The Tata Group

(→The group as in Oct 2016) |

(→Tata Trusts) |

||

| (55 intermediate revisions by 3 users not shown) | |||

| Line 1: | Line 1: | ||

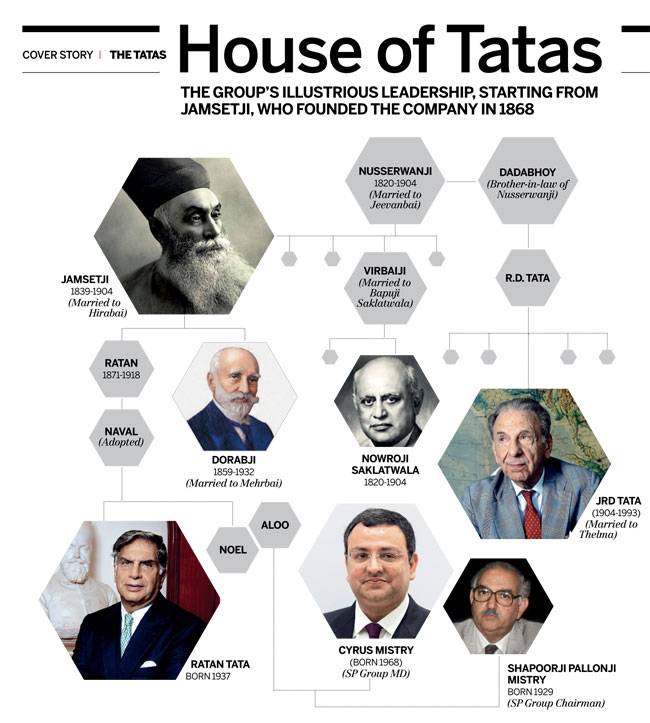

| − | [[File: Chairmen of Tata Sons, 1868- | + | [[File: The Tatas , India Today .jpg| The Tatas , India Today |frame|500px]] |

| + | |||

| + | [[File: Chairmen_of_Tata_Sons,_1868-2017.jpg|Chairmen of Tata Sons, 1868-2017 |frame|500px]] | ||

| + | |||

| + | [[File: Chairmen of Tata Sons, 1868-2016b.jpg| Chairmen of Tata Sons, 1868-2016 <br/> [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=Mistry-first-Tata-chairman-who-didnt-head-the-29102016001044 ''The Times of India'']|frame|500px]] | ||

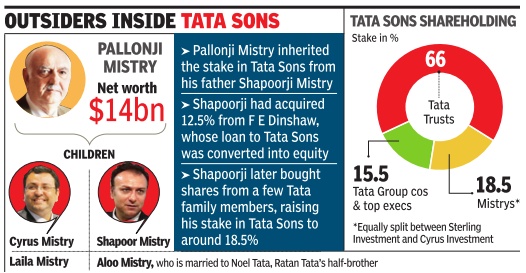

[[File: Tata Sons shareholding pattern, The turnover and market capitalisation; performance of Tata companies under Cyrus Mistry, 2012-16.jpg| i) Tata Sons shareholding pattern, Oct 2016; <br/> ii) The turnover and market capitalisation of the Tata Group, 1991-2016, under Ratan Tata and Cyrus Mistry. <br/> iii) The performance of Tata companies under Cyrus Mistry, 2012-16.<br/> [http://epaperbeta.timesofindia.com/Gallery.aspx?id=25_10_2016_023_022_008&type=P&artUrl=Mistrys-big-decision-To-sell-UK-steel-unit-25102016023022&eid=31808 ''The Times of India'']|frame|500px]] | [[File: Tata Sons shareholding pattern, The turnover and market capitalisation; performance of Tata companies under Cyrus Mistry, 2012-16.jpg| i) Tata Sons shareholding pattern, Oct 2016; <br/> ii) The turnover and market capitalisation of the Tata Group, 1991-2016, under Ratan Tata and Cyrus Mistry. <br/> iii) The performance of Tata companies under Cyrus Mistry, 2012-16.<br/> [http://epaperbeta.timesofindia.com/Gallery.aspx?id=25_10_2016_023_022_008&type=P&artUrl=Mistrys-big-decision-To-sell-UK-steel-unit-25102016023022&eid=31808 ''The Times of India'']|frame|500px]] | ||

{| class="wikitable" | {| class="wikitable" | ||

| + | |||

|- | |- | ||

| + | |||

|colspan="0"|<div style="font-size:100%"> | |colspan="0"|<div style="font-size:100%"> | ||

| + | |||

This is a collection of articles archived for the excellence of their content.<br/>You can help by converting these articles into an encyclopaedia-style entry,<br />deleting portions of the kind nor mally not used in encyclopaedia entries.<br/>Please also fill in missing details; put categories, headings and sub-headings;<br/>and combine this with other articles on exactly the same subject.<br/> | This is a collection of articles archived for the excellence of their content.<br/>You can help by converting these articles into an encyclopaedia-style entry,<br />deleting portions of the kind nor mally not used in encyclopaedia entries.<br/>Please also fill in missing details; put categories, headings and sub-headings;<br/>and combine this with other articles on exactly the same subject.<br/> | ||

| + | |||

| + | |||

Readers will be able to edit existing articles and post new articles directly <br/> on their online archival encyclopædia only after its formal launch. | Readers will be able to edit existing articles and post new articles directly <br/> on their online archival encyclopædia only after its formal launch. | ||

See [[examples]] and a tutorial.</div> | See [[examples]] and a tutorial.</div> | ||

| + | |||

|} | |} | ||

[[Category:Economy-Industry-Resources|T]] | [[Category:Economy-Industry-Resources|T]] | ||

| + | |||

[[Category:India|T]] | [[Category:India|T]] | ||

=The Tata group= | =The Tata group= | ||

| + | |||

[[File: Ratan Tata's investments, company and sector.jpg|Ratan Tata's investments, company and sector; Graphic courtesy: [http://epaperbeta.timesofindia.com/Gallery.aspx?id=02_09_2015_027_027_010&type=P&artUrl=Tata-backs-food-startup-Holachef-02092015027027&eid=31808 ''The Times of India'']|frame|500px]] | [[File: Ratan Tata's investments, company and sector.jpg|Ratan Tata's investments, company and sector; Graphic courtesy: [http://epaperbeta.timesofindia.com/Gallery.aspx?id=02_09_2015_027_027_010&type=P&artUrl=Tata-backs-food-startup-Holachef-02092015027027&eid=31808 ''The Times of India'']|frame|500px]] | ||

| + | |||

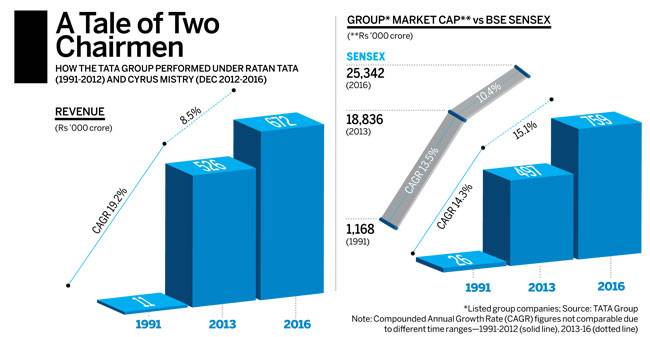

== Chairman, SDTT was always Chairman, Tata Sons: till Mistry == | == Chairman, SDTT was always Chairman, Tata Sons: till Mistry == | ||

| − | |||

| + | [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=Mistry-first-Tata-chairman-who-didnt-head-the-29102016001044 Reeba Zachariah & Namrata Singh, Mistry first Tata chairman who didn't head the Trusts, Oct 29 2016 : The Times of India] | ||

A Diarchy? Ratan Tata Continued To Run Trusts | A Diarchy? Ratan Tata Continued To Run Trusts | ||

| Line 59: | Line 72: | ||

Ishaat Hussain, who had worked under Ratan Tata, continued as director. This was the arrangement till August 2016, barely months before Mistry was sacked, when more directors were nominated, altering once again the composition of the board. TVS chairman Venu Srinivasan was brought in as a residual director, industrialist Ajay Piramal as independent director, and Amit Chandra, Bain Capital MD and brother-in-law of Nitin Nohria, as a representative of Tata Trusts. | Ishaat Hussain, who had worked under Ratan Tata, continued as director. This was the arrangement till August 2016, barely months before Mistry was sacked, when more directors were nominated, altering once again the composition of the board. TVS chairman Venu Srinivasan was brought in as a residual director, industrialist Ajay Piramal as independent director, and Amit Chandra, Bain Capital MD and brother-in-law of Nitin Nohria, as a representative of Tata Trusts. | ||

| + | |||

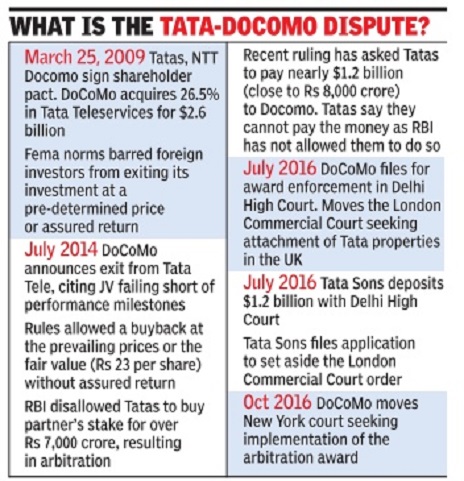

==The group as in Oct 2016== | ==The group as in Oct 2016== | ||

| − | |||

| + | [http://timesofindia.indiatimes.com/business/india-business/Steel-to-salt-10-key-facts-about-Tata-Group/articleshow/55053792.cms AFP | Oct 25, 2016 Steel to salt: 10 key facts about Tata Group] | ||

