Cotton: India

This is a collection of articles archived for the excellence of their content. |

Contents |

History

Earliest cotton in Arabia came from India: Study

Chandrima Banerjee, March 4, 2021: The Times of India

For about 600 years, Mleiha was the political centre of southeast Arabia before it was abandoned in the 3rd century CE. For decades, emergence of the tropical cotton plant in the arid Arabian peninsula has been a question archaeologists have tried to answer. Oman, they had concluded, was the source of the ancient Arab cotton trade. But now, scientists from the Museum of Natural History in Paris have found that the earliest cotton in the Arab region came from northwest India.

“This, along with archaeological and textual evidence of developed cotton production centres in Indo-Pakistani regions show that long-distance sea-borne trade between the Oman Peninsula and western India was wellestablished by early 1st millennium CE,” lead scientist Dr Saskia Ryan told TOI.

While their findings do not push back dates for the earliest known Indo-Arabian trade, which goes back to the 3rd millennium BCE, it shows that the exchange was much wider than earlier thought and how a plant of tropical origin appeared in the arid Arabian peninsula. The latter was the question with which they had started out.

The paper, published in Nature journal ‘Scientific Reports’, said a Greek handbook for merchants compiled by an Alexandrian sailor in the 1st century CE identified Ozênê (Madhya Pradesh), Masalia (Andhra Pradesh) and Abêria (Between Barygaza and Ozênê) as places where cotton was produced.

Just around that time, there was a proliferation of cotton in West Asia. But while archaeological evidence like peppercorns from Kerala and Asian rice from western India at the burnt down building indicated trade with India, the fortress also had Egyptian amphorae, glass vessels and Nubian lamps. So, the cotton remains could have been from other places like Mesopotamia or Egypt.

The irony, however, is that a fire that ravaged one of the most important buildings of Mleiha is also what preserved it for posterity. It’s a mud brick building with 15 rooms around a central courtyard with signs of a life hastily abandoned in forgotten objects and prized possessions carelessly thrown around, and, the evidence of the ancient Indian trade route, cotton — specifically, 31 whole seeds, 79 fragments and 7 raw fibre clusters.

When the scientists analysed the cotton at Mleiha, they found that it matched the range in mainland Gujarat and Kachchh. And so, the authors of the paper concluded that unlike wheat, barley and other modern plants, cotton was not from anywhere close but “most likely came from vast distances away, likely western Indian provinces”.

Bt cotton

Impact on productivity

The Hindu Business Line, Jan 30, 2017

Though India is the largest producer of cotton, the yields per acre are one of the lowest in the world. Things changed with the introduction of Monsanto's Bt-seed in India in 2002-03, and cotton sowing area grew significantly from about 87.86 lakh hectares in 2004-05 to 119 lakh hectares in 2014-15 (it has dropped to 105 hectares this season). Bt cotton accounted for around 95 per cent of the area.

The shift has made a difference in the productivity, depending on the water availability, some argue. They say the crop is protected against the boll-worms, allowing it to grow its normal growth. Subsequently, yields increased from 2-5 quintals per hectare in the pre-Bt era, to 6-12 quintals per hectare.

Over the years, farmers like Patel across the country have chosen Bt-seed for a better crop. Gujarat was among the first to take up hybrid technology for cotton cultivation much before the introduction by Monsanto's seeds. Initially, the H4 variety, named Sankar-4 variety picked up but it faced issues of unopened bolls, which was overcome in Sankar-6 variety, which is widely used at present.

Despite the progress, the yield have stagnated for over a decade. An increase in pest attacks, and thus the production costs, have been a major problem plaguing the growers in recent years.

Cotton production which touched a record of over four crore bales in 2013-14, fell to 386 lakh bales in 2014-15 and declined further to 338 lakh bales in 2015-16, the lowest in last five years. The drastic drop during 2015-16 was mainly due to the white-fly attack.

The gains — mainly the yield advantage and the drop in spends on insecticides/pesticides —that the average Indian cotton grower saw with the introduction of the genetically modified or Bt cotton since 2002-03 are on the decline. This is mainly on two counts. Firstly, the current generation of Bt cotton - Bollgard II - introduced in 2009, has started weakening against the mence of pink boll-worm.

