Digital payments, transactions: India

Contents |

Digital payments, transactions

Towards a cashless future

November 13, 2016: The Times of India

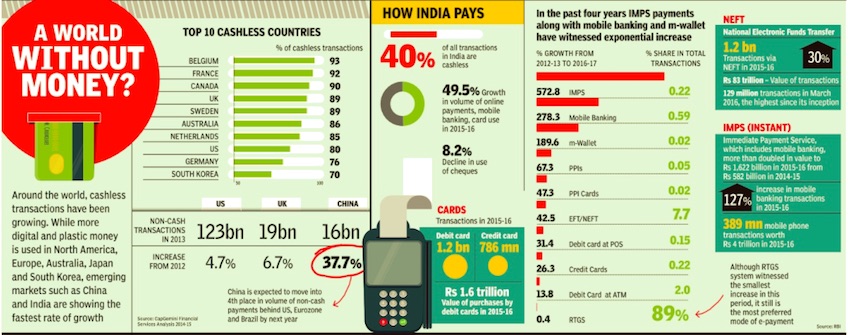

See graphic:

Top cashless countries, IMPS payments-% growth from 2012-17, year-wise and % share in total transactions, 2012-17, year-wise

2011–22

Nov 9, 2022: The Times of India

From: Nov 9, 2022: The Times of India

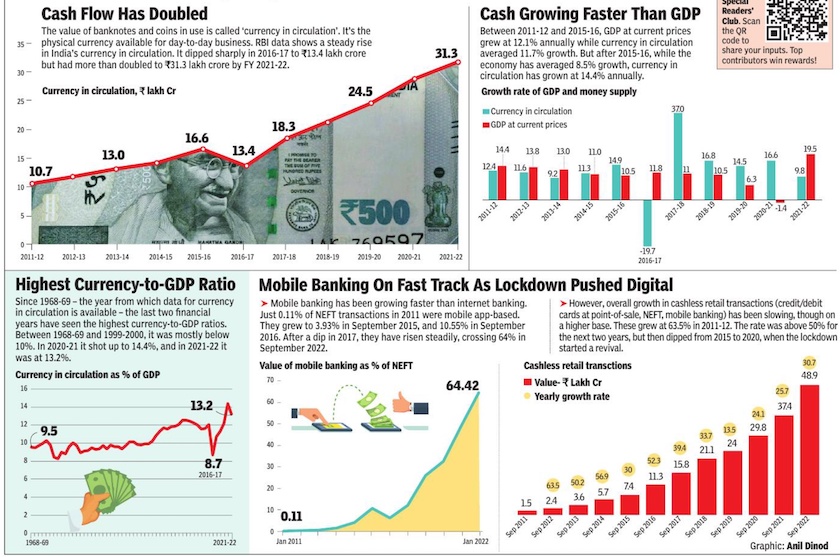

Cashless payments had been rising steadily in the past decades, but it was the Covid-19 pandemic that spurred the big switch to digital transactions. However, Atul Thakur finds that Indians still love cash and its circulation is growing like never before.

2014-19, year-wise

Source: RBI, Worldpay Global Payments Report, March 3, 2020 The Times of India

From: Source: RBI, Worldpay Global Payments Report, March 3, 2020 The Times of India

From: Source: RBI, Worldpay Global Payments Report, March 3, 2020 The Times of India

From: Source: RBI, Worldpay Global Payments Report, March 3, 2020 The Times of India

From: Source: RBI, Worldpay Global Payments Report, March 3, 2020 The Times of India

