Indian money in offshore entities: The Panama Papers

The International Consortium of Investigative Journalists and, |

A: 2016

The Suddeutsche Zeitung, ICIJ and The Indian Express investigation

The treasure trove of records was accessed by Munich-based newspaper Suddeutsche Zeitung which a year ago collaborated with the International Consortium of Investigative Journalists (ICIJ) and, in turn, with over 100 media organisations to investigate its contents.

In July 2015, The Indian Express signed an agreement with ICIJ for being the Indian partner for The Panama Papers project. Since then, a team of 25 reporters, led by the newspaper’s investigative team, joined 375 journalists in 76 countries.

The Indian Express reporters did field visits across the country to check on addresses mentioned in these records.

The Indian Express asked each one named whether they had informed RBI or the Income Tax department about these companies.

The results of that investigation — that begin in a series starting today — tell a story that’s as much about draconian foreign investment laws as it’s about glaring gaps in the regulatory apparatus.

Clearly, it covers the period when India began signing tax agreements with other countries to accelerate cooperation on undisclosed and untaxed assets. And the years when tracking black money has become the centre of political and economic discourse.

The worldwide expose also comes just six months after the 90-day “compliance scheme” for declarations of offshore assets and accounts ended on September 30, 2015 and brought just Rs 3,770 crore from 637 declarants.

The window now closed, strict penalties and a jail term have been announced for anyone found to have undisclosed and undeclared foreign assets and accounts.

The Panama Papers is the third successive collaborative project done by The Indian Express with the ICIJ on offshore investments.

The first was in 2013, titled “Offshore Leaks.” There were 612 Indians on that list which included two politicians who were then Members of Parliament (including Vijay Mallaya) and several top industrialists.

The revelations led to several persons getting tax notices and subsequently being prosecuted for non-declaration of the offshore companies.

The second ICIJ-The Indian Express collaboration, under the aegis of the French newspaper, Le Monde, was published in February 2015. It was called “Swiss Leaks” and contained data of HSBC (Geneva) account holders — balances dating to 2006-07 — among whom there were 1,195 Indian account holders. (See Indian money in HSBC, Switzerland )

Significantly, this was almost double of the 628 names given by the French authorities to the Indian government in 2011 and the scope of the HSBC probe was expanded following the expose.

Indians in the names released by Panama Papers

See graphic

The main findings

[In 2015], it was Swiss Leaks, a global list with over 1,100 Indians with secret bank accounts in HSBC Geneva, which shaped the debate over black money parked overseas. (See Indian money in HSBC, Switzerland and other similar Indpaedia pages.)

Now come The Panama Papers.

- Panama Papers: 424 names in probe, 49 are by Enforcement Directorate

- Panama Papers: 424 under probe, India gets data on 165 cases with links to offshore firms

- Panama papers: SC to hear plea seeking court monitored CBI investigation

- Panama Papers: Lahore HC rejects plea seeking PM Nawaz Sharif's removal

- Panama Papers: 415 Indians under scanner as probe widens

More than 11 million documents from the secret files of Mossack Fonseca, a law firm headquartered in tax haven Panama, known for its factory-like production of offshore companies for its worldwide clientele of the well-heeled.

These records reveal a list of individuals who have paid the firm — and bought the benefits of the secretive, lax regulatory system in which it operates — to set up offshore entities in tax havens around the world.

Over 500 Indians figure on the firm’s list of offshore companies, foundations and trusts. There are also 234 Indian passports (handed over by clients as part of the incorporation process), an eight-month-long investigation of over 36,000 files by The Indian Express has revealed.

Of these, The Indian Express has checked the authenticity of over 300 addresses.

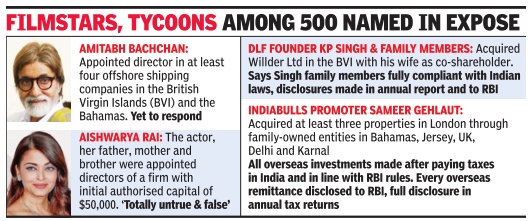

From film stars Amitabh Bachchan and Aishwarya Rai Bachchan to corporates including DLF owner K P Singh and nine members of his family, and the promoters of Apollo Tyres and Indiabulls to Gautam Adani’s elder brother Vinod Adani. Two politicians who figure on the list are Shishir Bajoria from West Bengal and Anurag Kejriwal, the former chief of the Delhi unit of Loksatta Party.

From Mumbai ganglord the late Iqbal Mirchi, the list includes scores of businessmen with addresses in nondescript neighbourhoods in Panchkula, Dehradun, Vadodara and Mandsaur. Addresses of individuals, in many cases, The Indian Express found out, led to physical locations, but with no trace of the individual.

Or, as in one case, belonged to a tenement in a chawl in Mumbai.

Not just individuals, a close scrutiny of The Panama Papers by The Indian Express also reveals details of hitherto unknown deals, in some cases involving the government, too.

These include cricket franchise deals and, in several cases, linkages to those who have previously been under CBI or Income Tax scrutiny.

As per RBI norms, no Indian citizen could float an overseas entity before 2003 — in 2004, for the first time individuals were allowed to remit funds of up to $25,000 a year under the Liberalised Remittance Scheme, and this limit stands at $250,000 a year now.

But while RBI let individuals buy shares under LRS, it never allowed them to set up companies abroad, having clarified it through an FAQ mid-way in September 2010.

In most of the cases in The Panama Papers, companies were set up long before the rules were changed and the purpose, experts said, was to park foreign exchange in a tax haven. It was only in August 2013 that individuals were allowed to set up subsidiaries or invest in joint ventures under the Overseas Direct Investment window.

The Panama Papers come at a time when the Special Investigating Team (SIT) on black money headed by former Supreme Court Judge M B Shah is finalising its new action-taken report.

The formation of the SIT was the very first decision taken by the Narendra Modi Government in May 2014.

B:2018

Panama Papers: The Aftermath

Panama Papers - The Aftermath: The fresh investigation of Indian individuals and entities reveals how Mossack Fonseca, which serviced their accounts, scrambled to respond to an unprecedented global crackdown. Significantly, it also confirms the existence of several customers who had hitherto denied any links. And lifts the veil on the financial trail of new clients.

Two years after the Panama Papers blew the lid off how the global elite, including over 500 Indians, park and move their money in and out of secret tax havens, the Panama Papers are back — to reveal telling new details. More than 1.2 million fresh documents, at least 12,000 of them linked to Indians, have been investigated by The Indian Express, in collaboration with the International Consortium of Investigative Journalists and German newspaper Suddeutsche Zeitung. Just as was done with the earlier set of over 11.5 million documents in 2016.

This fresh investigation of Indian individuals and entities who figure in this new set of papers reveals how Panamanian law firm Mossack Fonseca, which serviced their accounts, scrambled to respond to an unprecedented global crackdown. Significantly, confirming, in the process, the existence of several customers who had hitherto denied any links. And lifting the veil on the financial trail of new clients.

Clearly, this new set — Panama Papers: The Aftermath — which The Indian Express has investigated, , will provide further teeth to the inquiries and audits ordered by the government and its investigative agencies.

This second lot of the Panama Papers highlights details of offshore companies incorporated by a clutch of Indian businessmen who did not figure in the 2016 leak. These include Ajay Bijli, owner of PVR cinemas, and members of his family; Kavin Bharti Mittal, CEO of Hike Messenger and son of Sunil Mittal; and, Jalaj Ashwin Dani, son of Asian Paints promoter Ashwin Dani.

The new papers also show that several companies set up by Indians were, first, sent notices by Mossack Fonseca (several by November 2016) to produce missing information and these letters mentioned the name/s of the Beneficial Owner (BO), wherever available, or demanded that the name be immediately disclosed.

In the next stage, Mossack Fonseca served 90-day notices to clients informing them that the firm would resign as Registered Agent because the companies failed to meet legal due diligence requirements.

Those whose links to offshore entities have been confirmed by Mossack Fonseca in a series of messages include Shiv Khemka, Amitabh Bachchan, Jehangir Sorabjee, K P Singh of the DLF Group and his immediate family, Anurag Kejriwal, Navin Mehra of Mehrasons Jewellers and Hajra Iqbal Memon and his family.

An illustrative case is how, shortly after the 2016 expose, Mossack Fonseca, in its communications, named Amitabh Bachchan as director of two companies Lady Shipping Ltd and Treasure Shipping Ltd and, subsequently, served the 90-day notice to him via UK-based Minerva Trust — the administrator for these companies — addressing him as director of a third company, Sea Bulk Shipping Company Ltd. The notice conveyed Mossack Fonseca’s intent to resign as the company’s agent saying that Sea Bulk Shipping did not fulfil “our due diligence requirements”.

Bachchan, who is under official scrutiny in connection with the Panama Papers, has denied any link to these companies and did not respond to an email sent by The Indian Express earlier this week.

