Oil and Natural Gas Corporation (ONGC)

This is a collection of articles archived for the excellence of their content. |

Contents |

History

Anilesh S. Mahajan , Stepping on the gas “India Today” 21/8/2017

ONGC anchors the country's domestic oil production. It owns the biggest oil fields both onshore and offshore, including Bombay High, which produces 285,000 barrels a day, and the Barmer block, which produces over 200,000 barrels daily. Of the seven basins open for commercial production, six were opened by ONGC.

ONGC has its origins in the Nehruvian era. The draft of the 1948 industrial policy laid emphasis on developing the petroleum sector. Prior to Independence, undivided India had only two oil producing companies, Assam Oil and Attock. In 1955, India decided to copy the Soviet model and formed the Oil and Natural Gas Directorate. But Jawaharlal Nehru and his deputy minister in the ministry natural resources, Keshava Deva Malviya, soon realised the model wasn't working. In 1956, the directorate was raised to the status of commission with enhanced powers, although it continued to be under the government. The mandate of the commission was to plan, promote, organise and implement programmes to develop petroleum resources, including the sale of products produced by it. This was a time when private players dominated the limited exploration that India offered

Introduction

The Oil and Natural Gas Commission was established on 14th August 1956 as a statutory body under Oil and Natural Gas Commission Act for the development of petroleum resources and sale of petroleum products. As per the decision of the Government, Oil and Natural Gas Commission was converted into a Public Limited Company under the Companies Act, 1956 and named as “Oil and Natural Gas Corporation Limited” from 1st February 1994.

In March 2004, the Government disinvested around 10 per cent of the equity shares of ONGC through a public offer in the domestic capital market at Rs 750 per share. After disinvestment, shareholding of the Government in ONGC came down to around 74.15 per cent. The Authorized and Paid-up Capital of ONGC as on 31st March 2011 is Rs 15000 crore and Rs 4277.74 crore respectively. It has been accorded 'Maharatna Company' status.

Crude oil and natural gas production by ONGC during 2010-11 was 27.28 Million Metric Tonne (MMT) and 25.32 Billion Cubic Metre (BCM) respectively.

Borrowings

US dollar-denominated bond/ 2019

Nov 29, 2019: The Times of India

From: Nov 29, 2019: The Times of India

Flagship explorer ONGC has raised $300 million in overseas borrowing by issuing its first US dollar-denominated bond, even as the state-run company sees its cash pile depleted due to acquisitions made on government nudge. The company issued the 10-year bond at 3.375% interest, the lowest coupon rate ever achieved by any Indian corporate for papers with tenure of 10 years or longer.

Chairman Shashi Shanker said ONGC funds its operations from internal accruals and it has capacity to do the same in future also. “The offering of USD bond, however, was important to set a benchmark for ONGC group which has become an integrated energy major after the acquisition of HPCL (refiner and fuel retailer Hindustan Petroleum). It is anticipated that once the benchmark is set, it will facilitate group entities to raise funds at a competitive price,” he said.

Company’s director (finance) Subhash Kumar said the yield was one of the best achieved, which further reinforces the credentials of ONGC as an integrated energy major. “It is also expected that this issuance will enhance the group visibility in international market which will also pave way for upgraded corporate governance,” he said.

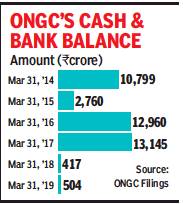

ONGC is testing new waters for raising funds as its cash pile stands depleted at Rs 504 crore as of March 31, down from Rs 13,145 crore as of March 31, 2017 due to acquisition of Gujarat State Petroleum Corporation’s 80% stake in the Gujarat government-owned company’s gas field off the Andhra coast.

Gas hydrates in Krishna-Godavari basin, 2015

The Times of India Jan 09 2016

Sanjay Dutta

Flagship explorer ONGC has struck a gas reserve in the form of hydrates otherwise known as `fire ice' off the Andhra coast that could turn out to be four times larger in terms of yield than Reliance Industries Ltd's discovery of 2002, India's biggest so far.

The discovery was made in August last year by the second exploratory expedition under the government's gas hydrate programme in collaboration with scientists from US and Japan, which have separately inked research MoUs with India.

The discovery validates the government's stress on finding alternative sources of energy and efforts to attract investments in the exploration business. It would also be a boost for PM Modi as he moves to promote a gasbased economy in tune with India's commitment to mitigate climate change. Irrespective of the cur rent depressed oil and gas price price scenario, which makes fresh investments unviable, the hydrates discovery would put India back in reckoning in terms of prospectivity . It would also return the spotlight on the eastern offshore, described as `India's gas bowl' and `India's North Sea' after Reliance's gas discovery. The region lost its glory in the aftermath of output falling from Reliance's field.

Sources in the Directorate General of Hydrocarbons, the oil ministry's technical arm co-ordinating the gas hydrates programme, said the discoveries have been made in Blocks 982, D3, D6 and D9 in the Krishna-Godavari basin, off the Andhra coast.These blocks are 30 Kms south-west of Reliance industries Ltd's natural gas block KG-D6.