India's largest conglomerate Tata Sons is back in the hands of Ratan Tata after the sudden sacking of Cyrus Mistry. Here are key things you need to know about the Indian giant. | India's largest conglomerate Tata Sons is back in the hands of Ratan Tata after the sudden sacking of Cyrus Mistry. Here are key things you need to know about the Indian giant. | ||

| Line 84: | Line 98: | ||

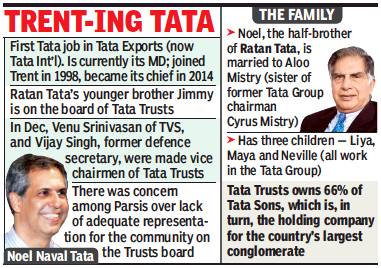

10. Tata Motors is also bearing the brunt of weak sales of its luxury unit Jaguar Land Rover, while Japanese mobile services provider NTT Docomo is demanding Tata coughs up a $1.17 billion arbitration payment awarded at an international hearing. | 10. Tata Motors is also bearing the brunt of weak sales of its luxury unit Jaguar Land Rover, while Japanese mobile services provider NTT Docomo is demanding Tata coughs up a $1.17 billion arbitration payment awarded at an international hearing. | ||

| − | |||

| − | |||

| − | |||

| − | + | [[Category:Economy-Industry-Resources|TTHE TATA GROUPTHE TATA GROUP | |

| + | THE TATA GROUP]] | ||

| + | [[Category:India|TTHE TATA GROUPTHE TATA GROUP | ||

| + | THE TATA GROUP]] | ||

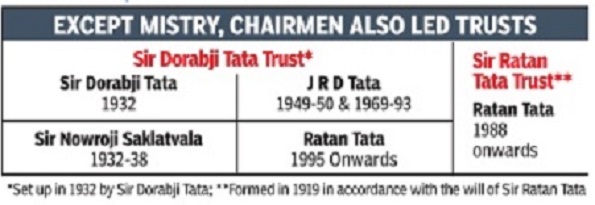

| − | + | == Cyrus Mistry’s shares in TCS, other Tata companies== | |

| − | Shapoorji | + | [[File: Holdings in Tata companies.jpg| The Shapoorji Pallonji Group’s holding in listed Tata companies, Nov. 2016<br/> [http://epaperbeta.timesofindia.com/Gallery.aspx?id=02_11_2016_021_027_003&type=P&artUrl=PALLONJIS-STAKE-IN-TATAS-IS-WORTH-Rs-81000CR-02112016021027&eid=31808 ''The Times of India'']|frame|500px]] |

| − | + | [[File: Holdings in Tata companies2.jpg| Cyrus Mistry’s own stakes in listed Tata companies, Nov. 2016<br/> [http://epaperbeta.timesofindia.com/Gallery.aspx?id=02_11_2016_021_027_003&type=P&artUrl=PALLONJIS-STAKE-IN-TATAS-IS-WORTH-Rs-81000CR-02112016021027&eid=31808 ''The Times of India'']|frame|500px]] | |

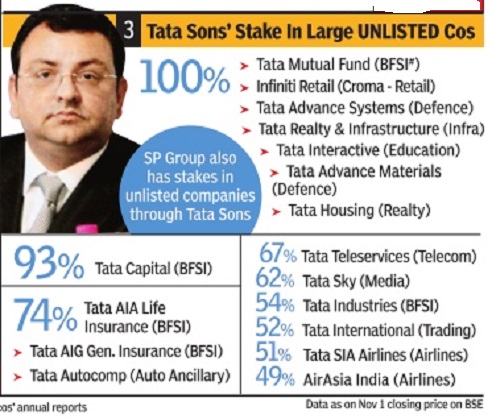

| − | + | [[File: Holdings in Tata companies3.jpg| Tata Sons’ stake in large, unlisted Tata companies, Nov. 2016 <br/> [http://epaperbeta.timesofindia.com/Gallery.aspx?id=02_11_2016_021_027_003&type=P&artUrl=PALLONJIS-STAKE-IN-TATAS-IS-WORTH-Rs-81000CR-02112016021027&eid=31808 ''The Times of India'']|frame|500px]] | |

| − | On October | + | [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=Cyrus-owns-Rs-1000cr-TCS-shares-02112016021033 Partha Sinha & Reeba Zachariah, Cyrus owns Rs 1,000cr TCS shares, Nov 02 2016 : The Times of India] |

| + | |||

| + | Cyrus Mistry , the ousted chairman of Tata Sons, holds nearly Rs 1,000crore worth of stocks of Tata Consultancy Services (TCS), the crown jewel within the Tata Group, the software major's annual report showed.Mistry also holds small stakes in other group companies -Tata Motors, Indian Hotels, Tata Global, Tata Chemicals and Tata Power -company filings showed. He's still the chairman of all these and some other group companies. | ||

| + | |||

| + | The stocks owned by Mistry is in addition to the 18.5% stake that his family , Shapoorji Pallonji (SP) Group, holds in Tata Sons, the Tata Group's holding company .Going by the value of stakes held by Tata Sons in the group's listed entities, and calculating SP group's stake on a pro-rata basis, the worth of SP Group's holding on November 1 was Rs 81,140 crore. Of this, SP Group's stake in TCS itself is worth Rs 63,158 crore, that is more than three-fourths of the total value. Other companies which contribute substantially to the value of holding by Mistry's family in Tata Sons are Tata Motors (Rs 7,983 crore), Tata Communications (Rs 1,500 crore), Tata Steel (Rs 2,279 crore), Titan (Rs 1,281 crore) and Tata Power (Rs 1,234 crore). | ||

| + | |||

| + | Other than direct holding in 15 listed companies, Tata Sons has indirect control over several other listed companies in which it holds stakes through group companies.For example, Indian Hotels holds controlling stake in Oriental Hotels and Benares Hotels, while Tata Steel controls Tata Sponge Iron and Tata Chemicals holds majority stake in Rallis India. | ||

| + | |||

| + | Tata Group also holds majority stakes in several unlisted companies through Tata Sons, which have not been valued. | ||

| + | |||

| + | ==LIC: the largest institutional investor== | ||

| + | [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=LIC-likely-to-back-board-decisions-02112016021023 LIC likely to back board decisions, Nov 02 2016 : The Times of India] | ||

| + | |||

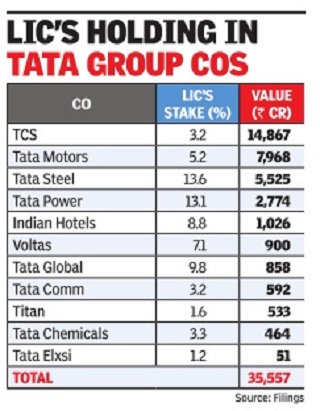

| + | [[File: The stake of the Life Insurance Company of India in Tata group companies, Nov. 2016.jpg| <br/> The stake of the Life Insurance Company of India in Tata group companies, Nov. 2016 [http://epaperbeta.timesofindia.com/Gallery.aspx?id=02_11_2016_021_023_010&type=P&artUrl=LIC-likely-to-back-board-decisions-02112016021023&eid=31808 Nov 02 2016: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | |||

| + | ''PSU Largest Institutional Investor In Tata Group Cos'' | ||

| + | |||

| + | Life Insurance Corporation (LIC) is the largest institutional investor in the Tata Group with stocks worth about Rs 37,000 crore. The life insurer has substantial minority stakes in Tata Steel (13.6%) and Tata Power (13.1%). | ||

| + | |||

| + | Tata Sons holds 31.35% in steel major and 33.01% in the automobile maker. LIC also holds 9.8% in Tata Global Beverages, 8.8% in Indian Hotels and 7.1% in Voltas. Historically, LIC has played a passive role in promoter-led companies and has been relatively more active in professionally managed companies without any identifiable promoter such as L&T, Axis Bank and ITC. | ||

| + | |||

| + | Despite having a large stake, LIC does not have a board position in most of the companies. However, former LIC chairman D K Mehrotra is on the board of Tata Steel. | ||

| + | |||

| + | LIC acting chairman V K Sharma was one of the few institutional investors that Ratan Tata had met after the ouster of Mistry . | ||

| + | |||

| + | Indian institutions had not interfered even in the '90s when Ratan Tata consolidated his control over the group. | ||

| + | |||

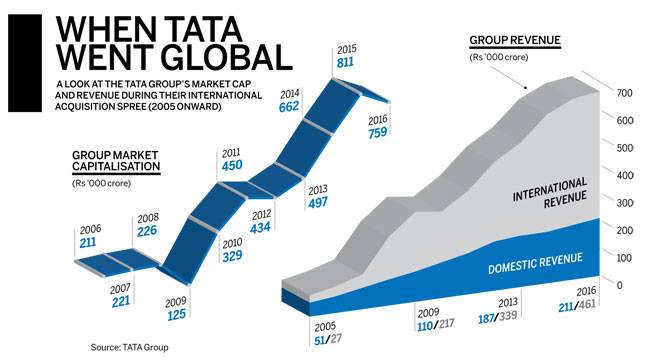

| + | == Noel Tata joins Tata Trusts board== | ||

| + | [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2019%2F02%2F14&entity=Ar00506&sk=9A205488&mode=text Reeba Zachariah, Ratan’s half-brother Noel joins Tata Trusts board, February 14, 2019: ''The Times of India''] | ||

| + | |||

| + | [[File: Noel Naval Tata.jpg|Noel Naval Tata <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2019%2F02%2F14&entity=Ar00506&sk=9A205488&mode=text Reeba Zachariah, Ratan’s half-brother Noel joins Tata Trusts board, February 14, 2019: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | |||

| + | Tata Trusts, which controls India’s largest conglomerate, the Tata Group, has inducted chairman Ratan Tata’s half-brother Noel Tata, 62, on the board. The appointment is seen as paving the way for a potential successor to the present chairman. | ||

| + | |||

| + | Speculation about Noel’s entry has been gathering steam with the small but prominent Parsi community rooting for a Tata family member to helm the Trusts in the future. TOI had reported on the likelihood of Noel, who is chairman of Trent and MD of Tata International, finding a seat on the board of the Trusts, in its December 13, 2018, edition. | ||

| + | |||

| + | |||

| + | Noel had backed Ratan Tata in battle against Cyrus Mistry | ||

| + | |||

| + | With trustees having no retirement age, Ratan Tata, 81, is expected to continue as chairman. The appointment of Noel, 62, however, comes at a time when the Trusts is battling allegations of income tax law violations, and managing trustee R Venkataramanan steps down. (TOI had reported his impending exit on Feb 8.) With Noel’s induction, all three Tata brothers are now on the board of the Trusts, which disbursed Rs 1,200 crore in fiscal 2018 for philanthropic projects. Ratan Tata’s younger brother Jimmy has been a trustee for nearly three decades. | ||

| + | |||

| + | Several Parsis, including trustee Noshir Soonawala, are believed to have expressed concern to Ratan Tata over the lack of representation from the community on the board of the Trusts, which has played a key role in the social sector besides being at the forefront of Indian industry through the $111-billion saltto-steel Tata group. Jehangir H Jehangir, a fellow Parsi and philanthropist spearheading the Jehangir Hospital in Pune, was also appointed on the board on Wednesday. | ||

| + | |||

| + | The low-key Noel Tata who makes his entry on the Tata Trusts board, has been rarely seen with its present head Ratan Tata. His interactions with Ratan Tata despite his role as a group director have been limited. However, in the recent past their equations have changed. “At the Tata leadership summit last July, Noel and Ratan Tata went back home together in the same car,” said a Tata executive. | ||

| + | |||

| + | Noel had also backed Ratan Tata in the battle against Cyrus Mistry, former group chairman and his brotherin-law. Ratan Tata is also known to be close to Noel’s three children, who work in the conglomerate. | ||

| + | |||

| + | While heading Tata International, the smaller among group companies, Noel has found mention as a possible contender for the Tata Sons chairman’s post. His entry into the Trusts would now be the most prominent role he has been cast in. According to Tata Sons’ Articles of Association, Trusts can nominate one-third of directors on the holding company’s board. There is speculation that Noel may soon represent Trusts’ interests on Tata Sons board as well. | ||

