Sensex

(→2016: Highest rise ever) |

(→2016: Highest rise ever) |

||

| Line 145: | Line 145: | ||

[[File: Top 5 day-after surges post budget.jpg| Top 5 day-after surges post budget; Graphic courtesy: [http://epaperbeta.timesofindia.com//Article.aspx?eid=31808&articlexml=7th-heaven-Sensex-flies-777-highest-rise-in-02032016001075 ''The Times of India''], Mar 02, 2016|frame|500px]] | [[File: Top 5 day-after surges post budget.jpg| Top 5 day-after surges post budget; Graphic courtesy: [http://epaperbeta.timesofindia.com//Article.aspx?eid=31808&articlexml=7th-heaven-Sensex-flies-777-highest-rise-in-02032016001075 ''The Times of India''], Mar 02, 2016|frame|500px]] | ||

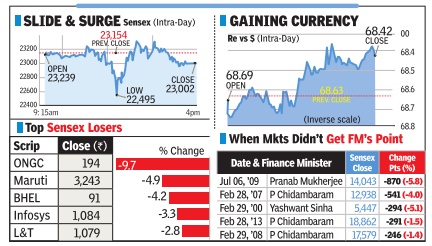

[[File: Slide and surge, sensex, intra-day; Top sensex losers; Gaining currency, rupee-dollar and Finance Minister and change in points.jpg|Slide and surge, sensex, intra-day; Top sensex losers; Gaining currency, rupee-dollar and Finance Minister and change in points; Graphic courtesy: [http://epaperbeta.timesofindia.com//Article.aspx?eid=31973&articlexml=After-False-Note-D-St-Tunes-In-01032016004019 ''The Times of India''], March 1, 2016|frame|500px]] | [[File: Slide and surge, sensex, intra-day; Top sensex losers; Gaining currency, rupee-dollar and Finance Minister and change in points.jpg|Slide and surge, sensex, intra-day; Top sensex losers; Gaining currency, rupee-dollar and Finance Minister and change in points; Graphic courtesy: [http://epaperbeta.timesofindia.com//Article.aspx?eid=31973&articlexml=After-False-Note-D-St-Tunes-In-01032016004019 ''The Times of India''], March 1, 2016|frame|500px]] | ||

| + | |||

| + | |||

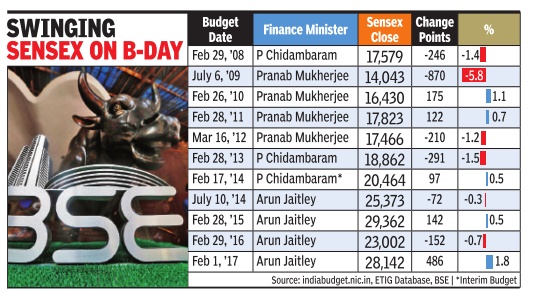

| + | [[File: Swinging Sensex on Budget day, 2008-2017.jpg|Swinging Sensex on Budget day, 2008-2017; [http://epaperbeta.timesofindia.com/Gallery.aspx?id=02_02_2017_021_020_007&type=P&artUrl=A-welcome-retro-amendment-for-FPIs-No-tax-02022017021020&eid=31808 The Times of India], Feb 2, 2017|frame|500px]] | ||

| + | |||

| + | |||

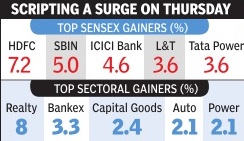

''' 7th heaven: Sensex flies 777, highest rise in 7 yrs ''' | ''' 7th heaven: Sensex flies 777, highest rise in 7 yrs ''' | ||

Revision as of 18:38, 4 April 2017

This is a collection of articles archived for the excellence of their content. |

Contents |

Sensex versus the NSE

NSE top bourse, but sensex bigger brand

Partha Sinha The Times of India Mar 05 2015

A little more than two decades ago, the National Stock Exchange (NSE) -currently the largest bourse in India in terms of turnover -was created by the government to compete with and break the monopoly of the Bombay Stock Exchange. BSE then was a cosy brokers' club with a complete dominance over the stock trading in the country . To counter trading by a limited number of brokers, the gov ernment created an exchange that was the country's first computer-driven online stock exchange, promoted by some of the leading institutions of that time.