Secondly, over the last two years a new class of insects, called the sucking pests have emerged; this year they were found in Maharashtra. As a result, the farmers' spend on pesticides that had come down with the advent of Bt cotton, is again increasing. The escalating costs have squeezed the margins.

Pressure is mounting on farmers. Latest figures released by the National Crimes Records Bureau says that about 88 per cent of the suicides committed by farmers in 2015 happened in the seven states that grow cotton intensely (see box below).

The pink menace

"We thought the Bt technology would save our crop from worm attack. It did for a few years, but the problem continues to persist and the yield is falling with every passing year," Patel says.

The pink boll-worm, the worst nightmare for a cotton grower in the country, has made a comeback with an vengeance as it has been increasingly developing resistance to the Bt gene. Across the cotton-growing states including Karnataka, Andhra Pradesh and Telangana, reports of outbreak of pink boll-worm have surfaced this kharif season.

"The repeated outbreaks over the last two years shows that technology is not working," says S Ramaswami, Chairman and Managing Director of Rasi Seeds, one of the leading companies in the domestic seeds market. "However it is controllable, provided farmers use pesticides regularly," Ramaswamy adds.

White fly attack that caused significant losses to cotton growers in Punjab in the last two seasons had also become a menace for farmers in Maharashtra, though the intensity of the pest attack was not that severe as witnessed in the northern state.

"I had to take up at least four additional sprays to keep the white fly under check this year," says Champatrao Shinde, a farmer in Kharangana Gode village near Wardha in Maharashtra’s Vidharbha region. A round of insecticide spray would add costs by ₹1,000 per acre.

"Also, the rains this year, though timely, led to an increase in weeds, for which I had to incur an additional cost to remove them," Shinde adds. As a result, the cost of cultivation has gone up from around ₹16-18,000 per acre to around ₹22,000.

Though higher prices this year have helped him absorb the rise in costs, he is unsure about a repeat in the next season.

Pricing cap

The seeds industry are also apprehensive of its future after the Government recently capped prices of Bt cotton seeds. While in the recent planting season the price control order had little impact given the excess supply, the breeders and seed companies were forced to offer discounts to the farmers. Nevertheless, the cap is a setback for many in the seeds industry.

Technology developers in the agri-biotech space say the move will hurt investments in research and development. This may have a major implication on the new products that are in the pipeline.

Immediately after the Government's move, Monsanto, through its local partner and investee company Mahyco pulled out the Bollgard II RRF — its next product in India for which it was seeking regulatory approval. Going a step ahead, Monsanto also threatened to pull out of the country.

Incidentally, Bayer acquisition of Monsanto in a $66-billion all-cash deal has triggered consolidation in the global agri-input space. Post merger, the consolidated entity would command 70 per cent of the cotton acreages in the US and in many other countries including India. Besides these developments, the uncertainty over commercialisation of the GM crops in the country continues.

This development clouds the prospects of cotton farmers looking for better and stronger seeds to withstand pest attacks. Otherwise, any new cotton seed could best be a variant of existing hybrids/technologies.

"Availability of a new technology in current scenario is very rare. There is no new technology in the pipeline. Unless new technology hits the markets, farmers have no option but to make do with the sprays for controlling the pink boll-worm," says Rasi's Ramaswamy. A breakdown might make it impossible to counter the boll-worm. "We are heading there in another two-three years," Ramaswamy warns while visualising the scenario of the pre-Bt days, when farmers needed up to 25 rounds of spraying to protect their crop. "The new products in the near-term would be mainly from better breeding efforts," said Bharat Char, Technology Lead at Mahyco.

Alternatives

In the absence of a new technology, the domestic industry might have to depend on the three alternatives that are emerging. The three include one each from public, private and non-governmental sectors. While the GM varieties developed by the Nagpur-based CICR (Central Institute for Cotton Research) are ready for use by farmers, some NGOs are holding the fort with the desi varieties.

The CICR is using the first generation GM technology in lanky desi varieties and is looking to promote the concept of high density plantation as against the relatively spacious planting in the hybrid model (hybrid plants require more space). CICR had taken up multi-location trials of the Bt varieties across the country and plans to select the varieties specific to the region.

CICR Director Keshav Kranti said the seed will help the farmers reduce the duration of the crop, drastically reducing the pressure on scare moisture in the rain-fed areas. Even if the yield reduces by a few bolls per plant, the losses could be made up as the farmers could plant more plants per unit of land.

