Solar power: India

This is a collection of articles archived for the excellence of their content. Readers will be able to edit existing articles and post new articles directly

|

Contents

|

Advantages of using solar power

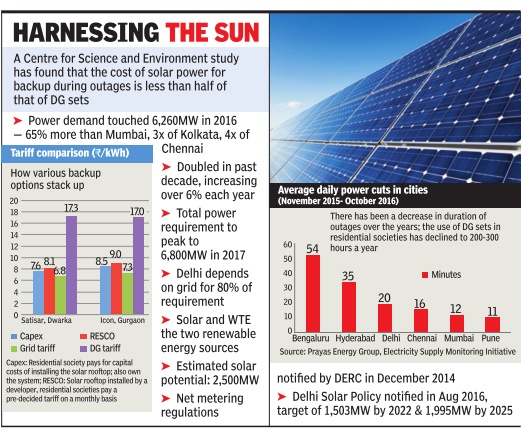

solar rooftop plants are cheaper backup than DG sets: Jan 11 2017, The Times of India

Solar rooftop units could be a much cheaper option for large apartment complexes, which usually depend on polluting diesel generator sets for power backup. A new study by the Centre for Science and Environment (CSE) has found that the cost of using solar plants is less than half of what one would spend on a DG set.

The study reveals that the cost of power generation from a DG set, including the capital cost, is Rs 27-33 per unit, compared to rooftop solar tariff of Rs 10 per unit. Though most consumers perceive solar power to be expensive, prices of panels have fallen sharply in the past few years, thus bringing down the cost of rooftop projects.The cost of solar panels account for 50-55% of the total project cost.

The photo voltaic module prices have fallen from 1.95 euros per watt in March 2010 to 0.53 euros in July 2016. “The cost of electricity generation through solar rooftop with battery backup comes to around Rs 7-8 per unit, which is half the cost of electricity supplied through DG sets. In addition, rooftop plants can reduce the monthly bill of the consumers as the extra units generated through these plants can be supplied to the grid,“ the report said.

To compare the costs of solar rooftop and DG sets, CSE, along with cKinetics--an advisory firm--conducted a feasibility study of five housing societies in Delhi, Haryana, UP and Rajasthan. Two of these are Satisar in Dwarka, which has 245 flats and a 112 KW DG set (partial backup).Satisar faces an outage of about 48 minutes per day .

The other is ICON in Gurgaon, which has 344 flats with a1,112 KW DG set (full backup). ICON faces about 16 minutes of outage per day . The team assessed the feasibility based on various parameters such as rooftop area, load needs and average outages. Two models were considered--Capex--the residential society pays for the capital costs of installing the solar rooftop and RESCO, under which installation is done by a developer. Societies pay a pre-decided tariff on a monthly basis.

Under both models, the cost of supply of power was between Rs 6 and Rs 9 for all the societies. As a backup system for outages, a rooftop plant will work only if it has battery storage. In other words, it's like an inverter fuelled by clean energy , experts explained.

A BSES Rajdhani Power Limited official has clarified that solar rooftops will have to work with reliable grid supply since they cannot provide full backup unlike DG sets. “Solar rooftop can meet basic needs during brief outages but cannot provide full backup (power to run energy-intensive appliances like ACs),“ he said.

The report reasons that with the decrease in duration of outages, the use of DG sets in residential societies has declined to only 200-300 hours per year. The BSES official highlighted that there were other benefits of having a solar rooftop plant--they could bring down power bills apart from providing backup during outages.

Capacity (of solar power in India)

India and the world

As in 2019

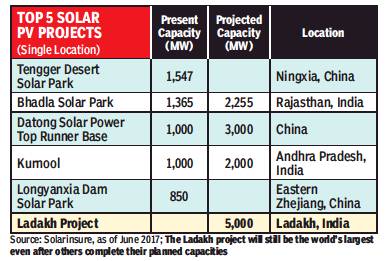

From: Sanjay Dutta, Ladakh will soon be home to world’s largest solar plant, January 13, 2019: The Times of India

See graphic:

Top 5 solar pv projects in India and the world, as in 2019

India as a whole

2018: 20 gw

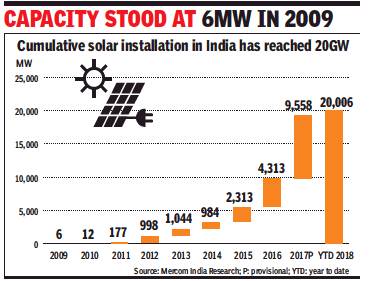

India hits 20GW solar capacity milestone, January 31, 2018: The Times of India

From: India hits 20GW solar capacity milestone, January 31, 2018: The Times of India

See graphic:

Cumulative solar installation in india, 2009-18

'Achieves It 4 Yrs Ahead Of Original Target=

India has achieved 20 gw (giga watt) cumulative solar capacity, achieving the milestone four years ahead of the target for 2022 originally set in the National Solar Mission.

The achievement comes on the back of a major renewable energy push by Modi government, which after coming to power in 2014 had scaled up the target to 100 gw of solar capacity by 2022.

According to the latest India research report by green energy market tracker Mercom Capital, the utility-scale cumulative installations now stand at approximately 18.4 gw, with rooftop solar accounting for another 1.6 gw.

For the first time, solar was the top source of new power capacity additions in India during the calendar year 2017, with preliminary figures showing solar installations reaching 9.6 gw in this period and accounting for 45% of total capacity additions.