In its initial days, NSE enjoyed the monopoly of setting up trading terminals across the country , while its main rival BSE was not allowed to do so. It was only after NSE captured a large chunk of share trading across the country and also dominated regional stock exchanges that BSE got the permission to go pan-In dia. That, too, after a huge struggle by BSE brokers.

What helped NSE to outwit BSE and grow rapidly was the savvy use of technology . The launch and spread of online trading, which also created several jobs among the youth, was a big differentiator. According to one institutional dealer, in mid-1990s, he got his first job with a family-run broking firm simply because he had very basic knowledge of computers. “My employer would treat me with a lot of respect and would often brag to fellow brokers that he had someone who knew computers,“ the dealer said.

Along with computerized trading, NSE also led the automation and paperless trading in the Indian market. NSDL, the first depository in the country is a subsidiary of NSE that led the demat revolution in India. Also, it was the first exchange to have a clearing corporation, an independent third party that facilitated settlement and helped low er trading and settlement risks in the market.

Despite the dramatic rise and rise of NSE, at least on one count it still falls behind BSE: The Brand. Sensex as a brand that punches way above its weight compared with NSE's nifty. “Although most of the brokers look at nifty to gauge investor sentiment, outside of this community , among the general mass, sensex still remains the primary gauge for the robustness of the market and the economy ,“ said a former exchange official.

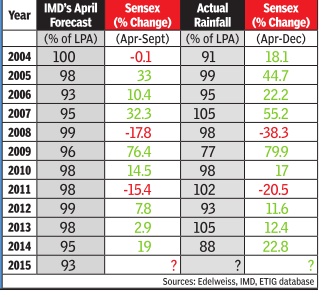

Co-relation between monsoon and market

Apr 24 2015

Although Dalal Street is feeling the jitters of a below-normal monsoon prediction by the Indian Meteorological Department, data show no correlation between Met's predictions, actual rains and the overall market trend. For example, 2009 saw the worst drought in recent times with the country witnessing 77% of the long period average (LPA) rainfall during monsoon.However, that year the sensex rallied 76% between April, when Met's initial monsoon estimates are published, and September, when the monsoon officially ends. On the other hand, the sensex fell over 20% in 2011, the year that saw one of the best monsoons in over a decade

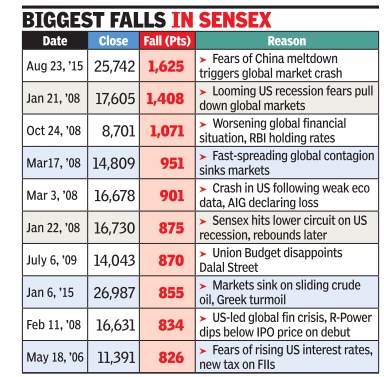

Manic Mondays

The Times of India, Aug 25 2015

7 of 10 biggest mkt slumps on Mondays

They don't call it Manic Monday for nothing. Seven of the 10 biggest single-day falls on Dalal Street have taken place on a Monday. This is true for both intra-day crashes as well as sensex closing levels.The second highest closing fall of 1,408 points was also on Monday, January 21, 2008.

