Gautam Adani

This is a collection of articles archived for the excellence of their content. |

Contents |

A profile

As an industrialist

He has emerged as India's most-talked-about industrialist due to his proximity to PM Narendra Modi. An entrepreneur who made his fortunes in Gujarat, where he worked closely with Modi, he was a part of the PM's business delegation to Japan in August and his trip to the United States in September.

Adani Enterprises shares have risen threefold, Adani Ports by 65.36 per cent and Adani Power by 53.94 per cent since September 2013.

He has set audacious goals for himself, announcing big-ticket moves immediately after the BJP swept the Lok Sabha elections in May 2014. Acquired Dhamra Port in Odisha in May 2014 and a Lanco Infratech power plant in August 2014.

Silent treatment

Rarely speaks in public. He remained silent in the face of allegations of favouritism made by Modi's rivals Rahul Gandhi and Arvind Kejriwal during the 2014 poll campaign.

As in 2022

Harit Mehta, Sep 25, 2022: The Times of India

From: Harit Mehta, Sep 25, 2022: The Times of India

When Boris Johnson called on India-made billionaire Gautam Adani at his sprawling office in Ahmedabad during an official visit to India as UK’s prime minister, he was curious as to why the fastest-growing conglomerate hadn’t already moved its headquarters to Mumbai or Delhi. “Unlike the big cities, there are no distractions here. I can focus on work here,” Adani told Johnson with a smile. “Besides, I like sticking to my roots. ”

Being grounded for this teetotaller tycoon means observing a strict vegetarian diet and not uncorking the bubbly while sealing deals: “I prefer raising a toast with sparkling water,” he says with a laugh. Moored to Ahmedabad, the Adani group has made about 40 acquisitions across the world over the past decade, 35 of them in the past five years.

Over the past year alone, this 60-year-old, first-generation businessman has added Rs 1,600 crore a day to his wealth, now amounting to about Rs 11. 5 lakh crore. To put things in perspective, he has surpassed fellow Gujarati Mukesh Ambani. In 2021, Ambani was ahead of Adani by Rs 2 lakh crore in terms of total net worth. In 2022, Adani is ahead of Ambani by Rs 4. 6 lakh crore.

The Adani empire was built in 40 years out of virtually nothing. Born to a Gujarati Jain family of textile traders who migrated from Tharad in north Gujarat to Ahmedabad, Adani had seven siblings with whom he grew up in the modest Ratanpole area of the Walled City.

One of the fi rst triggers for his limitless aspiration was a comment made in jest by his maternal uncle just after Adani had taken his matriculation exams in 1977. The uncle joked that Adani would have to carryon with the small family-run textile business no matter how much he studied. “That set off something inside me. I was a good student. But those words started a thought process of thinking big,” he says. Adani joined a college in Mumbai soon thereafter. While studying commerce, his sharp trading instincts made him try his hand at the diamond trade. He had to drop out of college to help his family run the small textile factory they had started in Gujarat. And, for a while, he turned entrepreneur himself, making plastic from granules. In the late 1980s he realised that trading was his forte and set up Adani Exports, which turned into the country’s leading player within no time because of the speed with which Adani could spot opportunities and strike deals anywhere in the world.

“Dreams were infinite but finances finite,” he says with engaging frankness. The group used credit lines with Gujarat State Export Corporation (GSEC), a state-owned company which encouraged export businesses. Some years later, the company decided to cut its risk and curtail edits spread. “When we couldn’t get credit lines easily, we had to do something different. We could grow so much because we didn’t take the easy road. We were born again in the true sense,” Adani says. Nobody imagined that two decades later the Adani Group would acquire GSEC.

“Not many believe me when I say I always go with the flow,” says Adani while enjoying a simple but scrumptious Gujarati lunch – perhaps his only indulgence after Hindi movies. It was this go-with-the-fl ow principle that laid the foundations of India’s first private port in Mundra. When an American company pulled out of a joint venture to build a jetty in the early 1990s, Adani did not give up the plan as momentum had been built up. As luck would have it, in 1995, Gujarat launched a new port policy focused on the PPP(public-private partnership) model to develop six ports. Mundra was one of them.