But the country has reached the milestone at a time when protectionist measures threaten to slow down activity in the industry. The pace of overall solar installations is expected to be less impressive in 2018 as several protectionist government policies appear poised to increase costs and uncertainty.

“The government’s revised solar installation target of 100 gw by 2022 has recently been clashing with PM Modi’s ‘Make in India’ initiative to promote domestic manufacturing. The recommendation for 70% safeguard duty on (solar panel) imports, the ongoing anti-dumping case, and a 7.85% port duty on imported modules are together creating an atmosphere of regulatory uncertainty that is taking a toll on the industry and slowing down installation activity,” the Mercom report quoted CEO Raj Prabhu as saying.

The rooftop solar sector also witnessed steady growth in 2017 alongside the rise in gridconnected utility-scale capacity. In a display of government’s commitment to this segment, solar power producer Azure Power on Tuesday won a project to electrify 152 schools with rooftop solar projects of 11.35 mw. The company will sign the agreement with Navodaya Vidyalaya Samiti, an autonomous body under human resources development ministry.

Andhra Pradesh

2021: India’s largest floating solar power plant

Aug 22, 2021: The Times of India

Andhra Pradesh can now boast of India’s largest floating solar power plant after state-run NTPC commissioned a 25MW project on the reservoir at its Simhadri coal-fired power station in Vishakhapatnam.

Floating solar power projects are seen as a gamechanger in India's quest for building 450 GW (gigawatts) renewable energy capacity because of their inherent advantages over onland projects, which require large contiguous tracts of non-farming, non-forest land. Floating solar reduces temperature-related losses due to the cooling effect of water they float on, reduce evaporation rate of water bodies and have lower maintenance costs.

NTPC’s floating solar installation covers 75 acres of the Simhadri reservoir’s surface. It will produce power from more than a lakh of solar PV modules for lighting 7,000 households. The project will annually save 46,000 tonnes of CO2 emission and 1,364 million litres of water, which is adequate to meet the requirement of 6,700 households in a year.

The floating solar plant is part of the coal-burning behemoth’s plan to turn green by adding a 60 gigawatts renewable energy capacity by 2032. It is also the first solar project to be set up under the power ministry’s 2018 ‘flexibilisation’ scheme allowing generators to supply power from any of their sources, based on plant efficiency, to reduce discoms’ cost.

NTPC is also building a 100 MW floating solar power plant on the reservoir of its Ramagundam thermal power station in Tamil Nadu. Green Energy Development Corporation of Odisha Ltd has tied up with NHPC to explore, plan and develop commercially feasible floating solar power projects with a total capacity of 500 MW in a phased manner on the state's reservoirs.

Diu

First UT/ state to run 100% on solar power

The harnessing of solar energy has made Diu the country’s first energy surplus Union territory and a model for an effective way for people to harness this renewable energy source. In just three years, Diu has made rapid progress in solar power generation. The Union territory has an area of just 42 square kilometres. Despite scarcity of land, solar power plants have been installed over more than 50 acres.

Diu generates a total of 13 megawatts of electricity from solar power generating facilities daily. Around 3 MW is generated by rooftop solar plants and 10 MW by its other solar power plants.

Three years ago, the people of Diu consumed electricity supplied from the power grid owned by the Gujarat government, resulting in huge line losses. Once the local power company started generating electricity from solar energy, the electricity loss was significantly reduced.

Daman and Diu electricity department executive engineer Milind Ingle told TOI, “The population of Diu is only 56,000. For water and electricity, the Union territory was solely dependent on the Gujarat government. To overcome this limitation, the administration of the Union territory decided to set up solar power plants in Diu.”

Ingle said, “Diu’s peak-time demand for electricity goes up to 7 MW and we generate about 10.5 MW of electricity from solar energy daily. This is way more than the consumption demand requirement.”

He said solar power has come as a big relief for local residents as their monthly bill charges have fallen by around 12%. Previously, the 0-50 units charge was Re 1.20 per unit and 50-100 units was Re 1.50 per unit. But once the solar power plants began operating, the Joint Electricity Regulatory Commission for Goa and the Union territories removed the 0-50 units slab. They now have revised the 1-100 units charge to Re 1.01per unit.

Karnataka

Pavagada: "Shakti Sthala" solar park

Karnataka achieved one more milestone in the solar sector with Chief Minister Siddaramaiah inaugurating the first phase of the Pavagada solar park, which is set to become the world’s largest when it attains its full potential of 2,000 MW.

The first phase of the park has 600 MW while another 1,400 MW will be added by December 2018. It is located in Thirumani of Tumakuru district and has been christened ‘Shakti Sthala’.

Addressing a public meeting at Thirumani to mark the inauguration of the first phase, Mr. Siddaramaiah termed the solar park as the “Eighth among Wonders of the World” built at an estimated cost of ₹16,500 crore.

Describing it as a historical day, Mr. Siddaramaiah said setting up the world's largest solar park is an important milestone in the history of Karnataka.

“We are thankful to all those farmers who have leased out their lands to the government for the project,” he said, adding that 2,300 farmers of five villages of Pavagada taluk have leased out 13,000 acres of land at ₹21,000 per acre per annum with 5% increase once in two years. They have joined the government as partners, shareholders, stakeholders, and are also beneficiaries of the mega project.

Boost to region

Shakti Sthala will help boost economic activity in the most backward and drought-prone Pavagada taluk.

Shakti Sthala is expected to attract industries, which in turn will help in job creation and prevent migration of unemployed youth, he said. Before establishing the project, the land rates in the area were around ₹25,000 per acre, but now it has touched ₹ 5 lakh per acre, he said.

