The Tata Group

This is a collection of articles archived for the excellence of their content. Readers will be able to edit existing articles and post new articles directly |

Contents |

Tata Group's overseas takeovers

[ 20 Oct, 2006 1554hrs IST PTI ]

Snapshot of Tata Group's takeovers abroad

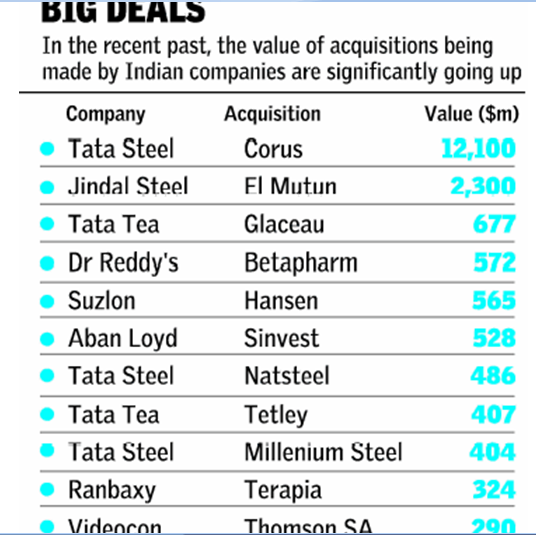

NEW DELHI: Tata Steel's successful move to acquire its much bigger rival Corus Group is the latest in a series of takeovers abroad executed by India's largest and one of the oldest corporate groups.

The acquisitions have meant that 30 per cent of the group's revenues today come from overseas operations.

Following are the major acquisitions by Tata Group companies in the past few years:

- Tata Tea acquires 30% in US' Glaceau (Energy Brands) in August 2006 for $677 mn

- Tata Tea buys 33 per cent in South African tea company Joekels through its subsidiary Tetley Group

- Tata Tea acquires US-based Eight'O clock coffee company for $220 mn (Rs 1,050 cr) in June 2006

- Tata Chemicals picks 63.5% in UK's Brunner Mond Group for Rs 508 crore in December 2005

- Tata Steel acquires Millennium Steel of Thailand in December 2005 for $404 mn (Rs 1,800 crore)

- TCS buys out Chilean BPO firm Comicorn for $23 mn (Rs 107.02 crore) in November 2005

- TCS acquires Sydney-based FNS in October 2005

- Tata Technologies purchases INCAT International, UK in October 2005 for $91 mn (Rs 411 crore)

- Tata Tea acquires Good Earth Corp in October 2005 for around $32 mn

- Tata Auto Comp (TACO) takes over German auto components maker Wundsch Weidinger

- VSNL acquires Teleglobe International in July 2005 for $239 mn

- Tata Steel buys Singapore's NatSteel in August 2004 for over Rs 1,300 crore.

- VSNL takes over Tyco Global Network for $150 mn (Rs 690 crore)

- Tata Chemical acquires Moroccan company Indo-Maroc Phosphore for Rs 166 crore

- Tata Motors picks 21% stake in Spain's Hispano Carrocera for Rs 70 crore

- Tata Tea buys Tetley, UK in February 2000 for Rs 1,870 crore

- Tata Motors takes over Daewoo Commercial Vehicle Company of Korea in March 2004 for Rs 459 crore.

Acquisitions

INDIA ON SONG, TAKES CORUS ALONG Tatas Outgun Brazilians, Take World By Storm

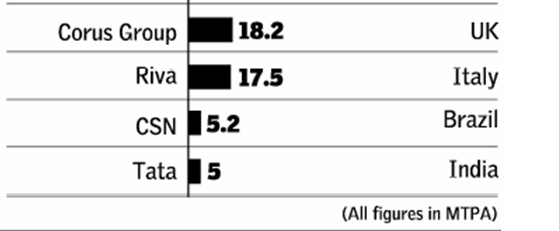

Mumbai: India’s high noon came when it was midnight in London. In the duel between the Tatas and Brazil’s CSN for Anglo-Dutch steelmaker Corus, the Indians held their nerve as the auction went into the ninth and final round. CSN bid 603 pence to a share; the Tatas, who had made an offer of 590p in the eighth round, upped it by 18p to 608p. The Brazilians blinked.

For $12 billion, Rs 54,000 crore if you will, Tata Steel created history when it finally secured the scalp it wanted so badly — that of Anglo-Dutch steelmaker Corus, forged out of what was once the mighty British Steel — to carve out for itself a chunk of the global steel industry.

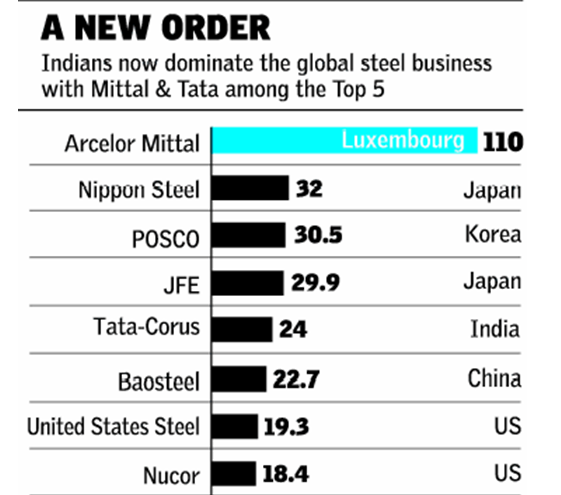

This acquisition makes the 100-year-old Tata Steel the fifth largest steel producer in the world, with an annual output of around 25 million tonnes and 87,000 employees on its rolls — a dramatic departure from only a day ago when it was ranked 56th.