To use a cliché, Adani has never looked back since. Mundra port was commissioned in 1998, and by the time Narendra Modi took the Gujarat CM’s chair in 2001, the Adani Group had transformed from an export house to an infrastructure company. Asked about his purported proximity to PM Modi, Adani says he has maintained good relations with everybody cutting across party lines. Among those he befriended was the late Chimanbhai Patel – then Gujarat CM from the Congress – at Ahmedabad airport. In the last few weeks alone, he has met Mamata Banerjee and Uddhav Thackeray – no friends of the BJP. And he has been investing in states governed by various political parties. On the business front, too, there are questions as to whether he’s in too much of a hurry, and whether he’s been overly aggressive in borrowing to grow – but none of this worries him.

In affluence, this college dropout has spectacularly graduated from a Fiat to a fleet of BMWs and a Ferrari. Apart from helicopters, the group owns half a dozen airplanes – four more will be added to the fleet soon. A soaring market capitalisation (shareholderwealth) – which on Friday catapulted the group past the Tatas as the most valued in the country – and growing clout have not changed the man. The same holds true for his wife Priti and sons Karan and Jeet, who remain unassuming and simple despite skyrocketing riches, say people close to Adani.

Ironically, for a man foraying into the media business, he doesn’t like publicity. “He keeps a low profile even during company AGMs. Even now he is extremely choosy in accepting from a deluge of requests to speak. He epitomises the maxim that actions speak louder than words,” says a close aide. “He possesses one of the fi nest art collections in the country, but he doesn’t like talking about it. He loves being self-effacing, Gujarati-style,” says a top art curator of the country.

“Gautam Adani has evolved as a businessman. But his core remains the same – humble and hands-on,” says a close associate who underlines his boss’s habit of answering every message and mail before he retires to bed. His responsiveness, his admirers say, is based on genuine empathy. One day, a widowed Kutch woman completely unknown to him sent an email saying that while her son already had a job, it was her desire that he be employed with the Adani Group. Adani forwarded the email to an executive the moment he fi nished readingit. The woman’s son was hired the next day. The man is now a rising star, a turn of events that testifies not only to Adani’s random acts of kindness but also his uncanny instinct to back the hunger for success he sees among the middle class.

“He visits the best restaurants across the world but still loves the experience of a fast-food joint. He owns the best brands but loves to shop online to get a feel of it,” says a family member.

“He may have taken you to task at offi ce but once at home, he is a different man,” says another family member, recalling how the billionaire never compromises on vacations and get-togethers with his extended family. An employee recalls how Adani chided a group CEO for being a workaholic. “Gautambhai invited this top executive and his family to spend a Sunday with him just so he could take a break from work. ”

THE JOURNEY TO THE WORLD’S SECOND-LARGEST FORTUNE

Adani Group, which has a market cap of 22L crore, had a humble beginning. In 1988, Gautam Adani set up Adani Enterprises to start a commodities trading business. In the last two decades, the group entered many sectors through greenfield projects, acquisitions and JVs. His net worth is 11. 5L crore now

YEAR-WISE DEVELOPMENTS

1988-2020 – August 22

Partha Sinha, August 31, 2022: The Times of India

From: Partha Sinha, August 31, 2022: The Times of India

Mumbai: In a little over two and half years, Gautam Adani’s wealth has galloped over 13 times. In January 2020, his net worth was about $10 billion. In Indian currency, Adani’s current net worth translates to nearly Rs 11 lakh crore.

For perspective, only two companies in India–Reliance Industries (RIL) and Tata Consultancy Services (TCS) — are valued more than the business tycoon’s net worth. RIL’s market cap is Rs 17.9 lakh crore while TCS’s is at Rs 11.8 lakh crore.

Musk, the founder of electric passenger vehicle leader Tesla and space explorations firm SpaceX, currently has a net worth of $251 billion and leads the world’s rich list. He is followed by Amazon’s Jeff Bezos with a net worth of $153 billion.

The Adani group, with a combined market cap of a little over $250 billion (or about Rs 20 lakh crore) now, had a humble beginning. In 1988, Adani set up Adani Enterprises (then Adani Exports) to start a commodities trading business. Soon he set up Mundra port for captive export-import operations. Within a decade it also emerged as the biggest coal trading company in the country and one of India’s largest foreign exchange earners.

In the last two decades the group has entered several new businesses, through green field projects, acquisitions and joint ventures. It set up thermal and renewable power generation projects, acquired several ports along India’s coastline and also set up power transmission lines across the country. It will be setting up data centres, and started its media business and has made huge investment commitments in the renewable energy space. The rapid rise of the group has also attracted investment from top firms such as Total Energies SE and Abu Dhabi’s IHC.