Rajasthan

Bhadla solar plant

Amitabh Sinha, Catching the sun at Bhadla solar park, June 18, 2017: The Indian Express

Located in Rajasthan’s Jodhpur district, Bhadla’s normal temperatures oscillate between 46 and 48 degrees Celsius, while hot winds make even the relatively lower 40 degrees Celsius unbearable.

Bhadla, an arid sprawl in Rajasthan spread over 45 sq km, is where over a million glistening silicon panels fuel India’s ambitious plan to generate 1,00,000 MW of solar energy by 2022.

Bhadla is almost unlivable. Located in Rajasthan’s Jodhpur district, its normal temperatures oscillate between 46 and 48 degrees Celsius, while hot winds make even the relatively lower 40 degrees Celsius unbearable. Sand storms are an almost daily occurrence, and sometimes create massive dunes on the roads, temporarily cutting off certain areas. The nearest habitation is about 50 km away, in Bap, while any semblance of an urban settlement is 80 km in the other direction to Phalodi, a tehsil town.

All of which makes Bhadla an almost perfect setting for a solar power plant. As such, this sandy, dry and arid piece of land, about 200 km north of Jodhpur and about 320 km west of Jaipur, now houses a project that will, in less than two years, become India’s largest solar park. When all the four phases of the project are completed and become operational by December next year as is expected, Bhadla will be capable of producing 2,255 MW of electricity.

Spread across 45 sq km, the size of a small mofussil town, the solar park is part of India’s grand plans to generate 1,00,000 MW of solar energy by 2022. “Solar radiation is very good here. And it receives this kind of radiation almost the entire year. Crucially, the state government had already installed power evacuation infrastructure (transmission lines, transformers to carry power to the grid). But the biggest factor was availability of land. Here, we had large amounts of government-owned barren land that was ideal for the development of solar energy,” says B K Dosi, managing director of the Rajasthan Renewable Energy Corporation Limited, the main developer of the project.

More than 30 similar parks are in various stages of development in other states, as the country embarks on its boldest expansion of the power sector, with an aim to deliver electricity to all and meet an expected increase in demand fuelled by economic growth. India has already committed to ensuring that by 2032, at least 40 per cent of its electricity would be generated from renewable sources. A majority of this would come from solar energy. Recent estimates have put India’s exploitable solar energy potential to be in the range of 7,50,000 MW if about three per cent of wasteland is made available.

Bhadla offers a glimpse into that future. A sight that will become familiar not just in the hinterland but also a permanent feature of the urban landscape as solar panels find their spaces on rooftops of city buildings. About 40 per cent of the 1,00,000 MW target is to be met through such decentralised rooftop solar systems.

Large solar parks like the one in Bhadla are designed to evoke the wonderment that dams and huge power plants did in the 1960s and 1970s. From the middle of one of the blocks, all that the eye can see in every direction are gleaming silicon surfaces of solar panels, interspersed with small buildings that serve as control rooms or house transformers and other equipment.

Over a million solar panels have already been installed, though only about 15 per cent of the total park is currently operational. The panels appear shiny white under bright sunlight, with the hues on their surface changing with the time of the day — orange in the early mornings and around sunset, and a light blue under an overcast sky.

Among the first players to start operations here is the National Thermal Power Corporation (NTPC), which began producing electricity from Bhadla in February this year. NTPC is developing four blocks of 65 MW each as part of the second phase of the project that will eventually see an installation of 680 MW. The first phase of 75 MW is also operational. The NTPC blocks alone produce between 12 and 13 lakh million units of electricity a day, enough to power about 200 average urban households for a year.

There are about 300 other people working at the Bhadla site — technicians, maintenance staff, construction workers, security guards and cleaners (people whose job is to wipe the dust off the solar panels). About 30 per cent of the workforce, especially those involved in construction, come from neighbouring villages. A few locals, with engineering degrees or diplomas from polytechnics, have found jobs as technicians and computer operators.

But solar parks are not particularly labour-intensive. They are relatively simple in design as well. Of all the different means of power generation, solar parks are probably the least complicated to operate. Unlike thermal power plants, hydroelectric projects or nuclear reactors, there is not much equipment involved. Solar panels, cables, inverters and transformers are almost all that are needed to run a plant.

Individual solar panels are capable of generating about 300 watts of direct current (DC), which means a 1 MW (1,000 kW) plant would have between 3,000 and 4,000 of these panels. Each of the four blocks developed by NTPC (4 x 65 MW) has about 2.5 lakh solar panels.

The DC power supply has to be converted into alternating current (AC) to allow for changes in voltage using transformers. This conversion takes place in the inverter room, of which there are several in the Bhadla park. The AC voltage is then ‘stepped up’ and carried on high-voltage transmission lines to the grid, from where electricity is distributed to different users.

Solar power plants also take very little time to become functional. A thermal power plant typically takes about 5-6 years to be operational from the date of start of construction. In the case of a nuclear power plant, this can go up to 10 years or more. Hydroelectric projects have even longer gestation periods due to social, environmental and engineering complications. In comparison, the NTPC blocks at Bhadla took about nine months to start producing electricity.

But it is the environmental benefits that has India pushing massively for solar energy. Unlike thermal power, produced mainly by burning coal or gas and which still accounts for almost 70 per cent of India’s total electricity generation, solar energy is clean. It does not pollute the environment and is also a renewable source. With carbon dioxide emissions — thermal power plants are one of the biggest sources — being responsible for global warming and the consequent climate change, countries across the world are shifting to cleaner sources of electricity production. Solar, wind, biogass, and even nuclear energy, fit the bill.