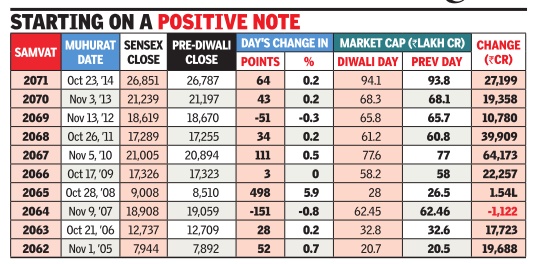

Muhurat day trading

Samvat 2061-71 (2005-15)

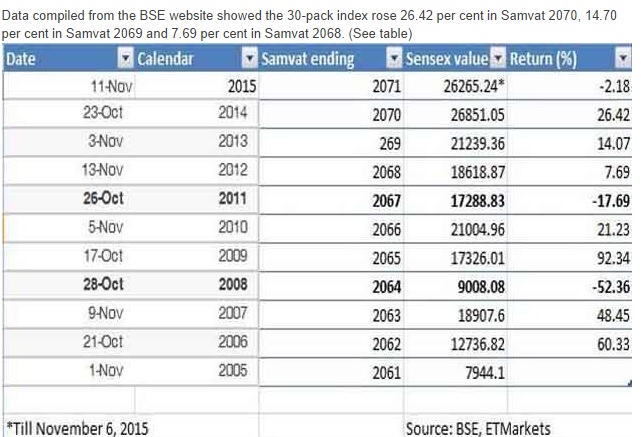

Amit Mudgill, ECONOMICTIMES.COM Nov 9, 2015

Samvat 2071 3rd worst for Sensex in a decade

(Data compiled from the BSE…)

It was the third worst Samvat in a decade for BSE benchmark Sensex, as a less-than-expected pace of earnings revival, fading hopes of big-bang reforms and high volatility in equity markets globally had a bearing on the domestic market.

With just one day left for investors to participate in the auspicious muhurat trading, investors would not hope to see a repeat of Samvat 2071, during which the BSE Sensex shed some 2 per cent. The fall, though minuscule, has ended a long winning streak for the BSE benchmark in three consecutive Samvats. The Hindu Samvat runs from Diwali to Diwali. Data compiled from the BSE website showed the 30-pack index rose 26.42 per cent in Samvat 2070, 14.70 per cent in Samvat 2069 and 7.69 per cent in Samvat 2068. (See table)

The equity benchmark has given negative returns in only three Samvats in last one decade. Besides the Samvat that is ending on Tuesday, Samvat 2070 (2010-11) witnessed a 17.69 per cent fall in the Sensex while Samvat 2067 (year 2007-2008) saw the index lose 52 per cent.

Calendar 2011 had witnessed the downgrading of the US to AA+ from AAA rating by rating agency Standard & Poor's for the first time in history, triggering weakness in equities across the globe. During 2007-2008, markets crashed globally after the collapse of Lehman Brothers, as many other US financial institutions, such as Freddie Mae and Fannie Mac, faced trouble, triggering a chain reaction, what is now known as the global financial crisis.

However, Samvat 2071 was different in the sense that global markets fell this time on concerns over a slowing Chinese economy and the strengthening of the US economy, which has made a liftoff imminent after eight years of near-zero interest rate regime.

For minute-by-minute market/stock updates, follow our Twitter handle @ETMarkets

Back home, a delay in delivery on reforms by the NDA government weighed on the market sentiment through the Samvat.

"The May 2014 election result was a landmark in Indian politics, as the Modi-led NDA coalition won an outright majority in the Lok Sabha. The fact that a single party crossed the halfway mark on its own for the first time in 30 years raised hopes that the long-awaited economic reforms will be out on fast track. However, things have not gone smoothly, largely due to the BJP's lack of a majority in the Rajya Sabha. As a result, reforms that require legislative approvals -- notably the emblematic and key land acquisition and GST reforms bills -- are stuck in a parliamentary logjam," Vivek R Mishra, Asia Equity Strategist, Societe Generale, said in a note.

"Our sense is that there is a serious structural change that has taken place globally between emerging and developed markets," said Jahangir Aziz, JPMorgan.

In an interview with ET Now, Aziz said: "If you look at global trade, it has flatlined both in terms of US dollar and as a percentage of global GDP since 2010. If you look at what drove the fortunes of emerging markets, including India, prior to the crisis or through the recovery phase, it was this massive increase in global trade. It is not a six-month or 12-month phenomena, it has been happening since 2010."