Panama Papers: New records reveal fresh financial secrets of Indian clientsThousands of new documents connected to Mossack Fonseca’s Indian clients also reveal a disparate pattern — while some Indian owners of offshore companies rushed to liquidate their firms, others asked Mossack Fonseca to continue as their agent. Some even increased their holdings — like Lokesh Sharma, owner of British Virgin Islands-based Mardi Gras Holdings, who increased the authorised share capital 30 times in February 2017.

While P R S Oberoi resigned as director of J&W Inc, a Bahamas company, in May 2016, Shishir Bajoria, who claimed his name in Mossack Fonseca records was a clerical mistake, contacted Mossack Fonseca through an intermediary to change the beneficial ownership of Haptic (BVI) Ltd which was liquidated in May 2016…

Particularly revealing is a May 9, 2016 email received by Mossack Fonseca from P P Shah and Associates, a Mumbai-based accountancy firm, in connection with offshore entity Whitefield Global Investments Ltd, whose beneficiaries are Baroda-based Chirayu Amin and members of his family.

It couldn’t be more direct: “Huge turbulence is started in the financial world including India. We need to respond to the Indian authorities asap as they have initiated inquiries based on the leaked report and documents which we understand are by and large correct information and documents…”

The very day of the Panama Papers expose, the Indian government had announced a probe by a Multi Agency Group (MAG).

Panama Papers: Two years on

Two years on, the information from the Central Board of Direct Taxes (CBDT) — which heads the probe unit — is that in all, 426 Indians named in the Panama Papers have been put under the scanner and, until June 2018, Rs 1,088 crore ($162.4 million) of undisclosed income has been detected.

The tax authorities continue to take action against those named in the Panama Papers and until November 2017, searches and surveys have been conducted in 58 cases. Prosecutions against 16 Indians named in the Panama Papers have been filed in courts.

As recently as June 13, three Delhi-based owners of entities were subject of early-morning simultaneous searches. They are Devesh Bahl and Rajeev Vaid (BVI entity: Pythhos Technology); Mohit Jain (BVI entity: Om Metals SPRL Limited) and Gurpal Singh Khurana (BVI entity: Top India Limited).

Prominent Indian names in the Panama Papers, 2016

#PanamaPapersIndia Part 2: Politician, industrialist, jeweller| April 8, 2016 | Indian Express

#PanamaPapersIndia Part 6: Metal scrap dealer to NRIs in USA and Dubai |May 4, 2016 | Indian Express

The posts below have been arranged in the alphabetical order of the company’s name or the first- mentioned individual’s surname

Vinod Adani

Write back | Why drag me in brother’s business: Adani

Responding to The Indian Express report ‘2 months after Adani brother set up firm in Bahamas, a request to change name to Shah’, a statement released by the Adani Group stated that “the reported account holder — Mr Vinod Adani who is the elder brother of Mr Gautam Adani has been a Non-Resident Indian (NRI) for about 30 years and has his own established business interests outside India”.

“It is strange that Mr Gautam Adani’s name is mentioned in the headline though he is not the account holder and the story actually pertains to Indians having not legitimate bank accounts abroad. This is a deliberate attempt to draw Mr Gautam Adani’s name, not just to mislead the readers at large but mischievously sensationalising the matter,” it stated.

“Adani Group and the Indian resident family members of Adani family always conduct transactions within the framework of extant regulatory guidelines and provisions. We welcome the government initiatives to reach to the bottom of this matter pertaining to the black money trail including Panama leaks and assure our fullest cooperation in any kind of investigation for that matter,” it stated.

Gopal Anand

Offshore entity: Project and Management Services Ltd

Location: BVI

Project and Management Services Limited was registered and incorporated on August 7, 1997. Gopal Anand held all 100 ordinary shares since August 15, 1997. It was struck off the register on April 30, 2015.

Anand, 70, is an MBA from XLRI who worked for over 40 years from 1974 in Africa as a management consultant. He no longer resides in the Bengaluru address listed in MF files but lives elsewhere in the city, along with his wife Tara.

Records with the Registrar of Companies show that an Indian firm Ojas Diamonds Pvt Ltd — with Tara and Mumbai industrialist P D Jhaveri as partners — was registered in September 1990 at the same address listed in MF files. A January 2000 Memorandum of Association of a medical transcription firm called New Planet Solutions Pvt Ltd, where Anand is a director, also shows the address listed by MF for the BVI entity.

RESPONSE: “I specialised in rescuing sick companies in Africa. I have been an NRI since 1974 and only moved back here a couple of years ago. I started Project Management Services at a cost of $ 500 to provide consultancy services to rescue African companies. I was based abroad and did not move any money from India to the firm. The firm is closed now. I have been residing in India and paying taxes here over the last two years,” Gopal Anand said.

“Since I was working in Africa I was not paying taxes in India until two years ago and there was no requirement for clearances from India to set up PMS. I stopped running the firm which was providing managerial services to companies in Africa around five to six years ago,’’ Anand said.

– Johnson TA/Bengaluru

Shishir K Bajoria

Offshore entity: Haptic (BVI) Limited

Location: British Virgin Islands (BVI)

Shishir-BAJORIA-BJP-759Shishir K Bajoria belongs to one of the oldest business families in Kolkata trading in jute and tea. He is the promoter of SK Bajoria Group, which has steel refractory units in six countries with an annual turnover of $200 million.

Bajoria is listed as a beneficial owner of Haptic (BVI) Limited, which was set up in the BVI on October 26, 2015 by Mossack Fonseca & Co (MF) along with First Names Group (Isle of Man), a corporate services provider.

MF records show the entity was formed “to receive assets from sister company and settle new trust” with its activities to be carried out “in Isle of Man/UK”. The value of its assets was more than $1 million. On December 2, 2015, First Names Group proposed to liquidate the company.

Core Holdings Corp (Charlestown, St Kitts and Nevis) was appointed the director and one share was issued to Castle Hill (Nominees) Ltd (Isle of Man). MF records for Haptic include a copy of Bajoria’s passport (Z002543) as proof of identity and lists Alipore in Kolkata as his India address. A close associate of former chief minister late Jyoti Basu, Bajoria quit his CPI-M membership and joined the BJP in August 2014. He is one of the key BJP campaigners in the upcoming assembly polls in West Bengal.

Response: “My family through a private limited company holds majority shareholding of IFGL Refractories Ltd which has a subsidiary IFGL Worldwide Holdings Ltd (IWHL) in Isle of Man. Also, my wife and myself are shareholders of Sonnish Ltd, another Isle of Man company. So I am a client of First Names Group, Isle of Man. I have not, nor have ever, owned (beneficially or otherwise) Haptic BVI Ltd. I believe that any connection to me was made in error,” said Bajoria.

First Names Group representative C G Hepburn said: “We made an administrative error on a form which we sent to Mossack Fonseca. The erroneous beneficial owner information on the form was entirely our fault, as was the enclosure of the copy verification document.”

— Jay Mazoomdaar/New Delhi

Gargi Barooah

Overseas entity: Walker Foundation

Location: Panama

Gargi Barooah, daughter-in-law of the late Dr Hemendra Prasad Barooah, Padma Shri and the grand old man of Assam’s tea industry, was the sole beneficiary of Walker Foundation set up in Panama in April 2010. Gargi moved to the US with her minor daughter in 2010.

Both Gargi and her daughter are shareholders in BA Industries, the family group of companies that controls more than half a dozen tea gardens in Assam. Gargi has also served as a non-executive director in B&A Packaging India Ltd and B&A Multiwall Packaging Ltd since February 2008.

Through Mossack Fonseca, Uruguay firm CHT Asesores y Consultores set up Walker Foundation in Panama on April 8, 2010, and Walker Investments Management INC in the British Virgin Islands on April 15, 2010. One Mark Cassidy, a British citizen with a California address, was the Protector of the Panama foundation and the sole director of the BVI company. Gargi Barooah was the sole beneficiary of the foundation, and one Rory Mark Keegan, a British citizen with an Italy address, held all 50,000 shares at $1 each in the company, Mossack Fonseca records show.

Walker Foundation was set up with assets not less than $10,000 which “consisted of funds deposited in Hordeñana y Asociados Sociedad de Bolsa SA”. The Uruguayan firm is controlled by financial consultant Gonzalo Carlos Hordeñana. Hordeñana is also the founding partner of Baker Tilly Uruguay, a member of Baker Tilly International, a global network of accountancy and business advisory firms.

Sometime in 2012, records show, Barooah stopped responding, and Baker Tilly Uruguay told Mossack Fonseca that all office bearers and the registered agent of Walker Foundation would have to find a way to resign independently since it was unclear if the client wanted to continue or dissolve the foundation. Walker Investments Management INC (BVI) too was inactivated on October 31, 2012.

— Jay Mazoomdaar/New Delhi

Sylvia Fay Bhatia & Alok Bhatia

Overseas entities: Hazelwood Enterprises Limited, Others

Location: British Virgin Islands

Mossack Fonseca documents show that Sylvia Fay Bhatia owns at least five companies in the British Virgin Islands either herself or with her husband Alok Bhatia. The address given is of Saket, New Delhi. Sylvia is the daughter of Australian mining billionaire Chris Wallin.