As part of its 2008 National Action Plan on Climate Change, India had set a target of 20,000 MW of electricity generation from solar energy by 2020. Back then, solar energy had a negligible contribution to India’s electricity mix, with the only renewable source producing significant amounts of energy being wind. At the time, production costs of solar energy were prohibitively high as compared to conventional sources like coal. The per unit price of solar generated electricity used to be close to Rs 15 while thermal plants were able to sell power for between Rs 3 and Rs 6 per unit. With the economics against it, solar generation capacity in India was less than 3,000 MW between 2008 and 2014, despite several incentives and the setting up of a National Solar Mission.

But something miraculous was also happening during this time. Owing to demands from many countries, including China, and rapid development in technology, prices of photo-voltaic systems saw a sharp decline. In some countries, prices in 2014 fell to almost 20 per cent of their 2008 levels. Generating electricity from these solar systems suddenly seemed a financially viable proposition. During this time, the global installed capacity of solar electricity increased six times.

It was against this backdrop that the NDA government decided to dramatically raise its solar energy ambition and increase the target of solar power from 20,000 MW to 1,00,000 MW, while extending the target timeframe by two additional years. Due to the aggressive push from the government, India added about 10,000 MW of installed solar capacity in the last two and a half years, compared to the 3,000 MW in the previous seven years. More than 30 solar parks of different sizes, in 20 states, are in varying stages of development. In February this year, the government approved doubling of targeted production from solar parks — from 20,000 MW to 40,000 MW. This would require the setting up of at least 50 solar parks, each with a capacity of 500 MW.

The volumes have ensured that prices of solar energy have come crashing down in India as well. Solar companies are now bidding to sell their electricity at Rs 3 and 4 per unit — comparable, if not cheaper, to electricity produced from conventional sources like coal. In fact, the bidding for the third phase of the Bhadla project last month saw the per unit price falling to Rs 2.44, the lowest so far. Two days before that, the fourth phase had been bid out at Rs 2.62 per unit. In March last year, the second phase of Bhadla had been bid for Rs 4.34 per unit. Government officials expect that Rs 3 per unit price will become a norm very soon.

Tamil Nadu

2013: TN leads

Tamil Nadu takes India's solar power capacity up 30%

Sushma U N, TNN | Sep 17, 2013

Tamil Nadu takes India's solar power capacity up 30%

India has 1,759.43MW of grid-connected solar power, with close to 800MW coming from Gujarat. The projects are expected to be ready for commissioning next year.

CHENNAI: India's installed solar power capacity is poised to jump 30% with the Tamil Nadu government close to signing power purchase agreements for 700 megawatts (MW) by the end of October.

Once the plants are up and running, Tamil Nadu will have the second largest solar power capacity in India after Gujarat, the pioneer in such projects in the country.

India has 1,759.43MW of grid-connected solar power, with close to 800MW coming from Gujarat. The projects are expected to be ready for commissioning next year.

As part of TN's solar power policy, which aims at installing 3,000MW of capacity by 2015, a total of 52 companies will sign agreements with the Tamil Nadu Generation and Distribution Corporation (Tangedco) for capacity totalling 698MW at a tariff of 6.48 per unit (with a 5% increase annually for 10 years).

This comes at a time when the country's national solar policy is tottering. The second phase of the Jawaharlal Nehru National Solar Mission (JNNSM) has been delayed by over five months with no sign of the programme being kick-started any time soon.

Solar power is the most expensive form of renewable energy and rupee depreciation has added to the woes of companies importing high-end photo voltaic panels.

"There has been a lot of uncertainty over solar power companies and negativity had set in. But now there are projects in the pipeline and activity for players across the board will go up," said Madhavan Nampoothiri, founder and director of RESolve Energy Consultants, an energy consultancy firm.

In 2013 Tangedco held individual meetings with solar power developers asking them to submit documents for proof of land ownership and bank guarantees for financing. "Thirty companies are yet to submit the documents and we have given time till October 30. Once this is in place, power purchase agreements will be signed," a senior official from Tangedco said.

Companies that have the documents in place have started working on the project. "The meeting with the Tangedco chairman and other members was a manner of assurance of support and we have started progress on our project. The team is on the site and we are in talks with banks for financing," said T R Kishor Nair, President, Welspun Energy, which is setting up a 60 MW plant in Trichy district. Solar policies in other states haven't made as much progress and capacities also aren't as large as in Tamil Nadu. While Andhra Pradesh has a target of 1,000 MW, tariff is a deterrent for investors as it is fixed at Rs 6.49 with no annual hike. The programmes in states like Punjab (300 MW) and Karnataka (130 MW) are on a smaller scale and are in the nascent stage. What adds to Tamil Nadu's attractiveness is that the state has high solar radiation of 5.6 - 6.0 kWh per square meter with around 300 clear sunny days in a year, the third highest in India.

Kamuthi, Tamil Nadu

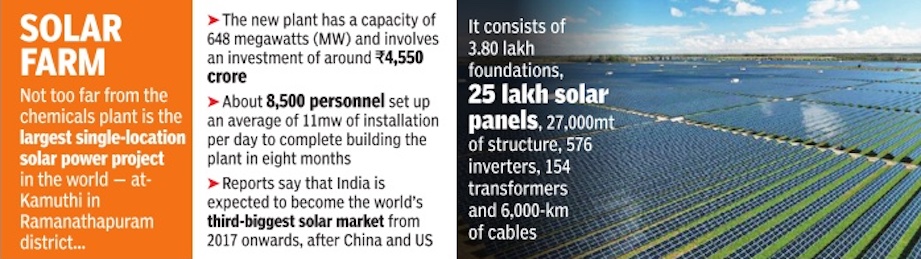

World's largest solar power plant opens in Kamuthi, 22nd September 2016: The Indian Express

The world’s largest solar power plant in one single location kicked off operations in Kamuthi in Ramanathapuram district. A project of Adani Green Energy (Tamil Nadu), the renewable energy wing of the Adani Group, the plant has a capacity of 648 megawatts (MW) and has been set up with an investment of around `4,550 crore.