The acquisition also marks the emergence of India Inc as a potent force in the global business. It was only last year that Mittal Steel headed by Lakshmi Mittal forged a blockbuster $32.4 billion deal to create Arcelor Mittal, the world’s largest steel company. ‘‘I believe this will be the first step in ensuring that Indian industry can step outside the shores of India in an international market and acquit itself as a global player,’’ said Ratan Tata, chairman, Tata Group.

While Corus Steel’s fate was eventually decided during the course of a single night, the process to find a buyer for the beleaguered European company had started in October 2005, when its bankers, Credit Suisse, set up Project England, the code name for a potential sale.

At that time, Corus was trading on the London Stock Exchange (LSE) at 300 pence a share. ‘‘We didn’t go to them, they came to us, much before Mittal started talking to Arcelor,’’ said Ratan Tata, one of the earlier suitors wooed by Corus.

EMPIRE STRIKES BACK

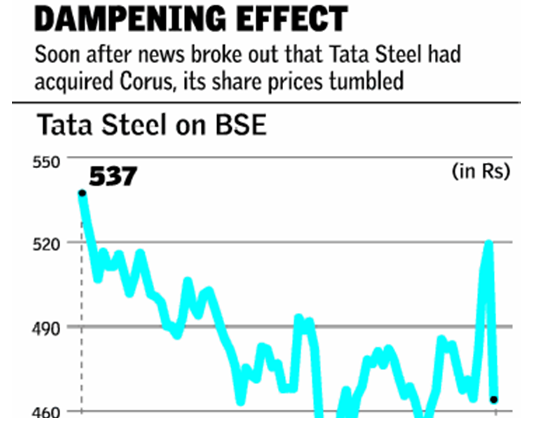

A hundred years ago, the chief of British railways had poked fun at Jamsetji’s steel dreams... A Big Deal: Winners, Losers Rs 54,000 Crore Tatas to pay $12 bn (Rs 54,000 crore) to acquire Corus at 608 pence (Rs 526 ) per share, which is about 34% higher than its original offer of 455p (Rs 389) made on October 20. It’s also 70% higher than Corus’s average share price over the year prior to the original Tata offer. Tata Steel’s share price, at the end of trading on Jan 31 (Wed) is about 9% down from when it made the first offer while Corus’ is up 27% Tata Steel shareholders have lost, at least in the short-term, while Corus shareholders have gained big-time with shares at seven-year high

WHERE WILL THE MONEY COME FROM

Of the $12bn, $4.1 bn will be pumped in as cash through the equity route by Tata Steel. The rest will be in the form of debt raised from three banks, ABN Amro, Credit Suisse & Deutsche Bank. The equity will be bridge financed

MARKET ISN’T HAPPY

CLSA, one of the largest foreign brokerage houses in India, has put a ‘sell’ advice on Tata Steel, saying it had paid too much for Corus. Tata Steel stock closed almost 11% lower at Rs 464 from Tues closing

SPEEDBREAKERS

The British Steel Workers Union has vowed to oppose the deal tooth and nail

The Benefits Triples Tata Steel’s capacity to almost 28m tonnes from 8.7 million in an industry where consolidation appears inevitable in order to leverage scales Gives it access to high-value Euroopean market; also it can ride on the back of a renowned brand Acquisition cost’s about $710 per tonne whereas greenfield would have cost $1200 per tonne, say Tatas The Dangers

Tatas have paid a heavy price. The final offer is nine times Corus’ earnings before interest, tax, depreciation and amortisation (EBIDTA), while Mittal paid less than five times Arcelor’s earnings It now needs to service a very large debt burden Integration can be a problem in such acquisitions, because of both distance and culture It’s by far the biggest takeover in the history of India Inc 2nd biggest acquisition in global steel, behind Mittal’s Steel’s $38.3bn takeover of Arcelor last year Lifts Tata Steel from 56th to 5th in global steel sweepstakes with combined revenue of $24.4bn. Two of the top 5 are now in Indian hands; Lakshmi Mittal’s Mittal-Arcelor is No. 1 Tatas overtake the Mukesh Ambani-Reliance Group to become India’s largest business house. Revenues vault from Rs 70,509 cr last year to Rs 148,885 cr, compared to Reliance’s Rs 88,965 cr. Combined m-cap, at Rs 299,075 cr, is higher than Reliance’s Rs 228,677 cr

When we first talked about acquiring Corus, many thought it was an audacious move for an Indian company to make a bid for a European steel company much larger than itself. That was something which had not happened before...This will be the first step in ensuring that Indian industry can step outside the shores of India in an international market and acquit itself as a global player