The Tata Group

| Line 1: | Line 1: | ||

| + | [[File: Tata Sons shareholding pattern, The turnover and market capitalisation; performance of Tata companies under Cyrus Mistry, 2012-16.jpg| i) Tata Sons shareholding pattern, Oct 2016; <br/> ii) The turnover and market capitalisation of the Tata Group, 1991-2016, under Ratan Tata and Cyrus Mistry. <br/> The performance of Tata companies under Cyrus Mistry, 2012-16.<br/> [http://epaperbeta.timesofindia.com/Gallery.aspx?id=25_10_2016_023_022_008&type=P&artUrl=Mistrys-big-decision-To-sell-UK-steel-unit-25102016023022&eid=31808 ''The Times of India'']|frame|500px]] | ||

| + | |||

[[File: Ratan Tata's investments, company and sector.jpg|Ratan Tata's investments, company and sector; Graphic courtesy: [http://epaperbeta.timesofindia.com/Gallery.aspx?id=02_09_2015_027_027_010&type=P&artUrl=Tata-backs-food-startup-Holachef-02092015027027&eid=31808 ''The Times of India'']|frame|500px]] | [[File: Ratan Tata's investments, company and sector.jpg|Ratan Tata's investments, company and sector; Graphic courtesy: [http://epaperbeta.timesofindia.com/Gallery.aspx?id=02_09_2015_027_027_010&type=P&artUrl=Tata-backs-food-startup-Holachef-02092015027027&eid=31808 ''The Times of India'']|frame|500px]] | ||

| + | |||

{| class="wikitable" | {| class="wikitable" | ||

|- | |- | ||

| Line 12: | Line 15: | ||

[[Category:Economy-Industry-Resources|T]] | [[Category:Economy-Industry-Resources|T]] | ||

[[Category:India|T]] | [[Category:India|T]] | ||

| − | + | ||

| − | [ | + | =The Tata group= |

| + | ==As in Oct 2016== | ||

| + | [http://timesofindia.indiatimes.com/business/india-business/Steel-to-salt-10-key-facts-about-Tata-Group/articleshow/55053792.cms AFP | Oct 25, 2016 Steel to salt: 10 key facts about Tata Group] | ||

| + | |||

| + | |||

| + | India's largest conglomerate Tata Sons is back in the hands of Ratan Tata after the sudden sacking of Cyrus Mistry. Here are key things you need to know about the Indian giant. | ||

| + | |||

| + | 1. It is arguably India's most famous family conglomerate. Established by Parsi industrialist Jamsetji Tata in 1868, the sprawling steel-to-salt conglomerate is now worth more than $100 billion and operates in more than 100 countries globally. Tata Sons is the holding company of the Tata Group. | ||

| + | |||

| + | 2. There are very few areas into which Tata has not ventured, with the group dealing in everything from salt and tea to watches, luxury cars and opulent five-star hotels. | ||

| + | |||

| + | 3. Its most high-profile companies are India's largest carmaker Tata Motors, which owns Britain's Jaguar Land Rover, the IT outsourcing giant Tata Consultancy Services (TCS), Tata Steel, Tata Global beverages and Tata Chemicals. | ||

| + | |||

| + | 4. The Tata Group is also in telecommunications through its company Tata Teleservices while its hotel chain runs Mumbai's Taj Mahal Palace and other high-end establishments. | ||

| + | |||

| + | 5. Tata's tentacles have stretched across the globe in recent years as it went on a buying spree, picking up a number of major names including Britain's Tetley Tea and the Anglo-Dutch steel firm Corus. | ||

| + | |||

| + | 6. Ratan Tata, the media-shy septuagenarian, has taken interim charge, four years after making way for Mistry, and is leading the hunt for a new successor. | ||

| + | |||

| + | 7. Tata took the reins of the group in 1991 and led it for 21 years during which he was credited with driving its expansion abroad in the 2000s. | ||

| + | |||

| + | 8. Each Tata company operates independently and has its own board of directors answerable to shareholders. Notable CEOs include Guenter Butschek at Tata Motors and Natarajan Chandrasekaran of TCS. | ||

| + | |||

| + | 9. Like many businesses, it's facing major headwinds in the form of the sluggish global economy, volatile currencies and fluctuating commodity prices. Tata Group's revenue slipped 4.6 percent for the financial year ended March while a number of its firms have their own problems. Tata Steel is the most notable. It's struggling to find a buyer for its huge loss-making British assets, with 15,000 jobs in the UK at risk, while TCS profits are down as clients tighten their purse strings. | ||

| + | |||

| + | 10. Tata Motors is also bearing the brunt of weak sales of its luxury unit Jaguar Land Rover, while Japanese mobile services provider NTT Docomo is demanding Tata coughs up a $1.17 billion arbitration payment awarded at an international hearing. | ||

