HCL Technologies

This is a collection of articles archived for the excellence of their content. |

Acquisitions

2018: : HCL Tech acquires IBM’s software assets

From: Shilpa Phadnis, HCL Tech acquires IBM’s software assets for $1.8bn, December 8, 2018: The Times of India

Products Have 5K Users, Addressable Mkt Pegged At $50Bn

HCL Technologies is placing a massive bet on software products. The company said it will spend $1.8 billion to buy select software assets of IBM, making it perhaps the largest acquisition of a business by an Indian IT services company. The products are in the areas of security, marketing and commerce. Some 5,000 customers already use these products and the company said there is an addressable market of $50 billion.

Indian investors were not convinced about the value of the deal, and pushed the HCL Tech share price down by 5% on Friday. But some analysts said it’s too soon to make a judgment and attributed the stock market response to a lack of understanding among investors on how to value a software business, as against Indian IT’s traditional services business, and on HCL’s new strategic priorities. The deal will be financed through a combination of internal accruals and a debt of $300 million.

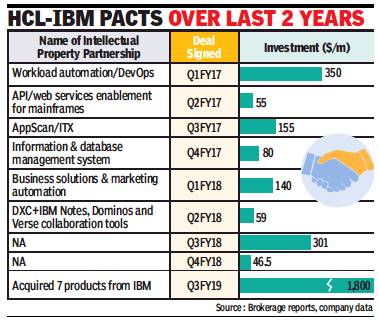

For IBM, the products are old and do not fit into its current focus areas related to the cloud and cognitive computing. But these are products that many enterprises around the world continue to use, and who would like to continue using them, provided they are upgraded, managed and serviced. HCL has had an intellectual property (IP) partnership with IBM for about two years on some of these products, where the former would develop the products and the latter would sell and service them. Now, HCL is buying out all of these products, and some others.

“With this move, HCL gains the entire value chain for these products — the development teams, partners, resellers, clients and service organisations. HCL’s plan is to revive these products, which already have an established client base, offer upgrades, cloud-enable the products where possible, and, first, build a large software business of its own and, second, leverage these tools in their services business as well,” Hansa Iyengar, IT analyst in Ovum Research, said.

HCL Technologies CEO C Vijayakumar said the products being acquired are in large growing market areas like security, marketing and commerce. “We expect incremental revenue of $650 million on a run-rate basis in the second year after (deal) close,” he said. He added that the revenue in the first year is expected to be $25 million lower due to the transition and ebitda margin is expected to be over 50% on a run-rate basis.

Pankaj Kapoor of brokerage firm JM Financial said the acquisitions would also require incremental investments in sales and product engineering capabilities to achieve the stated financial objectives.