Banking, India: Real policy (repo) rates

This is a collection of articles archived for the excellence of their content. Additional information may please be sent as messages to the Facebook community, Indpaedia.com. All information used will be gratefully acknowledged in your name.

This is a collection of articles archived for the excellence of their content. |

Contents

|

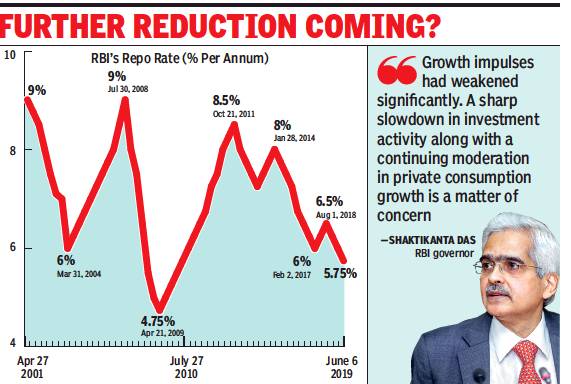

Loans: Policy repo rate

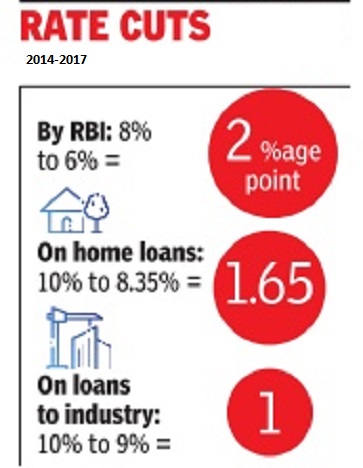

2014-17

Following the [August 2017] announcement, the policy repo rate -the rate at which RBI lends to banks -stands reduced to 6.0% from 6.25%, the lowest since November 2010. Consequently , the reverse repo rate -the rate at which RBI borrows from banks -stands adjusted to 5.75%

From The Times of India

See graphic:

Rate cuts, 2014-17

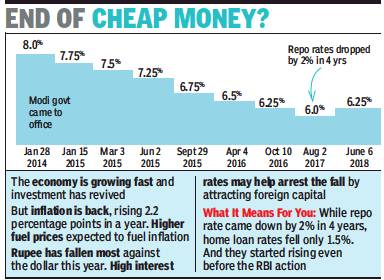

2018: 25-basis-point increase to 6.25%

1st rate hike in Modi govt’s 4 yrs could make home loans dearer, June 7, 2018: The Times of India

From: 1st rate hike in Modi govt’s 4 yrs could make home loans dearer, June 7, 2018: The Times of India

Fear Of Inflation Drives RBI Move

Prompted by inflation fears and emboldened by growth, Urjit Patel on Wednesday delivered his first rate hike since taking over as Reserve Bank of India governor in September 2016. It’s also a first during Narendra Modi’s four-year tenure as PM.

While economic growth makes every government happy, it dreads sharp price rises, especially ahead of elections. The Modi government will be praying for a good monsoon because it’ll help spur growth and check inflation.

All six members of the RBI’s monetary policy committee (MPC) voted in favour of a 25-basis-point (100bps=1 percentage point) hike in the policy rate, taking it to 6.25%. It could lead to another round of marginal increases in home loan rates in the coming months; all major banks have in the last one week raised lending rates by 10bps.

Wednesday’s hike follows five rate cuts during Raghuram Rajan’s time as governor – 4 of 25 bps each and one of 50 bps – and two, both of 25bps, by Patel, the last in August 2017.

Eco activity has shown sustained revival, says RBI

RBI governor Urjit Patel has maintained the RBI’s stance at neutral, which means that the central bank could go either way in the next policy in August.

Patel said RBI's decision was driven by its inflationtargeting mandate. The last rate hike – for 50 bps, to 8% – was by Rajan in January 2014.

In its statement, the RBI said that domestic economic activity has exhibited sustained revival in recent quarters and the output gap has almost closed. “Investment activity, in particular, is recovering well and could receive a further boost from swift resolution of distressed sectors of the economy under the Insolvency and Bankruptcy Code,” it added.

What has tempered the positive sentiment created by sharper growth – the Central Statistical Organisation last week announced a healthy 7.7% economic expansion for January-March – is the spectre of inflation. Data released since RBI’s April policy showed inflation jumped to 4.58% in that month from 4.28% in March. It is showing signs of firming up further with crude oil prices rising more than 10%. The rupee has also come under pressure with the US dollar gaining against most emerging market currencies.

