Space technology: India

This is a collection of articles archived for the excellence of their content. |

Contents |

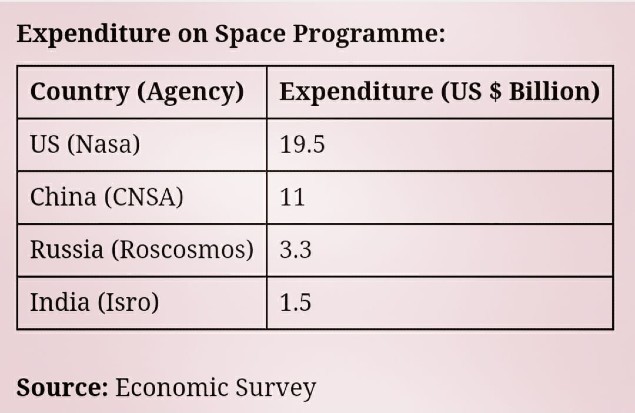

Govt. expenditure on space programme

2018 + Satellite launches, 2013-18

From: Chethan Kumar, China spent 7 times more than India on space; US 13 times, January 31, 2020: The Times of India

From: Chethan Kumar, China spent 7 times more than India on space; US 13 times, January 31, 2020: The Times of India

NEW DELHI: The Chinese government — whose push for the space programme has seen the Chinese space agency race ahead in the past few years — has spent seven times more than what the Indian government has spent on its space programme, the Economic Survey 2019-2020 shows.

Conceding that India’s government space expenditures still lags behind that of the major players in the space sector, the survey says: “China, which has become a key player in the space sector in recent years spent about seven times more than India in 2018.” It further shows that the US spent about 13 times more than India in the same year.

While India’s Isro spent about $1.5 billion in 2018, US’ Nasa spent $19.5 billion and China’s CNSA spent $11 billion (see table for more).

Stating that India has been pursuing a policy that engages the private industry more in delivering space-related goods and services, the survey notes: “...Various areas have been identified for attracting private investments including the production of Polar Satellite Launch Vehicle (PSLV); satellite integration and assembly; production of composite materials; production of solid, liquid, cryogenic and semi-cryogenic propellants; and production of electronic packages, testing, and evaluation for avionics and satellite subsystems.”

It added that the global space economy for 2018 tallied about $360 billion, which includes space systems manufacturing and space-based services.

Satellite Launches

India also compares poorly in terms of the number of satellites it launched in the six years between 2013 and 2018.

While Isro, on average launched about 5-7 satellites, agencies of other countries have launched many more. For instance, in 2018, Isro launched seven satellites, while Russia, the US and China dominated the sector with 20, 31, and 39 satellites, respectively.

Further, explaining the focus areas in this sector, the survey said: “Among key areas of focus, the first area has been satellite communication, with INSAT/GSAT system as the backbone to address the needs for telecommunication, broadcasting and satellite-based broadband infrastructure in the country.”

The second area, it said, has been earth observation and using space-based information for weather forecasting, disaster management, national resource mapping, and governance, while the third area has been satellite-aided navigation including GAGAN and NavIC.

“GAGAN, a joint project between ISRO and the Airports Authority of India (AAI), augments GPS coverage of the region to improve accuracy and integrity for civil aviation applications and better air traffic management over Indian airspace. NavIC, a regional Navigation system has also been established for providing Position, Navigation and Timing (PNT) Services,” the survey adds.

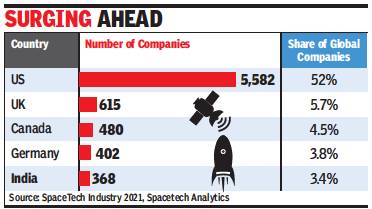

India’s rank in the world

Private firms in 2020

Chethan Kumar, June 3, 2021: The Times of India

From: Chethan Kumar, June 3, 2021: The Times of India

Amid all the pandemic gloom, good news emerging from India’s space tech sector is that the number of private firms — more than 350 — is already more than Japan, China and Russia, putting India in fifth place globally.

Of the 10,000-odd firms analysed as part of a global report that projects the space tech economy to touch $500 trillion by 2025, over 5,500 are in the US, followed by the UK, Canada and Germany. The report lists 368 firms in India compared to 288, 269 and 206 in China, France and Spain, respectively. Japan and Russia have 184 and 56, respectively.

Isro chairman K Sivan said: “There has been a good response from the industry, both big and small. The number of proposals with INSPACe has also gone up by around 30% compared to the end of 2020.” As per the report by Spacetech Analytics titled ‘SpaceTech Industry 2021/Q2 Landscape Overview’, most companies globally (2,820) are in navigation and mapping, followed by 1,000 manufacturing firms, 718 doing space communication, remote sensing (211), aerial imaging (152), spacecraft development (80), space travel (58), and space medicine (48).