| + | |||

| + | Noel’s entry coincides with Venkataramanan (Venkat), who has been overseeing the Trusts’ operations for the last five years, exiting. The announcement did not name a replacement for Venkat. | ||

| + | |||

| + | Speculation is that R Pavitra Kumar could be given interim charge as CEO of the Trusts. Venkat has been under the Income Tax department’s scrutiny for noncompliance of rules. | ||

| + | |||

| + | The department withdrew tax exemptions of the Trusts on account of Venkat’s salary that ran into a few crores, stating that the income drawn by the managing trustee was beyond the permissible limit under the rules. | ||

| + | |||

| + | The department had sought to cancel Trusts’ licences for non-compliance of rules on usage of funds. Some time ago, Venkat was also named in a corruption case by CBI for allegedly breaking rules to obtain a flying licence for Air Asia India. He is expected to be shifted into another role within the Tata group. | ||

| + | |||

| + | With Noel’s induction, all 3 Tata brothers are now on the board of the Trusts, which disbursed Rs 1,200cr in 2018 for philanthropic projects | ||

| + | |||

| + | ==2019 Feb: changes in the Tata Sons board== | ||

| + | [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2019%2F02%2F16&entity=Ar02507&sk=0B02EB26&mode=text Reeba Zachariah, Bain Capital MD and former diplomat quit Tata Sons board, February 16, 2019: ''The Times of India''] | ||

| + | |||

| + | |||

| + | Bain Capital MD Amit Chandra and former Indian ambassador to the US Ronen Sen are exiting the board of Tata Sons, the holding company of the $111-billion Tata conglomerate. | ||

| + | |||

| + | Chandra and Sen will be the latest to quit the board of Tata Sons after Nitin Nohria and Vijay Singh, who stepped down last year. The Bain Capital MD represented controlling shareholder Tata Trusts’ interest on the holding company’s board, while Sen is an independent director. | ||

| + | |||

| + | On November 20, 2018, TOI had reported that Chandra had stepped down from the Trusts’ board and that he also planned to relinquish his position at Tata Sons. Chandra has been cutting down his assignments to increase focus on his own philanthropic activities. | ||

| + | |||

| + | On the other hand, Sen will be stepping down from Tata Sons in line with the company’s retirement policies. The board took note of the developments at its meeting on Friday. Chandra and Sen had voted in favour of Cyrus Mistry’s removal as chairman of Tata Sons in October 2016. Mistry’s removal had triggered a controversy at the conglomerate, dragging the two into it. | ||

| + | |||

| + | Following the two exits, the strength of the Tata Sons board has now been reduced to eight members. Since Tata Sons has changed its status from a deemed public limited company to a private limited company, it can have a minimum of two members and a maximum of 15 directors with liabilities. | ||

| + | |||

| + | However, the Trusts would want to have one third of Tata Sons’ board members to be its representatives in accordance with the holding company’s Articles of Association as crucial proposals like acquisitions and investments require majority support of the nominee directors of the Trusts. Three days ago, Trusts inducted Noel Tata and Jehangir H Jehangir on its board and speculation is that both or either of them could be appointed on the holding company’s board as well in the future. | ||

| + | |||

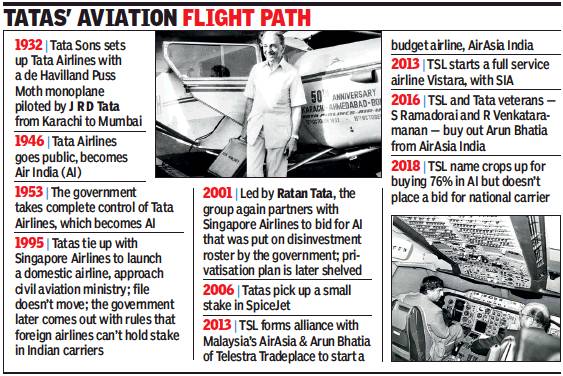

| + | =Aviation= | ||

| + | ==1952-2018: a brief history== | ||

| + | [[File: The Tatas in Aviation; 1952-2018- a brief history.jpg|The Tatas in Aviation <br/> 1952-2018: a brief history <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2018%2F10%2F18&entity=Ar00703&sk=96BA3F6A&mode=text Reeba Zachariah & Boby Kurian, Tatas in talks to pick up stake in struggling Jet?, October 18, 2018: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | '''See graphic''': | ||

| + | |||

| + | ''The Tatas in Aviation <br/> 1952-2018: a brief history'' | ||

| + | |||

| + | =Nataraja Chandrasekaran, 2017- = | ||

| + | |||

| + | Tata Consultancy Services CEO [[Nataraja Chandrasekaran]] was in Jan 2017 named the new Chairman of Tata Sons, the holding company of the $103 billion Tata Group. | ||

| + | |||

| + | A five-member panel comprising Ratan Tata, TVS Group head Venu Srinivasan, Amit Chandra of Bain Capital, former diplomat Ronen Sen and Lord Kumar Bhattacharya, was constituted in October to shortlist candidates for the position, the Economic Times reported. | ||

| + | |||

| + | N Chandrasekaran had been the CEO and Managing Director of Tata Consultancy Services since 2009. Since October 2016, he had also served on the board of Tata Sons. | ||

| + | |||

| + | = DoCoMo = | ||

| + | |||

| + | ==The Tatas’ legal battle, 2014-16== | ||

| + | |||

| + | [[File: TheTata, DoCoMo legal battle, 2014-16.jpg|TheTata, DoCoMo legal battle, 2014-16 |frame|500px]] | ||

| + | |||

| + | [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=Mistry-questioned-original-DoCoMo-deal-after-sacking-02112016022064 Mistry questioned original DoCoMo deal after sacking, Nov 02 2016 : The Times of India] | ||

| + | |||

| + | |||

| + | |||

| + | Tata Sons and DoCoMo have been in a legal battle since the end of 2014 over the amount of money the Tatas have to pay DoCoMo for the Japanese telecom major to exit the joint venture. After Mistry was removed, media reports had quoted Tata sources to say that he was coming in the way of an amicable settlement with DoCoMo. | ||

| + | |||

| + | The eight-point statement begins by saying, “Insinuations that the DoCoMo issue was handled under the watch of Mistry in a manner inconsistent with Tata culture and values are baseless. The suggestion that Ratan Tata and the trustees would not have approved of the manner in which the litigation was conducted is contrary to what transpired.“ | ||

| + | |||

| + | It goes on to say ,“A number of discussions on the Docomo situation had been held in the Tata Sons board. Mr Mistry had always mentioned that the Tatas should honour all commitments within the law . This stance is based on Tata Sons' board view and was always consistent with the series of board meetings in which the Docomo is sue was discussed.“ Mistry's office said that the agreement with DoCoMo was executed before he became the chairman of the Tata Group. In 2009, when Ratan Tata was chairman of Tata Sons, the company brought in the Japanese telecom major as a partner in Tata Teleservices. DoCoMo had paid $2.6 billion for a 26.5% stake in Tata Teleservices. | ||

| + | |||

| + | After Mistry was ousted, he, in a letter to the board of Tata Sons on October 25, had criticised the original partnership structure of the venture with DoCoMo and said it raised “several questions about its appropriateness from a commercial or prudential perspective wit hin the then prevailing Indian legal framework“. | ||

| + | |||

| + | In January 2015, DoCoMo had moved courts after Tata Sons said that Indian laws did not allow it to buy back the Japanese company's stake at a pre-agreed price of $1.2 billion.In June 2016, DoCoMo won a $1.2 billion arbitral award from a London court and moved courts to enforce the award in India, US and UK jurisdictions.Later, Tata Sons deposited $1.2 billion with Delhi high court. | ||

| + | |||

| + | Mistry's statement added that the Tatas had requested DoCoMo to join them in seeking the approval from Reserve Bank of India, but the Japanese company did not agree. | ||

| + | |||

| + | =Flashpoints= | ||

| + | |||

| + | |||

| + | |||

| + | ==Small shareholders vis-à-vis boards== | ||

| + | |||

| + | [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2018%2F07%2F10&entity=Ar02111&sk=56A0223E&mode=text Reeba Zachariah, Small shareholder, board ties in focus, July 10, 2018: ''The Times of India''] | ||

| + | |||

| + | [[File: 2016-18- Mistry vs. the Tatas, a timeline of the conflict.jpg|2016-18- Mistry vs. the Tatas, a timeline of the conflict <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2018%2F07%2F10&entity=Ar02111&sk=56A0223E&mode=text Reeba Zachariah, Small shareholder, board ties in focus, July 10, 2018: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | ''NCLT’s Dismissal Of Mistry Petition May Impact Investor-Backed, Closely Held Cos'' | ||

| + | |||

| + | The National Company Law Tribunal’s dismissal of the plea by ousted chairman Cyrus Mistry against Tata Sons on Monday has put the spotlight on the relationship between promoters, boards and minority shareholders. | ||

| + | |||

| + | The NCLT, among other things, has said that the Tata Sons board was “competent” to remove its executive chairman Mistry and that Ratan Tata and others didn’t act as shadow directors. The order, unless dismissed by a higher court, would have a bearing on closely held companies where private equity and venture capital investors are minority shareholders, and newage startups that are increasingly managed by the board. | ||

| + | |||

| + | A broad swathe of industry observers and corporate governance experts agreed with the verdict that the board is entitled to remove its chairman and that shareholders have the right to remove him/ her from the company’s directorship, while some are questioning the definition of ‘competence’, especially if it becomes a precedent-setting order. | ||

| + | |||

| + | Sanjay Asher, partner at legal firm Crawford Bayley, said, “In a corporate democracy, majority rules — which means majority members of the board can remove the chairman and majority shareholders can strip him of his directorship.” | ||

| + | |||

| + | Shriram Subramanian, MD of shareholder advisory fir m InGover n, said, “It is not clear on what basis the competency of the board is decided, as any board member of any Indian company can then be said to be competent to take action. All mismanagement and oppression issues would have been perpetrated by competent managements and boards.” | ||

| + | |||

| + | The NCLT, according to industry experts, hasn’t touched upon board deliberations and the outcome of those. Sandeep Parekh, former Sebi director and now founder of Finsec Law Advisors, said, “The tribunal seems to have ignored the elephant in the room — fiduciary duties of directors. For example, how did a Tata Sons board, which gave excellent rating to its chairman less than three months ago, suddenly find his performance inadequate, especially when new directors had just joined the board.” | ||

| + | |||

| + | Parekh added, “In any case, other serious issues like insider trading and relatedparty transactions will be looked into by Sebi as the NCLT does not have jurisdiction over those.” | ||

| + | |||

| + | [[Category:Economy-Industry-Resources|TTHE TATA GROUPTHE TATA GROUPTHE TATA GROUPTHE TATA GROUPTHE TATA GROUP | ||