According to Bank of India MD & CEO Dinabandhu Mohapatra, the fact that the RBI has revised its consumer price inflation forecast upward to 4.8-4.9% for the first half of FY19 shows that it will keep a hawk eye on retail prices in the months ahead. While a rate hike will lower the value of banks’ bond portfolios, the RBI has provided lenders some relief by allowing them to spread losses over four quarters. Also, medium and small enterprises have been given some relief in loan repayment. And the RBI’s decision recognizing banks' government bond holdings for meeting liquidity coverage norms will leave banks with more funds for lending, which is expected to keep rates under check.

The RBI’s rate hike may have surprised some analysts, but the growth forecast of 7.5% for FY19 boosted market sentiment with the sensex closing 276 points higher. Yes Bank MD & CEO Rana Kapoor said, “While the rate action is primarily in response to global uncertainty, especially from crude oil prices, it also signifies that the central bank is comfortable on the improving growth outlook.”

CARE’s chief economist Madan Sabnavis said, “The upside risk to the inflation emanates from the rising crude oil prices globally along with minimum support price impact.” He said the pace of inflation would depend on the progress and spread of monsoon.

“We expect one more interest rate hike by at least 25bps during the calendar year 2018, whereas we cannot rule out the possibility of two rate hikes by the end of the financial year 2018-19,” said Sabnavis.

“Investment activity, in particular, is recovering well and could receive a further boost from swift resolution of distressed sectors of the economy under the Insolvency and Bankruptcy Code,” RBI said in its statement

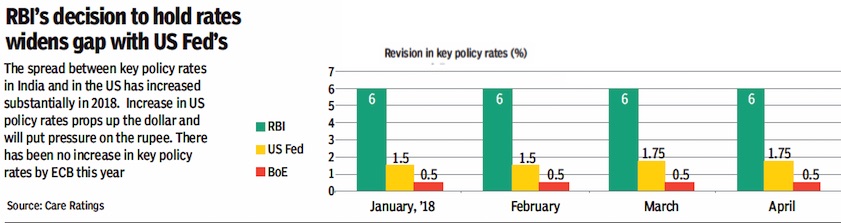

2018, Jan-Sept, vis-à-vis US Fed, BoE

From: October 6, 2018: The Times of India

From: October 6, 2018: The Times of India

See graphics:

2018, January-April: RBI’s key policy rates, vis-à-vis those set by the US Fed and BoE

2018, May-September- RBI’s key policy rates, vis-à-vis those set by the US Fed and BoE

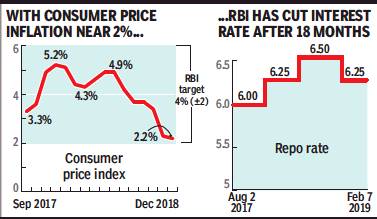

2017 Aug- 2019 Feb

Mayur Shetty, Das debuts as RBI guv with surprise rate cut, February 8, 2019: The Times of India

From: Mayur Shetty, Das debuts as RBI guv with surprise rate cut, February 8, 2019: The Times of India

6-Member Panel Voted 4-2 For 25bps Reduction

Unveiling his maiden monetary policy on Thursday, RBI governor Shaktikanta Das announced a quarter percentage point (25 basis points) rate cut, citing lowerthan-expected inflation. It was the first rate cut in 18 months and came after two rate increases in the interim period.

The decision to reduce rates was a split one. Of the sixmember Monetary Policy

Committee, four, including Das and RBI ED Michael Patra, voted in favour while deputy governor Viral Acharya and external member Chetan Ghate voted against cutting rates. However, a change in policy stance from “calibrated tightening” to “neutral” was approved unanimously.

Asked whether banks would cut rates in response, Das said he would be meeting bank chiefs within the next fortnight and raise the issue of monetary policy transmission.

It was vital to act decisively, says RBI guv

The RBI governor on Thursday triggered concerns of back-tracking on the central bank’s move to peg retail loans to an external benchmark from April 2019, by referring to RBI’s earlier circular as a discussion paper. A clarification from the central bank is awaited.

Das also made it easier for banks to lend to top-rated finance companies. He also indicated that an interim dividend to the government was forthcoming.

Explaining the rationale for the rate cut, Das said it was “vital to act decisively and in a timely manner to address the objective of growth once price stability as defined (in RBI's inflation-targeting mandate) is achieved.”