=Tata Group's overseas takeovers= | =Tata Group's overseas takeovers= | ||

[http://epaper.timesofindia.com/Default/Client.asp?Daily=CAP&showST=true&login=default&pub=TOI&Enter=true&Skin=TOINEW&AW=1393708348876 Times of India] | [http://epaper.timesofindia.com/Default/Client.asp?Daily=CAP&showST=true&login=default&pub=TOI&Enter=true&Skin=TOINEW&AW=1393708348876 Times of India] | ||

| Line 126: | Line 154: | ||

Launched in 2006, the Tata Innovista programme promotes innovation across Tata companies worldwide. Over the past decade, it has seen a 15-fold increase in innovation across 70 companies. The top innovation projects this year are expected to deliver an estimated benefit of $1.1 billion annually , the Tata Group said. | Launched in 2006, the Tata Innovista programme promotes innovation across Tata companies worldwide. Over the past decade, it has seen a 15-fold increase in innovation across 70 companies. The top innovation projects this year are expected to deliver an estimated benefit of $1.1 billion annually , the Tata Group said. | ||

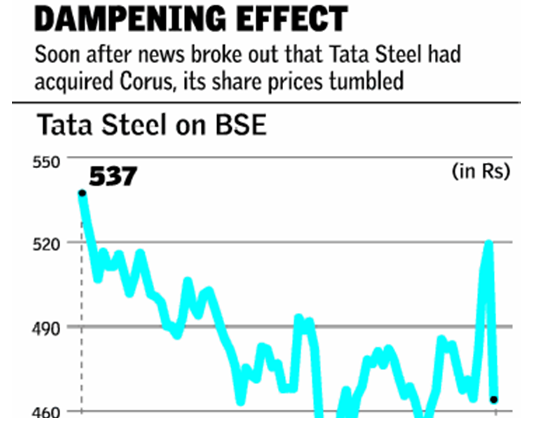

| + | =Cyrus Mistry, 2012-16= | ||

| + | See graphic | ||

| + | [[File: Cyrus Mistry, 2012-16.jpg| Cyrus Mistry, 2012-16 <br/> [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=MISTRYS-4-YEARS-SPATE-OF-ASSET-SALES-25102016023029 ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | |||

| + | == Cyrus Mistry’s big decision== | ||

| + | [http://timesofindia.indiatimes.com/business/india-business/Mistrys-big-decision-To-sell-UK-steel-unit/articleshow/55040346.cms Cyrus Mistry’s big decision: To sell UK steel unit, Reeba Zachariah & Partha Sinha | TNN | Oct 25, 2016, The Times of India] | ||

| + | |||

| + | *Mistry worked with his family enterprise Shapoorji Pallonji group, a real estate and construction giant. | ||

| + | |||

| + | *The most important decision Mistry took was to sell the beleaguered steel business in the UK | ||

| + | |||

| + | *This was a tough decision for Mistry considering that the acquisition of Corus in 2007, led by Ratan Tata himself. | ||

| + | |||

| + | MUMBAI: The kind of changes Cyrus Mistry brought about while at the helm of the Tata Group reflected that he was in a hurry to bring in a transformation. After all, Mistry was handed over a legacy he did not help create, unlike several other Tata Group chiefs who worked and rose through the ranks of the group companies. | ||

| + | |||

| + | Ratan Tata, whom Cyrus had replaced four years ago, had started his career in the Tatas at Nelco, which made a mark with its Nelco Blue Diamond colour TVs. JRD Tata, Ratan Tata's predecessor, has been a Tata lifer. In contrast, Mistry worked with his family enterprise Shapoorji Pallonji (SP) group, a real estate and construction giant. With nearly 18.5% holding, the SP group is the single largest shareholder in Tata Sons, the main promoter of most of the Tata Group companies. In November 2011, he was picked as Ratan Tata's successor to lead the $100-billion-plus group. | ||

| + | |||

| + | In his less than four-year tenure, perhaps the most important decision Mistry took was to sell the beleaguered steel business in the UK, which was turning out to be a drain on Tata Steel's balance sheet. This was a tough decision for Mistry considering that the acquisition of Corus in 2007, led by Ratan Tata himself, was considered to be an audacious move by an Indian entity. This, along with the group acquisition of the iconic auto brand Jaguar Land Rover, bolstered the Tatas' image globally. Recently, the group also decided to exit the urea business — another legacy of the past — to Yara Group of Norway. | ||