| + | THE TATA GROUP]] | ||

| + | [[Category:India|TTHE TATA GROUPTHE TATA GROUPTHE TATA GROUPTHE TATA GROUPTHE TATA GROUP | ||

| + | THE TATA GROUP]] | ||

| + | [[Category:Pages with broken file links|THE TATA GROUP]] | ||

| + | |||

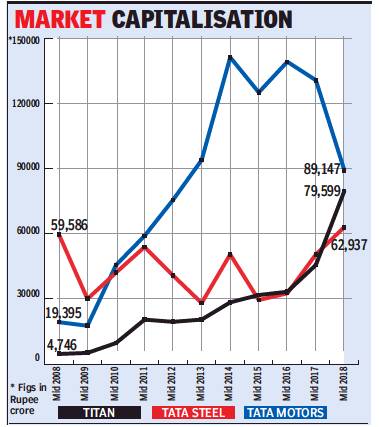

| + | =Market capitalisation= | ||

| + | |||

| + | ==Titan, Tata Steel, Tata Motors: 2008-2018== | ||

| + | |||

| + | [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2018%2F06%2F19&entity=Ar01906&sk=627EBB04&mode=text Avik Das & Sujit John, GST, local themes put Titan on fast track, June 19, 2018: ''The Times of India''] | ||

| + | |||

| + | [[File: Market capitalisation- Titan, TATA Steel and TATA Motors.jpg|Market capitalisation- Titan, TATA Steel and TATA Motors <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2018%2F06%2F19&entity=Ar01906&sk=627EBB04&mode=text Avik Das & Sujit John, Bhaskar Bhat, GST, local themes put Titan on fast track, June 19, 2018: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | Bhaskar Bhat has had a great career at Titan, rising to be the Tata Group company’s MD in 2002, and building it into an over $2-billion revenue entity. But even by those standards, last year must have been special. | ||

| + | |||

| + | The jewellery-andwatch firm’s top line grew 21% and net profit jumped 53%, a performance that sent its share price soaring, taking its market cap to $12 billion, a little behind Tata Motors ($13.3 billion) and ahead of Tata Steel (9.4 billion). Ten years ago, Titan’s market cap was a quarter of Tata Motors’ m-cap and less than 10% of Tata Steel’s. And in November, in a recognition of Bhat’s success and contributions, the 64-year-old was elevated to the board of directors of Tata Sons, the holding company that controls India’s largest conglomerate. | ||

| + | |||

| + | When we ask Bhat about it, he modestly acknowledges the company had a very good year. “You know that. Competition has kind of got demolished jewellery primarily, but in all segments, for all unorganised businesses.” GST, demonetisation, and the Nirav Modi/Mehul Choksi episodes have all worked to the benefit of Tanishq, Titan’s jewellery brand. It accounts for 83% of Titan’s overall income, and grew by over 24% last year. Many of India’s jewellers have dealt in cash, avoided paying taxes, and have been conduits for those who wanted to launder black money. But the government is cracking down on efforts to convert black money into gold — by insisting on a PAN card for gold transactions above Rs 2 lakh, and keeping a closer watch on jewellers’ transactions. “Customers are even getting scared of being caught on camera (dealing in cash at stores),” says Bhat. | ||

| + | |||

| + | This, combined with the introduction of GST that makes transparent accounting more imperative, has made plain gold jewellery no longer very remunerative for small players, and more so because it is a very low-margin business. Banks, too, have become wary of lending to jewellers following the Nirav Modi scandal. Consequently, business is moving to organised players like Tanishq. | ||

| + | |||

| + | Watches, which Titan began with and became almost a monopoly at one point — demolishing incumbent HMT, is now a fraction of the jewellery business, but nonetheless a growing one. Mobile phones have become timekeepers for many. So Titan has focused on making watches cool, a fashion accessory a positioning that has worked especially with the young. | ||

| + | |||

| + | “Today, it has gone beyond even just good looks. There has to be some meaning attached to it. For example, I wear a different watch every day. Today I wore this mechanical watch because this director was coming — he’s an engineer. It’s a conversation piece,” Bhat says. | ||

| + | |||

| + | The effort now is to increase the extent of “smartness” in every watch — a lesson many have learnt from Apple, which has become the world’s biggest watchmaker. Titan will not give up its analogue legacy (moving hands on the clock face). But it will introduce some of the most relevant digital features, such as fitness measurements, into watches. | ||

| + | |||

| + | Asked about Titan’s newest business, the sari brand Taneira, Bhat says it’s still too small to even call it a business. “I can call it a business when it hits Rs 100 crore,” he says, but adds that the concept has been accepted well. Taneira’s value proposition is ‘India under one roof’. “We think it will do well because the India story is seeping into Indians,” says Bhat. “They are seeking a strong Indian identity.” | ||

| + | |||

| + | =Cyrus Mistry= | ||

| + | |||

| + | See the page [[Cyrus Mistry]] | ||

| + | |||

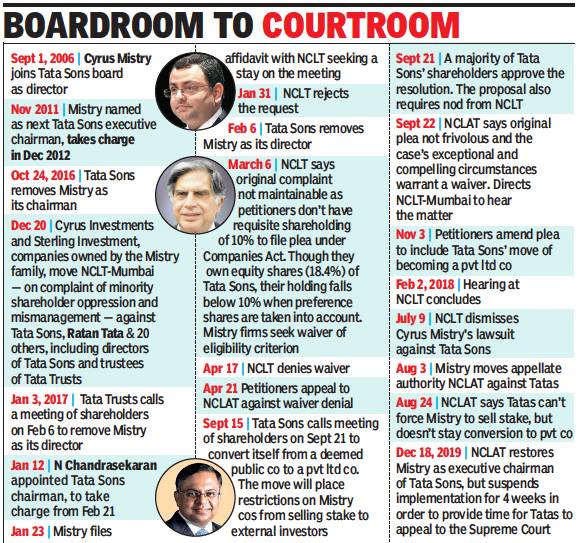

| + | ==2006-2019: the course of the dispute== | ||

| + | [[File: 2006-2019, the course of the Cyrus Mistry vs. the Tatas dispute.jpg|2006-2019, the course of the Cyrus Mistry vs. the Tatas dispute <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2019%2F12%2F19&entity=Ar02110&sk=7AE2C95C&mode=text Dec 19, 2019 ''Times of India''] |frame|500px]] | ||

| + | |||

| + | '''See graphic''': | ||

| + | |||

| + | '' 2006-2019, the course of the Cyrus Mistry vs. the Tatas dispute '' | ||

| + | |||

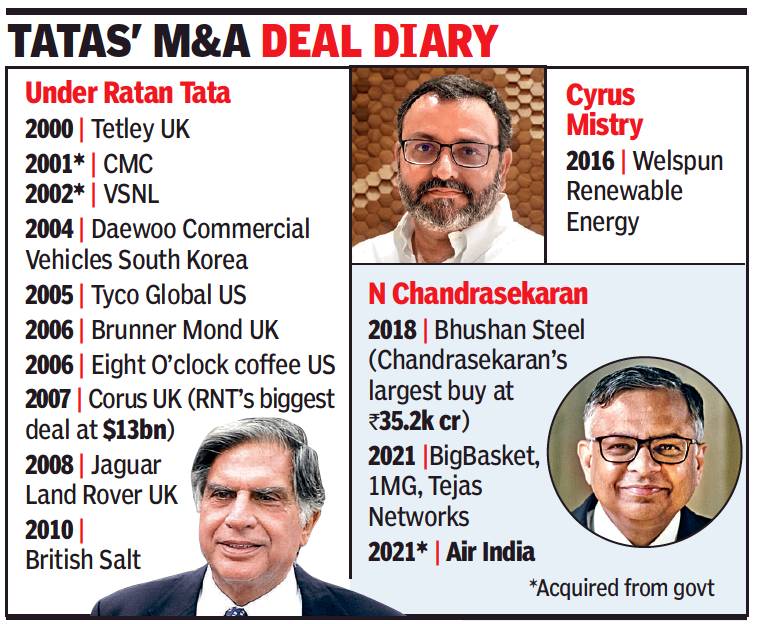

| + | =M&As= | ||

| + | ==2000-21== | ||

| + | [[File: The Tatas and M&As, 2000-21.jpg|The Tatas and M&As: 2000-21 <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL/2021/10/09&entity=Ar02701&sk=35773ED7&mode=text Oct 9, 2021: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | '''See graphic''': | ||

| + | |||

| + | '' The Tatas and M&As: 2000-21 '' | ||

| + | |||

| + | [[Category:Economy-Industry-Resources|TTHE TATA GROUPTHE TATA GROUPTHE TATA GROUPTHE TATA GROUPTHE TATA GROUP | ||

| + | THE TATA GROUP]] | ||

| + | [[Category:India|TTHE TATA GROUPTHE TATA GROUPTHE TATA GROUPTHE TATA GROUPTHE TATA GROUP | ||

| + | THE TATA GROUP]] | ||

| + | [[Category:Pages with broken file links|THE TATA GROUPTHE TATA GROUPTHE TATA GROUP | ||

| + | THE TATA GROUP]] | ||

| + | |||

| + | =Naval Tata’s family= | ||

| + | |||

| + | ==Jimmy Tata== | ||

| + | |||

| + | [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=The-brother-a-Tata-trustee-who-lives-in-21122016029030 Reeba Zachariah & Vipashana V K, The brother, a Tata trustee, who lives in the shadows, Dec 21, 2016: The Times of India] | ||

| + | |||

| + | '''Jimmy, Ratan Tata's Reclusive Younger Sibling, Opens Up To TOI And Shares His Copious Correspondence With Bombay House''' | ||

| + | |||

| + | This is a tale of the other brother. While reams of newsprint and countless TV hours have been dedicated to one, the other has never made it to the headlines.Not many are even aware of his existence. For most of his 76 years, Jimmy Naval Tata has lived in the shadow of his larger-than-life older brother, Ratan Naval Tata. | ||

| + | |||

| + | A shareholder in Tata Sons and several other Tata companies, the reclusive Jimmy is a trustee of Sir Ratan Tata Trust, a position he inherited after his father Naval died in 1989 in accordance with his will. Naval was originally not a Tata; he was born in a middle-class Parsi family and was adopted by Sir Ratanji Tata's wife Navajbai after his father died. | ||

| + | |||

| + | Barring his trusteeship, Jimmy has no role to play at Bombay House -the epicentre of the war between Ratan Tata and Cyrus Mistry . | ||

| + | |||

| + | But from his spartan 2BHK apartment on the sixth floor of Hampton Court in Colaba, he has kept track of every little twist and turn at India's largest conglomerate, almost to the point of obsession. | ||

| + | |||

| + | He doesn't own a mobile phone and he does not have a secretary . Newspapers seem to be his window to the outside world. He writes in flowing long-hand and his signature bears a certain resemblance to Ratan Tata's. A TV sits, covered in cloth, in one corner of his living room.The walls are lined with files and large, dusty suitcases. | ||

| + | |||

| + | When asked for his views on the ongoing war, he hands over six bulging files and says, “Whatever you want to know about me and my opinions is in here.“ The files, which are in our possession, contain hundreds of pages of hand and typewritten letters to the trustees of Sir Ratan Tata Trust and the board of Tata Sons over many years -right up till Nov 18, 2016. They convey his unhappiness over a range of decisions, including the appointment of Harvard Business School dean Nitin Nohria to the board of the Tata group's holding company about three years ago. | ||