Since September 2004, Mossack Fonseca records show, Sylvia has been the director and sole shareholder in Comme Trading Limited which, in turn, is director and sole shareholder in Watami Trading Limited. Both companies were incorporated in the BVI in April 2004.

According to the documents, Comme also became sole shareholder of Giant Gold Holdings Limited (BVI), which was previously held by a bearer share, in September 2004. Between September 2004 and June 2007, Comme also held shares of Asian Coal Holdings Limited (BVI). The shares were transferred to Coal PTY Limited (Australia).

Mossack Fonseca records that in October 2005, Sylvia changed her surname — Wallin to Bhatia — and her Australian passport number. In September 2009, she set up Lombard Global Group Limited (BVI) as the sole shareholder. In March 2011, the shares were transferred to Watami Trading, also owned by her through Comme Trading.

In October 2006, Sylvia became sole shareholder of Hazelwood Enterprises Limited, a company incorporated in the BVI in August that year. Husband Alok became 50 per cent stakeholder in August 2008. Documents submitted in March 2015 show that they held 100 shares each.

In 2006, Sylvia Fay Bhatia became sole shareholder of Hazelwood

In May 2014, Mossack Fonseca-BVI said “as a Corporate Service Provider… bound to observe the respective anti-money laundering laws”, it required basic due diligence information on these companies. The Mossack Fonseca-Hong Kong office, however, asked the BVI office to wait. “We will ask the DD (due diligence) from this client when they have any new request of their companies,” it wrote in an email on December 19, 2014.

RESPONSE: Sylvia and Alok Bhatia did not respond to a questionnaire which was delivered by hand at their Saket residence in New Delhi.

Jay Mazoomdaar/New Delhi

Nish Bhutani

Offshore entity: Arts Alliance Media BVI Ltd

Location: BVI

Nish Bhutani, global head of product at Vuclip, a US-based online video-on-demand firm, held 3.41 per cent, or 34,583 ordinary shares of $ 0.01 value each, in Arts Alliance Media BVI Ltd. The company was incorporated on April 17, 2003 in the BVI. His residence mentioned in the Mossack Fonseca documents is 26 Ridge Road, Malabar Hill, Mumbai. The bulk of the shareholding in the company — 81.55% or 827,416 shares — is with a company called Cheetah International Investments Ltd, headquartered in Guernsey.

Bhutani joined Vuclip in March this year. The company has recently launched its online streaming service Viu in India. Before joining Vuclip, Bhutani was senior vice president of online retailer Myntra.com. Between September 2008 and June 2015, he was the chief operating officer of Saffronart, the world’s largest online auctioneer for fine art and collectibles. Bhutani moved Saffronart to a tech platform. Since then, Saffronart has held several highly successful online auctions, accompanied by physical catalogues and preview events in cities like Mumbai, New Delhi, New York, London and Hong Kong. Bhutani has also co-founded London-based Arts Alliance Media, which runs the largest digital cinema network outside the US. He was on the board and senior management of Lovefilm, Europe’s largest online movie subscription service, which was acquired by Amazon.

RESPONSE: When contacted, Bhutani told The Indian Express, “I have been a US citizen since 1999, and moved to India in 2008. These shares were given to me by my employer as part of an employee incentive plan, when I was working in the UK. As I am now an Indian resident, these shares have been fully disclosed to the Indian tax authorities as part of my foreign assets declaration.”

— KHUSHBOO NARAYAN/MUMBAI

Preetam Bothra and Sweta Gupta

Offshore entities: World Wide Group Holding Limited, Jupiter Group Holding Limited

Location: BVI

Bothra and Gupta are shareholders of World Wide Group Holding Limited and Jupiter Group Holding Limited, two companies formed in BVI in 2004. Between them, Bothra (60,000) and Gupta (40,000) hold all shares of World Wide Group Holding Limited since May 2013. Earlier, the shares were held by Jupiter Group Holding Limited (BVI) and Triansu Holdings Limited (BVI).

In May 2013, Pradip and Kritin Bothra transferred 40,000 shares of Jupiter Group Holding Limited (BVI) to Preetam Bothra and Sweta Gupta, who got 20,000 shares each, the MF papers show. Additionally, Preetam held 15,000 shares of Jupiter (BVI) since 2004, of which he transferred 5,000 to Pradip in 2009. In all, Preetam and Sweta hold 30,000 and 20,000 shares of Jupiter (BVI). Triansu Holdings Limited (BVI) was set up in January 2005 and inactivated in October 2012. Its shareholding remains unclear.

In India, Preetam and Sweta are the directors of Jupiter Nirman Private Limited, incorporated on January 27, 2000. The company has an authorised share capital of Rs 1,000,000 and a paid up capital of Rs 265,000 and is involved in civil construction.

RESPONSE: When contacted, Sweta Gupta said: “Why should I share any such details with The Indian Express?” She subsequently did not respond to detailed queries sent as text messages.

— Aniruddha Ghosal/Kolkata

Pradeep Kaushikray Buch

Offshore entity: Overseas Pearl Limited

Location: BVI

MF records show Buch had been a shareholder of Overseas Pearl Limited — which was registered in the BVI in 2001 — at least until 2004. His Vadodara address has been listed in the records. Nine lakh shares of Overseas Pearl Limited have been shown against his name, which were given to him after company resolutions passed in 2001 and 2003. A UAE national and another Vadodara-based businessman are also listed as the company’s shareholders. Buch lives in the Race Course Road area of Vadodara, and says he is an engineer and manager.

RESPONSE: “I have no overseas company. It does not belong to me. I am a professional engineer-manager. I do not know anything about companies like Overseas Pearl Limited. You may be mistaken about the address. I am basically a management consultant for companies in Dubai and Tanzania.”

— Aditi Raja/Vadodara

Samaresh Chakrabarti

Offshore entity: Robbins Investments Ltd

Location: BVI

On October 1, 1997, the company was incorporated and Samaresh Chakrabarti issued one share. Rima Chakrabarti, listed as his daughter with a New York address, was also issued a share on the same day. Both were appointed as directors on October 1, 1997.

At a meeting held on July 6, 2003, the appointment of Rittick Chakrabarti as a director was confirmed. Rima acted as chairman during the meeting and Samaresh as secretary. The meeting also resolved to issue one share to Rittick, who also listed a New York address. He was issued one share on July 6, 2003. Accordingly, Rittick provided a letter giving consent to act as a director on the same day. Samaresh Chakrabarti died in 2012.

RESPONSE: Samaresh’s brother, Amaresh Chakrabarti, who retired in 2015 from the Reliance facility in Jamnagar, said: “Samaresh worked with Reckitt and Colman and several other companies. His daughter (Rima) and son (Rittick) live in New York. I have never heard of Robbins Investments Ltd. I am not in touch with Rima and Rittick.”

-Aniruddha Ghosal & Esha Roy/ Kolkata

Amit Chopra

Offshore entity: Hohan Solutions Ltd

Location: Seychelles

MF records show that Amit Chopra, resident of Manimajra in Chandigarh, has been holding 25,000 shares of Hohan Solutions Ltd since the incorporation of the company on December 30, 2011. Sunil Jamndas Mundra, with a Dombivili (East) address in Mumbai, held the other 25,000 shares. Hohan Solutions Ltd was struck off the registry on December 31, 2013.

The Indian Express visited Chopra’s Chandigarh address on May 1 but was unable to meet him. At the residence, his father R B Chopra refused to provide an email ID or phone number.

RESPONSE: “Amit has got nothing to do with the company that you are mentioning,” said R B Chopra, Amit’s father. He added that his son worked with ICICI Bank but refused to provide any details.

–Khushboo Sandhu/Chandigarh

Sushila, Prerna and Gaurav Chopra

Offshore entities: Jelenta Investments Limited, Zenith Metallik Alloys Limited

Location: BVI

The three Chopras have been shareholders of Jelenta Investments Limited since the company was set up in the British Virgin Islands (BVI) on April 9, 2010. Jelenta Investments Limited (BVI), in turn, is the shareholder of Zenith Metallik Alloys Limited, set up in the BVI on April 11, 2012. Records of both companies are kept in Hong Kong.

Sushila, Prerna and Gaurav are also directors of Zenith Metallik Alloys Limited, an Indian company incorporated on February 18, 2011. Its authorised share capital is Rs 120,000,000, and its paid up capital is Rs 110,342,496. This had been a partnership between the members of the Chopra family from October 2006 onward.

The Indian company is described as a complete metals and ferro-alloy solutions firm that specialises in providing raw materials for a range of industries. Associated companies of Zenith Metallik Alloys Ltd (India) include Mayurbhanj Metals Limited, Lall Marketing, Chopra Tobacco Company, Lall Investments Private Ltd, and Mayur General Engineering Limited.

RESPONSE: Gaurav Chopra did not respond to phone calls and messages.