| + | |||

| + | Apart from undoing some of the legacies of the group, Mistry took the conglomerate into the new age e-commerce business with Tata CLiQ. As he prepared the blueprint for the group's new business strategy, Mistry also looked to expand the defence business. Early this year, the group sold 74% in data centre unit of Tata Communications to Temasek Holdings-owned Singapore Technologies Telemedia for $500 million. And in September this year, Mistry made it clear that the group won't shy away from paring more assets if needed. He was clearly looking to cut down on debt, which had ballooned to $24.5 billion. | ||

| + | |||

| + | During Mistry's term, high-value legal cases also rose sharply. The Tatas are fighting DoCoMo of Japan, its telecom partner, in a $1.7-billion lawsuit which has also impacted the Tata name badly. TCS, a group company, is also facing a $940 million lawsuit in the US. | ||

| + | |||

| + | During the months leading to his exit+ , Mistry was slowly coming into his own and steadily changing the way the group conducts its business. Mistry recently said group companies "need to earn the right to grow", hinting that performance of each of the group company would determine its place in the portfolio. | ||

| + | == Why Mistry was abruptly sacked as Tata chairman== | ||

| + | [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=Had-Amar-not-helped-me-I-wouldve-been-25102016015006 Changes in culture and management style were seen to erode ‘values’, Boby Kurian | TNN | Oct 25, 2016 The Times of India] | ||

| + | |||

| + | *The old guard, known for honouring commitments, was unhappy with the way dispute with DoCoMo was handled | ||

| + | |||

| + | *Some observers believe the trusts weren’t fully in sync with the functioning of the Group Executive Council set up by Mistry. | ||

| + | |||

| + | *Mistry had a different management perspective and perhaps needed time to evolve | ||

| + | |||

| + | MUMBAI: Seasoned Bombay House watchers offer illuminating pictures of how the Tatas handled the Corus acquisition (under Ratan Tata) in contrast to the messy divorce from DoCoMo (under Cyrus Mistry) to underscore the change in management styles+ and perhaps explain Mistry's abrupt dismissal. | ||

| + | |||

| + | A top investment banker recalled that Credit Suisse had offered Tatas a financing package that helped it aggressively outbid its Brazilian rival for Corus Steel in the UK. Once the deal was done, two other MNC banks approached the company's top brass with a more comfortable funding plan involving cost savings of about $400 million. As Tata Steel weighed in favour of the new funding option, Credit Suisse fetched up with a letter from the Tatas showing its commitment to $120 million in fees whether or not the financing was availed from it. | ||

| + | |||

| + | Bombay House top brass was left fuming that a bank had the temerity to place a demand on them. But when the matter was taken up to the then group chairman Ratan Tata, his decision was simple: There was a commitment made to Credit Suisse which must be honoured. Having paid the European bank, Tata Steel went ahead with the cheaper financing option. | ||

| + | |||

| + | Almost a decade later, Tata is telling DoCoMo, the Japanese partner in the troubled telecom business, that it would honour a put option to buy out at a pre-determined price but with a caveat. It would have to comply with Indian regulations. It's a small tweak to the much storied magnanimity and commitment of the Tatas. DoCoMo has already won the arbitration and blamed Tata's adamant stance for not resolving the dispute. (RBI had rejected Tata's proposal to pay a price which is higher than the 'fair value' to buy out its Japanese partner's stake after the finance ministry told the central bank to 'stick to the rules', leaving the issue to be resolved through arbitration). | ||

| + | |||

| + | "For a nuanced Tata watcher, this was a big change. In the past, Tatas would have told a battery of lawyers that there's a commitment and they must find a way around the problem," says the person quoted above. "The philosophy out there was that we would be fine in the long run," he adds, while explaining how this has served the group well over time. "What is the Tata Group? A string of under performing companies, if you exclude TCS and JLR, but strutting around because of the value system it firmly holds," says a person who has worked with the Bombay House extensively. | ||

| + | |||

| + | Was Tata Changing? | ||

| + | |||

| + | Also, there were indications that the group was getting preoccupied with decimal points, with a newfound eagerness to gather the last rupee. This was a mindset shift which roiled the Japanese ally and stymied other divestment plans aimed at de-leveraging the group's nearly $25-billion debt, says the banker mentioned earlier. It also surprised some insiders, including the Trusts that control Tata Sons, the holding company of the diversified salt-to-software behemoth. The Trusts started taking a keen interest in Mistry's new book-keeping ways. | ||

| + | |||

| + | Not just that. The handling of a harassment case at a group company, involving a senior functionary, led to considerable consternation among old-timers who were left fretting at the ways Tata was changing. The complainant had approached the chairman before quitting the job in disquiet. "The message from the top to a distraught employee didn't befit the group or the post," says the second person, cited earlier, with access to the group. | ||