| + | |||

| + | There is a July 2015 letter from him to Tata Sons -according to which he holds 3,262 ordinary shares -with a subject line, `In case of liquidation of Tata Sons Ltd', where he has estimated the break-up value at more than “Rs 10 lakh croreshare“. Every page of every letter sent and received is rubberstamped with his name and address. Many of them point to strained relations with the people at the helm of the group that bears his family name. | ||

| + | |||

| + | Also in the files are countless newspaper clippings -related mostly to the Tata Group -accompanied by sharp, caustic comments. Jimmy told TOI that he started his career with the Tata Group under his father in the textile business, which subsequently ran into rough weather. Jimmy and Ratan have a half-brother Noel, from Naval Tata's second wife Simone. Noel is MD of Tata International and chairman of Trent, and brother-in-law of Cyrus Mistry , and there's been speculation in the media about his chances of being named the next chairman of Tata Sons. | ||

| + | |||

| + | People working in the building where Jimmy lives said the bachelor rarely steps out and is extremely wary of opening the door to visitors. TOI visited him twice, and only after a close examination of our ID cards did he let us in. | ||

| + | |||

| + | Jimmy , who also owns shares in TCS, Tata Motors, Tata Steel, Tata Chemicals, Indian Hotels and Tata Power, said he had never voted on any resolution of the Tatas and had, right from the beginning, decided to abstain from the extraordinary general meetings to remove Cyrus. | ||

| + | |||

| + | When asked whether he would, like the group's founders, leave his estate to a trust after his death, pat came the reply , “Let them fight it out just as they are fighting now“. | ||

| + | |||

| + | =Noel Naval Tata’s children= | ||

| + | |||

| + | == Leah, Maya and Neville== | ||

| + | |||

| + | [http://timesofindia.indiatimes.com/business/international-business/tata-scions-work-their-way-up-the-tata-chain/articleshow/56699430.cms Kala Vijayraghavan & Megha Mandavia, Jan 21, 2017: The Times of India] | ||

| + | |||

| + | Generation Next has been making quiet progress in the $103-billion Tata Group. Leah, Maya and Neville, the children of Noel Naval Tata, Ratan Tata's half-brother, are working their way up in group companies just like other professionals, senior officials familiar with the matter said. | ||

| + | |||

| + | Leah, the eldest, is with Indian Hotels Company, the operator of the Taj group of hotels. Younger daughter Maya works as an analyst at Tata Capital, the flagship financial services company. Neville is with retail chain Trent, which his father helped build. Their presence in the group has been kept under wraps for a while and little information is available in the public domain. They've been so discreet in the workplace that many of their colleagues probably don't even know about their lineage. | ||

| + | |||

| + | All three have graduated from institutes in London and Spain, a senior official said. Leah did a Masters in marketing at the IE Business School in Madrid, according to her LinkedIn profile. | ||

| + | |||

| + | Aged between early 20s and early 30s, they are quiet and extremely well-behaved, have no hang-ups and are keen to work their way up the ladder, according to a senior official. The low-profile and mediashy Noel Tata, who is chairman of Trent and managing director of Tata International, has insisted that they shouldn't get any preferential treatment, officials said. "Their father has given clear instructions to the respective organisations that they should be treated as regular employees," said an official. | ||

| + | |||

| + | "They do not mention their surnames and have merged into the system," a top official said. Noel Tata did not respond to an emailed questionnaire until press time. Leah, Maya and Neville have each been assigned to a business in which they have shown interest. Leah has spent most of the past 10 years with Indian Hotels, except for a three-month stint in 2010 when she interned with Louis Vuitton. She started her career as assistant sales manager at the Taj Hotels Resorts & Palaces in 2006 and is now assistant manager - development. | ||

| + | |||

| + | Neville manages hyperlocal food at Trent, the operator of Westside, Star Bazaar and Landmark stores, which has a joint venture with Tesco. "He has been given the challenge of fixing that part which is still not making a lot of money," an official said. "All of them are bright, humble and hardworking and will be great managers." Another senior official said Noel Tata wanted them to be exposed to all aspects of business and learn the ropes. | ||

| + | |||

| + | "He did not want them to make the same mistake he did of being confined to certain parts of the business," another official said. "Possibly, Noel is making sure they have enough exposure." Ratan Tata, when asked about a successor for the Tata Group, had said in an interview in 2011 that Noel Tata was not ready for the responsibility. He said that Noel Tata should have had "greater exposure than he has had". | ||

| + | |||

| + | "All successful family businesses ask their children to work in different business segments before their growth is accelerated," said Kavil Ramachandran, executive director of the Thomas Schmidheiny Centre for Family Enterprise at the Indian School of Business in Hyderabad. "But Tatas are not like any other promoter family... they are not trying to make wealth for the family. The children will reach the top only if they are good. I don't think they see themselves as successors." | ||

| + | |||

| + | Noel Tata's name frequently came up among the internal candidates shortlisted for the role of Tata Sons chairman, both when Ratan Tata stepped down in 2011 and when Cyrus Mistry was sacked in October. Not much is known about their family equations. Noel Tata is son of Naval H Tata and his second wife Simone. He is married to Aloo Mistry, the sister of former Tata Sons chairman Cyrus Mistry. While Cyrus Mistry and Noel Tata are known to have a cordial relationship, their interaction at board meetings chaired by Mistry was minimal. | ||

| + | |||

| + | =Overseas takeovers= | ||

| + | |||

| + | ==As in 2016== | ||

| + | |||

| + | ''' See graphic ''' | ||

| + | |||

| + | [[File: India Today , November 7,2016 .jpg| India Today , November 7,2016 |frame|500px]] | ||

| + | |||

| + | ==As in 2006== | ||

| − | |||

[http://epaper.timesofindia.com/Default/Client.asp?Daily=CAP&showST=true&login=default&pub=TOI&Enter=true&Skin=TOINEW&AW=1393708348876 Times of India] | [http://epaper.timesofindia.com/Default/Client.asp?Daily=CAP&showST=true&login=default&pub=TOI&Enter=true&Skin=TOINEW&AW=1393708348876 Times of India] | ||

| + | |||

[ 20 Oct, 2006 PTI ] | [ 20 Oct, 2006 PTI ] | ||

| − | |||

Snapshot of Tata Group's takeovers abroad | Snapshot of Tata Group's takeovers abroad | ||

| + | |||

NEW DELHI: Tata Steel's successful move to acquire its much bigger rival Corus Group is the latest in a series of takeovers abroad executed by India's largest and one of the oldest corporate groups. | NEW DELHI: Tata Steel's successful move to acquire its much bigger rival Corus Group is the latest in a series of takeovers abroad executed by India's largest and one of the oldest corporate groups. | ||

| Line 117: | Line 390: | ||

* Tata Tea buys 33 per cent in South African tea company Joekels through its subsidiary Tetley Group | * Tata Tea buys 33 per cent in South African tea company Joekels through its subsidiary Tetley Group | ||

| + | |||

| + | |||

* Tata Tea acquires US-based Eight'O clock coffee company for $220 mn (Rs 1,050 cr) in June 2006 | * Tata Tea acquires US-based Eight'O clock coffee company for $220 mn (Rs 1,050 cr) in June 2006 | ||

| + | |||

* Tata Chemicals picks 63.5% in UK's Brunner Mond Group for Rs 508 crore in December 2005 | * Tata Chemicals picks 63.5% in UK's Brunner Mond Group for Rs 508 crore in December 2005 | ||

| + | |||

* Tata Steel acquires Millennium Steel of Thailand in December 2005 for $404 mn (Rs 1,800 crore) | * Tata Steel acquires Millennium Steel of Thailand in December 2005 for $404 mn (Rs 1,800 crore) | ||

| + | |||

* TCS buys out Chilean BPO firm Comicorn for $23 mn (Rs 107.02 crore) in November 2005 | * TCS buys out Chilean BPO firm Comicorn for $23 mn (Rs 107.02 crore) in November 2005 | ||

| + | |||

* TCS acquires Sydney-based FNS in October 2005 | * TCS acquires Sydney-based FNS in October 2005 | ||

| + | |||

* Tata Technologies purchases INCAT International, UK in October 2005 for $91 mn (Rs 411 crore) | * Tata Technologies purchases INCAT International, UK in October 2005 for $91 mn (Rs 411 crore) | ||

| + | |||

* Tata Tea acquires Good Earth Corp in October 2005 for around $32 mn | * Tata Tea acquires Good Earth Corp in October 2005 for around $32 mn | ||

| + | |||

* Tata Auto Comp (TACO) takes over German auto components maker Wundsch Weidinger | * Tata Auto Comp (TACO) takes over German auto components maker Wundsch Weidinger | ||

| + | |||

* VSNL acquires Teleglobe International in July 2005 for $239 mn | * VSNL acquires Teleglobe International in July 2005 for $239 mn | ||

| + | |||

* Tata Steel buys Singapore's NatSteel in August 2004 for over Rs 1,300 crore. | * Tata Steel buys Singapore's NatSteel in August 2004 for over Rs 1,300 crore. | ||

| + | |||

* VSNL takes over Tyco Global Network for $150 mn (Rs 690 crore) | * VSNL takes over Tyco Global Network for $150 mn (Rs 690 crore) | ||

| + | |||

* Tata Chemical acquires Moroccan company Indo-Maroc Phosphore for Rs 166 crore | * Tata Chemical acquires Moroccan company Indo-Maroc Phosphore for Rs 166 crore | ||

| + | |||

* Tata Motors picks 21% stake in Spain's Hispano Carrocera for Rs 70 crore | * Tata Motors picks 21% stake in Spain's Hispano Carrocera for Rs 70 crore | ||

| + | |||

* Tata Tea buys Tetley, UK in February 2000 for Rs 1,870 crore | * Tata Tea buys Tetley, UK in February 2000 for Rs 1,870 crore | ||

| − | |||

| + | * Tata Motors takes over Daewoo Commercial Vehicle Company of Korea in March 2004 for Rs 459 crore. | ||

| + | ===Acquisitions=== | ||

| − | |||

INDIA ON SONG, TAKES CORUS ALONG | INDIA ON SONG, TAKES CORUS ALONG | ||

| Line 156: | Line 444: | ||

A hundred years ago, the chief of British railways had poked fun at Jamsetji’s steel dreams... | A hundred years ago, the chief of British railways had poked fun at Jamsetji’s steel dreams... | ||