— ANIRUDDHA GHOSAL & ARSHAD ALI/KOLKATA

Dharam Vir Chugh

Offshore entity: Haida Investments Ltd

Location: BVI

MF records name Dharam Vir Chugh, a resident of Delhi’s Ashok Vihar, as the beneficial owner of Haida Investments Ltd. A certificate issued by United Bank of India (Kamla Nagar Branch) on May 17, 2007, and Chugh’s driving licence issued on October 6, 2006, are also part of the records.

The company was set up on January 2, 2007. PM Nominees Ltd (BVI) held all 100 shares of the company from April 4, 2007. BVI firm PM Directors Ltd served as director till February 10, 2012. The present director of Haida Investments Ltd is Zuelig Management Corp, another BVI firm.

RESPONSE: “I have no idea about this company. I am a retired 80-year-old man,” Chugh said.

–Aditi Vatsa/New Delhi

Sumant Gaurishanker Daftary & Vasumati Sumant Daftary

Offshore entity: Lila International Ltd

Location: BVI

Lila was incorporated on April 15, 2002 with Sumant and Vasumati as the first directors. Both held 50 shares each at a par value of $1 per share. On November 10, 2005, both transferred the shares to Barfield Nominees Ltd. On the same day, Sumant resigned as secretary and their daughter Mala-Sonya Sumant Daftary was appointed managing director. On July 8, 2014, Mala-Sonya, a US citizen with an Egypt address, acquired 100 shares from Barfield Nominees. MF papers list Mala-Sonya’s occupation as “consultant”.

Vasumati passed away on February 20, 2015 while Sumant resides at their listed Mumbai address with his daughter.

RESPONSE: “No comments,” said Mala-Sonya, in response to a questionnaire handed over to her at the Mumbai address.

-Srinath Rao/ Mumbai

Ranjeev Dahuja, Kapil Sain Goel

Offshore entities: Bealls International Corp

Location: BVI

Panchkula-based Ranjeev Dahuja and Kapil Sain Goel run Berkeley Automobiles, with dealerships of Hyundai and Tata Motors, in Chandigarh.

MF records list both as directors of Bealls International Corp which was set up in the BVI in June 2012. Both have equal shareholding of 5,000 shares each, and their passports and Panchkula addresses are on record. The company, is, however shown to have been wound up in October 2013.

RESPONSE: Ranjeev Dahuja said: “Kapil and I formed this company a few years ago but we never started any operations under it. It was an offshore company, but we did not operate it for long.”

Kapil Sain Goel said: “Ranjeev and I started this company but we realised soon that there was not enough profit margin in it. We were basically misguided by somebody to begin that venture. But we never operated it. We did not even open any bank account in that company’s name. We just opened it online, and never used it.”

— Varinder Bhatia/Chandigarh

Behram Bomani Dubash

Offshore entity: Zen Services Ltd

Location: Bahamas

Behram Dubash was issued 5,000 shares in Zen Services Limited on December 21, 1998. He ceased to be a shareholder on November 14, 2011. The 5,000 shares were issued to The Ramesh Foundation at the address C/O Domar Heiligkreuz, 6 9990 Vaduz, Liechtenstein, on November 14, 2011.

The company has two directors: Exchange Nominees Limited, appointed on January 17, 2001, and Raztron Limited, appointed on December 21, 1998 — both carry the same Isle of Man address. It was struck off the register for non-payment of licence fees, but restored on March 10, 2003.

RESPONSE: Dubash does not reside at the listed Mumbai address and is based in the USA. “I have been a Non-Resident Indian for many years. This company was set up during the period that I was an NRI and did not require any RBI permission or income-tax reporting. In any case, the company was dissolved years ago,” said Dubash, in response to a questionnaire handed over to his son Tuhad Dubash.

-Srinath Rao/Mumbai

Darab Dubash

Offshore entity: Al Arkan Trading (Europe) Ltd

Location: Bahamas

Darab Dubash was appointed a director of Al Arkan on April 30, 1998 and resigned on September 26, 2005. On May 25, 1998, Darab Dubash was allotted 1,200 shares of $1 each. On the same day, JDO Secretaries Ltd was allotted 800 shares of $1 each. On October 13, 2000, Dubash transferred his shares to JDO Secretaries Ltd.

On November 15, 2005, the board of directors noted that the beneficial owner (Dubash) had requested that the shares be transferred to Savoy Oak Foundation with an address at Liechtenstein and that the company’s bank accounts held at HSBC in Isle of Man be closed. On November 10, 2011, it was resolved that as per Dubash’s request, on completion of liquidation of Savoy Oak Foundation, the shares be transferred to Dubash again and on to Julius Baer Trust Company (New Zealand). It was also resolved that a bank account in the company’s name be opened at Bank Julius Baer & Co Ltd, Guernsey — and that on receipt of new account numbers, the balance in the HSBC accounts be transferred directly to the new account at Bank Julius Baer & Co Ltd.

RESPONSE: Dubash does not reside at the Mumbai address listed at the time of incorporation of Al Arkan Trading and stays mostly in the USA. “I have been a Non-Resident Indian for the past 20 years. This company was set up when I was a non-resident Indian, therefore Reserve Bank of India and income-tax reporting was not required. I ceased to own any shares in this company several years ago,” said Dubash, in response to a questionnaire handed over to his son Arvind Dubash.

-Srinath Rao/Mumbai

Gandhi Hareshkumar Dwarakadas

Offshore entity: Northglenn Group Ltd

Location: BVI

Hareshkumar was issued one share in Northglenn on January 18, 2001, and was appointed a director the same day. Gandhi Viral Haresh, with an Australia address and two passports listed, was issued 49,999 shares on April 3, 2001.

On March 30, 2001, Dwarakadas wrote to the company’s board of directors forwarding remittance of $49,999 as deposit for shares of $1 each with a request to allot the shares. A Certificate of Incumbency of April 9, 2001, states that Dwarakadas was appointed a director on January 18, 2001 and held 50,000 shares of $1 each.

RESPONSE: The Indian Express was not allowed entry at the listed Mumbai address of Dwarakadas. He is yet to respond to a questionnaire handed over at the gate on April 26.

-Rohit Alok/Mumbai

Garware family

Offshore entities: Rondor Overseas Ltd, others

Location:BVI and Panama

MF records show that the Garware family, comprising Ashok Garware, Aditya Garware and Sushma Garware, is associated with a clutch of offshore entities. Ashok Garware is a shareholder in Rondor Overseas Ltd, registered in BVI on May 10, 1996, holding 1,000 shares of $1 each and a capital of $10,000.

Aditya Garware and Sushma Garware hold a Power of Attorney (PoA) in a number of Panamanian corporations that issued bearer shares.

Ashok Garware is the executive chairman of Global Offshore Services, earlier known as Garware Offshore Services, which owns and operates a fleet of anchor-handling tugs cum supply vessels and platform supply vessels in India, Europe and the Far East. Garware’s son Aditya is the managing director of Global Offshore. Other firms of the Garware Group include Garware Goa Nets, Garware Marine Industries and Garware Offshore International Services Pte.

MF documents show that Aditya and Sushma Garware held PoAs in at least six Panamian corporations: Avior SA, VRA Team Corp SA, U R Great SA, Wellman SA, Yukon Portfolio SA and Python Corp. All these corporations were floated in 2008 with Aditya and Sushma being issued PoAs for three years. But these companies were inactive since 2009 and Aditya signed off their dissolution on July 22, 2014.

Another Panamanian entity Orel Corporation SA, too, issued PoAs to Ashok Garware and Maneesha Shah in January 2011 and November 2010, respectively, but these were revoked in July 2012. The Garwares also set up Fujiyama Team Foundation with initial assets of $10,000 and Ashok, Sushma and Aditya as the principal beneficiaries. The public deed for the foundation was signed on October 26, 2010, and it was registered on November 1, 2010. However, it was struck off the register on January 15, 2013.

When contacted, A C Chandarana, company secretary and president Legal & Admin of Global Offshore Services, said: “Your questionnaire pertains to matters which are more than five years old, we have once again checked with Mr Garware and his family (presently travelling), who recalled that there were some entities owned by foreign friends who were considering investments in India and accordingly granted POAs for the said purpose. However, since the intention with which these companies were set up was not executed, the said POAs lapsed and the entities were dissolved.”

“We wish to state that Mr Aditya Garware and Mrs Sushma Garware, as POA holders, were not beneficial owners of the said entities and were advised that there is no requirement of reporting the existence of POA to any authorities. The same applies to Mr Ashok B Garware and Mrs Manisha.

“We once again reiterate, in view of what is stated above, that Mr Ashok B Garware and family are not in any way connected or concerned with the entities mentioned in your email.”

— ENS/Mumbai

Prasanna V Ghotage and Vaman Kumar

Offshore entity: Nordbell Commercial Ltd

Location: BVI

Iron ore exporter Prasanna V Ghotage, 49, his wife Neha, and associate Vaman Kumar were shareholders in Nordbell Commercial Ltd, an offshore company set up in the BVI in July 2007. Ghotage’s mother Vilasini, who, according to the extended family, passed away two years ago, too was a shareholder. In 2010, Ghotage and Vilasini sold 12,000 shares to Vaman Kumar, MF records show.