| + | |||

| + | With the Tata Trusts turning their attention to the recent developments, strategic decisions across group companies were being elevated to the Tata Sons board. This reduced the space to maneuver for Mistry. | ||

| + | |||

| + | Some observers believe the trusts weren't fully in sync with the functioning of the Group Executive Council set up by Mistry, which worked closely with the boards, CEOs and senior management of Tata companies. There was strong criticism of GEC members Madhu Kannan, Nirmalya Kumar, and N S Rajan who now face an uncertain future. The Trusts, which have majority voting rights in Tata Sons' board, had started assessing the changed management style and its impact on the group which is facing sluggish growth. | ||

| + | |||

| + | 5th Year That Wasn't | ||

| + | |||

| + | These developments came to the forefront even as Mistry entered his fifth year as chairman and was due for, most thought, a routine renewal. | ||

| + | |||

| + | |||

| + | Mistry, who spearheaded Shapoorji Pallonji Group before taking over the mantle at the Tata Group, was perceived to be attempting to secure his position by building strong ties with the country's political establishment. Some of his GEC appointees reportedly advised Mistry that as Tata chairman he had an opportunity to play a bigger role with the establishment at a time when the credibility of most business houses stood diminished. | ||

| + | Top Comment | ||

| + | Tatas are so attached to their values that they cannot see it getting compromised at whatever the cost. If they were driven by profit alone they would have conquered the world by now.Chirag Chaudhary | ||

| + | |||

| + | |||

| + | Mistry had a different management perspective and perhaps needed time to evolve. His backers saw in him a chairman who struggled with a difficult global economy and some unwieldy acquisitions he inherited. | ||

| + | |||

| + | |||

| + | Mistry, only the second group chairman not to have a Tata surname, was initially part of selection committee searching for Ratan Tata's successor. He so impressed fellow committee members during deliberations — detailing what a future Tata chairman should be like — that they actually gave him the job. In the end, it didn't quite work out. "Ratan Tata is a big picture man, a visionary. Mistry brims with energy and is very hands-on (for a Tata chairman). The change was very 'in- your-face' for the old-guard," one of the senior-most CEOs at the group said. He had to go. | ||

Revision as of 20:27, 25 October 2016

ii) The turnover and market capitalisation of the Tata Group, 1991-2016, under Ratan Tata and Cyrus Mistry.

The performance of Tata companies under Cyrus Mistry, 2012-16.

The Times of India

This is a collection of articles archived for the excellence of their content. Readers will be able to edit existing articles and post new articles directly |

Contents |

The Tata group

As in Oct 2016

AFP | Oct 25, 2016 Steel to salt: 10 key facts about Tata Group

India's largest conglomerate Tata Sons is back in the hands of Ratan Tata after the sudden sacking of Cyrus Mistry. Here are key things you need to know about the Indian giant.

1. It is arguably India's most famous family conglomerate. Established by Parsi industrialist Jamsetji Tata in 1868, the sprawling steel-to-salt conglomerate is now worth more than $100 billion and operates in more than 100 countries globally. Tata Sons is the holding company of the Tata Group.

2. There are very few areas into which Tata has not ventured, with the group dealing in everything from salt and tea to watches, luxury cars and opulent five-star hotels.

3. Its most high-profile companies are India's largest carmaker Tata Motors, which owns Britain's Jaguar Land Rover, the IT outsourcing giant Tata Consultancy Services (TCS), Tata Steel, Tata Global beverages and Tata Chemicals.

4. The Tata Group is also in telecommunications through its company Tata Teleservices while its hotel chain runs Mumbai's Taj Mahal Palace and other high-end establishments.

5. Tata's tentacles have stretched across the globe in recent years as it went on a buying spree, picking up a number of major names including Britain's Tetley Tea and the Anglo-Dutch steel firm Corus.

6. Ratan Tata, the media-shy septuagenarian, has taken interim charge, four years after making way for Mistry, and is leading the hunt for a new successor.

7. Tata took the reins of the group in 1991 and led it for 21 years during which he was credited with driving its expansion abroad in the 2000s.

8. Each Tata company operates independently and has its own board of directors answerable to shareholders. Notable CEOs include Guenter Butschek at Tata Motors and Natarajan Chandrasekaran of TCS.

9. Like many businesses, it's facing major headwinds in the form of the sluggish global economy, volatile currencies and fluctuating commodity prices. Tata Group's revenue slipped 4.6 percent for the financial year ended March while a number of its firms have their own problems. Tata Steel is the most notable. It's struggling to find a buyer for its huge loss-making British assets, with 15,000 jobs in the UK at risk, while TCS profits are down as clients tighten their purse strings.

