Income Tax India: Expert advice, 2017-18

This is a collection of articles archived for the excellence of their content. |

How to pay less taxes in 2017-18, and after

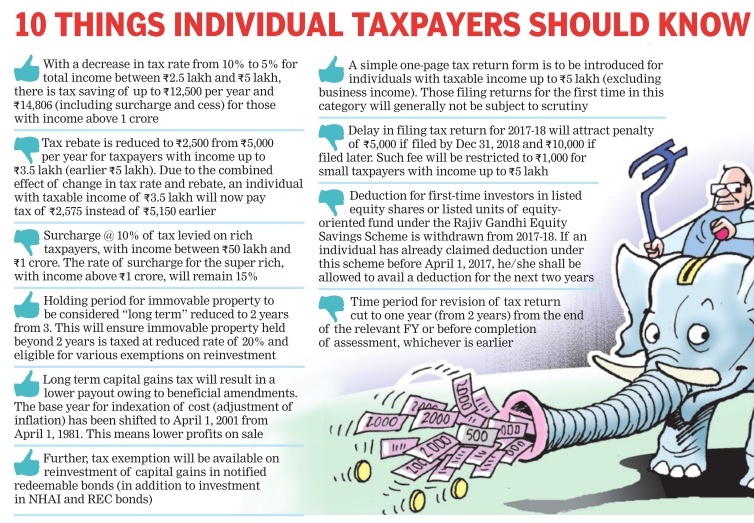

See graphic.

3 personal income tax mistakes to avoid

The Times of India, Feb 02 2017

3 PERSONAL INCOME TAX GOOGLIES YOU SHOULD WATCH OUT FOR Investing in house property is an attractive proposition, with availability of home loans. In case of self-occupied property, the interest on home loan is allowed a deduction of up to 2 lakh. However, if the property has been let out (which is typically the case if you own more than one house), the interest was fully allowed.This, in some instances, could result in a loss under the head `Income from House Property'. The loss could be set off fully against income under other heads such as salary income, during that particular financial year. Now, there is a cap of 2 lakh for set off of such loss from house property, against other heads of income.The unabsorbed loss can be carried forward and set off over a period of eight years, but such adjustment is possible only against income from house property

Self-employed individuals, such as professionals like doctors or advocates, or even those engaged in vocations, like fitness trainers or beauticians, can now invest up to 20% of their gross total income in the National Pension Scheme (NPS).They would get a tax deduction from their taxable income. However, here is the catch. The overall limit of aggregate investments of 1.5 lakh stands

Withdrawals from NPS attract tax. Forty per cent of the total amount standing to your credit in the NPS is not taxable on closure or opting out of the scheme. From April 1, 2017, on partial withdrawal, up to 25% of the contribution made by the employee is tax-free. While investments made by self-employed in NPS have been given a fillip, the benefits on withdrawal are available only to the salaried