| + | |||

A Big Deal: Winners, Losers | A Big Deal: Winners, Losers | ||

| + | |||

Rs 54,000 Crore | Rs 54,000 Crore | ||

| + | |||

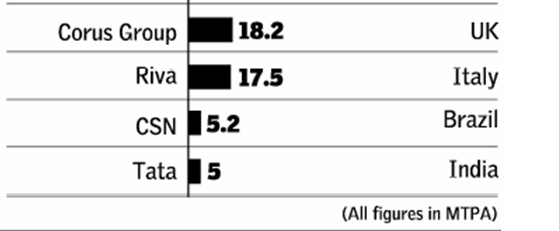

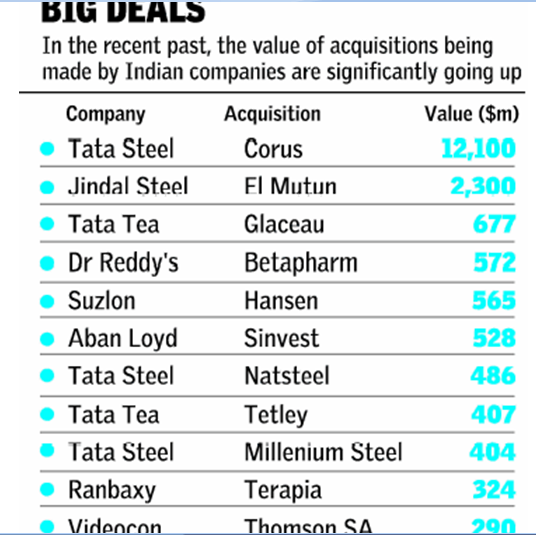

Tatas to pay $12 bn (Rs 54,000 crore) to acquire Corus at 608 pence (Rs 526 ) per share, which is about 34% higher than its original offer of 455p (Rs 389) made on October 20. It’s also 70% higher than Corus’s average share price over the year prior to the original Tata offer. Tata Steel’s share price, at the end of trading on Jan 31 (Wed) is about 9% down from when it made the first offer while Corus’ is up 27% Tata Steel shareholders have lost, at least in the short-term, while Corus shareholders have gained big-time with shares at seven-year high | Tatas to pay $12 bn (Rs 54,000 crore) to acquire Corus at 608 pence (Rs 526 ) per share, which is about 34% higher than its original offer of 455p (Rs 389) made on October 20. It’s also 70% higher than Corus’s average share price over the year prior to the original Tata offer. Tata Steel’s share price, at the end of trading on Jan 31 (Wed) is about 9% down from when it made the first offer while Corus’ is up 27% Tata Steel shareholders have lost, at least in the short-term, while Corus shareholders have gained big-time with shares at seven-year high | ||

| − | + | '''Where will the money come from''' | |

Of the $12bn, $4.1 bn will be pumped in as cash through the equity route by Tata Steel. The rest will be in the form of debt raised from three banks, ABN Amro, Credit Suisse & Deutsche Bank. The equity will be bridge financed | Of the $12bn, $4.1 bn will be pumped in as cash through the equity route by Tata Steel. The rest will be in the form of debt raised from three banks, ABN Amro, Credit Suisse & Deutsche Bank. The equity will be bridge financed | ||

| − | + | '''Market is not happy''' | |

| + | |||

[[File: The sales and price of the Nano car, 2009-16.jpg| The sales and price of the Nano car, 2009-16<br/> [http://epaperbeta.timesofindia.com/Gallery.aspx?id=28_10_2016_026_024_011&type=P&artUrl=Successor-might-insist-on-exit-clause-28102016026024&eid=31808 ''The Times of India'']|frame|500px]] | [[File: The sales and price of the Nano car, 2009-16.jpg| The sales and price of the Nano car, 2009-16<br/> [http://epaperbeta.timesofindia.com/Gallery.aspx?id=28_10_2016_026_024_011&type=P&artUrl=Successor-might-insist-on-exit-clause-28102016026024&eid=31808 ''The Times of India'']|frame|500px]] | ||

| Line 174: | Line 466: | ||

''' The Benefits ''' | ''' The Benefits ''' | ||

| + | |||

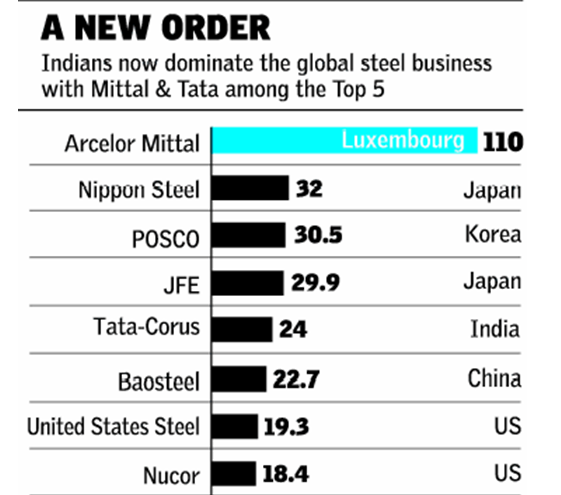

Triples Tata Steel’s capacity to almost 28m tonnes from 8.7 million in an industry where consolidation appears inevitable in order to leverage scales Gives it access to high-value Euroopean market; also it can ride on the back of a renowned brand Acquisition cost’s about $710 per tonne whereas greenfield would have cost $1200 per tonne, say Tatas | Triples Tata Steel’s capacity to almost 28m tonnes from 8.7 million in an industry where consolidation appears inevitable in order to leverage scales Gives it access to high-value Euroopean market; also it can ride on the back of a renowned brand Acquisition cost’s about $710 per tonne whereas greenfield would have cost $1200 per tonne, say Tatas | ||

| − | The Dangers | + | '''The Dangers''' |

Tatas have paid a heavy price. The final offer is nine times Corus’ earnings before interest, tax, depreciation and amortisation (EBIDTA), while Mittal paid less than five times Arcelor’s earnings | Tatas have paid a heavy price. The final offer is nine times Corus’ earnings before interest, tax, depreciation and amortisation (EBIDTA), while Mittal paid less than five times Arcelor’s earnings | ||

| + | |||

It now needs to service a very large debt burden | It now needs to service a very large debt burden | ||

| + | |||

Integration can be a problem in such acquisitions, because of both distance and culture | Integration can be a problem in such acquisitions, because of both distance and culture | ||

It’s by far the biggest takeover in the history of India Inc | It’s by far the biggest takeover in the history of India Inc | ||

| + | |||

2nd biggest acquisition in global steel, behind Mittal’s Steel’s $38.3bn takeover of Arcelor last year | 2nd biggest acquisition in global steel, behind Mittal’s Steel’s $38.3bn takeover of Arcelor last year | ||

| + | |||

| + | |||

Lifts Tata Steel from 56th to 5th in global steel sweepstakes with combined revenue of $24.4bn. Two of the top 5 are now in Indian hands; Lakshmi Mittal’s Mittal-Arcelor is No. 1 | Lifts Tata Steel from 56th to 5th in global steel sweepstakes with combined revenue of $24.4bn. Two of the top 5 are now in Indian hands; Lakshmi Mittal’s Mittal-Arcelor is No. 1 | ||

Tatas overtake the Mukesh Ambani-Reliance Group to become India’s largest business house. Revenues vault from Rs 70,509 cr last year to Rs 148,885 cr, compared to Reliance’s Rs 88,965 cr. | Tatas overtake the Mukesh Ambani-Reliance Group to become India’s largest business house. Revenues vault from Rs 70,509 cr last year to Rs 148,885 cr, compared to Reliance’s Rs 88,965 cr. | ||

| + | |||

Combined m-cap, at Rs 299,075 cr, is higher than Reliance’s | Combined m-cap, at Rs 299,075 cr, is higher than Reliance’s | ||

| + | |||

Rs 228,677 cr | Rs 228,677 cr | ||

| Line 196: | Line 496: | ||

[[File: tata1.png | |frame|500px]] | [[File: tata1.png | |frame|500px]] | ||

| + | |||

[[File: tata 2.png |Major international acquisitions by Indian companies |frame|500px]] | [[File: tata 2.png |Major international acquisitions by Indian companies |frame|500px]] | ||

| + | |||

[[File: tata 3.png |The impact of the Tata-Corus acquisition on Tata shareholders |frame|500px]] | [[File: tata 3.png |The impact of the Tata-Corus acquisition on Tata shareholders |frame|500px]] | ||

| + | |||

| + | |||

| + | =Profits, revenues= | ||

| + | ==2013-19== | ||

| + | [[File: The Profits and revenues of the Tata group, 2013-19.jpg|The Profits and revenues of the Tata group, 2013-19 <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2019%2F12%2F19&entity=Ar02102&sk=3CABB369&mode=text Dec 19, 2019 ''Times of India''] |frame|500px]] | ||

| + | |||

| + | |||

| + | '''See graphic''': | ||

| + | |||

| + | '' The Profits and revenues of the Tata group, 2013-19 '' | ||

| + | |||

| + | [[Category:Economy-Industry-Resources|TTHE TATA GROUPTHE TATA GROUPTHE TATA GROUPTHE TATA GROUPTHE TATA GROUP | ||

| + | THE TATA GROUP]] | ||

| + | [[Category:India|TTHE TATA GROUPTHE TATA GROUPTHE TATA GROUPTHE TATA GROUPTHE TATA GROUP | ||

| + | THE TATA GROUP]] | ||

| + | [[Category:Pages with broken file links|THE TATA GROUPTHE TATA GROUPTHE TATA GROUP | ||

| + | THE TATA GROUP]] | ||

=Research and development= | =Research and development= | ||

| + | |||

| + | ==2015 plans== | ||

| + | |||

[http://epaperbeta.timesofindia.com//Article.aspx?eid=31808&articlexml=Tatas-bet-on-innovation-with-26bn-RD-spend-14052015021020 ''The Times of India''], May 14 2015 | [http://epaperbeta.timesofindia.com//Article.aspx?eid=31808&articlexml=Tatas-bet-on-innovation-with-26bn-RD-spend-14052015021020 ''The Times of India''], May 14 2015 | ||

| Line 207: | Line 529: | ||

In what could be the highest research and development (R&D) expenditure by an Indian conglomerate, the salt-to-software Tata Group spends Rs 16,000 crore, or $2.6 billion, on innovations as the Cyrus Mistry-led enterprise bets big on new technologies to boost growth. | In what could be the highest research and development (R&D) expenditure by an Indian conglomerate, the salt-to-software Tata Group spends Rs 16,000 crore, or $2.6 billion, on innovations as the Cyrus Mistry-led enterprise bets big on new technologies to boost growth. | ||

| + | |||

The diversified Indian multinational spends 2.5% of its revenue on R&D, which is much higher than the government's R&D spend of 0.9% of the country's gross domestic product (GDP). | The diversified Indian multinational spends 2.5% of its revenue on R&D, which is much higher than the government's R&D spend of 0.9% of the country's gross domestic product (GDP). | ||

| Line 216: | Line 539: | ||

Launched in 2006, the Tata Innovista programme promotes innovation across Tata companies worldwide. Over the past decade, it has seen a 15-fold increase in innovation across 70 companies. The top innovation projects this year are expected to deliver an estimated benefit of $1.1 billion annually , the Tata Group said. | Launched in 2006, the Tata Innovista programme promotes innovation across Tata companies worldwide. Over the past decade, it has seen a 15-fold increase in innovation across 70 companies. The top innovation projects this year are expected to deliver an estimated benefit of $1.1 billion annually , the Tata Group said. | ||