10. Tata Motors is also bearing the brunt of weak sales of its luxury unit Jaguar Land Rover, while Japanese mobile services provider NTT Docomo is demanding Tata coughs up a $1.17 billion arbitration payment awarded at an international hearing.

Tata Group's overseas takeovers

Times of India [ 20 Oct, 2006 PTI ]

Snapshot of Tata Group's takeovers abroad

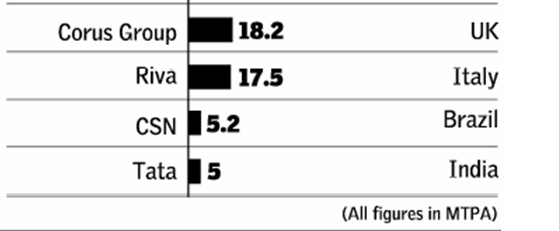

NEW DELHI: Tata Steel's successful move to acquire its much bigger rival Corus Group is the latest in a series of takeovers abroad executed by India's largest and one of the oldest corporate groups.

The acquisitions have meant that 30 per cent of the group's revenues today come from overseas operations.

Following are the major acquisitions by Tata Group companies in the past few years:

- Tata Tea acquires 30% in US' Glaceau (Energy Brands) in August 2006 for $677 mn

- Tata Tea buys 33 per cent in South African tea company Joekels through its subsidiary Tetley Group

- Tata Tea acquires US-based Eight'O clock coffee company for $220 mn (Rs 1,050 cr) in June 2006

- Tata Chemicals picks 63.5% in UK's Brunner Mond Group for Rs 508 crore in December 2005

- Tata Steel acquires Millennium Steel of Thailand in December 2005 for $404 mn (Rs 1,800 crore)

- TCS buys out Chilean BPO firm Comicorn for $23 mn (Rs 107.02 crore) in November 2005

- TCS acquires Sydney-based FNS in October 2005

- Tata Technologies purchases INCAT International, UK in October 2005 for $91 mn (Rs 411 crore)

- Tata Tea acquires Good Earth Corp in October 2005 for around $32 mn

- Tata Auto Comp (TACO) takes over German auto components maker Wundsch Weidinger

- VSNL acquires Teleglobe International in July 2005 for $239 mn

- Tata Steel buys Singapore's NatSteel in August 2004 for over Rs 1,300 crore.

- VSNL takes over Tyco Global Network for $150 mn (Rs 690 crore)

- Tata Chemical acquires Moroccan company Indo-Maroc Phosphore for Rs 166 crore

- Tata Motors picks 21% stake in Spain's Hispano Carrocera for Rs 70 crore

- Tata Tea buys Tetley, UK in February 2000 for Rs 1,870 crore

- Tata Motors takes over Daewoo Commercial Vehicle Company of Korea in March 2004 for Rs 459 crore.

Acquisitions

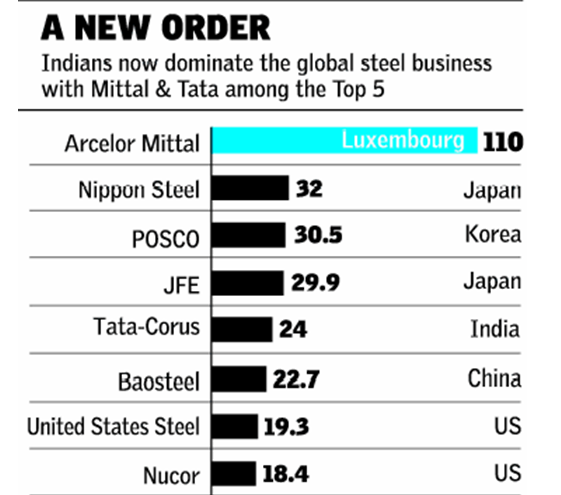

INDIA ON SONG, TAKES CORUS ALONG

Tatas Outgun Brazilians, Take World By Storm

Mumbai: India’s high noon came when it was midnight in London. In the duel between the Tatas and Brazil’s CSN for Anglo-Dutch steelmaker Corus, the Indians held their nerve as the auction went into the ninth and final round. CSN bid 603 pence to a share; the Tatas, who had made an offer of 590p in the eighth round, upped it by 18p to 608p. The Brazilians blinked.

For $12 billion, Rs 54,000 crore if you will, Tata Steel created history when it finally secured the scalp it wanted so badly — that of Anglo-Dutch steelmaker Corus, forged out of what was once the mighty British Steel — to carve out for itself a chunk of the global steel industry.

This acquisition makes the 100-year-old Tata Steel the fifth largest steel producer in the world, with an annual output of around 25 million tonnes and 87,000 employees on its rolls — a dramatic departure from only a day ago when it was ranked 56th.