Following the policy, the repo rate stands reduced to 6.25% from 6.5%. According to Acharya, the outlook for prices had changed in December itself following a crash in oil prices, but the central bank did not change the stance, choosing to move in small steps.

The RBI has forecast GDP growth of 7.4% for FY20 with the first half growth expected to be in the range of 7.2-7.4% and 7.5% in the third quarter. RBI has also forecast a CPI inflation path of 2.8% for Q4 of FY19 followed by 3.2-3.4% in the first half of FY20 and 3.9% in the third quarter of the next fiscal.

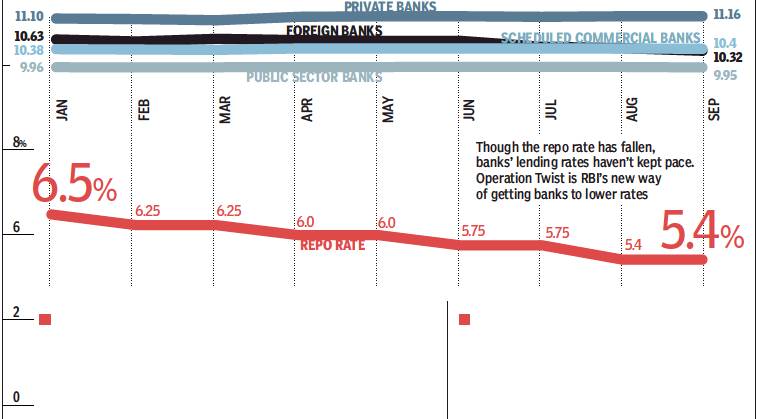

2019, Jan- September

See graphic:

The repo rate in 2019, Jan- September

2019, June

June 7, 2019: The Times of India

From: June 7, 2019: The Times of India

Repo rate lowest since 2010 after RBI’s third cut this year

Seeks To Make Loans Cheaper To Boost Eco

Mumbai:

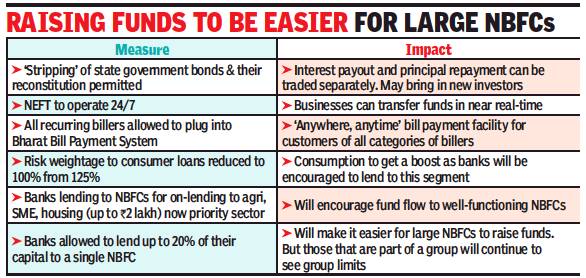

In a move that should make mortgages, auto loans and other borrowings cheaper, the Reserve Bank of India cut interest rates by 25 basis points for the third time this year and hinted at more cuts by changing its policy stance from “neutral” to “accommodative”. Emboldened by benign inflation and availability of buffer foodgrain stock, the central bank’s monetary policy committee (MPC) voted unanimously to bring down the repo rate from 6% to 5.75% — the lowest since September 2010. Repo rate is the price commercial banks pay to the RBI for short-term funds.

Announcing the MPC decision, RBI governor Shaktikanta Das said, “Growth impulses had weakened significantly. A sharp slowdown in investment activity, along with a continuing moderation in private consumption growth, is a matter of concern.” He added that the fact that the bank’s stance was changed to accommodative meant that rate hikes were off the table for now. Responding to comments that the earlier two rate cuts were not passed on, Das said banks have passed on 21 basis points through a reduction in lending rate. “In the past the transmission took about four to six months. But this time, it has happened in two to three months’ time. Going forward we expect faster and higher transmission by banks,” he said.

A third reason for the rate cut was the return of the Narendra Modi-led NDA government in the polls last month, which has firmed up hopes of fiscal responsibility.

Following the rate cut, the bond and the forex markets reacted positively. The yield on the 10-year benchmark government bond yield fell to 6.8%, compared with Tuesday’s close of 7%. The rupee, which had weakened to 69.36 against the dollar ahead of the RBI decision, strengthened to 69.28 in afternoon trade.

The pressure behind RBI's rate cut hat-trick

June 13, 2019: The Times of India

NEW DELHI: The Reserve Bank of India on Thursday announced a 25 basis points (0.25%) cut in repo rate (the rate at which it lends to banks), the third rate cut in a row. The repo rate now stands at 5.75%, the lowest since July 2010. The central bank also revised its GDP growth expectations for 2019-20 downwards from 7.2% earlier to 7% now.