| − | |||

| − | |||

| − | |||

| − | |||

| − | + | = Shapoorji Pallonji Group vs. the Tatas= | |

| + | ==The Tata- Mistry relationship, 1936-2016== | ||

| − | + | [[File: The Mistry stake in Tata Sons, as in 2016.jpg| The Mistry stake in Tata Sons, as in 2016 |frame|500px]] | |

| − | + | [[File: Ratan Tata Vs Cyrus Mystery , India today , Nov.7,2016 .jpg| Ratan Tata Vs Cyrus Mystery , India today , Nov.7,2016 |frame|500px]] | |

| − | + | [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=Friends-frenemies-foes-Twists-in-Tata-Mistry-ties-29102016027031 Reeba Zachariah, Friends, frenemies, foes: Twists in Tata-Mistry ties Oct 29 2016 : The Times of India] | |

| − | + | [[File: How Mistrys came on board Tata Sons.jpg|How Mistrys came on board Tata Sons <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2020%2F09%2F23&entity=Ar02100&sk=B842DCB7&mode=text Reeba Zachariah, September 23, 2020: ''The Times of India'']|frame|500px]] | |

| − | + | [[File: The Shapoorji Pallonji Group’s shares in Tata Sons , as in 2020.jpg|The Shapoorji Pallonji Group’s shares in Tata Sons , as in 2020 <br/> The SP Group first became shareholders of Tata Sons in 1965 by acquiring 40 ordinary shares and 48 preference shares of its paid-up share capital. “Thereafter, over the years, Cyrus Investments and Sterling Investment acquired Tata Sons’ shares (largely through bonus and rights issue of shares), which have allowed them to reap great economic reward <br/> Cyrus Investments and Sterling Investment have acquired majority of their shareholding through bonus issue and rights issues. While Cyrus and Sterling invested merely Rs 69 crore, they have received dividends of around Rs 872 crore from Tata Sons from 1991 to 2016.” <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2020%2F09%2F23&entity=Ar02101&sk=3E7E7FCD&mode=text Dhananjay Mahapatra, September 23, 2020: ''The Times of India'']|frame|500px]] | |

| − | + | [[File: The Tatas vs the Shapoorji Pallonji Group, 2016-Sept 20..jpg|The Tatas vs the Shapoorji Pallonji Group, 2016-Sept 20. <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2020%2F09%2F23&entity=Ar02101&sk=3E7E7FCD&mode=text Dhananjay Mahapatra, September 23, 2020: ''The Times of India'']|frame|500px]] | |

| − | + | '''See graphics''': | |

| − | See | + | |

| − | + | '' How Mistrys came on board Tata Sons '' | |

| − | + | '' The Shapoorji Pallonji Group’s shares in Tata Sons , as in 2020 <br/> The SP Group first became shareholders of Tata Sons in 1965 by acquiring 40 ordinary shares and 48 preference shares of its paid-up share capital. “Thereafter, over the years, Cyrus Investments and Sterling Investment acquired Tata Sons’ shares (largely through bonus and rights issue of shares), which have allowed them to reap great economic reward <br/> Cyrus Investments and Sterling Investment have acquired majority of their shareholding through bonus issue and rights issues. While Cyrus and Sterling invested merely Rs 69 crore, they have received dividends of around Rs 872 crore from Tata Sons from 1991 to 2016.” '' | |

| − | + | ||

| + | '' The Tatas vs the Shapoorji Pallonji Group, 2016-Sept 20. '' | ||

| − | |||

| − | |||

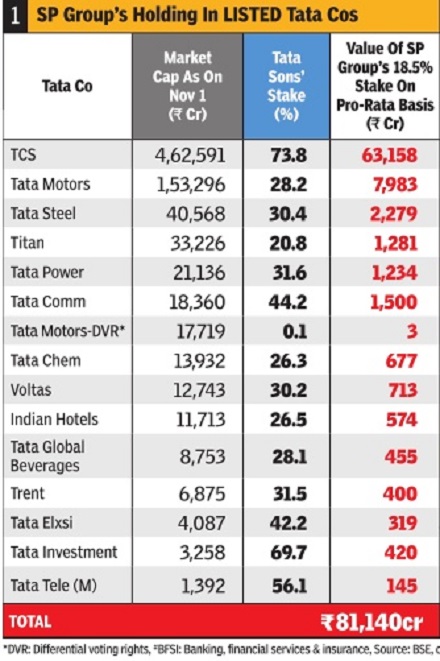

| − | + | The Tata-Mistry relationship is perhaps best described Facebook style: It's complicated. Cyrus Mistry's family and the Tatas have at times been friends, and at other times frenemies since the time Cyrus's grandfather Shapoorji Mistry acquired a sizable stake in Tata Group's main holding company , Tata Sons in 1936. | |

| − | + | A Tata observer said that the Mistry family's holding in Tata Sons and their presence on the board has often been a matter of discomfort for the Tatas. “Cyrus's removal as company chairman could be a master stroke that may put pressure on the Mistrys to check them out from Tata Sons,“ the observer said. But that may be a trifle optimistic.Tata Sons is currently one of India's richest privately held companies. Mistrys' 18.5% stake in Tata Sons is worth billions of dollars, and Tatas may find it an uphill task to buy them out, just as they have found it in the past. Tata Sons is the holding company of hundreds of unlisted and nearly 30 listed companies. The listed companies alone are valued at about Rs 8.3 lakh crore (about $125 billion). Going by the value of only the listed companies within the Tata fold, the 18.5% stake held by the Mistry family would be worth about $23 billion. | |

| − | + | Shapoorji had acquired Tata Sons shares from the heirs of eminent financier FE Dinshaw in 1936, seven years after Cyrus' father was born.Dinshaw had lent nearly Rs 1 crore to Tata Sons to finance its power unit in 1926 but the latter couldn't repay the amount and, subsequently, the loan got converted into 12.5% stake of Tata Sons. Later, Shapoorji bought some more shares from JRD Tata's siblings, thus increasing his stake to 18.5%. | |

| − | + | The story goes that JRD Tata's siblings in a fit of anger had sold their shares to the builder, who has made some famous Bombay landmarks like the Brabourne Stadium and SBI headquarters. Not much is known about why Nowroji Saklatvala, who was chairman of Tata Sons between 1932 and 1938, did nothing to prevent the stake sale. JRD Tata, who succeeded Saklatvala, is reportedly said to have been upset with the entry of a non-Tata family (Shapoorji) into Tata Sons.Mistrys' large shareholding gave them one seat on the board of Tata Sons. | |

| − | + | After Shapoorji's death in 1975, Pallonji (Cyrus' father) took his position at Tata Sons.While Shapoorji was believed to have had a tumultuous relationship with the Tatas, Pallonji had a much friendlier relationship with the family . Also, he never interfered with the functioning of Tata Sons. A year after Pallonji stepped down in 2005, Cyrus, his youngest son, took his position at Tata Sons. And in November 2011, Cyrus was named chairman of Tata Sons, the first non-Tata to head the company. | |

| − | + | On October 24 afternoon, the 80-year-old relationship between the Tatas and the Mistrys turned bitter again. | |

| + | ==Mistry vs. Tata Sons: NCLT rejects Mistry's petition/ 2018== | ||

| − | + | [https://timesofindia.indiatimes.com/business/india-business/nclt-rejects-cyrus-mistrys-petition-against-tata-sons/articleshow/64913733.cms Swati Deshpande, July 9, 2018: ''The Times of India''] | |

| − | + | ||

| − | [ | + | |

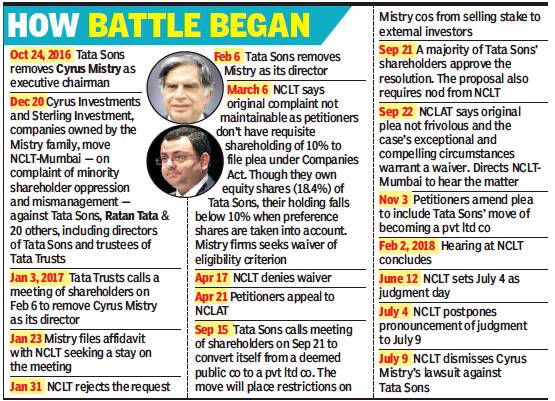

| − | + | The Mumbai bench of National Company Law Tribunal (NCLT) rejected a petition filed against Tata Sons by minority shareholders who had alleged that Cyrus Mistry’s sudden ouster in 2016 as chairperson of Tata Group holding company was oppressive. | |

| − | + | Mistry was removed as executive chairman, Tata Sons, on October 24, 2016 by its board. It led to two of his family-run investment firms dragging the corporate monolith and 22 others including Tata Sons chairman emeritus Ratan Tata, various other Tata trustees and directors that December to the company law tribunal to complain of oppression and mismanagement. | |

| − | + | The NCLT held that Mistry as Chairman was removed because board of directors lost faith. “The Board is competent to remove Mistry. No selection committee was needed,” said judicial member B S V Prakash Kumar as he read out from the verdict. | |

| − | + | The pronouncement has come as sweet victory for Tata Sons whose counsel Abhishek Singhvi had argued extensively that the whole petition was a “proxy battle” by Mistry who he had likened to a “Trojan horse” while arguing earlier. | |

| − | + | The bench held, “Removal of Mistry as director is because of acrimonious behaviour and is justified.” It also said, “Proportional representation not possible as articles do not mandate it.” | |

| − | + | “No merit in legacy issues - do not fall within section 241 of the Companies Act—which provides for minority shareholders to move for relief agaisnt acts of oppression," the bench added. | |

| − | + | “Ratan Tata and Soonawala’s suggestions cannot trigger plea for relief under sections 241-242. No merit in shadow directors argument,” said NCLT. | |

| − | + | The tribunal found “No merit that articles including article 75 are oppressive against petitioner,” and said. “Just and equitable ground is added to mismanagement and hence petition is dismissed.” | |

| − | + | Tatas welcomed the NCLT verdict. " The NCLT order vindicates the position of Tata Trusts and Tata Sons,'' said a statement issued by the company. | |

| − | + | “The judgement has only re-affirmed and vindicated that Tata Sons and its operating companies have always acted in a fair manner and in the best interest of its stakeholders. The Tata Group has always been committed and will continue to be committed to transparency and good corporate governance of global standards,” said Mr N Chandrasekaran, Chairman Tata Sons. | |

| − | + | “Tata Sons hopes that a finality will be given to the judgement of NCLT, Mumbai by all concerned in the larger interest of companies, the shareholders and the public,” Mr Chandrasekaran added. | |

| − | + | Reacting to the verdict against it, the office of Cyrus Mistry in statement to the media said, "The ruling is disappointing, although not surprising. We will continue to strive for ensuring good governance and protection of interests of minority shareholders and all stakeholders in Tata Sons from the wilful brute rule of the majority." | |