The acquisition also marks the emergence of India Inc as a potent force in the global business. It was only last year that Mittal Steel headed by Lakshmi Mittal forged a blockbuster $32.4 billion deal to create Arcelor Mittal, the world’s largest steel company. ‘‘I believe this will be the first step in ensuring that Indian industry can step outside the shores of India in an international market and acquit itself as a global player,’’ said Ratan Tata, chairman, Tata Group.

While Corus Steel’s fate was eventually decided during the course of a single night, the process to find a buyer for the beleaguered European company had started in October 2005, when its bankers, Credit Suisse, set up Project England, the code name for a potential sale.

At that time, Corus was trading on the London Stock Exchange (LSE) at 300 pence a share. ‘‘We didn’t go to them, they came to us, much before Mittal started talking to Arcelor,’’ said Ratan Tata, one of the earlier suitors wooed by Corus.

EMPIRE STRIKES BACK

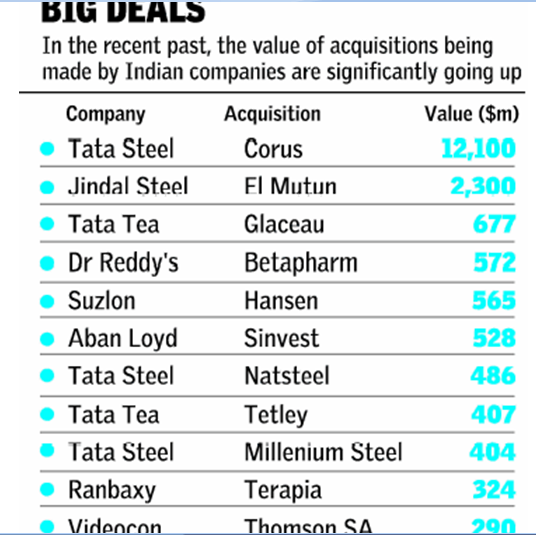

A hundred years ago, the chief of British railways had poked fun at Jamsetji’s steel dreams... A Big Deal: Winners, Losers Rs 54,000 Crore Tatas to pay $12 bn (Rs 54,000 crore) to acquire Corus at 608 pence (Rs 526 ) per share, which is about 34% higher than its original offer of 455p (Rs 389) made on October 20. It’s also 70% higher than Corus’s average share price over the year prior to the original Tata offer. Tata Steel’s share price, at the end of trading on Jan 31 (Wed) is about 9% down from when it made the first offer while Corus’ is up 27% Tata Steel shareholders have lost, at least in the short-term, while Corus shareholders have gained big-time with shares at seven-year high

Where will the money come from

Of the $12bn, $4.1 bn will be pumped in as cash through the equity route by Tata Steel. The rest will be in the form of debt raised from three banks, ABN Amro, Credit Suisse & Deutsche Bank. The equity will be bridge financed

Market is not happy

CLSA, one of the largest foreign brokerage houses in India, has put a ‘sell’ advice on Tata Steel, saying it had paid too much for Corus. Tata Steel stock closed almost 11% lower at Rs 464 from Tues closing

SPEEDBREAKERS

The British Steel Workers Union has vowed to oppose the deal tooth and nail

The Benefits Triples Tata Steel’s capacity to almost 28m tonnes from 8.7 million in an industry where consolidation appears inevitable in order to leverage scales Gives it access to high-value Euroopean market; also it can ride on the back of a renowned brand Acquisition cost’s about $710 per tonne whereas greenfield would have cost $1200 per tonne, say Tatas

The Dangers

Tatas have paid a heavy price. The final offer is nine times Corus’ earnings before interest, tax, depreciation and amortisation (EBIDTA), while Mittal paid less than five times Arcelor’s earnings It now needs to service a very large debt burden Integration can be a problem in such acquisitions, because of both distance and culture

It’s by far the biggest takeover in the history of India Inc 2nd biggest acquisition in global steel, behind Mittal’s Steel’s $38.3bn takeover of Arcelor last year

Lifts Tata Steel from 56th to 5th in global steel sweepstakes with combined revenue of $24.4bn. Two of the top 5 are now in Indian hands; Lakshmi Mittal’s Mittal-Arcelor is No. 1

Tatas overtake the Mukesh Ambani-Reliance Group to become India’s largest business house. Revenues vault from Rs 70,509 cr last year to Rs 148,885 cr, compared to Reliance’s Rs 88,965 cr. Combined m-cap, at Rs 299,075 cr, is higher than Reliance’s Rs 228,677 cr

When we first talked about acquiring Corus, many thought it was an audacious move for an Indian company to make a bid for a European steel company much larger than itself. That was something which had not happened before...This will be the first step in ensuring that Indian industry can step outside the shores of India in an international market and acquit itself as a global player

Research and development

The Times of India, May 14 2015

Reeba Zachariah

Tatas bet on innovation with $2.6bn R&D spend

In what could be the highest research and development (R&D) expenditure by an Indian conglomerate, the salt-to-software Tata Group spends Rs 16,000 crore, or $2.6 billion, on innovations as the Cyrus Mistry-led enterprise bets big on new technologies to boost growth. The diversified Indian multinational spends 2.5% of its revenue on R&D, which is much higher than the government's R&D spend of 0.9% of the country's gross domestic product (GDP).