Broadly , commercially useful gas hydrates are formed when methane or natural gas get trapped in icicles. These are found at places with extreme cold temperatures such as the Arctic region, Alaska and Siberia; or below seabed under high pressure of water depth.

There are two main technologies being successfully tried to free gas either by depressurising or injecting CO2 which replaces gas in the icicles.

But there's a catch. Or two. Cost of production is a worry , especially in a depressed market. Technology for producing gas from hydrates is still in pilot stage though considerable suc cess in Japan, US and Canada gives hope. Indeed, Japan has declared it would start commercial gas production from its offshore hydrates from 2020 after proving commerciality of the technology by 2018. ONGC intends to benefit from Japan's experience and technology by starting pilot production from its discovery from 2017.

The sources put the initial reserves potential of the hydrates at 134 tcf (trillion cubic feet). Even if ONGC manages to pump out a tenth of the reserves, the discovery could yield nearly 13 tcf of gas against RIL's 9 tcf.

Gas in Reliance’s KG-D6 block

RIL was unduly benefited: Justice Shah panel

The Times of India, Sep 01 2016

Reliance Industries derived “unjust benefit“ as a result of gas flowing into its KG-D6 block from the adjacent field of state-run ONGC in the Krishna-Godavari basin, and is liable to pay compensation to the government, the Justice A P Shah panel has said. The report, submitted to the oil ministry on Wednesday and put up on the ministry website the same evening, held RIL responsible for having “unfairly retained“ the benefit and not disclosing the fact that the underground gas pools in both the blocks were interconnected.

ONGC, which had moved the Delhi HC against RIL on the issue, too came in for sharp criticism, with Justice Shah suggesting a probe into previous management's lethargy in acting on information suggesting interconnected gas pools.

The one-man panel, under the retired Delhi HC chief justice, was appointed to suggest a way forward in the dispute. The panel was tasked to examine US-based consultant DeGolyer & MacNaughton's report validating ONGC's claim of gas from its block migrating to RIL's fields since it went into production in 2009. According to the D&M re port, more than 11billion cubic meters of gas, worth nearly Rs 11,000 crore, flowed from ONGC's area to Reliance's fields till March 2015. The report said the migration of gas after this date has to be ascertained.The Shah panel accepted the US consultant's report in its en tirety, rejecting Reliance's objections over what it called “asymmetry in data“.

“The report has gone into economic and legal implications of the gas migration issue under the ambit of production sharing contract. You must give us an opportunity to go through it. The ministry has 30 days to take appropriate action,“ oil minister Dharmendra Pradhan said after going over the report with Justice Shah for nearly an hour. The government's decision to put the report on the website was being seen by many as an indication of its willingness to act on the findings.

RIL and ONGC spokespersons declined to comment, saying they were not privy to the report's content when TOI contacted them before the report was made public. RIL has consistently denied doing any wrong, saying it had drilled wells within its own area and with approvals from authorities.

Value of undue enrichment to RIL was $3bn

The value of Reliance Industries’ alleged “undue enrichment”, owing to migration of gas from staterun ONGC block to its KG D-6 field off the Andhra coast, has doubled to $3 billion from $1.5 billion estimated in March 2015, according to government sources.

With much at stake, the government has asked attorney general K K Venugopal to personally monitor its challenge to an arbitration award in favour of RIL. India’s largest private sector oil company had initiated the arbitration proceedings after the government had slapped a recovery notice for $1.5 billion. The government is set to move the court, seeking refund of the undue benefit seen to have been derived by RIL.

RIL declined to comment on the issue.

“The order by the arbitration tribunal in favour of RIL has negated Indian laws, which will be the main focus of the A-G’s contention in the appeal,” a source said. The government is also relying on the

fact that RIL-led consortium of RIL-Niko-BP was aware that extraction of gas from its KG D-6 will lead to migration of gas from ONGC’s block and that it failed to bring this to the notice of the authorities.

This was also highlighted by the Justice A P Shah Commission, which was set up by the government in December 2015 after ONGC moved the Delhi High Court in 2014 on the gas migration issue.

RIL’s partner in the venture Niko had obtained a report from the US-based oilfield consultancy firm DeGolyer MacNaughton (D&M) in 2003, where the latter had said that if they extract gas from KGD6 field, gas from ONGC’s block will migrate as well, the source said.

ONGC had in 2014 dragged RIL and the government to Delhi High Court, seeking appointment of an independent agency to verify its claims as RIL wells were too close to ONGC’s block and that migration of its gas had taken place. D&M again gave its report in 2015, confirming what it had said earlier.

HR issues

Mittal 1st woman director on ONGC board

November 28, 2018: The Times of India

Alka Mittal joined the board of ONGC as director (human resources) on Tuesday, becoming the first woman to break the glass ceiling in India’s flagship exploration company.

A post-graduate in economics and a doctorate in commerce and business studies, Mittal joins the ranks of Roopshikha Saikia Bora, director (finance) at Oil India; and Nishi Vasudeva of Hindustan Petroleum, the first woman to head an Indian oil company.

