheaper. The I-T law permits you to claim the total interest paid during the pre-delivery period as a deduction in five equal instalments starting from the financial year in which the construction was completed or you acquired your apartment (generally this denotes the date of possession). Of course, the maximum you can claim as deduction per year continues to be Rs 2 lakh.

Caution point: A certifi cate from the lender is required to claim deduction on interest even if the lender is an employer or a friend. To claim deduction of Rs 2 lakh, it is essential that the acquisition or construction is completed within 3 years from the end of the fi nancial year in which the loan was taken; else the deduction allowed will be limited to Rs 30,000.

Union Budget 2015

Set off your interest payment:

As income from a 'self-occupied property' is nil, deduction of interest, in technical parlance, will mean a loss under the head 'Income from house property'. This "loss" can be set off against other income, which includes salary income, in the same year. This reduces your total tax liability. Any loss not set off within the same year can be carried forward and set off in the next 8 years. However, in the subsequent years, such set-off is possible only against 'Income from house property'. So even if you let out your property next year, this carry-forward of loss can bring a marginal relaxation in your tax liability.

Definition Of 'self-occupied' property:

Here is some guidance on what exactly constitutes 'self-occupied' property. If you are suddenly transferred to another city (where you live in a rented apartment) your own property will be considered as 'self-occupied'. Also, if you have opted to purchase a new apartment in a tier-2 town where property is cheaper and continue to stay in a rented house, this new apartment would be regarded as 'self-occupied' entitling you to deduction of housing loan interest.

Hot tip: If you have bought the new apartment jointly — say with your spouse — then each of you is entitled to a deduction of Rs 2 lakh, as explained above. In case you have a working son or daughter and the bank is willing to split the loan three ways, all three can avail deduction up to Rs 2 lakh each. Repayment Of Your Housing Loan: The principal repayment of the housing loan made by you is allowed as a deduction from your gross total income (subject to an overall cap with other eligible investments of Rs 1.5 lakh). Please refer to the section on savings.

Caution point: Unlike deduction of interest, deduction of principal repayment will be allowed only if the loan is taken from specifi ed institutions like banks or LIC.

Buying an apartment and your TDS obligations:

As per the I-T law, the buyer of an immovable property worth Rs 50 lakh or more is required to deduct (and deposit) withholding tax at the rate of 1% from the consideration payable to the seller. In case of failure to comply with the provisions, interest and penalty are imposed on the buyer.

Thus, if the purchase price of your fl at is Rs 50 lakh or more, then you have to comply with the tax deduction at source (TDS) obligations. You will be required to furnish information about the tax deducted and deposited online on the Tax Information Network (TIN) website in Form 26QB (URL is onlineservices). Further, you will also have to download Form 16B, which is the TDS certificate from the website (URL is tdscpc) and issue it to the seller.

Caution point: If you have booked a fl at and are paying the builder in instalments, but the value of the fl at as per the sale agreement is more than Rs 50 lakh, then tax has to be deducted against each instalment payment. You also need to comply with the timelines for deduction and deposit of TDS and fi ling of the information online and submission of the TDS certifi cate to the builder.

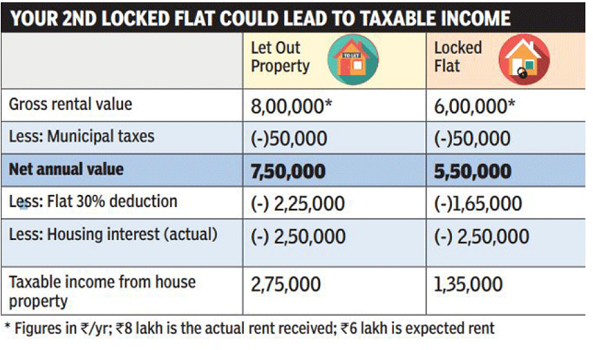

Letting out your second house:

Investing in real estate has become attractive, but make sure not to keep your second house (which is not a self-occupied property — as explained above) unoccupied: it makes better sense from the I-T law perspective to rent it out. Your second house, if locked and empty (with no income accruing from it in the form of rent), will still attract tax on its 'deemed value'. In other words, tax is calculated at expected market rent.