A significant amount of the total R&D expenditure by the $103-billion conglomerate goes into automotive, software, materials and metallurgy, with Tata Motors being the most lavish spender within the group. The other major spenders within the group are Tata Steel, Tata Consultancy Services (TCS) and Tata Global Beverages.

The group's research bill has gone up by 28% from Rs 12,500 crore three years ago.

While Nano remains its flag-bearer of innovation, the group's other path-breaking products include Titan Edge, the thinnest watch, and Tata Swach, the world's low-cost water purifier. The conglomerate, under the Tata Innovista programme, has been con ducting research in several areas like products, services, processes, digitization and design, expecting them to deliver billions of dollars in revenue.

Launched in 2006, the Tata Innovista programme promotes innovation across Tata companies worldwide. Over the past decade, it has seen a 15-fold increase in innovation across 70 companies. The top innovation projects this year are expected to deliver an estimated benefit of $1.1 billion annually , the Tata Group said.

Cyrus Mistry, 2012-16

See graphic

The Times of India

Cyrus Mistry’s big decision

- Mistry worked with his family enterprise Shapoorji Pallonji group, a real estate and construction giant.

- The most important decision Mistry took was to sell the beleaguered steel business in the UK

- This was a tough decision for Mistry considering that the acquisition of Corus in 2007, led by Ratan Tata himself.

MUMBAI: The kind of changes Cyrus Mistry brought about while at the helm of the Tata Group reflected that he was in a hurry to bring in a transformation. After all, Mistry was handed over a legacy he did not help create, unlike several other Tata Group chiefs who worked and rose through the ranks of the group companies.

Ratan Tata, whom Cyrus had replaced four years ago, had started his career in the Tatas at Nelco, which made a mark with its Nelco Blue Diamond colour TVs. JRD Tata, Ratan Tata's predecessor, has been a Tata lifer. In contrast, Mistry worked with his family enterprise Shapoorji Pallonji (SP) group, a real estate and construction giant. With nearly 18.5% holding, the SP group is the single largest shareholder in Tata Sons, the main promoter of most of the Tata Group companies. In November 2011, he was picked as Ratan Tata's successor to lead the $100-billion-plus group.

In his less than four-year tenure, perhaps the most important decision Mistry took was to sell the beleaguered steel business in the UK, which was turning out to be a drain on Tata Steel's balance sheet. This was a tough decision for Mistry considering that the acquisition of Corus in 2007, led by Ratan Tata himself, was considered to be an audacious move by an Indian entity. This, along with the group acquisition of the iconic auto brand Jaguar Land Rover, bolstered the Tatas' image globally. Recently, the group also decided to exit the urea business — another legacy of the past — to Yara Group of Norway.

Apart from undoing some of the legacies of the group, Mistry took the conglomerate into the new age e-commerce business with Tata CLiQ. As he prepared the blueprint for the group's new business strategy, Mistry also looked to expand the defence business. Early this year, the group sold 74% in data centre unit of Tata Communications to Temasek Holdings-owned Singapore Technologies Telemedia for $500 million. And in September this year, Mistry made it clear that the group won't shy away from paring more assets if needed. He was clearly looking to cut down on debt, which had ballooned to $24.5 billion.

During Mistry's term, high-value legal cases also rose sharply. The Tatas are fighting DoCoMo of Japan, its telecom partner, in a $1.7-billion lawsuit which has also impacted the Tata name badly. TCS, a group company, is also facing a $940 million lawsuit in the US.

During the months leading to his exit+ , Mistry was slowly coming into his own and steadily changing the way the group conducts its business. Mistry recently said group companies "need to earn the right to grow", hinting that performance of each of the group company would determine its place in the portfolio.

Why Mistry was abruptly sacked as Tata chairman

- The old guard, known for honouring commitments, was unhappy with the way dispute with DoCoMo was handled

- Some observers believe the trusts weren’t fully in sync with the functioning of the Group Executive Council set up by Mistry.