2020-21: world’s top wealth gainer

BLOOMBERG, March 13, 2021: The Times of India

Adani world’s top wealth gainer

Gautam Adani has added more billions to his wealth than any one else in the world this year on the back of investor excitement around his ports-to-power plants conglomerate.

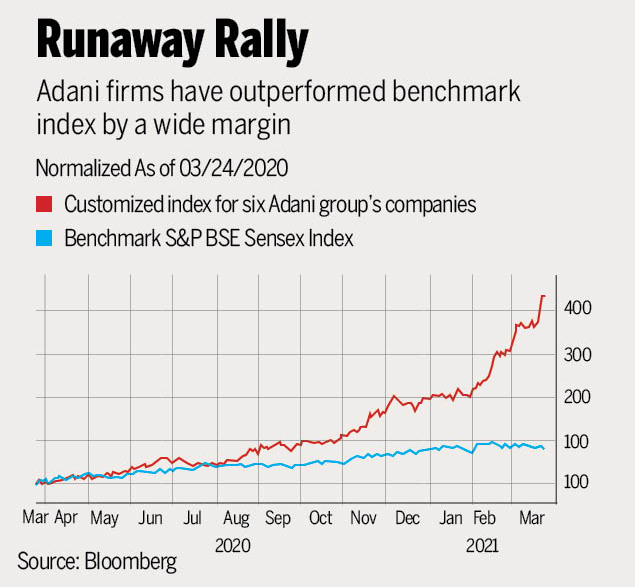

The net worth of Adani has jumped $16.2 billion in 2021 to $50 billion, according to the Bloomberg Billionaires Index. This has made him the year’s biggest wealth gainer, beating even Elon Musk, who has tussled with Jeff Bezos in 2021 for the title of world’s richest. Shares of all Adani group stocks, except one, have rallied at least 50% this year.

The surge in wealth dwarfs the $8.1 billion added by Adani’s compatriot and the richest person in Asia, Mukesh Ambani. It also underscores the rising heft of the self-made billionaire, who has lured investment from Total to Warburg Pincus. Adani has been rapidly expanding his conglomerate, adding ports, airports, data centres and coal mines in India, while doggedly proceeding with his controversial Carmichael coal project in Australia.

“Adani has been consistently expanding business in areas that are resilient to market cycles,” said Sunil Chandiramani, founder and CEO at Nyka Advisory Services. “Now with the entry in data centres business, the group has also indicated its appetite for venturing into technology.”

Adani Total Gas has jumped almost 97% this year, while the flagship Adani Enterprises has advanced 87%. Adani Transmission is up 77%. Adani Power and Adani Ports have gained more than 50% in 2021.

Details: As in 2021 March

Bloomberg, March 25, 2021: The Times of India

From: Bloomberg, March 25, 2021: The Times of India

From: Bloomberg, March 25, 2021: The Times of India

World's biggest wealth surge heralds rise of India's next Ambani

NEW DELHI: After spending two decades building a business empire centered around coal, Indian billionaire Gautam Adani is now looking beyond the fossil fuel to cement his group’s future. His ambitious plans are getting a boost from Prime Minister Narendra Modi.

Adani has emerged as India’s infrastructure king, diversifying from mines, ports and power plants into airports, data centers and defence -- sectors Modi considers crucial to meeting India’s economic goals. Investors are rewarding the pivot, betting the tycoon’s strategy of dovetailing his interests with the government’s development program will pay off.

The group’s six listed units added a combined $79 billion to their market value in the past year at the height of a pandemic, capping the best 12 months in their history. That’s the most after the nation’s two biggest business empires, Tata group and Mukesh Ambani-led Reliance Industries Ltd. Blue-chip names including French oil giant Total SE and Warburg Pincus LLC have plowed money into Adani’s companies.

In less than two years, Adani has gained control of seven airports and almost a quarter of India’s air traffic. He has unveiled plans to boost his renewable energy capacity almost eightfold by 2025, positioning himself to benefit as the government debates ambitious climate targets that would cut net greenhouse gas emissions by mid-century. Last week, he won a contract to co-develop a port terminal in Sri Lanka, a neighbor India is courting to check China’s influence in the region. Adani Enterprises Ltd signed a pact last month with EdgeConneX to develop and operate data centers across India.

“Adani is politically savvy and invests in mostly sensible, long-dated infrastructure projects” broadly tied to government priorities, said Tim Buckley, director of energy finance for Australia and South Asia at the Institute for Energy Economics and Financial Analysis, or IEEFA. “So long as India sustains strong growth, the group is likely to prosper under his leadership and witness a surge in global investor interest.”