“The cotton seeds developed by the CICR should be ready for use by farmers. However, the quantity could be small as it is the first year. Multiplication would happen for the following year,” said Rajesh Kumar Singh, Joint Secretary, Union Ministry of Agriculture and Farmers Welfare.

The Hyderabad-based Centre for Sustainable Agriculture (CSA) is experimenting with desi varieties. It has teamed up with small farmers in Telangana’s Adilabad, Warangal and Wardha districts, covering an area of 200 acres.

“We also follow the high density method. What we have observed is that hybrid cotton, suitable only for irrigated areas, is being grown in rain-fed areas that are suitable for the desi varieties. The cost of production comes down significantly as usage of inputs is reduced,” said G Ramanjaneyulu, Chief Executive Officer of CSA. CICR is also trying to promote some of its desi varieties like the short-stapled Phule Dhanwantri.

Though this variety is seen to be resistant to pests like pink boll-worm, the yields are relatively lower to the Bt counterparts, besides having higher picking costs. While this makes desi seeds unpopular with farmers, CICR's Kranthi is bullish on the native option.

"The experience with the desi seed has been fairly good and that is the reason we expect higher sowing next year," added Rathi.

There have been calls to revive a shelved joint research project to develop a GM variety. While its future is still unknown, some firms have begun their own research initiatives. Nuziveedu Seeds (NSL), a top seller of BG-II seeds, is one among them. "Yes, we are developing one technology," said Chairman and Managing Director M Prabhakara Rao. The company is in the process of seeking regulatory nod for the trials.

In fact, the private initiative dates back to 2004 when the NBRI (National Botanical Research Institute) gave a licence to Swarna Bharat Biotechnics, a consortium of private seed firms. The two genes derived from (Bt) protects cotton against boll-worm and tobacco caterpillar. If the research schedule goes as planned, the NSL technology will take at least two years for use by farmers.

Besides, Rasi Seeds is also working on a new transgenic technology for cotton. Another transgenic technology for cotton has been developed by Delhi University’s Deepak Pental, who had also developed a transgenic mustard that's currently before the Government for approval. These efforts will have to be hastened to rescue the country’s cotton farmers faced as they are with unending hardships.

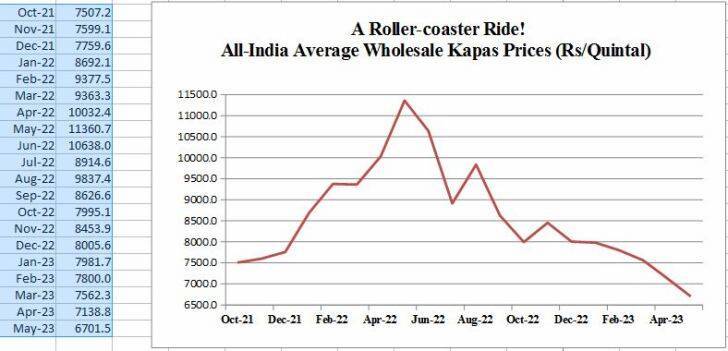

Cotton (kapâs) wholesale prices

2021-2023 April

From: Parthasarathi Biswas , Gopal B Kateshiya, June 8, 2023: The Indian Express

See graphic:

All India Average Wholesale Kapas Prices, October 2021- April 2023

Exports

Pakistan

Buys 40% of shipments in 2015-16

The Times of India, Aug 17 2016

Allirajan M

Pakistan turns largest buyer of Indian cotton

The relationship between India and Pakistan may not be in the best of shape these days but this has not prevented the neighbour from turning the biggest buyer of home-grown cotton.

Pakistan has emerged as the largest buyer of Indian cotton purchasing about 25 lakh bales (a bale is 170 kgs) which is about 40% of the shipments of the fibre from the country so far in the 2015-16 season, (October-September), trade and industry officials said. The country has so far exported about 65 lakh bales of cotton in the 201516 season. “Pakistan has turned a huge importer of our cotton. This has created a big impact,“ said J Thulasidharan, president, Indian Cotton Federation (ICF). “Pest attacks in Pakistan has resulted in a huge fall in production. So they imported cotton from India,“ said Atul J Asher, secretary, ICF.