- Mistry had a different management perspective and perhaps needed time to evolve

MUMBAI: Seasoned Bombay House watchers offer illuminating pictures of how the Tatas handled the Corus acquisition (under Ratan Tata) in contrast to the messy divorce from DoCoMo (under Cyrus Mistry) to underscore the change in management styles+ and perhaps explain Mistry's abrupt dismissal.

A top investment banker recalled that Credit Suisse had offered Tatas a financing package that helped it aggressively outbid its Brazilian rival for Corus Steel in the UK. Once the deal was done, two other MNC banks approached the company's top brass with a more comfortable funding plan involving cost savings of about $400 million. As Tata Steel weighed in favour of the new funding option, Credit Suisse fetched up with a letter from the Tatas showing its commitment to $120 million in fees whether or not the financing was availed from it.

Bombay House top brass was left fuming that a bank had the temerity to place a demand on them. But when the matter was taken up to the then group chairman Ratan Tata, his decision was simple: There was a commitment made to Credit Suisse which must be honoured. Having paid the European bank, Tata Steel went ahead with the cheaper financing option.

Almost a decade later, Tata is telling DoCoMo, the Japanese partner in the troubled telecom business, that it would honour a put option to buy out at a pre-determined price but with a caveat. It would have to comply with Indian regulations. It's a small tweak to the much storied magnanimity and commitment of the Tatas. DoCoMo has already won the arbitration and blamed Tata's adamant stance for not resolving the dispute. (RBI had rejected Tata's proposal to pay a price which is higher than the 'fair value' to buy out its Japanese partner's stake after the finance ministry told the central bank to 'stick to the rules', leaving the issue to be resolved through arbitration).

"For a nuanced Tata watcher, this was a big change. In the past, Tatas would have told a battery of lawyers that there's a commitment and they must find a way around the problem," says the person quoted above. "The philosophy out there was that we would be fine in the long run," he adds, while explaining how this has served the group well over time. "What is the Tata Group? A string of under performing companies, if you exclude TCS and JLR, but strutting around because of the value system it firmly holds," says a person who has worked with the Bombay House extensively.

Was Tata Changing?

Also, there were indications that the group was getting preoccupied with decimal points, with a newfound eagerness to gather the last rupee. This was a mindset shift which roiled the Japanese ally and stymied other divestment plans aimed at de-leveraging the group's nearly $25-billion debt, says the banker mentioned earlier. It also surprised some insiders, including the Trusts that control Tata Sons, the holding company of the diversified salt-to-software behemoth. The Trusts started taking a keen interest in Mistry's new book-keeping ways.

Not just that. The handling of a harassment case at a group company, involving a senior functionary, led to considerable consternation among old-timers who were left fretting at the ways Tata was changing. The complainant had approached the chairman before quitting the job in disquiet. "The message from the top to a distraught employee didn't befit the group or the post," says the second person, cited earlier, with access to the group.

With the Tata Trusts turning their attention to the recent developments, strategic decisions across group companies were being elevated to the Tata Sons board. This reduced the space to maneuver for Mistry.

Some observers believe the trusts weren't fully in sync with the functioning of the Group Executive Council set up by Mistry, which worked closely with the boards, CEOs and senior management of Tata companies. There was strong criticism of GEC members Madhu Kannan, Nirmalya Kumar, and N S Rajan who now face an uncertain future. The Trusts, which have majority voting rights in Tata Sons' board, had started assessing the changed management style and its impact on the group which is facing sluggish growth.

5th Year That Wasn't

These developments came to the forefront even as Mistry entered his fifth year as chairman and was due for, most thought, a routine renewal.

Mistry, who spearheaded Shapoorji Pallonji Group before taking over the mantle at the Tata Group, was perceived to be attempting to secure his position by building strong ties with the country's political establishment. Some of his GEC appointees reportedly advised Mistry that as Tata chairman he had an opportunity to play a bigger role with the establishment at a time when the credibility of most business houses stood diminished.

Top Comment

Tatas are so attached to their values that they cannot see it getting compromised at whatever the cost. If they were driven by profit alone they would have conquered the world by now.Chirag Chaudhary

Mistry had a different management perspective and perhaps needed time to evolve. His backers saw in him a chairman who struggled with a difficult global economy and some unwieldy acquisitions he inherited.

Mistry, only the second group chairman not to have a Tata surname, was initially part of selection committee searching for Ratan Tata's successor. He so impressed fellow committee members during deliberations — detailing what a future Tata chairman should be like — that they actually gave him the job. In the end, it didn't quite work out. "Ratan Tata is a big picture man, a visionary. Mistry brims with energy and is very hands-on (for a Tata chairman). The change was very 'in- your-face' for the old-guard," one of the senior-most CEOs at the group said. He had to go.