It's the economy: The latest rate cut comes at a time when the economy grew at its slowest in over four years. Among the challenges the economy faces, RBI says, are: Cash crunch in the system due to lower government spending (liquidity turned into a surplus only this month after remaining in deficit in April and May), a weak global demand due to trade wars that's hurting exports and investment activity and a weakening of private consumption, especially in rural areas. Plus, India's foodgrains production has dipped, growth in manufacturing activity has weakened, automobile sales have fallen, cement production and steel consumption (key indicators of construction activity) have slowed down.

Challenges ahead: The central bank notes that growth impulses of the economy have weakened significantly and a sharp slowdown in investment activity along with a continuing moderation in private consumption growth is a matter of concern. Hence, it wants to support efforts to boost demand and reinvigorate private investment activity. Experts say that by changing its stance from 'neutral' to 'accommodative', RBI has communicated that the growth slowdown is real.

Will you gain? Though consecutive rate cuts by RBI signal a drop in cost of funds for corporates and individual borrowers, banks haven’t passed on the benefits to their customers. Bankers say it is not possible to bring down their cost of funds without reducing deposit rates and bringing them down has been difficult as deposits have grown slower than loans. In 2018-19, bank deposit growth was 10% compared to 13% growth in loans. However, things may change this time as the RBI says that liquidity in the system has turned into a surplus for the first time in at least two months. If the surplus in the banking system continues for some time, lending rates are likely to come down.

Go cashless: The central bank has also decided to do away with the charge it levies on banks for RTGS (Real Time Gross Settlement) and NEFT (National Electronic Funds Transfer) transactions. If banks pass on the benefits to their customers (they used to pass on RBI's charges), online money transfers could become virtually free.

August 2019: 35 bps cut, probably a 1st in India

August 8, 2019: The Times of India

From: August 8, 2019: The Times of India

Das drops convention to opt for 35 bps cut, probably a 1st in India

New Delhi:

In April, RBI governor Shaktikanta Das told central bank governors about the need to “ think out of the box” and stop treating rate changes in multiples of 25 basis points (a quarter of a percentage point) as “sacrosanct”, suggesting it was just a convention.

Taking off from his speech at the “Governor Talks” event on the sidelines of the Fund-Bank meetings in Washington, the Monetary Policy Committee (MPC) opted for a 35 bps repo rate cut as a 25 bps cut was seen to be “inadequate”, while 50 bps would have been “excessive”. While MPC’s “unprecedented” cut was probably a first in India, Das said that some of the developed countries had changed ratesby 10-15bpsin the past.

The former bureaucrat suggested that there was nothing sacred about a 25 bps cut. “Too much should not be read into it, it is judgement call which MPC has taken,” he told reporters. With the latest reduction, the central bank has now put the ball in the Centre’s court to unveil measures to complement its rate cut. While the government unveiled some measures in the July 5 Budget, the financial markets have been unimpressed. The sharp slowdown in some sectors have triggered calls for the government to unveil measures to boost growth. Expectations are that some measures may be unveiled soon to smother the concerns over the slowdown and shield growth.

RBI has recognised the slowdown signals and has trimmed the growth estimate to for 2019-20 to 6.9% from the June policy forecast of 7%.“Addressing growth concerns by boosting aggregate demand, especially private investment, assumes the highest priority, while remaining consistent with the inflation mandate,” the monetary policy committee said in its statement, highlighting the need to bolster growth.

Economists said that it seems that all central banks have decided to surprise the markets with unanticipated policy changes. New Zealand cut its key policy rate by 50 basis points, Thailand also unexpectedly cut its rate by 25 basis point as against the market-wide expectation of status quo. “We believe apparent short cycle of monetary policy normalization by US Fed has turned into a uniform rate easing cycle across global central banks. 2019 seems to be worse than 2008 with external strife of trade wars now getting integrated with domestic growth weakness in emerging economies,” said Soumya Kanti Ghosh, group chief economic adviser at State Bank of India.

Oct 5, 2019: The Times of India

From: Oct 5, 2019: The Times of India

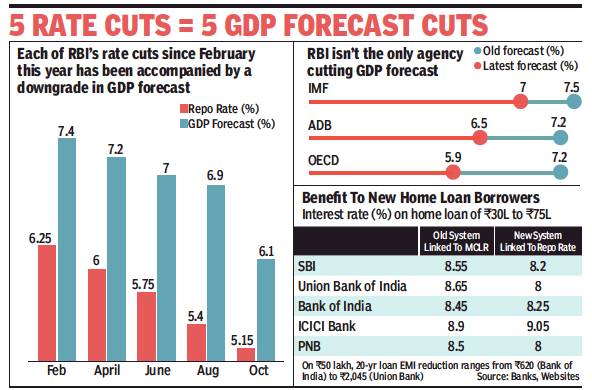

RBI cuts repo rate to 9-yr low, growth estimate to 7-year low

Most Banks To Pass On Benefit Immediately

Mumbai:

As expected, the the Reserve Bank of India (RBI) lowered its key policy rate yet again on Friday — the fifth successive time this year that it has done so in a bid to spur slowing economic growth. The latest cut, by a quarter percentage point, brought the benchmark repo rate (the rate at which RBI lends to banks) to a nine-year low of 5.15%.