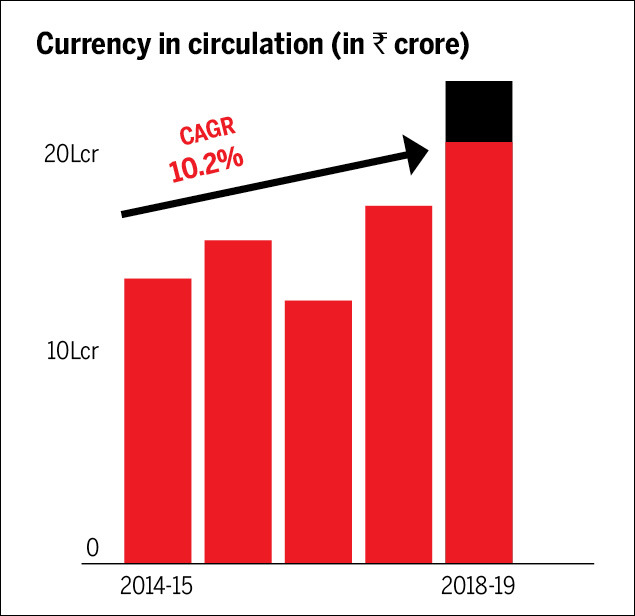

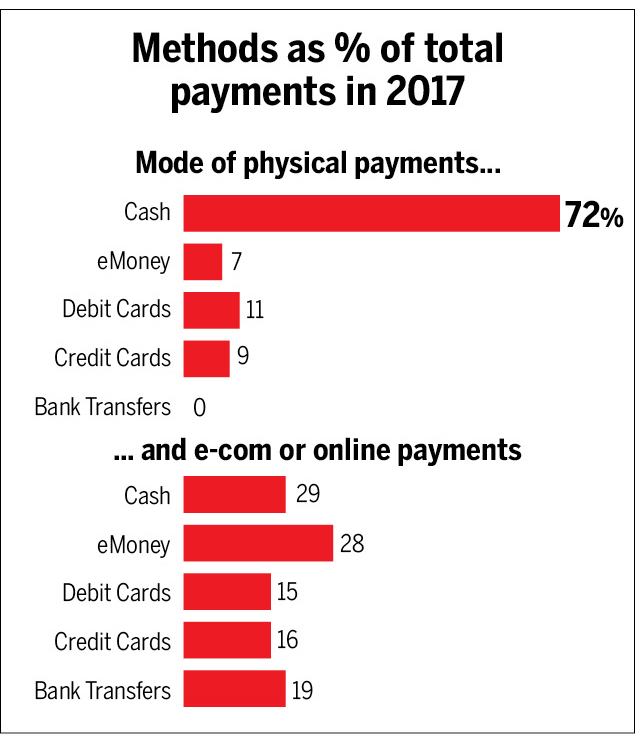

See graphics:

Currency in circulation, 2014-19, year-wise

Methods as % of total payments in 2017

Card usage trends (in %), cash withdrawal and payments, 2016-19, year-wise

No. of payment cards in circulation, debit cards and credit cards, 2014-19, year-wise

Digital payments by volume (in crore) and value (Rs. crore), 2016-19, year-wise

What demonetisation did to cash

In 2016-17, when demonetisation kicked in, it brought down the currency in circulation. However, the latter rebounded the very next year. Between 2014-15 and 2018-19, currency in circulation grew at an annual rate of 10.2%. However, without demonetisation, currency in circulation would have been Rs 3.5 lakh crore more than what it was in 2018-19.

Cash still the preferred payment option

But, although non-cash payments have risen, for payments made in person, cash remains, by far, the most preferred option. Even for online transactions, a fifth of payments are made by options like cash on delivery.

But Indians' love for cash slowing declining

Gradually, more and more Indians are turning towards cards. Use of debit cards is not confined to cash withdrawal alone, but is also being used as a mode of payment.

Between 2014-15 and 2018-19, debit and credit card payments grew 44% in volume and 40% in value terms.

In 2014-15, the number of debit cards stood at 55.3 crore. In a span of four years (2018-19), it nearly doubled to 90.6 crore before falling to 80.5 crore in December 2019, because of large-scale deactivation of old cards to make all cards chip and PIN compliant. During the same period, credit card numbers more than doubled.

Fondness for digital increasing

Since demonetisation, digital transactions have grown by 46% in value and 140% in volume thanks to a favourable regulatory environment, infrastructure upgrades and wider smartphone penetration. The most significant growth has been in Unified Payments Interface (UPI) and e-money transactions, which were a small share of total digital payments in 2016-17. Since then, UPI has become the largest mode of digital payments by volume, followed by e-money and debit card payments. In value, though, bank transfers still account for the largest chunk.

2017: 11% growth

Digital payments grow 11% in Dec YoY, January 18, 2018: The Times of India

Digital transactions for the month of December 2017 are 11% higher than the figure for December 2016, when transactions had shot up due to a withdrawal of cash from the system due to demonetisation.

According to data released by the NPCI, total electronic payment transactions crossed 1 billion in December 2017 to 1.06 billion compared to 957 million a year earlier. In value terms, the total transactions amounted to Rs 125.53 lakh crore, 20% higher than Rs 104 lakh crore last year.

Transactions in most segments were higher than the earlier year, except card payments. Payments using debit and credit cards fell to 263 million in December 2017 as compared to 311

million in December 2016. In value terms, however, card payments amounted to Rs 52,800 crore compared to Rs 52,200 crore in the previous year. The bump up in the number of digital transactions came from payments made using the Unified Payments Interface (UPI). Transactions using this account-to-account transfer platform rose 2 million to 145 million.

According to bankers, transactions on the UPI platform has got a big boost due to the entry of Google Tez and Paytm, which were running promotion campaigns to get users to switch to their platform.

The bump up in e-transactions came from payments made using UPI

2017- 22

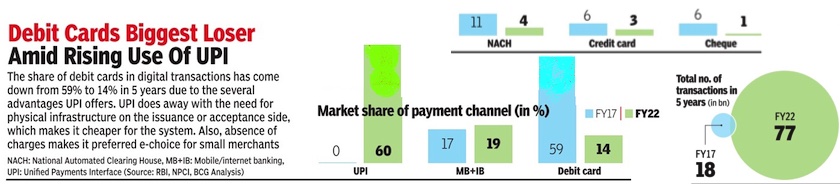

From: Dec 12, 2022: The Times of India

See graphic:

Market share of payment channel, 2017- 22

2020

India Vis-a-vis the world

From: Oct 28, 2021: The Times of India

See graphic:

The value of real time payments in India and comparable countries, presumably in 2020