Ghotage’s PVG Group operated over 3,000 trucks to transport iron ore at the height of the iron ore boom in the Bellary district of Karnataka. Vaman Kumar is an expert in the field of international trade and global commodity trade, especially iron ore.

Two other offshore entities are associated with the group, the MF papers show: Corsol Overseas SA and IRIV Holdings Limited. While Nordbell Commercial Limited is shown in the data to be a sharehoder of Corsol Overseas SA; IRIV Holdings Limited is shown to be a shareholder of Nordbell Commercial Limited.

In 2012, Ghotage, Vaman Kumar and one Manoj Dhirajlal Rajni from Goa, were accused of cheating the public sector BEML of Rs 30 crore, but the Karnataka High Court quashed the case in 2013. Ghotage was also accused of supplying poor quality iron ore by Hira Steel Ltd, a Mumbai firm. In 2015, a Goa police SIT chargesheeted Ghotage for failing to supply iron ore to a Raipur firm after taking an advance of Rs 17.5 crore. Ghotage has been in prison for a while. The Ghotages have several cases of debt recovery, wilful default, cheating, etc. against them.

Nordbell is shown in the MF papers as a Hong Kong based entity whose CEO in some trade documents is identified as Vaman Kumar. The company also had an office in Pune. “It shut down in 2010,” said a former employee of Nordbell Commercial in Pune.

“We have no contact with Prasanna Ghotage’s family or their businesses. His mother died two years ago,’’ said a member of Prasanna Ghotage’s brother Suhas Ghotage’s family, when contacted in Goa. Neither Prasanna Ghotage nor Vaman Kumar could not be contacted.

— Johnson TA/Bengaluru

Rajesh Kumar Gupta

Offshore entity: Southwest Minerals Ltd

Location: BVI

MF records show that Rajesh Kumar Gupta, resident of Delhi’s Sainik Farms, is one of the four beneficiary owners of Southwest, which was formed on November 4, 2004. The other three were his cousin Amit Gupta (Shanghai), Xue Qi (Beijing) and Liu Zeng (Beijing), all recorded as residents of China.

Records show that Rajesh Gupta held 8,500 ordinary shares since July 4, 2005 while Amit Gupta held 8,000 shares. Xue held 50,000 shares between November 11, 2004 to July 4, 2005. After July 4, 2005, Xiu held 16,500 shares and Liu held 17,000 shares. Southwest was struck off the registry on April 30, 2015.

RESPONSE: “This is the first time that I have heard of such a company. Amit Gupta is my cousin. We are in the food business and our company manufactures wheat flour. I am the director of Suruchi Foods while Amit Gupta is a shareholder. We have been running this company for more than 20 years. I am a resident of this country. Amit Gupta lives in Sainik Farms, too. He has never lived in Shanghai,” said Rajesh Kumar Gupta over the phone.

–Aditi Vatsa/New Delhi

Satya Prakash Gupta

Overseas entity: Sterling Global Partners Limited

Location: Ras Al Khaimah (UAE)

Delhi businessman Satya Prakash Gupta set up Sterling Global Partners Limited in August 2015 through financial service providers Anglo Manx Trust Company Limited and Mossack Fonseca (MF) in Ras Al Khaimah, United Arab Emirates (UAE).

In Delhi, Gupta runs M/s Sterling Security System, “a service providing company for creating business opportunities in India for multinational companies worldwide”, and M/s Sterling Exports. He is also the president of GT Karnal Road CETP Society.

Before setting up the UAE company, Mossack Fonseca records show, the 67-year-old Gupta took up a “full-time job” as Global Head (Marketing and Business Development) with M/s NextGen General Trading LLC (Dubai) in March 2015. His two-year contract from April 1 mentions an annual salary of $100,000 plus performance bonus, and annual travel and business reimbursement up to $1 million.

Soon after setting up Sterling Global Partners Limited in the UAE, records show, Gupta booked a business centre room — Henry VII — for himself in London’s St James’ Court, a Taj hotel, for three years from October 2015 at a “discounted rate” of GBP 1,000 per month.

Earlier, in July 2015, Anglo Manx Trust rushed MF, saying that the client (Gupta) “would like to incorporate as soon as possible” and they “basically just need a name that starts with Sterling or Platinum”.

During the “due diligence process”, Anglo Manx Trust said on August 3 that the “activities of the company will be general trading” and its shareholder would be Grosvenor Nominees Limited of Isle of Man. Copies of the passports of the first directors — British citizens Christopher Smith and Joanne Thompson — provided by Anglo Manx Trust were attached.

Declaring that she would also be the first secretary herself, Joanne Thompson said that the “beneficial owner is Mr Satya Parkash Gupta, H-3/1 Part III, Model Town, Delhi, India. Date of Birth 09/12/1948”. A copy of his passport was attached as proof of identity, the records show.

Sterling Global Partners Limited was set up on August 17, 2015, with a capital of US $100 divided into 100 shares. The company’s registry documents were sent to Dubai-based consultancy firm AbiliTrade.

In November 2015, Anglo Manx Trust sought some referrals from Mossack Fonseca for opening a bank account for Sterling Global in Dubai. They said that they were applying to Barclays UK for a London bank account and “have been advised that Barclays require a minimum turnover of $ 1 billion”.

In December, the shares of Sterling Global were to change hands for the third time. “We will also need to change the shareholding again to the beneficial owner which may be travelling to Dubai in the next week or two,” wrote Thompson.

RESPONSE: In an email, Gupta wrote: “It is correct that I am the beneficiary owner and share holder of Sterling Global Partners Limited set up at Ras Al Khaima (UAE). There are no assets in the company. As there is no acquisition of assets in the company, the question of any source for their acquisition does not arise. We render advisory services for various projects, technologies, commodities, metals and hydrocarbons globally…

“Being an NRI, to my understanding, I am not required to inform Reserve Bank of India. Regarding Income Tax authorities, I informed them regarding my status as NRI at the designated office. There are no bank accounts in Dubai of the company. However, we have opened a bank account in London for functioning of regular business.

— Jay Mazoomdaar/New Delhi

Ismail Umarbhai Hukkawala & Aziza Ismail Hukkawala

Offshore entity: Hina Investments Pvt Ltd

Location: BVI

Hina was incorporated on September 9, 1997, and two bearer certificates, each representing 1,250 shares, were issued. On May 31, 2001, 1,250 shares were transferred each to Ismail and his wife Aziza. On May 31, 2004, Aziza received all 2,500 shares. From December 12, 2004, all shares were transferred to Professional Nominees Ltd (till September 9, 2005) and Jupiter Nominees Incorporated (till August 3, 2007). The shares are now held by Minerva Trust Company Ltd. All companies have the same address: 43/45 La Motte Street St. Helier, JE4 8SD, Jersey. Cidel Bank and Trust Inc (Barbados) acted as the trustees for Hinas Trust, the sole shareholder of the company on June 15, 2006.

Ismail Hukkawala died in Abu Dhabi in 2005. Aziza returned to Sabarkantha in Gujarat where she lives with her daughter and son-in-law Shafi Zaaz, a businessman. Hukkawala was employed with state-owned Bank of Baroda and was posted in Abu Dhabi. Zaaz said Hukkawala quit BoB and joined National Bank of Abu Dhabi. He was a chartered accountant and acted as a consultant after retirement, said Zaaz.

RESPONSE: Hukkawala’s son-in-law Shafi Zaaz said: “We have not received any communication from any bank or any government agencies. After he (Hukkawala) passed away due to a heart attack, my mother-in-law returned to Modasa and since then we are living together. Her other three children live in the US.”

-Satish Jha/Ahmedabad

Vinod Ramchandra Jadhav

Offshore entities: A number of firms

Location: BVI

Vinod Ramchandra Jadhav is the chairman of Pune-based Sava Healthcare, with manufacturing facilities in Ahmednagar and Bangalore. The company is involved in research and development, and manufacture of healthcare products and veterinary products.

MF records show that Jadhav is listed as a director or shareholder in a clutch of offshore firms, mostly set up in the BVI between 2010 to 2015. They include Sava Portfolio Holdings Limited, Easycall Holdings Ltd, STF Portfolio Holding Limited, RIM International Corp and MaplePharm Holdings Inc. Liquidation proceedings have been initiated for at least two of these entities.

RESPONSE: Jadhav stated: “All our global companies and directorships and relevant incomes are declared to RoC (Registrar of Companies), Income Tax and RBI as needed every year. But the same were not declared in last year’s amnesty scheme since it was applicable for companies or individuals which didn’t declare their foreign assets. But myself and Sava group didn’t need to go for an amnesty scheme because we have never hidden any company or asset abroad anytime in the past.”

— Parthasarathi Biswas/Pune

Vivek Jain

Offshore entities: Sacvinam Global SA, Radiant World Holdings

Location: BVI, Hong Kong

Vivek Jain, a B.Com graduate, runs an agriculture equipment store in Madhya Pradesh. MF records show that he is a director in Sacvinam Global SA, a company registered in the British Virgin Islands in 2010, and a shareholder in Radiant World Holdings, registered in Hong Kong in 2011.