Jayakumar Venkatesan, CEO, Valles Marineris International, which helps train global astronauts through its partners in Russia, says: “The model Isro is following must change to that in the US. We can’t have a vendor-customer relationship model if we want industry to grow, it must be partnership based.”

The report, which projects the space tech economy to touch $10 trillion by 2030 from the current $380 billion, has also analysed investments made in such companies during the said quarter. It has reviewed 10,000 firms, 5,000 investors, 150 R&D hubs and associations, and130 government organisations across the world.

Total early-stage investments in space technologies in 2021 are $68 billion. “With a total of $28 billion invested in 3,086 companies, the US is an undisputed leader. This is six times the amount invested in companies in China — the second largest country in terms of space tech investment ($4.8 billion invested in 122 companies),” the report says. China is followed by the UK, where funding is mostly raised from public sources and IPOs. India is in fourth place with investments in about 110 firms, totalling not more than $2 billion.

“One of the main aims of opening up the space sector was to enhance India’s share in the global space tech economy from around 3% to more than 10% in the next few years,” Sivan said.

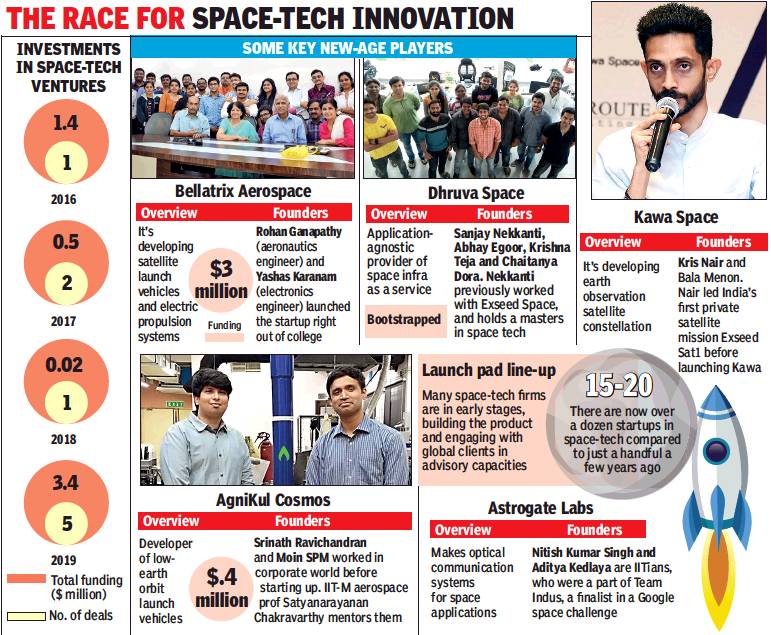

Start-ups, private

As in 2019

Sindhu Hariharan, Oct 6, 2019: The Times of India

From: Sindhu Hariharan, Oct 6, 2019: The Times of India

A growing requirement for smaller and relatively low-cost satellites has brought a host of startups into action in a frontier that, so far, has been the exclusive domain of government agencies and a select few empanelled private firms.

There are now 15 to 20 startups in space technologies sector compared to just a handful a few years ago. These enterprises are working on a variety of solutions to make payloads and launches more economical, and to improve communications. Some are focused on advanced propulsion systems and full-stack tech platforms.

Despite the long gestation period of startups, cash infusions in space-tech ventures has increased almost 3x from 2016 to 2019, according to data from research group Tracxn. In the nine months this year, there have been five deals of around $4 million as against just one ($1.4 million) in 2016.

Most space-tech startups are in their early stages, inching towards a final product and engaging with global clients in advisory capacities. Many of the entrepreneurs behind these firms are young space enthusiasts, who were a part of ventures such as Team Indus and Isro’s student satellite initiative YouthSat. Some others are aerospace professionals. They are all driven by the same object of making space operations better and cheaper for countries and corporations.

“India is on a par with major powers in space tech, and the global attention has helped the domestic sector mature,” said Srinath Ravichandran, co-founder of Agnikul Cosmos, which was incubated at IIT-Madras.

Ravichandran counts a strong academic environment in IITs and IISCs and Isro’s openness to engage with private players as key drivers. Agnikul Cosmos uses 3D printing to make launch vehicles for low-orbit satellites. It closed a seed round in February this year and is currently in the middle of a fundraising round.

Kawa Space is another prominent startup in the sector. It builds critical infrastructure that makes space-enabled solutions accessible to everyone.

