Ports: India

This is a collection of articles archived for the excellence of their content. |

Contents |

Capacity

2017: underutilisation of existing port capacity

From: The Times of India, October 11, 2017:

See graphic:

Occupancy and effective capacity of India’s major ports, 2017

Container traffic

2019>21

Sidhartha, Nov 17, 2021: The Times of India

From: Sidhartha, Nov 17, 2021: The Times of India

While globally, exporters have been grappling with a shortage of containers and a massive spike in freight post-Covid reopening, this appears to be far worse on the eastern front as goods have to be transported by road to Mumbai, Visakhapatnam or Cochin to find shipping lines that are headed to the right destination. The strained supply chains across the world is seen to be one of the factors adding to inflationary pressures, particularly in the US.

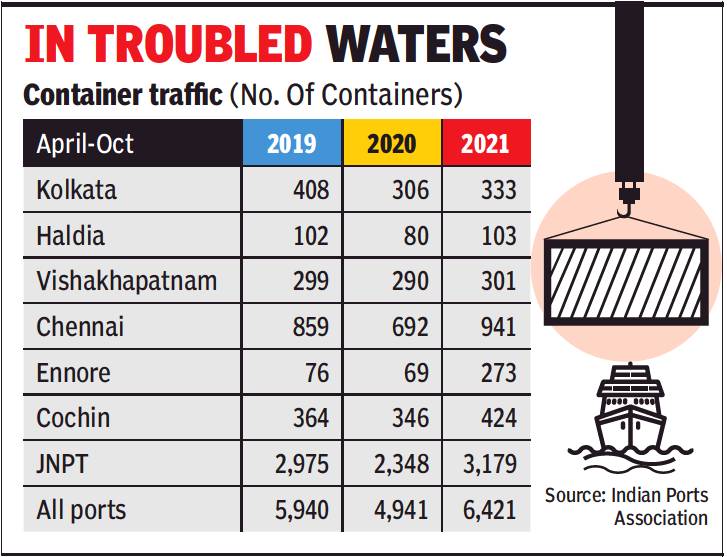

The problem is visible in the numbers. Indian Ports Association’s latest data shows that during April-October, container traffic at Kolkata remained 18% lower than 2019 level, when the national average for all ports was an increase of over 8%. Haldia Docks just about managed to overtake the prepandemic level (see graphic).

From Kolkata, goods are shipped either to Colombo or Singapore before they head to their final destination. And, the draught in Kolkata often plays a part. So, when the container crisis started, shipping lines were taking empty containers from the port to meet the requirements in other destinations, until the port authorities clamped down on it. While the Centre is trying to tackle the problem, government officials as well as businesses concede that this issue is unlikely to be resolved for several more months. Exporters in the eastern part are hoping that the acute shortage is resolved as they have to shell out 10% more. A tea exporter said transport cost per container adds up to around Rs 1 lakh and then there are other charges such as those paid for warehousing, loading and unloading, which add up to another Rs 30,000-40,000.

“The problem is less in west and north India. This is in addition to the higher freight,” said Mahesh Keyal, a ferro alloy exporter, who was until recently paying nearly Rs 2,000 a tonne for shipping goods via Vishakhapatnam. It now costs $1,400-1,500 to ship a container from Kolkata to Chittagong, over three times the pre-pandemic rates, said Keyal. Similarly, the tea exporter said, shipping a container to CIS countries can cost around $11,000, as against $5,500-6,000 about June.

What’s worse is that few shipping lines are not taking consignments to these countries, resulting in Indian exporters losing out to competitors in Sri Lanka or Kenya. “Our cargo is packed and lying. We are incurring interest cost, our delivery and payment cycles have got elongated, resulting in higher working capital requirements,” the exporter said.

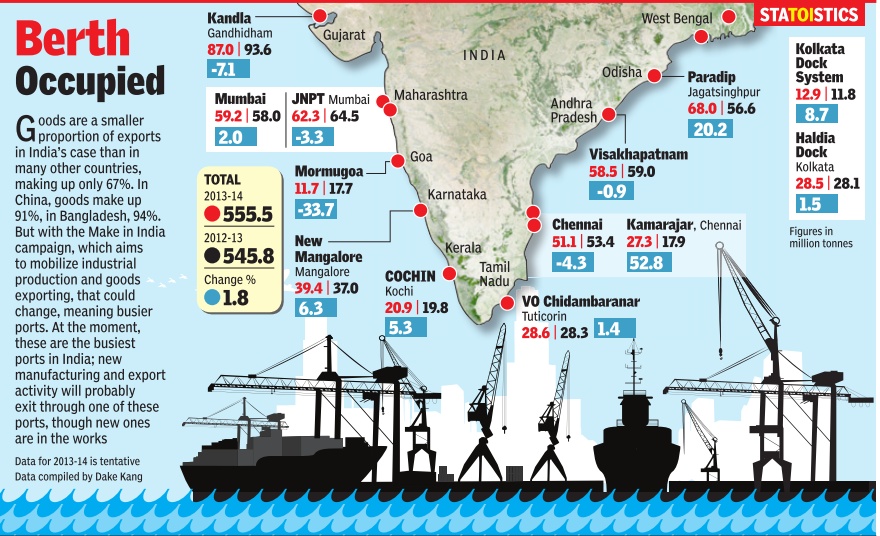

Goods exported and imported from Indian ports

Growth and profits, statistics

Growth and profits: 2009-17

Dipak Dash, In three yrs, major ports double operational profit, June 12, 2017: The Times of India

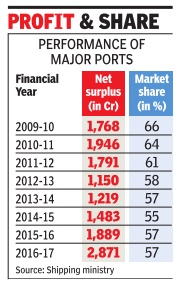

The focus of Modi administration on port and port-led development has resulted in a revival of the financial fortunes of major ports in the past three years. The 12 major ports put together have nearly doubled their operational profit of close to Rs 2,500 crore in 2013-14 to Rs 5,070 crore in the last financial year.

The upswing has happened as a consequence of the many steps that the shipping ministry took under Nitin Gadkari to fix the systemic and operational deficiencies.The most significant of these was the reduction of vessel turn-around time from four days in 2014-15 to less than three and-half days. Turnaround time is a process in which a ship unloads freight and reloads for the next trip.

According to shipping ministry data, the net profit of these ports has more than doubled in the past three years from Rs 1,219 crore in 2013-14 to Rs 2,871 crore in last fiscal year. These ports have also increased their market share, which was declining in comparison to private and minor ports. They have also outshone non-major ports as far as cargo growth is concerned. Last year while non-major ports registered only 2% increase, major ports saw 5% growth.

The data shows that operating margin which had seen a persistent decline--falling from 42% in financial year 2007-08 to 28% in 2013-14--has been restored to a 10year high of 43%. “All this has been accomplished with improvement in efficiency and minimal capital infusion. The increased profits have helped shipping ministry increase its investment in new ports and access infrastructure,“ said a ministry official. While the major ports lost cargo share to private ports every year since 2008, they still handled close to 60% of India's total cargo. But with their financial performance declining year on year, it was perceived that major ports were waiting to become another non-performing public undertaking.

The shipping ministry launched Project Unnati in 2014 under which efficiency of equipment was studied and every activity was scrutinised to identify excesses mistakes. “We found that ship loaders in Paradip were being run at less than 50% of their potential capacity .In Kandla, where ships were being sent back as berths meant to handle them were packed, it was found that with minor adjustment, the same infrastructure can handle more than double the volume.Project Unnati identified over 104 such initiatives across 12 major ports. These initiatives are being monitored regularly by the minister,“ a ministry official said.