“A plant of this magnitude reinstates the country’s ambitions of becoming one of the leading green energy producers in the world,” said Gautam Adani, Chairman, Adani Group.

Around 8,500 personnel worked to average about 11 MW of installation a day, to set up the plant in the stipulated time, Adani added.

The plant is part of the State government’s target to generate 3,000 MW in line, with its new solar energy policy unveiled in 2012. The company had sourced equipment and machinery from various parts of theworld to set up the 648 MW capacity within a record time of eight months.

The plant comprises 3,80,000 foundations, 25,00,000 solar modules, 27,000 metric tonnes of structure, 576 inverters, 154 transformers and 6,000 km of cables. The entire 648 MW is now connected to the Kamuthi 400 KV substation of Tantransco.

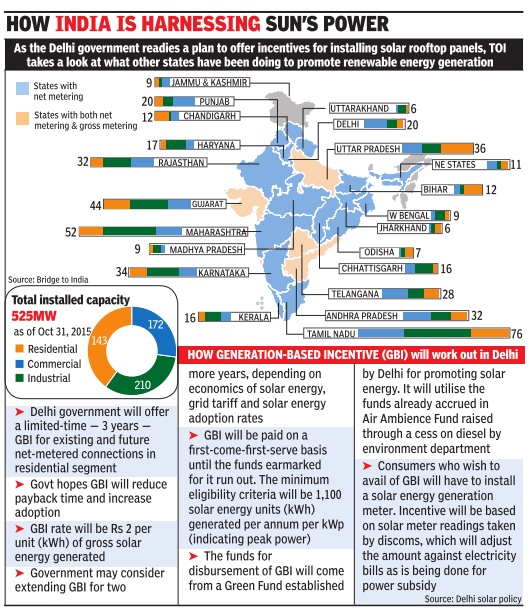

2015, state-wise capacity

From: The Times of India, March 17, 2017

See graphic

State-wise solar power installed capacity in India, 2015

Funding

2018: more than doubles to $10bn

March 14, 2018: The Times of India

From: March 14, 2018: The Times of India

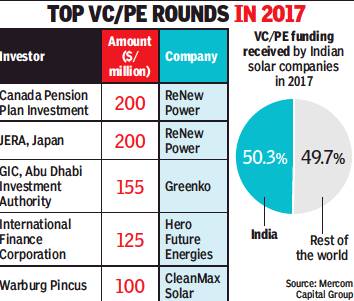

The Indian solar industry attracted $10-billion financing in 2017, more than doubling from $4 billion in 2016 as projects gathered steam on the back of the government’s push to create 100GW (giga watt) solar power capacity by 2022. According to latest data from green energy market tracker Mercom Capital, Indian solar companies received $800 million in venture capital and private equity investments, which account for half of such investments globally and indicate the traction of India’s solar policy among global investors.

In terms of total funding, Indian solar companies raised $3.6 billion through venture capitals, private equity funds, public market and debt in 2017. This accounts for 28% of such funding globally.

Project financing alone rose to about $6.4 billion on the back of nearly 10GW of solar installations coming along as compared to $3.5-billion financing activity with installation of 4GW of solar capacity in 2016.

The increase in corporate funding in 2017 was largely spurred by large private equity deals, the largest being announced by ReNew Power, which closed two deals worth $200 million each. A host of other companies announced deals worth more than $100 million each.

Debt financing also saw a significant year-on-year growth. Most of the debt activity among Indian solar companies came in the form of new bonds.

Government policies

Delhi's net-metering for rooftop systems a model for world?

ii) Advantages of decentralised solar PV systems in cities. ;

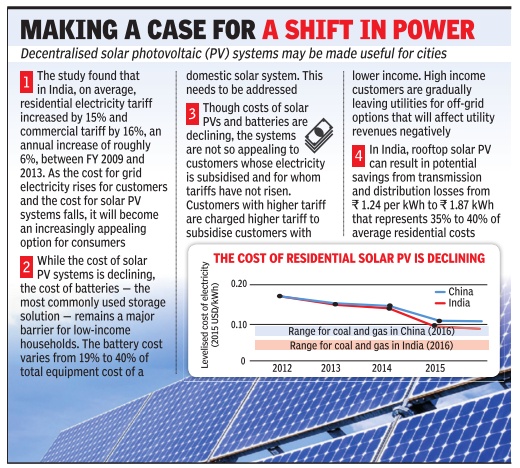

From: GREEN VENTURE - Delhi's solar energy model best for power-hungry cities, says int'l study, Sep 8, 2017: The Times of India

Even Brazil Wants To Have Net Metering Policy Like Capital

An international report on how energy-poor cities can be powered while containing polluting has cited Delhi's net-metering policy for solar rooftop systems as a probable solution for providing cheap electricity . The World Resources Institute's report, titled “Powering Cities in the Global South“, was released on Wednesday. The report also pointed out that Brazil was contemplating legislation changes to its renewable energy norms to enable a Delhi-like policy.