Records show that Jain held 79,000 shares in 2010 of Sacvinam, which has another director named Nahar Pinkesh. Radiant is listed as a shareholder of Sacvinam Global SA and a document dated December 2, 2011 shows that Jain was allotted 8.2 lakh shares of the company. His address in Mandsaur is reflected accurately in MF records.

RESPONSE: Jain said: “I have no idea about the existence of these companies. If a company is registered in my name and my address is given, I should have known. Pinkesh Nahar is the brother of my cousin’s husband Sachin Nahar. Pinkesh is a principal player in the two offshore entities. I was one of the many suppliers of mill scale (the flaky surface of hot rolled steel) and iron ore material that was collected at a plot owned by the brothers at Kandla Port in Gujarat. But in 2014, I stopped working with Sachin and Pinkesh because I made little profit since the export of these items to China stopped. I have had good business relations with the Nahar brothers but never suspected they were into any such activity.”

— Milind Ghatwai/Mandsaur

Amrita Jhaveri

Offshore entity: Amaya Limited

Location: Seychelles

Art diva opened Seychelles company to hold ‘asset in Switzerland’

In a 2013 interview to Sotheby’s magazine, art collector Amrita Jhaveri, speaking on her Amaya Collection, said the word in Sanskrit means without illusion. Mossack Fonseca documents show that Amaya Limited was the company she set up in Seychelles in 2005, primarily to “hold asset in Switzerland”.

The company was set up as A M Art India Private Limited on July 25, 2005 through HSBC Private Bank (Suisse) SA as client. Jhaveri had the power of attorney and Mossack Fonseca, as the registered agent, provided office bearers. The company issued a bearer share for 5,000 shares at $ 1 each to Jhaveri. It was renamed Amaya Limited on December 8, 2005.

For eight years, interaction between Mossack Fonseca and company administrators was mostly limited to occasional complaints about receiving bulky art catalogues. But it all changed after the Seychelles International Business Companies Act 1994 was amended in November 2013, necessitating change of bearer shares to registered shares and publication of an annual report from 2014 onward.

Told about the new legal requirements, an HSBC Private Bank (Suisse) executive wrote back to Mossack Fonseca in April 2014: “Until we have this subject clarified, we cannot go to our customers to ask for signature of the Indemnity letter as we will need to explain what type of financial records you need. As we only have holding companies for account held in Switzerland, they do not have financial statements. Once you know what type of information is acceptable, kindly let us know?”

In August 2014, documents show, Mossack Fonseca clarified that Amaya required to share details of the company’s activities, names of the countries where these activities were taking place, and a certified copy of Jhaveri’s passport as identity and address proof of the shareholder.

On September 5, 2014, the bearer share issued in 2005 was cancelled and all 5,000 shares were transferred to Jhaveri as resident of 27 Sadhana, Gamadia Road, Mumbai 26. The same day, Amaya indemnified Mossack Fonseca for providing office bearers, and authorised them to furnish company records if requested by the Seychelles Revenue Commission to meet an obligation under a tax treaty or by the Financial Intelligence Authority under the Money Laundering Act.

On January 26, 2015, Axel-Charles Stern, Managing Director, HSBC Private Bank (Suisse), asked Mossack Fonseca to “put it (Amaya) in ‘Struck Off’ status”. In response, Mossack Fonseca advised that if the company was not legally dissolved, it would continue to be active and have legal liabilities until the period for the last paid licence expired, which, in Amaya’s case, would be December 31, 2016.

“It is the duty of the Registered Agent,” Mossack Fonseca said, “to obtain and keep on its file all the pertinent documents for up to 5 years after the termination of the business relationship… Finally, if company is not formally dissolved, before closing the company file in our internal controls, our nominee directors shall revoke any enduring powers issued by them and shall declare that all registers and accounting records are kept at your address”.

On February 5, 2015, Stern confirmed that “the company needs to be ‘struck off’ as the dissolution process in Seychelles is difficult”.

Mossack Fonseca asked Stern to provide pending information on the last activity or purpose of the company and where it was carried out.

“The main activity is to hold asset in Switzerland, with some commercial activities (purchases and sales of paintings),” Stern replied.

Mossack Fonseca removed Amaya Ltd from its internal records and revoked the power of attorney issued to Jhaveri.

RESPONSE: Amrita Jhaveri did not respond to multiple emails and phone calls since March 16. Jhaveri Contemporary’s Mumbai office claimed they received the email only on April 6 and passed on the queries to Jhaveri, who was in London.

-Jay Mazoomdaar/ New Delhi

Onkar Kanwar

Offshore entity: J&S Systems Corporation

Location: BVI

Onkar Kanwar, chairman of Apollo Group, and his family members floated an offshore entity, J&S Systems Corporation, in BVI in 2010 and two trusts in 2014.

MF records show that the entity holds a million shares of 0.01 pence each in London Stock Exchange-listed Mercom Oil Sands plc, an apartment in London’s iconic ‘The Tower’, and accounts in Barclays Bank, Singapore, and Cayman National Bank and Trust Company Ltd in Isle of Man. The balance in Cayman on November 30, 2014 was GBP 3,65,478.26, records show.

Apart from Onkar Kanwar, Neeraj Kanwar and Simran Kanwar, who became the first shareholders in J&S on October 6, 2010, shares are also held by Onkar’s wife Taru Kanwar. J&S was registered on July 30, 2010 and the promoters disclosed that the source of funds in the entity would be proceeds from business trade.

Onkar Kanwar is categorised as a Politically Exposed Person by MF’s Compliance Department because he was a board member of the Kerala State Industrial Development Corporation from May 25, 2010 till September 20, 2014.

The address of Taru and Onkar in New Delhi’s Shanti Niketan is the same as that of Neeraj and Simran. In November 2013, the shareholding of J&S showed Onkar held 440 shares, Neeraj 570, Simran 430, Taru 100. Another 200 shares each were held by Simran and Neeraj together for their children Jai Karan and Syra. Records show that Onkar was a registered shareholder till March 14, 2014.

On January 30, 2014, Tara and Onkar floated a settlement called T&O Trust with Harneys Trustees Ltd. The final beneficiaries of the settlement were Jai Karan and Syra. On the same day, Neeraj and Simran floated a settlement S&N Trust with Harneys, listing Jai Karan and Syra as final beneficiaries.

In both cases, records show, the Trust Fund comprising 100 shares were to be split between Jai and Syra equally upon a “terminating event”.

Response: A spokesperson of Apollo Tyres stated: “India lawfully permits foreign investments in accordance with certain regulations. Any investment abroad, that the Kanwar family may have, is in due compliance with Indian laws, where applicable, including making disclosures wherever required. Much of family mentioned in your mail, are Non Residents of India (NRIs). They are covered by other nation’s permissible laws for their foreign investments, and are not covered by Indian laws & restrictions on residents, in matters such as Income Tax and RBI.”

— P Vaidyanathan Iyer/New Delhi

Kavita Kapilashrami

Offshore entity: Perfect Ten Group Ltd

Location: BVI

MF records show that Kavita Kapilashrami has been holding all 100 shares in Perfect Ten Group Ltd since November 29, 2010. RFG Nominees Ltd (Bahamas) held these shares from November 10-29, 2010.

Perfect Ten Group (BVI) was set up on July 1, 2010 and holds 100 shares in Pythhos Technology Holding (BVI) Inc since its incorporation on November 29, 2010. The other shareholders of Pythhos are BVI companies Park Presidio Ltd (400 shares) and Vivanta Holding Inc (100 shares), US resident MaryLouise K Dowd (100 shares) and Singapore’s Thakral Pte Ltd (1,220 shares since November 30, 2012). Kapilashrami was not available at the listed address in Gurgaon, and neighbours said she had shifted to another residence in the city a few years ago. When contacted, Kapilashrami described herself as “a vedic astrologer” with more than 10 years of experience and said that her husband was an entrepreneur.

RESPONSE: “I am no longer the beneficiary of Pythhos Technology Holding. I don’t know about Perfect Ten Group,” said Kapilashrami over the phone.

–Abhishek Angad/New Delhi

Anurag Kejriwal

No. of offshore entities: 3 plus 2 foundations

Location: British Virgin Islands (BVI), Panama

Anurag Kejriwal was the Delhi president of Lok Satta Party before being expelled following a purported sting operation by a TV channel ahead of the 201 4 Lok Sabha elections. MF records list him as a director in at least three offshore entities in the British Virgin Islands (BVI) and show that he floated at least two private foundations in Panama. He is also shown as holding power of attorney of another BVI company.

The Lok Satta was founded in 2006 by Jayaprakash Narayan, a former IAS officer. Kejriwal led the party’s unit in Delhi and was a member of its National Steering Committee but was expelled after the sting operation in April 2014. He lives in Delhi, has business interests in Kolkata.

