The Reserve Bank of India

(→Governors of the Reserve Bank of India) |

(→The post of Governor) |

||

| Line 34: | Line 34: | ||

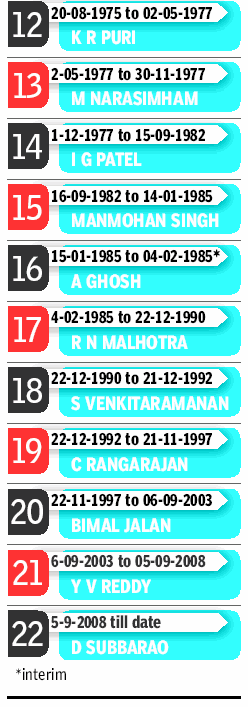

The RBI Act allows the government to specify the term but the ? tenure cannot exceed five years, with a possibility of reappointe ment. In recent years, only S Venkitaramanan, who spent two years as RBI governor, has had a shorter stint than Raghus ram Rajan. | The RBI Act allows the government to specify the term but the ? tenure cannot exceed five years, with a possibility of reappointe ment. In recent years, only S Venkitaramanan, who spent two years as RBI governor, has had a shorter stint than Raghus ram Rajan. | ||

| + | |||

| + | |||

| + | =Selection of Governor, Dy. Governor= | ||

| + | [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=In-a-first-panel-to-list-RBI-guv-11062016001061 The Times of India], Jun 11 2016 | ||

| + | |||

| + | Rajeev Deshpande | ||

| + | |||

| + | In a break from tradition, the government has tasked a selection committee headed by cabinet secretary P K Sinha with shortlisting candidates for Reserve Bank of India governor -a decision that was taken earlier by the Prime Minister in consultation with the finance minister. | ||

| + | In the past, chiefs of other regulatory bodies -including insurance, pension and Sebi -have been shortlisted by search committees. But this will be the first time the RBI governor will be appointed similar ly, signalling a major shift in government stance and ending the special treatment given to central bank chiefs. The decision to route the RBI governor's appointment through the financial sector regulatory appointment search committee (FSRASC) seems intended to cool speculation over Raghuram Rajan being considered for a second term. | ||

| + | |||

| + | The FSRASC, set up in 2015, had interviewed candidates for Sebi chief. In February 2016, the government ignored its recommendation and reappointed U K Sinha for a year. A part from the cabinet secretary, the committe comprises additional principal secretary to PM P K Mishra, who is a permanent government nominee, and three outside experts -Rajiv Kumar of Centre for Policy Research, Manoj Panda of the Institute of Economic Growth and Bimal N Patel from Gujarat National Law University. A finance ministry representative will be a special invitee. The panel's recommendation will be sent to the appointments committee of cabinet headed by the PM, which will decide on the governor. | ||

| + | |||

| + | Going by the current thinking in official circles, a second term for Rajan could well be on the cards despite occasional reports that put him at cross-purposes with the government over issues like rate cuts or `Make in India'. At the same time, the government does not seem keen to imbue the appointment with a greater profile of attention. The committee route would be in sync with PM Narendra Modi's remark that the appointment is an “administrative decision“ that will be taken closer to September when Rajan's term ends. | ||

| + | |||

| + | The committee's recomendation for RBI deputy governor was a break from past practice as previously, the head of the regulatory body presided over the selection committee. This time around, the RBI governor was a member of the FSRASC. | ||

| + | |||

| + | The process of making top-level appointments to regulatory bodies has been problematic, with the choices often being seen to be politically influenced. Even with the committee-bound process, the choice for sensitive posts will no doubt be vetted by the political authority. But the decision to make FSRASC the recommending body that could well put up a single name instead of a short list for a regulator is aimed at reducing discretion and putting all such bodies on a par. | ||

=Policy reviews= | =Policy reviews= | ||

Revision as of 19:46, 16 July 2016

This is a collection of articles archived for the excellence of their content. Readers will be able to edit existing articles and post new articles directly |

Contents |

The post of Governor

The Times of India, June 20, 2016

Who can be an RBI governor?

Unlike the appointment of fo ur deputy governors, there are no fixed rules. But most RBI governors have been civil servants (11), followed by economists (five). There has also been one banker, an insurance company executive and one RBI employee who have gone on to be the governor.

How are candidates selected?

In the past, candidates were shortlisted by the government, and the Prime Minister appointed the governor in consultation with the finance mi nister. On some oc casions, some of the candidates we re called for an in LEARNING formal interaction WITH THE TIMES with the finance mi nister (D Subbarao was appointed through this route) although the final decision was taken by the PM. Now, the government has tasked a committee headed by the Cabinet secretary to shortlist candidates and the final decision will be taken by PM Narendra Modi.

Is there an age cap or are some qualifications stipulated?

No, there is neither an age restriction nor qualifications are specified in the law. Governments have opted for those with understanding of overall economy , the financial sector as well as those familiar with th functioning of the government

What is the RBI governor' tenure?