While highlighting the three solutions -decentralised solar photovoltaic (PV) system, clean cooking fuel and energy-efficient buildings and appliances -the system in the Indian capital was pointed out as exemplary. Net-metering was introduced in Delhi in 2014. Under this, home owners can either own a solar power system or lease their roof space to project developers. Roof owners can also pay a monthly lease rent to have a solar PV system put up by project developers. “The electricity generated from such a system is used to meet the household's or rooftop owner's energy needs, with the excess being fed into the grid,“ the report stated.

The report also noted the Pay As You Go (PAYG) process, popular in rural parts of Africa where customers acquire solar systems for a small deposit. They then buy daily usage “credits“ for 0.50 dollars, a sum that is less than the price of traditional kerosene lighting.

The report stated that underutilised rooftops in cities could be put to use under policies such as Gujarat's “Rent a Roof “ in which residents give their rooftops to private solar energy companies that pay them around Rs 3 for every unit of energy produced. There is mention also of Bengaluru's net-metering programme in which owners of rooftop solar PV systems are paid a promotional rate every month for net excess generation flowing to the grid.

Scaling up decentralised PV systems would also curb emission, the report said.This low-pollution measure could be crucial in mega cities of South Asia, where the polluting PM2.5 concentrations are double that in cities in developed countries, the report said. In 2010, China, India, Africa and Latin America comprised about one-quarter of total urban greenho use gas emissions from buildings, transport and waste disposal. In a business-asusual scenario, where no measures are taken to reduce emissions, these regions will be responsible for 56% of total urban emissions in 2050.

“Solar PV is a viable option even where individuals do not have adequate rooftop space. Community-owned, community-shared solar systems are a promising model in such cases. Such systems can be constructed on communityor municipality-owned land or buildings,“ said the report while pointing out that the cost of rooftop PV panels is declining swift ly. The average cost of electricity from residential rooftop solar PV in India and China in 2015 was within the range of cost of electricity from natural gas in both the countries. This didn't include the cost of battery storage, which remains steep.

According to the WRI report, most poor households in developing countries spend 14-22% of their incomes on energy . Households are considered “energy poor“ if they spend 10% or more of their income on fuel or electricity .The report, therefore, suggests making solar PV panels accessible to low-income households through utilities, banks, micro-finance institutions or through leasing options and PAYG programmes.

2018, Delhi NCR/ Mukhyamantri Kisan Aay Badhotri Solar Yojana

Pretika Khanna, July 24 2018: Livemint

Under the scheme, Delhi farmers will be able to provide one-third of their land to solar power companies on rent for 1 lakh per acre on a yearly basis

The government said that the rent will increase by 6% each year. The agreement will be for 25 years.

“Delhi government has announced a big step for farmers in rural Delhi. They can earn huge income from lifted solar plant in their field which can earn them approximately ₹ 1 lakh per acre per year in their income. This would be a multi-fold increase from their current incomes," Delhi chief minister and AAP national convener Arvind Kejriwal said, while addressing a press conference to announce the decisions taken by the cabinet.

According to the statistical handbook of Delhi, the total cropped area in the national capital is 34,750 hectares.

To not hinder farming in the one-third area, the minimum structure height for placing solar plant will be 3.5 meters which will allow passage for tractors and other farming equipments.

Along with rent, the government also plans to provide 1,000 units of electricity per acre free of cost to the farmers. The electricity generated from these solar parks will be used to provide power to government offices. The move would save the government ₹ 300-400 crore.

“Farmers will also get 1,000 units per acre electricity free. This electricity, the companies will sell to different departments of the Delhi government like Delhi Jal Board. Through this scheme departments can buy electricity for ₹ 4 per unit against the ₹ 9 that they are paying right now. This will not only help farmers but also help the government save money and also provide clean energy to Delhi," Kejriwal added.

Projects, initiatives

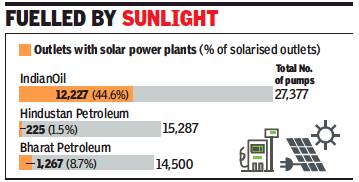

Oil retailers invest in solar plants: 2018

Sanjay Dutta, Oil retailers bet big on solar with easy loans, November 29, 2018: The Times of India

From: Sanjay Dutta, Oil retailers bet big on solar with easy loans, November 29, 2018: The Times of India

Cos Going Green To Cut Costs

Oil companies betting big on solar energy doesn't sound ironic any more. Setting up solar power plants is not a token of commitment to the environment. Instead, it is making business sense as rising cost of running petrol pumps eat into dealer income.

No wonder India's staterun fuel retailers are persuading petrol pump owners to go green by setting up solar power units. Experiments by IndianOil, the country’s largest fuel retailer, in 2015 showed running outlets on solar power costs less than burning diesel in generators to keep pumps running, especially in the hinterland.

Since then, IndianOil, which holds sway over nearly half of India’s fuel retail market, has been driving its dealers to switch to green power by arranging easy loans through a tieup with SBI and other assistance. Bharat Petroleum and Hindustan Petroleum, too, have joined the bandwagon but have been slower.

“Solarisation of petrol pumps is part of IndianOil’s green commitment. Our target is to run 100% retail outlets on solar power in the next two years. The focus will be on rural areas where we have Kisan Seva Kendras (lowcost, stripped-down versions of petrol pumps),” IndianOil chairman Sanjiv Singh told TOI.

“A solar plant not only ensures continuous power but it ensures quality power and prevents equipment (at outlets) from tripping due to supply interruptions or (voltage) fluctuation. Pollution from generators is also checked,” Singh said.