Interestingly, if you let out the second house, you can deduct the entire amount of interest you are paying on it without any cap from the rent received. If there is a loss, you can deduct it from your taxable income. For example, if your interest outgo is Rs 10 lakh and the rent is Rs 6 lakh, you can get a tax benefi t on Rs 5.8 lakh (Rent Rs 6 lakh less: (a) Standard deduction of 30% of rent which is Rs 1.8 lakh and (b) Interest Rs 10 lakh). This is applicable for any number of houses and there is no cap on the amount of deduction you can claim.

SELLING YOUR APARTMENT:

If you sell your house, whether it is self-occupied or your second apartment, you will incur capital gains tax (given that there has been appreciation in property prices, it is unlikely that you will be making a loss).

Capital gains is the difference between the sale proceeds and the cost of acquisition of the apartment you are selling. Further, capital gains can be either short-term or longterm depending on the tenure for which the house was held. A short term capital gains will have a different tax impact than a long-term capital gains (LTCG).

If the house is held for not more than 36 months, on sale, you will incur a short-term capital gain, which is subject to income tax based on your applicable slab rate. If you fall in the lower tax bracket with a tax rate of 10.3%, short-term capital gains will not pinch you. Else you could end up with a 33.99% tax rate.

If the property is held for a longer period, LTCG arise. The cost of acquisition used for computing LTCG is the indexed cost of acquisition (in other words an adjustment is made for infl ation). Tax is levied on LTCGs at 20% (plus surcharge and cess).

Reinvesting in residential property or securities:

To be able to save tax on capital gains, you must invest the entire LTCG from the sale of residential property in another (only one) residential property in India. Such investment can either be within one year before or two years after the date of sale. You could also construct another residential property in India within three years of the date of sale.

Also, you may deposit the amount of capital gains under capital gains account scheme with a bank in case investment in new property is not made before fi ling of I-T return (not later than the due date for fi ling your I-T return). If the entire amount is not reinvested or not deposited in capital gains account scheme, the remaining portion of the gain will be taxable.

Caution point: Exemption from LTCG will not be available in case the reinvestment is made in more than one fl at, even if the same are adjoining fl ats, or in a commercial property. Further, while the RBI permits you to invest in property overseas (a remittance of $250,000 or Rs 1.5 crore approx per year is permitted which can even be used for property acquisition), if LTCGs are reinvested in property overseas you will not get the tax exemption.

Exemption is also available on investments made in certain bonds within six months of sale. They include Rural Electrifi cation Corporation and NHAI. The maximum amount that can be so invested is Rs 50 lakh.

Hot tip: Such exemption is also available on sale of any other long term capital asset.

Property tax, state/UT-wise

Delhi: No property tax on vacant land: HC

Property tax relief: HC quashes NDMC bylaws, August 19, 2017: The Times of India

In a major relief to property owners in New Delhi Municipal Council (NDMC) areas, the high court has struck down NDMC bylaws of 2009, under which it was empowered to charge property tax even on vacant land.

A bench of Justice S Muralidhar and Justice Pratibha M Singh also “invalidated“ the action taken by the civic agency under the new bylaws, which had brought about a change in the method of arriving at the rateable value for the purposes of property tax.

The court's direction came on a batch of 28 writ petitions filed in the last few years by group of individuals, corporates and residents welfare associations alleging that under the 2009 NDMC bylaws, the civic body was charging property tax on vacant land at a rate equal to the constructed area.The petitioners argued that such amendment to bylaws was carried out despite the fact that in a large portion of the NDMC area, no construction is permitted on vacant land due to Lutyen's Bungalow Zone restrictions or Archaeological Survey of India regulations.Hence the owners argued they can't be penalised for not doing something which is prohibited under law.

Allowing the petitions challenging the constitutional validity of these byelaws, the bench said it “invalidates all actions taken by the NDMC under the new bylaws in terms of levy , assessment, collection and enforcement of demand of property tax. All property demands made under the new byslaws are hereby invalidated and declared unenforceable.“ It further said that in terms of the interim order passed by the court, the excess of the tax deposited has to be refunded but exact amount can be determined only as per the existing rules under the NDMC Act.

“Such refund of excess tax deposited would be in accordance with the law. It will be open to the individual tax payers to seek appropriate remedies in regard to refund together with interest at the appropriate stage after completion of the assessment in terms of the extant provisions of the NDMC Act,“ the bench said in its 40-page order.