The RBI Act allows the government to specify the term but the ? tenure cannot exceed five years, with a possibility of reappointe ment. In recent years, only S Venkitaramanan, who spent two years as RBI governor, has had a shorter stint than Raghus ram Rajan.

Selection of Governor, Dy. Governor

The Times of India, Jun 11 2016

Rajeev Deshpande

In a break from tradition, the government has tasked a selection committee headed by cabinet secretary P K Sinha with shortlisting candidates for Reserve Bank of India governor -a decision that was taken earlier by the Prime Minister in consultation with the finance minister. In the past, chiefs of other regulatory bodies -including insurance, pension and Sebi -have been shortlisted by search committees. But this will be the first time the RBI governor will be appointed similar ly, signalling a major shift in government stance and ending the special treatment given to central bank chiefs. The decision to route the RBI governor's appointment through the financial sector regulatory appointment search committee (FSRASC) seems intended to cool speculation over Raghuram Rajan being considered for a second term.

The FSRASC, set up in 2015, had interviewed candidates for Sebi chief. In February 2016, the government ignored its recommendation and reappointed U K Sinha for a year. A part from the cabinet secretary, the committe comprises additional principal secretary to PM P K Mishra, who is a permanent government nominee, and three outside experts -Rajiv Kumar of Centre for Policy Research, Manoj Panda of the Institute of Economic Growth and Bimal N Patel from Gujarat National Law University. A finance ministry representative will be a special invitee. The panel's recommendation will be sent to the appointments committee of cabinet headed by the PM, which will decide on the governor.

Going by the current thinking in official circles, a second term for Rajan could well be on the cards despite occasional reports that put him at cross-purposes with the government over issues like rate cuts or `Make in India'. At the same time, the government does not seem keen to imbue the appointment with a greater profile of attention. The committee route would be in sync with PM Narendra Modi's remark that the appointment is an “administrative decision“ that will be taken closer to September when Rajan's term ends.

The committee's recomendation for RBI deputy governor was a break from past practice as previously, the head of the regulatory body presided over the selection committee. This time around, the RBI governor was a member of the FSRASC.

The process of making top-level appointments to regulatory bodies has been problematic, with the choices often being seen to be politically influenced. Even with the committee-bound process, the choice for sensitive posts will no doubt be vetted by the political authority. But the decision to make FSRASC the recommending body that could well put up a single name instead of a short list for a regulator is aimed at reducing discretion and putting all such bodies on a par.

Policy reviews

2014: RBI shifts to bi-monthly policy review

TIMES NEWS NETWORK

Mumbai: The Reserve Bank of India will shift to a system of announcing its policy statement bi-monthly with the first such policy being announced on April 1, 2014. Bankers widely expect RBI to hold on to rates given that pressure on inflation is easing and the rupee has also been firming up.

Until the mid-90s, RBI had only two monetary policy reviews a year. After Bimal Jalan took charge as governor in 1997, he introduced quarterly reviews. His successor Y V Reddy introduced a mid-quarter review, which resulted in an announcement every 45 days.

A panel headed by RBI deputy governor Urjit Patel had recommended that the central bank monetary policy committee meet every two months to review rates.

Governors of the Reserve Bank of India

The Times of India 2013/08/07

Duvvuri Subbarao: 2008-2013

Subbarao, man who fell into cauldron of woes

Surojit Gupta | TNN

The Times of India 2013/08/07

New Delhi: For Duvvuri Subbarao it was baptism by fire when he took over the reins of the Reserve Bank of India nearly five years ago.

As soon as he stepped into the corner office at the central bank headquarters in Mumbai’s Mint Road, a tsunami struck the global financial system. The force of the 2008 global financial meltdown meant that RBI had to call on all its resources to shield the economy from being brutalized.

Subbarao, a mild-mannered former civil servant, remained unfazed. With the government, he scripted a recovery process stabilizing the economy, helping it weather the storm better than some of its peers.

But this was short-lived. The economy was buffeted by stubborn inflation, including double-digit food inflation, prompting the central bank to focus on taming prices. It raised rates furiously, almost 13 times, to throttle inflation.

Of late, frosty ties between RBI and the finance ministry have dominated discussions. Critics slammed the policy to tackle inflation while the government sometimes expressed disappointment. Finance minister P Chidambaram, who is careful with words, appeared disappointed as RBI left interest rates unchanged.

“Growth is as much a challenge as inflation. If the government has to walk alone to face the challenge of growth then we will walk alone,” Chidambaram said highlighting the need for an inflation-growth balance.

Adding to Subbarao’s problems, the fiscal situation deteriorated. Growth slowed. Scandals and policy missteps, such as retrospective taxes forced investors to the sidelines. Subbarao bravely continued calling for action on the fiscal front to enable him to slash interest rates. That didn’t happen until Chidambaram stepped in as finance minister in September. His reform initiatives helped restore the health of public finances. RBI obliged with a rate cut. But this came with a caveat on the ch a l l e n g e s on the prices front.

As things appeared to settle down, the crisis on the currency front emerged, prompting RBI to work towards taming the volatile forex market.

