Robots: India

This is a collection of articles archived for the excellence of their content. |

Contents |

The robotic process automation (RPA) industry

2014

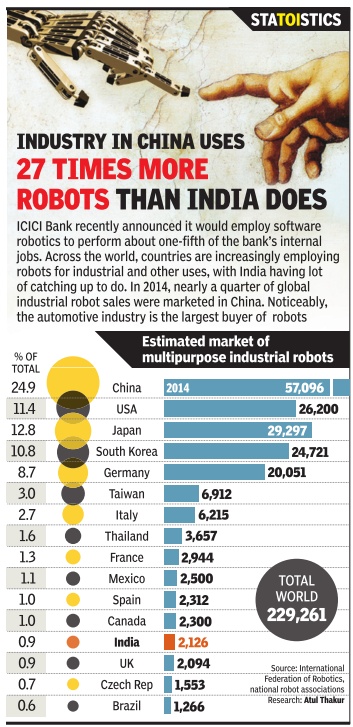

See graphic:

Estimated market of multipurpose industrial robots, 2014

2016

May 14, 2018: The Times of India

From: May 14, 2018: The Times of India

HIGHLIGHTS

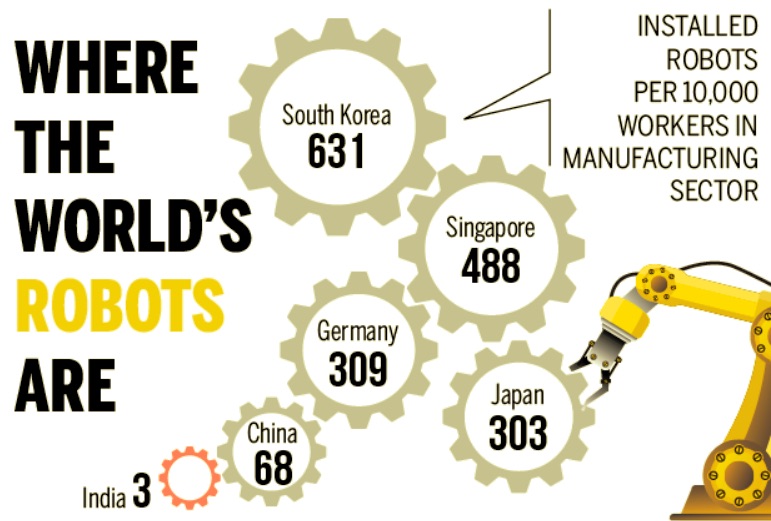

Though robot sales in India has increased, but it's far behind Europe and South Korea

South Korea installed 631 robots per 10,000 workers in the manufacturing sector, according to International Federation of Robotics, Statista

Robot sales in India increased by 27 per cent to a new peak of 2,627 in 2016, but it's way behind Europe and South Korea, which lead in automation, according to International Federation of Robotics, Statista.

