Snack foods: India

This is a collection of articles archived for the excellence of their content. |

Packaged snack foods

As in 2019

Namrata Singh, ₹5 packs a punch in fast-moving snacks, April 12, 2019: The Times of India

From: Namrata Singh, ₹5 packs a punch in fast-moving snacks, April 12, 2019: The Times of India

Drives Half Of The Sales As Individual, On-The-Go Consumption Gains Traction

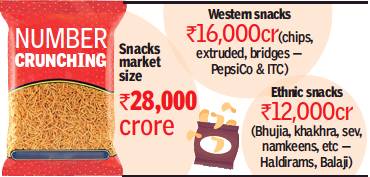

In what is a clear indication of a rise in on-the-go consumption, the affordable Rs-5 price point has emerged as the largest driver of sales for the snacks market. More than half (around 55%) of the sales in the Rs 28,000-crore snacks market falls under this price point, even though players follow a differentiated strategy for growing their other larger packs as well.

Growing at a healthy doubledigit rate, snacks has emerged as one of the fastest growing FMCG categories, with more than 7 million shops. As the market continues to attract new players, who are experimenting with fresh flavours to drive consumption, the magic price point of Rs 5 would stand them in good stead. ITC divisional chief executive (foods) Hemant Malik said, while growth across all price points has been robust for snacks, the Rs-5 stock keeping unit (SKU) has helped in driving distribution and consumer penetration. It is predominantly consumed individually.

“The ease of availability, coupled with increase in choice and shift in consumption pattern from unbranded/commodity snacks to packaged, is the largest contributor for the category buoyancy. The price point purchased by consumers is greatly influenced by consumption occasions and disposable incomes,” said Malik.

Industry experts said price points like Rs 5 in snacks and biscuits, as also in personal care categories (where the entry price points are as low as Re 1 and Rs 2 in shampoos, for instance), are considered breakthrough price points. They drive brand penetration in a big way. For shampoos, low unit priced sachets constitute the bulk (65-70%) of the market in volumes.

Parle Products category head Mayank Shah said Rs 5 and Rs 10 together comprise 75% of overall biscuits market, which includes unorganised as well. “Parle popularised the Rs-5 price point in biscuits and now other players have also entered this price segment. We see the Rs-10 price point also picking up pace now,” said Shah.

PepsiCo India senior director (foods category) Dilen Gandhi also said that, while the Rs-5 pack — which is the lowest entry price point — accounts for a majority of sales for its wider accessibility among consumers and retailers, over the last twothree years Rs 10 is catching up on growth, specially in urban market due to increased spending by the consumer on snacking. “This trend is true for Pepsi-Co India as well and with the growing Indian economy and more disposable income, we see Rs 10 becoming even more salient,” said Gandhi. PepsiCo makes Kurkure and Lay’s.

ITC’s ‘Bingo’ operates across multiple sub-segments in the snacks industry, and the saliency of price points varies across all. There is a significant proportion of sales coming from Rs 10 and Rs 20 in ‘Bingo Mad Angles’ and ‘Bingo Potato Chips’ portfolio. However, the ‘Bingo No Rulz’ portfolio, which falls under the extruded segment, is dominated by the Rs-5 price point.

Given the affordability factor, the Rs-5 price point cannot be ignored by new entrants who are looking to scale up their operations. RP-Sanjiv Goenka Group company Guiltfree Industries, which has created a disruption in the western snacks market by positioning its brand ‘Too Yumm’ on the healthy snack plank, is now entering the Rs-5 price point to drive penetration.

Guiltfree Industries VP (marketing) Anupam Bokey said, “According to Nielsen, we are clocking Rs 28-crore sales per month and have garnered a 2% share of the national western snacks market. We now plan to enter the largest price point segment — the Rs-5 packs — which, we believe, would significantly help drive our distribution and trials and add to our share of the market. This is despite the fact that we are priced at a 40% premium to other snacks.”