"In addition, the kind of impact that growth in developed markets used to have on emerging markets has been more or less absent in last five years. So if you look at the last five years, developed markets have actually increased growth rates from, say, minus half a per cent during the crisis period to about one-and-a-half per cent. But emerging markets have more or less lost about 350 to 400 basis points in average growth rate. The old model has come to its end," he said.

2014: rises marginally

Sensex rises marginally in Muhurat trading

Mumbai: TIMES NEWS NETWORK The Times of India Oct 25 2014

At any gathering of brokers, analysts and investors, a major part of the conversation currently revolves around the new government and its policies. Thursday evening's Muhurat trading session at P J Towers, the headquarters of BSE in south Mumbai, which saw the sensex closing 64 points higher at 26,851, was no different. Top brokers and independent money managers shared their views on almost every decision of the Narendra Modi government and its impact on the market, and there were enough number of willing listeners as the one-and-halfhour long special trading session continued at the exchange's Convention Hall.

During the session, which was to mark the start of Samvat Year 2071 -the New Year for the trading community on Dalal Street dominated by the Gujaratis -the sensex's gains were backed mainly by index heavyweights like Reliance Industries, TCS and ITC. Nifty closed 19 points higher at 8,015.

Usually, the indices close higher after the Muhurat session as traders do not sell shares during this session that is preceded by a puja of God dess Lakshmi, who symbolizes wealth and prosperity .

The day's session at BSE started with felicitation of some of the top brokers on the exchange during the past one year, and then the opening bell ringing ceremony . This year, Bollywood actor Kajal Aggarwal, of “Singham“ fame, rang the opening bell. In Samvat 2070, the sensex had gained 26%.

There was a bullish undertone in what the brokers, money managers and analysts had to say as they have huge expectations from the Modi government. However, there were some notes of caution as well.

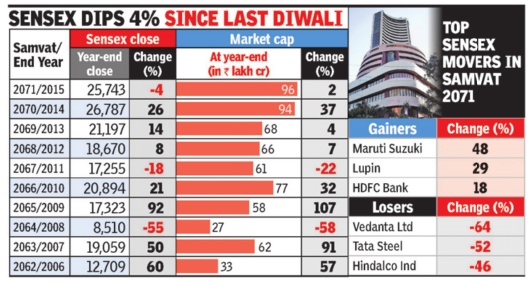

2014-15/ Samvat 2071: Worst in four years

The Times of India, November 11, 2015

Samvat 2071 in the traditional calender of the trading community on Dalal Street, has turned out to be the worst year for the sensex in terms of returns in the last four years. The benchmark index lost 4% even as investors waited for the 18-monthsold Narendra Modi government to deliver on its promises of faster economic growth and development. In terms of investors' wealth, however, the year saw about Rs 2 lakh crore being added to BSE's market capitalization at Rs 96.1lakh crore, reflecting smarter gains for nonsensex stocks. Newly listed stocks like Interglobe Aviation (IndiGo airlines) and Coffee Day Enterprise (Cafe Coffee Day), which together have contributed about Rs 35,000 crore worth of market value, also contributed to investors' wealth during Samvat 2071, exchange data showed.

The year, which started strong, ended on a cautious note for investors on the back of the Bihar drubbing suffered by the Modi-led NDA. However, the go od sign for Dalal Street is that two days after the elections results were out, the government liberalized foreign investment rules in 15 sectors, including manufacturing, defence, banking and agriculture through executive orders. This was “reflective of the government's commitment to boost investment as well as improve the ease of doing business“, said a note from Radhika Jain, partner, Walker Chandiok & Co LLP , an management consultancy and advisory firm.

Market players said it was a good sign that the poll drubbing is not forcing the government to take the populist route and dump the economic reforms process for growth and development. Some analysts said the poll debacle may turn out to be a blessing in disguise for the government and the economy . Others feel the Modi government would be less effective to take the legislative route to reforms given its minority position in the Rajya Sabha and therefore will depend more on executive decisions to get the reforms process moving forward. In such a situation, investors willing to stay invested for the long run will benefit.