Cotton production in Pakistan is estimated to have fallen by 35% to around 97 lakh bales in 2015-16 season. Pakistan usually imports about 12 lakh bales of cotton a year. India is the largest producer of cotton in the world with the Cotton Advisory Board (CAB) pegging production for the 2015-16 season at 338 lakh bales.While Pakistan imported most of its cotton from India when prices were ruling at around `34000 per candy , textile mills are buying cotton from Africa and Australia at a much higher price, industry officials said. With domestic cotton prices ruling higher than international prices, textile mills in the region, who were buying the commodity from Africa, have started importing cotton from Australia. While the cost of home-grown cotton is about `50000 per candy, Australian cotton is available at around `48000 per candy , officials said. A leading textile mill in the region imported about 50000 bales of Australian cotton recently .

“We are importing Australian cotton as West African cotton is no longer available. The quality of Australian cotton is also quite good,“ senior industry officials said. Mills started buying West African cotton as costs were lower. Two leading textile mills in south India--each of them bought about 2 lakh bales of West African cotton in April-June.

High prices in the domestic market has pushed up cotton imports in the 2015-16 season.While CAB, which comprises representatives of the textile industry , trade, ginners and government officials, had projected imports of around 15 lakh bales during 2015-16, trade and industry officials said that imports have already crossed 20 lakh bales. Imports stood at around 14.5 lakh bales during 2014-15.

China, the largest buyer of cotton from India in the past, reduced its imports significantly after it accumulated huge stocks as reserves. China imported around 80 lakh bales of cotton from India in 2013-14 season. But cotton exports to China plunged by over 50% in 2014-15. India exported about 58 lakh bales of cotton in 2014-15.

Procurement by government

2008, 2020: record years

Priyanka Kakodkar, May 28, 2020: The Times of India

The Cotton Corporation of India (CCI) has made a record procurement of 94.5 lakh bales of cotton across the country despite the disruption caused by the ongoing lockdown. The figure is higher than last year’s procurement of 10.7 lakh bales and the previous high of 90 lakh bales in 2008.

The bulk of the purchase or 86 lakh bales was made before the lockdown began. “The procurement this year is at an all-time high. We have procured 31% of the arrivals of 303 lakh bales worth over Rs 25,000 crore,” said CCI chairperson P Alli Rani.

While government purchase for cotton is a lifeline, majority of the farmers depend on the private market, where prices have plunged. The pandemic has shrank both domestic and global demand for India’s cotton. Market prices have plummeted, pushing farmers to sell to the government. The government’s minimum support price for cotton is Rs 5,500 per quintal but market prices range from Rs 2,800 to Rs 4,000 per quintal. The Cotton Association of India (CAI), which represents the industry, has estimated that domestic demand will drop by 51lakh bales this year owing to various disruptions.

Subsidies

2010- c.2017, India paid more than WTO allows: USA

India paid more in cotton subsidies than WTO allows: US, November 13, 2018: The Times of India

India has paid out far more in cotton subsidies than the World Trade Organisation (WTO) allows, with payments “vastly in excess” of what it had officially declared, the US said in a filing to the trade watchdog.

The US assessment of India’s market price support (MPS) for cotton said New Delhi was allowed to pay out up to 10% of the value of production, but the actual figure had ranged from 53% to 81% since 2010.

Indian Commerce Ministry officials declined to make an immediate comment on the US document, but India has previously dismissed US allegations that it pays higher subsidies than permitted.

Along with more than 45 countries, India has demanded that MPS should be calculated by using the recent reference period instead of 1986/88 prices, which was built into the equation at the creation of the WTO, said a government official, who declined to be named.

While India’s calculations are based on dollar terms, the US calculations are based on local currency, said the official, who has direct knowledge of the trade negotiations.

The US filing is the latest in a series of analyses of publicly available data that Washington has submitted to the WTO, each one setting out apparent breaches of WTO rules that are hiding in plain sight. Previous submissions have targeted China and Vietnam as well as India. “The United States is providing this information to other (WTO) Members in the interest of promoting transparency surrounding India’s MPS policies,” the filing said. “This document is for the purpose of discussion by WTO members.”

India has been the secondlargest cotton producer since 2006, behind China, and the second-largest exporter since 2007, the document said.

“The US looks forward to future discussion of the significance of India’s MPS for cotton for both India’s market and for world markets — both with India and with other members,” it said.