2018

From: March 24, 2018: The Times of India

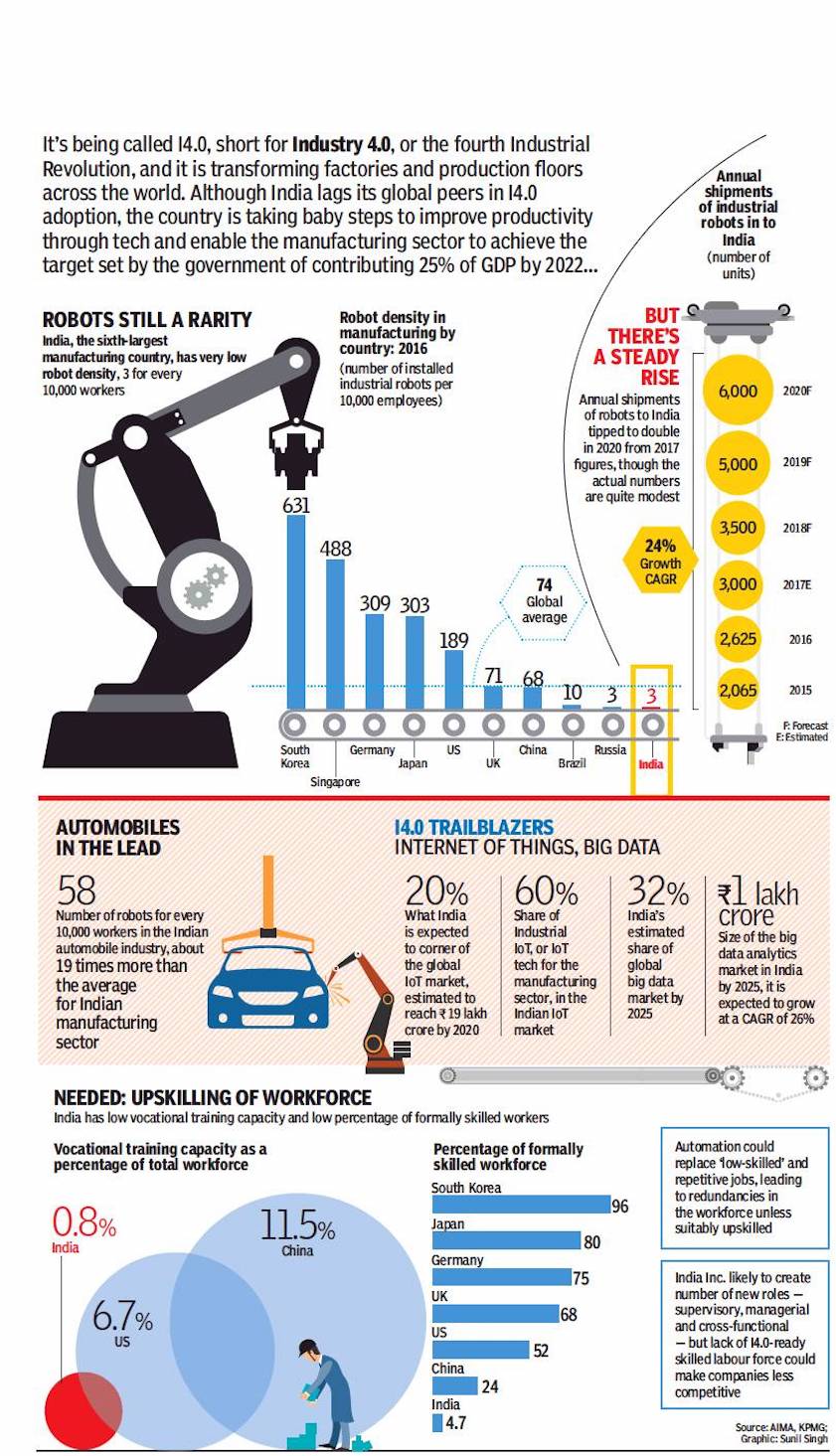

See graphic:

Robot density in India and the world, 2018

2019/ Creating millionaires

Shilpa Phadnis, Oct 4, 2019: The Times of India

From: Shilpa Phadnis, Oct 4, 2019: The Times of India

Key Highlights

The robotic process automation companies have been very liberal in offering stock options to employees

Firms like UiPath, which has 400 employees in India, offers stock options to every employee

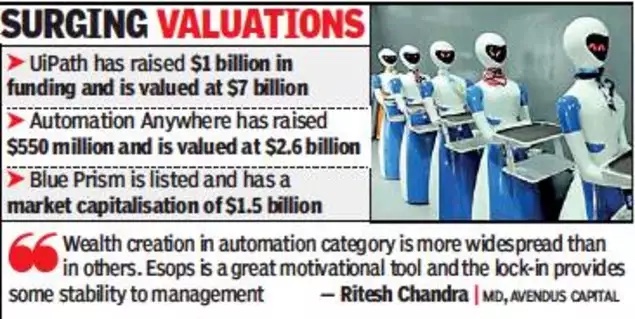

BENGALURU: The numbers of bot millionaires, including in India, are rising rapidly as valuations of robotic process automation (RPA) firms like UiPath and BluePrism soar. These companies have been very liberal in offering stock options to employees.

UiPath, which has 400 employees in India, offers stock options to every employee. The enterprise RPA company has around 30 senior employees at the level of director and above whose options are worth between Rs 1 crore and Rs 3 crore, industry sources told TOI.

Vice-presidents in UiPath get an average of 12,000 options. Mid-level employees, who get a salary of around Rs 15 lakh, receive between 1,000 and 1,500 options, sources said. The options have a grant price and are assigned a fair market value at the time of vesting.

UiPath has raised $1 billion in total funding. Most recently it raised $570 million in its series D round that valued the company at $7 billion, and made co-founder Daniel Dines, who owns a 20% stake, the world’s first bot billionaire.

Data platform Forge Global showed that in 2015, when UiPath raised $30 million, its share was valued at $0.92. In less than five years, this has grown to $39.5 a piece. Some employees in the US liquidated their stock in the Series B round, sources said. An email sent to UiPath on the stock compensation did not elicit a response.

BluePrism has an employee share plan but details for employees in India is not disclosed. Its 2018 annual report showed that it has issued 33,969 shares under the employee stock purchase plan. The options vest over a three-year period, one third each year.

Automation Anywhere gives stock options to select employees, but the company declined to share details.

The cycle time for wealth generation is much faster than for traditional IT firms and at par with new age firms like Flipkart.

Ritesh Chandra, managing partner in Avendus Capital, said that wealth creation in the automation category is more widespread than in most other categories. “Esops is a great motivational tool and the lock-in provides some stability to the management (stock options are tied to continued employment with the company). There’s limited availability of liquidity to these employees given the fact that most of these are private companies. But we are seeing avenues emerge for people to monetise their stock options in a far more structured manner which is not predicated around a financing round or a public listing,” he said.

Vivek Wadhwa, distinguished fellow at Carnegie Mellon University’s college of engineering at Silicon Valley, said this is the same situation as in Silicon Valley during the dotcom boom, when for the first time, thousands of Indians become millionaires.

“The ones such as Raju Reddy, Naren Gupta, and Vinod Dham are still highly respected and looked up to. They spend most of their time investing in others and teaching them the ropes," he said. Vijay Govindarajan, professor at Tuck at Dartmouth, said India benefitted from the IT outsourcing boom starting in the 1990s, and it is now the decade of digital technologies such as mobile, social, cloud, AI, big data, and blockchain. They are the biggest value creators.

“Digital transformation is a one-way traffic. This is not optional. It is the oxygen which will help India be a legitimate leader. They will fundamentally reshape economies. India must give every incentive to entrepreneurs and big companies to leverage these technologies to drive growth. That is the biggest value creator. Suffice it to say, India must step up digital entrepreneurship, else the country runs the risk of becoming irrelevant,” he said.