All these result in uninterrupted operation and no loss of sales. Depending upon the size of the petrol pump, a 24 kw (kilo watt) rooftop photovoltaic system can reduce costs by more than Rs 7 lakh a year. This is nearly 50% less than the average annual electricity bill, based on commercial rates that are higher than domestic tariffs, for grid supply. There are other benefits too such as accelerated depreciation.

Power supply from the grid in rural areas and the hinterland still remain patchy and also suffer from low, high or fluctuating voltage. Petrol pump owners in these areas depend on generators, which pushes up running cost and eats into dealer margin.

Solar power market

2015-16: large corporates dominate

The Times of India, Sep 09 2016

Sanjay Dutta

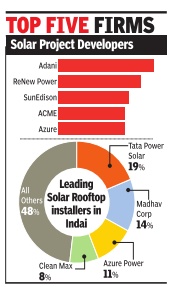

Solar power market: Little room for small players under the sun India's fragmented solar power market is gradually witnessing a build-up of domination by private equity-backed large corporates, with the Adani group putting the largest number of projects in the pipeline and Tata Power leading in rooftop installation. The shift is indicated by the fact that the top 20 developers account for almost 80% of projects under development.But they account for only 58% of the 8.1GW (Giga Watt) capacity already installed, while the rest is spread among 500 other companies, says a report by global green energy market tracker Mercom Capital.

The government has set a target of installing 175 GW solar power capacity by 2022 as part of its overall climate management plan. This is one of the factors encouraging big corporates, which have leveraging capacity to raise cheaper funds, to enter the arena. “In a tough market driven hyper-competitive rever by hyper-competitive reverse auctions and low margins, large conglomerates with deep pockets and strong balance sheets that can access financing at much lower rates, private equity-backed firms, and international companies with access to cheaper funding abroad are well-positio ned to dominate the sector.Other than one-off projects, smaller developers will struggle to grow as financing, low bids, and the policy push towards larger projects will make growth challenging,“ the report says.

Adani has put projects with a total capacity of 2 GW in the pipeline to capture 11% of the market within two years of entering the sector. ReNew Power, a wind and solar company backed by Goldman Sachs, is right behind with a 10% market share. The remaining pecking order is made up of SunEdison, which is slated for acquisition, with 8.5% market share, ACME 8%, Azure Power 5%, Tata Power 3.8%, Suzlon and Hero Future Energies with 3.7% of the market.

As far as installed capacity goes, Tata Power leads by notching up a 9% share by acquiring Welspun's project portfolio. ACME follows with 7% share, SunEdison 5.5% and Adani 5%.

Tata Power leads the roof top segment with more than 100 MW capacity , even though the market itself is struggling to take off. By all accounts, only 601 MW rooftop solar projects have been installed so far as available incentives have not been enough to move the market forward.

One of the reasons is that even though there is net-metering policy and policy proposals in many states, implementation has been tardy . It takes six to eight months in some states just to process paperwork.

There is no subsidy available for commercial and industrial customers, which make up almost 70% of the rooftop market.

Accelerated depreciation is set to come down to 40% in 2017-18 from the existing 80%. The government's decision to increase solar parks from 20 GW to 40 GW to make up for slow rooftop adoption indicates that the 40 GW rooftop solar goal by 2022 is not rooftop dependent.

Tariff and cost

2016: drops to Rs.3

The Times of India, December 1, 2016

The Times of India

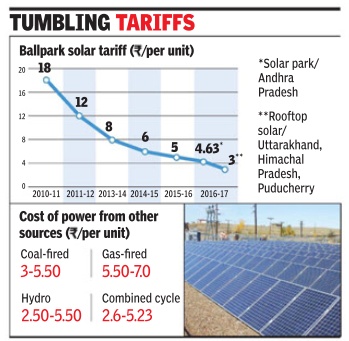

At Rs 3 per unit, solar power tariff sinks to new low

It's not just oil that is on a slide. While globally crude has slid some 70% in the last year-and-ahalf, solar power tariffs have sunk to a new low of Rs 3 per unit the same as average cost of power from state-run NTPC's coal-fired plants.

The new record came from Gurgaon-based Amp from Gurgaon-based Amplus Energy Solutions in a Solar Energy Corporation of India's auction of rooftop solar power projects and beats the previous low of Rs 4 per unit for a solar park in Rajasthan by a quarter.

The rooftop projects will be installed on buildings of NGOs, educational institutes, hospitals, trusts and notfor-profit companies in these states. The lowest tariff quote for these projects is same as average tariff offered by state-run generation utility NTPC for power from its coal-fired plants and nearly half of tariffs charged by some private power producers.

Till now, a solar project at Badhla in Rajasthan held the record for the lowest tariff at Rs 4 per unit in the solar park category . The lowest tariff before that was Rs 4.34 per unit, quoted by Fortum India in January for one of the six packets of 70 mw (420 mw total) each bid out by state-run generation utility NTPC for an earlier phase of the Bhadla solar park. SunEdison was the first to pull down solar power tariffs below the Rs 5 per unit-mark by quoting a tariff of Rs 4.63 per unit for a project in Andhra Pradesh.

In a statement issued on Wednesday , Amplus said the Rs 3 per unit tariff will apply to grid-connected rooftop projects in Uttarakhand, Himachal Pradesh and Puducherry .

Similar projects in Karnataka, Madhya Pradesh and Maharashtra will get solar power at Rs 5.56 per unit. For Rajasthan, the tariff will be Rs 5.38 a unit, The price for Haryana will be Rs 5.76 and Punjab will be Rs 6.20 per unit.