Some economists said the RBI under Subbarao misjudged the signals. “You cannot separate two or three issues, one of which is that when it comes to inflation and growth, both monetary and fiscal policies matter. In my assessment, the country had the most unfortunate fiscal policies compounded by the most unfortunate monetary policy,” economist Surjit Bhalla said. “The RBI misjudged the economy, determinant of inflation, determination of growth and determinant of the exchange rate.”

He said the RBI under Subbarao had misjudged food inflation and hiked rates. “What could’ve been a virtuous cycle has been turned into a vicious cycle,” Bhalla said. Not all would agree with such a harsh summation.

Raghuram Rajan: 2013-

Engineer-turned economist with a rockstar’s appeal

Surojit Gupta & Sidhartha | TNN

The Times of India 2013/08/07

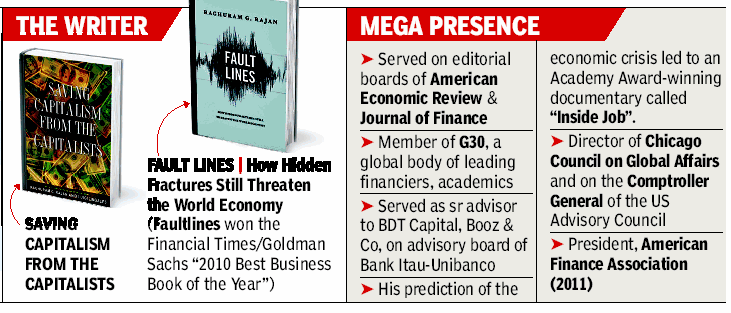

Rated by peers across the world as one of the most influential economists of his generation, Rajan, 50, is among the youngest RBI governors (PM Manmohan Singh took charge when he was 10 days short of his 50th birthday). Rajan was the youngest-ever — also the first non-westerner — chief economist of the IMF, from 2003 to 2006. In 2005, he predicted the financial crisis of 2008-09, but was brushed aside by economists such as former US treasury secretary and Harvard University president Lawrence Summers, who called him a “Luddite”.

The Bhopal-born son of a bureaucrat has always been a high achiever: a gold medalist at both IIT Delhi and IIM Ahmedabad, he completed his PhD from the Massachusetts Institute of Technology.

Traditionally, the chief economic advisor, a professional economist in a sea of bureaucrats, sat in one corner of the North Block. But weeks after taking charge as the government’s chief economist, Raghuram Rajan moved into a fi rst floor room, adjacent to finance minister P Chidambaram’s, signalling a shift in power equations.

In the year that Rajan has spent on Raisina Hill, he gained in stature and enjoyed the confidence that few of his predecessors enjoyed. From being an economist focused on banking and finance, Raghu, as colleagues call him, was slowly initiated into complex issues dealing with the political economy in a chaotic democracy.

His detractors, skeptical that he lacked administrative experience, were silenced when Rajan joined hands with his boss to mend the economy.

Even when it came to deciding on a key political demand from states such as Bihar and West Bengal for special category status and a debt recast, Chidambaram leaned on the 50-yearold Raghu to find a way out. Before he shifts to Mumbai’s Mint Road, Rajan would’ve finalized the contours of a possible policy change, based on a soon-to-be ready development index against the current system of gauging states on the basis of geography.

When it came to core issues, the government invariably turned to the engineerturned-economist. The sharp slide in the rupee prompted the government to draft Rajan in as one of the main firefighters to draw up a plan to increase dollar inflows. Unlike the hush-hush way in which decisions were taken in the past, Rajan invited private and foreign bankers to North Block to stitch up a plan to navigate the rupee out of choppy waters. Based on his inputs, the government announced its intent to go for quasisovereign bonds, without ruling out the possibility of India’s first sovereign fund-raising. Be it calming the jittery markets or over-enthusiastic reporters, he used all his charm and intellect, sometimes switching to Hindi. His rockstar appeal attracted a swarm of eager listeners wherever he was listed to speak.

Picking up from where his predecessor left, Rajan moved to reshape the dowdy Economic Survey that is tabled a day ahead of the Union Budget. Drafting many young economists in the Economic Division, he ensured new thoughts run through the pages of the economic report card. And, he will leave his imprint behind with a quarterly update.

Monetary Policy Committee, 2016

The Hindu, June 28, 2016

The Centre brought the Monetary Policy Committee (MPC) one step closer to reality by notifying the changes made to the Reserve Bank of India (RBI) Act in June 2016.

The six-member Committee — tasked with bringing “value and transparency to monetary policy decisions” — will comprise three members from RBI, including the Governor, who will be the ex-officio chairperson, a Deputy Governor and one officer of the central bank.

Composition

The other three members will be appointed by the Centre on the recommendations of a search-cum-selection committee to be headed by the Cabinet Secretary.

“These three members of MPC will be experts in the field of economics or banking or finance or monetary policy and will be appointed for a period of four years and shall not be eligible for re-appointment,” according to the statement.

The Committee is to meet four times a year and make public its decisions following each meeting.