| − | + | "The ruling is in line with the earlier position expressed by the Tribunal. An appeal on merits will be pursued. Matters like TTSL, Air Asia, recovery of dues from Siva, non-closure of a loss-making Nano, a struggling resolution of Tata Steel Europe, all present serious issues that will be pursued. Not only the facts that were under consideration but also subsequent facts and developments that continue to evidence oppression and mismanagement will be under scrutiny and will be pursued in full earnest." | |

| − | + | Mistry's office added, "Ours has always been a principled fight to restore the Tata Group to its glorious days of high standards, best practices and most importantly, the best value systems. In this journey, no matter how hard it may seem, as shareholders who have always supported the Tata Group, it remains our duty to protect the Tata Group from those were destroying value and making the Group vulnerable to external forces." | |

| − | + | The main grouse is that Mistry’s ouster itself is an act of oppression by Tata Sons, the group holding company, “to prevent him from carrying out a clean-up op against mismanagement.’’ Tata Trusts owns 66 per cent shareholding in Tata Sons. The challenge also centres around five articles of association, including veto rights of majority of Trust nominated directors, which Mistry family feel are oppressive to both, public and their interest as minority shareholders. | |

| + | The petition before NCLT is filed by Cyrus Investments and Sterling Investment Corporation. But Tata Sons’ counsel Abhishek Singhvi called it a “scurillous’’ attack and “Mistry’s proxy litigation.’’ | ||

| − | Mistry | + | The Mistry family firms owns 18.6 per cent in Tata Sons, making it the second largest shareholder. But voting rights is for holding less than 4 percent. |

| − | + | ||

| − | + | ||

| + | Mistry took over the reins to a $103 billion conglomerate from Ratan Tata, when he turned 70 years old, in December 2012. Five months after his removal as chairman, Tata Sons removed him as its director too. | ||

| − | Mistry had | + | The investments of the Mistry firms had appreciated from the initial Rs 70 crore when they first became shareholders in 1965, to Rs 58000 crore in March 2016, said Tata Sons. In over 50 years, they had never once complained of any mismanagement or oppression, much less of any interdiction by Ratan Tata or N A Soonawala, as they did now, argued Tata Sons. |

| + | The ultimate relief provided under the Companies Act for the challenge now raised is winding up of the company—among India’s largest. The NCLT while earlier denying Mistry relief, had hailed the Tata Group as a “salt to software’’ giant, an “untiring provider’’ and a “household name’’ with a global footprint. | ||

| − | + | After a chequered battle with the matter being sent back to the Mumbai tribunal by its appellate body in Delhi, it was heard since last November by the main bench of BSV Prakash Kumar and V Nallasenapathy, on merits. The bench had concluded a lengthy, animated, seemingly bitter sometimes stormy hearing early February. | |

| − | + | ||

| − | + | ||

| − | + | ||

| + | Mistry camp’s legal team of counsel C A Sundaram and Janak Dwarkadas had launched an all-out legal battle and made long submissions to bring home their five point allegations that the actions of Tata Sons run by majority shareholders, its chairman emeritus Ratan Tata, various other Trustees right from ousting Mistry was oppressive to minority shareholders’ interest, replete with mismanagement and contrary to provisions of the company law. There was no cause on merits to remove Mistry whose performance was rated high by the company itself, argued his lawyers. | ||

| − | + | Tata Sons’ Counsel Abhishek Singhvi had hit back at length too to refute their entire case as nothing but an “act of vendetta’’ lacking in any merits by “a Trojan horse’’ relying only on a “ruse’’ to publicly air his displeasure at the loss of his office.’’ | |

| − | + | Tata Sons had Nitesh Jain of Shardul Amarchand Mangaldas, and host of other senior counsel including Ravi Kadam, Mohan Parasaran, Sudipto Sarkar Mistry for various trustees. Their collective plea was that “Business decisions taken over a decade ago, some even two decades ago, also those which have Mistry’s “express consent” are being raised as “so-called issues and concerns’’ by two of his family owned companies making it apparent that “it is yet another attempt to besmirch the reputation of Tata Group,’’ with “no credible material to establish any oppression or mismanagement.’’ | |

| − | + | Singhvi said the attack on “lack of corporate governance was a bogey.’’ He hailed Ratan Tata as a revered corporate legend and said Tatas are held up as examples on corporate governance for rest of India Inc. | |

| − | + | It was also argued by Tata group lawyers that a board position with Tata Sons is offered by invitation and cannot be sought as of right based on shareholdings. | |

| − | + | Tata Sons argued that the law clearly allows removal of a chairperson and director and Mistry was removed by a majority of 7 out of 9, Mistry being one who didn't vote for his removal and one had abstained. Singhvi had delved into legal semantics on use of word “ prejudice” in the new 2013 Companies Act and said that Mistryfailed to prove any. | |

| − | + | A key allegation was that the Tata Sons Board had turned into a ‘super board’ was ‘shadow’ directors, and its oppressive articles 121, 121A vested veto powers with majority of the Trust nominated directors which could “prejudice’’ interest of public, minority shareholders and the company itself. The Mistry camp cited as examples of alleged mismanagement, the “Nano project, Corus, discovery and handling of the alleged Air Asia India fraud, NTT Docomo case.’’ | |

| − | + | Sundaram had argued that the proposed conversion Tata Sons from public to private was a an oppressive move. Much force was put by Sundaram also into how article 75 in the company memorandum of association would be a significant oppressive tool The apprehension was that it would be used now as a tool for oppression as it allows compulsory purchase of shares of any shareholder including Mistry, the two petitioning companies which together hold over 18 percent shares, he said. | |

| − | + | Singhvi had said that at all times for over 100 years, irrespective of the changes in Indian law, Tata Sons had always "remained a company exhibiting private characteristics". The change was now only a technicality under the law, was his response. | |

| − | + | After Mistry replied to some letters from the Income Tax department after he was removed from office, without any authority to do so, Tatas counsel Singhvi had submitted that the behaviour amounted to that of a Trojan Horse as costing the group dearly. | |

| − | + | The NCLT had in 2017dismissed the petitions on maintainability as the Mistry firms lacked the requisite 10 percent equity shares to make them eligible to file, as minority shareholder, an oppression and mismanagement plea under sections 241, 242 and 244, of the Companies act. | |

| − | + | The verdict evoked cheers and jeers. Singhvi told TOI, “Having argued this case for over two years, the taste and smell of victory is sweet. We succeeded on every point. It is a precedent setting judgement on many issues.’’ He added, “ People should leave egos and call a closure to a fight well fought, but lost. Tata is too precious a brand name to be incessantly attacked out of personal ego. We have no doubt that if carried to NCLAT we will have another intellectually satisfying experience.’’ | |

| − | + | ===NCLT’s order=== | |

| − | == | + | |

| − | + | ||

| + | [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2018%2F07%2F10&entity=Ar02209&sk=9B20A842&mode=text Swati Deshpande, NCLT finds no merit in purported legacy issues, July 10, 2018: ''The Times of India''] | ||

| − | The | + | The NCLT held: |

| − | + | The removal of Cyrus Mistry (CPM) as executive chairman of Tata Sons on October 24, 2016 is because the board of directors and the majority shareholders, i.e. Tata Trusts, lost confidence in CPM as chairman and not because by contemplating that CPM would cause discomfort to Ratan Tata, N A Soonawala and other answering respondents for purported legacy issues › Board competent to remove executive chairman. No selection committee was required before removing Mistry as executive chairman › There is no merit in representation on board to petitioners proportionate to the shareholding of the petitioners and this is not possible so long as the Articles of Association does not envisage it › Tribunal has not found any merit in purported legacy issues such as Siva, TTSL, Nano car, Corus, Mehli Mistry, AirAsia issue, or that they are acts of oppression and mismanagement › Tribunal has also not found merit that the application under section 14 of CA 2013 for conversion to private co is an act of oppression › There is no merit in argument that Tata and Soonawala’s notices and suggestions amounted to interference in administering the affairs of the co and was prejudicial to the interests of the co › There is no merit in the argument that Tata and Soonawala acted as ‘shadow directors’ and no action under Companies Act as sought is required in this regard › Tribunal does not find merit that Articles of Association 75, 104B, 118, 121 are oppressive against the minority shareholders › There is no merit in the argument that majority rule has taken back-seat by introduction of corporate governance in the Companies Act. If corporate democracy is the genus, corporate governance is a specie. They are never in conflict with each other. The management is more accountable to the shareholders under the present regime › It is observed that remedy for prejudice caused is included under the Act in addition to remedy for oppressive acts. It is further observed that just and equitable ground is included as a pre-condition in mismanagement issues, which was not the case under the old Act. | |

| − | + | ===‘Minority shareholders bound by rule of majority’=== | |

| − | + | [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2018%2F07%2F13&entity=Ar02902&sk=D5FE855B&mode=text Swati Deshpande & Reeba Zachariah, ‘Minority shareholders bound by rule of majority’, July 13, 2018: ''The Times of India''] | |

| − | + | The National Company Law Tribunal (NCLT) — in its written order in the Cyrus Mistry versus Tata Sons case, which was released has observed that “whoever invested more shall have his say over the affairs of the company”. The tribunal said, “It is obvious that minority sailing along with majority is bound by the rule of majority. Otherwise, it will become curtailment of the rights of majority shareholders.” | |

| − | + | The NCLT said that since Ratan Tata heads Tata Trusts, which owns two-thirds of Tata Sons, the conglomerate has to be run “at the wish of the majority shareholders”. | |

| − | + | Mistry’s family firms, which together hold a little over 18% in Tata Sons, had complained about the abuse of the company’s articles of association by Ratan Tata and his business dealings with close friends, C Sivasankaran and Mehli Mistry. The companies also raised concerns about the expensive Corus acquisition, the bleeding Nano car project and aviation “misadventures”, which had caused huge losses to the Tata Group. Mistry’s family firms made the complaint after he was abruptly removed as the chairman of Tata Sons in October, 2016. | |

| − | The | + | The NCLT, in its 368-page order, said that “Mistry assumed in his mind that he was given a free hand to run the affairs of the company”, an idea which is “incongruous to corporate governance and corporate democracy”. The NCLT said, “In corporate democracy, decision making always remain with the board of directors as long as they enjoy the pleasure of the shareholders. Likewise, even executive chairman will also continue as long as he enjoys the pleasure of the board.” |

| − | + | The NCLT said that although Mistry was appointed as the chairman to preside over the board, he “could not become a sovereign authority over the company because the superior body in any company at first level are the shareholders, thereafter, the board, elected by those shareholders”. | |

| − | + | ''' ‘Seeking info on co’s affair doesn’t amount to meddling’ ''' | |

| − | + | ||

| − | + | ||

| − | + | ||

| + | Petitioners Have Tried To Steamroll Biz Decisions Upon Tata To Bully Him: NCLT | ||

| − | + | The tribunal, which made scathing observations, said that because of the “heartburn” for Mistry being removed from the chairman’s post, the petitioners have tried to “steamroll all the business decisions upon Ratan Tata” as “mismanagement” in a bid to “bully” him. | |