“Currently, organisations that want to deploy spaceenabled solutions build, test and launch satellites, and supporting ground stations and infrastructure required to operate them. This means they own and operate the asset in space on their own. Now, imagine if someone built all the infrastructure, services, associated plumbing and the software required to do what the likes of AWS did to computing, but for space,” said Kawa Space founder Kris Nair.

Kawa is backed by Speciale Invest, Paytm’s Vijay Shekhar Sharma, AngelList India, and others.

IISc-incubated Bellatrix Aerospace is one of the most well-funded ventures in the segment, having raised around $3 million from IDFCParampara, GrowX Ventures and Bollywood star Deepika Padukone’s KA Enterprises, among others. “Fundraising is definitely harder than developing the technology,” said Yashas Karanam, COO, Bellatrix. But it was getting better, he added.

The startup is currently working with Isro to refine its product, a one-of-its-kind electrical propulsion system. It built most critical parts inhouse to reduce imports. Karanam said the vendor ecosystem for space tech needed more depth to achieve greater degree of localisation.

Speciale Invest, a deep tech-focused investment firm, which has backed Agnikul Cosmos, Kawa Space and Astrogate Labs, believes mainstreaming of the sector is only a matter of time. “We have tracked over 30 companies working on space tech,” said Vishesh Rajaram, managing partner, Speciale Invest, noting almost a 70-80% fall in launch costs globally.

Though initial R&D costs at space startups may be high, average sale contracts, after proof of concept, run into millions of dollars, making them sound bets, he added.

Sanjay Nekkanti, cofounder of Dhruva Space, said India always had smallscale private enterprises supporting the country’s space programmes. “But what we didn’t have earlier is startups working on full-stack solutions in the sector,” he said. Dhruva Space provides application-agnostic space platform solutions for enterprises. It estimates that anywhere between 300 and 1,200 satellites will be sent into space annually over the next 10 years, with an average 700 small satellite launches every year from 2023 onwards.

According to Nitish Kumar Singh, co-founder of Astrogate Labs, more mainstream venture capitalists are now interested in space tech and access to grants and angel funds has also improved.

Bengaluru-based Astrogate is working to replace traditional radio frequency systems with optical laserbased ones, which don’t need spectrum licensing, for satellite communication needs. Its co-founders, Nitish Singh and Aditya Kedlaya, were a part of Team Indus, a finalist in Google Lunar XPrize challenge. Team Indus was backed by Nandan Nilekani, Ratan Tata and Flipkart founders Sachin Bansal and Binny Bansal, among others.

“We hope the Space Activities Bill, once passed in Parliament, will enable more public-private engagement in aerospace industry,” Singh said. The bill, expected to be passed soon, will promote and regulate space activities and encourages participation of non-governmental agencies in India’s space activities. Bellatrix’s Karnam said a regulatory framework to send vehicles into space would give private Indian enterprises a boost, opening up opportunities for global joint ventures.

Farooq Adam, co-founder of online-to-offline startup Fynd, who has backed Astrogate Labs in personal capacity, is excited about the segment, but stressed that it is in its early stages. “We are backing companies from an IP perspective right now, but we have to watch as they prove their business models,” Adam said.

Kawa’s Nair thinks the time is right for space-tech startups to scale. “The breakout moment that computing had in the enterprise (segment) is about to happen in space. Everyone servicing the industry is playing their part to make the sector more accessible, bring down costs and build largescale adoption,” he said.

Dhruva’s Nekkanti said the next decade would be a golden era for space. “Possible manned missions to the Moon, human space-flight programmes, lower costs to access space, and more satellite launches — it’s going to be an exciting arena for startups,” he said.

Privately built launch vehicles

2022\ Skyrocket Aerospace

Swati Bharadwaj, Nov 19, 2022: The Times of India

Sriharikota : Hyderabad-based space tech startup Skyroot Aerospace created history when it successfully launched India’s first privately built launch vehicle, Vikram-S, into suborbital space.

The single-stage rocket was launched by Isro at the Sounding Rocket Complex of Satish Dhawan Space Centre as part of Mission Prarambh.

Twenty seconds post-launch, Vikram-S achieved a hypersonic velocity of Mach-5 and hit a peak altitude of 89. 5km in 155 seconds.

The 6m-long rocket weighing545kg carried three payloads of Indian startups — Space Kidz India and N-SpaceTech —and an international payload of Armenian BazoomQ Space Research Lab. Vikram-S was airborne for nearly five minutes, in which it covered 121. 2km, before splashdown in the Bay of Bengal.

“This is a small step by a space startup and a giant leap for the Indian space industry,” Skyroot co-founder & CEO Pawan Kumar Chandana said.

See also

Indian Space Research Organisation (ISRO)

Space technology: India