Institute of Petroleum Safety, Health and Environment Management, Betur

Successes, as in 2021

Sanjay Dutta, Sep 20, 2021: The Times of India

An in-house institute of ONGC has emerged as a hub for fire safety and disaster management training for the oil, petrochem and airports industries in the Asia-Pacific region.

IPSHEM (Institute of Petroleum Safety, Health and Environment Management), set up by ONGC in Goa for training its personnel, is now doing a brisk business by training personnel from Russia’s Rosneft, French major Total and domestic oil majors such as Cairn India, IndianOil, GAIL, Hindustan Petroleum and Oil India Ltd. Airport operators GMR and Airports Authority of India are the latest entities to enrol their personnel for training.

“We have received queries from West Asia also,” IPSHEM head and ONGC executive director Atul Garg told TOI, prompting a debate whether to turn IPSHEM into a SBU (special business unit) for the industry.

“There are several issues, the first being priority for training ONGC personnel. We have a backlog due to Covid shutdown of in-house personnel who need to be trained in aspects such as sea survival to fire safety. So we will complete the in-house training before looking at meeting industry demand,” Garg said, adding that a Rs 120 crore expansion plan has been drawn up.

Natural Gas

2014-18: production

Sanjay Dutta, ONGC bucks global trend with record gas output, November 28, 2018: The Times of India

From: Sanjay Dutta, ONGC bucks global trend with record gas output, November 28, 2018: The Times of India

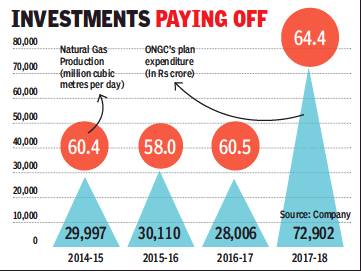

Once oil prices began sliding in 2014, explorers around the world scrambled to cut costs by rolling back investment plans and shedding jobs. While global upstream funding fell a quarter off its $800 billion peak over the next two years, two companies continued to drill and pump money into new projects — Russian giant Rosneft and India’s flagship explorer ONGC.

Kremlin-backed Rosneft enjoyed the benefit of low production cost, a large domestic base for oilfield services and the safety net of mostly rouble-denominated payments. ONGC had no such comfort but it made up by contracting for new fields and expansion projects of existing ones at bargain prices.

The strategy is paying off now, with the company’s natural gas production hitting an all-time high of 70 mcmd (million cubic meters per day) this month, marking more than 6% year-on-year growth against the global average of 3-4%. Gas sales also hit a record level at 56 mcmd, with captive consumption accounting for the rest.

Company executives said gas output will rise to 116 mcmd in the next three years as new projects and a clutch of discoveries are brought on stream quickly. To put things in perspective, the current production volume can run CNG and PNG services in 10-11 markets the size of Delhi-NCR or run a power plant of 12,000 mw. The uptick coincides with the government’s push for expanding CNG and PNG services to cover 70% of the country’s population and raise the share of natural gas in the energy basket to 15% from 6% with a view to reduce India’s carbon footprint.

ONGC had flagged off 17 production-related projects entailing capex of Rs 76,000 crore through oil’s downturn between 2014 and 2017. This is among the highest ongoing upstream funding programmes globally. It is pumping Rs 57,000 crore in the KGDWN-98/2 project in the Bay of Bengal as well as in developing other discoveries off the west coast.

Along with these investments, a more decisive and aggressive stance of the company management has contributed to lifting performance. “Contracts of major project engineering companies, whom nobody would touch earlier, have been terminated and others have been put on notice for delay in recent times. Time-bound project completion and accountability are new mantras in the company. There is no slack,” a company executive said.

Riggs

Sagar Samrat, 1973, 2023

January 4, 2023: The Times of India

New Delhi : Old, it seems, is gold for ONGC. The staterun explorer has put into operation its first mobile offshore production unit (MOPU) built by converting ‘Sagar Samrat’, the iconic 1973 jack-up rig that helped discover the Mumbai High field in 1974 and was well past its use-by date.

Sagar Samrat was given its new avatar at a cost of Rs 1,800 crore. It started production from the WO-16 cluster of marginal offshore fields,130 kms from the Mumbai coast, on December 29 and will add 6,000 barrels of oil to the company’s output from current location, the company said. “Sagar Samrat MOPU will handle up to 20,000 barrels per day of crude, with a maximum export gas capacity of 2. 4 million cubic metres per day,” it said.

This is a unique initiative and one of the most complex projects for ONGC. In its earlier avatar, Sagar Samrat had been involved in 14 key offshore discoveries and drilling of 125 wells.

The conversion was awarded to a consortium of Mercator Oil & Gas Ltd, Mercator Offshore (P) Ltd and Gulf Piping Company on November 17, 2011.

Though the conversion was undertaken with the WO-16 cluster in mind, the company said the converted rig will be shifted to other locations for monetisation of other discoveries.