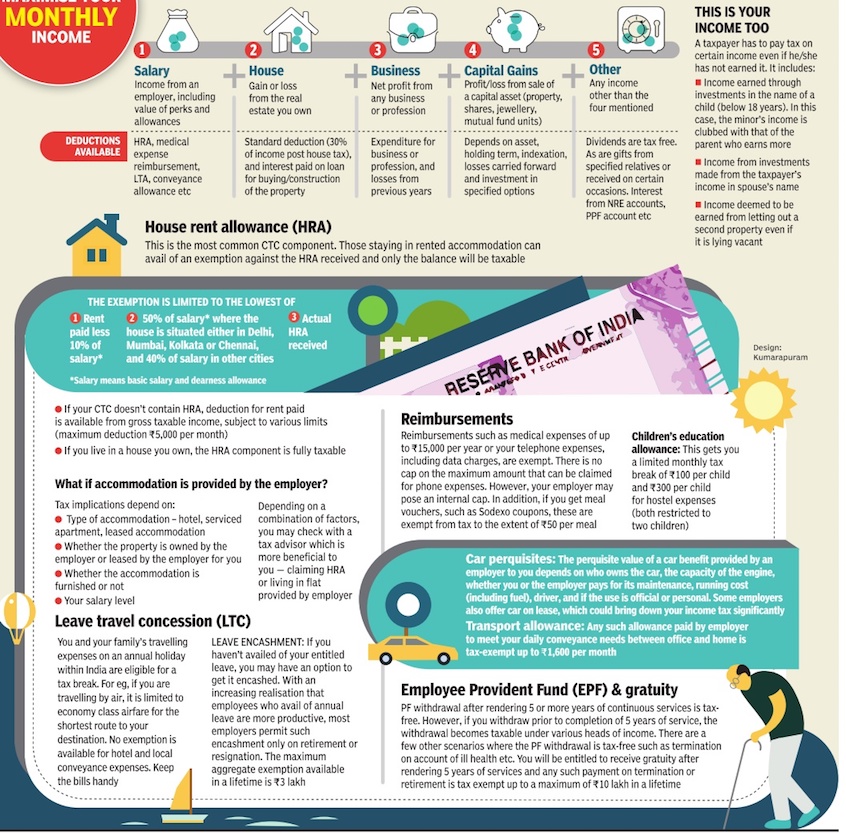

How to maximise your monthly income

See graphic

How to maximise your annual income

See graphic

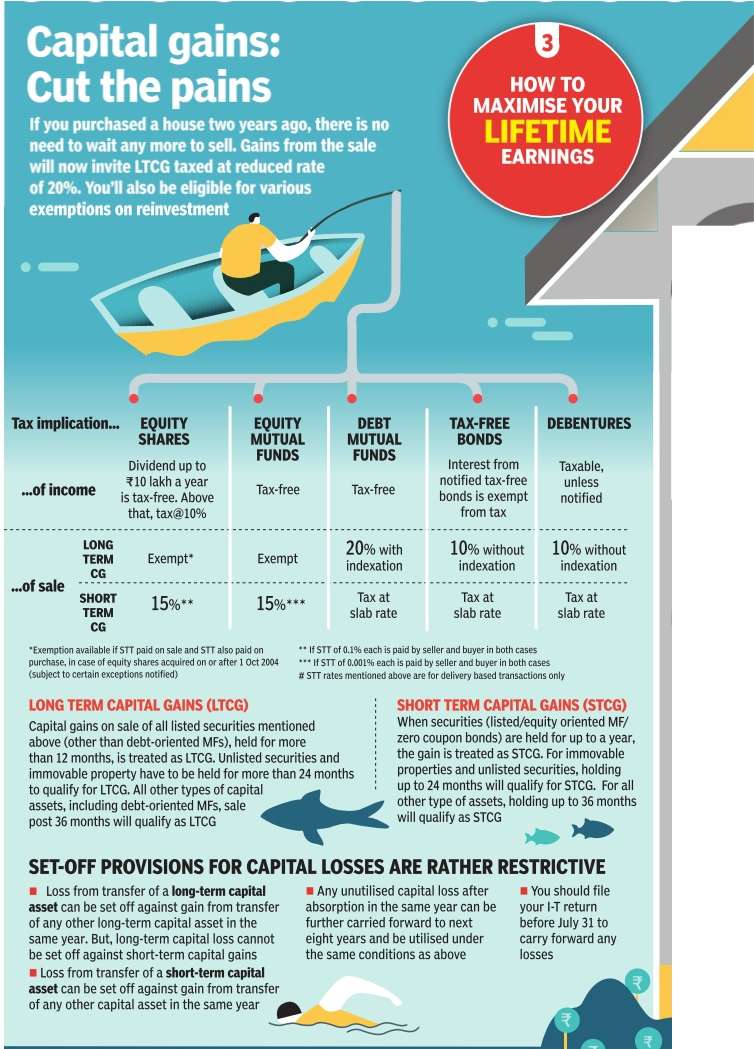

How to maximise your lifetime earnings

See graphic

Tips from experts

The Times of India, Feb 02 2017

1. JOINT HOME LOANS

If you have purchased a new apartment jointly, say, with your spouse, and are also paying the home loan jointly, then each of you is entitled to deduction of 2 lakh-2.5 lakh. In case you have a working sondaughter and the bank is willing to split the loan three ways, all three can avail deduction

2. PERK

Hotel accommodation given by employer for the first 15 days when you move to a new town on transfer is not a taxable perquisite

3. TRAVEL

LTC exemption is allowed to you as a salaried employee in respect of two domestic journeys taken in a block of 4 calendar years. The current block of four years commenced on January 1, 2014.So if you haven't taken that much-needed break last year, do so now. Keep proper tabs, retain relevant travel bills and claim your LTC

4. TRANSPORT

For claiming transport allowance exemption, you don't need to submit expense proof. But if you are incurring expenses on official travel, your employer can reimburse the expense on the basis of the claim submitted (backed by bills) and this is not taxable