“It will be a tough year for the market, especially considering the pipeline of primary issues and government divestments,“ said Arun Kejriwal, director, KRIS. “Making money will entail discipline and skill sets. Reforms will galore over the next 2-3 quarters. However, it will take longer for tangible results to be seen,“ Kejriwal said.

2015/ Samvat 2072: Best gains in 7 years

The Times of India, Nov 12 2015

Sensex's best Muhurat gains in 7 yrs

Rises 124 points on 1st day of samvat 2072 trading on govt's FDI move

The Muhurat day trading for Vikram Samvat year 2072, the new year for the Hindu lunar calendar, ended on a strong note, thanks mainly to the government's late Tuesday announcement allowing easier foreign investment in 15 sectors, with the sensex ending 124 points higher, its best Diwali day closing in seven years. Although the mood among those present at BSE's Convention Hall was downbeat compared to last year when the Modi-led government was just a few months old, veterans at Dalal Street said the Centre was working hard and its decisions relating to the economic reforms process is expected to start showing results soon.

On Diwali day , brokers worship Lakshmi, the Godess of wealth and prosperity at BSE's Convention Hall which used to be the trading rink till computers replaced the open outcry system of trading. Brokers, along with their family members, trade on terminals set up temporarily for the Muhurat session at the same hall. According to another official at a broking house, the government's attempts to bo ost investment in the economy is bearing results, albeit slowly , and some private sector companies are also starting to invest in building capacities.

The gains on Diwali day's one-and-half hours special trading session was led by Axis Bank, Sun Pharma and L&T, while Hero MotoCorp and ITC were the top laggards. The session also added nearly Rs 63,500 crore to investors' wealth with the BSE's market capitalisation now at Rs 96.78 lakh crore. Institutional participation was minimal as it was a banking holiday . Extending its gains for the third straight day, gold prices advanced by Rs 15 to Rs 26,250 per ten grams in muhurat trading at the bullion market on increased buying by jewellers, driven by the ongoing festive season. Token buying activity on the auspicious occasion of Diwalialso supported the upside, traders said. Silver also edged up by Rs 25 to Rs 34,900 per kg. AGENCIES

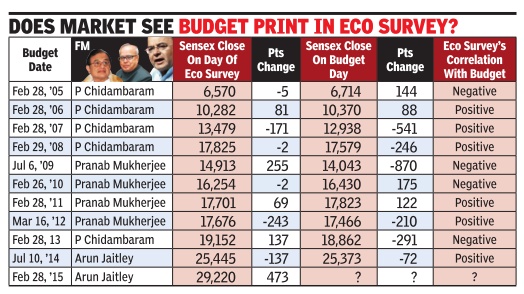

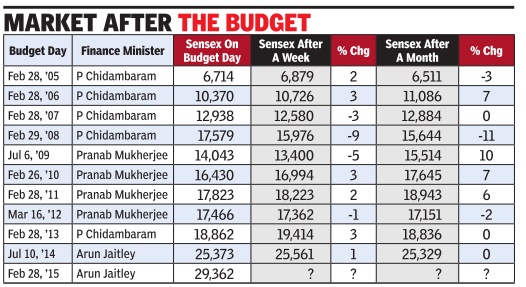

Reaction to annual Union Budget

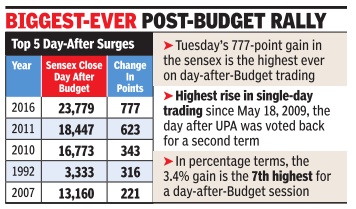

2016: Highest rise ever

The Times of India, Mar 02, 2016

7th heaven: Sensex flies 777, highest rise in 7 yrs

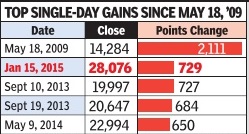

Investors on Dalal Street lif ted the sensex by a record 777 points-its biggest single-session gain on the day after the Budget.Investor wealth rose by Rs 2.5 lakh crore overall. The jump of 3.4% to 23,779 was also the biggest singleday gain in nearly seven ye ars since the sensex shot up 2,111 points on May 18, 2009, the day Congress-led UPA government returned to office.