Price has dropped because of subsidies

Apr 16 2017 : The Times of India

Dark side of solar success: It may kill thermal power, banks

SWAMINATHAN S ANKLESARIA AIYAR

The latest solar power auction has yielded an electricity price of just Rs 3.15unit, down from Rs 5 two years ago. This seems competitive with coal-based thermal power. The government has raised its solar capacity target to 40GW by 2020 and 100GW by 2030, up from 12GW today. This promises to replace dirty coal-based power by cheap, renewable power.

What's not to like? Plenty. Solar power has many hidden subsidies. Its true cost is far higher than for thermal power.

A far bigger problem is that solar power is given preference when supply exceeds demand, so thermal plants have to back down. The plant load factor (PLF) or capacity utilisation of coal-based plants was 76% six years ago, but is now just 58%. India used to be perennially short of electricity, but now most regions have surplus. India now exports power to Bangladesh, Nepal and Myanmar.

Thermal producers had expected the power shortage to continue, and hoped for at least 70% PLF , yielding good profits. But at today's PLF of 58%, many are in trouble, especially merchant plants selling power on the open market because they don't have power purchasing agreements with state governments. If average PLF falls below 48%, and that of merchant plants falls even more -as is likely if solar capacity soars to 40,000MW by 2020 -then many coal-based projects will go bust. These are financed overwhelmingly by loans, not equity . Interest on loans must be paid even if plants lie idle, so high interest costs can kill projects when the PLF falls.zxc Around 65GW of new thermal power plants are already in the pipeline. These, plus new solar plants, threaten a rising power surplus at a time of tepid demand growth. The consequent PLF collapse could bankrupt many projects, hugely burdening lenders.Many banks are already staggering under enormous bad debts, and now face the threat of a fresh avalanche. That will hit the whole economy .

In sum, explosive solar power growth looks a blessing, but can become a curse. We should hurry slowly .

The notion that solar power has become cheap er than coal-based power is an illusion (though, hopefully it will become reality if costs keep fall ing). An official answer to a question in Parliament said, “The government is promoting solar energy through fiscal and promotional incentives such as capital andor interest subsidies, tax holidays on earnings for 10 years, generation based incentives, accelerated depreciation, viability gap funding, financing rooftop solar as part of home loans, con cessional excise and customs duties, preferences for power generated from renewables.“ Whew!

Besides, the government offers a 25% capital subsidy for solar equipment production. The solar parks attracting the recent low bids get cheap or free land from state governments, a big implicit subsidy since 1,000MW needs 5,000 acres. At an investor conference last year, one solar entrepreneur es timated the true cost of solar power (sans implicit and explicit subsidies) at Rs 6/ unit without storage and Rs 8/ unit with stor age. A captive coal-based power station working flat out yields power at just Rs 2.50unit, far cheaper than solar power. Com mercial thermal plants have quoted Rs 1.77 to Rs 4unit.

2017: tariff drops below cost of coal-fired power

Sanjay Dutta, Solar tariff drops below cost of coal-fired power, May 11, 2017: The Times of India Solar power tariffs appear to be on a free fall in India to find a new floor at Rs 2.62 per unit, some 18% lower than the average price of Rs 3.20 charged by India's largest generation utility , NTPC, for electricity generated by its coal-fired plants.

The historic low was quoted by Phelan Energy and Avaada Power during bidding for packages of 50 MW and 100 MW, respectively , of the fourth phase of Bhadla solar power project in Rajasthan.

Softbank Cleantech won a 100 MW packet quoting Rs 2.63 per unit. “ Another milestone towards PM @narendramodi's vision of clean affordable power for all,“ power minister Piyush Goyal tweeted early Wednesday soon after the bidding closed.

This beats the previous low of Rs 3.15 per unit quoted by Solairedirect in the auction for NTPC's 250MW project at Kadapa in Andhra last month.

The lowest tariff-levelised over 25 years -quoted for a grid-connected solar power project before that stood at Rs 3.30 per unit, on a basic bid of Rs 2.97 a unit for the first year, quoted in February for the first unit of the 750MW Rewa solar park in Madhya Pradesh.

Solar power tariffs have been falling in the last three years due to the Narendra Modi government's thrust on raising India's green energy footprint and reduce oil imports by 10% by 2030. After coming to power in 2014, the Modi government meta morphosed the UPA 's National Solar Mission by setting a target of building 175GW (giga watt) of green energy capacity by 2030. But a section of industry players cautioned that the “hidden costs“ of integrating such largescale plants into grid should be considered when calculating the landed cost. According to these players.grid-connected solar PV (photo voltaic) plants use transmission lines only 20% of the time compared to 70% by traditional plants, which makes it 3.5 times costlier to wheel solar power.

Also, operation of conventional plants will have to be ramped down or up to maintain balance between supply and demand.This would result in lower plant load factor for conventional power stations, which are expected to drop to 50% levels from current 60%. This in turn would push up the fixed cost component in the average cost of power and push them out of favour with state utilities.

As reported, solar tariffs had sunk to Rs 3 per unit quoted by Gurgaon-based Amplus Energy Solutions in auctions conducted by Solar Energy Corporation of India.

See also

Power: India, 2 (ministry data)

Green (renewable) energy: India, 1

Green (renewable) energy: India, 2 (ministry data)

Petroleum, diesel, kerosene, India: I

Petroleum, diesel, natural gas, India, II (ministry data)

Solar power: India