5. PROVIDENT FUND

There is a block-in period of 5 years for PPF withdrawals. But a loan on the accumulated balance may be obtained (after expiry of one year from the end of the financial year in which initial deposit was made) for certain purposes, subject to various limits

6. HOUSE RENT

An individual can claim deduction under Section 80GG for rent paid even if the employer doesn't give HRA. The condition is that he or she doesn't own a house and neither does the spouse or child. The deduction is subject to a ceiling of 5,000 per month

7. ESOPS

No need to pay tax when options are granted by your employer to you under an employee stock option plan.Taxability arises on actual allotment of shares and not on grant or vesting of options.Such income is taxed as regular salary income and is subject to tax withholding by the employer

8. HRA & LOAN

So you get HRA and have a home loan? HRA exemption and interest deduction on housing loan can be availed simultaneously, if the house bought with the loan is in a city different from the place of work, where you've rented a house as daily commuting is not possible

Home loans

All about home loans in your interest, Feb 2, 2017: The Times of India

For those who have been eyeing a home for years, 2017 may be a good year to jump in. Home loan rates are down, as are property prices. Plus you get tax breaks

Five things you need to know about house property

1 Even a loan taken from an employer, friend, private lender is eligible for deduction--but only on interest and not principal. And you'll need a certificate from the lender

2 Booking an apartment which is under construction is sometimes cheaper. I-T law permits you to claim the total interest paid during the pre-delivery period as a deduction in five equal instalments starting from the financial year in which the construction was completed or you acquired your apartment (generally this denotes the date of possession).Of course, the maximum you can claim as a deduction per year continues to be 2 lakh, in case of self-occupied property

3 It makes tax sense to purchase the new apartment jointly say with your spouse, then each of you is entitled to a deduction of 2 lakh for interest funded by each of you, as explained above. In case you have a working sondaughter and the bank is willing to split the loan three ways, all three can avail deduction up to 2 lakh each on selfoccupied property

4 If you have a second house, it makes better tax sense to rent it out rather than keeping it empty . An empty second house will still attract tax on its `deemed value'.In other words, tax is calculated at expected market rent

5 Expenses towards repair and maintenance are not allowed as a deduction income from house property . However, a standard deduction @ 30% of gross value (generally the rent received) is allowed to compensate for repair and maintenance expenses of a house property . This is allowed irrespective of actual expense. Also, deduction towards municipal taxes paid during the financial year is allowed irrespective of the year to which it pertains. The above is not applicable to self-occupied property

Tax benefits on principal

Equated monthly instalments (EMIs) are typically divided into principal (the amount you took as loan) and interest (the cost of servicing the loan) Principal is allowed as a deduction from your gross total income (subject to an overall cap of 1.5 lakh with other eligible investments)

Tax benefits on interest paid

Interest payable on `selfoccupied' property is subject to a maximum deduction of 2 lakh under the head `Income from house property'. It can be set off against other income, which includes salary income, in the same year. This reduces your total tax liability. But to claim this, it is essential that the acquisition or construction is completed within 5 years from the end of the financial year in which the loan was taken; else the deduction will be limited to 30,000 Additional deduction of 50,000 for interest paid shall be allowed for first-time buyers if certain conditions are fulfilled

Documents you should have for tax purposes

See graphic.

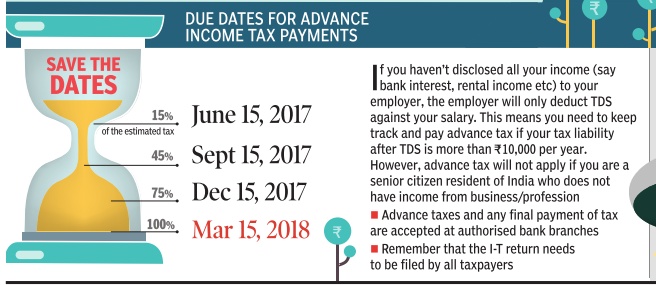

Due dates for advance income tax payments

See graphic:

Due dates for advance income tax payments, 2017-18

See also

Direct taxes: India / Income Tax India: Expert advice / Income Tax India: Expert advice, 2016-17 / Income Tax India: Expert advice, 2017-18 / Income Tax India: Expert advice, 2018-19 / Income Tax India: Laws / Income Tax India: NRIs / Wealth tax: India