The first company that the Kejriwals set up in BVI was Nedstar Ltd

Lok Satta had announced the candidature of Kejriwal from Krishna Nagar constituency for the Delhi assembly elections in December 2013, ten months after he was elected its state unit chief. The party, however, did not field any candidate in Delhi.

Kejriwal is a director in at least three offshore companies — Newington Group Trading Ltd, Nedstar Commercial Ltd and Krims Investments Inc – all registered in BVI. He also holds power of attorney with all rights in another company called Biscay Overseas Ltd, also registered in BVI.

The Kejriwal family has also floated two private foundations — The Nedstar Foundation and The Pruak Foundation. Nedstar Commercial also entered into a trade finance agreement with BNP Paribas (Suisse) SA to partly fund the sale and purchase of goods on September 3, 2007.

Anurag and wife Uttara Kejriwal are primary beneficiaries of the Nedstar Foundation and Pruak Foundation. Both foundations had initial assets of $10,000, and the final beneficiary was Priyavrata Kejriwal, the couple’s son, a minor.

Kejriwal, according to the Ministry of Corporate Affairs data, is a director in three companies — Anurag Intex (Chem) Pvt Ltd, Prawnex Seafoods International Ltd and Sucant Investments Pvt Ltd. Uttara is a director in two of these companies — Anurag Intex and Prawnex Seafoods. All the three companies are “active”, as per the data.

Anurag Intex, headquartered in Kolkata, West Bengal, is also a shareholder in BVI-registered Nedstar Commercial Limited. Anurag, Uttara and Tara Kejriwal are the other shareholders in Nedstar Commercial Ltd.

Kejriwal and Uttara were appointed as directors in Newington Group Trading Limited on April 27, 2009. But within a year, as they exited the entity, MF provided one of its own companies Directorship Management Ltd to act as a director on July 30, 2010. The same day, the board authorised Anurag to represent the company in India and Singapore in proceedings by or against the company.

On August 25, 2010, the board granted a General Power of Attorney to Kejriwal. In other words, Kejriwal got to control all affairs of the company, without his name showing as a director in the company.

The first BVI company the Kejriwals set up was Nedstar Commercial Ltd. The BVI firm’s Register of Members shows Anurag, Uttara, Tara and Kolkata-headquartered Anurag Intex (Chem) Private Ltd as members at various points of time from May 21, 2007 till December 15, 2008. Finally, The Nedstar Foundation became the sole member.

RESPONSE: Anurag Kejriwal said: “I am a businessman, and I trade in iron ore. We acted as agents. We got commissions through proper business channels. My partners had agreed to finance or support the exports of iron ore. So they said I could set up these entities. A chartered accountant helped us set them up.”

On whether he had informed Indian authorities about these companies, Kejriwal said: “The offshore bug did bite me. But I soon realised that setting up entities in BVI and Panama can land me in problems. Nothing remains a secret. Moreover, there were too many hassles with the Reserve Bank of India rules relating to offshore. When these entities were set up, the RBI’s Liberalised Remittance Scheme (LRS) allowed an individual to spend up to $100,000 a year abroad. But I was told that all income whatsoever earned in the offshore entities had to be brought back to India every three months. Moreover, getting bank credit for exports was not so easy. The foreign banks ask for a strong capital base, which we did not have. So these entities were closed down by 2010. The two foundations were closed within a short period of them being set up.”

—P Vaidyanathan Iyer/New Delhi

Amrendra Kumar

Offshore entity: Ingold Resources Ltd

Location: BVI

Ingold was incorporated on February 26, 2001 and issued 50,000 bearer shares on April 4, 2001. MF records show that these shares were transferred to Amrendra Kumar, then listed as a resident of Moscow, on March 9, 2010. Records also show that Kumar is the beneficial owner of Ingold.

The other listed address of Amrendra is in Gurgaon, which is a bungalow that was under renovation when The Indian Express visited on April 27. No one was available for comment at the address, but when Amrendra’s father Ram Nath Singh was contacted on a telephone number provided by neighbours, he denied any knowledge of Ingold and said that his son was working in Dubai.

Mossack Fonseca (MF) records show that Ingold entered into a Trade Finance Security Agreement dated October 8, 2001 with BNP Paribas (Suisse) SA and the discharge date was February 2, 2014.

RESPONSE: “I’ll not be able to respond to your emails but let me tell you that I have been an NRI for over 25 years now,” said Amrendra Kumar over phone.

-Abhishek Angad/New Delhi

Bhavanasi Jaya Kumar

Offshore entities: Nandan Technologies Ltd, Yes de Ventures SA, Grandbay Canal Ltd, Others

Location: BVI

Hyderabad-based businessman Bhavanasi Jaya Kumar figures in the MF records as a director of some of these companies along with Srinivas Prasad and Volam Bhaskar Rao. Nandan Technologies Ltd, the records show, was opened in the BVI in 2008, and Grandbay Canal Ltd in 2015. Jaya Kumar was director of six companies associated with Nandan Technologies.

RESPONSE: Jaya Kumar said: “I have nothing to do with offshore companies like Nandan Technologies Ltd, Yes de Ventures SA or Grandbay Canal Ltd. Volam Bhaskar Rao was the managing director who handled everything. I am not aware of any offshore accounts. The original company Nandan Technologies was closed down in 2014.” On Lotus Integrated Solutions and Lucid Info, two other companies that figure in the MF list, Jaya Kumar first denied knowledge. When told that the address of both companies is his flat, No. 204 in Meenakshi Royal Court Apartments, he said they were his wife’s companies. He denied being associated with Sika Securities or Bee Pee Investments.

On the legality of the firms, he said: “I do not know what is the status now, it has been five years. But we took all necessary permissions. I have no knowledge about declarations to tax authorities.”

— Sreenivas Janyala/Hyderabad

Jagpreet Singh Lamba

Offshore entity: Petunia Group Holdings Ltd

Location: BVI

Records show Jagpreet Singh Lamba, resident of Delhi’s Defence Colony, is the beneficial owner of Petunia Holdings Ltd. The company was set up on November 18, 2013 as a shelf company. It was acquired on January 6, 2014 and MTC Investments Ltd (Dubai) held one share till it was transferred to Lamba on March 12, 2014.

MCD UAE Ltd, represented by Tara Kelly and Mehul Goradia, acted as the sole director of Petunia Holdings Ltd (BVI). According to minerva-trust.com, Kelly and Goradia are members of the Dubai team of Minerva Trust (Jersey), a corporate service provider.

On June 11, 2015, Petunia Holdings Ltd (BVI) dissolved its subsidiary Aoon Intertrade FZE based in Sharjah International Airport Free (SAIF) Zone due to “slowdown in business”.

RESPONSE: At his Defence Colony residence, Lamba’s wife said he was travelling abroad. Speaking over the phone, Lamba said he would ask his “office to email all the details”. His office is yet to respond. The Indian Express delivered a questionnaire at Lamba’s residence but is yet to receive a response.

–Jay Mazoomdaar/New Delhi

Bharmal Lodha

Offshore entity: Dependable Investments Ltd

Location: British Virgin Islands (BVI)

Bharmal Lodha is a director and shareholder in the company that was incorporated on January 2, 1996. On December 1, 2000, Lodha was issued two share certificates, the first representing one share and the second representing 7,999 shares. On the same day, he was also appointed a director. Mossack Fonseca (MF) documents describe his profession as ‘merchant’. On October 20, 2010, Lodha signed a resolution that the Register of Directors and Register of Members be adopted as the original RoD and RoM of the company.

Lodha was appointed as director by Hemendra Narharilal Patel, an NRI with a Kowloon address, who was himself appointed as a director in the company on January 29, 1996. On the same day, he was issued one share and subsequently issued 1,999 shares on December 1, 2000. In February 2012, Louis Lai & Luk, a Certified Public Accountant representing Dependable informed MF that the company will not pay the annual licence fee and registered agent fee for 2012 and will let the BVI government strike it off for non-payment. It also resigned as administrator for Dependable. The company was struck off the register on October 31, 2012.

RESPONSE: “Dependable Investments Limited, British Virgin Islands, was set up by my former employer Hemendra Patel. He is an NRI. I was employed with him at a steel firm in Dubai in 2000. He used my name as a director and shareholder. I don’t know why he floated the company. I don’t know whether RBI permission was sought to incorporate the company. I was an NRI between 1998 and 2001 and was not required to disclose the information to income-tax authorities. I contacted Patel recently and he told me that the company was closed a long time ago. I have asked him for the closure certificate and he said that he is currently in Hong Kong and would send it to me once he is back in India.”

– Srinath Rao/Mumbai

Mohan Lal Lohia

Offshore entities: Venton Group Ltd, Lohia Charitable Foundation

Location:BVI & Panama

Well-known industrialist Mohan Lal Lohia is Chairman Emeritus of Indo Rama Synthetics and Chairman of Indo Rama Holdings Ltd. MF documents show that Lohia is the “first director” of Venton Group Ltd, registered in the BVI in 2007 with its objectives listed as “broad” and India address as Greater Kailash in New Delhi. In November 2012, MF was instructed via email to let Venton “die a natural death”.