But the news was overshadowed by the RBI’s announcement that it was sharply reducing India’s growth forecast for the fiscal year to 6.1% — which would be the lowest in 7 years — from the earlier estimate of 6.9%.

Spooked investors promptly went into selling mode, resulting in the Sensex falling 434 points to 37,673.

The five repo rate cuts that have taken place during RBI governor Shaktikanta Das’s tenure collectively add up to 135 basis points (bps).

While the earlier 115 bps rate cuts brought down bank lending rates by only 29bps, the current revision will immediately get passed on in full.

RBI has asked banks to link their lending rates to an external benchmark like the repo rate, which has been chosen by most banks. As a result, SBI’s interest rate on home loans (below Rs 30 lakh) is set to fall below 8% for the first time in more than a decade.

The cut in GDP growth estimate is the sharpest in recent memory and follows a raft of government measures to stimulate the flagging economy, including a dramatic revamp of the corporate tax rate structure.

RBI’s decision to cut rate was unanimous

The 135 bps cumulative reduction in repo rate delivered in 2019 along with the recent cut in corporate tax by the government should help to revive growth in coming months,” said Zarin Daruwala, CEO, India, Standard Chartered Bank.

The decision of the RBI's monetary policy committee to cut the repo rate was unanimous with one member, Ravindra Dholakia, seeking a 40-bps cut. While RBI’s rate cut was modest considering its sharp downward revision of growth, Das promised to continue with an 'accommodative’ policy as long as is necessary to ensure growth momentum. While this stance was prompted by benign inflation, the 'top priority' for Das is growth, which at 6.1% is forecast to be at a seven-year low.

Besides dealing with the prospects of slower growth, Das also had to allay fears arising out of a spate of failures among NBFCs and the fraud in Punjab & Maharashtra Cooperative Bank – one among the top five cooperatives in the country.

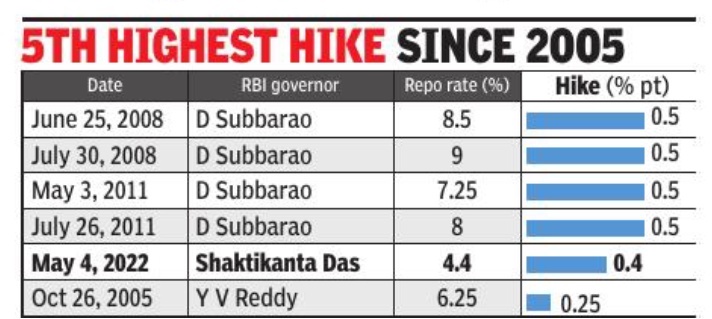

2022: RBI hikes key rate by 40 bps after 4 years

May 5, 2022: The Times of India

From: May 5, 2022: The Times of India

Mumbai: In a surprise move, the Reserve Bank of India (RBI) announced an increase in key interest rates by 40 basis points, the first increase since August 2018 and the sharpest in nearly 11 years, as it shifted gears to tame surging prices.

Rising prices against the backdrop of the war in Ukraine and breakdown of supply chains have emerged as a key policy challenge, prompting central banks around the world to raise interest and tackle soaring prices.

Home loans and other retail loans and those availed by businesses will get costlier as around 40% bank credit is linked to the repo rate, which is what banks earn on the overnight funds that they park with the RBI. The monetary policy committee also increa- sed the cash reserve ratio (share of deposits banks keep with RBI) by 50 basis points to 4. 5% to suck out some cash from the system. The repo rate has been revised to 4. 4%. A 40-basis-point increase (100 basis points equal one percentage point) in key policy rates will raise the EMI on a Rs 1-crore home loan of 15-year tenure by Rs 2,176.

The decision sent the market crashing with the sensex closing 1307 points lower. Between the time the RBI governor’s statement started and market closed, the index fell 900 points.