The focus on India’s infrastructure forms “the core of our ‘nation building’ philosophy” and the group has created thousands of jobs and delivered unprecedented value to its shareholders, Adani said at a JPMorgan India Summit in September. A representative for the group declined to comment for this story.

After starting out as a commodities trader in the late 1980s, Adani is now richer than Jack Ma and is India’s second-wealthiest person with a net worth of $56 billion. He added $50 billion to his fortune in the past year, about $5 billion more than Ambani, Asia’s richest man, according to the Bloomberg Billionaires Index. Adani’s net worth rose more than any other billionaire’s this year.

Adani shot into the international limelight when he won a coal project in Australia in 2010. Ever since, he’s come under attack from climate activists including Greta Thunberg. A “Stop Adani” campaign by environmentalists disrupted development, with pressure building on lenders to turn off the credit tap. In a 2019 interview with Bloomberg News, Adani said the project’s goals were energy security for India and jobs for locals.

But back home, Adani has been at the center of another controversy that got louder especially after Modi became prime minister in 2014. Opponents of the powerful leader say Adani’s success is largely due to his closeness to Modi -- an allegation denied by the tycoon -- and his propensity to align his investments with Modi’s policy objectives.

Critics point to reports that the government under Modi relaxed airport bidding rules, helping Adani’s group qualify despite having shown no prior experience running an airport. A lease the conglomerate won in the southern state of Kerala faced challenge in court, with a local minister last year calling the winning bid an “an act of brazen cronyism.”

The Adani group rejected those claims and said it won through a competitive process. In a January 21 statement, the government said Adani was the top bidder among 86 registrations, and the process was transparent. The Supreme Court is still hearing the dispute. The Adani group representative declined to comment.

Old links

Like Modi, Adani hails from Gujarat. About two decades ago, Adani publicly backed Modi when a crisis threatened to end the rising politician’s career. Modi was under attack by rivals and businessmen who accused him of failing to prevent riots in 2002. Adani created a regional industry lobby and helped kick off a biannual global investment summit in Gujarat in 2003 that boosted Modi’s pro-business credentials.

“The connection between Modi and Adani dates back to 2003,” said Nilanjan Mukhopadhyay, a political analyst who wrote the biography “Narendra Modi: The Man, the Times.” “Adani’s fortunes will certainly take a beating” without Modi in power. Should that happen, he will start forging close ties with the new ruling party, Mukhopadhyay said.

Responding to his opponents, Modi said in a Parliament speech last month that the role of private enterprise in the economy is as important as the public sector, and wealth creators are a necessity. The Adani representative declined to comment.

Deft revamp

Buoyant credit markets helped fuel Adani’s expansion. Adani Ports & Special Economic Zone Ltd sold a 10-year dollar bond in January at a 3.10% coupon, compared with 4.375% in June 2019. Adani Green Energy Ltd signed a $1.35 billion loan facility last week from 12 banks including Standard Chartered Plc and Sumitomo Mitsui Banking Corp, one of the biggest renewable loans in Asia.

While Credit Suisse Group AG estimates the group’s gross debt jumped 29% to $24 billion in the six months through September from a year earlier, a spinoff and ring fencing of units in 2015 has provided comfort to creditors.

The biggest threat Adani faces is coal. Financial institutions around the world are increasingly under pressure to avoid funding energy projects using the dirtiest fossil fuel. Adani Enterprises is India’s biggest importer and also a contract miner for 101 million tons annually. His investments of more than $2 billion in Australia are running into challenges and delays, and could pose a risk to any of the units stepping in to fund the development.

Cutting imports

Adani’s new ventures face far fewer headwinds. He has plans for defence manufacturing, heeding Modi’s calls to help cut reliance on expensive imports. He is also scaling up production of solar panels and modules, again under Modi’s “Make in India” appeal. The foray into data centers follows the government’s proposed law that requires data to be stored locally.

Adani’s penchant for attracting foreign capital also jibes with the priorities of a Modi administration that doesn’t have a large enough budget to finance its infrastructure priorities. Warburg invested $110 million in Adani Ports and Special Economic Zone this month, while France’s Total took its total investment in Adani Green to $2.5 billion.

“All told, Adani Group is doing all the right things,” said Chakri Lokapriya, chief investment officer at TCG Asset Management Co in Mumbai, whose fund recently sold its holdings in Adani units but is looking to buy again. “In coming years, Adani group will own controlling stakes in critical gateways to infrastructure, power generation and information technology.”