Investors were enthused by finance minister Arun Jaitley's resolve to stick to the fiscal deficit target of 3.5% of GDP and proposed investments aimed at boosting the rural economy as well as India's infrastructure. Hopes of a rate cut by RBI also propelled the sensex. Foreign investors bought net stocks worth Rs 1,761 crore during the day, a sig nificant reversal from a net nificant reversal from a net outflow of Rs 2,100 crore on the Budget day . Twenty-seven of the top 30 BSE companies closed higher with ITC, ICICI Bank and Maruti leading the surge. The day's strong buying also lifted investors' wealth measured in terms of BSE's market capitalisation, to Rs 88.17 lakh crore from Rs 85.67 lakh crore on Monday .

According to Amar Amba ni, head of research, IIFL, sev eral measures, announced in disparate areas, promise posi tive yield in the medium to long term. “Farmers and budding entrepreneurs have handsome takeaways, so does the bottomend of the salaried class.

The rural and farm sector allocations including MGNREGA, irrigation, electrification, crop insurance, interest subvention and cooking gas subsidies are laudable as they would make a difference to countless BPL families across the length and breadth of the country ,“ he said. “The silver lining, however, was that the fiscal deficit target of 3.9% (of GDP) was met and target of 3.5% has been maintained for fiscal 2017. This raises expectations of a rate cut from the RBI,“ Ambani said. The FM's decision to not raise fiscal deficit for next fiscal had also started a rally in the bond market on Monday which continued on Tuesday , although it was slightly muted with the yield on the benchmark 10-year government security softening by 3 basis points (100 basis points =1percentage point) to close at 7.60%. In the last three sessions yield has softened 16 basis points as bond prices rallied (bond prices and yields are inversely related).

“There is a high chance of a rate cut by the RBI, but may not come immediately ...that could come in RBI's April 5 policy meeting,“ a bond dealer said.

2017: an even higher rise

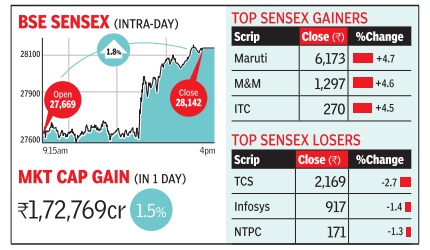

Sensex vaults 486 points, most ever on Budget day, Feb 2, 2017: The Times of India

In the biggest points gain for the sen sex on a Budget day ever, the index jumped 486 points (1.8%) on Tuesday , riding on the government's resolve for fiscal discipline and economic reforms and the relief announced for taxpayers. The sensex ended the day at 28,142 -a three-month high. Foreign investors, however, were muted in their response to the Budget. Their net buying of stocks was worth Rs 93 crore, while bullish domestic funds recorded anet inflow figure of Rs 1,134 crore. The day's rally was led by auto and banking & financial sector stocks, while IT and pharma continued to witness selling pressure due to emerging business hurdles in the US, the largest export market for these companies.

The day's gains, which made investors richer by over Rs 1.7 lakh crore with BSE's current market capitalisation now at nearly Rs114 lakh crore, were also boosted by short covering by speculators who had gone short, anticipating a tough Budget for the market in particular.

Brokers said some of the FM's proposals signalled that India is open for business. “The Budget affirms India's commitment to globalisation and an open market against a global trend of protectionism. The abolition of FIPB is a strong signal towards the same, as is the clarification on tax on indirect transfer,“ said Leo Puri, MD, UTIMF .

Brokers also feel that the tax proposals are a long-term positive. “The proposed reduction in tax will be constructive for improving overall compliance and collection efficiency . This will also be positive for greater flow of savings to formal channels,“ said Shilpa Kumar, MD & CEO, ICICI Securities.

See also

Sensex <> The stock market: India <> Mutual Funds: India <> Rupee: India