MF records show that Lohia also set up the Lohia Charitable Foundation, an NGO, in Panama in January 2010 with a corpus of $10,000. Apart from Lohia, his grandson Amit Lohia and daughter-in-law Seema Lohia are listed as members of the foundation’s family council. There are no closure documents available for the foundation, with records listing communication, such as requests for copies of incumbency certificates, till as late as July 2015.

Response: A company spokesperson said: “Mohan Lal Lohia is father of Shri Om Prakash Lohia, chairman and managing director of our company. Mohan Lal Lohia, Seema Lohia and Amit Lohia all are non-residents and are settled abroad. Although I am not aware about the overseas entities as stated in your mail, however, to my understanding activities carried overseas by NRIs are not required to be informed to Income Tax authorities or Reserve Bank of India in India.”

— Ritu Sarin/New Delhi

Ashok Malhotra

Offshore entity: E&P Onlookers Limited

Location: BVI

Ashok Malhotra was the shareholder and director of E&P Onlookers Ltd, a company set up in the British Virgin Islands on September 25, 2008, according to MF records. Sandeep Rastogi, a British citizen, was the company’s first director. Malhotra became the director of E&P Onlookers Ltd on February 18, 2009. Sandeep Rastogi resigned and transferred all five shares to Malhotra, records show.

They show that Malhotra held the shares at least till September 4, 2009, and signed a resolution as the sole director of E&P Onlookers Limited (BVI) on November 10, 2009. E&P Onlookers Ltd was inactivated on June 28, 2010.

RESPONSE: Malhotra said: “Sandeep Rastogi is a friend. Even if the shares were transferred, as you say, I don’t remember that at all. It had been a long time and the shares were sold off immediately. It was only for a month or so.”

— Aniruddha Ghosal/Kolkata

Ashok Malhotra

Offshore entity: E&P Onlookers Limited

Location: BVI

Living in a modest peach coloured apartment building at 35B Prince Ghulam Mohammad Shah Road, 63-year-old Ashok Malhotra is being administered medication. “I have cancer,” he says, adding,”I am very unwell, I won’t be able to talk much.”

Malhotra, who figures in the Mossack Fonseca (MF) papers, says he knows of the case. “When is it being published? Someone from The Indian Express office had called me. I won’t be able to give you details. This was years ago. I had the company E&P Onlookers Limited, but just for a couple of months. There was a middleman,” he says.

Asked what he does, Malhotra first says “offshore”, then adds mysteriously, “oil”.

But he quickly changes his story. “I was in service,” he says. “I was in sales in the Kolkata branch of a Delhi-based company. I can’t tell you the name of the company. I am retired now, and live here with my family. My son doesn’t live in Kolkata. Look at my home, does it look like the home of someone who has a lot of wealth?” he asks.

Originally from Himachal, Malhotra says he has lived in Kolkata all his life.

In a neighbouring colony, another house rented out to small-time construction company, is listed as Malhotra’s office address on listings sites on the Internet. The address is 60/112 Hari Pada Dutta Lane, and the name of the office is listed as Swift Consultants Private Limited. Landlady Devika Roy says, “Yes, Ashok Malhotra had an office here. But that was some six-seven years ago. I don’t know what they did, he never came himself. Two of his boys would come and sit here.”

— Esha Roy/Kolkata

Johnny Manglani

Offshore entities: JM Group of Companies Ltd, Others

Location: BVI, Cyprus

A major player in men’s fashion clothing, Johnny Manglani has registered a host of offshore entities in the BVI and Cyprus. There are almost 1,000 MF documents listed for one of them, JM Group of Companies Ltd, which was registered in 2007, including records of at least seven other Cyprus firms of which it is shown as the holding company. Manglani’s wife Elmira and daughters Anita and Dasha are listed as shareholders of JM Group of Companies Ltd.

JM Group of Companies was incorporated in the BVI in 2007

An MF mail from 2013 shows that all these companies trade in fashion garments from Italian manufacturers such as Corneliani, Artioli, Belvest, Dalmine and Raffaele Caruso Hettabretz, and the French company Zilli. Manglani runs at least 12 Italian couture boutiques in Russia, with other stores opening in Macau and Singapore.

Manglani has also set up another company, Uomo Collezioni Corporation, which is also the name of his flagship stores abroad. It was set up in 2007 in the BVI with the holding company JM Group of Companies Ltd as its shareholder. All the shares of another company, Hepworth Investments Ltd, have been pledged to the holding company.

MF documents show that in July 2011 he arranged for a revolving overdraft facility of Euro 2.5 million from a Bank in Cyprus. Documents show the revolving overdraft was taken in the name of Jadem Limited with the “purpose” of financing working capital needs (purchase of inventory) relating to trading of fashion garments in Russia under the Uomo Collezioni trademark. The guarantor for the agreement is Manglani himself. Manglani’s Mumbai address islisted in several other company incorporation documents and the passport provided to MF.

RESPONSE: Manglani said: “I am a Singaporean citizen and want to clarify that I am not aware of the information below (the questions sent to him)… I highly recommend that you chase corrupt Indian citizens and crooked businessmen rather than Singaporeans…”

— RITU SARIN/NEW DELHI

George Mathew

Offshore entities: Soul Rhythm International Limited, Others

Location: BVI

Thiruvananthapuram native George Mathew is a chartered accountant who moved to Singapore 12 years ago. He launched a firm, Future Books, which describes itself as a one-stop service-provider for setting up companies.

MF records show Mathew has been associated with a clutch of offshore entities registered in the BVI around 2011. He is shown as a director or nominee director, and several Powers of Attorney have been signed by him for the companies, among which there is a lot of cross-shareholding. BVI companies linked to him include Soul Rhythm International Limited, Seabridge Group Holdings Ltd, Azaxel Asset Holdings Limited, Hallwood Enterprise Ltd, and The Wonderful Solutions Corporation. MF records contain his addresses in Singapore and Kerala.

RESPONSE: Mathew told The Indian Express from Singapore that he has been an NRI for several years, and RBI regulations did not apply to him. “For the last 12 years, I have been away from India,” he said. Asked about Wonderful Solutions and Soul Rhythm International Limited, Mathew said: “These companies belong to our clients, who are natives of Singapore. The RBI and the Income-Tax Department of India have little to do with them.”

— Shaju Philip/ Thiruvananthapuram

Thomas Peediakkal Parambil Mathew & Pirwani Abdul Kadar Kasambhai

Offshore entity: Pamkind Ltd

Location: Bahamas

On February 8, 2001, Pamkind was incorporated, and Thomas Mathew and Pirwani Abdul Kadar Kasambhai issued one share each and appointed directors.

Mathew has been working in Indonesia for the last two years. He worked for a firm in Bahrain in the 1990s before moving to the UK and back to Alappuzha in Kerala. Later, Mathew went to Malaysia and returned to Alappuzha before moving to Indonesia.

Kadar Pirwani is a resident of Adamji Nagar in Vartej village on the outskirts of Bhavnagar city. Pirwani, who studied up to Class VIII, helped his father in the family business of brick kilns before entering the ship-breaking industry in 1990-91. He partnered with Ajay Kumar Bhatia of Punjab and started recycling ships under the banner Baldev Shipbreakers at the Alang yard in Bhavnagar.

Gujarat Maritime Board took possession of the plot of Baldev Shipbreakers in 2001-02, says Pirwani, adding that the matter is pending in Gujarat High Court. Pirwani said he now trades in metal scrap while Bhatia has settled in Dubai.

RESPONSE: Pirwani said he came in contact with Mathew after deciding to form a shell company. “We incorporated a company to purchase ships. But the company couldn’t do any business and we closed it down within two years. Mathew was a broker who provided the service of incorporating offshore companies. We gave him around Rs 1 lakh and provided details of my passport for setting up the company. He also became a director. We chose the Bahamas as one could set up a company there with a capital of just $1 and because ships were available there. He spent around Rs 50,000 for incorporating the company kept the balance Rs 50,000 as his profit for the services provided,” said Pirwani.

“The company never did any business. I did not even receive papers of its incorporation. Matthew told me that the formality of setting up the firm had been completed. After the recycling plot was taken away from us by the GMB, we defaulted on a bank loan and decided to close down Pamkind Limited,” said Pirwani. Asked if he obtained RBI permission, Pirwani said, “It was not an investment. I had given the money to Mathew for setting up the new company. Even if it is treated as investment in an overseas company, the amount was just $1, which would not require RBI permission.”

“Almost all ship-breakers have an overseas firm since incorporating one is so cheap. Plus, in the event of a ship capsizing or its operation being halted due to any claim, the liability will be just $1,” he said.

When contacted on April 28, Thomas Mathew’s wife Asha Thomas said: “He might have launched the firm in the Bahamas when he was in the UK in the early 2000s. But it did not take off. He might have registered the firm but not undertake any business activity. I don’t know anything more,’’ she said. Thomas declined to provide Mathew’s contact details in Indonesia and said she had asked him “to call you back’. He is yet to respond.